Sodium Molybdate Market Size and Forecast – 2025 – 2032

The Global Sodium Molybdate Market size is estimated to be valued at USD 245 million in 2025 and is expected to reach USD 393 million by 2032, exhibiting a compound annual growth rate (CAGR) of 6.8% from 2025 to 2032.

Global Sodium Molybdate Market Overview

Sodium molybdate is an inorganic compound primarily used as a corrosion inhibitor, fertilizer additive, and catalyst component. The compound offers excellent water solubility and thermal stability, making it suitable for metal treatment fluids, lubricants, and pigment manufacturing. In agriculture, sodium molybdate acts as a micronutrient source that enhances nitrogen fixation and plant enzyme activity. Industrial-grade products are formulated to meet specific purity and particle-size requirements for use in cooling systems, dyes, and ceramics. Technological developments have optimized crystallization and drying processes to improve product uniformity, while eco-friendly synthesis routes are being explored to minimize environmental impact.

Key Takeaways

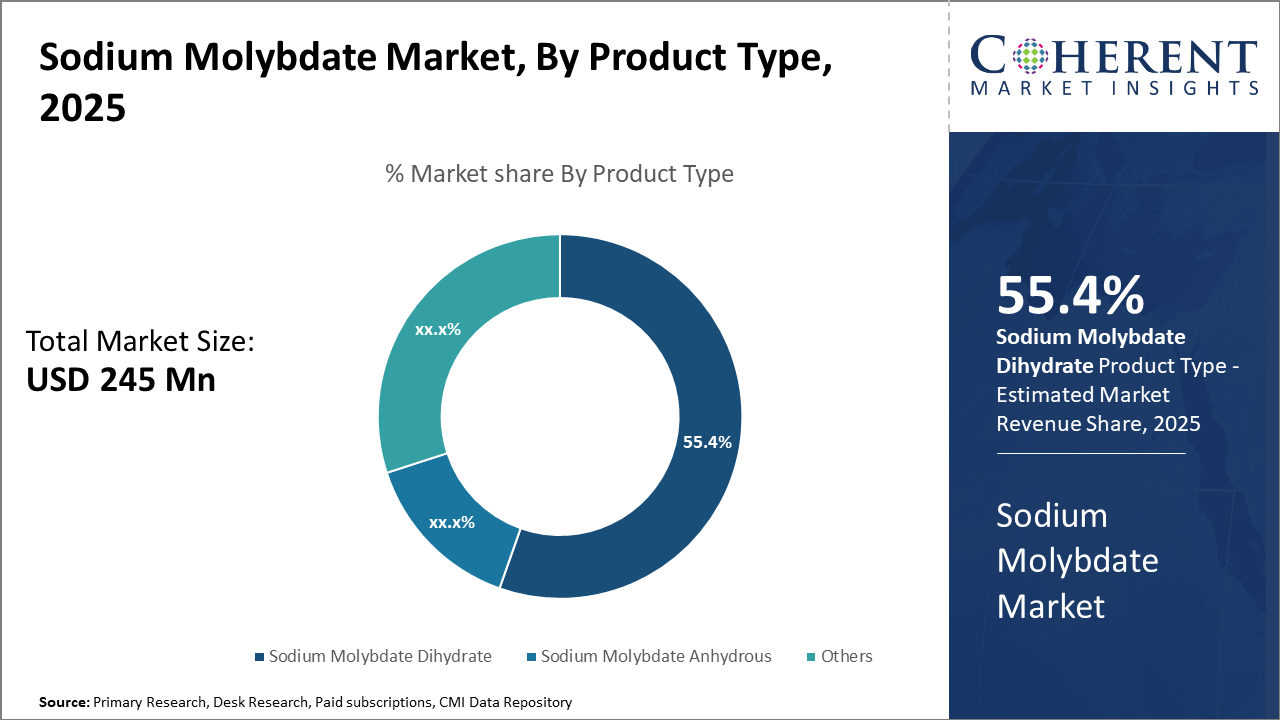

The Sodium Molybdate Dihydrate holds the largest industry share at 55.4%, propelled by superior solubility, favorable for diverse applications.

In terms of application, corrosion inhibitors dominate due to heightened regulations for corrosion management in industrial sectors, capturing significant market revenue.

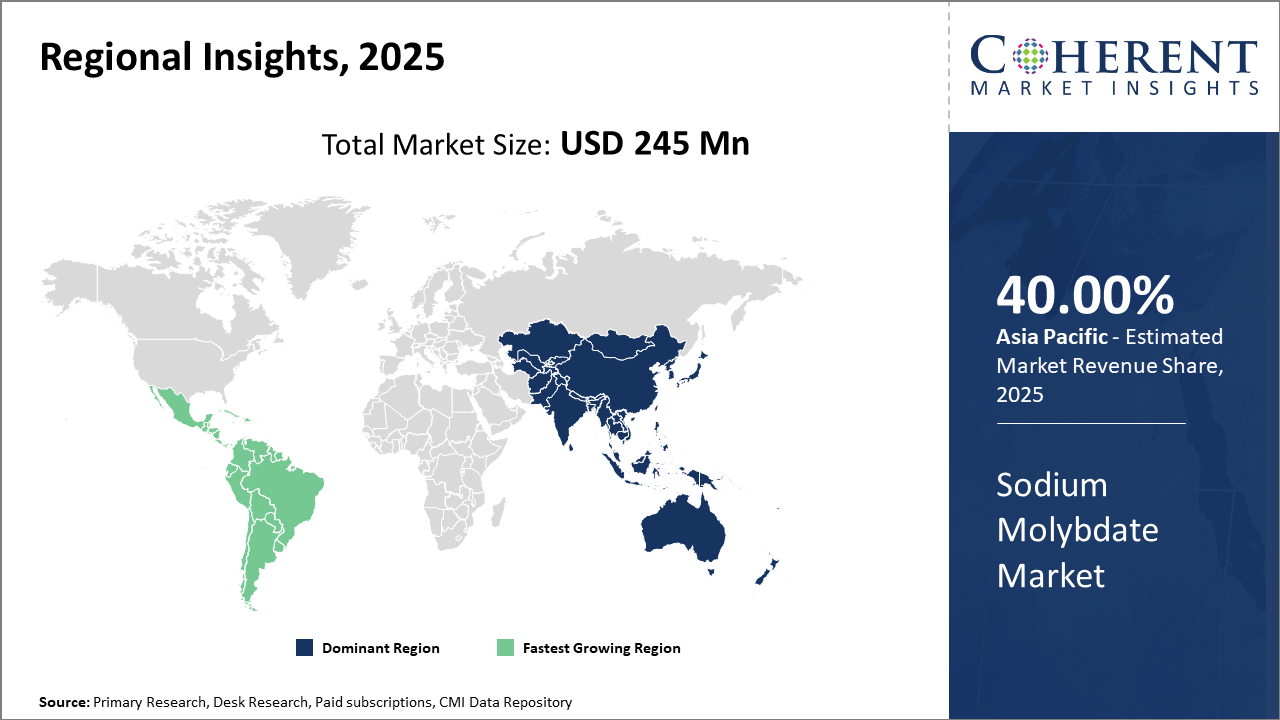

Regionally, Asia Pacific leads in market revenue fueled by pronounced industrial growth and expanding agricultural modernization projects.

Latin America is emerging as a key growth area due to its rising agricultural demands and increasing sodium molybdate utilization.

Sodium Molybdate Market Segmentation Analysis

To learn more about this report, Download Free Sample

Sodium Molybdate Market Insights, By Product Type

Sodium Molybdate Dihydrate dominates the market share. This dominance is primarily due to its superior solubility and widespread use in numerous industrial applications, such as fertilizers and pigments, facilitating enhanced market revenue. The fastest-growing subsegment is Sodium Molybdate Anhydrous which is gaining traction owing to its stability and use in high-purity chemical applications. Other minor subsegments include specialized variants employed in niche industrial processes, each contributing to overall market segmentation. Sodium Molybdate Dihydrate holds a pivotal position because it balances cost-effectiveness with functional efficiency, which remains critical for ongoing industry trends.

Sodium Molybdate Market Insights, By Application

Corrosion Inhibitors dominating the market share, as they are extensively used in the automotive and construction industries, addressing significant market growth owing to increasing infrastructure development and vehicular production in key markets. The fastest-growing subsegment is the Agricultural application; its growth is accelerated by rising awareness of micronutrient deficiencies in crops and enhanced agricultural output initiatives. Pigments and Dyes remain steady contributors due to their use in industrial coatings, while the ‘Others’ category includes specialty applications such as catalysts and laboratory reagents, although their market share remains comparatively low.

Sodium Molybdate Market Insights, By End-User

Chemical Manufacturing dominates the market share, driven by the extensive use of sodium molybdate in synthesizing agrochemicals, pigments, and corrosion protection compounds. The Automotive sector is the fastest-growing subsegment, riding on the imperative to develop highly durable and corrosion-resistant vehicle components influenced by regulatory pressures in North America and Europe. Agriculture serves primarily as a growing niche, given the rising adoption of molybdenum-based fertilizers in emerging economies. Accelerated innovation in chemical manufacturing and automotive material science propels expansion in these segments, shaping overall market dynamics and revenue.

Sodium Molybdate Market Trends

Recent market trends emphasize sustainability, with manufacturers introducing eco-friendly sodium molybdate variants that lower environmental impact without compromising product efficiency.

For example, in 2024, companies in Europe launched bio-based sodium molybdate for agriculture, which enhanced crop yield while meeting stringent regulatory mandates.

Moreover, digital tools like AI-based forecasting and blockchain-enabled supply chains are revolutionizing market dynamics, providing better demand prediction and transparency.

Sodium Molybdate Market Insights, By Geography

To learn more about this report, Download Free Sample

Asia Pacific Sodium Molybdate Market Analysis and Trends

In Asia Pacific, dominance in the Sodium Molybdate market is anchored by rapid industrial growth in China and India, accounting for nearly 40% of the industry share. The region benefits from abundant raw material availability, supportive government policies promoting chemical manufacturing, and expanding agricultural demand, with firms such as TATA Chemicals significantly contributing to market expansion.

Latin America Sodium Molybdate Market Analysis and Trends

Meanwhile, Latin America exhibits the fastest growth with a CAGR exceeding 8%, driven primarily by Brazil’s agricultural modernization and increasing pesticide and fertilizer use, incorporating sodium molybdate compounds. Favorable trade policies and increased foreign investments have enhanced market ecosystem robustness in this region.

Sodium Molybdate Market Outlook for Key Countries

USA Sodium Molybdate Market Analysis and Trends

The USA’s Sodium Molybdate market is propelled by surging demand in chemical manufacturing and automotive corrosion inhibitor applications. In 2024, U.S. imports rose 15%, reflecting expanding usage in infrastructure maintenance projects. Leading companies like Chemserve Environmental Solutions and American Elements have invested in localized production facilities, ensuring supply chain robustness amid geopolitical uncertainties. Regulatory emphasis on product safety and quality also elevates market standards, fostering business growth and innovation.

Brazil Sodium Molybdate Market Analysis and Trends

Brazil’s Sodium Molybdate market benefits strongly from its agriculture-driven economy. The rising adoption of sodium molybdate-based micronutrient fertilizers expanded 14% in 2024, aiding crop health and yields. Government initiatives supporting sustainable farming practices and chemical input modernization have fueled demand. Key players focusing on distribution partnerships and supply chain optimizations have gained a competitive advantage, boosting market share consistently.

Analyst Opinion

Supply and Production Capacities Reflect Strong Market Opportunities: The worldwide production capacity for sodium molybdate increased by 8% in 2024, led by expansions in Asia Pacific chemical hubs. This has contributed to stabilizing pricing trends, facilitating market players to balance supply and demand effectively.

Demand Diversification Across End-Use Industries Continues to Bolster Growth: In 2025, demand from the agriculture sector grew by 12%, driven by increased usage as a micronutrient fertilizer, especially in Brazil and India. This diversification reflects evolving market insights into product applications, enhancing revenue streams.

Import and Export Trends Indicate Shifting Regional Dynamics: The United States increased its sodium molybdate imports by 15% in 2024, signaling rising domestic consumption, while exports from China have shown steady growth of 7%, displaying a notable shift in global supply chain dynamics.

Pricing Fluctuations Affect Market Share Allocation Among Leading Players: In 2024, pricing adjustments due to raw material availability impacted profit margins for manufacturers in Europe, compressing market share by approximately 3%, underscoring the importance of supply chain resilience.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 245 million |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 6.8% | 2032 Value Projection: |

USD 393 million |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | TATA Chemicals, Chemserve Environmental Solutions, American Elements, Zumro Chemicals, Duferco, Brenntag AG, Cronimet Mining, GCE Group, GFS Chemicals. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Sodium Molybdate Market Growth Factors

The market growth is primarily fueled by rapid industrialization in emerging economies, which drives demand for corrosion inhibitors, particularly in automotive and construction sectors. Increasing awareness about sustainable agriculture practices propels the usage of sodium molybdate as a micronutrient fertilizer, with markets such as Brazil and India amplifying the penetration by 14% year-on-year. Technological advancements improving molybdate extraction and purification processes have enhanced production efficiency, contributing to lower costs and expanded market scope. Regulatory frameworks targeting reduced environmental impact from chemical additives push innovations, encouraging market players to develop eco-friendly sodium molybdate derivatives, further boosting industry share and business growth.

Sodium Molybdate Market Development

In May 2023, a leading chemical producer announced significant investments to expand its production capacity of high-purity sodium molybdate, aimed at meeting the rising global demand in corrosion inhibition, catalyst formulation, and industrial chemical applications. The expansion focuses on improving production efficiency, purity levels, and supply reliability, strengthening the company’s position in the specialty chemicals and water treatment markets.

In August 2024, a specialty chemicals supplier entered into a strategic partnership with an agricultural input manufacturer to develop and launch a sodium molybdate-based micronutrient solution tailored for precision farming. This innovation enhances crop nutrient uptake and nitrogen fixation efficiency, supporting sustainable agriculture practices and helping farmers optimize yields while minimizing environmental impact.

Key Players

Leading Companies of the Market

TATA Chemicals

Chemserve Environmental Solutions

Zumro Chemicals

Duferco

Brenntag AG

Cronimet Mining

GCE Group

GFS Chemicals.

Several top market players have adopted strategic collaborations to expand their distribution networks primarily in the Asia Pacific and North America. For instance, American Elements partnered with regional distributors in India, leading to a 10% increase in market penetration in 2024. Innovation-driven growth has been evident where TATA Chemicals launched advanced sodium molybdate-based corrosion inhibitors, improving product efficacy and reducing environmental footprint, gaining considerable traction among automotive manufacturers in Europe.

Sodium Molybdate Market Future Outlook

The market is expected to expand steadily with growing demand for eco-friendly corrosion protection solutions and micronutrient fertilizers. The continued push toward cleaner industrial processes will sustain its use in metal treatment fluids and water systems. Advances in refining technology and sustainable mining will enhance product consistency and lower environmental impact. Additionally, the compound’s catalytic potential in chemical synthesis and energy storage applications may open new growth avenues, especially as green chemistry gains prominence.

Sodium Molybdate Market Historical Analysis

Sodium molybdate production historically developed as an extension of molybdenum mining and refining industries, with primary applications in metallurgy, agriculture, and water treatment. The compound gained traction as an effective corrosion inhibitor and micronutrient source during the late 20th century. Agricultural modernization and the need for trace mineral fertilizers expanded demand, particularly in emerging economies. Its industrial utility in metal coatings, lubricants, and catalysts also diversified end-user applications. Environmental awareness led to the gradual replacement of toxic chromates and phosphates with molybdate-based inhibitors, improving sustainability credentials.

Sources

Primary Research Interviews:

Industrial Chemists

Corrosion Inhibitor Specialists

Fertilizer Manufacturers

Metallurgical Engineers

Databases:

U.S. Geological Survey (USGS)

FAO Fertilizer Statistics

European Chemicals Agency (ECHA)

PubChem Database

Magazines:

Chemical & Engineering News

Industrial Heating

Paint & Coatings Industry

Fertilizer International

Journals:

Journal of Molecular Catalysis A

Materials Chemistry and Physics

Industrial & Engineering Chemistry Research

Journal of Agricultural and Food Chemistry

Newspapers:

The Hindu Business Line (Industry)

China Daily (Metals)

Financial Times (Commodities)

Mint (Manufacturing)

Associations:

International Molybdenum Association (IMOA)

American Chemical Society (ACS)

Fertilizer Association of India (FAI)

European Chemical Industry Council (Cefic)

Share

Share

About Author

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients