Seed Treatment Fungicides Market Size and Forecast – 2025 – 2032

The Global Seed Treatment Fungicides Market size is estimated to be valued at USD 3.8 billion in 2025 and is expected to reach USD 6.2 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.6% from 2025 to 2032.

Global Seed Treatment Fungicides Market Overview

Seed treatment fungicides are chemical or biological agents applied to seeds before planting to protect them from fungal pathogens that cause seedborne and soilborne diseases. These treatments ensure better germination, healthier seedlings, and improved crop yield. The products are typically formulated as powders, liquids, or coatings that adhere to the seed surface. Common active ingredients include triazoles, strobilurins, and carboxamides, which inhibit fungal growth.

Recent innovations involve combining fungicides with insecticides, micronutrients, and bio-stimulants for broader protection and early plant vigor. These fungicides are vital in modern agriculture to safeguard high-value seeds and reduce dependency on foliar applications.

Key Takeaways

The Cereals & Grains segment leads with a dominant 50% market share, driven by high-volume cultivation and significant seed treatment adoption due to pathogen prevalence in these crops.

Among fungicide types, Triazoles maintain dominance due to their broad-spectrum efficacy and resistance management capabilities.

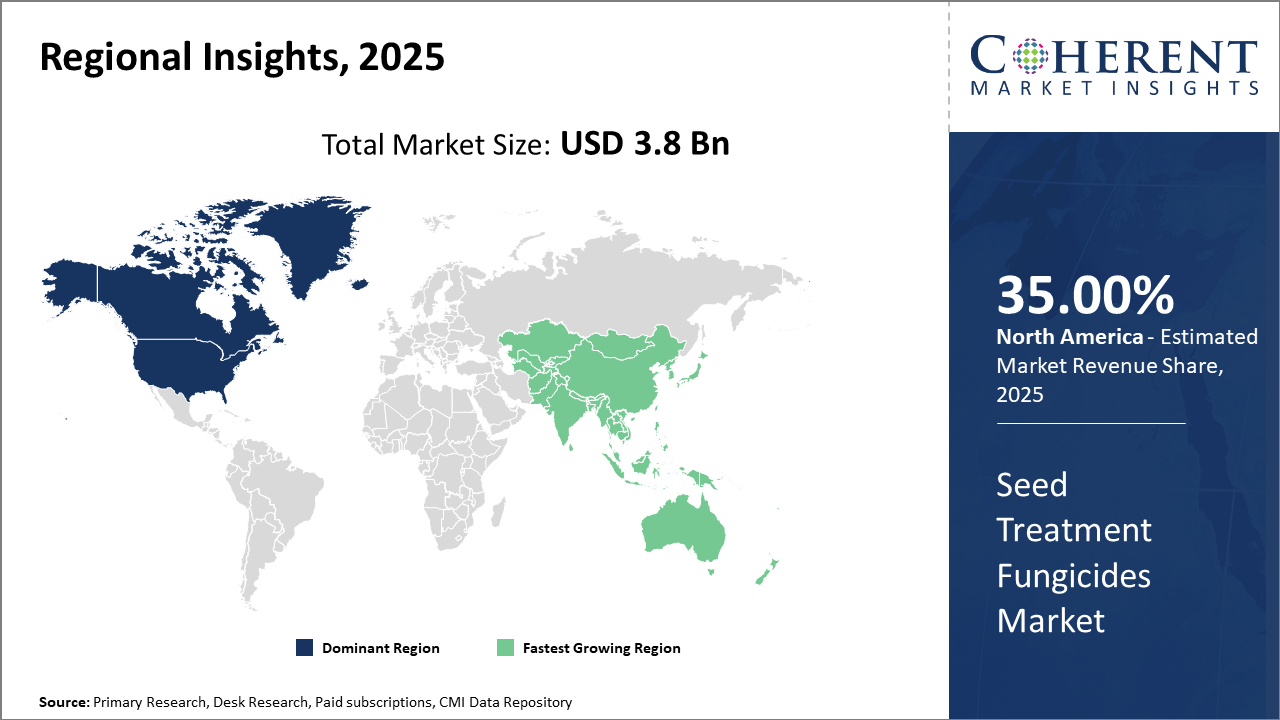

Regionally, North America commands the largest market share, attributed to advanced agricultural infrastructure and well-established distribution networks facilitating rapid fungicide adoption.

Asia Pacific holds the fastest-growing region status with a CAGR surpassing 9%, supported by increasing investments in seed technology and governmental initiatives promoting sustainable crop protection in China and India.

Europe’s emphasis on eco-friendly seed treatment products contributes to shifting market trends and steady growth in the region.

Seed Treatment Fungicides Market Segmentation Analysis

To learn more about this report, Download Free Sample

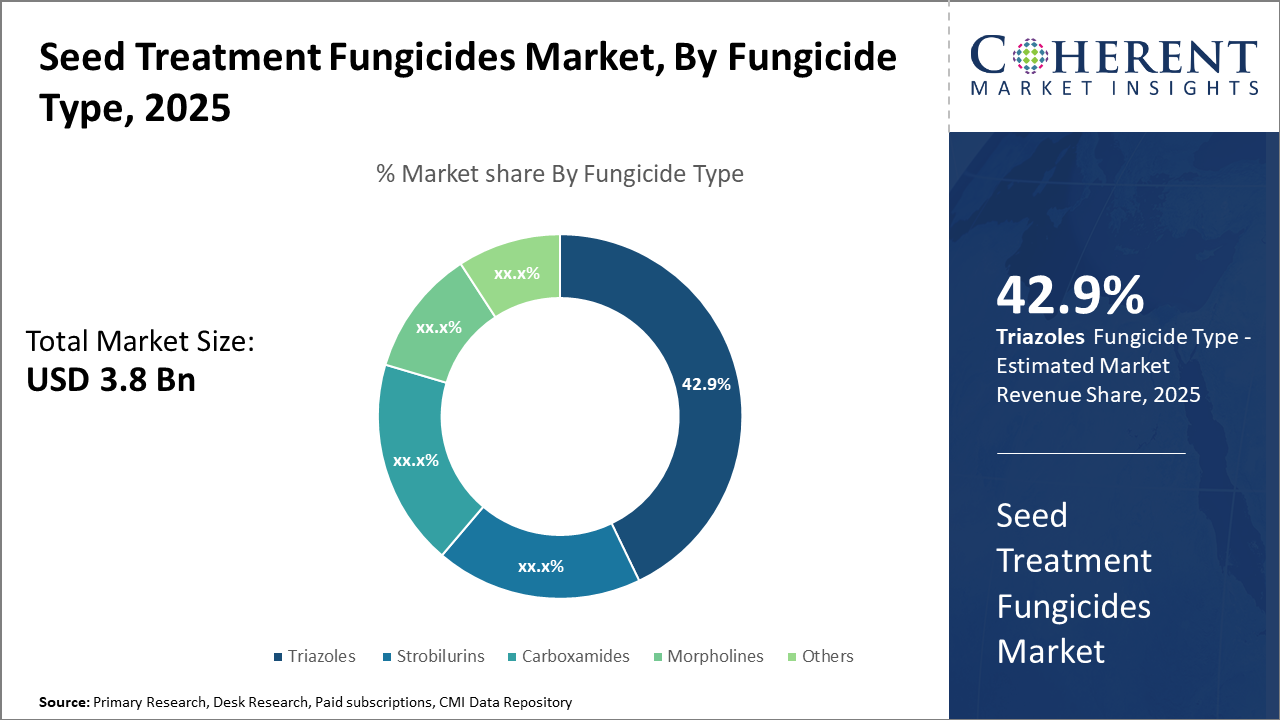

Seed Treatment Fungicides Market Insights, By Fungicide Type

In terms of fungicide type, Triazoles dominate the market share (42.9%). Triazoles lead due to their broad-spectrum activity and capability to manage resistance, making them indispensable in seed treatment formulations for cereals and oilseeds. Strobilurins represent the fastest-growing subsegment, attributed to their exceptional protective and curative properties coupled with low environmental impact, increasingly preferred in high-value crops. Carboxamides, Morpholines, and Others fill niche roles with specific pathogen targets but contribute smaller shares.

Seed Treatment Fungicides Market Insights, By Crop Type

Cereals & Grains are dominating the market share at 50%. This dominance is due to large-scale cultivation and high vulnerability to fungal seed diseases, compelling widespread seed treatment adoption, especially in corn and wheat. Oilseeds & Pulses are the fastest-growing subsegment, witnessing rapid growth propelled by increased health-conscious consumer demand and the expansion of soybean and pulse farming in the Asia Pacific and Latin America.

Seed Treatment Fungicides Market Insights, By Formulation

In terms of formulation, Wettable Powder dominates the market share as a proven, versatile fungicide delivery system. However, Suspension Concentrate is the fastest-growing subsegment, favored for its ease of use, reduced dust generation, and better environmental profile, especially in precision agriculture settings. Dry Flowable and Granules also meet specific application needs, providing convenience and longer shelf life in varying agricultural conditions.

Seed Treatment Fungicides Market Trends

Recent market trends underscore a decisive tilt toward sustainable seed treatment solutions, reflecting global efforts to minimize chemical usage while ensuring crop protection efficacy.

For instance, the rise of microbial fungicides in Europe has been notable, with product launches increasing by 22% in 2024 compared to the previous year, indicating heightened consumer and regulatory acceptance.

Parallelly, precision agriculture integration enables data-driven applications, reducing input costs and environmental impact, exemplified by North American firms deploying AI-based treatment advisory platforms with proven 15% operational cost savings in field trials in 2025.

Additionally, emerging markets such as Latin America have shown increasing governmental support via subsidies and training programs for seed treatment fungicides, contributing to an overall upward trend in market revenue and business growth.

Seed Treatment Fungicides Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Seed Treatment Fungicides Market Analysis and Trends

North America maintains its leadership in the Seed Treatment Fungicides market with over 35% market share, boosted by advanced agricultural infrastructure, supportive regulatory frameworks, and the strong presence of key market companies. The U.S., in particular, drives demand with extensive corn and soybean cultivation, applying over 60% treated seeds annually as per USDA 2024 data. Innovative product launches and digital farming practices further reinforce this position.

Asia Pacific Seed Treatment Fungicides Market Analysis and Trends

Asia Pacific exhibits the fastest growth at a CAGR exceeding 9%, fueled by rising agricultural mechanization, government support for sustainable farming, and increasing awareness of seed treatments among smallholder farmers. Countries like China and India are pivotal, investing in seed treatment technologies to combat local fungal diseases, supported by companies accelerating market penetration with localized formulations.

Seed Treatment Fungicides Market Outlook for Key Countries

USA Seed Treatment Fungicides Market Analysis and Trends

The U.S. seed treatment fungicides market stands as one of the most mature and largest globally. With well-established agribusiness players, the country contributes a significant portion of the market revenue, driven by corn, soybean, and wheat farming sectors. Extensive R&D initiatives and effective crop protection policies underpin advancements. Leading players maintain dominance through continuous innovation, demonstrated by rapid adoption of integrated seed treatment packages incorporating fungicides and insecticides, boosting crop yields by up to 15% as reported in the 2024 Agricultural Statistics.

India Seed Treatment Fungicides Market Analysis and Trends

India’s market is rapidly expanding due to the increasing importance of seed treatment in enhancing crop health amid diverse climatic stresses and diseases affecting cereals and oilseed crops. Government initiatives promoting high-quality seed use and increasing private sector involvement are key growth enablers. The rise in the organic and biofungicide segment, constituting 12% of total sales in 2024, highlights shifting consumer and regulatory preferences, with major domestic and multinational companies tailoring products for humid and tropical conditions.

Analyst Opinion

Increasing Adoption of Novel Chemical Formulations: The enhanced efficacy of newer chemical classes like triazoles and strobilurins is driving market growth, accounting for over 45% of the market share in fungicide formulations in 2024. For instance, advancements in active ingredients have translated into 12% higher seed germination success rates in U.S. corn crops in recent field trials.

Expansion in Demand from Emerging Agricultural Economies: Rising cultivation of high-value crops in countries such as India and Brazil is fueling demand, with imports of seed treatment products up by 15% year-over-year in Brazil alone during 2024. This demand surge indicates a shifting market dynamic favoring high-growth, underpenetrated regions.

Integration of Seed Treatment Fungicides in Sustainable Farming Practices: Government incentive programs promoting reduced pesticide usage have led to an 8% increase in fungicide-treated seed adoption in the European Union, highlighting the shift toward environmentally conscious market growth strategies.

Supply Chain Optimization and Pricing Stabilization: Enhanced supply chain efficiencies combined with price stabilization have supported a 5% growth in revenue in 2025 compared to the previous year, particularly in North America where logistic innovations have shortened delivery timelines by 20%, catalyzing business growth through improved market access.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 3.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.6% | 2032 Value Projection: | USD 6.2 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | BASF SE, Bayer CropScience AG, Syngenta AG, Corteva Agriscience, FMC Corporation, UPL Limited, ADAMA Agricultural Solutions Ltd., Sumitomo Chemical Co., Ltd., Nufarm Limited, Sipcam Oxon S.p.A., Makhteshim Agan Industries Ltd., Isagro S.p.A. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Seed Treatment Fungicides Market Growth Factors

Several pivotal drivers underpin the continual market growth. Firstly, the rising global demand for food security, coupled with the need to improve crop resilience against increasingly resistant pathogens, propels this market forward. For instance, Asia Pacific’s increased funding in agricultural technologies has directly led to a 20% rise in fungicide seed treatment adoption in rice cultivation by 2024. Secondly, innovation in eco-friendly fungicide formulations substitutes conventional chemicals, supported by stricter regulatory frameworks, boosting market revenue by 7% in 2025. Furthermore, increasing farmer awareness programs funded by regional governments have educated end-users about improved fungicide applications, reflected in a 12% increment in adoption rates in North America during the last two years.

Seed Treatment Fungicides Market Development

In January 2025, Dhanuka Agritech acquired the global rights for Bayer AG's Iprovalicarb and Triadimenol fungicides for approximately ???165 crore. This strategic deal gives Dhanuka access to over 20 countries across Latin America, EMEA, Asia, and India. The company also plans to move its manufacturing of Iprovalicarb to its Dahej facility within two years to increase cost efficiency.

In September 2025, Syngenta announced Seeker®, a fungicide for soybeans and wheat in Brazil. It features Fenpropidin, a member of the Piperidine group (FRAC 5), and is targeted at diseases that have developed resistance to older products. It aims to provide better disease control, especially at late stages (grain fill) for rusts and Cercospora spp. in soybean.

Key Players

Leading companies of the market:

BASF SE

Syngenta AG

Corteva Agriscience

FMC Corporation

UPL Limited

ADAMA Agricultural Solutions Ltd.

Sumitomo Chemical Co., Ltd.

Nufarm Limited

Sipcam Oxon S.p.A.

Makhteshim Agan Industries Ltd.

Isagro S.p.A.

Market companies are aggressively adopting R&D-driven growth strategies, commonly focusing on mergers and acquisitions to enhance product portfolios. For example, Bayer’s acquisition of Monsanto has consolidated its seed treatment fungicide capabilities, driving a 15% jump in its product pipeline between 2023 and 2024. Another notable strategy involves technological collaborations, such as Syngenta partnering with digital agriculture platforms to optimize application precision, enhancing field efficiency demonstrated through a 10% reduction in fungicide usage reported in 2024 trials.

Seed Treatment Fungicides Market Future Outlook

In the future, the seed treatment fungicides market is poised for steady expansion with rising emphasis on sustainable agriculture and environmental safety. Biological fungicides derived from microorganisms and natural compounds are expected to gain prominence, addressing growing regulatory restrictions on chemical use. Advancements in nanotechnology and precision application systems will further improve seed coating efficiency and minimize wastage. Increasing global food demand, along with government initiatives promoting high-yield and disease-resistant crop varieties, will sustain market momentum. Additionally, collaborations between agrochemical companies and research institutions are likely to accelerate innovation in customized fungicide formulations for specific crop types and climatic conditions.

Seed Treatment Fungicides Market Historical Analysis

The seed treatment fungicides market developed as agricultural practices advanced and the need for early-stage crop protection became more apparent. Historically, seed treatment methods were rudimentary, often involving simple coating techniques using basic fungicidal powders to prevent surface-level infections. However, the shift toward intensive farming and hybrid seeds in the mid-20th century led to more sophisticated formulations and application technologies. Over the years, the market has evolved from the use of chemical-based fungicides to more targeted and efficient systemic solutions capable of offering longer protection. The adoption of integrated pest management (IPM) practices and the emphasis on improving seed germination rates and yield quality have been major historical growth drivers.

Sources

Primary Research interviews:

Agronomists

Crop Protection Specialists

Seed Technologists

Agricultural Extension Officers

Databases:

FAO Agricultural Statistics

USDA Crop Protection Database

Syngenta & Bayer CropScience Reports

Magazines:

AgriBusiness Global

CropLife

The Farmer’s Journal

Farm Progress

Journals:

Journal of Agricultural Science

Crop Protection Journal

Plant Disease

Agronomy Journal

Newspapers:

The Economic Times (Agriculture)

The Hindu Business Line (Agri-Business)

Financial Express (Rural Economy)

Reuters Agriculture

Associations:

CropLife International

American Phytopathological Society

International Seed Federation (ISF)

Food and Agriculture Organization (FAO)

Share

Share

About Author

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients