Prescription Narcotic Cough Preparations and Expectorants Market Size and Forecast – 2026 – 2033

The Prescription Narcotic Cough Preparations and Expectorants Market is valued at about US $4.28 billion in 2026 and is expected to grow at a ~6.0% CAGR to reach ~US $50.3 billion by 2033 driven by rising respiratory conditions and therapeutic demand.

Global Prescription Narcotic Cough Preparations And Expectorants Market Overview

The Prescription Narcotic Cough Preparations and Expectorants market comprises physician‑prescribed medications that suppress severe coughs and help clear mucus in respiratory conditions like chronic bronchitis, asthma, and COPD. These drugs combine narcotic cough suppressants with expectorants to improve breathing and symptom relief. Demand is driven by rising respiratory disease prevalence and patient awareness, but strict narcotic regulations and addiction risk challenge growth. Market participants are innovating with safer formulations and delivery systems to balance efficacy with safety.

Key Takeaways

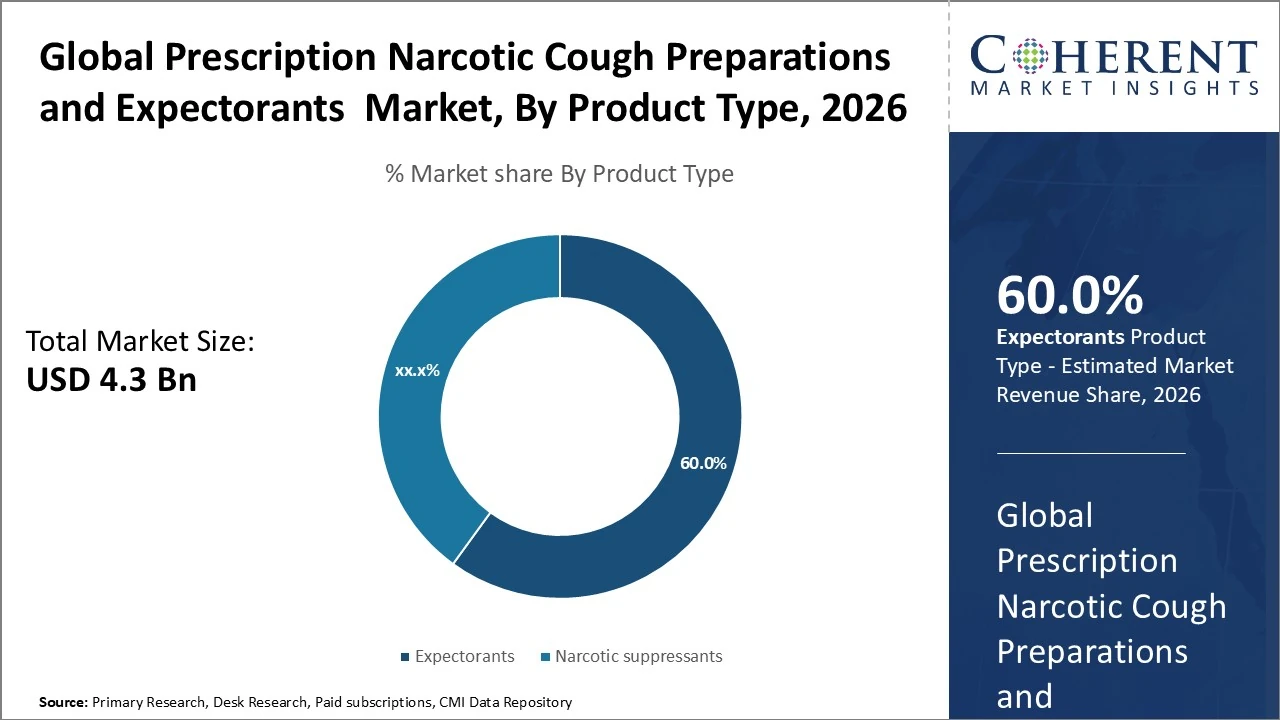

By Product Type - Expectorants are agents that liquefy mucus are widely used in clinical practice, accounting for an estimated majority of prescriptions 60%.

Oral formulations dominate with 70% market share.

Retail pharmacies/pharmacy outlets hold a significant share (43%), driven by wide accessibility of prescription and combination cough treatments.

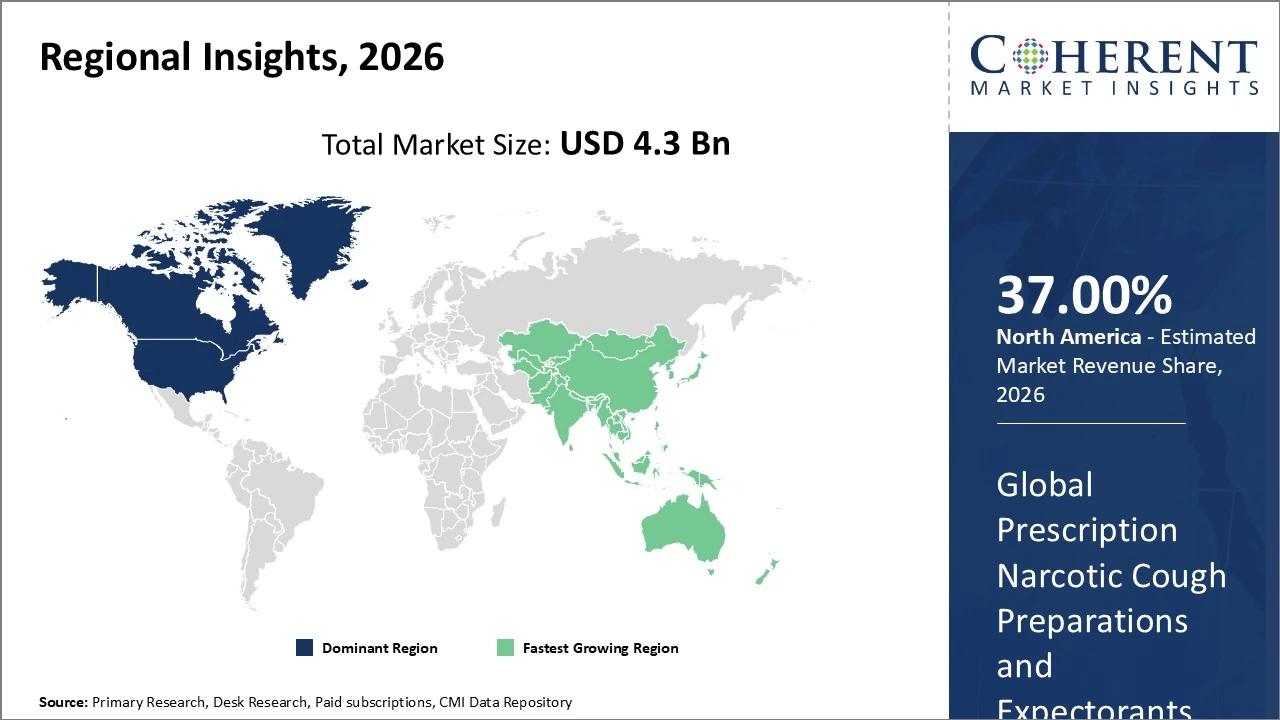

North America is the largest regional prescription narcotic cough preparations and expectorants segment which makes up 37% shares.

Prescription Narcotic Cough Preparations and Expectorants Market Segmentation Analysis

To learn more about this report, Download Free Sample

Prescription Narcotic Cough Preparations and Expectorants Market Insights, By Product Type

Expectorants are agents that liquefy mucus are widely used in clinical practice, accounting for an estimated majority of share in cough treatment, often outperforming suppressants in both acute and chronic cases. Narcotic suppressants represent a smaller proportion (~40%) due to regulatory restrictions and addiction risk, with non‑opioid suppressants increasingly preferred. Combination products that include both expectorant and suppressant functions are also growing. Overall, expectorants and combinations hold the largest share and expected growth prospect in the category.

Prescription Narcotic Cough Preparations and Expectorants Market Insights, By Technology

Market segmentation by technology in prescription narcotic cough preparations and expectorants highlights traditional oral formulations (70%) such as syrups and tablets that use established active ingredients like codeine or guaifenesin. Extended‑release and controlled‑release delivery systems (15%) improve dosing convenience and therapeutic consistency. Novel delivery technologies (10%) including inhalable aerosols or fast‑dissolve strips enhance patient experience and onset time. Digital health and e‑prescribing tools (5%) are increasingly integrated for prescription management and telehealth facilitation. Continued R&D focuses on safer non‑opioid suppressants and advanced drug delivery to balance efficacy with compliance and regulation.

Prescription Narcotic Cough Preparations and Expectorants Market Insights, By End-User

In the Prescription Narcotic Cough Preparations and Expectorants market, hospital pharmacies and healthcare settings account for a major portion (36%) of demand due to acute and chronic respiratory care needs and physician‑managed prescriptions. Retail pharmacies/pharmacy outlets hold a significant share (43%), driven by wide accessibility of prescription and combination cough treatments. Online pharmacies contribute (16%) with rapid growth supported by digital health and e‑commerce adoption. Smaller segments like specialty clinics or other channels make up the remainder (5%). Overall, healthcare and pharmacy channels dominate end‑user consumption globally.

Prescription Narcotic Cough Preparations and Expectorants Market Trends

Increasing focus on non‑opioid antitussives and combination therapies to reduce addiction risk and meet regulatory compliance.

Growth in extended‑release, controlled-release, and fast-dissolve formats for improved efficacy, compliance, and patient convenience.

Expansion of telehealth, e-pharmacies, and personalized medicine approaches, alongside rising interest in natural and herbal cough remedies.

Prescription Narcotic Cough Preparations and Expectorants Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Prescription Narcotic Cough Preparations and Expectorants Market Analysis and Trends

In North America, the prescription narcotic cough preparations and expectorants segment remains a key respiratory care market, with the region accounting for a significant share (37%) of the broader cough and cold medicines landscape due to high healthcare spending, widespread pharmacy networks, and respiratory disease prevalence. Growth is supported by ongoing product innovation and digital pharmacy distribution, though stricter opioid regulations are steering demand toward safer and non‑opioid alternatives.

Asia Pacific Prescription Narcotic Cough Preparations and Expectorants Market Analysis and Trends

In Asia Pacific, the prescription narcotic cough and expectorants segment is the fastest‑growing regional market, driven by rising respiratory disease prevalence, urban air pollution, and expanding healthcare access. The region accounts for an estimated ~33% of global cough‑related drug demand, with China dominating ~42% of regional value and India and Japan contributing the remainder. Expectorants and combination treatments are especially strong, supporting robust growth at a ~7.5% CAGR through the next decade. Growth drivers include expanding middle‑class consumption, stronger rural healthcare penetration, and a shift toward safer non‑opioid formulations under tighter regulations.

Prescription Narcotic Cough Preparations and Expectorants Market Outlook for Key Countries

USA Prescription Narcotic Cough Preparations and Expectorants Market Analysis and Trends

In the United States, prescription cough suppressants and expectorants form a significant portion of the broader cough remedies landscape, with the U.S. accounting for 35% of prescription cough drug value globally and steady growth driven by chronic respiratory conditions and physician‑managed therapy usage. Prescription formulations (including narcotic‑based combos like guaifenesin/codeine) continue to serve chronic and post‑infectious coughs, even as opioid restrictions tighten. Retail and hospital pharmacy channels dominate distribution at 65% combined.

Germany Prescription Narcotic Cough Preparations and Expectorants Market Analysis and Trends

In Germany, the prescription narcotic cough and expectorants market is part of a broader cough remedies segment worth several hundred million USD, growing at a moderate 3.5% CAGR through the next decade due to strong healthcare infrastructure and rising respiratory disease awareness. Retail pharmacies dominate distribution, accounting for roughly 75% of sales, with online pharmacy channels growing. Expectorants and combination products are gaining traction, while strict opioid regulations limit narcotic cough prescriptions to a smaller share of the overall cough medication mix, pushing demand toward safer non‑opioid alternatives and holistic formulations.

Analyst Opinion

Increasing rates of chronic bronchitis, COPD, and acute respiratory infections are expanding the need for effective cough management medications.

Strict controls on opioid‑based cough suppressants constrain market share and push innovation toward safer, non‑opioid alternatives.

Extended‑release, combination, and novel delivery technologies are becoming key differentiators to improve efficacy and patient adherence.

Digital pharmacy and telehealth adoption are reshaping distribution, with online orders growing rapidly relative to traditional pharmacy channels.

Competition from non‑narcotic, herbal, and OTC treatments is increasing, prompting portfolio diversification and enhancing consumer choice.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 4.28 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 6.0% | 2033 Value Projection: | USD 50.3 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Pfizer Inc., AstraZeneca plc, Merk & co., Novartis AG, Johnson & Johnson, Sanofi SA | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Prescription Narcotic Cough Preparations and Expectorants Market Growth Factors

The market growth is primarily driven by rising prevalence of respiratory diseases such as chronic bronchitis, asthma, and COPD, increasing the demand for effective cough management. Aging populations in developed regions further elevate chronic cough incidence. Innovation in formulations and delivery technologies, including combination products and extended‑release syrups, enhances treatment efficacy and patient compliance. Growing awareness of respiratory health, urban pollution, and seasonal infections contribute to steady prescription rates. Additionally, digital pharmacy platforms and telehealth services expand accessibility, while healthcare expenditure growth supports wider adoption of prescription cough suppressants and expectorants globally.

Prescription Narcotic Cough Preparations and Expectorants Market Development

The market is evolving with a focus on safer and more effective formulations, including non‑opioid antitussives, combination therapies, and mucolytic-expectorant blends. Advances in drug delivery technologies such as extended‑release syrups, fast-dissolve strips, and inhalable aerosols improve patient compliance and therapeutic outcomes. Regulatory frameworks are shaping product innovation, especially regarding narcotic restrictions, while digital health and e-pharmacy adoption are expanding distribution channels. Regional growth in Asia Pacific and North America is supported by rising respiratory disease prevalence, urbanization, and aging populations. Companies are also investing in R&D for holistic and herbal alternatives, broadening market appeal.

Key Players

Leading Companies of the Market

Pfizer Inc.

AstraZeneca plc

Merck & Co., Inc.

Novartis AG

Johnson & Johnson

Sanofi S.A.

Key players in the Prescription Narcotic Cough Preparations and Expectorants market include Pfizer, Johnson & Johnson, Novartis, Merck, Sanofi, AstraZeneca. They compete through R&D, innovative formulations, regulatory compliance, and extensive distribution networks, driving market growth and product diversification.

Prescription Narcotic Cough Preparations and Expectorants Market Future Outlook

The market is expected to grow steadily through 2033, driven by rising respiratory disease prevalence, aging populations, and increased awareness of cough management therapies. Non‑opioid and combination formulations will gain prominence due to regulatory restrictions on narcotics and patient safety concerns. Innovative drug delivery technologies, including extended-release syrups, fast-dissolve strips, and inhalable options, will enhance treatment adherence and efficacy. Digital health platforms and e-pharmacy channels will expand accessibility and convenience. Regional growth will be strongest in Asia Pacific and North America, while Europe will focus on regulatory compliance and product safety, shaping global market trends.

Prescription Narcotic Cough Preparations and Expectorants Market Historical Analysis

Historically, the market has been driven by high prevalence of respiratory illnesses and the widespread use of narcotic cough suppressants such as codeine combined with expectorants. From the early 2000s to 2020, growth was supported by hospital and retail pharmacy distribution channels, particularly in North America and Europe, with gradual expansion in Asia Pacific. Regulatory scrutiny on opioids began shaping market dynamics in the 2010s, encouraging safer non‑opioid alternatives. Product innovation, including combination therapies and syrup formulations, emerged to enhance patient compliance. Overall, the market maintained moderate growth, balancing demand and regulatory constraints.

Sources

Primary Research Interviews:

Industry Executives & Decision-Makers

Sales & Marketing Managers

Distributors & Wholesalers

Hospital & Retail Pharmacists

Databases:

PubMed

ClinicalTrials.gov

Embase

Journals:

Journal of Thoracic Disease (JTD)

Pulmonary Pharmacology & Therapeutics

Respiratory Medicine

Expert Opinion on Pharmacotherapy

Newspapers:

The Washington Post

The Wall Street Journal

The Guardian

The New York Times

Associations:

American Thoracic Society (ATS)

European Respiratory Society (ERS)

International Pharmaceutical Federation (FIP)

American Pharmacists Association (APhA)

Share

Share

About Author

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients