Gonorrhea Diagnostic Market Size and Forecast – 2026 – 2033

The Global Gonorrhea Diagnostic Market size is estimated to be valued at USD 1.2 billion in 2026 and is expected to reach USD 2.3 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 9.4% from 2026 to 2033.

Global Gonorrhea Diagnostic Market Overview

The gonorrhea diagnostic market includes a range of products designed to detect Neisseria gonorrhoeae infections accurately and efficiently. Key product categories include nucleic acid amplification tests (NAATs), which are widely used due to their high sensitivity and specificity, culture-based tests for antimicrobial resistance monitoring, and rapid point-of-care tests that enable quick diagnosis in clinical and remote settings. Additional products include reagents, assay kits, instruments, and consumables used in laboratories and hospitals. Advancements in molecular diagnostics, automation, and integrated testing platforms are driving product innovation, improving early detection, treatment decisions, and disease management globally.

Key Takeaways

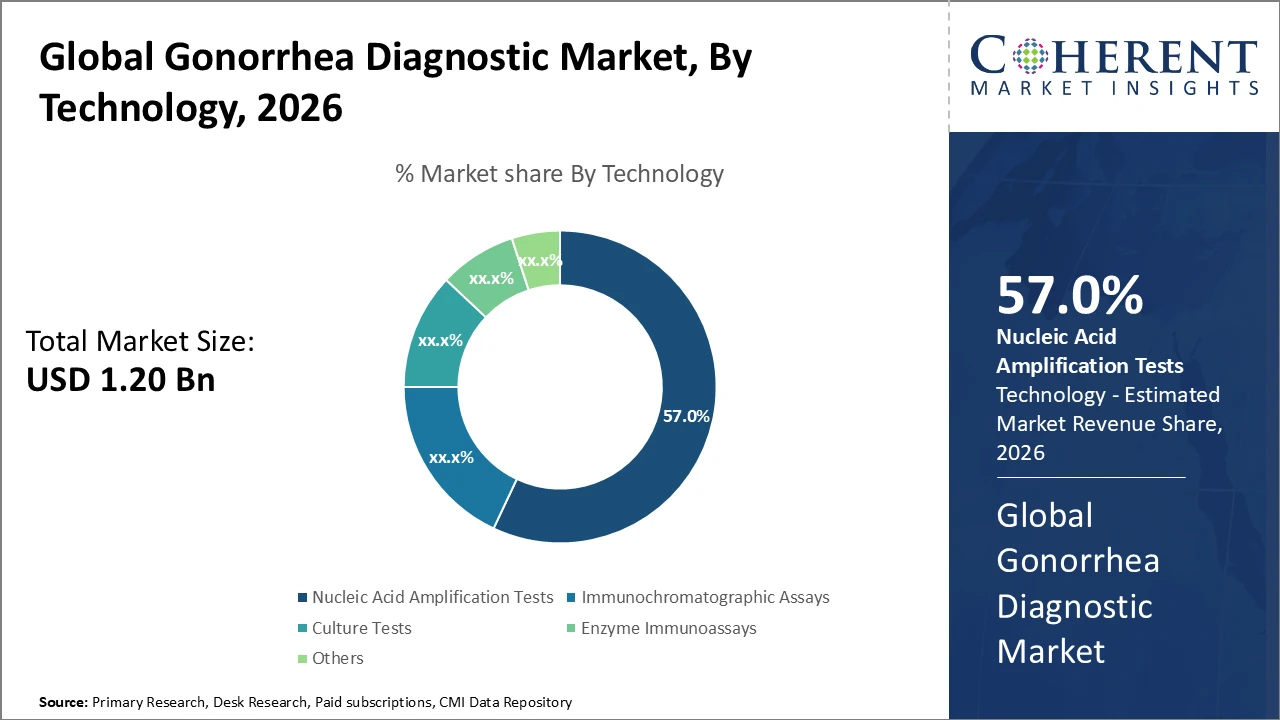

The Nucleic Acid Amplification Tests (NAATs) segment dominates the gonorrhea diagnostic market, driven by superior accuracy, high sensitivity, and rapid turnaround times.

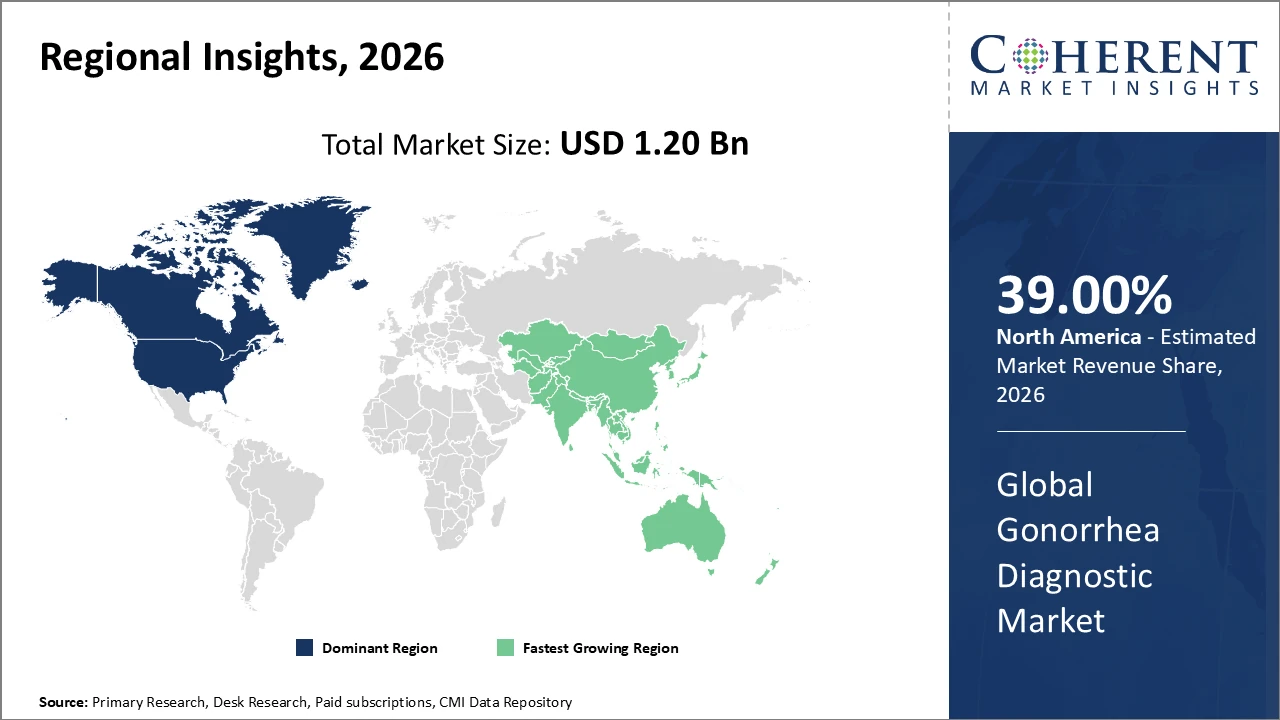

North America leads the global market, supported by advanced healthcare infrastructure and favorable government reimbursement policies that encourage routine STI screening.

Asia Pacific is expected to register the fastest CAGR, driven by rising healthcare investments, increasing STI awareness, and expanding laboratory networks in countries such as China and India.

Gonorrhea Diagnostic Market Segmentation Analysis

To learn more about this report, Download Free Sample

Gonorrhea Diagnostic Market Insights, By Technology

Nucleic Acid Amplification Tests (NAATs) dominate the gonorrhea diagnostic market due to their high sensitivity and specificity, allowing accurate detection even in asymptomatic patients. This subsegment continues to benefit from ongoing technological advancements and strong adoption across clinical and laboratory settings worldwide. Immunochromatographic assays are the fastest-growing subsegment, driven by their rapid turnaround time, ease of use, and effectiveness in decentralized and resource-limited environments, which supports rapid market penetration.

Culture tests, although less widely used because of longer processing times, remain essential for antibiotic susceptibility testing and monitoring antimicrobial resistance. Enzyme immunoassays serve niche screening purposes but are gradually losing relevance as molecular diagnostics gain prominence. Other diagnostic methods include emerging biosensor-based technologies that are still in early developmental stages.

Gonorrhea Diagnostic Market Insights, By End User

Hospitals dominate the gonorrhea diagnostic market share due to their large patient volumes, well-established diagnostic infrastructure, and seamless integration within broader healthcare systems, enabling high-throughput testing. Diagnostic laboratories closely follow, leveraging specialized technologies and advanced automation to support higher testing capacities while serving multiple hospitals and clinics. STD clinics represent the fastest-growing segment, driven by their focused approach to sexually transmitted infections and increased support from public health funding and awareness programs. The others category includes community health centers and mobile testing units, which are gaining importance by improving access to diagnostics in rural, remote, and underserved populations.

Gonorrhea Diagnostic Market Insights, By Sample Type

Urine samples dominate the gonorrhea diagnostic market share due to their non-invasive nature and convenience, making them highly suitable for large-scale screening programs and outpatient settings. Their growing adoption is driven by improved patient comfort and ease of collection, storage, and transport, which supports wider testing coverage. Swab samples, including endocervical and urethral specimens, remain a traditional and reliable method with high diagnostic accuracy, although their growth is slower compared to urine-based diagnostics. Blood samples are primarily used in serological studies and have limited applicability in direct gonorrhea detection, representing a niche segment. Other sample types, such as saliva, are emerging and remain largely experimental but show potential for future diagnostic applications.

Gonorrhea Diagnostic Market Trends

The gonorrhea diagnostic market is experiencing rapid adoption of multiplex testing capabilities that enable simultaneous detection of gonorrhea and other sexually transmitted infections, improving clinical workflow efficiency.

In 2025, multiplex assays contributed to an estimated 30% increase in testing throughput in North American clinical laboratories.

Decentralization of testing is a key trend, driven by the introduction of self-collection kits and integration with telehealth platforms.

These decentralized solutions recorded approximately 22% adoption across Europe and Asia Pacific between 2024 and 2026.

Growing concerns over antimicrobial resistance have prompted regulatory agencies to approve advanced molecular resistance assays.

Several leading diagnostic companies launched resistance-focused molecular products in 2026, supporting improved disease management and reducing treatment failure rates.

Gonorrhea Diagnostic Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Gonorrhea Diagnostic Market Analysis and Trends

In North America, the gonorrhea diagnostic market holds the largest share, supported by a well-developed healthcare infrastructure, broad insurance coverage, and government-mandated screening programs. Ongoing innovation by leading players such as Hologic and Abbott Laboratories, particularly in NAAT technologies and antimicrobial resistance profiling, continues to strengthen the region’s market position. Additionally, supportive initiatives and guidelines from the Centers for Disease Control and Prevention (CDC) further accelerate market growth and promote routine STI testing across healthcare settings.

Asia Pacific Gonorrhea Diagnostic Market Analysis and Trends

The Asia Pacific region is experiencing the fastest growth in the gonorrhea diagnostic market, with a projected CAGR of 11.5%, fueled by increasing STI prevalence, rising healthcare investments, and expanding diagnostic infrastructure across China, India, and Southeast Asia. Government-led initiatives aimed at improving sexual health education and enhancing access to diagnostic services are key drivers supporting market expansion. Major companies, including Roche and Qiagen, have strengthened their presence in the region through expanded distribution networks and localized partnerships, positioning themselves to capitalize on the rapidly growing demand for gonorrhea diagnostics.

Gonorrhea Diagnostic Market Outlook for Key Countries

USA Gonorrhea Diagnostic Market Analysis and Trends

The U.S. gonorrhea diagnostic market benefits from strong public health awareness, broad insurance reimbursement, and proactive government-led screening initiatives. Investments targeting antimicrobial resistance have driven the introduction of advanced NAAT-based diagnostics capable of detecting resistance patterns. In 2026, Roche reported a 20% revenue increase from its gonorrhea diagnostic portfolio in the U.S., highlighting the market’s growth potential. Additionally, the presence of extensive, well-established laboratory networks supports high testing volumes and reinforces the country’s position as a global market leader in gonorrhea diagnostics.

Germany Gonorrhea Diagnostic Market Analysis and Trends

The Germany gonorrhea diagnostic market is driven by increasing awareness of sexually transmitted infections, strong healthcare infrastructure, and government-supported screening programs. Nucleic Acid Amplification Tests (NAATs) dominate due to high sensitivity, rapid results, and widespread clinical adoption, while immunochromatographic assays are gaining traction for point-of-care applications. Rising concerns over antimicrobial resistance have led to the adoption of advanced molecular resistance testing. Hospitals and diagnostic laboratories account for the largest end-user share, supported by robust laboratory networks. Emerging trends include multiplex STI testing and decentralized sample collection. Key players, including Roche, Abbott, and Hologic, continue to invest in innovation and localized partnerships to expand market reach.

Analyst Opinion

Rising adoption of nucleic acid amplification tests (NAATs) is a major driver of market growth, as these tests offer superior sensitivity and specificity compared to conventional methods. In 2025, NAATs accounted for over 62% of global diagnostic revenue. U.S. diagnostic laboratories reported a 35% increase in NAAT usage between 2024 and 2026, reflecting a clear shift toward molecular diagnostics.

Demand-side factors, such as expanded STI screening programs by governmental health agencies, have significantly boosted market revenue. In 2026, the U.S. CDC increased funding for gonorrhea screening, resulting in a 20% rise in nationwide test volumes.

Pricing dynamics are shifting as companies launch cost-efficient point-of-care (POC) tests. For instance, new POC tests introduced in Asia Pacific in 2024 reduced average per-test costs by around 15%, driving higher adoption in emerging markets.

Market challenges persist, particularly in detecting antimicrobial resistance, which remains complex. However, research investments are increasing, with several 2025 pilot programs integrating resistance markers into routine diagnostics, signaling an important factor for future market development.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 1.20 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 9.4% | 2033 Value Projection: | USD 2.30 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Hologic, Roche Diagnostics, Abbott Laboratories, Becton Dickinson, Cepheid, Qiagen, Bio-Rad Laboratories, Thermo Fisher Scientific, Siemens Healthineers, Access Bio Inc. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Gonorrhea Diagnostic Market Growth Factors

Increasing government-supported screening initiatives are driving higher gonorrhea diagnostic testing volumes worldwide, particularly in regions with high STI prevalence. For example, Latin America experienced a 28% growth in screening programs between 2024 and 2026. Technological advancements, including point-of-care molecular tests, shorten turnaround times, enhance patient management, and support broader adoption in outpatient settings. Rising antimicrobial resistance in Neisseria gonorrhoeae has created demand for advanced diagnostics capable of resistance profiling, further boosting market growth. Additionally, awareness and education programs led by NGOs and public health agencies in emerging economies are expanding market reach by reducing stigma and promoting early testing.

Gonorrhea Diagnostic Market Development

In 2025, Roche introduced an upgraded NAAT-based assay for gonorrhea that not only provides highly accurate detection but also identifies key antibiotic resistance markers. This development enables faster clinical decision-making, improves treatment outcomes, and supports antimicrobial resistance monitoring, addressing a critical challenge in gonorrhea management.

In August 2025, England launched the world’s first gonorrhoea vaccination programme, which is expected to prevent up to 100,000 cases and save the NHS millions of pounds.

Key Players

Leading Companies of the Market

Hologic

Roche Diagnostics

Abbott Laboratories

Becton Dickinson

Cepheid

Qiagen

Bio-Rad Laboratories

Thermo Fisher Scientific

Siemens Healthineers

Access Bio Inc.

Competitive strategies in the gonorrhea diagnostic market are largely driven by product innovation and strategic partnerships. In 2025, Roche introduced multiplex PCR assays that enabled simultaneous detection of gonorrhea and chlamydia, significantly improving diagnostic throughput. Building on this approach, Abbott collaborated with regional healthcare providers in Asia Pacific in 2026 to deploy rapid, affordable point-of-care tests, expanding access in decentralized and resource-limited settings and driving a 25% increase in regional market share, thereby reinforcing its competitive position.

Gonorrhea Diagnostic Market Future Outlook

The gonorrhea diagnostic market is poised for robust growth, driven by rising STI prevalence, increasing public health initiatives, and technological advancements in molecular diagnostics. Nucleic Acid Amplification Tests (NAATs) will continue to dominate, while point-of-care and multiplex testing solutions are expected to expand rapidly, improving accessibility and clinical efficiency. Growing concerns over antimicrobial resistance will fuel demand for advanced assays capable of resistance profiling. Emerging markets, particularly in Asia Pacific and Latin America, offer significant growth opportunities due to enhanced healthcare infrastructure and awareness programs. Strategic collaborations, product innovation, and decentralized testing are likely to shape the market’s future trajectory.

Gonorrhea Diagnostic Market Historical Analysis

The gonorrhea diagnostic market has experienced steady growth over the past decade, driven by increasing awareness of sexually transmitted infections (STIs) and the need for early, accurate detection. Historically, culture-based tests and enzyme immunoassays were the primary diagnostic methods, valued for their reliability but limited by longer processing times and lower sensitivity. The adoption of Nucleic Acid Amplification Tests (NAATs) in the early 2010s marked a significant shift, offering higher sensitivity, specificity, and faster turnaround times, which gradually replaced traditional methods in hospitals and diagnostic laboratories. Public health initiatives and expanding STI screening programs further supported market expansion during this period.

Sources

Primary Research Interviews:

Infectious Disease Specialists

Clinical Microbiologists

Hospital Laboratory Directors

Diagnostic Device Manufacturers

Public Health Officials

Databases:

World Health Organization (WHO) Global Health Observatory

European Centre for Disease Prevention and Control (ECDC)

Global Burden of Disease (GBD) Database

Magazines:

Medical Design & Outsourcing

Diagnostic and Laboratory Medicine

Clinical Laboratory News

HealthTech Magazine

Medical Device Network

Journals:

Journal of Clinical Microbiology

Sexually Transmitted Infections Journal

Clinical Infectious Diseases

International Journal of STD & AIDS

Newspapers:

The New York Times (Health)

The Guardian (Health)

Financial Times (Healthcare)

The Hindu (Health)

Reuters Health

Associations:

World Health Organization (WHO)

Centers for Disease Control and Prevention (CDC)

International Society for Sexually Transmitted Diseases Research (ISSTDR)

European Centre for Disease Prevention and Control (ECDC)

American Sexual Health Association (ASHA)

Share

Share

About Author

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients