Global Residential Water Treatment Devices Market Overview

Residential water treatment devices are used to remove impurities by reducing the contamination level in water using a physical barrier, followed by processes of filtration and various others. Water treatment devices are used for various purposes, which majorly depends on the type of water. For instance, reverse osmosis system is most widely used for drinking water purpose. National Sanitation Foundation (NSF) is responsible for the certification of the different types of filters that are used to treat various types of waters.

Increasing awareness about water-borne illnesses such as typhoid, cholera, and diarrhea has resulted in the installation of home water treatment devices by consumers. Further, increasing purchasing power among the consumers is major factor fuelling the growth of water treatment devices market globally.

The high price of water treatment devices coupled with high installation costs for the same refrain price-sensitive consumers from installing such devices, which is one of the major factors hindering the growth of the market. However, the impact of this restraint is expected to minimize by the end of the forecast period due to increasing incidences of waterborne diseases.

Residential Water Treatment Devices Market Size and Forecast – 2025 – 2032

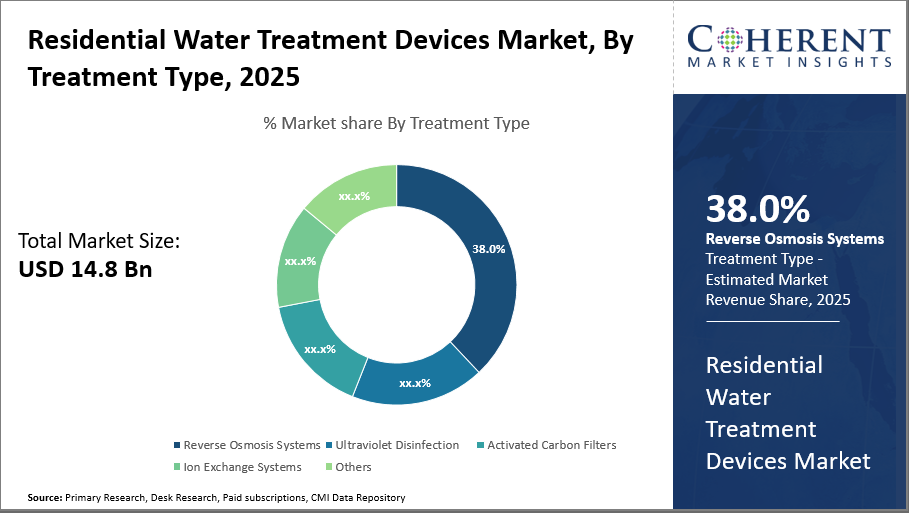

The Residential Water Treatment Devices Market size is estimated to be valued at USD 14.8 billion in 2025 and is expected to reach USD 25.3 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.1% from 2025 to 2032.

Key Takeaways

Reverse Osmosis Systems dominate the product type segment with a commanding 38% market share, driven by their efficiency in contaminant removal, while Activated Carbon Filters and Ultraviolet Disinfection technologies are rapidly growing due to increasing health concerns.

The Point-of-Use installation segment maintains a leading position owing to the rising need for localized water treatment solutions in urban residences, complemented by steady growth in Point-of-Entry installations for multi-family and larger buildings.

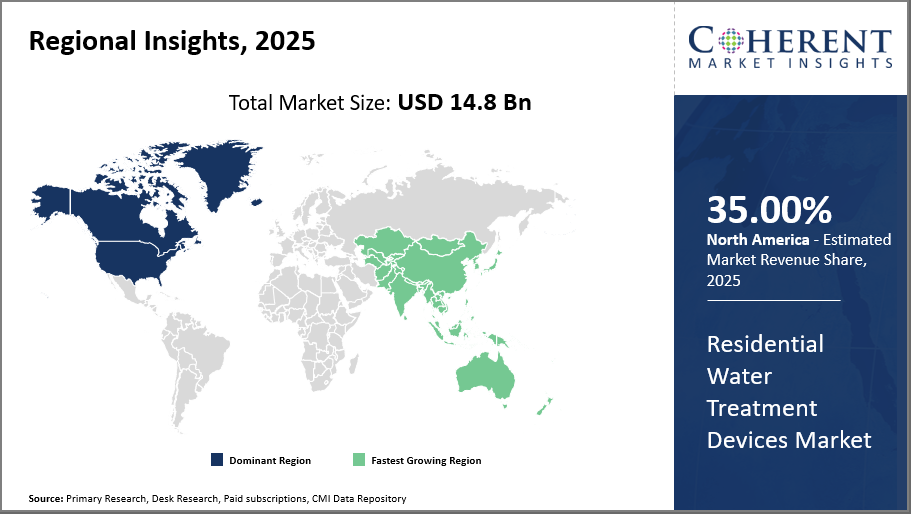

North America leads regional market share, accounting for roughly 35% of industry revenue, benefiting from stringent water safety regulations and advanced infrastructure, whereas Asia Pacific displays the fastest market growth with a CAGR above 9%, propelled by urbanization and rising disposable incomes.

Residential Water Treatment Devices Market – Segmentation Analysis

To learn more about this report, Download Free Sample

Residential Water Treatment Devices Market Insights, By Product Type

In terms of Product Type, the market is segmented into Reverse Osmosis Systems, Activated Carbon Filters, Ultraviolet Disinfection, Ion Exchange Systems, and Others among these, Reverse Osmosis Systems dominate the market share with 38%. This dominance is attributed to the system’s superior contaminant removal efficiency including heavy metals and pathogens. Reverse osmosis units are especially preferred in urban households with compromised municipal water quality.

Residential Water Treatment Devices Market Insights, By Installation Type

In terms of Installation Type, the market is segmented into Point-of-Use (POU), Point-of-Entry (POE), and Others; with Point-of-Use installations dominating the market share due to their convenience and affordability for individual households. POU devices have been critical in urban settings where localized point solutions provide immediate access to purified water at taps or under sinks.

Residential Water Treatment Devices Market Insights, By Application

In terms of Application, the market is segmented into Residential Buildings, Multi-family Housing, and Others. Residential Buildings capture the largest market share, fueled by standalone homes investing heavily in sophisticated water treatment technologies, spurred by concerns over water safety and health awareness.

Residential Water Treatment Devices Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Residential Water Treatment Devices Market Analysis and Trends

The market dominance of residential water treatment devices in North America is supported by established distribution networks, high consumer awareness, and strict government regulations for drinking water quality. Roughly 35% of market revenue comes from North America. Due of its large consumer expenditure and sophisticated R&D capabilities, the United States continues to lead this dynamic. Propelled by creative, adaptable solutions catered to regional water quality concerns, major firms like Pentair PLC and Culligan International maintain substantial market positions.

Asia Pacific Residential Water Treatment Devices Market

Asia Pacific, on the other hand, is growing at the quickest rate, with a projected CAGR of more than 9% from 2025 to 2032. The main driver is the rapid urbanization of nations like China and India, which is exacerbated by rising disposable incomes and increased concerns about water contamination. Adoption is also being accelerated by infrastructure improvements and government incentives. To take advantage of this boom, businesses like Kent RO Systems and LG Electronics are making significant investments in localized marketing techniques and regional production capacities.

Residential Water Treatment Devices Market Outlook for Key Countries

Market Analysis and Trends for Residential Water Treatment Devices in the United States

The U.S. market is characterized by sophisticated consumer preferences and stringent regulatory frameworks, ensuring high market revenue contributions. In 2024, the adoption rate of smart water purification systems increased by 28%, reflecting consumer demand for integrated solutions combining reverse osmosis and UV systems. Leading entities such as Pentair and Culligan have launched tech-advanced products tailored for home automation, empowering consumers with remote monitoring and control. Furthermore, government initiatives aimed at improving rural water quality have also expanded market scope, with increased penetration in suburban and semi-urban areas.

Market Analysis and Trends for Residential Water Treatment Devices in the India

India's Residential Water Treatment Devices market is buoyed by rapid urban population growth and pronounced water quality challenges. In 2025, sales of economical activated carbon filters and reverse osmosis units increased by 34%, driven by the prevalence of contaminants in municipal and groundwater supplies. Companies such as Kent RO Systems and LG are capitalizing on this demand by introducing budget-friendly and maintenance-efficient devices. Government programs promoting clean water access have boosted market outreach, while rising middle-class income levels are enabling broader adoption of sophisticated purification technologies.

Analyst Opinion

One critical demand-side indicator driving the Residential Water Treatment Devices market is the rising consumer inclination toward cost-effective purification solutions. For example, data from 2024 indicates a 17% year-over-year surge in sales of affordable reverse osmosis systems in North American households, reflecting increased consumer engagement with advanced water quality. This demonstrates the purchasing power shift toward technology-driven, yet economically viable, water treatment solutions.

On the supply side, production capacity expansion in Asia Pacific significantly influences market share. In 2025, manufacturing facilities specializing in water filtration membranes in India and China increased capacity by nearly 22%, prioritizing exports to Western and emerging markets. This expansion reduces lead times and enhances availability, addressing market growth challenges in distribution and supply chain complexity.

Import growth trends reveal increased reliance on eco-friendly and energy-efficient residential devices, especially in Europe. In 2024, imports of solar-powered water treatment units in Germany grew by 15%, underlining consumer and regulatory pressures to adopt sustainable products. This drives manufacturers to innovate product portfolios, aligning with the market dynamics of greener technologies.

A micro-indicator worth noting is the surge in multi-stage filtration systems designed for a range of water sources, including municipal and well water. In 2025, sales of multi-stage filter units grew by 19% in urban areas with compromised water infrastructure, suggesting a growing market segment linked to localized water quality concerns rather than generic purification.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 14.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 8.1% | 2032 Value Projection: | USD 25.3 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Pentair PLC, A. O. Smith Corporation, Culligan International Company, 3M Company, GE Appliances, Hyflux Ltd, Kent RO Systems Ltd, LG Electronics Inc., Whirlpool Corporation, Dow Chemicals. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Growth factors

The surge in urban population worldwide significantly increases demand for residential water treatment devices as infrastructure strains to provide safe potable water.

In 2025, urban areas accounted for over 60% of total market revenue, illustrating this direct growth linkage. Additionally, regulatory policies focused on water safety and chemical contamination mitigation have heightened standards for household water treatment solutions, particularly in North America and Europe.

The rising prevalence of water-borne diseases has accelerated demand in emerging economies, with Asia Pacific witnessing a double-digit grow rate partly attributed to increased infection-related concerns.

Apart from this, rapid technological advancements such as smart water treatment devices offering remote monitoring capabilities have expanded market scope by addressing convenience and efficiency, driving higher adoption rates among tech-savvy consumers.

Residential Water Treatment Devices Market Development

In May 2025, The Echo Pure Whole Home Water Filter, a complete, high-performance system made to supply purified water to every tap in the house, has been launched. Echo is the industry leader in hydrogen health products. This potent improvement eliminates the most important contaminants chlorine, chloramine, PFAS, lead, and fluoride by combining cutting-edge filtration with water softening. Additionally, it uses cutting-edge ultraviolet (UV) light technology to eliminate germs and viruses, reduce scale building, and enhance the taste, clarity, and odor of water. Every drop is safer, kinder, and cleaner whether you're showering, drinking, or doing laundry.

Market Trends

The market is witnessing a pronounced shift toward hybrid water treatment devices combining reverse osmosis and ultraviolet sterilization to provide comprehensive water safety solutions. In 2024, such hybrid device sales increased by 21% in urban U.S. households, aligning with higher consumer expectations for multi-layer protection.

Another emerging trend is the integration of IoT-enabled sensors in residential devices, allowing real-time water testing—a feature that saw a 30% sales upsurge in Europe in 2025. Furthermore, sustainable materials and energy-efficient designs are gaining traction as companies attempt to reduce environmental impact while boosting device lifespan, thereby reshaping industry trends.

Key Players

Pentair PLC

A. O. Smith Corporation

Culligan International Company

3M Company

Hyflux Ltd

Kent RO Systems Ltd

LG Electronics Inc.

Whirlpool Corporation

Dow Chemicals

Several market players are implementing innovative growth strategies such as strategic partnerships and acquisition of niche technology startups. For instance, one leading company expanded its smart filtration portfolio by partnering with IoT solution providers, resulting in a 25% increase in market revenue in 2024. Another company adopted vertical integration, enhancing production control and reducing costs, which led to a 15% increment in overall market share.

Outlook for the Residential Water Treatment Devices Market in the Future

The market for residential water treatment equipment has a promising future due to rising consumer awareness of waterborne illnesses and the need for clean, safe water. Significant drivers driving market expansion include rapid urbanization, population growth, and industrialization, particularly in the Asia-Pacific region. Adoption is anticipated to increase as a result of technological developments in water purifying techniques including reverse osmosis and ultraviolet light, as well as the creation of reasonably priced and easily navigable equipment.

The market will be further driven by government legislation encouraging clean water and the growing preference for effective and environmentally friendly water treatment methods. Furthermore, as industry and consumers look for sustainable water management techniques, it is projected that programs centered on water recycling and reuse will open up new opportunities. The availability and efficacy of residential water treatment equipment will be improved internationally because to key players' product advancements and strategic investments, which will help promote market expansion.

Historical Analysis

In November 2018, Culligan, a water treatment solution provider, launched the IW Reverse Osmosis System. This launch helped the company in expanding its product portfolio and therefore its customer base.

In July 2019, LG Electronics Inc. announced the sale of two of its water treatment subsidiaries, namely, Hi-Entech and LG-Hitach, to Techcross, a company which offered ballast water treatment systems and was an affiliated company of the Seoul-based Bubang Group. The two subsidiaries were sold at approximately US$ 200 million. Selling of subsidiaries by LG Electronics Inc. boosted their investment for future expansions.

In March 2014, Unilever PLC acquired a major stake in Qinyuan Group Co., a Chinese water-purification company. This acquisition was expected to capture the China water purification market, owing to the high demand for clean water from this region.

Sources

Primary Research interviews:

Distributors and dealers of water purifiers and filters

Retail chains (electronics & home appliances stores)

Plumbers and installation service providers

Databases:

OECD Statistics

FAO AQUASTAT

International Trade Centre (ITC) Trade Map

Magazines:

Water Quality Products Magazine

Water & Wastes Digest

WaterWorld Magazine

Journals:

Desalination and Water Treatment

Environmental Science & Technology

Journal of Environmental Management

Newspapers:

The Guardian (Water & Climate coverage)

The Times of India (Water crisis & infrastructure reports)

The Economic Times (Industry coverage)

Associations:

American Water Works Association (AWWA)

International Water Association (IWA)

Indian Water Works Association (IWWA)

Share

Share

About Author

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients