Starter Feed Market Size and Forecast – 2025 – 2032

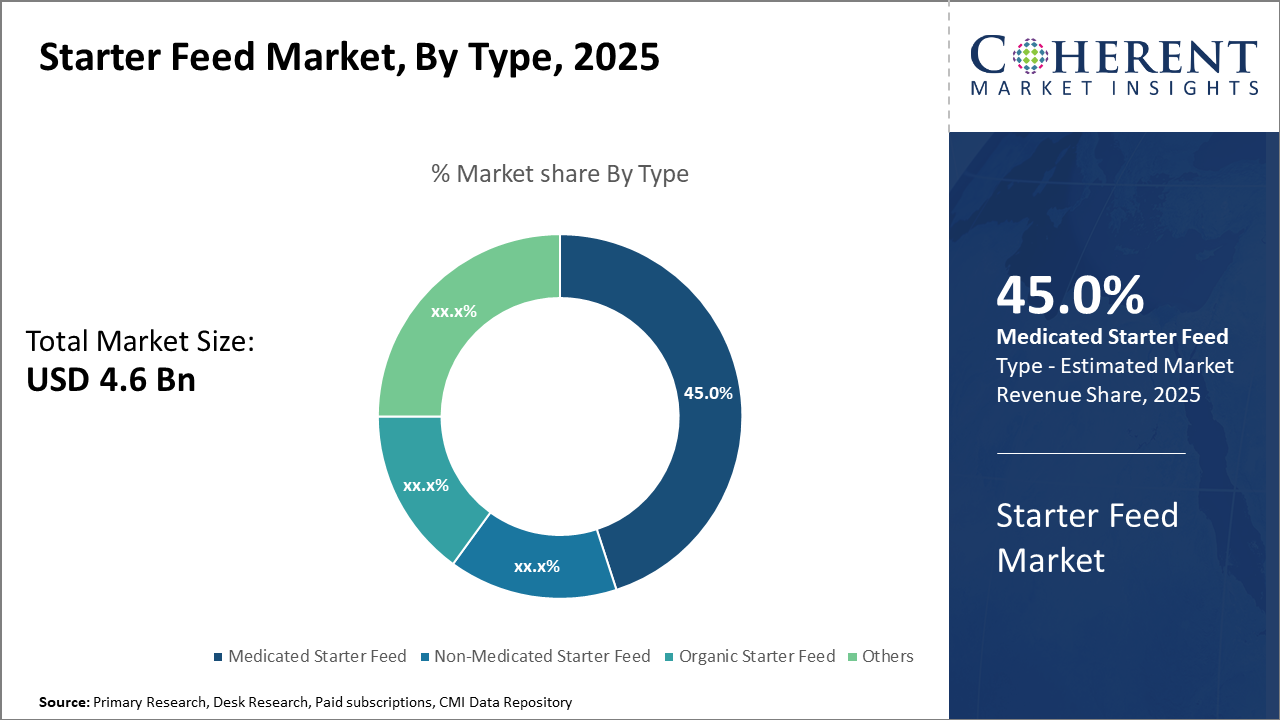

The Global Starter Feed Market size is estimated to be valued at USD 4.6 billion in 2025 and is expected to reach USD 7.9 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.1% from 2025 to 2032.

Global Starter Feed Market Overview

Starter feeds are nutritionally balanced formulations designed for the early developmental stages of livestock and poultry, supporting growth, immunity, and digestive health. These products are typically enriched with proteins, amino acids, vitamins, minerals, and probiotics to ensure optimal nutrient absorption and weight gain. They are available in mash, crumble, or pellet forms to suit different animal species and farming practices. Innovations in starter feed formulations emphasize the inclusion of natural additives, enzyme blends, and organic ingredients to promote gut health and reduce antibiotic dependence. The growing focus on feed efficiency and sustainable animal nutrition continues to drive product innovation in this category.

Key Takeaways

In terms of product segments, the medicated starter feed dominates with a 45% market share, driven by increasing regulatory support and demand for antibiotic-free performance enhancers.

Pelleted formulations lead owing to ease of consumption and improved nutrient retention, accounting for 60% of formulation revenue.

Poultry accounts for the highest livestock segment share (56%), reflecting its extensive commercial scale and nutritional sensitivity during the starter phase.

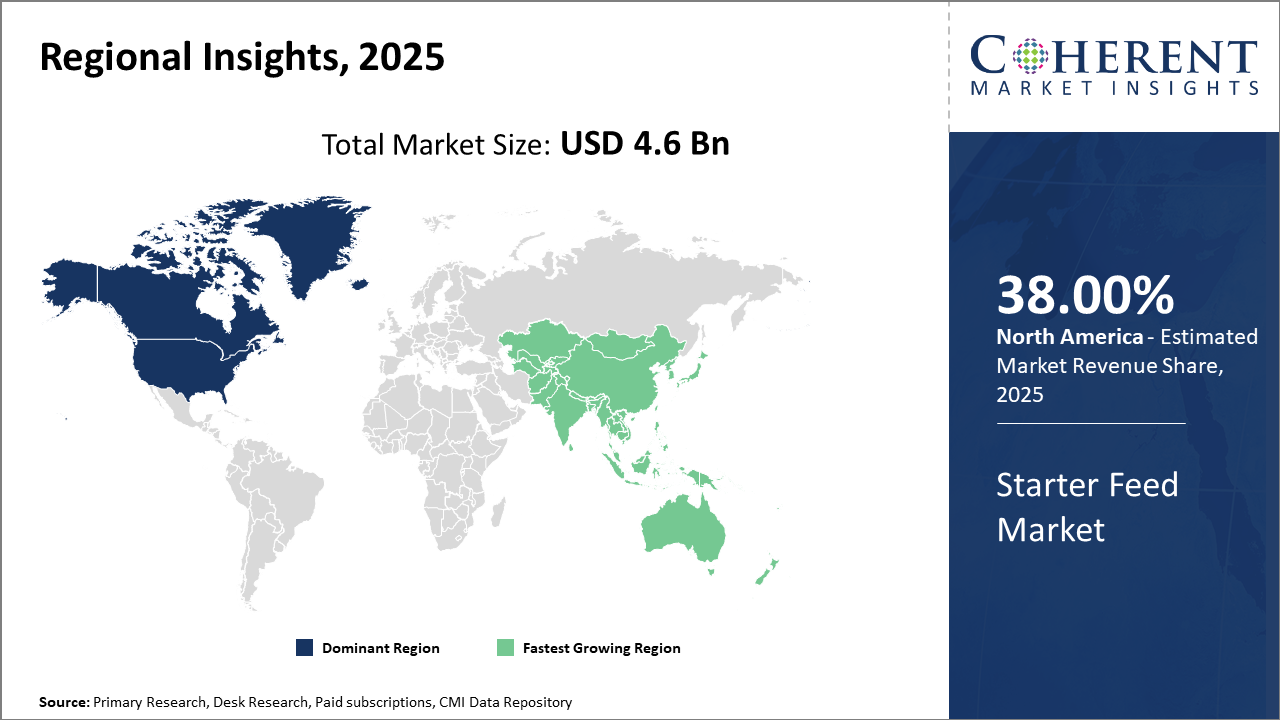

Regionally, North America leads in market revenue, supported by advanced feed production infrastructure and stringent quality standards, while Asia Pacific exhibits the fastest growth, with a CAGR surpassing 9%, fueled by expanding livestock farming across countries like China and India.

Starter Feed Market Segmentation Analysis

To learn more about this report, Download Free Sample

Starter Feed Market Insights, By Type

In terms of Type, Medicated Starter Feed dominates the market share at 45%. Medicated Starter Feed’s dominance is attributed to stringent regulations curbing antibiotic use and rising demand for safe, performance-enhancing additives in livestock nutrition. This subsegment is expanding rapidly, driven by advances in natural growth promoters and legal frameworks; its growth is bolstered by strong demand in North America and Europe. The fastest growing segment is Organic Starter Feed, with increasing consumer preference for naturally sourced ingredients and antibiotic-free livestock products generating robust growth, particularly in developed markets concerned with sustainability.

Starter Feed Market Insights, By Livestock

Poultry is dominating the market share at 56%, due to its vast commercial scale, early-stage nutritional sensitivity, and high consumption demand, which collectively drive elevated starter feed volumes. This segment’s expansion is led by optimized nutritional profiles and the introduction of pelleted and crumbled feed forms. The fastest growing livestock subsegment is Swine, propelled by increasing pork consumption globally and enhanced feed formulations addressing piglet growth and post-weaning survival rates. Ruminants, including calves and lambs, represent a stable but smaller share, emphasizing specialized feed to improve early life growth and immune resilience.

Starter Feed Market Insights, By Formulation

Pellets dominate with a 60% market share, as it is favored for uniformity in shape and nutritional density, facilitating improved feed intake and digestibility, especially within large-scale farming operations. The expanding use of precision feeding systems further supports pelleted feed’s dominance. Crumbles serve as an intermediate form, suitable for smaller livestock and easy transition from starter to grower feeds; this subsegment is growing steadily in markets with smaller farm operations. Mash feed, although less prevalent, retains a niche for cost-efficient feeding and use in backyard or traditional farms.

Starter Feed Market Trends

The Starter Feed market is increasingly shaped by the adoption of precision feeding technologies, enabling producers to tailor feed content to specific livestock needs, enhancing efficiency and reducing costs.

For instance, in 2024, several feed producers integrated AI-powered feed mixers improving nutrient uniformity by 15%.

The growing regulatory emphasis on antibiotic-free production has also accelerated uptake of probiotic-enriched starter feeds, evidenced by a 20% increase in sales of such products in North America during 2023-2024.

Furthermore, sustainability-oriented trends are fostering development of alternative protein sources, such as insect-based ingredients, which gained momentum following successful pilot programs in the European market in 2025.

Starter Feed Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Starter Feed Market Analysis and Trends

North America dominates the Starter Feed market share at 38% due to sophisticated feed manufacturing infrastructure and stringent quality norms. The U.S., especially, holds a substantial industry share thanks to the integration of R&D initiatives and regulatory frameworks fostering product innovation.

Asia Pacific Starter Feed Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth with a CAGR exceeding 9%, attributed to expansion in commercial livestock farming, particularly in China and India. Governmental incentives supporting animal husbandry modernization and growing meat consumption underpin this robust market expansion.

Starter Feed Market Outlook for Key Countries

USA Starter Feed Market Analysis and Trends

The USA’s Starter Feed market is driven by an advanced poultry and swine industry emphasizing early nutrition to optimize growth metrics. Leading companies such as Tyson Foods and Cargill have invested heavily in R&D to formulate medicated and organic starter feeds suited to antibiotic-free regulations introduced in recent years. Recent USDA reports highlight a 7% year-on-year increase in premium starter feed consumption aligned with sustainable and performance-driven livestock practices, reinforcing the USA’s critical position within the market.

India Starter Feed Market Analysis and Trends

India’s Starter Feed market is rapidly evolving, propelled by increased adoption of commercial poultry farming and favorable government schemes aimed at livestock productivity. Companies, including New Hope Group and For Farmers, have expanded local manufacturing capabilities to tap into the rising demand for medicated and pelleted starter feeds. Indian feed revenue surged by approximately 11% in 2024, reflecting growing farmer awareness and supply chain improvements, thus positioning India as a strategic growth hub in the Asia Pacific region.

Analyst Opinion

Demand-Side Dynamics: The surge in commercial poultry production to meet global protein consumption demands is a pivotal market driver. In 2024 alone, global poultry meat consumption increased by 5.6%, which directly bolstered starter feed volume requirements, reflecting a growing industry trend toward optimizing early-stage nutrition for maximum yield.

Pricing and Revenue Trends: Despite volatile raw material costs, pricing dynamics for starter feeds have shown resilience. In 2025, premium starter feed formulations incorporating probiotics and enzymes commanded a 12% price premium over conventional feeds, contributing to higher market revenue and shifting manufacturer strategies toward value-added products.

Production Capacity Expansion: Leading feed mills expanded their capacity by an average of 15% in 2024 to align with rising market demand, driven primarily by investments in automation and feed formulation technologies. This capacity scaling supports the anticipated market size growth and reinforces the competitive nature of supply-side dynamics.

Import-Export Movements: Developing countries such as India and Brazil have substantially increased starter feed imports by 18% year-over-year (2023-2024), driven by domestic demand surges and limited local feed ingredient availability. This trade flow impacts regional market shares and suggests dynamic shifts in market access and distribution channels.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 4.6 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 8.1% | 2032 Value Projection: | USD 7.9 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Cargill Inc., ADM Animal Nutrition, Nutreco N.V., Alltech Inc., Charoen Pokphand Foods Public Company Ltd., Tyson Foods Inc., ForFarmers N.V., De Heus Animal Nutrition, Evonik Industries AG, New Hope Group, Lallemand Animal Nutrition, Trouw Nutrition. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Starter Feed Market Growth Factors

Several factors are propelling the Starter Feed market’s growth trajectory. First, the global intensification of livestock farming—especially poultry and swine—necessitates nutrient-dense starter feeds to enhance early growth phases, improving feed conversion ratios significantly as documented in a 2024 U.S. study reporting a 9% increase in hatchling vigor. Second, growing adoption of specialized feed additives like enzymes and probiotics is transforming feed quality, thereby stimulating demand for premium starter feed products. Third, regulatory reinforcement on antibiotic alternatives in feed is accelerating the shift toward medicated starter feeds with natural growth promoters, an industry change evident from the 2023 EU ban on antimicrobial growth promoters. Lastly, rising disposable incomes and increasing meat protein consumption rates in emerging economies are expanding the market scope, as reflected in the 2024 report of a 14% growth in per capita poultry consumption in the Asia Pacific.

Starter Feed Market Development

In March 2024, EASY BIO, a leading South Korean animal nutrition company, expanded its global presence by acquiring Devenish Nutrition LLC, the North American division of Devenish Holdings Limited. The acquisition was finalized through EASY BIO USA, marking a strategic move to bolster its feed additive and premix business in the United States, Canada, and Mexico

In March 2025, the Indian Poultry Alliance (IPA), a subsidiary of the Allana Group, acquired Kwality Animal Feeds Pvt. Ltd. for ???300 crore (approximately USD 35.2 million). Founded in 1983 and headquartered in Belagavi, Kwality is a fully integrated poultry company with operations spanning feed mills, soya processing, breeding farms, hatcheries, broiler integration, and value-added poultry products.

Key Players

Leading Companies of the Market

Cargill Inc.

Nutreco N.V.

Alltech Inc.

Charoen Pokphand Foods Public Company Ltd.

Tyson Foods Inc.

ForFarmers N.V.

De Heus Animal Nutrition

Evonik Industries AG

New Hope Group

Lallemand Animal Nutrition

Trouw Nutrition

Competitive strategies have seen companies like Cargill and ADM embracing digital feed formulation platforms to optimize nutrient delivery, resulting in a reported 7% increase in feed efficiency in commercial trials during 2024. Additionally, strategic acquisitions and localized manufacturing expansions by entities such as Nutreco have improved regional penetration in Asia Pacific, enhancing their market share notably in high-growth markets like India and China.

Starter Feed Market Future Outlook

The future of the starter feed market lies in precision nutrition and sustainability. Advances in feed formulation technology will enable nutrient customization based on species, genetics, and farm conditions. Artificial intelligence and sensor-based monitoring systems are expected to optimize feed conversion ratios and nutrient utilization in real time. Growing emphasis on antibiotic alternatives will drive further innovation in gut health enhancers and enzyme technologies. Additionally, the adoption of insect-based and plant-derived proteins will support environmentally responsible production. With a rising global focus on animal productivity and traceability, starter feeds will continue to evolve toward more efficient, eco-friendly, and health-oriented solutions.

Starter Feed Market Historical Analysis

Starter feeds have long been fundamental to modern livestock and poultry farming, evolving from simple grain-based blends to highly engineered nutritional formulations. Historically, feed manufacturers prioritized calorie density and basic protein content. However, as animal genetics and production efficiency improved, the need for specialized starter nutrition became more pronounced. The incorporation of amino acids, vitamins, minerals, and enzymes transformed early feeds into scientifically balanced diets designed to maximize early growth, immune function, and digestive efficiency. The industry’s shift toward sustainable and antibiotic-free feeding practices led to the inclusion of probiotics, prebiotics, and natural growth promoters, aligning with global trends in animal welfare and food safety.

Sources

Primary Research interviews:

Animal Nutritionists

Poultry & Livestock Farm Managers

Feed Technologists

Agribusiness Experts

Databases:

FAO Animal Feed Statistics

USDA Livestock Data

Global Feed Survey (Alltech)

Magazines:

Feed Strategy

Poultry World

World Grain

Livestock Farming

Journals:

Animal Feed Science and Technology

Journal of Animal Physiology and Animal Nutrition

Poultry Science

Journal of Dairy Science

Newspapers:

The Economic Times (Agri & Dairy)

The Hindu Business Line (Agriculture)

The Guardian (Food & Farming)

Reuters (AgriBusiness)

Associations:

American Feed Industry Association (AFIA)

Food and Agriculture Organization (FAO)

International Feed Industry Federation (IFIF)

World Poultry Science Association (WPSA)

Share

Share

About Author

Shivam Bhutani has 6 years of experience in market research and strategy consulting. He is a Market Research Consultant with strong analytical background. He is currently an MBA candidate specializing in Business Analytics from BITS Pilani.

He is adept at navigating diverse roles from sales and marketing to research and strategy consulting. He excels in market estimation, competitive intelligence, pricing strategy, and primary research. He is skilled at analysing large datasets to provide precise insights, helping clients in achieving strategic transformation across various industries. He is skilled in leveraging data visualization techniques to drive innovation and enhance business processes.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients