Peanut Allergy Vaccine Market Size and Forecast – 2026 – 2033

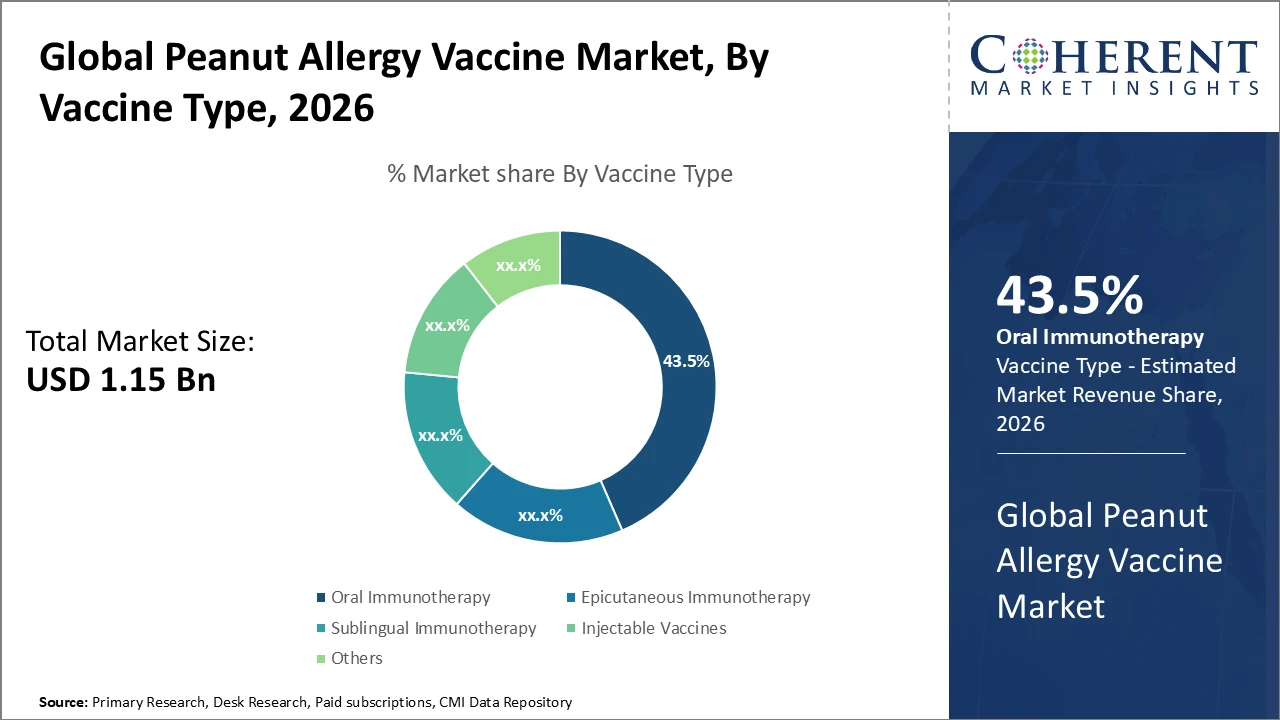

The Global Peanut Allergy Vaccine Market size is estimated to be valued at USD 1.15 billion in 2026 and is expected to reach USD 3.42 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 16.9% from 2026 to 2033.

Global Peanut Allergy Vaccine Market Overview

The peanut allergy vaccine market is emerging as a critical segment within the global allergy and immunotherapy landscape, driven by the rising prevalence of peanut allergies, especially among children. Increasing awareness, improved diagnostic rates, and the growing burden of severe allergic reactions are fueling demand for long-term preventive treatments. Advances in immunotherapy, including oral, epicutaneous, and injectable vaccine approaches, are accelerating research and development activities. Supportive regulatory pathways, strong clinical pipelines, and increasing healthcare investments further contribute to market growth. Additionally, unmet clinical needs and the limitations of avoidance-based management are encouraging innovation, positioning the peanut allergy vaccine market for significant expansion in the coming years.

Key Takeaways

Oral immunotherapy dominates the market due to ease of administration and strong clinical efficacy, capturing 43.5% of the total market share.

Pediatric patients represent the largest demographic segment, accounting for 52.7% of the market, driven by early intervention and preventive treatment strategies.

Hospital pharmacies remain the preferred distribution channel for vaccine administration, holding 49.3% of the overall distribution share.

Peanut Allergy Vaccine Market Segmentation Analysis

To learn more about this report, Download Free Sample

Peanut Allergy Vaccine Market Insights, By Vaccine Type

Oral Immunotherapy (OIT) dominates the market with a 43.5% share, driven by its less invasive nature and higher patient compliance, supported by clinical evidence indicating lower dropout rates compared to injectable vaccines. Epicutaneous Immunotherapy (EPIT) is the fastest-growing subsegment, fueled by its favorable safety profile and ease of application, particularly in pediatric immunization programs. Sublingual Immunotherapy (SLIT) primarily serves patients requiring long-term maintenance therapy, while injectable vaccines are generally reserved for individuals with severe allergy profiles. Other subsegments include emerging combination immunotherapies currently under clinical evaluation, aimed at expanding treatment options and improving therapeutic outcomes.

Peanut Allergy Vaccine Market Insights, By Patient Demographics

Pediatric patients dominate the market with a 52.7% share, driven by proactive immunization strategies and widespread early diagnosis protocols that prioritize vaccination during childhood to prevent severe allergic reactions. The adult segment is the fastest-growing subsegment, supported by rising awareness and an increase in adult-onset peanut allergies. The geriatric subsegment remains relatively niche but is gaining attention due to emerging evidence of age-related immune changes influencing allergy patterns. Other patient groups include individuals with complex comorbidities who require customized vaccine regimens and specialized clinical management.

Peanut Allergy Vaccine Market Insights, By Distribution Channel

Hospital pharmacies dominate the market due to stringent storage requirements and the need for controlled administration environments for vaccines. Retail pharmacies are experiencing rapid growth, supported by expanded accessibility and the rollout of local immunization campaigns. Specialty clinics play a key role by offering customized allergy management that integrates diagnosis with vaccine therapy. Online pharmacies represent an emerging subsegment, serving remote patients through vaccine delivery and telehealth support, although they currently account for a smaller share of the market. Other distribution channels include institutional programs and government-run immunization centers.

Peanut Allergy Vaccine Market Trends

There is a growing shift toward personalized peanut allergy vaccines, driven by advances in genomics and immunology.

In 2026, a pilot program in Germany used biomarker-based patient segmentation to customize vaccine dosages, resulting in an 18% improvement in efficacy rates.

Adoption of oral immunotherapy vaccines is increasing over injectable options due to patient preference for less invasive treatments.

Data reported in 2025 showed a 25% higher adherence rate among patients receiving oral vaccines compared to injectable types.

Integration of digital health tools, such as mobile apps for vaccine monitoring, is improving patient engagement and follow-up.

A 2026 North American study demonstrated enhanced treatment outcomes linked to digital health–supported vaccine management.

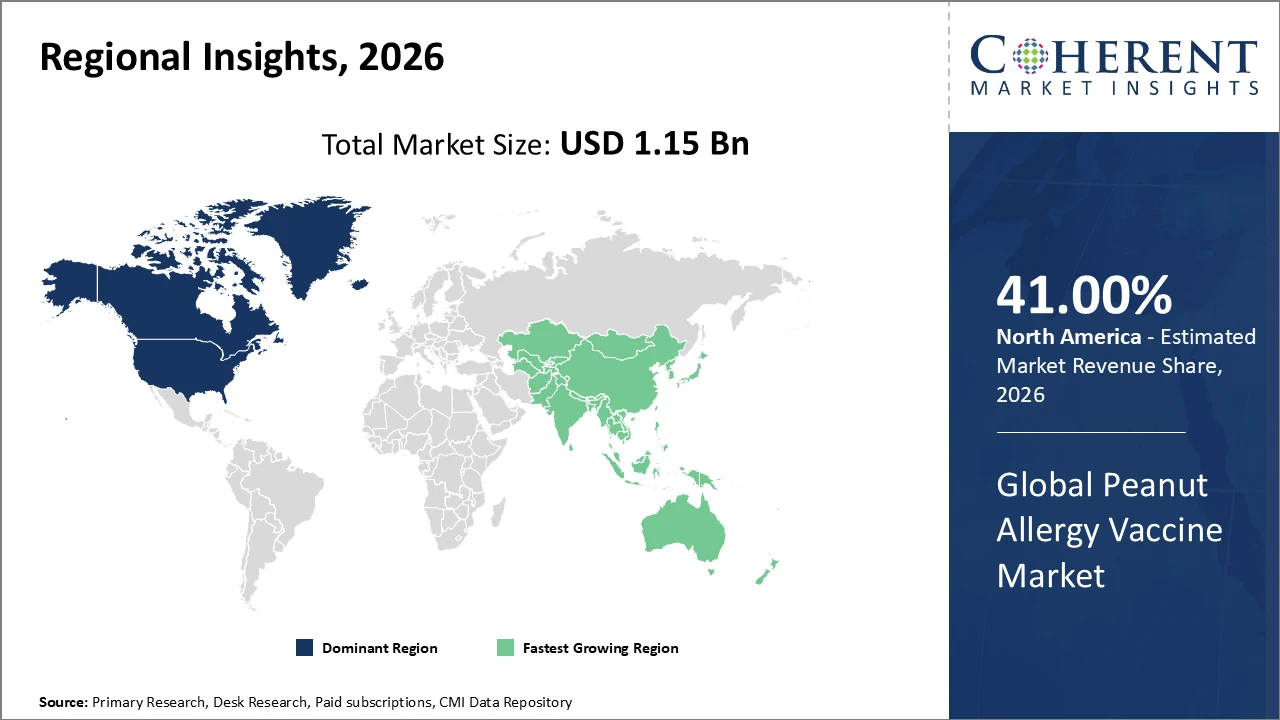

Peanut Allergy Vaccine Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Peanut Allergy Vaccine Market Analysis and Trends

In North America, dominance in the peanut allergy vaccine market is driven by a mature healthcare infrastructure, extensive immunization programs, and strong research and development investments. The region accounts for over 41% of the market share, supported by a robust pipeline of patented vaccines and efficient regulatory approval processes. Major U.S.-based players play a key role in advancing innovation, while Canada strengthens market penetration through nationwide allergy awareness and prevention initiatives.

Asia Pacific Peanut Allergy Vaccine Market Analysis and Trends

Meanwhile, the Asia Pacific region exhibits the fastest growth, with a CAGR of 19.4%, driven by the rising incidence of peanut allergies, increasing disposable incomes, and government initiatives aimed at improving healthcare access. India’s expanding biotech manufacturing capabilities and China’s growing healthcare expenditure play pivotal roles in accelerating market expansion. The regional market ecosystem is further strengthened by the presence of emerging local companies and increasing multinational investments focused on addressing the needs of a rapidly expanding patient population.

Peanut Allergy Vaccine Market Outlook for Key Countries

USA Peanut Allergy Vaccine Market Analysis and Trends

The U.S. market is pivotal due to the high prevalence of peanut allergies and advancements in immunotherapy. In 2025, the FDA approved several novel vaccines, while patient awareness campaigns increased diagnosis rates by 22%. Leading companies such as Aimmune Therapeutics and DBV Technologies have established extensive clinical trial networks and production facilities in the U.S., enabling rapid commercialization and market expansion. This dynamic supports strong business growth and continuous innovation, positioning the U.S. as a key hub in the global peanut allergy vaccine market.

Germany Peanut Allergy Vaccine Market Analysis and Trends

Germany’s peanut allergy vaccine market is witnessing steady growth, driven by high healthcare standards, early allergy diagnosis programs, and strong government support for immunization initiatives. Oral and epicutaneous immunotherapies are gaining traction due to their patient-friendly administration and proven clinical efficacy. Personalized vaccine approaches, leveraging biomarker-based patient segmentation, are emerging, improving treatment outcomes. The presence of leading pharmaceutical and biotech companies facilitates advanced research, robust clinical trials, and faster regulatory approvals. Increasing public awareness and proactive pediatric immunization programs further bolster market expansion. Germany’s focus on innovation and patient-centric care positions it as a significant contributor to the European peanut allergy vaccine landscape.

Analyst Opinion

The surge in diagnostic accuracy and advances in immunotherapy are driving market revenue growth. A 2025 U.S. clinical trial showed a 75% reduction in allergic reactions with a novel peanut allergy vaccine, highlighting efficacy as a key growth driver. Increasing prevalence, especially in pediatric populations, fuels demand, with the CDC reporting a 21% rise in peanut allergies among children between 2024 and 2026.

Production capacity has expanded, with leading manufacturers increasing GMP-certified facilities in North America and Europe to meet rising demand. In 2026, global vaccine output grew by 30%, supporting broader immunization programs. Value-based pricing strategies have also improved accessibility and market penetration.

Import-export dynamics between Asia Pacific and North America have strengthened supply chains. India’s biotech manufacturing and export of vaccine intermediates grew 22% from 2024 to 2026, supporting global market players and enabling rapid responses to demand.

The versatility of peanut allergy vaccines across age groups and risk profiles boosts market expansion. FDA approvals in 2026 for children aged 4–12 and adults widened market scope, supporting higher adoption rates, particularly in school-based immunization initiatives in developed countries.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 1.15 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 16.9% | 2033 Value Projection: | USD 3.42 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Aimmune Therapeutics Inc., Nestle Health Science, DBV Technologies, Allertein Biotech Ltd., Aravax Medical, Jubilant Therapeutics, ActoBio Therapeutics, Menarini Group, Pfizer Inc., Sanofi Pasteur | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Peanut Allergy Vaccine Market Growth Factors

The rising incidence of peanut allergies, particularly among pediatric populations, is a major driver of market growth. Epidemiological data from the World Allergy Organization indicate a 20% increase in global peanut allergy diagnoses between 2024 and 2026, fueling demand for vaccines. Regulatory advancements have also accelerated product approvals, creating a favorable environment for the introduction of innovative therapies, with the U.S. FDA’s fast-track designation programs in 2025 significantly shortening clinical development timelines. Additionally, advancements in vaccine delivery technologies, such as needle-free options, improve patient compliance and broaden market adoption. Increasing healthcare expenditure in emerging economies, especially in the Asia Pacific, further supports higher usage rates and facilitates overall market expansion.

Peanut Allergy Vaccine Market Development

In February 2025, a Phase 1 clinical trial led by Imperial College London evaluated VLP Peanut, a novel vaccine for peanut allergy. Early results indicate that the vaccine is well tolerated, reduces allergic reactions, and induces immune tolerance, supporting further investigation as a potential long-term treatment.

Key Players

Leading Companies of the Market

Aimmune Therapeutics

Nestle Health Science

DBV Technologies

Aravax Medical

Jubilant Therapeutics

ActoBio Therapeutics

Menarini Group

Pfizer Inc.

Allertein Biotech Ltd.

Sanofi Pasteur

Several leading companies have focused on strategic acquisitions and partnerships to strengthen their product pipelines and expand geographic presence. In 2025, Aimmune Therapeutics acquired specialized biotech start-ups, resulting in a 12% increase in their vaccine portfolio breadth, which directly boosted their market share. Similarly, Nestlé Health Science increased its R&D investment by 18% in 2024, leading to the launch of an oral immunotherapy product that captured 15% of market revenue within a year.

Peanut Allergy Vaccine Market Future Outlook

The peanut allergy vaccine market is poised for robust growth, driven by rising allergy prevalence, technological advancements, and increasing patient awareness. Innovations in oral, epicutaneous, and personalized immunotherapies are expected to expand treatment options and improve patient compliance. Emerging markets, particularly in Asia Pacific, will contribute significantly due to rising healthcare expenditure and government initiatives supporting immunization. Strategic partnerships, mergers, and clinical pipeline developments will further strengthen market dynamics. Digital health integration for patient monitoring and follow-up will enhance treatment outcomes. Overall, the market outlook reflects sustained expansion, wider accessibility, and continuous innovation in peanut allergy management over the coming decade.

Peanut Allergy Vaccine Market Historical Analysis

The peanut allergy vaccine market has witnessed steady growth over the past decade, driven by increasing awareness of food allergies and the limitations of avoidance-based management. Early research focused on oral and injectable immunotherapies, with clinical trials demonstrating efficacy in reducing allergic reactions, particularly in pediatric populations. Regulatory approvals in the U.S. and Europe, coupled with rising R&D investments, facilitated the introduction of novel vaccines. Hospital pharmacies and specialty clinics initially dominated distribution due to stringent storage and administration requirements. Gradually, advancements in delivery methods, such as epicutaneous and sublingual vaccines, along with growing patient acceptance, laid the foundation for current market expansion.

Sources

Primary Research Interviews:

Allergists and Immunologists

Clinical Trial Investigators

Pediatricians and General Physicians

Vaccine Manufacturers and Biotech Specialists

Databases:

World Health Organization (WHO) Allergy and Immunization Statistics

Centers for Disease Control and Prevention (CDC) Data on Food Allergies

Global Health Data Exchange (GHDx)

Magazines:

Vaccine News Daily

Pharmaceutical Technology

Immuno-Oncology News

MedTech Outlook

HealthTech Magazine

Journals:

Journal of Allergy and Clinical Immunology

Annals of Allergy, Asthma & Immunology

Pediatric Allergy and Immunology

Clinical and Experimental Allergy

Human Vaccines & Immunotherapeutics

Newspapers:

The New York Times (Health)

The Guardian (Health)

Financial Times (Healthcare)

The Hindu (Health)

Reuters Health

Associations:

World Allergy Organization (WAO)

American Academy of Allergy, Asthma & Immunology (AAAAI)

European Academy of Allergy and Clinical Immunology (EAACI)

International Society for Immunotherapy

Food Allergy Research & Education (FARE)

Share

Share

About Author

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients