Painting Masking Tapes Market Size and Forecast – 2025 – 2032

The Global Painting Masking Tapes Market size is estimated to be valued at USD 1.45 billion in 2025 and is expected to reach USD 2.35 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.25% from 2025 to 2032.

Global Painting Masking Tapes Market Overview

Painting masking tapes are adhesive tapes designed to create clean paint lines and protect surfaces during painting and coating operations. These tapes are made from paper, crepe, or polymer backing materials coated with pressure-sensitive adhesives. They are available in various widths, adhesion levels, and temperature tolerances for applications ranging from home interiors to automotive refinishing and industrial coatings.

High-performance masking tapes feature UV resistance, solvent resistance, and residue-free removal for smooth surfaces. Product advancements focus on eco-friendly adhesives, improved tensile strength, and precision edge technology for high-quality finishing in both manual and automated painting systems.

Key Takeaways

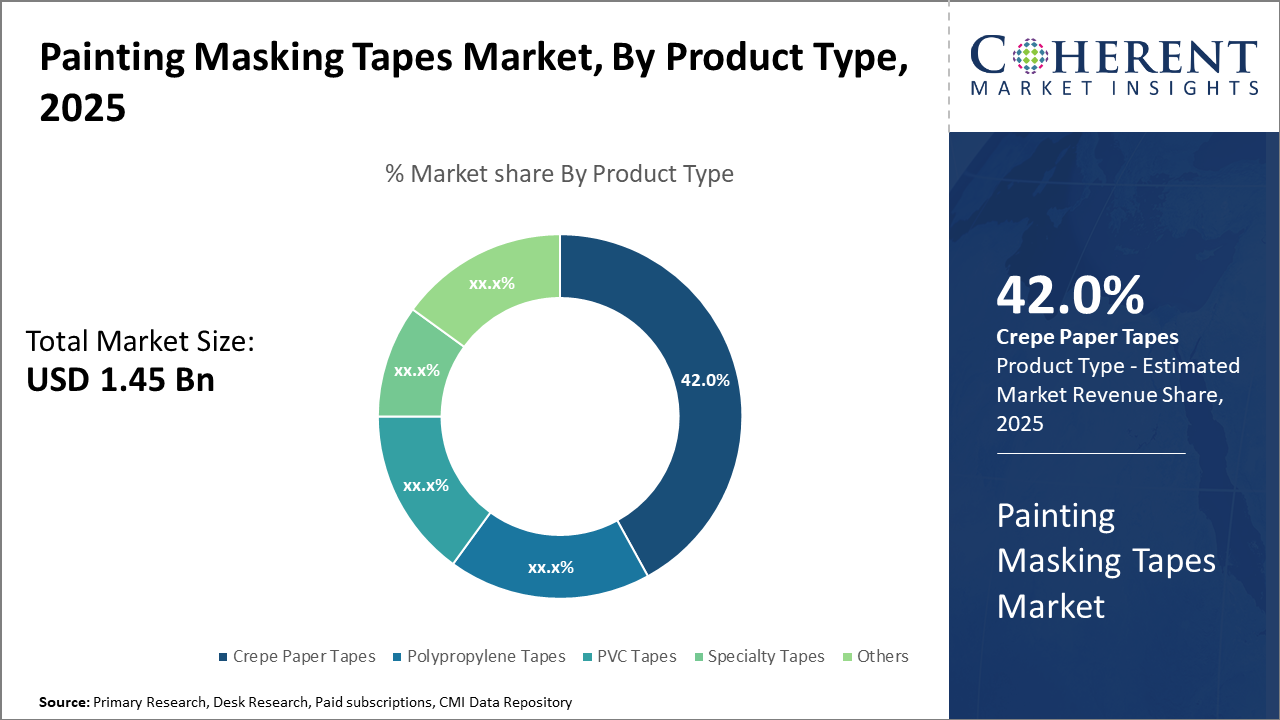

The Crepe Paper Tapes segment dominates the Painting Masking Tapes Market, commanding a 42% market share, driven by its cost-effectiveness and widespread compatibility with multiple applications.

The automotive application segment continues to lead in revenue generation, fueled by consistent demand from vehicle repair and manufacturing sectors.

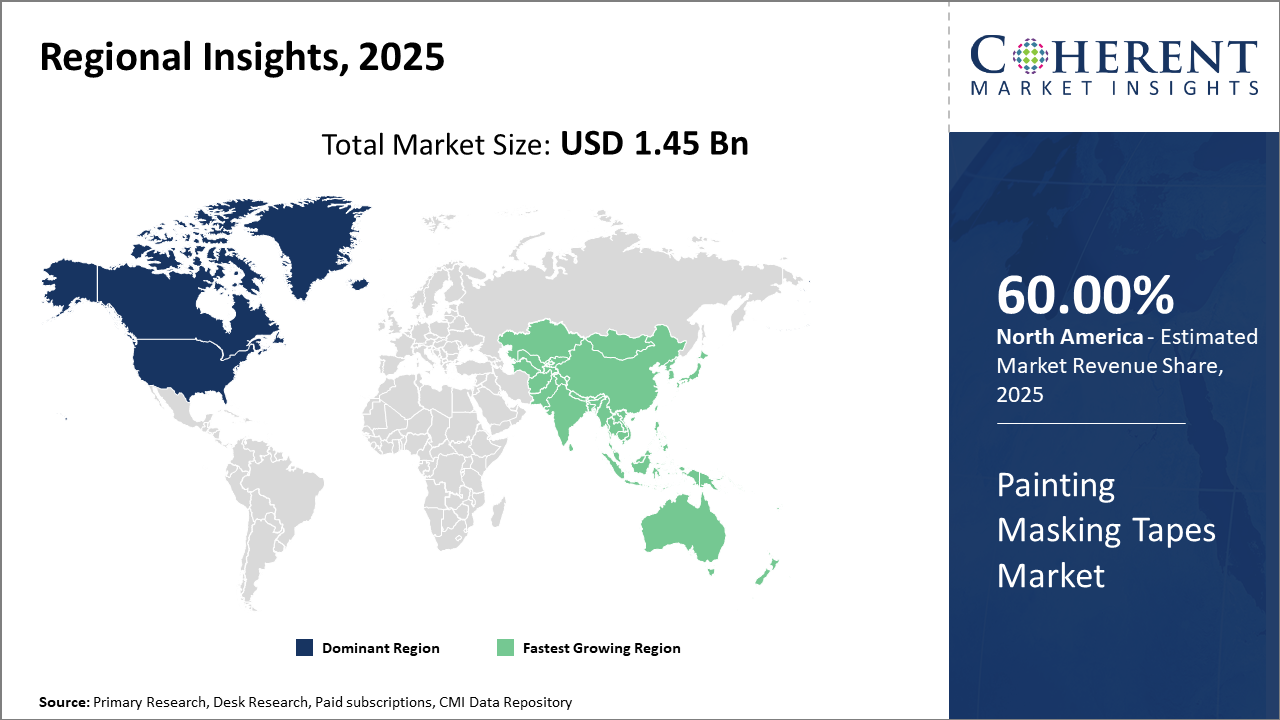

Regionally, North America holds the major industry share with 60% backed by stringent quality norms and OEM preferences, whereas Asia Pacific exhibits the highest CAGR driven by burgeoning industrial projects and construction activities in India and China.

Painting Masking Tapes Market Segmentation Analysis

To learn more about this report, Download Free Sample

Painting Masking Tapes Market Insights, By Product Type

Crepe Paper Tapes dominate the market share. Their exceptional conformability and ease of tearing make them highly favored for automotive and household applications, accounting for over 42% of sales volume. The fastest growing subsegment is Polypropylene Tapes, experiencing high demand in industrial uses due to their superior chemical resistance and longer lifespan, particularly in heavy-duty painting environments. PVC Tapes are valued for their abrasion resistance, suitable for more rugged applications but hold a smaller market share.

Painting Masking Tapes Market Insights, By Application

Automotive Refurbishing leads market share, driven by increasing vehicle maintenance and refinishing standards requiring tapes with high performance and residue-free removal. Industrial Painting and Coating is the fastest growing application segment, fueled by manufacturing sectors such as aerospace, shipbuilding, and machinery which require specialized tapes able to withstand harsh conditions like elevated temperatures and solvents. Construction and Household applications are stable contributors, supported by residential growth and interior finishing demands

Painting Masking Tapes Market Insights, By End User

Automotive is dominating the market due to the continuous rise in vehicle production and aftermarket servicing. The Industrial end user segment is expanding rapidly, attributed to growing adoption of painting masking tapes in electronics manufacturing, machinery, and aviation sectors where precision and durability are paramount. Construction end users sustain steady growth as urbanization drives decorative and protective coating needs. Consumer applications, including DIY use and small-scale repairs, contribute modestly but are witnessing gradual uptake due to increased product accessibility and user-friendly tape options.

Painting Masking Tapes Market Trends

To learn more about this report, Download Free Sample

Painting Masking Tapes Market Insights, By Geography

North America Painting Masking Tapes Market Analysis and Trends

In North America, the Painting Masking Tapes market holds the largest share globally due to mature automotive and industrial sectors, stringent environmental policies, and preference for premium tapes among OEMs. The region contributes over 60% of the global market revenue, supported by major manufacturers headquartered domestically and aggressive adoption of advanced masking technologies.

Asia Pacific Painting Masking Tapes Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth at a CAGR exceeding 9%, led primarily by China and India. Factors such as rapid industrialization, infrastructure investments, and expanding automotive markets create substantial demand for painting masking tapes. Government programs aimed at boosting manufacturing capabilities have facilitated growth, alongside entrance of notable entities increasing production capacity.

Painting Masking Tapes Market Outlook for Key Countries

USA Painting Masking Tapes Market Analysis and Trends

The U.S. market is characterized by intense demand for high-performance, eco-friendly masking tapes. Strong automotive refurbishment and aerospace industries drive consistent consumption. Key players like 3M Company and Shurtape Technologies dominate with innovative product launches geared towards reducing waste and improving application efficiency. Regulatory frameworks like EPA’s clean air standards further stimulate market growth by encouraging adoption of sustainable tapes.

China Painting Masking Tapes Market Analysis and Trends

China’s Painting Masking Tapes market benefits from extensive industrial expansion and urban development projects. The presence of diverse industrial sectors, including automotive, electronics, and construction, underpins robust tape demand. Domestic companies increasingly focus on R&D to match quality standards of international players. Government initiatives promoting green manufacturing also incentivize development of low-emission adhesive products, accelerating market dynamics in the region.

Analyst Opinion

Automotive refinishing remains a prominent demand-side indicator for painting masking tapes, accounting for over 35% of the market share in 2024. Reports from vehicle service centers indicate a 6% year-over-year increase in adoption of premium masking tapes, attributed to enhanced demarcation precision and paint protection standards. The booming automotive aftermarket reinforces this trend, especially in North America and Europe.

Manufacturers increasingly focus on solvent-free and low VOC (Volatile Organic Compounds) adhesive formulations to comply with recent environmental regulations. For example, major tape manufacturers launched eco-certified products in 2023, securing more than 15% revenue increase in green product lines. This supply-side innovation is expected to elevate market revenue substantially by 2032.

Industrial sectors including aerospace, shipbuilding, and machinery coatings have expanded their utilization of specialized painting masking tapes capable of temperature resistance up to 150°C. Industrial segment consumption grew 8% in 2024, driven by projects involving precision coatings and anti-corrosive applications, further fueling market growth dynamics.

Construction site management teams reported increased application of painting masking tapes for interior and exterior finishes. Regional construction booms, notably in Asia Pacific where infrastructural investments surged by 10% in 2024, boosted tape demand by 9% in such end-use verticals, enhancing the overall market share and addressing emerging regional growth strategies.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 1.45 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.25% | 2032 Value Projection: | USD 2.35 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | 3M Company, Intertape Polymer Group Inc., Scapa Group plc, Nitto Denko Corporation, Shurtape Technologies LLC, Berry Global Group Inc., Ardex Group, TCL Corporation, Zhonghao Chenguang Group Co., Ltd., IPG Industrial Products. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Painting Masking Tapes Market Growth Factors

Key growth drivers for the Painting Masking Tapes Market include: Firstly, the expanding automotive repair and OEM sector in emerging economies continues to face rising quality standards, prompting more sophisticated masking requirements demonstrated by a 7% growth in automotive tape shipments in 2024 alone. Secondly, increasing environmental regulations targeting VOC emissions have accelerated the adoption of sustainable masking tapes, with eco-sensitive product sales rising by 18% in 2023 across Europe and North America.

Furthermore, rapid urbanization and construction activities in Asia Pacific, especially in India and China, have driven demand for industrial coatings and corresponding masking solutions, registering double-digit growth in demand. Fourthly, advances in adhesive formulations boosting temperature resistance and adhesive strength have made painting masking tapes viable for industrial applications such as aerospace and shipbuilding, growing this niche segment at a notable pace.

Painting Masking Tapes Market Development

In February 2024, Rogers Corporation introduced its DeWAL® Plasma X™ plasma spray masking tape, marking a new milestone within the company’s DeWAL thermal-spray masking portfolio. The product is built from a silicone-rubber/glass-cloth laminate with an aggressive high-temperature silicone adhesive, rated for up to 260 °C (500 °F) and designed for use in plasma spraying, grit blasting, flame spraying, and similar demanding environments. It promises clean removal, strong conformity to complex geometries, and time-saving performance for heavy-duty industrial masking operations.

In January 2025, Shurtape Technologies, LLC launched FrogTape® Advanced™, a premium painter’s masking tape designed to raise performance in professional and DIY coatings applications. The new product features a washi-paper backing that is twice as strong as conventional crepe paper, tear-resistance, enhanced conformability in curves and corners, and clean removal for up to 28 days. Although not specific to 2024, this represents the latest in their high-end masking-tape portfolio.

Key Players

Leading Companies of the Market

3M Company

Intertape Polymer Group Inc.

Scapa Group plc

Nitto Denko Corporation

Shurtape Technologies LLC

Berry Global Group Inc.

Ardex Group

TCL Corporation

Zhonghao Chenguang Group Co., Ltd.

IPG Industrial Products

Several leading companies have shifted their growth strategies towards expanding green product portfolios and establishing strategic partnerships with automotive OEMs, which impacted their market presence positively in 2024. For instance, 3M’s collaboration with key automotive suppliers resulted in a 12% increase in market share regionally. Meanwhile, Tesla SE's investments in manufacturing plant expansions in Asia Pacific yielded a 15% rise in production capacity, supporting rapid growth.

Painting Masking Tapes Market Future Outlook

The future of the painting masking tapes market lies in eco-friendly and performance-oriented innovation. Waterborne adhesives, biodegradable backings, and solvent-free manufacturing processes will become industry standards. Automation in painting and robotic applications will demand tapes with superior conformability and high-temperature endurance. Rising industrial production and the continuing popularity of DIY renovations will sustain demand, while digital color-matching and smart material tracking could emerge as novel product differentiators in the premium segment.

Painting Masking Tapes Market Historical Analysis

Historically, painting masking tapes have been essential in automotive, industrial, and decorative applications, providing precision and surface protection during coating. Since the 2000s, product development has focused on improving adhesive performance, temperature resistance, and clean removal. Growth was supported by expanding automotive refinishing and DIY home improvement trends. Manufacturers diversified their product lines with UV-resistant and water-based adhesive tapes, addressing environmental regulations.

Sources

Primary Research Interviews:

Paint Technicians

Industrial Coating Engineers

Packaging Specialists

Adhesive Manufacturers

Databases:

OECD Manufacturing Statistics

UN Comtrade

Magazines:

Adhesives & Sealants Industry

Coatings World

Paint & Coatings Industry

Journals:

Journal of Adhesion Science and Technology

Progress in Organic Coatings

Surface Coatings International

Newspapers:

The Economic Times (Industry)

Financial Times (Manufacturing)

The Hindu (Business)

Business Standard (Industrial Goods)

Associations:

Adhesive and Sealant Council (ASC)

European Coatings Association

ASTM International

Share

Share

About Author

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients