Residential Intellectual Disability Market Size and Forecast – 2026 – 2033

The Global Residential Intellectual Disability Facilities Market size is estimated to be valued at USD 18.3 billion in 2026 and is expected to reach USD 29.1 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 6.2% from 2026 to 2033.

Global Residential Intellectual Disability Facilities Market Overview

This Market focuses on providing long-term residential care, support services, and structured living environments for individuals with intellectual and developmental disabilities. This market includes group homes, supported living facilities, and specialized residential care centers offering personal care, behavioural support, life skills training, and community integration. Growth is driven by increasing awareness of intellectual disabilities, rising demand for community-based and person-centered care models, supportive government policies, and expanding funding programs. Technological integration, individualized care planning, and improved service quality are shaping market development, while workforce shortages and regulatory challenges remain key constraints across regions.

Key Takeaways

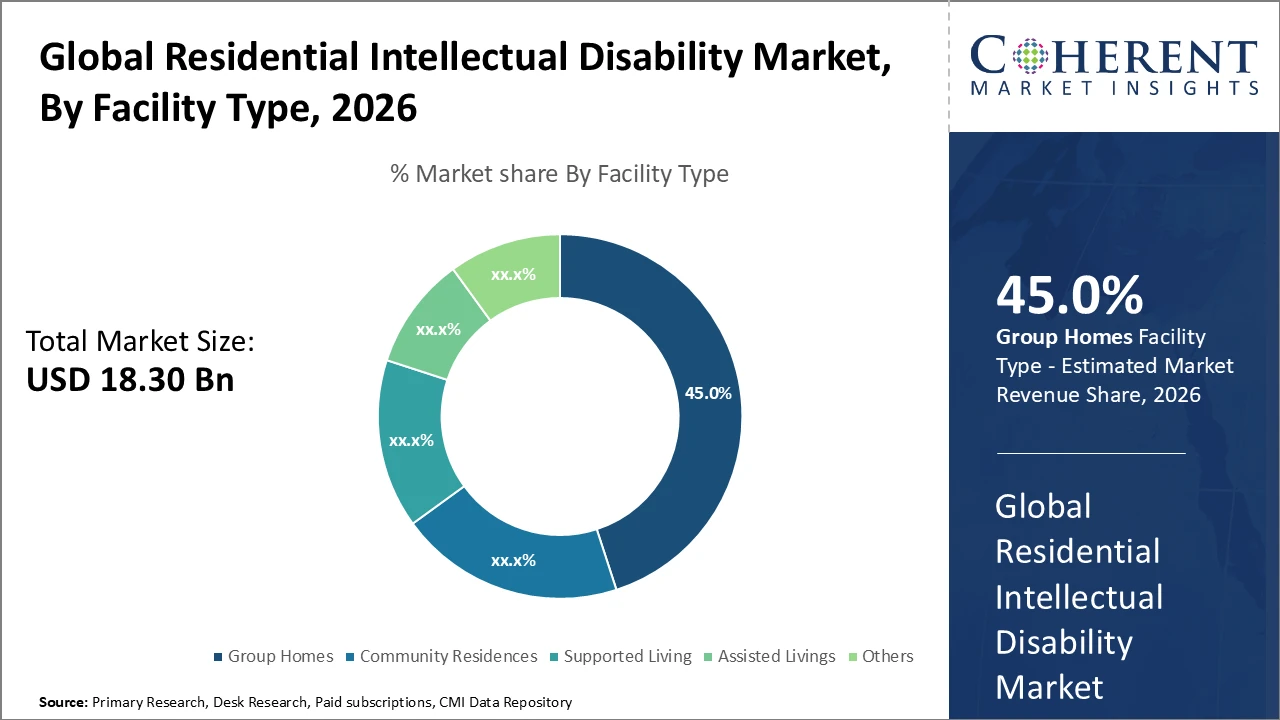

Group homes hold approximately 45% of the market share, driven by their cost efficiency and community-based living advantages that align with policy preferences in developed regions.

The mild intellectual disability subsegment generates the highest revenue because of higher prevalence rates and increased early intervention efforts.

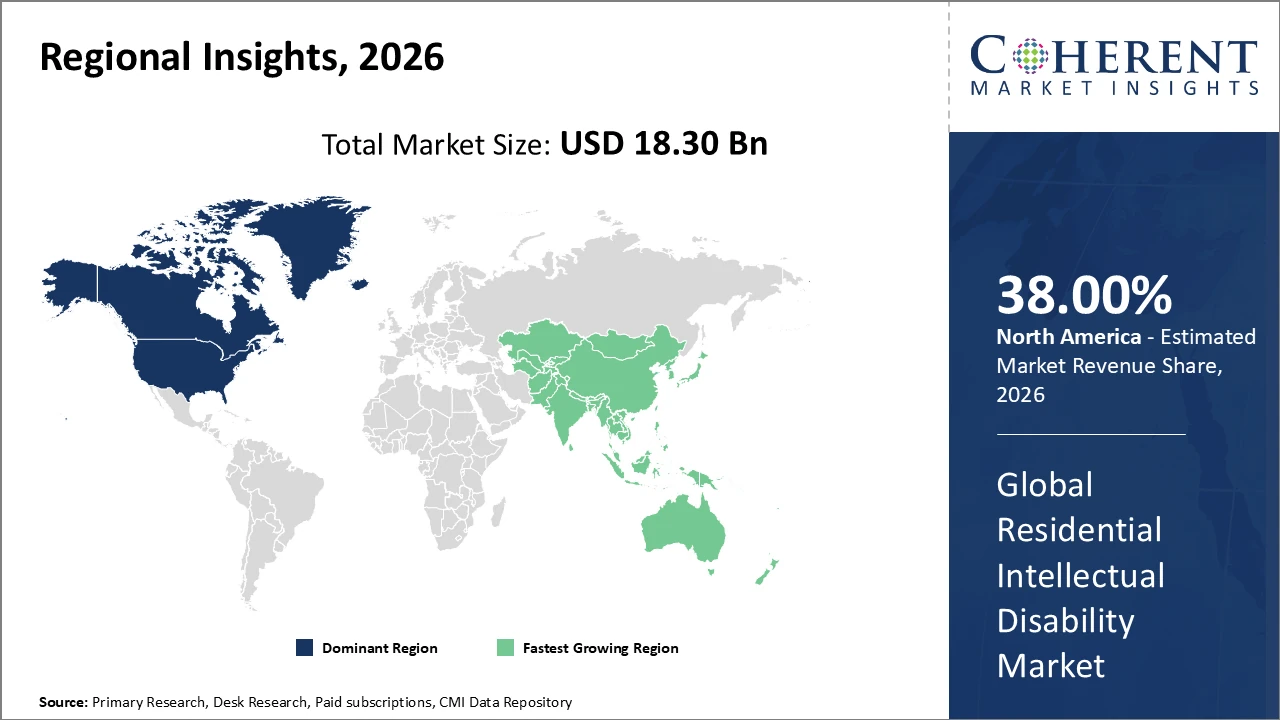

North America leads the market, supported by high healthcare spending and well-established regulatory frameworks for residential care services.

Europe shows steady growth, backed by strong government policies and collaborations with non-governmental organizations.

Asia Pacific is the fastest-growing region, driven by expanding healthcare infrastructure, rising awareness, and a growing vulnerable population.

Increased investments in emerging economies are reshaping revenue distribution and influencing cross-border industry trends.

Residential Intellectual Disability Market Segmentation Analysis

To learn more about this report, Download Free Sample

Residential Intellectual Disability Market Insights, By Facility Type

Group Homes dominate the market share due to their cost efficiency and well-established presence in North America and Europe, enabling greater community integration for individuals with intellectual disabilities. Supported Living is the fastest-growing subsegment, driven by increasing demand for personalized care and flexible residential arrangements, particularly in countries such as Germany and Australia. Community Residences offer a balanced level of care by combining independence with structured support, while Assisted Living facilities serve individuals who require ongoing medical supervision. Other facility types include specialized residential programs addressing niche care needs, as well as emerging hybrid models that integrate technology-enabled services with social care support.

Residential Intellectual Disability Market Insights, By Age group

Adults dominate the market due to higher demand for long-term residential care and occupational therapy services that support social and vocational integration. The elderly subsegment is the fastest growing, as aging individuals with intellectual disabilities increasingly require age-specific residential care solutions, a trend especially evident in North America and Europe. Facilities for children and adolescents focus on early intervention, education, and developmental therapies, while other segments include transitional programs designed to support the shift from juvenile care settings to adult residential environments.

Residential Intellectual Disability Market Insights, By Disability Type

Mild intellectual disability holds the dominant market share, driven by higher diagnosis rates and the availability of community-based care options that encourage early intervention. Severe intellectual disability represents the fastest-growing subsegment, supported by expanding development of specialized residential facilities offering intensive care and medical support, particularly in Europe and North America. The moderate and profound subsegments require highly tailored interventions and contribute uniquely to overall market segmentation and dynamics. Other categories include mixed or unspecified intellectual disability cases that necessitate flexible and adaptive residential care solutions.

Residential Intellectual Disability Market Trends

The market is experiencing rapid adoption of digital healthcare solutions, including virtual therapy and AI-driven personalized care plans, which have reduced costs and improved patient engagement.

This digital transformation trend has been particularly strong in North America and Europe during the 2024–2026 period.

Policy-driven deinstitutionalization is reshaping market dynamics, with governments in Canada and several European countries actively promoting community-based integration models.

These policy initiatives are driving increased demand for residential intellectual disability facilities in developed regions.

Asia Pacific is emerging as a fast-growing market due to a rising population with intellectual disabilities and increased healthcare expenditure.

Combined investments in residential care facilities in India and China increased by 18% in 2025, supporting infrastructure expansion and workforce development.

Residential Intellectual Disability Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Residential Intellectual Disability Market Analysis and Trends

In North America, the Residential Intellectual Disability Facilities market is dominated by a well-established healthcare ecosystem, extensive government funding, and the presence of leading market players such as BrightSky Communities. The region accounts for approximately 38% of the global market share, supported by high industry standards, advanced care delivery models, and progressive policy reforms that enhance market revenue and drive the expansion of residential care services.

Asia Pacific Residential Intellectual Disability Market Analysis and Trends

Meanwhile, the Asia Pacific region is the fastest-growing market, with a CAGR exceeding 7% between 2026 and 2033. This growth is supported by government initiatives promoting inclusive healthcare and social welfare, increasing awareness, and expanding market opportunities, particularly in China and India. Companies are leveraging emerging urban care infrastructure and rising disposable incomes, which are driving greater demand for residential intellectual disability facilities across the region.

Residential Intellectual Disability Market Outlook for Key Countries

USA Residential Intellectual Disability Market Analysis and Trends

The USA market serves as a key hub for Residential Intellectual Disability Facilities, driven by a mature residential care ecosystem, advanced technology adoption, and comprehensive insurance frameworks supporting individuals with intellectual disabilities. Legislative initiatives, such as the 2025 Mental Health Services expansion program, increased funding by 14%, promoting the development of group homes and supported living facilities. Leading companies like Pathway Group reported a 16% revenue growth, supported by improved service delivery platforms and partnerships with state governments. According to CDC data, an estimated 1.5 million individuals in the US live with intellectual disabilities requiring specialized residential care, sustaining strong market demand and growth.

Germany Residential Intellectual Disability Market Analysis and Trends

Germany is a key European market for Residential Intellectual Disability Facilities, driven by integrated care policies and strong governmental support systems. The enactment of the Federal Participation Act in 2024 strengthened supported living services, boosting market revenue by 11%. Prominent market players have expanded operations through collaborations with public health agencies, further increasing industry share. Germany’s focus on person-centered, community-based residential care fosters robust market dynamics and sets a benchmark for neighbouring European countries seeking to enhance service quality and inclusivity in the sector.

Analyst Opinion

Increased funding and policy support for intellectual disability care globally drive market growth; for example, updated EU healthcare policies in 2025 led to a 15% rise in the expansion of dedicated residential facilities, boosting market revenue.

Demand-side factors show rising adoption of specialized residential care, driven by aging populations with intellectual disabilities and integration needs in educational and occupational therapy programs; the U.S. reported a 9.5% increase in demand from 2024 to 2026.

Pricing dynamics are gradually stabilizing due to expanded insurance coverage and government subsidies, with average per capita expenditure on residential care decreasing by 3% between 2024 and 2025, improving affordability and adoption.

Micro-indicators such as enhanced caregiver training programs and facility certifications have improved service quality, supporting higher client retention and occupancy; in Australia, occupational therapy integration in residential facilities improved by 12% in 2025, positively impacting market growth and service efficacy.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 18.3 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 6.2% | 2033 Value Projection: | USD 29.1 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | BrightSky Communities, Pathway Group, The Walden Group, Moriah Group, CareCo Services, New Horizons Residential, Hopewell Living, Lifesparks, Spectrum Residential Services, Serenity Homes. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Residential Intellectual Disability Market Growth Factors

Several factors are driving the expansion of the Residential Intellectual Disability Facilities market. Increased governmental funding and subsidies aimed at improving residential care infrastructure have been pivotal, reflected in a 12% rise in public investments in community residences between 2024 and 2026. Demographic shifts, particularly the growing elderly population with intellectual disabilities, have heightened demand for specialized residential facilities, leading to a 9% increase in facility admissions in 2025. Technological advancements, including telehealth and remote monitoring tools, have enhanced service quality and operational efficiency, boosting occupancy rates and customer satisfaction. Additionally, rising societal awareness and advocacy for community integration have strengthened market dynamics, driving revenue growth across regions such as Europe and North America.

Residential Intellectual Disability Market Development

In November 2025, The Hyderabad initiative A Normal Home offers persons with intellectual disabilities a supportive residential setting. Promoting dignity, independence, and choice, it moves beyond institutional care. This group living model empowers residents to integrate into the community, fostering inclusion and a meaningful life of autonomy within a safe environment.

In October 2025, the Irish government opened two new residential centres in Galway to support persons with disabilities, including intellectual disabilities. These centres provide safe, community-based living environments that promote dignity, independence, and inclusion. The initiative strengthens empowerment and quality of life, marking a significant step in residential disability care.

Key Players

Leading Companies of the Market

BrightSky Communities

The Walden Group

Moriah Group

CareCo Services

New Horizons Residential

Hopewell Living

Lifeworks

Spectrum Residential Sevices

Serenity Homes

Several key market players have pursued aggressive growth strategies in recent years. BrightSky Communities expanded its footprint through acquisitions in 2025, resulting in a 20% increase in market share in North America. Similarly, Pathway Group leveraged technology integration in 2026 to enhance personalized care services, achieving a revenue growth of 14%. Companies have also focused on partnerships with local governments and NGOs to address regulatory compliance challenges, strengthening their competitive positioning and supporting sustained business growth in the Residential Intellectual Disability Facilities market.

Residential Intellectual Disability Market Future Outlook

The Residential Intellectual Disability Market is expected to experience steady growth in the coming years, driven by rising awareness, policy support, and increasing demand for community-based and personalized care. Technological advancements, including telehealth, AI-driven care plans, and remote monitoring, will continue to enhance service quality and operational efficiency. Aging populations and early intervention programs for children and adolescents will expand demand across age groups. Emerging markets in Asia Pacific, particularly China and India, are projected to grow rapidly due to rising healthcare investments and expanding care infrastructure. Overall, the market outlook remains positive, with continued innovation, government support, and societal advocacy fueling expansion.

Residential Intellectual Disability Market Historical Analysis

The Residential Intellectual Disability Market has shown steady growth over the past decade, driven by increasing recognition of the needs of individuals with intellectual disabilities and the shift from institutional care to community-based models. In North America and Europe, market expansion was supported by robust healthcare infrastructure, government funding, and policy reforms promoting person-centered care. Technological integration, such as electronic health records and early adoption of telehealth, began improving care delivery and operational efficiency. Rising awareness, advocacy, and early intervention programs for children and adolescents further contributed to demand. Historical trends also show gradual adoption of specialized facilities catering to severe and profound disabilities, shaping the market’s current segmentation and growth trajectory.

Sources

Primary Research Interviews:

Residential Care Facility Managers

Occupational Therapists and Behavioral Specialists

Social Workers and Care Coordinators

Healthcare Technology Providers

Databases:

WHO Disability Statistics

OECD Health Data

Global Residential Intellectual Disability Facility Reports

Magazines:

Disability & Care Magazine

Health Management Magazine

Residential Care Insight

HealthTech Magazine

Journals:

Journal of Intellectual & Developmental Disability

Disability and Health Journal

Journal of Applied Research in Intellectual Disabilities

Newspapers:

The New York Times (Health)

The Guardian (Health)

Financial Times (Healthcare)

The Hindu (Health)

Reuters Health

Associations:

World Health Organization (WHO)

International Association for the Scientific Study of Intellectual and Developmental Disabilities

National Association for Residential Care

American Association on Intellectual and Developmental Disabilities (AAIDD)

Share

Share

About Author

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients