Robotics Ad Automation Actuators Market Size and Forecast – 2025 – 2032

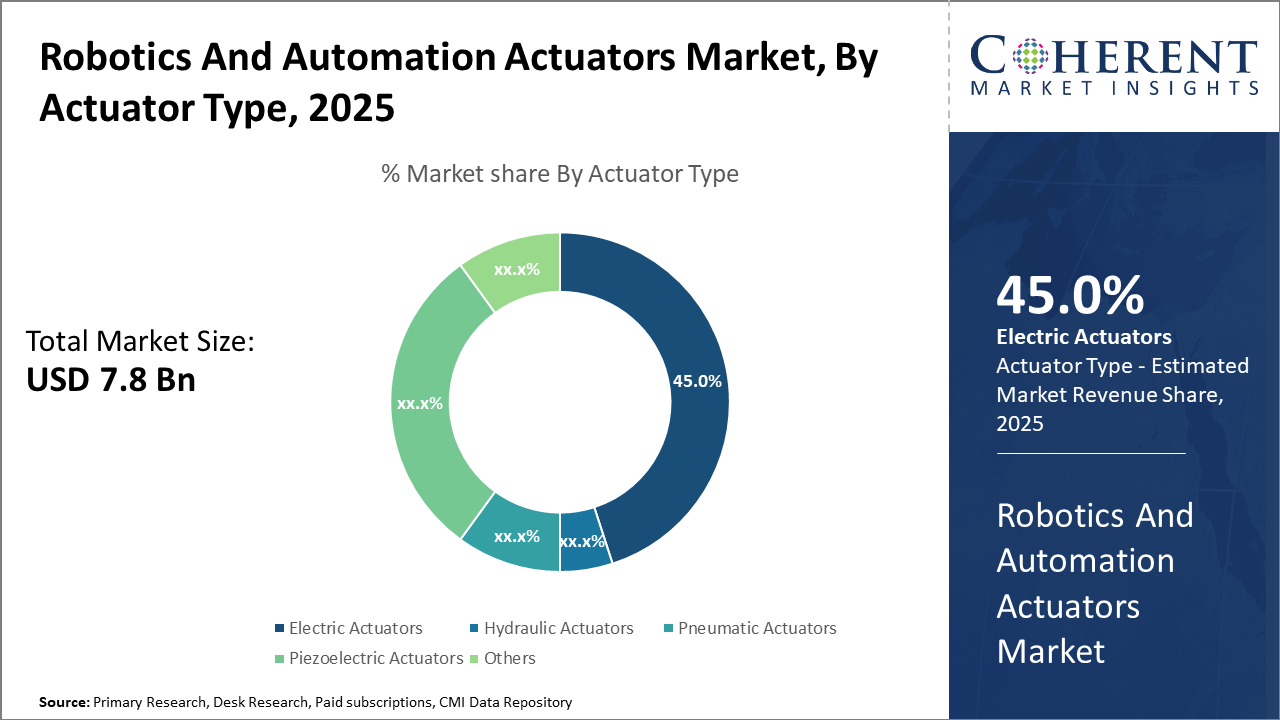

In 2025, the Robotics and Automation Actuators market size is estimated to be valued at USD 7.8 billion and is expected to reach USD 15.3 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.5% from 2025 to 2032.

Global Robotics And Automation Actuators Market Overview

Robotics and automation actuator products include electric, hydraulic, and pneumatic actuators responsible for generating motion in robotic arms, automated machinery, and industrial robots. They convert electrical or fluid power into linear or rotary movement, enabling precise positioning, gripping, lifting, and machine interactions. Modern actuators are designed with high torque density, fast response times, and integrated sensors for feedback control. Advanced models include smart actuators with embedded electronics, brushless motors, harmonic drives, and energy-efficient components tailored for collaborative robots, mobile platforms, and high-speed automation systems.

Key Takeaways

The Electric Actuators segment commands a leading market share of 45%, driven by its precision and energy-efficient features, and continues to witness robust growth due to broader industrial adoption.

Automotive manufacturing, accounting for 38% market share, remains the dominant application segment supported by rising automation and robotics in assembly lines.

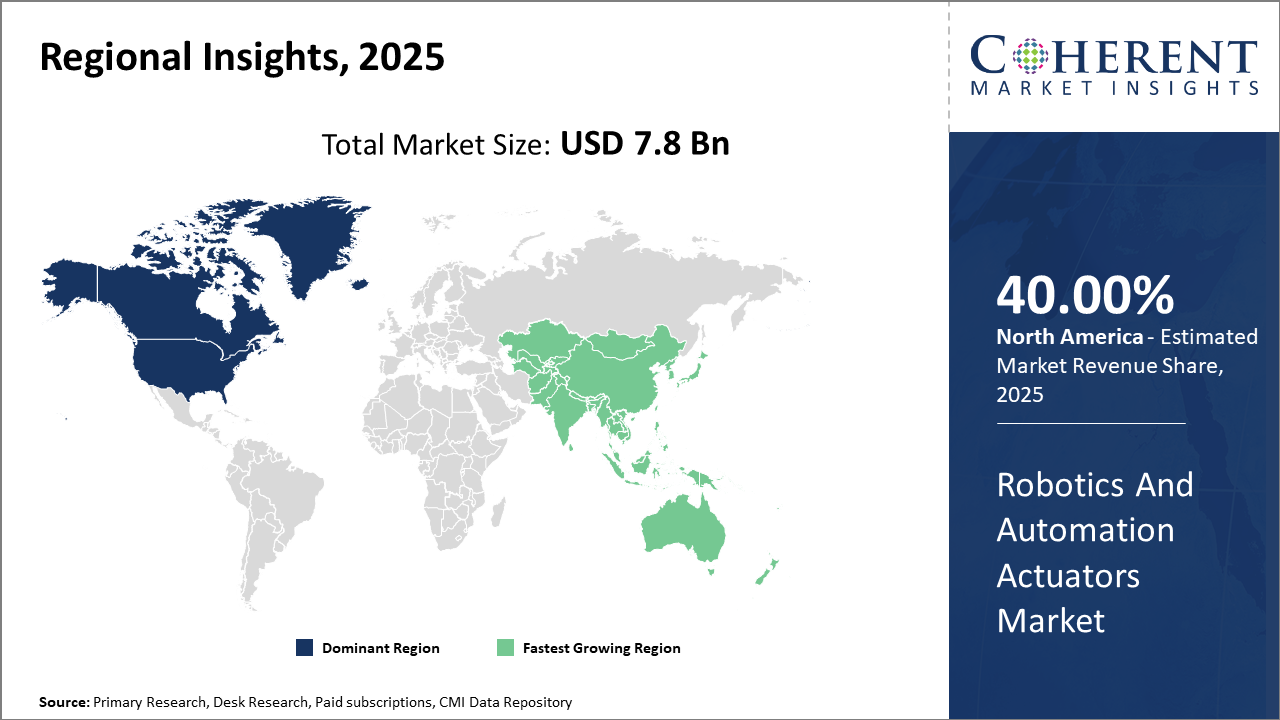

From a regional perspective, North America holds the largest industry share owing to well-established manufacturing ecosystems and supportive government policies fostering automation investments.

Asia Pacific emerges as the fastest-growing region, exhibiting a CAGR above 12%, propelled by increasing imports, localized manufacturing initiatives, and expanding industrial robotics deployments.

Robotics And Automation Actuators Market Segmentation Analysis

To learn more about this report, Download Free Sample

Robotics And Automation Actuators Market Insights, By Actuator Type

Electric Actuators dominate the market share with 45%. Electric actuator dominance stems from their superior energy efficiency, high precision, and adaptability to smart factory environments. They are favored in automotive assembly lines and electronics manufacturing, where exact control is vital. Hydraulic actuators, known for high force capability, maintain steady usage mainly in heavy machinery and aerospace sectors, benefiting from demand for robust automation solutions. Pneumatic actuators are preferred in the food & beverage industries for their cleanliness and speed, although their market share is gradually declining due to electric alternatives.

Robotics And Automation Actuators Market Insights, By Application

Automotive Manufacturing dominates with a 38% share. The automotive sector’s high automation levels and complex assembly operations require precision actuators, supporting the largest revenue stream. Electronics Production follows closely, capitalizing on miniaturized actuators for circuit board assembly and semiconductor fabrication. Aerospace applications demand high-reliability actuators, driving steady growth supported by stringent safety standards. Food & Beverage and Pharma sectors use actuators adapted for hygiene and regulatory compliance, with rising demand in packaging automation.

Robotics And Automation Actuators Market Insights, By Industry

Automotive leads the market share. The automotive industry’s rapid transition toward electric vehicles and autonomous cars is augmenting robotics-driven manufacturing processes that require advanced actuators. The electronics & Semiconductor industries, due to intensive precision requirements, form the fastest-growing subsegment driven by the exponential growth in IoT devices and mobile technologies. Aerospace & Defense demands actuators that meet extreme operational conditions and compliance, underpinning a niche but important business. Healthcare actuator demand is rising, especially for surgical robotics and diagnostic devices, propelled by growing investments in medical robotics.

Robotics And Automation Actuators Market Trends

The Robotics and Automation Actuators market trend emphasizes the rise of smart actuators integrated with IoT technology, which have enabled real-time monitoring and predictive maintenance.

This trend has translated to significant productivity gains, as companies adopting these smart solutions reported a 25-30% decrease in downtime in 2024.

Another prominent trend involves the shift toward electrically driven actuators due to sustainability initiatives, overtaking pneumatic and hydraulic counterparts for various applications, particularly in automotive and electronics production sectors.

For example, electric actuator revenues surged by 18% in Asia Pacific in 2024, reflecting customer preference for cleaner and efficient energy consumption.

Robotics And Automation Actuators Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Robotics And Automation Actuators Market Analysis and Trends

In North America, the market dominance arises from a well-established manufacturing ecosystem combined with government policies incentivizing Industry 4.0 adoption. The U.S., accounting for over 40% regional market share, benefits from strong supplier networks with companies like Parker Hannifin boosting innovation and expansion. Furthermore, extensive R&D investments by local companies in electric and piezoelectric actuators underpin sustained growth and business expansion.

Asia Pacific Robotics And Automation Actuators Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth, driven by rapid industrialization, government initiatives to promote automation, and a large manufacturing base in countries like China and India. The region’s market CAGR exceeds 12%, fueled by rising imports of high-precision actuators and local manufacturing expansions by market players like FANUC and Siemens. The burgeoning electronics assembly and automotive sectors in APAC are critical in accelerating actuator adoption.

Robotics And Automation Actuators Market Outlook for Key Countries

USA Robotics And Automation Actuators Market Analysis and Trends

The U.S. market is highly influential in shaping robotics actuator demand, with substantial investments in smart manufacturing and automation upgrades. Industrial automation spending rose by 20% in 2024, benefiting from wide-scale implementation of electric actuators. Leading companies such as ABB Ltd and Emerson Electric have intensified R&D efforts focused on IoT-compatible actuator systems, securing strategic contracts with automotive OEMs and aerospace firms. This growth is further supported by federal policies advocating advanced manufacturing technologies.

China Robotics And Automation Actuators Market Analysis and Trends

China’s Robotics and Automation Actuators market has expanded rapidly due to aggressive government-backed industry modernization plans under the “Made in China 2025” initiative, enhancing factory automation levels within key industrial hubs. Local adoption of electric actuators surged by 22% in 2024, supported by increased imports and domestic production capacities. Companies like Yaskawa Electric and Siemens have significantly expanded manufacturing presence, enabling scale advantages and reducing supply chain constraints. This market outlook remains bullish with continuing infrastructure development and expanding electronics industries.

Analyst Opinion

Increasing industrial automation adoption is a primary quantitative driver fueling market revenue, with robotics deployment in manufacturing plants rising by over 25% year-on-year in 2024. This surge correlates with enhanced production capacities, particularly in automotive and electronics sectors, leading to a notable 12% increase in actuator sales in the same year.

Demand-side indicators indicate escalating import volumes of precision actuators in Asia Pacific, especially China and India, increasing by 15% in 2024, which signals expanding use cases across packaging, food processing, and semiconductor production industries, amplifying region-specific market demand.

Pricing dynamics have observed a marginal decline between 2-3% due to technological advancements such as electro-hydraulic actuators, improving cost-efficiency and allowing broader market penetration among SMEs focusing on automating legacy systems in 2025.

Nano and micro actuator applications in medical robotics and electronics assembly lines have seen a 20% surge since 2023, representing a niche yet significant factor driving incremental market growth, evidenced by contract awards to leading robotics manufacturers supplying to healthcare providers.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 7.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 10.5% | 2032 Value Projection: |

USD 15.3 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | ABB Ltd, Siemens AG, FANUC Corporation, Parker Hannifin Corporation, Moog Inc., SMC Corporation, Bosch Rexroth AG, Emerson Electric Co., Honeywell International Inc., Yaskawa Electric Corporation, Mitsubishi Electric Corporation. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Robotics And Automation Actuators Market Growth Factors

Industrial modernization initiatives like Industry 4.0 have been pivotal in driving demand for advanced robotics and automation actuators, with factory modernization budgets increasing by 18% globally in 2024 alone. Rising labor costs and the shortage of skilled workforce in developed economies are pushing industries to automate processes rapidly, leading to a surge in actuator adoption, particularly electric types due to their energy efficiency and precision. Moreover, government policies promoting automation to boost manufacturing resilience, especially in North America and Europe, have resulted in increased investments by market players. Lastly, technological advances integrating IoT and AI with actuators enhance system adaptability and predictive maintenance, creating substantial opportunities as firms reported a 25% reduction in downtime after adopting smart actuator solutions.

Robotics And Automation Actuators Market Development

In November 2024, Curtiss-Wright expanded its Exlar portfolio with the launch of new hygienic electric actuators made from FDA-approved, corrosion-resistant materials, engineered for sanitary environments in the food & beverage, pharmaceutical, and packaging sectors. The actuators offer smooth, crevice-free surfaces for easier washdowns, higher precision motion control, and an energy-efficient alternative to pneumatic systems, supporting stricter hygiene and automation requirements.

In 2024, Bosch Rexroth introduced a next-generation smart servo-electric actuator platform featuring embedded edge-computing capabilities for real-time diagnostics and predictive maintenance. The system continuously streams operational data—including torque, position, vibration, and temperature—to the cloud, enabling equipment health monitoring, reduced downtime, and improved productivity across industrial automation, robotics, and smart factory applications.

Key Players

Leading Companies of the Market

ABB Ltd

Siemens AG

FANUC Corporation

Parker Hannifin Corporation

Moog Inc.

SMC Corporation

Bosch Rexroth AG

Emerson Electric Co.

Honeywell International Inc.

Yaskawa Electric Corporation

Mitsubishi Electric Corporation

Competitive strategies focus on technology innovation, with ABB Ltd securing multiple patents in piezoelectric actuators enhancing precision under harsh environments, resulting in a 15% sales uplift in industrial robotics segments in 2024. FANUC Corporation has aggressively expanded its regional footprint in Asia Pacific by establishing new manufacturing hubs, increasing local production capability by 30%, thereby accelerating market access and reducing logistics costs. Parker Hannifin Corporation's strategic acquisitions of niche hydraulic actuator startups have expanded its portfolio, boosting product diversification and market share across aerospace applications.

Robotics And Automation Actuators Market Future Outlook

The future outlook for robotic actuators is extremely strong as industries transition toward smart manufacturing, AI-integrated robotics, and automated supply chain systems. Demand for electric actuators will grow fastest due to their precision, energy efficiency, and compatibility with digital and IoT-enabled platforms. The expansion of EV manufacturing, semiconductor fabrication, and medical robotics will create high-value opportunities for specialized actuators with miniaturization, high torque density, and enhanced safety features. Predictive maintenance, self-diagnosing actuators, and AI-assisted motion control will emerge as major development areas. Global labor shortages and the shift to automation across logistics, warehouses, healthcare, agriculture, and construction will reinforce long-term market growth.

Robotics And Automation Actuators Market Historical Analysis

Historically, the robotics and automation actuators market has been intrinsic to the rise of industrial automation across manufacturing, automotive, electronics, and heavy industries. Early growth was dominated by hydraulic and pneumatic actuators due to their power and cost-effectiveness in repetitive industrial processes. However, the rapid expansion of high-precision robotics in the 2000s and 2010s shifted demand significantly toward electric actuators capable of delivering greater accuracy, programmability, and integration with advanced control systems. The emergence of collaborative robots (cobots), warehouse automation systems, and precision assembly lines further accelerated the need for compact, intelligent motion solutions. Technological advancements in sensors, motor efficiency, and digital control enabled new generations of actuators with improved responsiveness and real-time feedback capabilities.

Sources

Primary Research interviews:

Robotics engineers

Automation system integrators

Actuator manufacturers

Industrial equipment OEMs

Databases:

IEEE Robotics Data

IFR Robot Statistics

Magazines:

Robotics Business Review

Automation World

Industrial Automation Magazine

IEEE Spectrum

Journals:

IEEE Transactions on Robotics

Mechatronics

Sensors & Actuators

Robotics and Computer-Integrated Manufacturing

Newspapers:

Nikkei Asia (Manufacturing)

Financial Times (Technology)

The Wall Street Journal (Industry 4.0)

Reuters Tech

Associations:

International Federation of Robotics (IFR)

Robotic Industries Association (RIA)

IEEE Robotics Society

Industrial Automation Association

Share

Share

About Author

Ramprasad Bhute is a Senior Research Consultant with over 6 years of experience in market research and business consulting. He manages consulting and market research projects centered on go-to-market strategy, opportunity analysis, competitive landscape, and market size estimation and forecasting. He also advises clients on identifying and targeting absolute opportunities to penetrate untapped markets.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients