Pharmacy Benefit Management Market Size and Forecast – 2026 – 2033

The Global Pharmacy Benefit Management Market size is estimated to be valued at USD 360 billion in 2026 and is expected to reach USD 620 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 8.1% from 2026 to 2033.

Global Pharmacy Benefit Management Market Overview

Pharmacy benefit management (PBM) services are administrative platforms and solutions that manage prescription drug benefits on behalf of health insurers, employers, and government programs. PBM products include formulary design tools, claims adjudication systems, drug utilization review services, and rebate negotiation platforms. These services optimize drug spending, control utilization, and ensure compliance with clinical guidelines. PBMs also provide patient support programs, mail-order pharmacy services, and cost-sharing analytics. They play a central role in managing drug costs, improving access to medications, and enhancing the efficiency of pharmacy benefit operations.

Key Takeaways

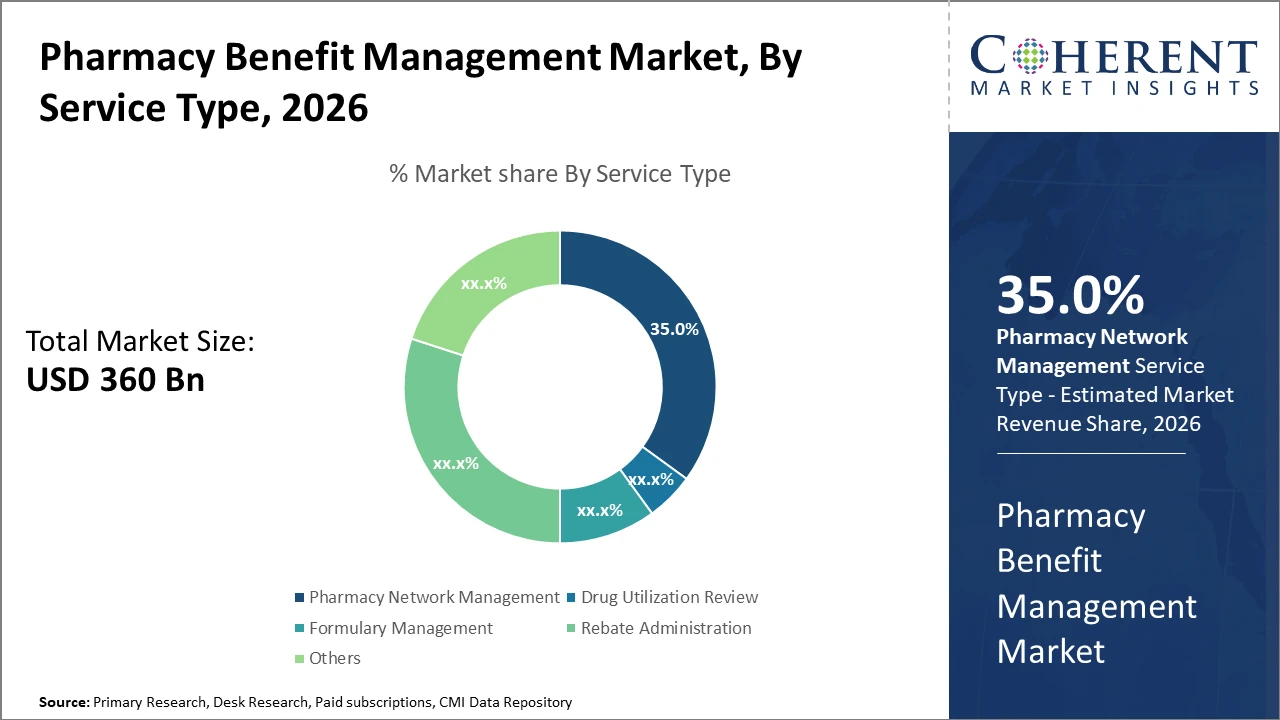

Market segments reveal that pharmacy network management dominates with a 35% market share, driven by extensive retail pharmacy collaborations.

Mail order pharmacy emerges as the fastest-growing delivery channel, primarily due to its convenience and cost efficiency, capturing significant market revenue growth.

The commercial payer segment leads end-user demand, reflecting increased employer-sponsored health plans with integrated PBM services.

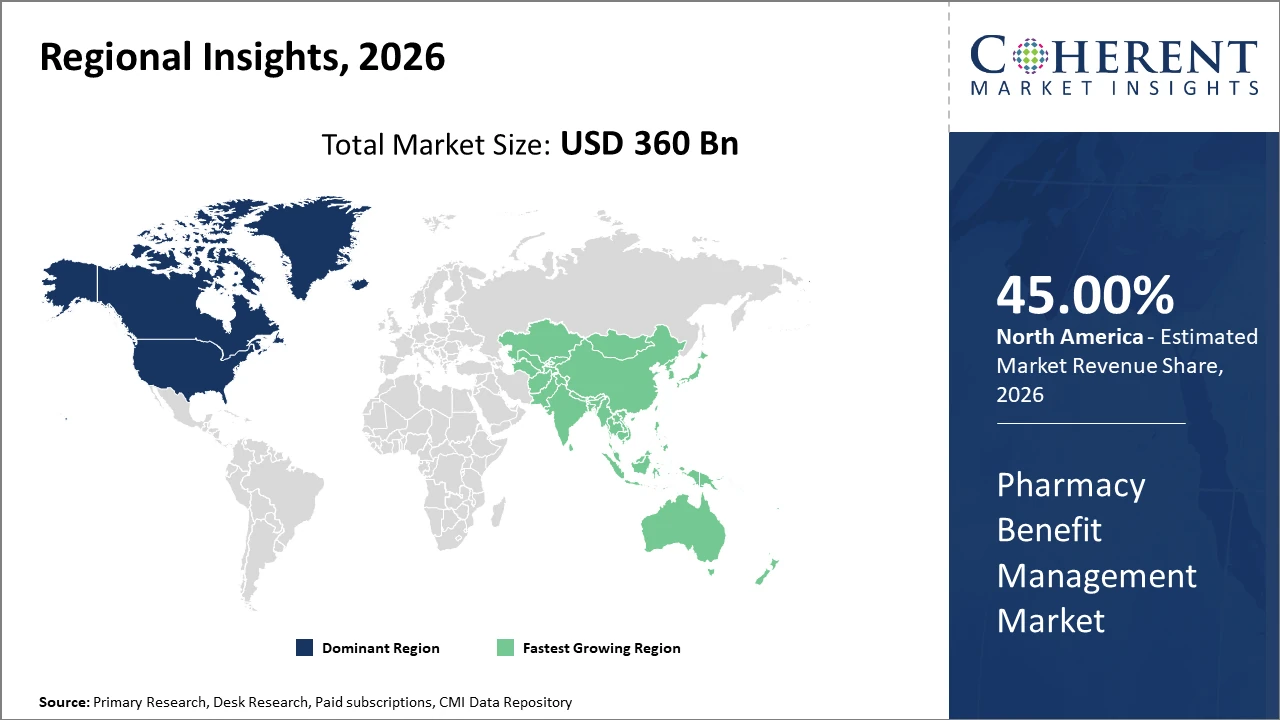

Regionally, North America holds dominance due to its mature healthcare infrastructure, accounting for over 45% of the Pharmacy Benefit Management market size, underpinned by robust regulatory frameworks and high specialty drug uptake.

Asia Pacific exhibits the fastest growth rate, supported by expanding healthcare access, burgeoning chronic disease prevalence, and government initiatives to boost pharmaceutical care access.

Pharmacy Benefit Management Market Segmentation Analysis

To learn more about this report, Download Free Sample

Pharmacy Benefit Management Market Insights, By Service Type

Pharmacy Network Management dominates the market share at 35%. This dominance is driven by the extensive agreements PBMs maintain with retail pharmacies, ensuring broad patient access and cost control. Pharmacy Network Management also facilitates optimized drug dispensing, which improves market revenue consistency. The fastest growing subsegment, Rebate Administration, is rapidly expanding due to increasing emphasis on managing manufacturer rebates effectively for payer cost savings. Drug Utilization Review and Formulary Management serve as critical support functions ensuring clinical appropriateness and cost-efficiency.

Pharmacy Benefit Management Market Insights, By End-User

Commercial Payers dominate this segment, driven by large employer-sponsored health insurance and rising private insurance enrollment. Their demand for cost containment and adherence programs fuels market growth. Government and public payers are witnessing steady expansion as well, prompted by increasing pharmaceutical expenditures within Medicare and Medicaid programs. The fastest-growing end-user segment is Self-Insured Groups, empowered by employer-driven customization of pharmacy benefits and better control over plan design. Employers play a critical role particularly in driving innovation in PBM services.

Pharmacy Benefit Management Market Insights, By Delivery Channel

Retail Pharmacy currently holds a dominant position due to its wide availability and consumer familiarity, ensuring a continuous high volume of prescriptions filled. However, Mail Order Pharmacy stands out as the fastest-growing subsegment, gaining popularity for enabling lower costs and greater convenience for chronic medication users, evidenced by a surge in utilization in 2025-26. Specialty Pharmacy also contributes significantly due to the rising share of specialty drugs requiring specialized handling and management. Online Pharmacies are gradually increasing market presence, supported by digital transformation and regulatory acceptance.

Pharmacy Benefit Management Market Trends

Recent years have underscored a transition in the Pharmacy Benefit Management market towards more sophisticated risk-sharing models between payers and PBMs.

A notable 18% increase in value-based contracts in 2025 validates this trend, reflecting a broader industry shift from fee-for-service toward outcome-driven remuneration.

Additionally, the surge in digital adoption further supports market expansion, as seen in 2026 when real-time benefit tools achieved a 15% improvement in drug cost savings across multiple health systems.

Another key development involves the rise of specialty drug management programs that accounted for over half of the total pharmaceutical spend in 2025, compelling PBMs to innovate in formulary design and patient support to contain costs.

These evolving dynamics signify a fundamental market shift towards holistic, technology-driven pharmacy benefit solutions.

Pharmacy Benefit Management Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Pharmacy Benefit Management Market Analysis and Trends

In North America, the dominance in the market stems from advanced healthcare infrastructure, stringent regulatory environments, and significant specialty drug demand. This region encompasses over 45% of the market share, with key players like CVS Health and OptumRx headquartered here. Government initiatives to control drug spending and promote transparency also create favorable market conditions. The U.S. accounts for the lion’s share due to its vast insured population and integrated PBM services across commercial and public payers.

Asia Pacific Pharmacy Benefit Management Market Analysis and Trends

Meanwhile, the Asia Pacific exhibits the fastest growth at a CAGR above 10%, driven by increasing healthcare expenditure, expanding insurance coverage, and rising chronic disease incidence. Countries like China and India have made substantial investments in healthcare digitalization and pharmaceutical infrastructure, fueling demand for efficient PBM solutions. Growing government focus on pharmaceutical benefit schemes and cost management further accelerates adoption in this region.

Pharmacy Benefit Management Market Outlook for Key Countries

USA Pharmacy Benefit Management Market Analysis and Trends

The USA's market remains the most mature and largest globally, with market companies heavily investing in specialty pharmacy networks and digital health platforms. For example, OptumRx’s predictive analytics solutions implemented in early 2025 contributed to a 14% reduction in medication non-adherence among beneficiaries. Legislative pressure for pricing transparency has enhanced the role of PBMs in negotiating rebates, resulting in over USD 200 billion in managed drug spend annually. Additionally, the commercial segment dominates due to extensive employer-sponsored plans, driving innovation in real-time benefit and patient engagement tools.

Germany Pharmacy Benefit Management Market Analysis and Trends

Germany's market reflects a steady increase in PBM adoption, supported by regulatory reforms promoting drug cost control in statutory health insurance. Market players have leveraged comprehensive formulary management and drug utilization review services to optimize therapy costs. Companies like CVS Health’s European subsidiaries and local firms expanded specialty pharmacy services in 2026, aligning with government efforts for precision medicine initiatives. Rising awareness of digital healthcare solutions and increasing self-insured employer groups also contribute to market expansion in Germany.

Analyst Opinion

Increasing utilization of specialty pharmaceuticals continues to expand the market scope. In 2025, specialty drugs accounted for over 50% of total drug spend, driving PBMs to reinforce their clinical management programs. Recent data from healthcare providers shows enhanced adherence rates through PBM-managed specialty pharmacies, directly influencing improved therapy outcomes and nudging market growth.

Pricing transparency and rebate management have become critical supply-side indicators shaping market dynamics. PBM entities are leveraging advanced analytics that enabled a 12% reduction in drug costs in 2024 for large commercial clients, per industry sources. This cost control mechanism fuels increased adoption of PBM services across both private and public sector payers.

The rise of digital platforms and real-time benefit tools has augmented demand-side dynamics by empowering prescribers and patients with immediate cost information. For example, incorporation of such tools in 2026 led to a documented 15% decrease in out-of-pocket prescription expenses among insured populations, enhancing market revenue share for PBM operators.

Fragmented healthcare systems globally create diverse use cases for PBMs, focusing not only on cost reduction but also on medication adherence and risk management. In the United States, 2025 witnessed 18% growth in value-based contracting facilitated by PBMs, which highlights their critical role in shifting industry trends towards patient-centric and outcome-based reimbursement models.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 360 million |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 8.1% | 2033 Value Projection: | USD 620 million |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Diplomat Pharmacy, IngenioRx, Medco Health Solutions, Navitus Health Solutions, Elixir Pharmacy, BioScrip, Inc., Caremark Rx, Inc. (a CVS Health subsidiary), Rite Aid Corporation, Walgreen Co., WellDyneRx | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Pharmacy Benefit Management Market Growth Factors

The growing prevalence of chronic diseases and the subsequent rise in specialty drug usage remain paramount market drivers, with specialty pharmaceuticals’ expenditure rising by 22% in 2025. Cost containment pressure on healthcare systems worldwide compels payers to increasingly rely on PBMs to manage drug spend efficiently. Additionally, digital transformation through real-time benefit tools and e-prescribing platforms enhanced user experience and adherence rates, supporting market growth strategies in 2026. Regulatory emphasis on drug pricing transparency has also escalated demand, enabling PBMs to negotiate better rebates and optimize formulary management, directly contributing to increased market revenue. Lastly, expanding employer-driven health plans with self-insurance options fuel growth in the commercial PBM segment, registering double-digit growth in 2026.

Pharmacy Benefit Management Market Development

In 2025, CVS Health launched CVS CostVantage, a new pharmacy benefit management (PBM) pricing and service model designed for commercial payers. The initiative was introduced to simplify PBM contracts, improve pricing transparency, and enable smoother transitions for employers and health plans by aligning drug reimbursement more closely with acquisition costs and clearly defined service fees.

In 2024, Xevant launched VerX, an AI-powered prescription optimization platform that enables real-time identification of the lowest net-cost medications. VerX analyzes formularies, rebates, and alternative therapies at the point of decision-making, helping payers and employers reduce pharmacy spend while maintaining clinical effectiveness and improving overall prescription affordability.

Key Players

Leading Companies of the Market

Diplomat Pharmacy

IngenioRx

Medco Health Solutions

Navitus Health Solutions

Elixir Pharmacy

BioScrip, Inc.

Caremark Rx, Inc. (a CVS Health subsidiary)

Rite Aid Corporation

Walgreens Co.

WellDyneRx

Competitive strategies adopted by leading companies focus on integrating AI-enabled analytics and expanding specialty pharmacy networks. For instance, OptumRx implemented advanced predictive modeling in 2025, reducing medication non-adherence by 14%. Additionally, CVS Health extended strategic partnerships with major pharmaceutical companies for exclusive rebate arrangements, achieving a 10% improvement in formulary compliance by 2026.

Pharmacy Benefit Management Market Future Outlook

The PBM market is poised to navigate ongoing regulatory, legislative, and competitive pressures while maintaining its role in drug cost management. Efforts to increase pricing transparency and realign rebate structures could alter economic incentives, prompting PBMs to innovate alternative value-based contracting models. Integration of real-world evidence and predictive analytics will enhance utilization management and clinical decision support capabilities. As specialty drugs and gene therapies continue to challenge affordability, PBMs will likely expand care coordination and patient support offerings to improve adherence and outcomes.

Additionally, the adoption of digital platforms for benefit administration, patient engagement, and real-time cost estimation will streamline processes and enhance stakeholder visibility. Global expansion into emerging markets may occur as healthcare systems seek expertise in managing complex pharmaceutical benefits within constrained budgets.

Pharmacy Benefit Management Market Historical Analysis

The pharmacy benefit management (PBM) market originated in the late 20th century as employers and insurers sought mechanisms to control rising prescription drug costs and improve formulary management. Early PBMs offered basic claims processing and reimbursement adjudication, but their role rapidly expanded as drug spending surged with the introduction of high-cost specialty medications. PBMs began negotiating discounts and rebates with pharmaceutical manufacturers and establishing preferred drug lists to steer utilization toward cost-effective therapies. The rise of managed care in the 1980s and 1990s further embedded PBMs within health plans, evolving their function to include utilization review, drug utilization evaluation, and clinical support programs.

Over time, consolidation among PBM providers and integration with larger insurance entities reshaped competitive dynamics, attracting scrutiny from regulators and stakeholders concerned about transparency and pricing practices. Nonetheless, PBMs have become central intermediaries in the U.S. prescription drug ecosystem, influencing formulary design, pharmacy networks, and cost-sharing mechanisms.

Sources

Primary Research Interviews:

PBM executives

health insurers

employer benefit manager

Pharmacists

healthcare policy expert

Databases:

CMS Drug Spending Data

IQVIA Institute Reports

OECD Health Data

Kaiser Family Foundation

Magazines:

Managed Healthcare Executive

Healthcare Finance News

Modern Healthcare

Pharmacy Times

Health Affairs Blog

Journals:

Health Affairs

American Journal of Managed Care

Journal of Health Economics

Pharmacoeconomics

Value in Health

Newspapers:

The Wall Street Journal (Healthcare)

Financial Times (Pharma)

Reuters Health Policy

Bloomberg Health,

The Washington Post

Associations:

Pharmaceutical Care Management Association

Academy of Managed Care Pharmacy

National Association of Health Underwriters

CMS

American Pharmacists Association

Share

Share

About Author

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients