Still Wine Market Size and Forecast – 2025 – 2032

The Global Still Wine Market size is estimated to be valued at USD 42.5 billion in 2025 and is expected to reach USD 65.3 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.1% from 2025 to 2032.

Global Still Wine Market Overview

Still wines are alcoholic beverages produced by fermenting grape juice without carbonation, offering a wide range of varietals, blends, and vintages. The products are characterized by their flavor profile, body, acidity, and aging potential, depending on grape type, terroir, and winemaking techniques. Bottled in glass with specific closures such as cork or screw caps, still wines include red, white, and rosé varieties, often packaged in different sizes from single servings to magnums. Specialty lines may include organic, biodynamic, or sulfite-free options for niche consumer preferences.

Key Takeaways

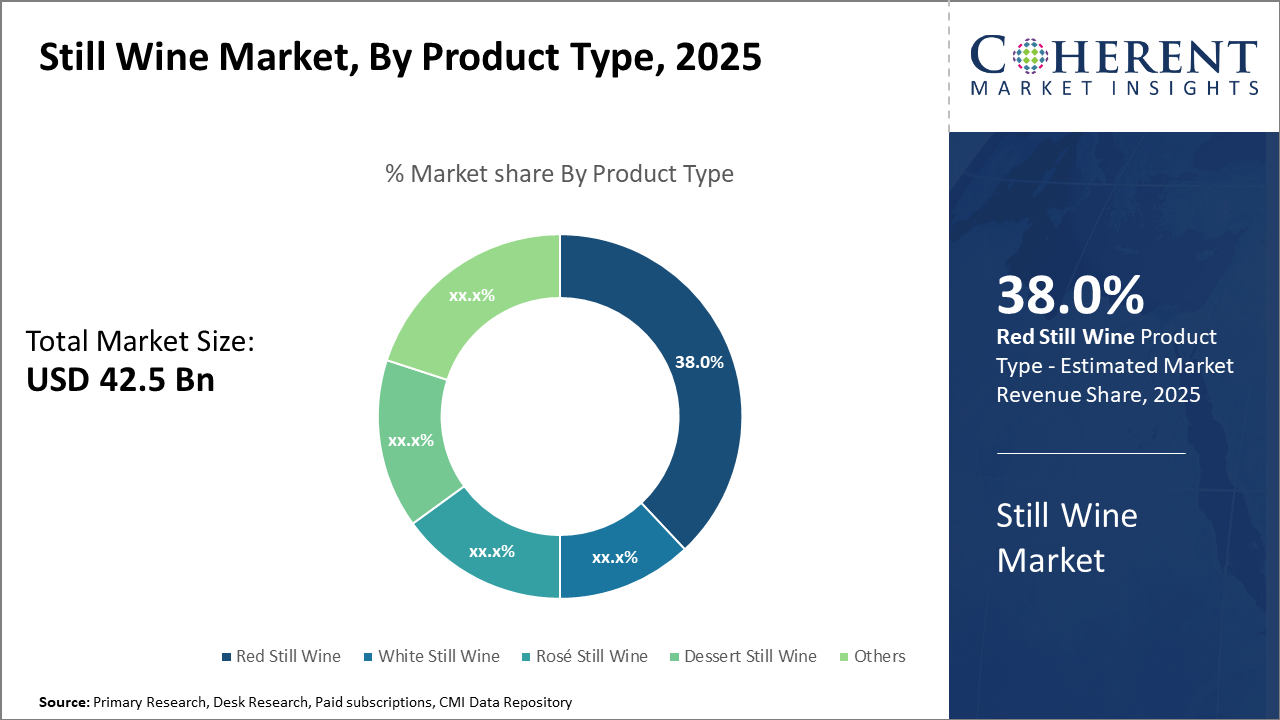

The Red Still Wine segment dominates with 38% market share, driven by consistent consumer preference for full-bodied varieties such as Cabernet Sauvignon and Merlot, reflecting strong business growth in traditional markets.

Bottled Wine remains the leading packaging format due to its premium positioning and consumer appeal in on-trade channels, accounting for over 60% of packaging market revenue.

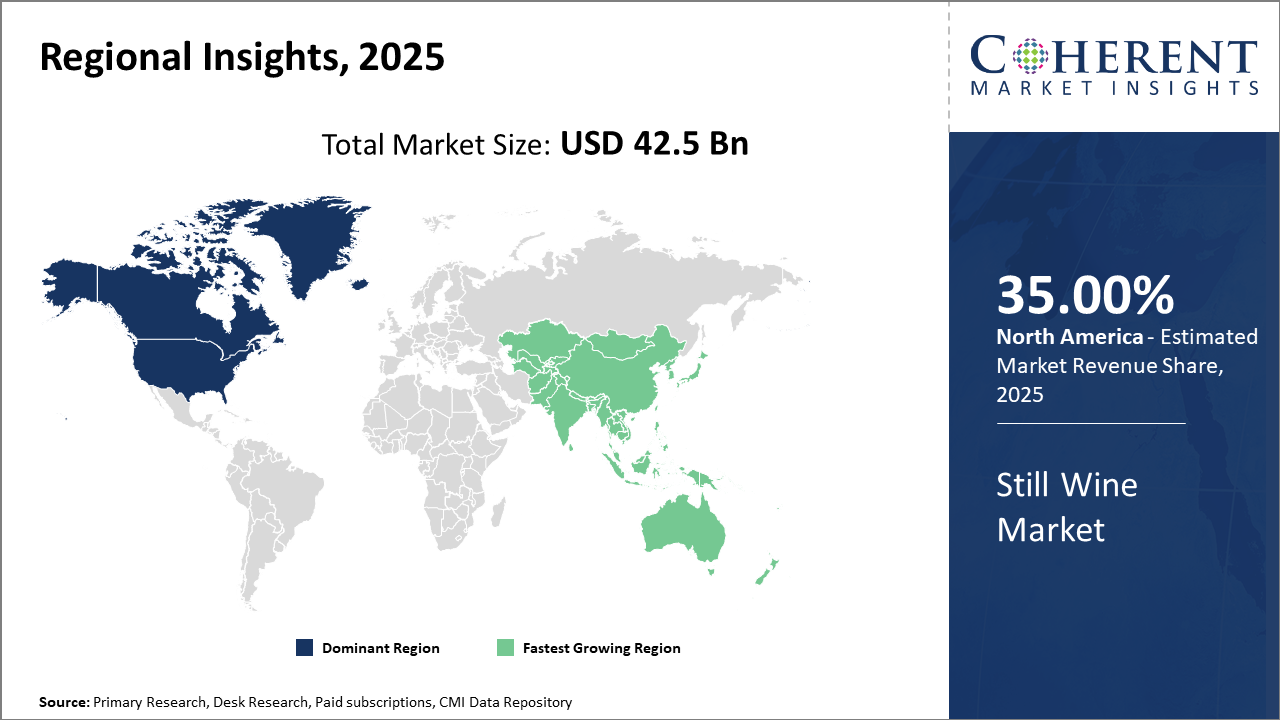

North America leads regional industry size with steady growth supported by expanding premium wine consumption and robust direct-to-consumer infrastructure.

Asia Pacific represents the fastest-growing regional market, exhibiting a CAGR of approximately 8%, attributed to increasing wine imports, evolving consumer taste, and expanding urban middle-class demographics.

Still Wine Market Segmentation Analysis

To learn more about this report, Download Free Sample

Still Wine Market Insights, By Product Type

Red Still Wine dominates the market share at 38%. The dominance is driven by its widespread popularity, particularly varieties like Cabernet Sauvignon and Merlot, known for full-bodied flavor profiles, which resonate with traditional and premium consumer segments. Red Still Wine also benefits from deep-rooted cultural associations in major wine-producing countries, supporting sustained demand. The fastest growing subsegment is Rosé Still Wine, which has gained traction among millennial and Gen Z consumers for its versatility and appeal in casual and premium settings, posting a double-digit growth rate in recent years.

Still Wine Market Insights, By Packaging

Bottled Wine remains the dominant segment due to its premium image and established consumer acceptance, commanding over 60% of the packaging segment’s revenue. Bottles are favored in on-trade sales and gifting scenarios, supporting business growth in traditional retail channels. However, Canned Wine represents the fastest growing subsegment, increasingly popular among younger demographics for its convenience and environmental benefits, expanding rapidly in urban markets.

Still Wine Market Insights, By Distribution Channel

Off-trade holds the dominant market share, driven by widespread retail penetration, including supermarkets and specialty wine stores, accounting for approximately 55% of sales. This distribution channel benefits from evolving consumer purchasing habits and convenience. Meanwhile, Direct-to-consumer is the fastest-growing channel, propelled by rapid growth in online wine sales, personalized marketing, and subscription models. This channel helps market players enhance margins and access broader demographics.

Still Wine Market Trends

The still wine market’s evolving trends emphasize consumer preference shifts toward authenticity, sustainability, and premiumization.

For instance, the organic still wine segment recorded a 14% increase in sales across Europe in 2024, driven by stricter environmental regulations and consumer consciousness.

Additionally, technology integration in vineyard management, such as AI-driven yield prediction, is improving resource efficiency and product consistency, vital for long-term market sustainability.

Sustainability initiatives also include water management and carbon footprint reduction, notably led by European producers aiming for carbon-neutral vineyards by 2030.

These trends reflect a broader market shift focusing on quality, environmental stewardship, and consumer engagement.

Still Wine Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Still Wine Market Analysis and Trends

In North America, the predominance in the Still Wine market is underpinned by a mature consumer base with high purchasing power and prevalent premiumization trends. The region accounted for over 35% of the total market share in 2025. The U.S., in particular, is a hotspot for consumer adoption of premium still wines coupled with a robust e-commerce infrastructure supporting direct-to-consumer sales.

Asia Pacific Still Wine Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth, with an expected CAGR of 8% over the forecast period, spurred by expanding urban middle classes and rising disposable incomes in China and India. Increased import of still wines, especially from South America and Europe, fuels widespread urban acceptance and experimentation with wine varieties. Government initiatives promoting wine tourism and consumption further elevate this region’s market ecosystem.

Still Wine Market Outlook for Key Countries

USA Still Wine Market Analysis and Trends

The U.S. wine market is characterized by steady growth in premium and organic product segments. In 2024, premium still wine sales grew by 8.5%, supported by strong demand in on-trade venues and growing e-commerce sales, which rose by nearly 22%. Leading players have invested in digital marketing platforms and sustainable viticulture practices to align with consumer preferences. High disposable income and the presence of multiple grape varietal producing regions, such as California and Oregon, reinforce the USA’s leading role globally.

China Still Wine Market Analysis and Trends

China’s still wine market is rapidly expanding due to rising wine consumption per capita and shifts toward Western lifestyle adoption. Import volumes increased 14% in 2025, with younger consumers driving demand for innovative varietals and product labeling transparency. Domestic production emphasizes hybrid and climate-resilient grapes to meet local tastes. Strategic collaborations between local distributors and international producers have bolstered market presence, fostering business growth and reinforcing China’s standing as a priority growth market.

Analyst Opinion

The rising adoption of premium and super-premium still wines is a pivotal market growth driver, with these segments collectively accounting for over 45% of market revenue in 2024. Recent data shows that in the U.S., premium still wine sales surged by 8.5% year-over-year in 2024, reflecting growing consumer willingness to invest in quality over quantity.

From a supply-side perspective, enhancements in viticulture technology, such as precision irrigation and pest monitoring, have increased production efficiency by approximately 12% globally in 2024. This efficiency boost has contributed to stabilizing prices despite escalating demand, supporting healthier margins for market players.

Regionally, Asia Pacific’s still wine import volume climbed by 14% in 2025, driven primarily by expanding middle-class demographics in China and India, who are embracing wine as a lifestyle beverage. This demand shift impacts the global trade flows, with South American producers increasingly targeting these markets.

Nano-market indicators highlight a rising trend in organic and biodynamic still wines, which captured nearly 18% of the new product launches globally in 2025. This movement is propelled by consumer health consciousness and environmental concerns, marking a key market dynamic influencing product development and market segmentation.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 42.5 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 6.1% | 2032 Value Projection: | USD 65.3 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Constellation Brands Inc., E. & J. Gallo Winery, Treasury Wine Estates, Viña Concha y Toro S.A., Pernod Ricard SA, The Wine Group LLC, Castel Frères, Accolade Wines, Jackson Family Wines, LVMH Moët Hennessy Louis Vuitton SE, Pernod Ricard USA, Grupo Peñaflor, Hardy Wine Company. | ||

|

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Still Wine Market Growth Factors

The rising global disposable income, particularly in emerging markets, is a prime driver of still wine market revenue growth. The premium and super-premium wine segments are especially benefiting from this economic uplift. Secondly, increasing health awareness has led to demand for organic, sulfite-free, and natural still wines, with organic wine consumption growing by over 12% globally in 2024. Thirdly, the expansion of e-commerce platforms and digital marketing strategies has boosted market penetration, with online sales of still wine increasing 18% worldwide in 2025. Lastly, growing wine tourism and experiential marketing in Europe and North America continue to enhance consumer engagement, pushing market companies to innovate with unique varietals and packaging solutions that meet regional taste preferences.

Still Wine Market Development

In August 2025, The Wine Group (TWG) launched alcohol-removed Sauvignon Blanc and flavored still wines to attract younger consumers with lighter, refreshing options. These products are part of a larger strategy to capture evolving "wine for all occasions" trends, featuring vibrant packaging, sustainable bottling, and flavor-forward profiles. This initiative marks a significant step toward inclusivity and innovation within the still wine market.

In October 2025, the Victorian Government in Australia launched its Five-Year Wine Strategy (2025–2030) to accelerate innovation, global trade, and sustainable production across its wine regions. The plan emphasizes investment in premium still wine exports, tourism integration, and workforce training to strengthen Victoria’s position as a high-value wine producer on the world stage.

Key Players

Leading Companies of the Market

Constellation Brands Inc.

E. & J. Gallo Winery

Treasury Wine Estates

Viña Concha y Toro S.A.

Pernod Ricard SA

The Wine Group LLC

Castel Frères

Accolade Wines

Jackson Family Wines

LVMH Moët Hennessy Louis Vuitton SE

Pernod Ricard USA

Grupo Peñaflor

Hardy Wine Company

Several leading market companies have adopted aggressive growth strategies, including market diversification, premiumization, and strategic acquisitions. For example, Treasury Wine Estates expanded its premium portfolio by acquiring high-growth boutique wineries in Australia in 2024, resulting in a reported 15% increase in market share within the luxury segment. Pernod Ricard’s digital transformation initiatives enhanced direct-to-consumer sales by 20% in North America during 2025, exemplifying innovative go-to-market strategies fueling business growth.

Still Wine Market Future Outlook

In the years ahead, the still wine market is poised for continued diversification, with sustainability, authenticity, and quality taking center stage. Consumer interest is shifting toward organic, biodynamic, and low-sulfite wines, reflecting health and environmental awareness. Premiumization is another defining trend, as consumers seek artisanal wines with distinctive provenance and storytelling value. The digitalization of wine sales, including online retail platforms and subscription-based wine clubs, is also expected to redefine product accessibility and customer engagement. Global wine tourism and educational marketing initiatives will further strengthen brand loyalty and expand the appeal of still wine among younger generations.

Still Wine Market Historical Analysis

Still wine has one of the oldest histories among alcoholic beverages, tracing back thousands of years to ancient civilizations that cultivated grapes for fermentation. For much of history, wine production remained a local, artisanal practice, with regional traditions influencing grape varietals and fermentation techniques. Industrial advancements in bottling, storage, and transportation transformed winemaking into a globalized industry, enabling widespread distribution and standardization of quality. The late 20th century brought the modernization of vineyards, with technological improvements in temperature control, filtration, and blending, which enhanced flavor precision and consistency. The growing culture of fine dining and social consumption also expanded the role of still wine in lifestyle and celebration.

Sources

Primary Research interviews:

Winemakers

Oenologists

Vineyard Managers

Wine Merchants/Retail Buyers

Databases:

OIV (International Organization of Vine and Wine) Statistics

Vinexpo / IWSR Wine Data

Statista Wine & Spirits Database

GlobalData Beverage Reports

Magazines:

Decanter

Wine Spectator

Wine Enthusiast

Drinks International

Journals:

American Journal of Enology and Viticulture

Journal of Wine Research

Food Chemistry (enology sections)

Journal of Agricultural and Food Chemistry

Newspapers:

The New York Times (Wine & Dining)

The Guardian (Food & Drink)

The Times (Food & Drink)

Financial Times (Life & Arts / Wine)

Associations:

International Organization of Vine and Wine (OIV)

Wine & Spirit Trade Association (WSTA)

American Wine Society

European Winegrowers Associations

Share

Share

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients