Macular Edema Treatment Market Size and Forecast – 2025 – 2032

The Global Macular Edema Treatment Market size is estimated to be valued at USD 5.9 billion in 2025 and is expected to reach USD 10.3 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.2% from 2025 to 2032.

Global Macular Edema Treatment Market Overview

Macular edema treatment products include a diverse range of pharmaceuticals and medical devices designed to manage retinal swelling associated with diabetic retinopathy, retinal vein occlusion, or post-surgical inflammation. The key product categories are anti-VEGF (vascular endothelial growth factor) injections, corticosteroid implants, and laser photocoagulation devices.

Anti-VEGF agents such as ranibizumab, aflibercept, and bevacizumab remain the gold standard for improving vision outcomes by reducing vascular leakage. Sustained-release intravitreal implants provide long-term therapeutic control, minimizing the frequency of injections. Technological advances have also enhanced retinal imaging and OCT-guided treatment planning, enabling precise and personalized therapy.

Key Takeaways

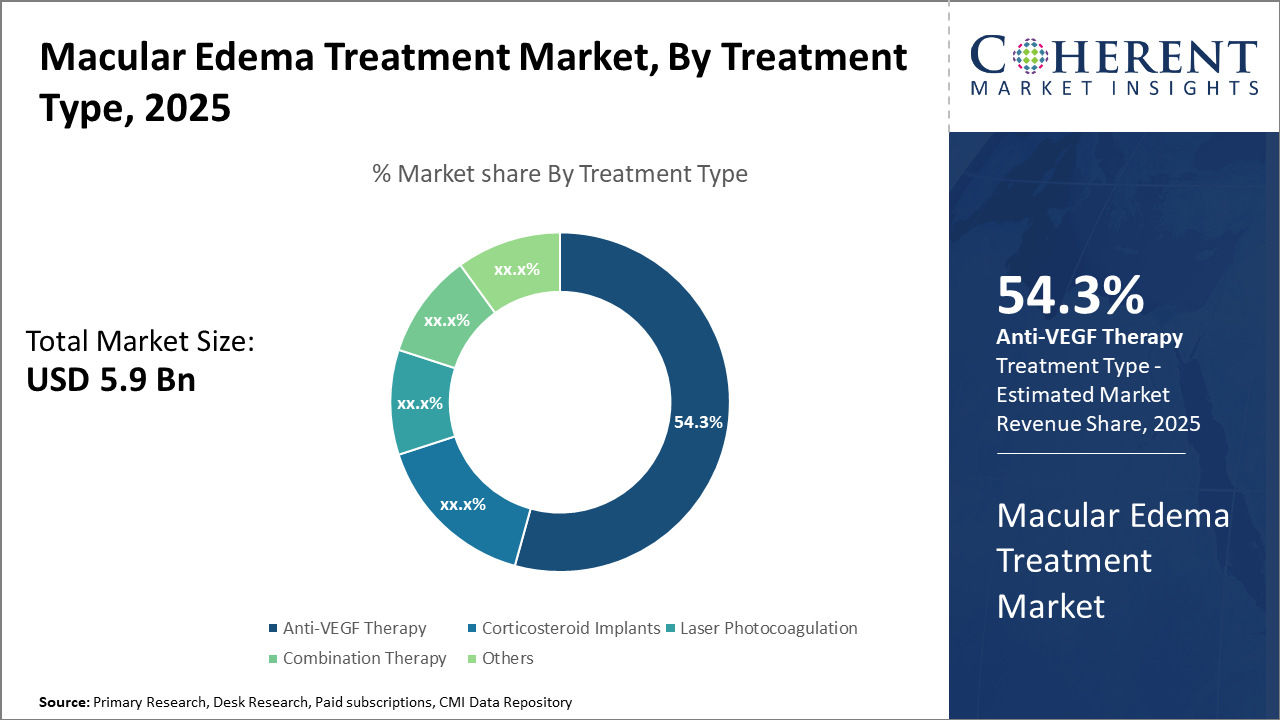

The anti-VEGF therapy segment led the macular edema treatment market share with 54.3%, driven by efficacy and adoption in diabetic macular edema cases. The combination therapy segment, however, shows potential as the fastest-growing due to emerging clinical trials.

Diabetic macular edema remains the largest indication subsegment, aligning with rising global diabetes prevalence and increased screening programs, particularly in North America and Europe.

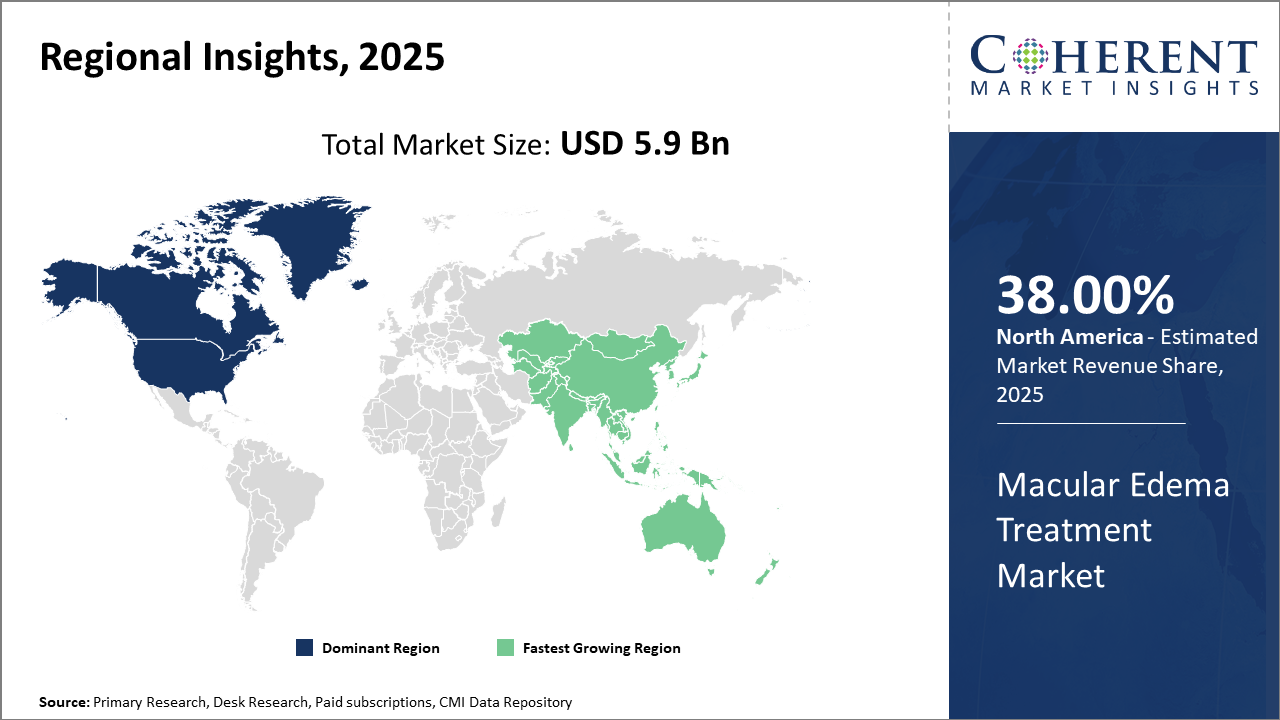

North America holds the dominant regional market share of 38% owing to advanced healthcare infrastructure and higher patient awareness, while Asia Pacific experiences the fastest CAGR of 10.1% fueled by improving healthcare access and local manufacturing capabilities.

Hospitals remain the key end-user segment, but specialty clinics are expanding rapidly due to improved outpatient treatment options and advancements in injectables.

Macular Edema Treatment Market Segmentation Analysis

To learn more about this report, Download Free Sample

Macular Edema Treatment Market Insights, By Treatment Type

Anti-VEGF Therapy dominates the market share. Anti-VEGF Therapy remains the cornerstone of macular edema treatment due to its proven efficacy and wide applicability, accounting for 54.3% of the market share. Its effectiveness in reducing retinal swelling and improving visual acuity, validated through robust clinical outcomes, propels sustained demand. The fastest growing subsegment, Combination Therapy, which integrates anti-VEGF with corticosteroids or laser treatment, is gaining momentum fueled by increasing clinical evidence demonstrating superior therapeutic outcomes in refractory cases. Corticosteroid Implants, known for their sustained drug release profiles, provide an alternative, particularly for patients unresponsive to anti-VEGF agents.

Macular Edema Treatment Market Insights, By Indication

Diabetic Macular Edema dominates the market share. Diabetic Macular Edema accounts for the largest industry share due to the persistent rise in global diabetes prevalence, driving increasing demand for targeted treatment. The substantial investment in patient awareness programs and national screening initiatives further bolsters its ascendancy. The fastest growing indication subsegment is Uveitis-Associated Macular Edema, reflecting increased identification and diagnosis rates aided by enhanced imaging techniques and evolving immunomodulatory therapies. Retinal Vein Occlusion maintains steady market participation owing to its significant patient population and expanding treatment options.

Macular Edema Treatment Market Insights, By End-User

Hospitals dominate the market share. Hospitals retain the highest market share, driven by comprehensive care capabilities, extensive patient volumes, and integrated ophthalmology departments. Their ability to administer advanced therapies such as intravitreal injections and implants under monitored settings ensures treatment efficacy and safety. The fastest growing subsegment, Specialty Clinics, has expanded rapidly, propelled by outpatient procedural advancements, cost-effective models, and patient preference for minimally invasive treatments. Ambulatory Surgical Centers, though smaller in volume, offer niche procedural services, including laser photocoagulation, contributing incremental growth.

Macular Edema Treatment Market Trends

Recent market trends indicate a marked shift toward sustained-release drug delivery systems and combination therapies, heightening treatment efficacy and patient compliance.

For instance, in 2025, the introduction of novel corticosteroid implants with extended release profiles has reduced injection frequency by 40%, enhancing patient adoption rates globally.

Additionally, telemedicine adoption accelerated in 2024 due to pandemic-driven shifts, especially in the Asia Pacific and Latin America, expanding market reach beyond traditional healthcare centers.

The growing emphasis on precision medicine backed by genomic research promises new avenues for market players.

Macular Edema Treatment Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Macular Edema Treatment Market Analysis and Trends

In North America, dominance in the Macular Edema Treatment market is propelled by strong healthcare infrastructure, high diagnosis rates, and extensive insurance coverage. With an estimated 28% market share in 2025, the U.S. leads due to significant investments in R&D by companies like Regeneron Pharmaceuticals and Novartis, fostering advanced product launches and robust clinical trials.

Asia Pacific Macular Edema Treatment Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth with a CAGR estimated at 10.1%, driven by rising diabetes prevalence, expanding healthcare access in emerging economies such as India and China, and increasing local production that reduces cost barriers. Government initiatives encouraging early screening and treatment adoption add further impetus to market growth.

Macular Edema Treatment Market Outlook for Key Countries

USA Macular Edema Treatment Market Analysis and Trends

The U.S. market remains the largest revenue contributor, supported by well-established healthcare policies and payer systems. Key companies such as Regeneron and Novartis have enhanced their presence through new drug approvals like brolucizumab for DME, which accounted for a 15% share of anti-VEGF treatments in 2025. The strong pipeline of gene therapies and AI diagnostic adoption continues to elevate the U.S. market’s growth trajectory.

Germany Macular Edema Treatment Market Analysis and Trends

Germany’s market benefits from early adoption of innovative therapies coupled with government reimbursement policies that expedite patient access. Market players like Bayer AG and Roche have introduced next-generation corticosteroid implants, gaining rapid traction. In 2024, Germany’s stringent regulatory environment, balanced with its robust healthcare infrastructure, supported steady market expansion, particularly in diabetic macular edema treatment delivery.

Analyst Opinion

Increasing adoption of anti-VEGF therapies continues to be a primary demand-side driver. Clinical data reveal that in 2024, approximately 65% of patients diagnosed with diabetic macular edema (DME) received anti-VEGF injections, contributing to a 25% rise in market revenue from pharmaceutical sales compared to 2023.

Growing diagnostic capabilities, including optical coherence tomography (OCT) advancements, have expanded early detection. The global installation of OCT devices increased by 15% in 2024, directly correlating with a 12% uplift in treatment initiation rates for macular edema.

Pricing dynamics remain a crucial supply-side indicator wherein biosimilar entrants have reduced treatment costs by up to 20% in specific regions, notably Europe. This price modulation enhanced patient accessibility, translating to a 10% increase in market volume during 2025’s first two quarters.

Regional import-export flows have shifted, especially in the Asia Pacific, where local manufacturing of corticosteroids surged by 18% in 2024, minimizing dependency on imports and reinforcing regional supply chains amid global trade disruptions.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 5.9 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 8.2% | 2032 Value Projection: |

USD 10.3 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Regeneron Pharmaceuticals, Novartis AG, Roche Holding AG, Pfizer Inc., Bayer AG, Alimera Sciences Inc., Santen Pharmaceutical Co., Ltd., Boehringer Ingelheim, DongKoo Bio & Pharma Co., Ltd., F. Hoffmann-La Roche Ltd., Versant Ventures, Bausch Health Companies Inc. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Macular Edema Treatment Market Growth Factors

The growing prevalence of diabetes worldwide remains the foremost driver; the International Diabetes Federation reported a 4.8% annual increase in the diabetic population globally in 2024, elevating the demand for macular edema treatments. Technological advancements in drug formulations, such as sustained-release corticosteroid implants approved by the FDA in late 2024, provide enhanced efficacy, encouraging adoption in clinical practices. Cost reductions driven by biosimilar approvals have improved treatment accessibility, particularly in European and the Asia Pacific markets. Lastly, increasing reimbursement coverage by health insurers across North America and Europe significantly mitigates financial barriers, ensuring steady market growth throughout 2025.

Macular Edema Treatment Market Development

In February 2025, – Susvimo (Roche): FDA approved Susvimo as the first continuous-delivery therapy for diabetic macular edema (DME). The implantable device provides sustained intraocular drug release, enabling patients to maintain vision with as few as two treatments per year, significantly reducing the burden of frequent anti-VEGF eye injections.

In August 2023, EYLEA HD (Regeneron): FDA approved the high-dose aflibercept formulation for DME and additional retinal diseases. The enhanced dosage supports longer dosing intervals and improved durability, expanding treatment choices for patients requiring more efficient macular edema management.

Key Players

Leading Companies of the Market

Regeneron Pharmaceuticals

Novartis AG

Roche Holding AG

Pfizer Inc.

Bayer AG

Alimera Sciences Inc.

Santen Pharmaceutical Co., Ltd.

Boehringer Ingelheim

DongKoo Bio & Pharma Co., Ltd.

F. Hoffmann-La Roche Ltd.

Versant Ventures

Bausch Health Companies Inc.

Companies like Regeneron Pharmaceuticals and Novartis AG have embraced strategic partnerships and regional expansions to bolster product pipelines and distribution channels. Notably, Novartis’ acquisition of cutting-edge drug delivery startups boosted its portfolio, resulting in a 14% increase in market share in North America during the latest fiscal year. Similarly, Roche’s investment in novel corticosteroid therapies facilitated entry into emerging markets, enhancing competitive positioning.

Macular Edema Treatment Market Future Outlook

The market is poised for transformative shifts toward longer-duration therapies and less invasive delivery methods. Sustained-release biologic implants, gene therapy approaches aiming for one-time or infrequent dosing, and port-delivery systems that refill implanted reservoirs are all advancing in clinical development and early commercialization. These longer-acting modalities promise to reduce clinic visit burden and improve adherence, which is critical for durable vision outcomes. Complementary innovations—point-of-care OCT, AI-aided retinal image triage, and tele-ophthalmology—will streamline follow-up and identify non-responders rapidly. Cost and reimbursement considerations will shape adoption, particularly in emerging markets where injection frequency is a barrier.

Macular Edema Treatment Market Historical Analysis

Macular edema management has evolved markedly since laser photocoagulation was the mainstay; the introduction of intravitreal anti-VEGF therapies in the 2000s revolutionized outcomes, particularly for diabetic macular edema (DME) and retinal-vein-occlusion-related edema. Anti-VEGF agents produced substantial gains in vision restoration and became the standard of care, but their need for frequent intravitreal injections imposed treatment burden and adherence challenges. Sustained-release corticosteroid implants offered alternative pathways for specific patient subsets, trading off side-effect profiles for reduced injection frequency. Advances in retinal imaging—especially OCT—improved early detection, treatment planning, and outcome monitoring, substantially increasing treatment uptake and visit frequency. Biologics manufacturing and delivery systems matured around repeated intravitreal administration, stimulating device and pharmaceutical process innovation.

Sources

Primary Research Interviews:

Ophthalmologists

Retina Specialists

Pharmaceutical Researchers

Clinical Trial Coordinators

Databases:

NIH Eye Institute Data

WHO Vision 2020

PubMed

Magazines:

Retina Today

Ophthalmology Times

The Ophthalmologist

Medical Device Network

Journals:

Investigative Ophthalmology & Visual Science

Retina Journal, Ophthalmology, Eye

Associations:

American Academy of Ophthalmology (AAO)

International Council of Ophthalmology (ICO)

WHO

European Society of Retina Specialists (EURETINA)

Share

Share

About Author

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients