Alkaline Proteases Market Size and Forecast – 2026 – 2033

The Global Alkaline Proteases Market size is estimated to be valued at USD 1.82 billion in 2026 and is expected to reach USD 3.46 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 9.4% from 2026 to 2033.

Global Alkaline Proteases Market Overview

Alkaline proteases are enzyme products that catalyze the breakdown of proteins under alkaline conditions. These enzymes are produced through microbial fermentation and supplied in liquid or powdered form. Alkaline proteases are widely used in detergents, food processing, leather treatment, pharmaceuticals, and biotechnology applications. Their ability to function at high pH and temperature makes them highly effective in industrial processes. Product performance depends on enzyme stability, activity level, and purity.

Key Takeaways

The Detergent application segment dominates the market, accounting for over 38% of market revenue due to increasing demand for sustainable cleaning solutions, with recent innovations enabling enzymes to operate effectively in cold-water formulations.

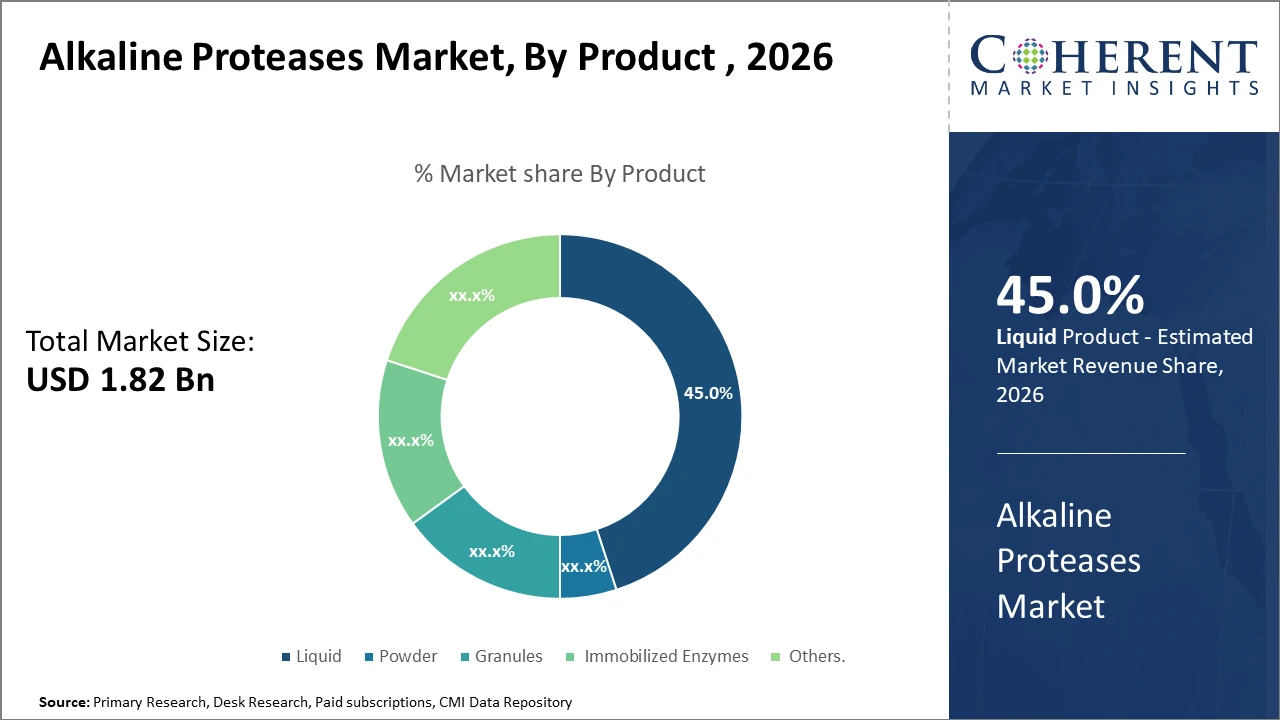

The Liquid product subsegment holds 45% market share, leading due to ease of formulation and higher enzyme stability compared to powders.

The Food & Beverages sector is the fastest-growing application, witnessing double-digit CAGR driven by enzyme applications in protein hydrolysis and flavor enhancement.

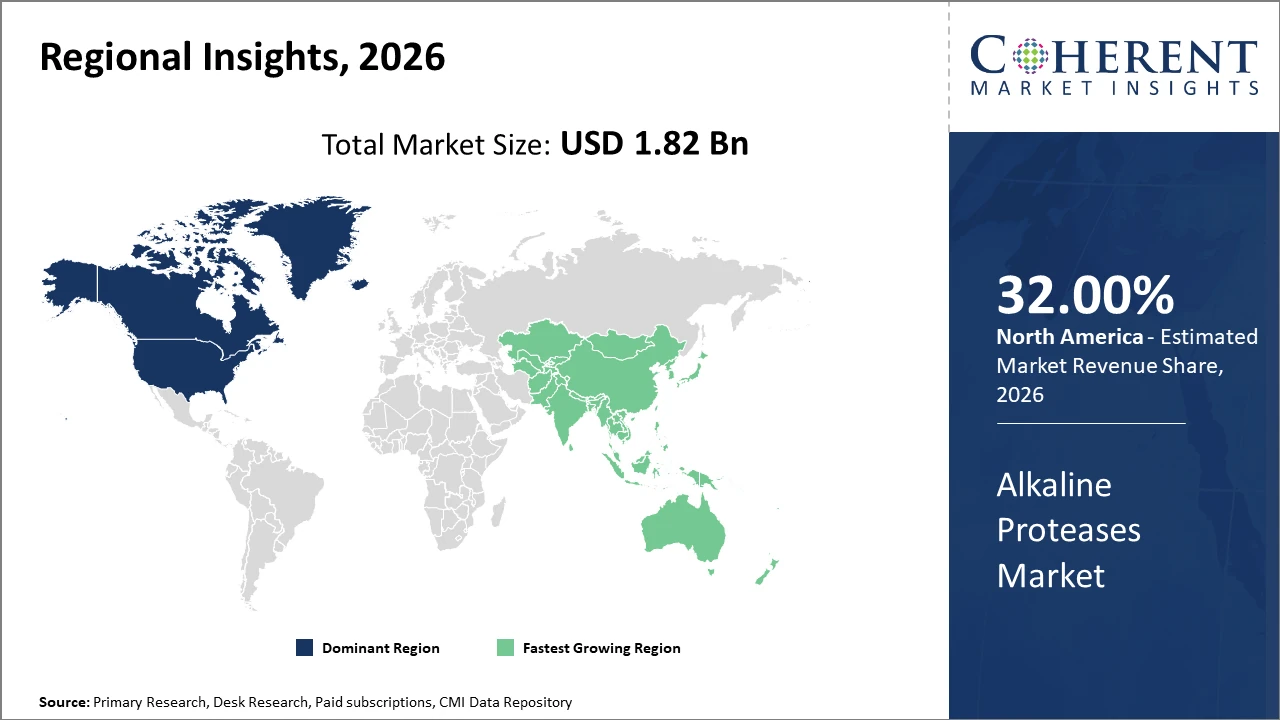

Regionally, North America leads market share by 32%, buoyed by strong pharmaceutical and household care industries investing in enzyme technology.

Conversely, Asia Pacific represents the fastest-growing regional market, propelled by aggressive enzyme adoption in detergents and expanding industrial enzyme manufacturing infrastructure across China and India.

Europe's mature market reflects steady demand driven by environmental policy mandates supporting bio-based products, while Latin America and MEA show emerging opportunities despite infrastructural challenges.

Alkaline Proteases Market Segmentation Analysis

To learn more about this report, Download Free Sample

Alkaline Proteases Market Insights, By Product Type

The liquid segment dominates the market share with 45%. The Liquids dominate primarily due to their enhanced stability and versatility in end-use formulations, facilitating consistent enzymatic activity in detergents and pharmaceuticals. The fastest-growing subsegment is Immobilized Enzymes, propelled by demand in industrial processes requiring enzyme reuse and cost efficiencies, offering enhanced catalytic action and operational stability. Powder remains a significant segment appreciated for its longer shelf life and ease of transportation. Granules and Others serve niche applications with a limited but stable market share.

Alkaline Proteases Market Insights, By Application

Detergents hold the largest market share at 38%, driven by the rising inclination toward biological formulations with high cleaning efficacy in household and industrial settings. Food & Beverages constitutes the fastest-growing subsegment, attributed to enzyme use in protein hydrolysis, flavor enhancement, and food preservation, backed by rising health-conscious consumer behavior and industrial demand. Pharmaceuticals leverage alkaline proteases for peptide synthesis and drug formulation, thus maintaining steady growth. Leather Processing and Textile segments represent mature markets with moderate growth, primarily due to adoption of eco-friendly processing technologies.

Alkaline Proteases Market Insights, By End-Use Industry

Household Care dominates owing to extensive use in detergents and personal care products, where enzymatic cleaning agents form a significant revenue source. Industrial Cleaning proves to be the fastest-growing segment, driven by stringent workplace hygiene standards and increasing demand for biodegradable cleaning formulations. Healthcare applications have stabilized growth due to enzyme incorporation in diagnostic kits and therapeutic agents. Agriculture and Biotechnological Research are emerging fields for alkaline proteases, supporting innovations in bio-fertilizers and molecular biology, respectively, fostering long-term industry trends.

Alkaline Proteases Market Trends

The market is being shaped by enzyme bioengineering advancements and sustainability compliance trends.

The shift toward recombinant enzyme variants offering superior performance under extreme alkaline conditions is evident, with 2025 seeing over 15 new patents filed globally in this domain.

Furthermore, rising consumer demand for eco-friendly detergents integrating biodegradable alkaline proteases has translated to increased R&D investments, particularly in North America and Europe, fostering innovative product launches.

Regional trends reflect North America’s dominance with a market share exceeding 32%, driven by extensive pharmaceutical applications and stringent environmental regulations that accelerate enzyme adoption.

The Asia Pacific region stands out for the fastest market growth with a CAGR approximating 11.2%, fueled by industrial expansion, government incentives on biotechnology, and mounting industrial cleaning needs.

Notably, China's investments in enzyme manufacturing hubs and India’s rising detergent industry consumption substantiate this growth narrative.

Alkaline Proteases Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Alkaline Proteases Market Analysis and Trends

In North America, the dominance in the market is underscored by the presence of mature biotechnological infrastructure, stringent environmental norms advocating enzymatic cleaning agents, and robust pharmaceutical manufacturing activities. The region commanded over 32% of the global market share in 2026. Leading market companies such as Novozymes A/S and DSM have spearheaded technological advances, introducing high-purity alkaline proteases tailored for medical and household applications, reinforcing competitive positioning. Government incentives favoring green technology adoption also positively influence market dynamics.

Asia Pacific Alkaline Proteases Market Analysis and Trends

Meanwhile, the Asia Pacific exhibits the fastest growth, with a CAGR surpassing 11.2%, catalyzed by expanding detergent and food processing industries, increasing production capacities, and rapid urbanization. Countries like China and India benefit from favorable trade policies, lower manufacturing costs, and growing consumer awareness of eco-friendly products. In these countries, companies such as Advanced Enzymes Technologies Ltd. and Shanghai Biochemical Technology Co. capitalize on localized production and distribution networks to tap into rising domestic demand.

Alkaline Proteases Market Outlook for Key Countries

USA Alkaline Proteases Market Analysis and Trends

The USA's market forms a cornerstone for global enzyme innovation, with sustained investments in enzyme bioengineering and green chemistry. The country accounts for nearly one-third of the North American market share, supported by strong pharmaceutical and detergent industries. Notable corporate players such as DuPont and BASF SE leverage advanced R&D centers and collaborations with universities to optimize enzyme functionality. Additionally, the nation’s regulatory regime that rewards sustainable bio-products propels adoption, contributing to a projected 8% annual revenue increase through 2026.

India Alkaline Proteases Market Analysis and Trends

India's market is characterized by rapid industrialization and growth in the detergent and food processing sectors, making it one of the fastest-evolving markets in Asia Pacific. Local industry leaders, including Advanced Enzymes Technologies Ltd. and Laba Biotech, have expanded manufacturing facilities to meet increasing domestic and export demands. The Indian government's biotechnology promotion schemes and favorable import-export regulations support enhanced enzyme innovation and competitive pricing. These factors collectively enable India to sustain a double-digit market growth trajectory while influencing global enzyme supply chains.

Analyst Opinion

Advancements in production capacity and fermentation technologies continue to set supply-side dynamics influencing market share. In 2024 alone, several biotechnological innovations contributed to a 12% increase in enzyme yield per batch, directly impacting market revenue and availability. Such enhanced capacity has led to pricing stabilization despite raw material cost fluctuations.

Demand-side indicators highlight the expanding imports of alkaline proteases, particularly in rapidly industrializing nations. For instance, India recorded a 15% import increase in alkaline proteases in early 2025, driven predominantly by rising pharmaceutical and detergent manufacturing activities. Varied use cases across food, textile, and leather industries further diversify revenue streams, expanding market scope significantly.

Pricing strategies across various geographies indicate a fragmented market, with pricing premiums observed in North America due to stringent quality standards. In 2024, North American producers introduced value-based pricing models reflective of eco-friendly formulations, demonstrating higher profitability and reinforcing industry share in premium product segments.

Nano-scale applications of alkaline proteases in bio-cleaning agents and personal care have emerged as potent market drivers. In 2025, over 8% of the market revenue was attributed to nano-enzyme derivatives, highlighting rising demand for specialty enzymes that exhibit enhanced catalytic efficiency and targeted bioactivity.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 1.82 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 9.4% | 2033 Value Projection: | USD 3.46 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Carlsberg Group, Jiangsu Biochemical Pharmaceuticals Co., Takasago International Corporation, Shanghai Biochemical Technology Co., Laba Biotech, Thermo Fisher Scientific, Meiji Seika Pharma Co., Henkel AG & Co. KGaA, Solvay S.A., BioCatalysts Ltd. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Alkaline Proteases Market Growth Factors

Rising environmental regulations in developed regions have accelerated adoption of bio-based detergent solutions containing alkaline proteases, which reduce chemical pollutants; this trend was manifested in Europe with over a 25% increase in bio-detergent sales in 2024. Advances in fermentation technology, including recombinant DNA techniques, have enhanced enzyme specificity and yield, reflected in a 10% growth in production efficiency globally in 2025. Expanding applications in pharmaceutical peptide synthesis have diversified market revenue, especially in North America, where a surge in biologics manufacturing prompted a 14% rise in alkaline protease demand in 2024. Lastly, growing consumer preference for sustainable and biodegradable products fosters market growth as companies shift toward enzymatic formulations, backed by a 30% surge in green enzyme patent filings in recent years.

Alkaline Proteases Market Development

In March 2023, Kemin Industries launched Kemzyme Protease in Indonesia, a multi-enzyme blend combining acid, neutral, and alkaline proteases. The product was developed for animal feed applications to enhance protein digestibility, improve feed efficiency, and reduce nitrogen waste, supporting both performance gains and environmental sustainability in livestock production.

In October 2023, DSM-Firmenich expanded its enzyme portfolio for food and bakery applications by appointing Azelis as its distributor in India. This move strengthened DSM-Firmenich’s market presence in the region, improving access to advanced enzyme solutions aimed at enhancing product quality, processing efficiency, and consistency for food manufacturers.

Key Players

Leading Companies of the Market

Carlsberg Group

Jiangsu Biochemical Pharmaceuticals Co.

Takasago International Corporation

Shanghai Biochemical Technology Co.

Laba Biotech

Thermo Fisher Scientific

Meiji Seika Pharma Co.

Henkel AG & Co. KGaA

Solvay S.A.

BioCatalysts Ltd.

Key competitive strategies include Novozymes’ launch of eco-optimized alkaline protease formulations in 2024, which delivered a 20% increase in cleaning efficiency, improving its market share in premium detergent segments. Meanwhile, DSM expanded its geographic footprint into Southeast Asia through strategic partnerships that boosted its production capacity by 18%, strengthening its hold on the Asia Pacific market. AB Enzymes pioneered immobilization techniques that enhanced enzyme reuse by over 30%, effectively lowering costs and attracting industrial clients.

Alkaline Proteases Market Future Outlook

The alkaline proteases market is expected to grow with increasing demand for sustainable and efficient industrial processes. Enzyme engineering will enhance stability and performance under extreme conditions. Growth in eco-friendly detergents and bio-based industrial solutions will support adoption. Expanding applications in pharmaceuticals and biotechnology will further diversify demand. The market will increasingly emphasize high-efficiency, low-environmental-impact enzyme solutions.

Alkaline Proteases Market Historical Analysis

The alkaline proteases market has its roots in industrial enzyme development for detergents and food processing. Initially sourced from natural organisms, early production methods lacked consistency and scalability. Advances in microbial fermentation and biotechnology enabled large-scale, cost-effective enzyme production. The detergent industry became a major driver, leveraging alkaline proteases for stain removal efficiency. Over time, applications expanded into pharmaceuticals, leather processing, and waste management. Regulatory frameworks and quality standards shaped production and formulation practices.

Sources

Primary Research Interviews:

Industrial Chemists

Enzyme Manufacturers

Detergent Formulators

Food Technologists

Process Engineers

Databases:

FAO Industrial Enzyme Reports

GlobalData Chemicals

ScienceDirect

OECD Chemical Database

Magazines:

Chemical Engineering Magazine

ICIS Chemical Business

Chemical Weekly

BioProcess International,

Industrial Enzyme News

Journals:

Enzyme and Microbial Technology

Applied Biochemistry and Biotechnology

Journal of Industrial Microbiology

Biotechnology Advances

Process Biochemistry

Newspapers:

Financial Times (Chemicals)

Reuters Commodities

The Hindu BusinessLine

Economic Times (Chemicals)

Wall Street Journal (Industry)

Associations:

American Chemical Society

European Federation of Biotechnology

Biotechnology Industry Organization

Society for Industrial Microbiology

Indian Chemical Council

Share

Share

About Author

Nikhilesh Ravindra Patel is a Senior Consultant with over 8 years of consulting experience. He excels in market estimations, market insights, and identifying trends and opportunities. His deep understanding of the market dynamics and ability to pinpoint growth areas make him an invaluable asset in guiding clients toward informed business decisions. He plays a instrumental role in providing market intelligence, business intelligence, and competitive intelligence services through the reports.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients