Purging Compound Market Size and Forecast – 2025 – 2032

The global Purging Compound market size is estimated to be valued at USD 310.6 million in 2025 and is expected to reach USD 547.7 million by 2032, exhibiting a compound annual growth rate (CAGR) of 9.1% from 2025 to 2032.

Global Purging Compound Market Overview

Purging compounds are cleaning materials used in plastic processing equipment such as injection molding machines, extruders, and blow molding systems to remove residual resin, colorants, and contaminants. These compounds are typically thermoplastic-based formulations containing high-viscosity polymers, cleaning agents, and abrasive additives. They prevent material degradation, color streaks, and contamination during material or color changes.

Purging compounds are available in mechanical, chemical, or hybrid types and can be used at processing temperatures similar to production resins. They help reduce machine downtime, waste, and maintenance costs. Modern purging compounds are designed for high efficiency, non-toxic composition, and easy handling.

Key Takeaways

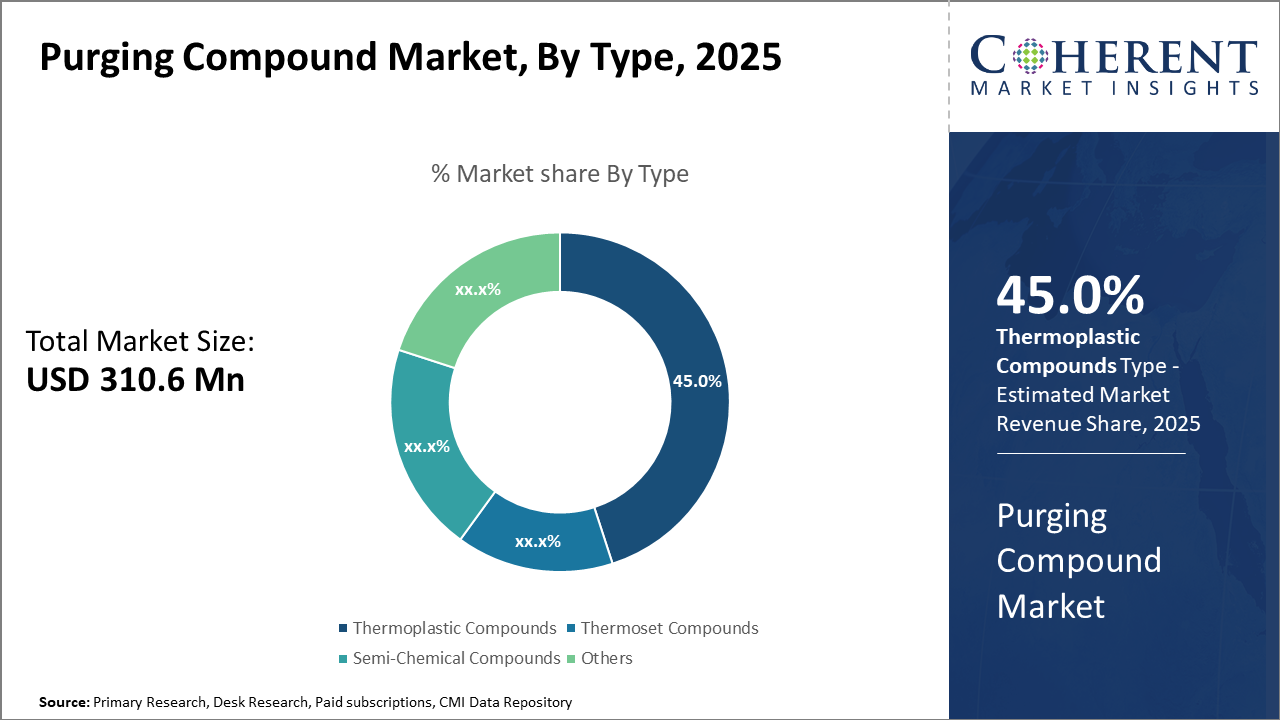

The Thermoplastic Compounds segment dominates the market share due to its versatile application and superior purging efficiency in polymer processing machinery. The fastest growth emerges from Semi-Chemical Compounds, catering to niche industries requiring specialized formulations. Other subsegments such as Thermoset Compounds continue to serve specific end-use cases efficiently.

Injection Molding remains the largest application segment within the Purging Compound market, benefiting from expanding automotive and packaging sectors that demand high throughput and minimal downtime. Extrusion is identified as the fastest-growing application with rising usage in semiconductor encapsulation and specialty films.

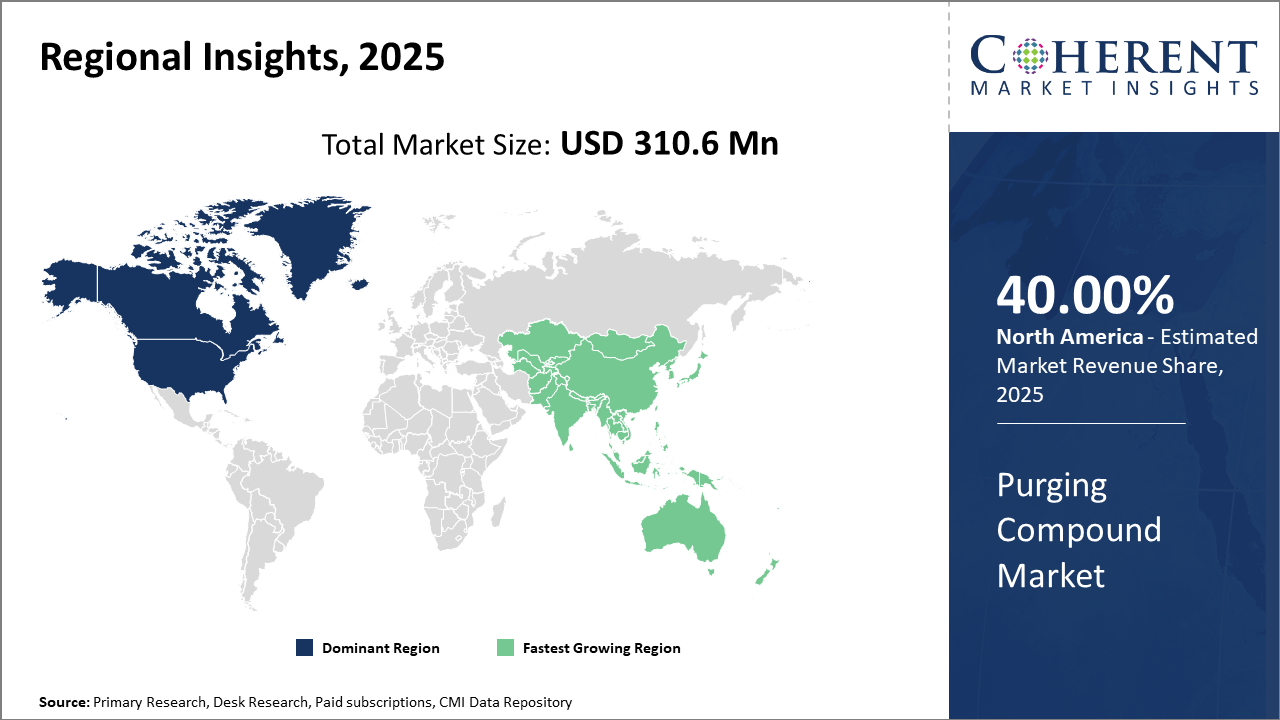

Regionally, North America holds a commanding market share given its mature polymer processing infrastructure and stringent quality standards, while Asia Pacific records the fastest growth, fueled by rising manufacturing investments and technological adoption, particularly in China and India.

Purging Compound Market Segmentation Analysis

To learn more about this report, Download Free Sample

Purging Compound Market Insights, By Type

In terms of Type, Thermoplastic Compounds dominate the market share at 45%. This dominance is primarily due to their superior compatibility and adaptability across a wide range of polymer processing methods, delivering efficient residue removal and color changeover benefits. Thermoplastic Compounds cater extensively to injection molding and extrusion processes where frequent color changes are critical. The fastest growing subsegment is Semi-Chemical Compounds, favored in industries demanding custom, less abrasive purging agents, such as electronics and medical devices.

Purging Compound Market Insights, By Application

Injection Molding holds the dominant market share, due to its expansive adoption in automotive, consumer goods, and the medical industry. Manufacturing necessitates reliable purging compounds to reduce downtime and maintain quality. Its dominance is underpinned by the complexity and precision required during frequent mold changes, making effective purging essential. Extrusion represents the fastest-growing application segment, driven by its increasing use in flexible packaging and technical films, where purging compounds optimize line efficiency and product integrity.

Purging Compound Market Insights, By End-User

The automotive sector dominates the market share. This segment’s dominance results from stringent purity and performance requirements in polymer components, where efficiency gains from purging compounds directly impact production throughput and defect reduction. Medical Devices are the fastest-growing subsegment, with increased polymer implant and precision device manufacturing necessitating contamination-free molding environments, leading to higher purging compound utilization. Packaging benefits from the rapid increase in sustainable packaging initiatives that require advanced purging formulations to handle biodegradable polymers effectively.

Purging Compound Market Trends

The Purging Compound market exhibits several notable trends, including accelerated eco-friendly product innovation and the digitization of quality control processes.

For example, Milacron’s 2024 introduction of solvent-free compounds significantly reduced hazardous emissions, setting a new industry benchmark.

Additionally, regional demand is undergoing a shift where the Asia Pacific is no longer just a manufacturing hub but an innovation center, supported by robust government policies encouraging sustainability.

The focus on bio-based and recyclable compounds is also reshaping product pipelines globally.

Purging Compound Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Purging Compound Market Analysis and Trends

In North America, the Purging Compound market’s dominance is driven by well-established polymer industries backed by rigorous environmental guidelines and premium quality expectations. The U.S. contributes significantly with high-value automotive and medical device manufacturing operations, fostering a demand that supports 40% of the overall industry share. Companies in this region invest heavily in technology to comply with strict regulations, maintaining market leadership.

Asia Pacific Purging Compound Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth with a CAGR surpassing 10% due to expanding polymer processing plants in China and India. Favorable government incentives, increasing foreign investments, and rising consumer demand for plastics-based products are central to this acceleration. Manufacturers such as RTP Company and Clariant have expanded their local production capabilities to capture this spurt.

Purging Compound Market Outlook for Key Countries

USA Purging Compound Market Analysis and Trends

The U.S. Purging Compound market is characterized by advanced technical adoption and a regulatory environment emphasizing stringent quality. Domestic OEMs and tier-1 suppliers dominate automotive polymer molding, leading to substantial compound consumption growth, which increased by nearly 7% in 2024. Companies are leveraging smart purging technologies to minimize waste and improve cycle times, feeding into broader efforts toward sustainability and operational efficiency.

China Purging Compound Market Analysis and Trends

China’s Purging Compound market is rapidly evolving, driven by aggressive expansion in polymer processing facilities and growing automotive sector output. The country recorded a 12% increase in purging compound consumption in 2024, aided by increased industrial automation and a shift to greener purging solutions encouraged by government environmental policies. Local and international players alike are establishing joint ventures and scaling production to meet this dynamic market demand.

Analyst Opinion

The growth trajectory of the Purging Compound market is strongly linked to rising polymer processing activities worldwide. For example, in 2024, polymer production increased by over 6% in Asia Pacific, driving an increased requirement for effective purging materials to prevent contamination and maintain equipment integrity. This supply-side indicator — increased polymer output — directly correlates with higher purging compound consumption, supporting the market size expansion.

Demand-side dynamics reveal that pricing strategies for purging compounds are stabilizing due to raw material optimization and enhanced formulation technologies. In 2025, manufacturers that adopted innovative blending methods reported up to 12% cost savings in compound production, benefiting both suppliers and end users through more competitive pricing and wider adoption.

Micro-indicators such as usage in precision applications within the medical and electronics sectors have contributed to nuanced market growth patterns. Recent data from 2024 highlights that medical device manufacturing precincts in North America increased purging compound consumption by 8%, attributed to stringent quality benchmarks that prevent cross-contamination during polymer molding.

Export trends show burgeoning activity in emerging regions, particularly Latin America and Southeast Asia. For instance, Brazil expanded its import volumes of purging compounds by 15% in 2024 to meet growing automotive polymer molding demands, illustrating how regional trade fluxes influence market revenue streams.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 310.6 million |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.1% | 2032 Value Projection: | USD 547.7 million |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Clariant AG, A. Schulman, Inc., RTP Company, Milacron Holdings Corp., Teknor Apex Company, Hexion Inc., BASF SE, Daikin Industries, Ltd., Solvay SA, Mitsui Chemicals, Inc., Evonik Industries AG. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Purging Compound Market Growth Factors

Increasing industrial automation and adoption of advanced polymer processing systems are pivotal drivers accelerating market growth. As machinery precision rises, the need for efficient and residue-free purging compounds becomes critical to minimize machine downtime and quality defects. Government environmental regulations mandating reduced chemical waste in plastics manufacturing have spurred demand for eco-compliant purging solutions, pushing numerous manufacturers to shift towards solvent-free and low-toxicity purging materials. Additionally, the growth of end-use sectors such as automotive and medical devices, where contamination control during polymer molding is essential, has expanded the purging compound market scope substantially.

Purging Compound Market Development

In February 2025, Chem-Trend introduced Ultra Purge™ 3615, a next-generation liquid purging compound designed for extrusion and blow molding applications. The product simplifies screw pulls and significantly reduces downtime, helping processors achieve faster material and color changes while minimizing resin waste.

In November 2024, Clariant AG unveiled EcoPURGE, a biodegradable, VOC-free purging compound aimed at packaging and consumer goods manufacturers. The launch supports the company’s sustainability goals by offering an environmentally responsible alternative without compromising on cleaning performance.

Key Players

Leading Companies of the Market

Clariant AG

A. Schulman, Inc.

Milacron Holdings Corp.

Teknor Apex Company

Hexion Inc.

BASF SE

Daikin Industries, Ltd.

Solvay SA

Mitsui Chemicals, Inc.

Evonik Industries AG

Leading companies in the Purging Compound market have aggressively pushed R&D to innovate high-performance and eco-friendly purging agents. For instance, RTP Company’s launch of bio-based purging compounds in 2024 drastically reduced VOC emissions and garnered high adoption in European automotive sectors. Meanwhile, Clariant AG implemented strategic partnerships in Asia Pacific that expanded its distribution footprint by 18%, resulting in significant revenue growth that underpins competitive strategies focusing on geographic expansion and product portfolio diversification.

Purging Compound Market Future Outlook

The future of purging compounds will emphasize environmentally friendly and high-performance formulations designed for modern polymer processing needs. Manufacturers are expected to develop non-toxic, biodegradable, and odor-free variants compatible with advanced thermoplastics and biopolymers. Automation and digital monitoring in production lines will increase demand for consistent and efficient purging performance. The focus will remain on reducing material waste, downtime, and energy consumption. As sustainability becomes a manufacturing priority, innovative purging compounds will continue evolving to support cleaner, safer, and more cost-effective plastic processing.

Purging Compound Market Historical Analysis

Purging compounds were developed to address the challenges of cleaning plastic processing machinery efficiently, replacing manual cleaning methods that caused downtime and material waste. Early formulations primarily focused on mechanical cleaning through abrasive action. Over time, chemical and hybrid purging compounds were introduced, offering better compatibility with different resins and equipment. These products became critical in color and material changeovers, especially in industries such as automotive, packaging, and electronics. Improved formulations allowed faster cleaning cycles, reduced residue buildup, and enhanced operational efficiency, marking a significant shift toward cleaner and more sustainable production practices.

Sources

Primary Research interviews:

Polymer Engineers

Plastic Processing Managers

Production Supervisors

Manufacturing Quality Experts

Magazines:

Plastics Technology

Injection World

Modern Plastics India

Polymer Update

Journals:

Journal of Applied Polymer Science

Polymer Engineering & Science

Journal of Plastic Film & Sheeting

Materials Today: Proceedings

Newspapers:

The Economic Times (Manufacturing)

The Times of India (Industry)

Plastics News

The Wall Street Journal (Manufacturing & Materials)

Associations:

Society of Plastics Engineers (SPE)

Plastics Industry Association (PLASTICS)

European Plastics Converters (EuPC)

American Chemical Society (ACS)

Share

Share

About Author

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients