Acetate Salt Market Size and Forecast – 2026 – 2033

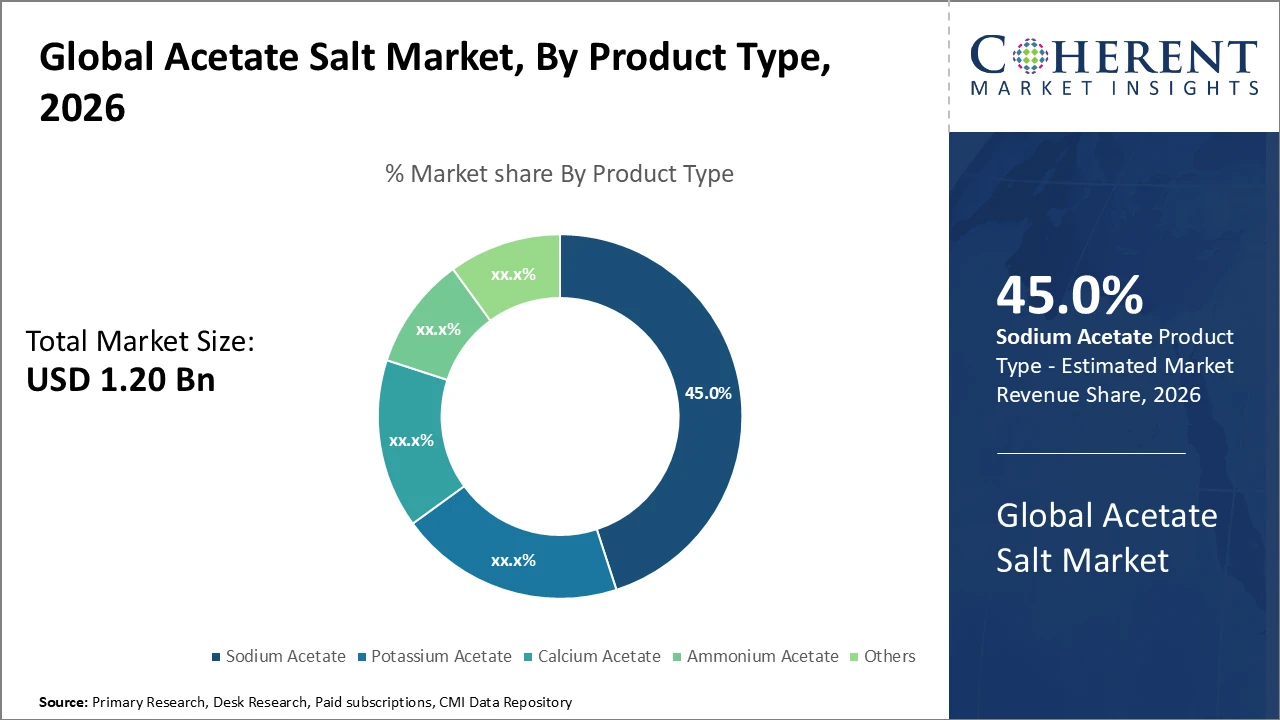

The Global Acetate Salt Market size is estimated to be valued at USD 1.20 billion in 2026 and is expected to reach USD 2.10 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 8.2% from 2026 to 2033.

Global Acetate Salt Market Overview

The acetate salt market comprises a diverse range of products, including sodium acetate, potassium acetate, calcium acetate, and ammonium acetate, each serving specific industrial and pharmaceutical applications. Sodium acetate is widely used in food preservation, textile processing, and de-icing solutions, while potassium acetate finds applications in fertilizers, animal feed, and eco-friendly de-icing agents. Calcium acetate is primarily utilized in pharmaceuticals, water treatment, and as a food additive, whereas ammonium acetate is employed in chemical synthesis, laboratory reagents, and pharmaceuticals. The versatility of these salts across multiple sectors, combined with growing demand for eco-friendly and specialty chemicals, continues to drive product adoption and market expansion.

Key Takeaways

Sodium acetate dominates the product segment with a 45% market share, driven by extensive adoption in the pharmaceutical and food industries due to its cost-efficiency and versatility.

The pharmaceutical application segment is expected to strengthen its market share further, supported by increased drug manufacturing and favorable regulatory approvals.

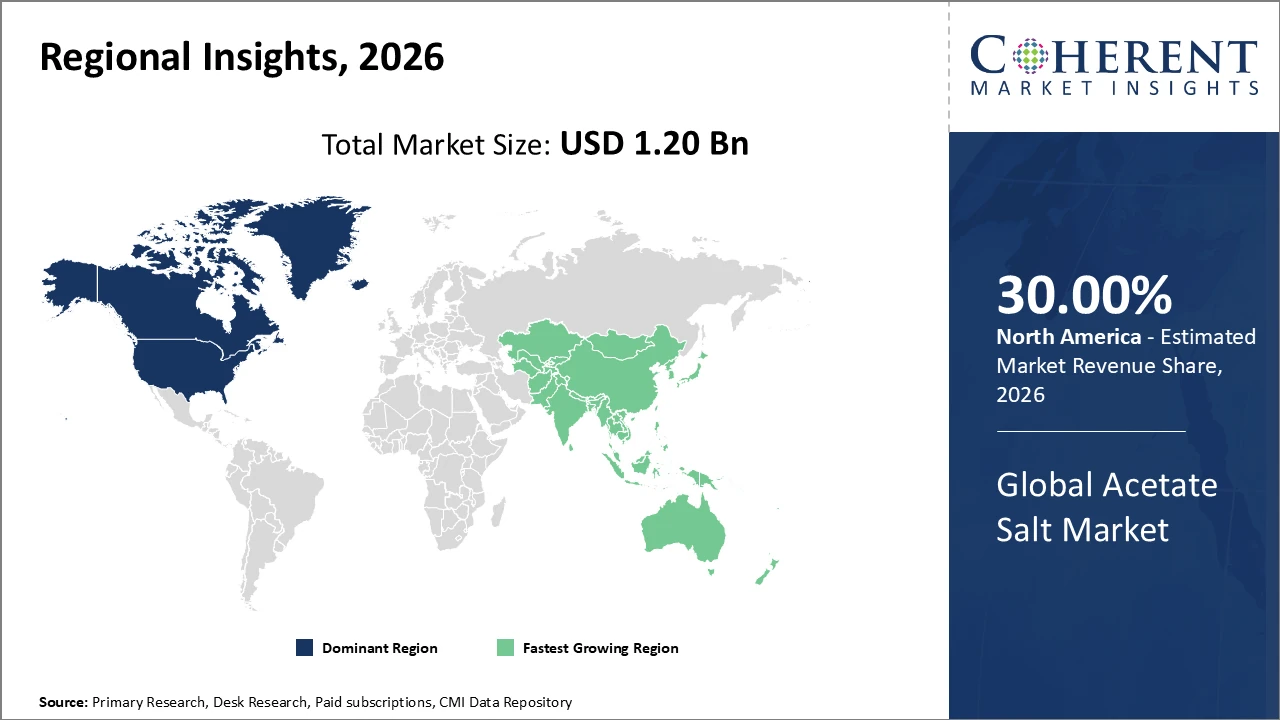

North America holds the largest regional market share, exceeding 30%, supported by strong healthcare infrastructure and active acetate salt production.

Asia Pacific exhibits the fastest CAGR, driven by expanding textile industries, rising exports, and government policies promoting chemical manufacturing.

Acetate Salt Market Segmentation Analysis

To learn more about this report, Download Free Sample

Acetate Salt Market Insights, By Product Type

Sodium acetate dominates the acetate salt market with a 45% share, driven by its extensive use in pharmaceuticals and food preservation, owing to its cost-effectiveness and chemical stability. Potassium acetate is the fastest-growing subsegment, fueled by increasing demand in de-icing fluids and as a buffering agent in medical applications, reflecting rising safety and environmental compliance requirements. Calcium acetate and ammonium acetate serve specific applications in dialysis and textile industries, contributing moderate market shares.

Acetate Salt Market Insights, By Application

The pharmaceutical segment dominates the acetate salt market, driven by their use as excipients and pH stabilizers in drug formulations, supported by rising global drug approvals and generic drug production. The food and beverages sector is the fastest-growing subsegment, fueled by increasing demand for organic and processed foods that require extended shelf life. Water treatment applications are also significant, with acetate salts used for eco-friendly water softening and corrosion control. Textile applications, while smaller in overall share, are growing due to expanding production in Asia Pacific. The ‘Others’ segment includes specialty uses such as adhesives and lubricants, supporting niche industrial demand.

Acetate Salt Market Insights, By Form

Anhydrous acetate salts dominate the market because of their stability and suitability for industrial applications that require moisture-free formulations. Trihydrate forms are the fastest-growing subsegment, driven by their adoption in pharmaceuticals and food industries, which benefit from their solubility and ease of handling. The ‘Others’ category includes specialized hydrated forms used in niche applications that demand specific chemical properties. Collectively, these product variations provide a wide market scope, allowing manufacturers to offer tailored solutions across diverse applications, from industrial processes to pharmaceuticals and food preservation, supporting overall market growth and versatility.

Acetate Salt Market Trends

In 2025, there was a strong industry shift toward biobased acetate salts, driving over 20% increase in R&D investments focused on sustainable chemistry.

Product innovation emphasizes environmentally friendly formulations, reflecting broader market commitment to sustainability.

Automation technologies have been adopted by major manufacturers, improving production efficiency and achieving 12% higher yield consistency in 2024.

Digital supply chain enhancements have reduced logistics bottlenecks, lowering lead times by nearly 10%.

These innovations and operational improvements have reduced inventory costs and reshaped market growth strategies across the acetate salt industry.

Acetate Salt Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Acetate Salt Market Analysis and Trends

North America leads the acetate salt market, driven by well-established pharmaceutical and food preservation industries, strong production capacities, and stringent regulatory enforcement ensuring quality and safety. The region accounts for over 30% of the global market share, supported by the presence of major domestic players such as BASF SE and Eastman Chemical Company. High adoption across pharmaceuticals, food processing, and industrial applications underpins steady demand. Additionally, investments in R&D, sustainable production methods, and technological innovations enhance product quality and operational efficiency. These factors collectively contribute to sustained market revenue, robust business growth, and the region’s continued dominance in the acetate salt industry.

Asia Pacific Acetate Salt Market Analysis and Trends

Asia Pacific is the fastest-growing acetate salt market, with a CAGR exceeding 9%, driven by the rapid expansion of textile manufacturing in India and China, supportive government policies, and rising exports. Increasing industrialization and infrastructure development in the region have boosted demand for acetate salts across textiles, food processing, and pharmaceuticals. Large-scale production facilities in China and India have scaled up output to meet both domestic consumption and international demand, strengthening the region’s export capabilities. Combined with favorable trade policies and investments in manufacturing technology, these factors are accelerating market growth and positioning Asia Pacific as a key driver of the global acetate salt industry.

Acetate Salt Market Outlook for Key Countries

USA Acetate Salt Market Analysis and Trends

The USA’s acetate salt market benefits from a highly advanced pharmaceutical sector, where these salts play a critical role in drug formulation and manufacturing. In 2025, pharmaceutical production value rose by 11%, coinciding with a 15% increase in domestic acetate salt consumption. Simultaneously, innovations in food preservation have expanded applications, contributing to a 10% growth in market revenue. Leading companies such as Eastman Chemical Company and BASF SE continue to drive R&D, developing specialized acetate salt variants that meet stringent regulatory standards and enhance performance. These factors collectively support sustained market growth and industry leadership in the United States.

Germany Acetate Salt Market Analysis and Trends

Germany’s acetate salt market is characterized by steady growth, driven by strong industrial and pharmaceutical demand. The country benefits from advanced chemical manufacturing infrastructure, stringent regulatory standards, and a focus on high-quality, sustainable production. Pharmaceuticals and food preservation are key application areas, supported by growing drug manufacturing and processed food industries. Industrial sectors, including textiles and water treatment, also contribute to market expansion. Innovation in biobased and specialty acetate salts, alongside automation and digital supply chain integration, is enhancing efficiency and product quality. Favorable government policies and R&D initiatives continue to promote market competitiveness and long-term growth in Germany.

Analyst Opinion

Supply-side dynamics indicate that manufacturers are expanding production capacities to meet rising demand in pharmaceutical and industrial sectors. In 2025, several plants across Asia increased output by 15%-20% year-over-year, supporting market growth through supply adequacy.

Demand is strongly driven by acetate salts’ use in food preservation, especially in perishables supply chains. In 2024, European import volumes rose 12%, fueled by the growing organic food segment, contributing to higher market revenue.

Raw material price fluctuations, particularly acetic acid, directly impact acetate salt pricing. A 5% price drop in North America in 2026 boosted product uptake by 7% among small-to-mid-size enterprises.

Exports from emerging economies such as India and China grew steadily, accounting for nearly 35% of global acetate salt trade in 2025, reinforcing global market competitiveness and business growth prospects.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 1.20 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 8.2% | 2033 Value Projection: | USD 2.10 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | BASF SE, Lanxess AG, Solvay SA, Merck KGaA, LG Chem Ltd, AkzoNobel N.V., Sanyo Chemicals Industries, Ltd., Evonik Industries AG, Eastman Chemical Company, Mitsubishi Chemical Corporation | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Acetate Salt Market Growth Factors

The acetate salt market is being driven by rising demand from the pharmaceutical sector, where their role in drug formulation and buffering capacity contributed to a 14% volume growth in 2025. Expansion in food preservation, fueled by increasing shelf-life requirements for organic and processed foods, led to a 10% year-over-year increase in acetate salt usage through 2026. Adoption in water treatment is growing due to the environmentally safer properties of acetate salts, supported by global regulatory changes in 2024 and 2025. Additionally, the developing textile industry in Asia Pacific, using acetate salts for dye fixation and fiber processing, is expected to grow at a CAGR of 9% from 2026 onwards.

Key Players

Leading Companies of the Market

BASF SE

Lanxess AG

Solvay SA

Merck KGaA

Sanyo Chemical Industries, Ltd.

LG Chem Ltd.

AkzoNobel N.V.

Evonik Industries AG

Eastman Chemical Company

Mitsubishi Chemical Corporation

Several leading market players have pursued capacity expansion and technological innovation to strengthen their market position. In 2025, BASF SE invested in advanced purification processes, improving product efficiency by 18% and driving broader industry adoption. Similarly, Celanese Corporation leveraged strategic partnerships with pharmaceutical companies to develop customized acetate salt formulations, enhancing application-specific usage and increasing end-use penetration by 20% in 2024. These strategies reflect a focus on operational excellence, product differentiation, and targeted market outreach, enabling companies to capture larger market shares while addressing evolving industry requirements and regulatory standards.

Acetate Salt Market Future Outlook

The global acetate salt market is expected to witness steady growth, driven by rising demand across pharmaceuticals, food preservation, water treatment, and textiles. Advances in biobased and specialty acetate salts, combined with increasing adoption of sustainable and eco-friendly production methods, will shape future market trends. Expanding industrialization and supportive government policies in Asia Pacific are likely to fuel regional growth, while North America and Europe maintain strong demand through established pharmaceutical and food sectors. Ongoing technological innovations, automation, and digital supply chain enhancements will improve efficiency, reduce costs, and enable tailored solutions, collectively supporting long-term market expansion and competitiveness.

Acetate Salt Market Historical Analysis

The acetate salt market has experienced steady historical growth, driven by its versatile applications across pharmaceuticals, food preservation, textiles, and industrial processes. Initially dominated by sodium and calcium acetate, the market expanded with rising demand for stable, cost-effective, and eco-friendly chemical solutions. North America and Europe led early adoption due to established chemical industries, advanced manufacturing infrastructure, and stringent quality regulations. Over time, Asia Pacific emerged as a key growth region, supported by industrialization, textile expansion, and increasing exports. Technological advancements, R&D investments, and the development of specialty and biobased acetate salts have historically strengthened market competitiveness and paved the way for future innovation.

Sources

Primary Research Interviews:

Chemical engineers and production managers

Pharmaceutical formulation specialists

Food technologists and preservation experts

Industrial chemists in textile and water treatment sectors

Supply chain and logistics managers

Databases:

Global Trade Atlas (for chemical exports/imports)

UN Comtrade Database

Magazines:

Food Processing Magazine

Chemical & Engineering News

ICIS Chemical Business

Food Processing Magazine

Pharmaceutical Technology

Journals:

Journal of Pharmaceutical Sciences

Journal of Industrial & Engineering Chemistry

Journal of Applied Polymer Science (for textile applications)

Food Chemistry Journal

Chemical Engineering Research & Design

Newspapers:

Financial Times (Chemicals & Industry)

Reuters (Commodities & Chemicals)

The Wall Street Journal (Business/Chemicals)

The Guardian (Science & Industry)

Bloomberg (Chemicals Market Reports)

Associations:

International Council of Chemical Associations (ICCA)

American Chemical Society (ACS)

European Chemical Industry Council (Cefic)

Specialty Chemical Industry Association (SCIA)

Chemical Industries Association (CIA, UK)

Share

Share

About Author

Pankaj Poddar is a seasoned market research consultant with over 12 years of extensive experience in the fast-moving consumer goods (FMCG) and plastics material industries. He holds a Master’s degree in Business Administration with specialization in Marketing from Nirma University, one of India’s reputed institutions, which has equipped him with a solid foundation in strategic marketing and consumer behavior.

As a Senior Consultant at CMI for the past three years, he has been instrumental in harnessing his comprehensive understanding of market dynamics to provide our clients with actionable insights and strategic guidance. Throughout his career, He has developed a robust expertise in several key areas, including market estimation, competitive analysis, and the identification of emerging industry trends. His approach is grounded in a commitment to understanding client needs thoroughly and fostering collaborative relationships. His dedication to excellence and innovation solidifies his role as a trusted advisor in the ever-evolving landscape of not only FMCG but also chemicals and materials markets.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients