Ornamental Fish Feed Market Size and Forecast – 2025 – 2032

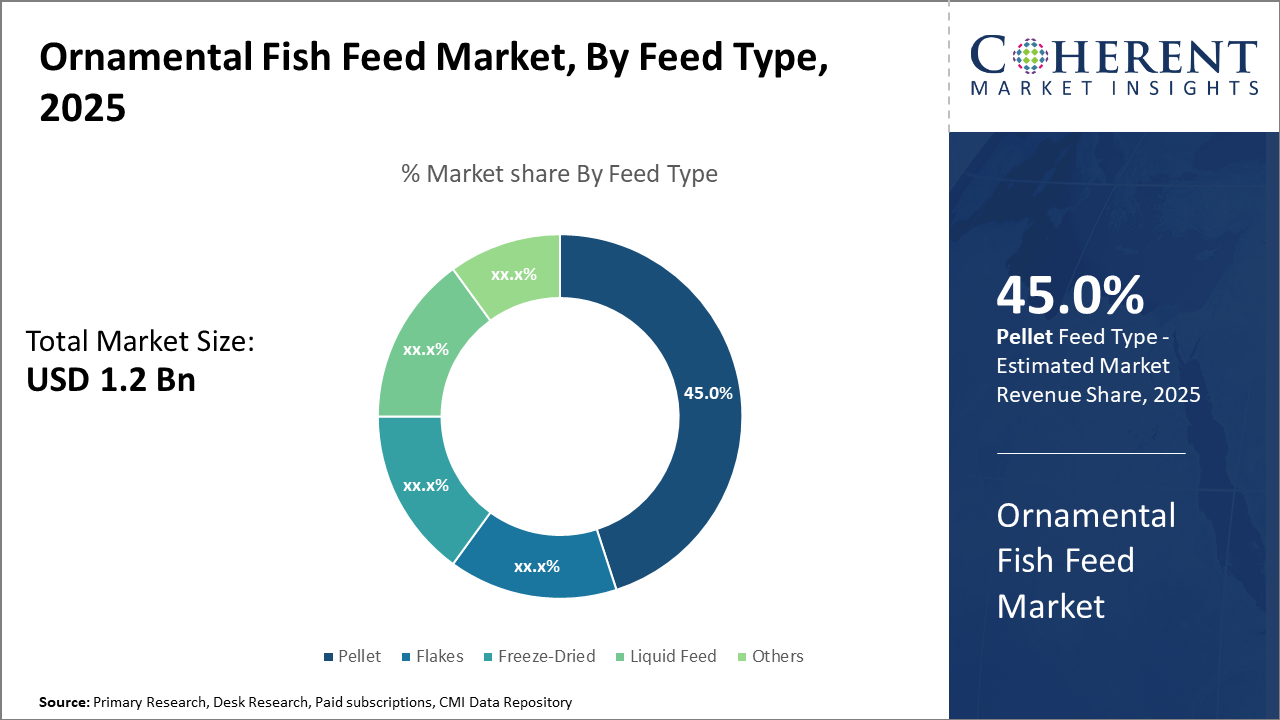

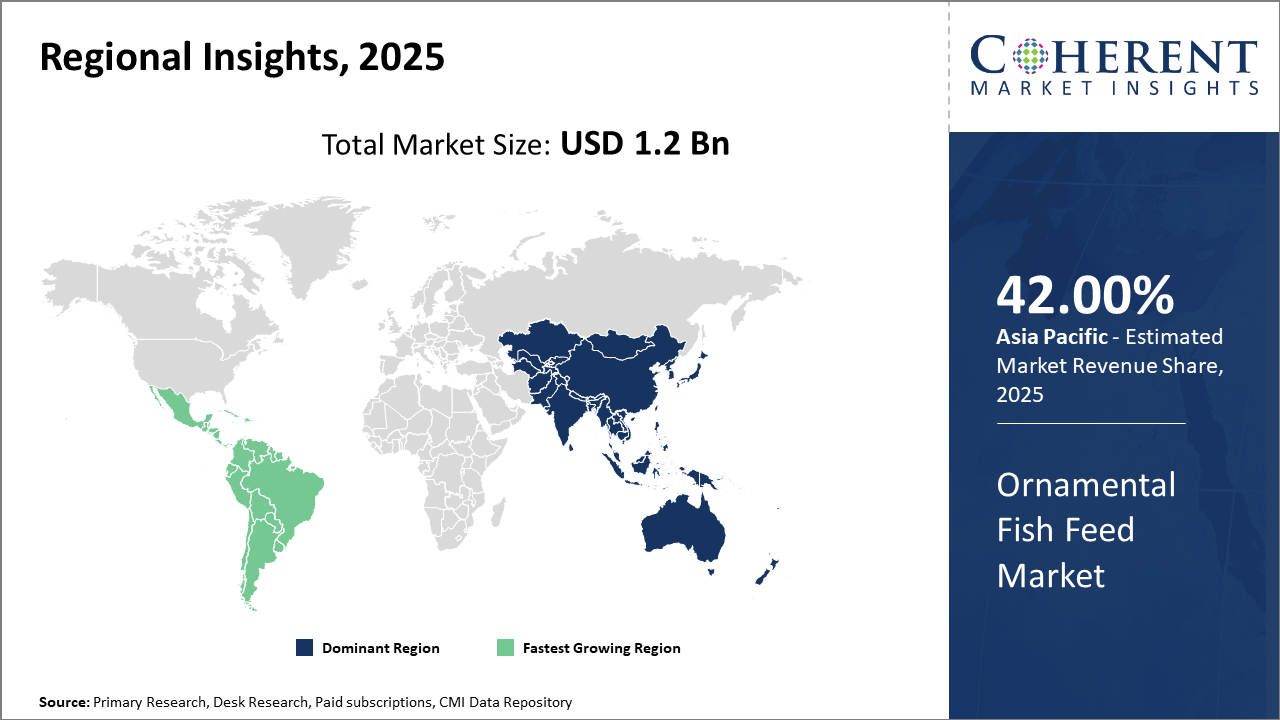

The Global Ornamental Fish Feed Market size is estimated to be valued at USD 1.2 billion in 2025 and is expected to reach USD 2.05 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% from 2025 to 2032.

Global Ornamental Fish Feed Market Overview

Ornamental fish feed products are specially formulated, nutrient-rich diets for aquarium and pond fish. They include flakes, pellets, micro-pellets, granules, and freeze-dried options, tailored to specific species’ size, feeding habits, and nutritional needs. Some products are enhanced with probiotics, color-enhancing carotenoids, or immune-support additives. Premium feeds focus on improving fish coloration, growth, and overall health while minimizing water pollution. Certain feeds are also slow-sinking or floating, supporting different feeding behaviors in freshwater and marine species.

Key Takeaways

Ornamental fish feed pellets dominate the market share due to their stability and nutrient density, while liquid feeds are emerging fastest due to ease of delivery in hatchery systems.

The freshwater ornamental fish application segment holds the largest industry share, supported by widespread freshwater aquaria ownership globally.

Asia Pacific remains the largest revenue contributor, with key subsegments leveraging advanced feed innovations to boost ornamental fish health and coloration.

North America and Europe exhibit steady growth driven by stringent quality norms and premium product demand, whereas Latin America is developing rapidly due to rising consumer spending on ornamental fish hobbies.

Ornamental Fish Feed Market Segmentation Analysis

To learn more about this report, Download Free Sample

Ornamental Fish Feed Market Insights, By Feed Type

Pellet feeds dominate the market share with 45% due to their balanced nutritional profiles and ease of use in both freshwater and marine environments, making them popular amongst bulk buyers and commercial breeders. The fastest-growing subsegment is Freeze-Dried feed, catalyzed by rising demand for natural and live food alternatives that promote fish health and vibrant coloration; its portability and prolonged shelf life appeal to hobbyists and retailers alike. Flakes serve as a cost-effective and widely available feed type popular among casual aquarium owners, while Liquid Feed finds niche applications in early-stage fry feeding due to enhanced digestibility.

Ornamental Fish Feed Market Insights, By Application

Freshwater ornamental fish applications dominate the market due to a broader species base, accessibility, and affordability, facilitating widespread adoption globally. Species such as guppies and tetras benefit from innovative feeds promoting coloration and disease resistance. Marine ornamental fish, however, is the fastest-growing subsegment fueled by increasing interest in saltwater aquaria and species with complex nutritional needs; advances in specialized marine feeds have reduced mortality rates, fostering business growth.

Ornamental Fish Feed Market Insights, By Distribution Channel

Commercial retailers maintain the largest market share due to entrenched physical presence, customer trust, and wide product variety, especially in urban and suburban regions. Online retailers are rapidly capturing market revenue share fueled by expanded internet penetration, convenience, and a growing preference for home delivery of specialty and customized feeds. Specialty aquariums contribute modestly but steadily by catering directly to enthusiasts demanding premium and disease-specific feeds.

Ornamental Fish Feed Market Trends

Recent market trends reveal an accelerated shift towards eco-friendly and health-promoting ornamental fish feeds.

In 2025, insect protein-based feed formulations captured over 20% of the market share in Asia Pacific, representing a notable shift from traditional fishmeal-based products. This reflects growing environmental consciousness and government-driven sustainability incentives in countries like China and Indonesia.

Additionally, AI-enabled feed customization streamlined feed efficiency in commercial hatcheries, reducing feed waste by 18% according to 2024 industry data.

Another significant trend is the rise of online retail channels, which accounted for 30% of ornamental fish feed sales in Europe and North America, strengthening accessibility for niche species owners.

Ornamental Fish Feed Market Insights, By Geography

To learn more about this report, Download Free Sample

Asia Pacific Ornamental Fish Feed Market Analysis and Trends

In the Asia Pacific, the dominance in the Ornamental Fish Feed market is underscored by favorable climatic conditions for ornamental fish farming and high consumer engagement in aquarium hobbies. The region commands over 42% of the ornamental fish feed market share, bolstered by strong government support for aquaculture innovation and the presence of major feed producers pioneering novel formulations.

Latin America Ornamental Fish Feed Market Analysis and Trends

Meanwhile, Latin America exhibits the fastest growth with a CAGR exceeding 9% attributed to increasing disposable incomes, expanding aquaponics ventures, and rising awareness of ornamental aquatic species as pets. Infrastructure developments and enhanced supply chain mechanisms also contribute to rapid market expansion.

Ornamental Fish Feed Market Outlook for Key Countries

USA Ornamental Fish Feed Market Analysis and Trends

The USA’s ornamental fish feed market is characterized by premium product demand, stringent quality standards, and technology-driven innovation. Players such as Cargill and Skretting have introduced high-nutrient and color-enhancement feeds tailored for species popular in North American aquaria. USA’s well-established pet industry infrastructure supports wide distribution, with e-commerce platforms gaining consistent traction—digital sales in 2024 grew by 12%. Additionally, programs promoting sustainable feed ingredients, including algae-based omega-3 supplements, have increased feed variability and boosted business growth.

Japan Ornamental Fish Feed Market Analysis and Trends

Japan’s ornamental fish feed market benefits from its strong cultural affinity for aquatic pets and advanced feed technology adoption. Leading companies focus on probiotic-enriched and vitamin-fortified feeds, ensuring fish health and vibrancy, catering to high consumer expectations. Domestic players such as Hikari Co., Ltd. have expanded product portfolios with innovations in freeze-dried and liquid feed forms. Japan’s stringent regulations on feed safety have encouraged product quality enhancement, supporting growth in both domestic consumption and export markets.

Analyst Opinion

Driving demand is reflected in the consistent increase in ornamental fish farming activities, where nutrition-specific feed formulations have boosted fish vitality, showing growth in market size. For example, in 2024, ornamental fish breeders in Southeast Asia reported a 12% rise in yield correlated with enhanced feed quality, emphasizing the role of feed innovation.

Pricing dynamics amid raw material volatility, particularly of fishmeal and soy protein, directly impact market revenue streams. In 2025, feed price fluctuations led to a 5% variation in market revenues across North America, influencing company margins and strategic procurement.

Import volumes of ornamental fish feed and ingredients have surged in regions such as Europe, driven by demand for exotic fish species requiring specialized nutrition. EU import data from 2024 reveals a 15% year-on-year growth in ornamental feed ingredients, underscoring market growth fueled by consumer demand trends.

Advancements in nano-feed technology and the incorporation of probiotics are shaping new micro-market segments within ornamental fish feed. Asia-Pacific held 40% of the segment revenue in 2024, due to early adopters implementing these novel feed formulations to reduce disease incidence and enhance color vibrancy.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 1.2 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.2% | 2032 Value Projection: | USD 2.05 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Zeigler Bros., Inc., Skretting AS, Cargill Incorporated, Aller Aqua A/S, Rangen, Inc., BioMar Group, Nutrafin, Tetra GmbH, JBL GmbH & Co. KG, Guppy Aquarium Feed Pvt. Ltd., Hikari Co., Ltd., Aquacare International | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Ornamental Fish Feed Market Growth Factors

Increasing consumer inclination towards ornamental fish as a hobby mainly propels the market growth, supported by rising urbanization and disposable incomes. Reports indicate a 10% surge in aquarium ownership in Europe over 2024, directly amplifying feed demand. Technological innovations in feed formulations, including color-enhancement and immunity-boosting ingredients, are fueling market revenue growth, with novel products accounting for 18% of total sales in 2025. Moreover, the expansion of e-commerce platforms has made specialized ornamental fish feed more accessible, particularly in remote regions of the Asia Pacific and Latin America. Environmental regulations promoting sustainable and eco-friendly feed components further stimulate market growth by incentivizing the adoption of alternatives to conventional feed ingredients.

Ornamental Fish Feed Market Development

In February 2025, Insectika Biotech (India) launched two novel insect-protein-based feeds: Yum Pro for Asian seabass (barramundi) and YuM ToM for aquarium fish. These feeds were developed in collaboration with ICAR-CIBA, using black soldier fly larvae as a protein source. The products aim to reduce dependence on traditional fish meal and provide sustainable, high-quality protein for both edible and ornamental fish.

In September 2024, the Indian Council of Agricultural Research – Central Institute of Freshwater Aquaculture (ICAR-CIFA) released the ‘Rangeen Machhli’ mobile app under the Pradhan Mantri Matsya Sampada Yojana (PMMSY). The app is designed to provide essential information/support for ornamental fish farmers, aquarium industry stakeholders, and hobbyists, to help with best practices, regulation, and marketplace information

Key Players

Leading Companies of the Market include:

Zeigler Bros., Inc.

Skretting AS

Aller Aqua A/S

Rangen, Inc.

BioMar Group

Nutrafin

Tetra GmbH

JBL GmbH & Co. KG

Guppy Aquarium Feed Pvt. Ltd.

Hikari Co., Ltd.

Several market players have adopted diversification and product innovation strategies to strengthen their positions. For instance, Skretting’s introduction of probiotic-based ornamental fish feeds in 2024 increased its revenue by an estimated 8% in the Asia-Pacific market. Cargill, leveraging partnerships with local distributors in North America, expanded its retail footprint by 20% in 2025, translating to enhanced market penetration and sustained business growth.

Ornamental Fish Feed Market Future Outlook

The future of the ornamental fish feed market is expected to be shaped by increasing demand for high-quality, species-specific, and functional feeds. Manufacturers are likely to focus on developing products enriched with probiotics, natural color enhancers, and immune-boosting ingredients to improve fish health and visual appeal. Sustainability will become a key trend, with companies exploring alternative protein sources such as insect meal and algae to reduce environmental impact. In addition, the rising popularity of smart aquariums and automatic feeding systems may create opportunities for innovative, slow-release, and technology-compatible feed products. Growing interest in premium and customized diets for exotic species is anticipated to further drive innovation and product diversification in this sector.

Ornamental Fish Feed Market Historical Analysis

The ornamental fish feed industry has evolved from simple flake or pellet diets to more sophisticated formulations tailored to species-specific nutritional needs, water parameters, and aesthetic goals (e.g. color enhancement). Over time, interest in probiotics, micro-pellets, slow-release feeding, and gut health has grown. Manufacturers have responded with incremental innovations—differently sized feeds, inclusion of carotenoids, and improved digestibility to reduce waste in aquaria. The industry has been driven by the growth of the aquarium hobby, rising disposable income in emerging markets, and increased interest in ornamental aquaculture.

Sources

Primary Research interviews:

Aquaculture Nutritionists

Aquarium Industry Experts

Ornamental Fish Breeders

Aquaculture Researchers

Databases:

FAO Fisheries & Aquaculture Department

ASFA

Global Aquaculture Alliance Publications

Aquatic Sciences and Fisheries Abstracts

Magazines:

Practical Fishkeeping

Tropical Fish Hobbyist

Aquarium Trade News

Fish World

Journals:

Journal of the World Aquaculture Society

Aquaculture Research

Reviews in Aquaculture

Newspapers:

The Times of India

The Hindu, Financial Express

Business Standard

Associations:

World Aquaculture Society

Ornamental Fish International

Global Aquaculture Alliance

European Aquaculture Society

Share

Share

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients