Implantable Cardioverter Defibrillators Market Size and Forecast – 2026 – 2033

The Global Implantable Cardioverter Defibrillators Market size is estimated to be valued at USD 9.20 billion in 2026 and is expected to reach USD 15.80 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 7.8% from 2026 to 2033.

Global Implantable Cardioverter Defibrillators Market Overview

The Implantable Cardioverter Defibrillators (ICDs) market comprises advanced medical devices designed to monitor heart rhythms and deliver life-saving electrical shocks to prevent sudden cardiac arrest. Key products include transvenous ICDs, which are implanted with leads placed inside the heart, and subcutaneous ICDs that avoid direct heart contact. The market also includes cardiac resynchronization therapy defibrillators (CRT-Ds) for patients with heart failure and arrhythmias. Technological advancements such as remote monitoring, longer battery life, and MRI-compatible devices are enhancing product adoption and improving patient outcomes across hospitals and cardiac care centers worldwide.

Key Takeaways

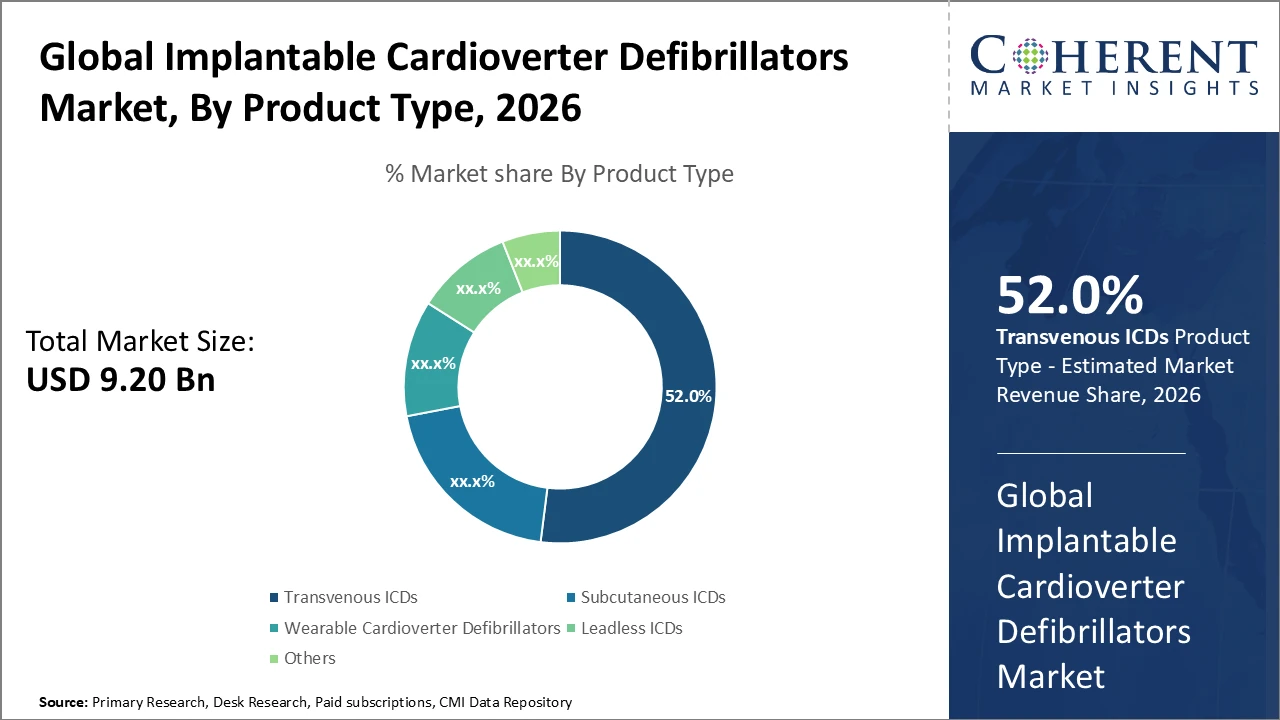

The Transvenous ICD segment dominates the product category due to its widespread clinical adoption and accounts for approximately 52% of total market revenue, reflecting continued physician and patient preference despite the rising adoption of subcutaneous alternatives.

Primary prevention applications are witnessing rapid expansion, supported by increased cardiovascular screening and early intervention strategies, which are significantly enhancing the segment’s market share and revenue growth.

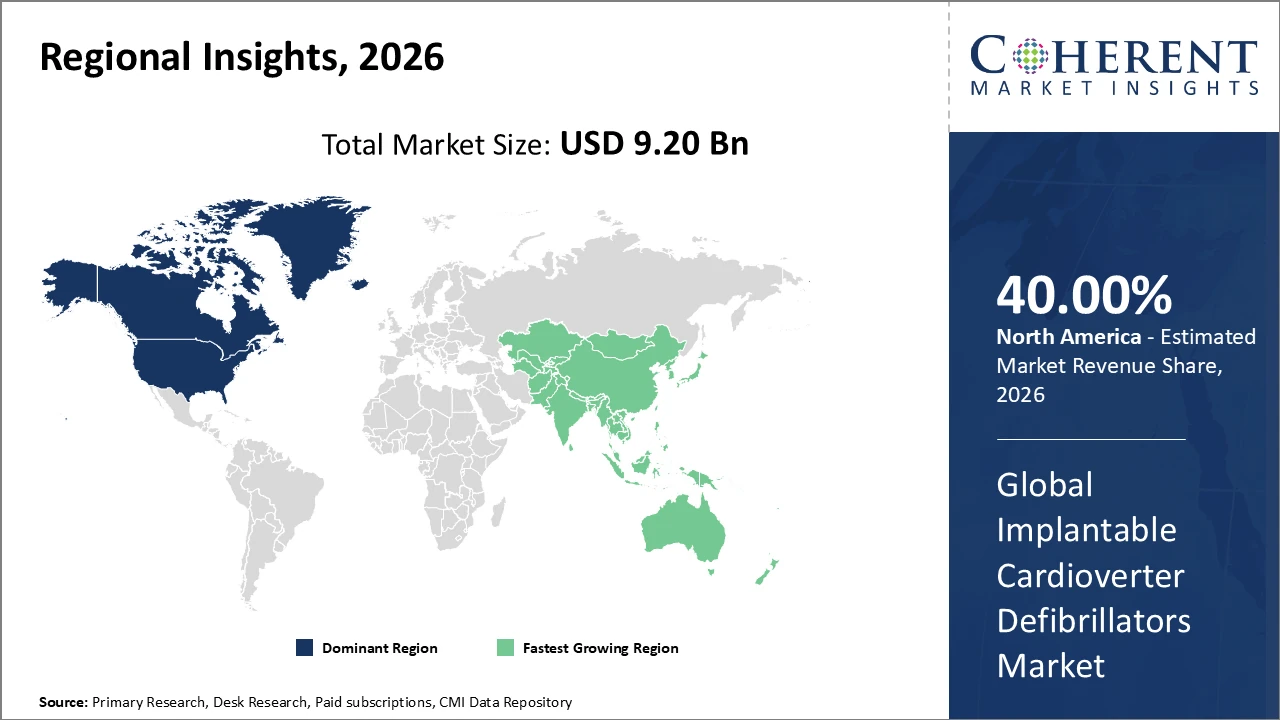

North America continues to lead the Implantable Cardioverter Defibrillators market, holding over 40% of the global share, driven by advanced healthcare infrastructure, high adoption of innovative devices, and supportive regulatory policies.

Asia Pacific represents the fastest-growing regional market, recording a CAGR above 9%, fueled by rising healthcare expenditures, favorable government initiatives, expanding patient populations, and growing awareness of cardiovascular diseases.

Implantable Cardioverter Defibrillators Market Segmentation Analysis

To learn more about this report, Download Free Sample

Implantable Cardioverter Defibrillators Market Insights, By Product Type

Transvenous ICDs dominate the market with a 52% share, driven by their proven clinical efficacy and widespread adoption, particularly in secondary prevention therapies. Subcutaneous ICDs represent the fastest-growing subsegment, supported by lower procedural risks and expanding patient eligibility, especially among younger populations. Wearable Cardioverter Defibrillators serve as temporary solutions for high-risk patients awaiting permanent implantation, contributing niche value to the market. Leadless ICDs currently hold a minimal share but demonstrate strong future potential due to their innovative lead-free design. Other categories include emerging variants and hybrid models tailored for specialized clinical applications.

Implantable Cardioverter Defibrillators Market Insights, By Application

Primary prevention dominates the market share, driven by increased early diagnosis, improved risk stratification, and a growing focus on preventive interventions for patients at high risk of heart failure and sudden cardiac arrest. Secondary prevention continues to play a critical role for patients with a prior history of life-threatening arrhythmias, sustaining consistent demand for implantable cardioverter defibrillators.

Implantable Cardioverter Defibrillators Market Insights, By End-User

Hospitals dominate the market share as they serve as primary care providers and handle the highest volumes of implantable cardioverter defibrillator procedures, supported by comprehensive infrastructure and multidisciplinary cardiac teams. Cardiac centers are the fastest-growing segment, driven by their specialized focus on cardiovascular care and increasing adoption of advanced electrophysiology laboratories and technologies. Ambulatory surgical centers are gaining traction by offering convenient and cost-effective implantation settings, particularly in developed healthcare markets. Other end users include outpatient facilities and specialized clinics, which contribute incrementally to overall market revenue through expanding access to cardiac rhythm management services.

Implantable Cardioverter Defibrillators Market Trends

The Implantable Cardioverter Defibrillators market is strongly positioned to benefit from accelerated digital integration within modern cardiac care pathways.

A 2026 clinical trial conducted by leading cardiac institutions demonstrated that AI-enabled ICDs reduced adverse cardiac events by 22%, highlighting a transformative shift toward intelligent device ecosystems.

Reimbursement frameworks in developed markets are becoming increasingly favorable for ICD upgrades and replacements, reinforcing long-term maintenance and recurring revenue opportunities for manufacturers.

Rising adoption of subcutaneous ICDs, supported by real-world evidence showing lower infection rates, reflects a notable change in physician preference and improved patient outcomes.

Expanding patient awareness through digital health initiatives and campaigns is driving demand among previously underpenetrated demographic groups, further supporting market growth.

Implantable Cardioverter Defibrillators Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Implantable Cardioverter Defibrillators Market Analysis and Trends

North America holds a dominant position in the Implantable Cardioverter Defibrillators market due to its well-established healthcare infrastructure, high per capita healthcare spending, and strong presence of major medical device manufacturers. Accounting for over 40% of the global market share, the region benefits from favorable reimbursement policies, advanced clinical practices, and early adoption of innovative ICD technologies such as subcutaneous and leadless devices. The United States leads the region, driven by high procedure volumes, strong physician expertise, and supportive regulatory frameworks, fostering continuous technological advancement and sustained market growth.

Asia Pacific Implantable Cardioverter Defibrillators Market Analysis and Trends

Meanwhile, the Asia Pacific region represents the fastest-growing market for Implantable Cardioverter Defibrillators, recording a CAGR exceeding 9%. This growth is driven by the rising burden of cardiovascular diseases, rapid improvements in healthcare infrastructure, and increasing patient awareness across emerging economies such as China and India. Favorable government initiatives supporting medical device imports, reimbursement expansion, and local manufacturing are further accelerating adoption. Additionally, global and regional market players are strengthening their presence by expanding distribution networks, forming strategic partnerships, and conducting clinical and educational programs, enabling deeper market penetration and long-term growth opportunities across the region.

Implantable Cardioverter Defibrillators Market Outlook for Key Countries

USA Implantable Cardioverter Defibrillators Market Analysis and Trends

The U.S. Implantable Cardioverter Defibrillators market represents a significant share of regional revenue, supported by advanced healthcare infrastructure and strong clinical adoption of innovative ICD technologies. With over 150,000 implantations annually as of 2025, the country contributes substantially to global market revenue. Innovations such as Medtronic’s extended battery life devices and Boston Scientific’s remote monitoring solutions have seen widespread acceptance among physicians and patients. Additionally, proactive patient management programs, growing awareness of heart failure, and rising prevalence of cardiovascular conditions continue to drive sustained market growth, positioning the U.S. as a critical hub for ICD adoption and technological advancement.

Germany Implantable Cardioverter Defibrillators Market Analysis and Trends

Germany’s Implantable Cardioverter Defibrillators market holds a leading position in Europe, underpinned by a sophisticated healthcare system and high investment in cardiac therapeutic devices. In 2026, over 25,000 ICDs were implanted, reflecting growing clinical confidence in advanced technologies, including subcutaneous ICDs. Supportive government reimbursement policies and hospital investments in cardiac electrophysiology have accelerated adoption. Major manufacturers maintain a strong presence through strategic partnerships with German cardiac centers, strengthening market positioning and growth strategies. Additionally, Germany’s emphasis on research-driven innovation continues to shape industry trends, driving the development and early adoption of next-generation ICD solutions across the region.

Analyst Opinion

Advances in device miniaturization are expanding ICD adoption, enabling implantation in broader patient populations, including pediatric and geriatric patients with limited anatomical space. In 2025, clinical trials with subcutaneous ICDs reported a 30% reduction in implantation complications compared to transvenous devices, boosting hospital acceptance.

Expanding indications across patient populations, particularly for primary prevention of sudden cardiac death in heart failure patients, are driving demand. Hospital data from 2024 showed a 12% year-over-year increase in ICD implantations among patients with reduced ejection fraction, contributing directly to market revenue growth.

Integration of remote monitoring and AI-driven diagnostics is transforming market dynamics. A 2026 registry study demonstrated that AI-enabled ICDs with remote monitoring reduced hospital readmissions by 18%, highlighting the value of connected technology investments.

Regional supply chain enhancements, supported by manufacturing hubs in North America and Asia Pacific, increased exports by 15% in 2025, ensuring timely ICD availability and strengthening global market share.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 9.20 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 7.8% | 2033 Value Projection: | USD 15.80 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Biotronik SE & Co. KG, LivaNova PLC, Cyberonics, Inc., EBR Systems, Inc., Abiomed, Inc., ELA Medical, Sorin Group | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Implantable Cardioverter Defibrillators Market Growth Factors

The key drivers shaping the Implantable Cardioverter Defibrillators market include the ongoing global rise in cardiovascular diseases, particularly atrial fibrillation and heart failure, which is fueling demand for life-saving ICD therapies. Technological innovations, such as leadless and subcutaneous ICDs, are reducing procedure-related complications and expanding patient eligibility, thereby enhancing market revenue. Favorable regulatory approvals and faster device commercialization in emerging economies, including India and China, are further accelerating business growth. Additionally, increasing clinician adoption of remote patient monitoring integrated with ICDs is optimizing post-implantation follow-up, improving patient outcomes, and reducing hospitalization rates. Collectively, these factors are driving sustainable market expansion and strengthening the global footprint of ICD technologies.

Implantable Cardioverter Defibrillators Market Development

In 2025, Medtronic introduced its Aurora extravascular ICD (EV‑ICD) system and the accompanying Epsila EV MRI lead in Japan, marking a significant advancement in ICD technology by delivering defibrillation therapy without placing leads inside the heart’s vascular system, thereby reducing procedural risks and enhancing patient safety. This MRI‑compatible next‑generation ICD is expected to boost clinician preference and broaden treatment options in the region.

Key Players

Leading Companies of the Market

Abbott Laboratories

Medtronic plc

Boston Scientific Corporation

Biotronik SE & Co. KG

LivaNova PLC

Cyberonics, Inc.

Abiomed, Inc.

EBR Systems, Inc.

ELA Medical

Sorin Group

Competitive strategies in the ICD market have focused on innovation and strategic collaborations. Medtronic’s 2024 launch of extended battery life ICDs, integrated with enhanced remote diagnostics, led to a 10% increase in device adoption across the U.S., strengthening its domestic market share. Meanwhile, Boston Scientific formed strategic partnerships with leading cardiac centers in Europe in 2025, enabling accelerated clinical trial data generation. These evidence-based outcomes reinforced the company’s market position, supporting physician confidence and driving increased procedural volumes. Such approaches highlight the importance of technological advancement combined with clinical validation in maintaining a competitive edge in the global ICD market.

Implantable Cardioverter Defibrillators Market Future Outlook

The future of the Implantable Cardioverter Defibrillators market is poised for robust growth, driven by rising cardiovascular disease prevalence, technological innovation, and expanding patient awareness. Advances in device miniaturization, leadless and subcutaneous ICDs, and AI-enabled remote monitoring are expected to enhance safety, broaden patient eligibility, and improve clinical outcomes. Emerging markets in Asia Pacific and Latin America offer significant expansion opportunities due to improving healthcare infrastructure and supportive government initiatives. Continued integration of digital health tools and predictive diagnostics will optimize patient management, while ongoing R&D and strategic partnerships among manufacturers will further drive market penetration, adoption, and long-term revenue growth globally.

Implantable Cardioverter Defibrillators Market Historical Analysis

The Implantable Cardioverter Defibrillators market has experienced steady growth over the past decade, driven by increasing prevalence of cardiac arrhythmias and sudden cardiac arrest worldwide. Historically, transvenous ICDs dominated the market due to their proven efficacy, while subcutaneous and wearable ICDs emerged as safer, less invasive alternatives. Technological innovations, such as improved battery life, remote monitoring, and MRI-compatible devices, gradually enhanced clinical adoption. North America led historically, supported by advanced healthcare infrastructure and high procedural volumes, while Europe and Asia Pacific showed moderate growth. Rising clinician awareness, favorable reimbursement policies, and expanding indications for primary and secondary prevention fueled consistent market expansion over the years.

Sources

Primary Research Interviews:

Electrophysiologists

Cardiologists

Cardiac Surgeons

Medical Device Manufacturers

Databases:

World Health Organization (WHO) – Cardiovascular Disease Statistics

OECD Health Data

Global Burden of Disease (GBD) Study

Magazines:

Medical Design & Outsourcing

Cardiovascular Business

MedTech Insight

HealthTech Magazine

Medical Device Network

Journals:

Journal of the American College of Cardiology (JACC)

Heart Rhythm Journal

Europace

Pacing and Clinical Electrophysiology

Newspapers:

The New York Times (Health)

The Guardian (Health)

Financial Times (Healthcare)

The Hindu (Health)

Reuters Health

Associations:

American Heart Association (AHA)

Heart Rhythm Society (HRS)

European Society of Cardiology (ESC)

International Society for Holter and Noninvasive Electrocardiology

Food and Drug Administration (FDA) – Medical Devices

Share

Share

About Author

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients