Textile Auxiliaries Market Size and Forecast – 2025 – 2032

The Global Textile Auxiliaries Market size is estimated to be valued at USD 13.7 billion in 2025 and is expected to reach USD 20.9 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.6% from 2025 to 2032.

Global Textile Auxiliaries Market Overview

Textile auxiliaries are specialty chemical formulations essential in various stages of textile manufacturing, including pretreatment, dyeing, printing, and finishing. These products improve fiber properties, enhance color fastness, and impart specific functional characteristics such as softness, water repellency, or antimicrobial resistance. Key auxiliary categories include wetting agents, dispersants, detergents, softeners, leveling agents, and fixing agents. Technological advancements have led to the development of eco-friendly and biodegradable auxiliaries, aligning with global sustainability and wastewater reduction goals. Modern auxiliaries are tailored for high-performance fabrics and synthetic fibers, offering superior compatibility with low-liquor ratio dyeing systems and digital textile printing processes.

Key Takeaways

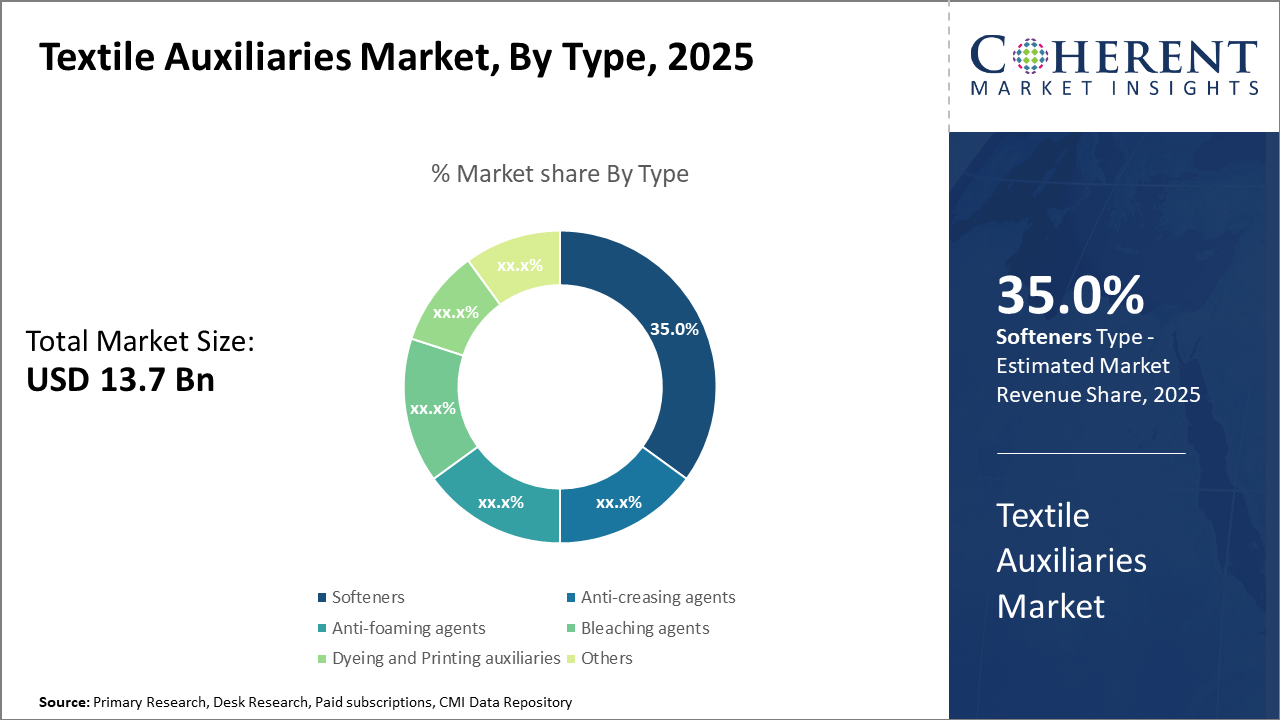

Softeners dominate the textile auxiliaries market segment with a 35% share, driven by their critical role in improving textile handle and softness

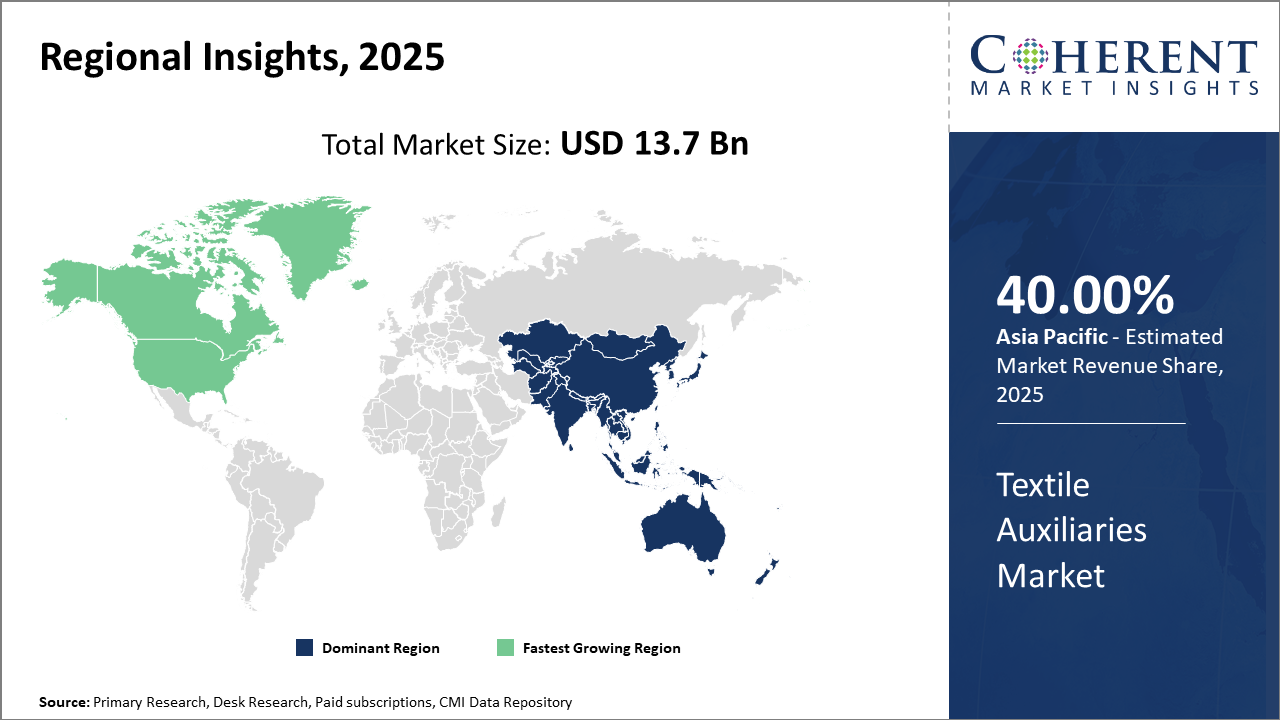

Asia Pacific dominates the overall market on account of expanding textile manufacturing bases and rising exports from countries like India and China

Textile Auxiliaries Market Segmentation Analysis

To learn more about this report, Download Free Sample

Textile Auxiliaries Market Insights, By Type

Softeners dominate the market share, representing 35%, due to their pivotal role in enhancing fabric hand feel and consumer acceptance. Their widespread compatibility with diverse textile fibers and contribution to premium quality apparel drive this segment. The fastest-growing subsegment is Dyeing and Printing auxiliaries, which are gaining traction due to expanding fashion trends demanding vibrant and durable coloration combined with eco-friendly processing. Anti-creasing agents reduce fabric wrinkling during wear and washing, thereby ensuring durability, while anti-foaming agents improve process efficiency in wet treatments.

Textile Auxiliaries Market Insights, By Application

Apparel textiles are the dominating subsegment due to rising global clothing consumption and fast fashion dynamics. The demand for improved textile surface finishes and better dyeing outcomes supports auxiliaries consumption in this segment. Industrial/technical textiles represent the fastest-growing subsegment, fueled by growing adoption in automotive, medical, and protective gear applications, where textile auxiliaries enhance performance attributes such as durability and resistance. Home textiles benefit from auxiliaries that improve fabric softness and longevity.

Textile Auxiliaries Market Insights, By Function

Finishing auxiliaries dominate the market as they impart critical properties like water repellency, anti-microbial effects, and wrinkle resistance, contributing significantly to perceived product value and industry revenue. Pre-treatment agents play a foundational role in preparing textile substrates for subsequent processing, ensuring quality output. Dyeing auxiliaries facilitate even coloration and fastness, which is increasingly vital with expanding diversified fiber blends and vibrant color demand.

Textile Auxiliaries Market Trends

Recent advances in biodegradable and enzymatic auxiliaries underline the thrust towards sustainability, with many manufacturers reducing chemical footprints by replacing synthetic auxiliaries.

For example, some Asian producers reported a 25% reduction in water usage due to the adoption of enzymatic pre-treatment aids in 2025.

Furthermore, digitalization of auxiliaries in dyeing and finishing is increasing process efficiencies and reducing defects, highlighted by European textile processors achieving 15% waste reduction through AI-enabled controls.

Textile Auxiliaries Market Insights, By Geography

To learn more about this report, Download Free Sample

Asia Pacific Textile Auxiliaries Market Analysis and Trends

In the Asia Pacific region, the dominance in the Textile Auxiliaries market is attributed to the region’s expansive textile manufacturing ecosystem and rising exports, primarily driven by China and India. The region accounts for over 40% of the global industry share due to robust investments in production capacity and escalating demand from apparel and technical textile segments. Government initiatives promoting sustainability and industrial advancement further bolster market growth.

North America Textile Auxiliaries Market Analysis and Trends

Meanwhile, North America exhibits the fastest growth trajectory with a CAGR outpacing other regions, underpinned by stringent environmental regulations and greater adoption of sustainable auxiliaries. Advanced textile finishing industries and rising product innovations led by key U.S. companies augment this expansion.

Textile Auxiliaries Market Outlook for Key Countries

USA Textile Auxiliaries Market Analysis and Trends

The USA's market showcases a robust framework influenced by regulatory frameworks emphasizing reduced chemical emissions in textile processing. Leading companies focusing on sustainable auxiliaries and digital technologies have driven considerable innovations. In 2024, approximately 45% of U.S. textile auxiliaries revenue arose from bio-based and specialty auxiliaries, signaling industry readiness for future environmental compliance. Research partnerships between manufacturers and end-users have accelerated tailored auxiliary solutions, strengthening overall business growth.

India Textile Auxiliaries Market Analysis and Trends

India’s textile auxiliaries market continues to expand swiftly, supported by increasing textile exports and government incentives promoting textile modernization under schemes like the Production Linked Incentive (PLI). The surge in demand for softeners and dyeing auxiliaries stems from the dominant apparel sector, comprising over 55% of total auxiliaries consumption. Local production capabilities have increased, with companies investing in eco-friendly auxiliaries to meet export compliance, resulting in a marked rise in India’s market share within the Asia Pacific region.

Analyst Opinion

Increasing adoption of bio-based and environmentally friendly textile auxiliaries is a pivotal growth driver. For instance, the usage of enzymatic auxiliaries has escalated by nearly 18% year-on-year in 2024, reflecting growing compliance with global sustainability standards such as REACH and EPA. This shift is instrumental in augmenting market revenue by catering to eco-conscious end users.

Supply chain optimization through advanced manufacturing processes is boosting production efficiency. Textile auxiliaries manufacturing capacity rose by 12% in the Asia Pacific in early 2025, largely credited to automation and the adoption of Industry 4.0 technologies. This capacity expansion is contributing significantly to market share gains in key industrial hubs.

Demand diversification across end-use industries like technical textiles and home furnishings is reshaping market dynamics. Technical textiles’ consumption of specialty auxiliaries saw a 14% increase in 2024, underpinned by rising demands in automotive and medical textile applications, thereby opening new avenues for market players to broaden their client base and increase penetration.

Pricing strategies aligned with volatile raw material costs have been critical for market players. In 2024, fluctuations in petrochemical derivatives led to a 7% price variation across the auxiliaries product range, compelling manufacturers to innovate on cost-efficiency to retain profitability without compromising quality, which in turn influenced overall industry trends.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 13.7 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 6.6% | 2032 Value Projection: |

USD 20.9 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Clariant AG, Huntsman Corporation, Archroma Management LLC, BASF SE, Dow Inc., Songwon Industrial Co., Ltd., N.S. International, Dystar, Pulcra Chemicals GmbH, LANXESS AG, Zschimmer & Schwarz GmbH & Co KG, Huntsman Textile Effects. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Textile Auxiliaries Market Growth Factors

The surge in demand for sustainable textile auxiliaries is driven by stringent environmental regulations and growing consumer awareness of eco-friendly products. Recent data indicate a 22% year-over-year growth in demand for bio-based auxiliaries in 2024. Expansion in technical textiles applications, including automotive and medical sectors, is another primary growth driver, with technical textiles accounting for approximately 28% growth in auxiliary consumption. Additionally, rapid growth in the apparel sector, especially in emerging economies like India and China, is propelling auxiliary demand due to increasing textile processing activities. Lastly, enhanced R&D investments fostering novel formulations for durability and multi-functionality are fueling product innovations that directly contribute to market revenue and share growth.

Textile Auxiliaries Market Development

In April 2024, Archroma introduced a highly sustainable, durable water repellent (DWR) specifically designed for outerwear and apparel fabrics, offering enhanced softness, durability, and environmental performance. Formulated with non-fluorinated, bio-based ingredients, the new DWR technology provides long-lasting water protection while maintaining the comfort and feel of natural fabrics. This launch reinforces Archroma’s leadership in eco-conscious textile chemistry, supporting the industry’s transition toward PFAS-free and sustainable performance finishes.

In August 2023, Huntsman partnered with local textile manufacturers in Vietnam to pilot its latest eco-enzymatic bleaching agents, marking a step forward in sustainable textile processing. The pilot aimed to demonstrate significant reductions in water and energy consumption while maintaining fabric whiteness and quality, aligning with Huntsman’s broader vision for eco-efficient, biotechnology-driven textile innovations.

Key Players

Leading Companies of the Market

Clariant AG

Huntsman Corporation

Archroma Management LLC

BASF SE

Dow Inc.

Songwon Industrial Co., Ltd.

N.S. International

Dystar

Pulcra Chemicals GmbH

LANXESS AG

Zschimmer & Schwarz GmbH & Co KG

Huntsman Textile Effects

Several leading companies have adopted integrated growth strategies combining sustainable product innovation and strategic acquisitions to enhance global reach. For example, after launching a new line of biodegradable textile auxiliaries in 2024, a leading chemical company expanded its market penetration across Europe, resulting in a 9% uplift in regional revenue. Another key player’s collaborative approach with textile manufacturers to customize auxiliaries not only improved client retention but also accelerated adoption by 15% in the Asia Pacific region.

Textile Auxiliaries Market Future Outlook

The textile auxiliaries market is poised for continued expansion driven by innovation, sustainability mandates, and advancements in fabric technology. The rise of functional and smart textiles, including antimicrobial, moisture-wicking, and flame-retardant fabrics, is expanding the demand for specialty auxiliaries. The integration of nanotechnology and enzyme-based formulations will redefine fabric treatment efficiency while reducing water and energy consumption. As textile production increasingly shifts toward circular models, eco-certified and biodegradable auxiliaries are expected to become the industry standard. Asia-Pacific will continue to dominate production, while European and North American markets focus on high-value functional textiles and digital printing auxiliaries. Overall, sustainability and performance optimization will shape the next generation of textile chemistry.

Textile Auxiliaries Market Historical Analysis

The market has grown alongside the expansion of global textile manufacturing and finishing technologies. Initially dominated by traditional chemical-based agents for dyeing and finishing, the market underwent a significant transformation in the 1980s and 1990s with the rise of synthetic fibers and eco-conscious textile processing. Manufacturers began focusing on enhancing performance while minimizing environmental damage, leading to the adoption of low-toxicity surfactants, biodegradable emulsifiers, and nonionic softeners. Growth in textile hubs such as China, India, and Bangladesh spurred the development of localized auxiliary production, while European companies led innovation in sustainable chemistry. Regulatory pressures from REACH and the EPA accelerated the transition to safer, more efficient formulations.

Sources

Primary Research Interviews:

Textile Chemists

Fabric Technologists

Sustainability Officers

Dyeing Process Engineers

Databases:

Textile Exchange Data Hub

Statista Textiles

WTO Trade Data

UNIDO Industrial Statistics

Magazines:

Textile World

Fibre2Fashion

Technical Textile Review

Textile Today

Journals:

Journal of Textile Engineering

Coloration Technology

Textile Research Journal

Dyes and Pigments

Newspapers:

The Times of India (Industry

The Guardian Sustainable Business

Business Standard Manufacturing

Financial Times Markets

Associations:

International Textile Manufacturers Federation (ITMF)

American Association of Textile Chemists and Colorists (AATCC)

European Textile Services Association (ETSA)

The Textile Institute

Share

Share

About Author

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients