Global Polybutadiene Market Overview

Polybutadiene is a polymer formed by polymerization of 1, 3-butadiene. It is a synthetic rubber, which is mostly used in the production of tires, and also to enhance the resistance of polystyrene and ABS (acrylonitrile butadienestyrene). Production of golf balls and coating of electronics also require polybutadiene. High resistivity of polybutadiene is a major factor augmenting its demand in tire manufacturing plants.

One of the significant drivers for the global polybutadiene market is the rapid growth in automotive and plastic industries. Properties such as low transition, high resistance, high tensile strength, abrasion resistance, and toughness fuel the demand for polybutadiene globally. Moreover, increasing demand for ecofriendly and fuel efficient tires is also driving the global polybutadiene market. However, price volatility of raw materials is a prominent restraint in the polybutadiene market.

Polybutadiene Market Size and Forecast – 2025 – 2032

The Polybutadiene Market size is estimated to be valued at USD 4.2 billion in 2025 and is expected to reach USD 6.1 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.4% from 2025 to 2032.

Key Takeaways

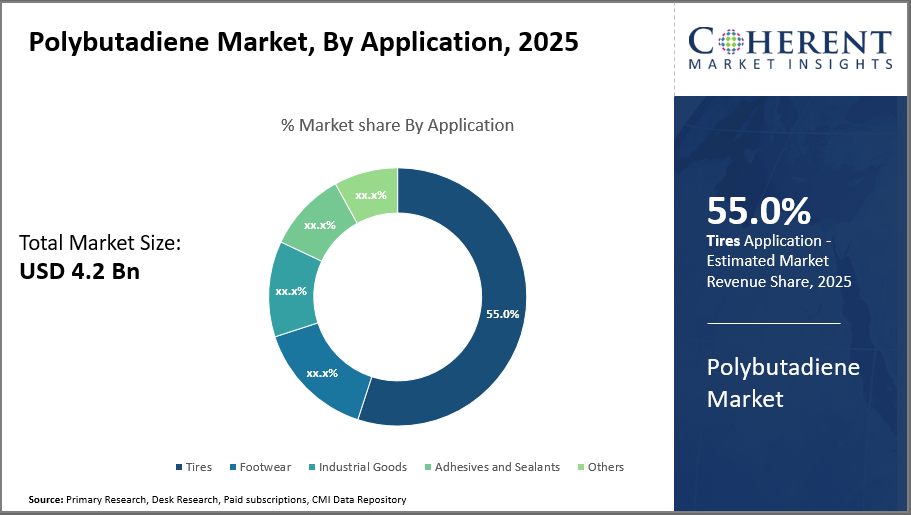

Tires as an application segment dominate the polybutadiene market, accounting for over 55% market revenue, driven by automotive sector demands, especially EV tire developments.

High-Cis polybutadiene leads the polymer type segment with significant preference due to its superior elastic properties needed for performance-intensive products.

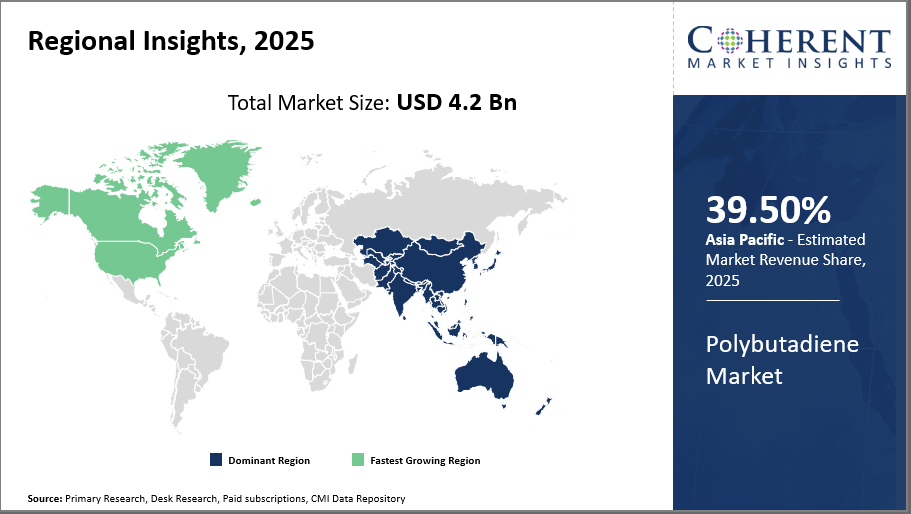

Asia Pacific holds the largest market share at 39.5%, backed by escalating production capabilities and consumption in China and India, supported by favorable government policies.

North America is focusing on innovation and sustainable production to capture niche segments amid stringent environmental regulations, providing lucrative growth avenues.

Polybutadiene Market – Segmentation Analysis

To learn more about this report, Download Free Sample

Polybutadiene Market Insights, By Application

In terms of Application the market is segmented into Tires, Footwear, Industrial Goods, Adhesives and Sealants, and Others, among which Tires dominate the market share with 55%. The tire segment benefits from expanding automotive production, particularly driven by electric vehicles that demand enhanced polymer properties such as low rolling resistance and improved durability. Growing environmental norms encourage tire manufacturers to adopt polybutadiene for eco-friendly high-performance solutions.

Polybutadiene Market Insights, By Polymer Type

In terms of Polymer Type the market is segmented into High-Cis Polybutadiene, Low-Cis Polybutadiene, Neat Polybutadiene, Solution-Polymerized Polybutadiene, and Others, with High-Cis Polybutadiene dominating the share due to its superior elasticity and tensile strength valued in tire and industrial applications. High-Cis is preferred for tires, offering enhanced wear resistance crucial for automotive growth.

Polybutadiene Market Insights, By End-Use Industry

In terms of End-Use Industry, the market is segmented into Automotive, Electronics, Construction, Consumer Goods, and Others, where Automotive dominates market share due to vast tire production demands and polymer integration in vehicle components. The automotive sector is the largest consumer of polybutadiene, with tire manufacturing comprising the majority share facilitated by trends such as electric vehicles and lightweight tires.

Polybutadiene Market Insights, By Geography

To learn more about this report, Download Free Sample

Asia Pacific Polybutadiene Market Analysis and Trends

In Asia Pacific, the dominance in the Polybutadiene Market is substantiated by 39.50% market share as of 2024, led primarily by China and India’s expanding automotive and industrial sectors. Government incentives for manufacturing, large-scale capacity expansions, and rising domestic consumption underpin this leadership. Major companies such as Lanxess and Japan Synthetic Rubber Corporation have significant production footprints here, fueling growth.

North America Polybutadiene Market Analysis and Trends

North America, on the other hand, is growing at the quickest rate, with a CAGR predicted to be above 6% between 2025 and 2032. Technological developments in synthetic rubber grades, the growing demand for electric vehicles, and government backing for sustainable materials are all factors contributing to growth. The resurgence of the US auto industry and rising polybutadiene imports demonstrate dynamic trade flows and changing market environments.

Polybutadiene Market Outlook for Key Countries

Market Analysis and Trends for Polybutadiene in the United States

United States leads North America in demand for polybutadiene, accounting for more than 45% of domestic consumption in 2024. Performance elastomers like polybutadiene were more in demand as a result of increased EV production and green vehicle requirements. Businesses such as Kumho Petrochemical and Arlanxeo respond to sustainability regulations and supply chain realignment to lessen reliance on imports by enhancing their market presence through innovation centers and capacity augmentation.

Market Analysis and Trends for Polybutadiene in the China

According to ambitious capacity increases and vertical integration by major players like Japan Synthetic Rubber Corporation and regional producers, China's polybutadiene market continues to be the largest in the world. Production and application diversification are further accelerated by the government's "Made in China 2025" project, which includes consumer goods and electronics. Sustained market momentum is supported by rising domestic vehicle sales and increased investments in specialty elastomers for high-performance tires.

Analyst Opinion

Increasing production capacity in Asia Pacific has driven polybutadiene market expansion, especially given the region’s dominance in rubber and tire manufacturing. Asia Pacific accounted for approximately 39.5% of the global market share in 2024, fueled by government incentives and robust automotive sectors, particularly in China and India. For instance, China's production capacity for synthetic rubber increased by over 8% in 2024 alone, underpinning broader market growth.

Price dynamics continue to shape demand patterns, with raw material cost fluctuations related to synthetic butadiene monomer impacting polybutadiene pricing globally. The average price for polybutadiene declined marginally by 2% year-over-year in 2024, improving affordability and encouraging adoption in downstream segments such as footwear and adhesives.

On the demand front, tire manufacturing remains the principal end user, accounting for nearly 55% of global demand in 2024. Enhanced performance demands in electric vehicles have catalysed increased usage of polybutadiene as a critical component for low rolling-resistance tires, with EV tire production surging by 12% globally in 2024.

Regional import patterns illustrate shifting trade balances with North America increasing imports by 7% in 2024 to meet rising demand in the automotive sector due to recovery from supply chain constraints. This trade adjustment reflects evolving market dynamics amid broader economic realignments and regulatory incentives promoting domestic vehicle production.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 4.2 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 5.4% | 2032 Value Projection: | USD 6.1 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Polychem Corporation, Japan Synthetic Rubber Corporation, Lanxess AG, Kumho Petrochemical Co., Ltd., Arlanxeo, Synthos S.A., Sibur Holding, TSRC Corporation, India Glycols Limited, JSR Corporation, Sinopec Limited | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Growth factors

Increasing Demand from Automotive Tires: The rising adoption of electric vehicles (EVs) and performance tires necessitates elastomers with specific elasticity and wear resistance characteristics, directly driving polybutadiene consumption.

Expanding Industrial Applications: Growth in the adhesives and sealants segment is significantly propelling market revenue, supported by a 9% year-on-year growth in industrial adhesives consumption reported in 2024.

Raw Material Availability and Technological Advances: Enhanced polymerization technologies are reducing production costs while improving product quality, thereby attracting new market players and expanding capacity.

Government Regulations and Sustainability Awareness: Regulations promoting non-polluting materials have encouraged the use of polybutadiene, which is recyclable and compatible with EU’s Green Deal directives implemented since 2023.

Polybutadiene Market Development

In June 2025, Evonik made the decision to locate its POLYVEST® ST-E 60's last stage of manufacture in Shanghai, China. This choice demonstrates the business's dedication to improving customer closeness and supplier security in Asia. By Q3 2025, the expansion should be completely operational. The expansion of silane-functionalized polybutadienes' manufacturing capacity is a major step toward solidifying Evonik's standing as a trustworthy partner in the market for specialty chemicals. Evonik hopes to satisfy the continuous demand for this high-performance additive—which is essential for a number of applications, such as rubber compounds, adhesives, coatings, tires, and sealants—by localizing and increasing its capacity worldwide.

Market Trends

The polybutadiene market is evolving with a pronounced transition towards sustainable material alternatives to meet global environmental targets.

Recent developments in bio-based butadiene production, including collaborations by companies like Synthos and biorefinery firms in 2024, reflect a significant shift.

Moreover, the rise in specialty grades tailored for high-performance EV tires and demand for low-emission manufacturing processes indicate a paradigm shift in product development.

Digitalization and Industry 4.0 adoption in production workflows have enhanced production efficiency, reducing lead times and minimizing costs.

Emerging regional policies incentivizing cleaner raw materials also foster market realignment emphasizing circular economy principles.

Key Players

Polychem Corporation

Japan Synthetic Rubber Corporation

Lanxess AG

Kumho Petrochemical Co., Ltd.

Arlanxeo

Synthos S.A.

Sibur Holding

TSRC Corporation

India Glycols Limited

JSR Corporation

Sinopec Limited

Several market companies focus on backward integration strategies to ensure consistent supply of raw materials, significantly reducing pricing volatility.

For instance, Lanxess AG’s acquisition of synthetic butadiene production facilities in 2024 resulted in a 15% reduction in production costs, solidifying its market share. Another competing strategy includes strategic partnerships aimed at innovation; Arlanxeo collaborated with automotive tire manufacturers in 2024 to develop eco-friendly polybutadiene grades, boosting product portfolio competitiveness and enhancing revenue streams.

Outlook for the Polybutadiene Market in the Future

The market for polybutadiene has a promising future because of the growing demand from the automotive sector, especially for tires, which benefits from the polymer's superior wear resistance and fuel efficiency. Growing infrastructure development and building activity around the world further help the market. The increasing use of polybutadiene to improve the flexibility and durability of other polymers is anticipated to increase demand due to advancements in polymer modification. Sustainability is also becoming more and more important, as eco-friendly products and bio-based production techniques gain popularity.

Further driving market expansion are growing applications in sectors like consumer goods, adhesives, sealants, and aerospace. Market participants are spending money on R&D to launch high-performance, novel polybutadiene solutions that meet changing consumer demands and regulatory requirements. Regionally, rapid urbanization, increased vehicle production, and industrial expansion play significant roles in driving growth, especially in Asia Pacific, North America, and Europe. More competition and innovation are anticipated in the market, with an emphasis on advanced materials technology and sustainable sourcing.

Historical Analysis

In March 2013, Mitsubishi Corporation joined forces with Ube Industries, Ltd., Lotte Chemical Corporation and wholly owned Lotte Chemical subsidiary, Lotte Chemical Titan to set up a three-company joint venture in Malaysia for the manufacture and sale of poly-butadiene rubber. This joint venture was established to overcome the increasing demand of poly-butadiene rubber in Asia.

In May 2014, SIBUR, a leading Russian gas processing and petrochemicals company, signed a contract with China Petroleum and Chemical Corporation (“Sinopec”) to establish a joint venture for the construction of a 50 ktpa butadiene nitrile rubber (or “NBR”) plant at the Shanghai Chemical Industry Park. This venture was established for expanding its production and commercial operations.

In December 2018, Kuraray Co. Ltd, PTT Global Chemical PCL and Sumitomo Corp. announced their investment in a project for the manufacture of butadiene derivatives in Thailand. This project was operated by a joint venture called Kuraray GC Advanced Materials Co. Ltd. and it was expected to increase the company’s annual capacity.

Sources

Primary Research interviews:

Procurement managers in tire companies

R&D heads at automotive OEMs

Chemical engineers specializing in elastomers

Databases:

International Rubber Study Group (IRSG) Statistics

OECD Data

FAOSTAT (for agricultural rubber substitutes comparison)

Magazines:

Chemical & Engineering News

European Rubber Journal

Rubber Asia

Journals:

Rubber Chemistry and Technology

Journal of Elastomers and Plastics

Polymer Degradation and Stability

Newspapers:

The Hindu BusinessLine

Financial Times (Commodities & Chemicals section)

The Wall Street Journal

Associations:

American Chemical Society (ACS) – Rubber Division

All India Rubber Industries Association (AIRIA)

European Tyre and Rubber Manufacturers’ Association (ETRMA)

Share

Share

About Author

Pankaj Poddar is a seasoned market research consultant with over 12 years of extensive experience in the fast-moving consumer goods (FMCG) and plastics material industries. He holds a Master’s degree in Business Administration with specialization in Marketing from Nirma University, one of India’s reputed institutions, which has equipped him with a solid foundation in strategic marketing and consumer behavior.

As a Senior Consultant at CMI for the past three years, he has been instrumental in harnessing his comprehensive understanding of market dynamics to provide our clients with actionable insights and strategic guidance. Throughout his career, He has developed a robust expertise in several key areas, including market estimation, competitive analysis, and the identification of emerging industry trends. His approach is grounded in a commitment to understanding client needs thoroughly and fostering collaborative relationships. His dedication to excellence and innovation solidifies his role as a trusted advisor in the ever-evolving landscape of not only FMCG but also chemicals and materials markets.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients