Electrical Stimulation Blood Pressure Treatment Devices Market Size and Forecast – 2026 – 2033

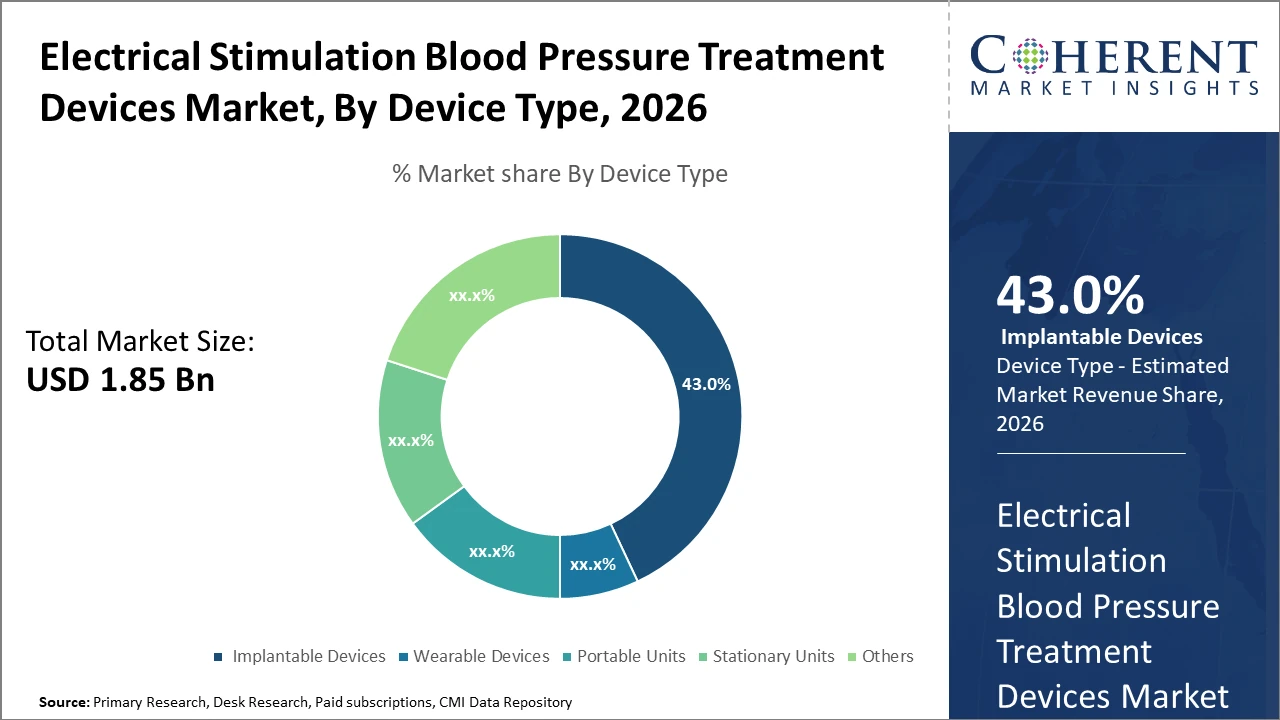

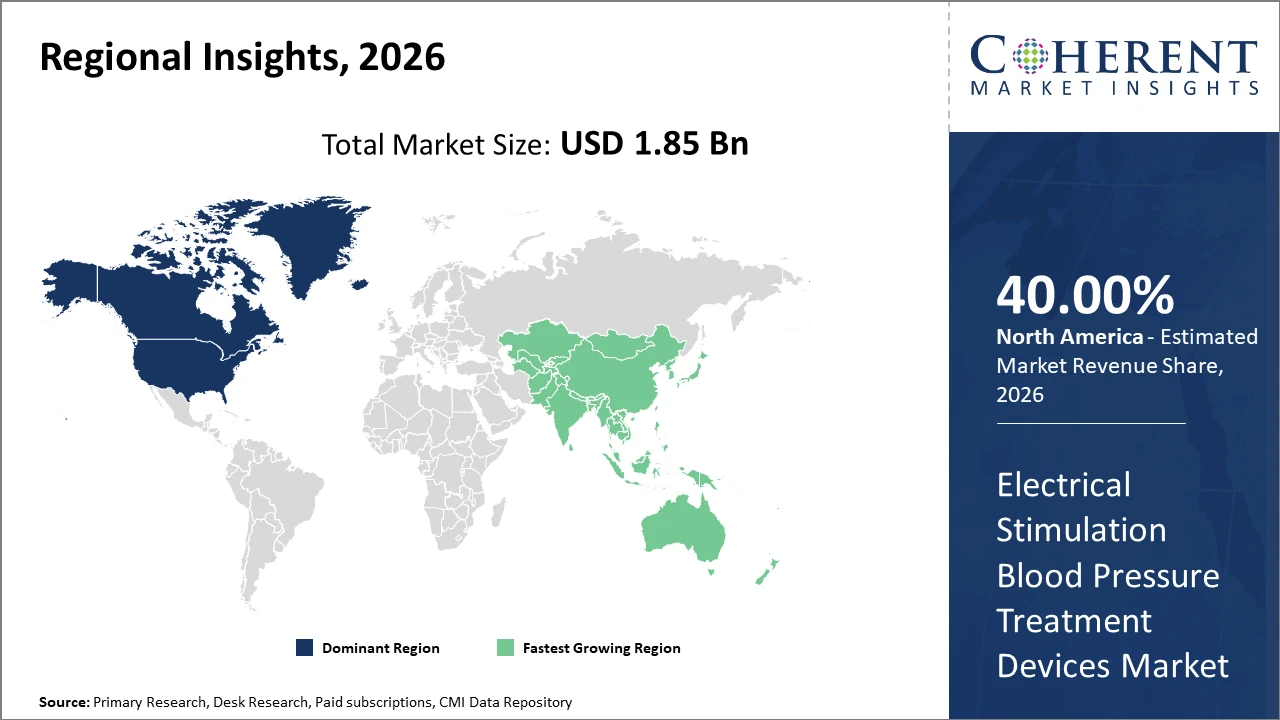

The Global Electrical Stimulation Blood Pressure Treatment Devices Market size is estimated to be valued at USD 1.85 billion in 2026 and is expected to reach USD 3.22 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 8.3% from 2026 to 2033.

Global Electrical Stimulation Blood Pressure Treatment Devices Market Overview

Electrical stimulation blood pressure treatment devices are medical products that use controlled electrical impulses to regulate neural pathways involved in blood pressure control. These devices may target specific nerves or vascular responses to lower hypertension without pharmacological intervention. The products can be implantable or external, depending on the therapy design. They are primarily used for patients with resistant hypertension. Safety, precision of stimulation, and long-term efficacy are essential product features.

Key Takeaways

Implantable Devices dominate the device type segment with 43% market share, primarily due to their superior efficacy and long-term control, whereas wearable devices are the fastest-growing segment, fueled by convenience and home care trends.

Hypertension Management remains the largest application segment, reflecting over 50% revenue share, driven by the increasing global burden of cardiovascular diseases.

North America accounts for a significant industry share owing to 40% advanced healthcare infrastructure and high adoption of technologically sophisticated devices.

Asia Pacific exhibits the fastest CAGR influenced by rising healthcare expenditure, expanding middle-class population, and government initiatives promoting non-pharmaceutical therapies in countries like China and India.

Electrical Stimulation Blood Pressure Treatment Devices Market Segmentation Analysis

To learn more about this report, Download Free Sample

Electrical Stimulation Blood Pressure Treatment Devices Market Insights, By Device Type

Implantable Devices hold the highest market share due to their ability to provide continuous, long-term blood pressure control, making them the preferred choice in clinical hypertension management. Their efficiency in modulating vascular pathways has resulted in significant outcome improvements, particularly in treatment-resistant hypertensive patients. However, the fastest growing subsegment is Wearable Devices, fueled by increased patient demand for mobility, non-invasiveness, and integration with telehealth platforms. These devices are particularly favored in home care settings, enabling continuous monitoring and self-management. Portable Units cater to episodic monitoring and user convenience, whereas Stationary Units are mostly confined to hospital environments.

Electrical Stimulation Blood Pressure Treatment Devices Market Insights, By Application

Postoperative Blood Pressure Regulation is the fastest growing subsegment, driven by increasing use of electrical stimulation devices to ensure hemodynamic stability in surgical wards. It offers a reliable alternative to pharmaceutical interventions, reducing medication-related adverse events. Chronic Disease Management solutions are seeing steady growth as multimorbidity rises, integrating blood pressure control within broader patient care regimes. Emergency Care applications remain more specialist and episodic.

Electrical Stimulation Blood Pressure Treatment Devices Market Insights, By End-User

Hospitals command the largest market share due to their role in acute management and availability of advanced electrical stimulation therapies under physician supervision. Clinics provide outpatient intervention, combining convenience with clinical oversight, thus forming a significant revenue source. Home Care Settings represent the fastest growth trajectory, propelled by patient empowerment, telemedicine advances, and device portability, facilitating long-term adherence. Rehabilitation Centers focus on integrated therapy for cardiovascular recovery, sustaining steady segment growth.

Electrical Stimulation Blood Pressure Treatment Devices Market Trends

Market trend analysis reveals that the Electrical Stimulation Blood Pressure Treatment Devices market is increasingly influenced by digital health integration, with devices capable of remote monitoring demonstrating 35% higher adoption rates globally in 2024.

The rise of AI-powered closed-loop systems has transformed blood pressure management paradigms, underscored by studies showing up to a 20% improvement in consistent hypertension control.

Additionally, value-based healthcare models incentivize patient-centric therapies, propelling the shift from pharmacological dependence to device-based solutions.

Notably, portable and wearable devices are accelerating market growth in home care settings, with consumer electronics companies entering this space, thereby expanding market scopes.

Electrical Stimulation Blood Pressure Treatment Devices Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Electrical Stimulation Blood Pressure Treatment Devices Market Analysis and Trends

In North America, dominance in the Electrical Stimulation Blood Pressure Treatment Devices market is driven by comprehensive healthcare infrastructure, supportive reimbursement policies, and high adoption rates of advanced medical devices. The U.S. alone accounts for over 45% of the regional market share, fueled by rising hypertension prevalence and widespread telehealth deployment. Key players headquartered in the region have executed aggressive R&D and marketing campaigns, reinforcing North American leadership in the market.

Asia Pacific Electrical Stimulation Blood Pressure Treatment Devices Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth, with a CAGR exceeding 10% between 2026 and 2033. Uptake is propelled by expanding healthcare access, emerging economies investing in medical technology, and government programs emphasizing non-invasive treatment solutions. Increasing collaboration between local manufacturers and global market companies has lowered costs and fueled market competitiveness within this region.

Electrical Stimulation Blood Pressure Treatment Devices Market Outlook for Key Countries

USA Electrical Stimulation Blood Pressure Treatment Devices Market Analysis and Trends

The USA market commands significant influence, supported by early adoption of cutting-edge implantable devices and a strategic focus on personalized therapy regimens. In 2024, over 40% of newly diagnosed hypertensive patients utilized electrical stimulation as part of multimodal treatment strategies. Major healthcare providers collaborate extensively with device manufacturers to incorporate AI-enabled monitoring, bolstering market revenue. Regulatory facilitation by the FDA and growing healthcare digitization accelerate technology penetration, making the U.S. a cornerstone in driving global market trends.

China Electrical Stimulation Blood Pressure Treatment Devices Market Analysis and Trends

China’s Electrical Stimulation Blood Pressure Treatment Devices market is rapidly expanding due to government initiatives targeting chronic disease management and substantial investments in healthcare infrastructure. Local manufacturers have gained market traction by offering cost-effective wearable devices tailored to rural and urban populations, contributing to a 12% increase in market revenue in 2024. Partnerships with international companies to transfer technology and enhance distribution networks further sustain China’s position as a key growth engine in the Asia Pacific region.

Analyst Opinion

Market penetration of wearable electrical stimulation devices is a critical demand-side indicator contributing to market revenue growth. In 2024, over 30% of newly diagnosed hypertensive patients in the U.S. adopted these devices as adjunct therapy, reflecting enhanced patient compliance. This shift indicates evolving use cases beyond clinical environments, including remote patient monitoring.

Supply-side factors such as manufacturing capacity expansion in Asia Pacific reduced unit costs by approximately 12%, stimulating wider affordability in emerging markets. Additionally, the increase in exports from countries like China and India by 18% YoY has escalated market availability globally.

Pricing dynamics are influenced heavily by technological integration, with next-generation devices incorporating AI-driven feedback systems commanding premiums yet capturing 22% market share in 2024. These developments have reinforced demand for precision therapy and personalized treatment regimens.

The expansion of telehealth services facilitated an upsurge in imports of compatible electrical stimulation devices, especially in North America, which reported a 25% increase in device imports in 2024 over 2023. This trend evidences growing healthcare digitalization impacting market growth strategies.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 1.85 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 9.1% | 2033 Value Projection: | USD 3.22 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | LivaNova PLC, Abbott Laboratories, Zoll Medical Corporation, ElectroCore, Inc., Stimwave LLC, Hoffman-La Roche AG, BioElectronics Corporation, Inspire Medical Systems, Soterix Medical, NeuroSigma Inc | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Electrical Stimulation Blood Pressure Treatment Devices Market Growth Factors

The increasing prevalence of hypertension globally, coupled with rising patient preference for non-invasive treatment options, is a primary market driver. According to the WHO, over 1.2 billion people worldwide suffered from hypertension in 2025, creating substantial demand for effective therapeutic devices. Technological advancements in miniaturization and battery efficiency enable portable device development, facilitating home use and increasing market adoption rates. Government healthcare initiatives promoting digital and remote monitoring solutions in developed countries have further accelerated product integration into clinical protocols. Additionally, growing awareness about the risks of conventional pharmacotherapy’s side effects is steering patients toward electrical stimulation alternatives, expanding market scope, and driving business growth.

Electrical Stimulation Blood Pressure Treatment Devices Market Development

In March 2025, Huawei debuted the HUAWEI WATCH D2 in India, expanding its presence in the medical-grade wearables segment. The smartwatch integrates advanced blood pressure monitoring technology using dedicated pressure sensors and an inflatable cuff mechanism, delivering clinically aligned readings that are more accurate than conventional optical-based wearables. The launch targets growing demand for proactive cardiovascular health management and continuous home-based monitoring.

In May 2025, Tenovi launched its Cellular Blood Pressure Monitor, designed to enhance cardiovascular care and stroke prevention through continuous remote patient monitoring (RPM). The device automatically transmits blood pressure data and detects irregular heart rhythms via cellular connectivity, enabling clinicians to track patients in real time without relying on smartphones or Wi-Fi. This launch supports the broader shift toward connected care models and value-based healthcare.

In February 2025, Medtronic received U.S. FDA approval for its BrainSense™ Adaptive closed-loop deep brain stimulation (DBS) system. While primarily approved for the treatment of Parkinson’s disease, the adaptive DBS technology is being actively researched for additional therapeutic benefits, including significant blood pressure reduction. Clinical studies have observed blood pressure decreases of up to 25/8.4 mmHg, highlighting the system’s potential future role in managing treatment-resistant hypertension.

Key Players

Leading Companies of the Market

LivaNova PLC

Abbott Laboratories

Zoll Medical Corporation

ElectroCore, Inc.

Stimwave LLC

Hoffman-La Roche AG

BioElectronics Corporation

Inspire Medical Systems

Soterix Medical

NeuroSigma Inc.

Leading companies’ competitive strategies focus heavily on mergers and acquisitions to consolidate technology portfolios; for instance, Medtronic’s acquisition of smaller innovative device manufacturers in 2024 expanded their market share by approximately 5%. Boston Scientific’s recent collaboration with AI firms resulted in an adaptive therapy platform launched in early 2025, allowing enhanced patient outcomes and market penetration in hospital settings.

Electrical Stimulation Blood Pressure Treatment Devices Market Future Outlook

Future growth in this market will be driven by the rising global prevalence of hypertension and increasing limitations of pharmacological treatments. Innovations in non-invasive and minimally invasive stimulation technologies are expected to significantly expand patient acceptance. Integration with digital health platforms, remote monitoring, and personalized therapy algorithms will enhance clinical outcomes and physician confidence. As healthcare systems seek long-term solutions for chronic cardiovascular conditions, electrical stimulation devices are expected to gain a stronger role as adjunct or alternative therapies, particularly for patients unresponsive to conventional medications.

Electrical Stimulation Blood Pressure Treatment Devices Market Historical Analysis

The electrical stimulation blood pressure treatment devices market emerged from decades of research into neuromodulation and autonomic nervous system regulation. Early studies focused on invasive approaches targeting neural pathways associated with hypertension, particularly for patients with treatment-resistant conditions. Initial devices were complex, costly, and limited to controlled clinical environments, which restricted market penetration. Regulatory approvals were challenging due to the need for long-term efficacy and safety data. Over time, technological advancements improved device precision, miniaturization, and patient tolerability. As clinical evidence supporting blood pressure reduction accumulated, the market gained credibility among specialists, although adoption remained niche due to limited awareness and reimbursement constraints.

Sources

Primary Research Interviews:

Cardiologists

Neurologists

Biomedical engineers

Medical device manufacturers

Databases:

FDA Medical Device Database

WHO Cardiovascular Data

MedTech Insight

Magazines:

Cardiovascular Business

Medical Device Network

MedTech Dive

MD+DI

DeviceTalks

Journals:

Hypertension

Journal of the American College of Cardiology

Circulation

Neuromodulation

European Heart Journal

Newspapers:

Financial Times (Health)

Reuters Medical Devices

The Wall Street Journal (Healthcare)

Bloomberg Health

The Guardian (Science)

Associations:

American Heart Association

European Society of Cardiology

AdvaMed

International Neuromodulation Society

American College of Cardiology

Share

Share

About Author

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients