Organic Chemicals Market Size and Forecast – 2026 – 2033

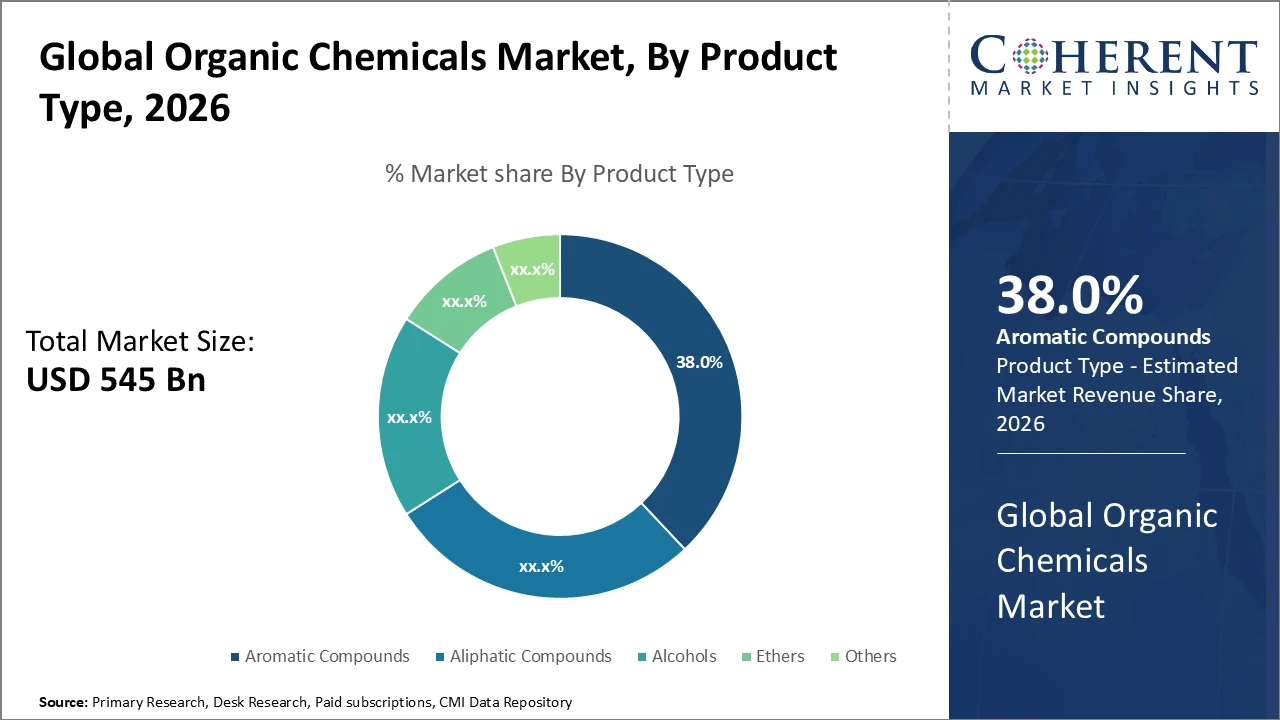

The Global Organic Chemicals Market size is estimated to be valued at USD 545 billion in 2026 and is expected to reach USD 815 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 5.7% from 2026 to 2033.

Global Organic Chemicals Market Overview

Organic chemicals are carbon-based compounds that form the foundation of many natural and synthetic substances. They typically contain carbon atoms bonded with hydrogen, oxygen, nitrogen, sulfur, or halogens, and are essential to life and industry. Organic chemicals occur naturally in plants, animals, and fossil fuels, and are also manufactured for industrial use. They are widely used in pharmaceuticals, agrochemicals, plastics, dyes, solvents, fuels, and food additives.

Key Takeaways

The aromatic compounds segment dominates the product category, holding 38% of the market share, driven by its critical role in pharmaceutical and agrochemical intermediates.

Pharmaceuticals remain the fastest-growing application segment due to rising demand for high-purity organic chemicals in innovative drug formulations.

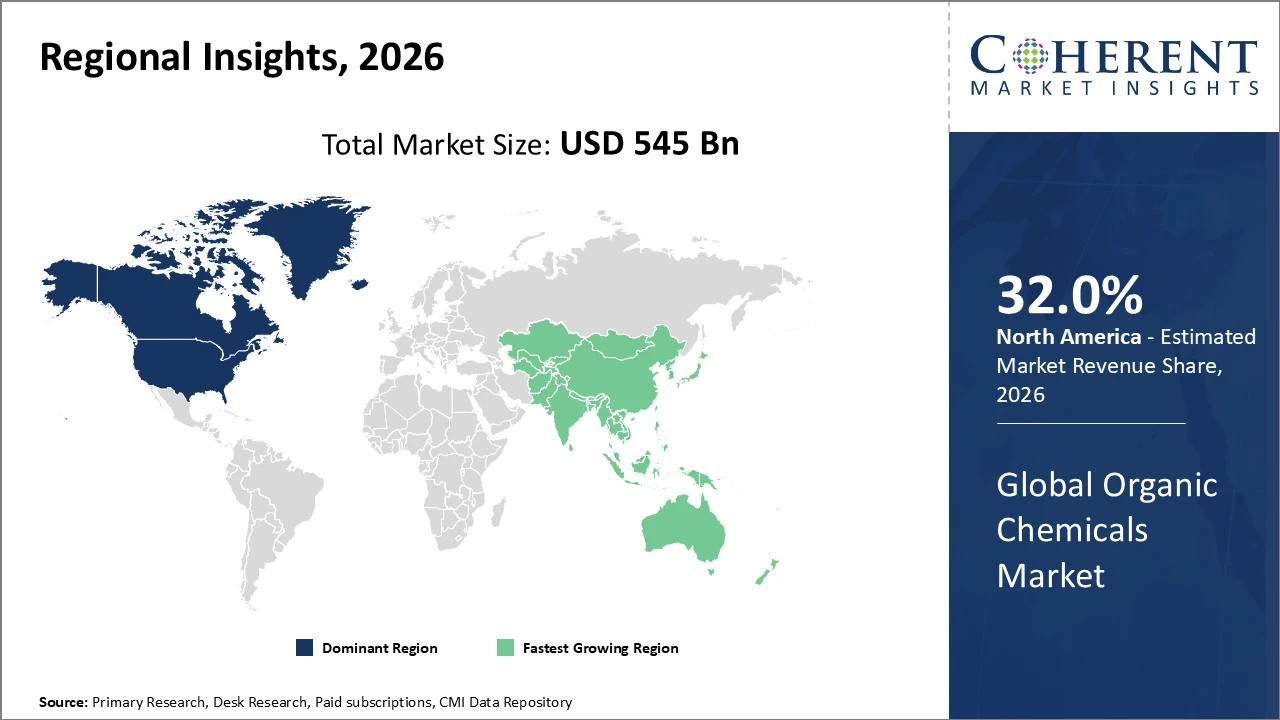

North America holds a leading market position, supported by extensive pharmaceutical and specialty chemicals manufacturing infrastructure.

Asia Pacific is the fastest-growing region, with a CAGR surpassing other regions, fueled by rapid industrialization and government policies promoting sustainable and eco-friendly chemical production.

Organic Chemicals Market Segmentation Analysis

To learn more about this report, Download Free Sample

Organic Chemicals Market Insights, By Product Type

Aromatic compounds dominate the organic chemicals market, holding 38% of the share due to their extensive use in pharmaceuticals, agrochemicals, and dyes. Advances in catalysts and synthetic processes have enhanced yield and purity, essential for complex specialty chemicals. Alcohols are the fastest-growing subsegment, driven by demand in solvents, personal care, and pharmaceutical formulations. Aliphatic compounds serve as key raw materials in plastics and coatings, maintaining a moderate market presence.

Organic Chemicals Market Insights, By Application

Pharmaceuticals dominate the organic chemicals market, driven by the growing prevalence of chronic diseases and the need for high-purity chemicals in complex drug development. This segment is also the fastest-growing, fueled by rising global healthcare expenditure and innovations in drug delivery systems. Agricultural chemicals follow, supported by increasing food demand and advancements in crop protection formulations. Personal care and cosmetics use organic solvents and fragrance ingredients, maintaining steady market contributions. Paints and coatings rely on organic binders and solvents for construction and automotive applications. Other applications include industrial cleaning and specialty chemicals, catering to niche manufacturing needs.

Organic Chemicals Market Insights, By End-User

Automotive dominates the organic chemicals market, driven by the growing use of organic chemicals in lightweight materials, paints, and adhesives that improve fuel efficiency. This segment is also a key growth driver, propelled by the electric vehicle revolution requiring specialty organic polymer precursors and battery-related chemicals. The construction sector benefits from organic chemicals in paints, coatings, and sealants, showing steady growth. Consumer goods rely on organic chemicals for packaging and personal care products, while electronics is an emerging subsegment, fueled by rising demand for high-purity organic semiconductors and specialty chemicals in electronic devices.

Organic Chemicals Market Trends

The Organic Chemicals market is increasingly aligning with environmental imperatives, with Europe leading the adoption of bio-based chemicals due to stringent green chemistry regulations.

Europe saw a 15% increase in bio-based organic chemical production in 2026, reflecting growing sustainability initiatives.

Digitization and AI-driven quality control in manufacturing are enhancing cost efficiency and product consistency globally, with U.S. plants reducing defect rates by 18% in 2025.

Volatile pricing of conventional feedstocks is shifting market preference toward renewable alternatives, reinforcing sustainability trends.

Emerging applications in electric vehicles and high-end electronics are driving demand for specialty organic chemicals, supporting market growth.

Organic Chemicals Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Organic Chemicals Market Analysis and Trends

In North America, the Organic Chemicals market is dominated by a robust pharmaceuticals industry, advanced manufacturing infrastructure, and regulatory frameworks that promote innovation and sustainability. The region accounts for roughly 32% of the global market, supported by ongoing investments in R&D and eco-friendly initiatives. The U.S. hosts leading companies that have pioneered green organic synthesis techniques and integrated digital technologies, such as AI-driven process optimization and quality control, to enhance efficiency and product consistency. These factors, combined with strong industrial capabilities and high demand across pharmaceuticals, automotive, and specialty chemical sectors, reinforce North America’s position as a key market leader.

Asia Pacific Organic Chemicals Market Analysis and Trends

Asia Pacific is the fastest-growing region in the Organic Chemicals market, with a CAGR exceeding 7%, driven by rapid industrialization, increasing urban populations, and supportive government policies promoting clean and sustainable chemistry. China and India play a central role in market expansion, fueled by strong demand from key end-use sectors including agriculture, automotive, and consumer goods. Cost-effective manufacturing, abundant feedstock availability, and expanding export networks further enhance the region’s competitiveness. Investments in advanced production technologies and infrastructure are accelerating output, enabling Asia Pacific to capture a larger market share and solidify its position as a leading global hub for organic chemicals.

Organic Chemicals Market Outlook for Key Countries

USA Organic Chemicals Market Analysis and Trends

The USA’s Organic Chemicals market is characterized by well-established pharmaceutical and specialty chemical manufacturing sectors. In 2026, adoption of bio-based chemicals increased by 10%, driven by stringent environmental regulations and government-backed innovation incentives. Leading companies such as Dow Inc. and BASF’s U.S. operations have invested significantly in process automation and sustainable production methods, enhancing operational efficiency and expanding market share. Strong demand is further supported by diverse end-user industries, including automotive, electronics, and consumer goods, ensuring steady growth. These factors collectively reinforce the U.S. position as a key global player in organic chemical production and innovation.

Germany Organic Chemicals Market Analysis and Trends

Germany’s Organic Chemicals market is a key European hub, driven by its advanced chemical manufacturing infrastructure, strong R&D capabilities, and stringent environmental regulations. The country leads in bio-based chemical adoption, with production increasing steadily to meet sustainability mandates and circular economy goals. Pharmaceuticals and specialty chemicals remain dominant end-use sectors, supported by innovations in high-purity synthesis and green catalytic processes. Automotive and industrial applications further contribute to market stability. Germany also benefits from export-oriented production, supplying organic chemicals across Europe and globally. Continuous investments in digitalization, process optimization, and sustainable technologies position the German market for steady growth and technological leadership.

Analyst Opinion

Increasing production capacity of specialty organic chemicals is driving market share growth. In 2025, several Asia Pacific manufacturers increased output by 15% using advanced catalytic synthesis, meeting rising regional demand for agrochemical intermediates and solvents.

Growing imports of bio-based organic chemicals indicate a shift toward sustainable raw materials. In 2024, Europe’s imports of bio-derived chemicals rose nearly 10%, driven by regulations targeting carbon footprint reduction and environmentally aligned production practices.

Nano-scale innovations in organic compound formulation are enhancing pharmaceutical and cosmetic applications. Trials in 2026 showed nano-emulsions of organic solvents improved drug delivery performance by 20%, boosting adoption.

Volatility in crude oil and natural gas prices, key feedstocks, affected raw material costs by up to 8% between 2024 and 2026, prompting supply chain diversification and increased use of bio-based alternatives, supporting market growth strategies.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 545 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 5.7% | 2033 Value Projection: | USD 815 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | BASF SE, Dow Inc., SABIC, Evonik Industries AG, Clariant AG, Covestro AG, Eastman Chemical Company, LG Chem, Mitsui Chemicals, Albemarle Corporation | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Organic Chemicals Market Growth Factors

Rapid urbanization and rising infrastructure spending have boosted demand for organic chemicals in paints, coatings, and construction materials, with Asia Pacific’s construction chemical consumption increasing 9% in 2025. Stringent environmental regulations are driving adoption of bio-based and green chemicals, evidenced by a 15% year-over-year rise in sustainable compound production in Europe in 2026. Growth in the pharmaceutical industry is fueling demand for high-purity organic intermediates, with pharma accounting for 27% of consumption in 2024. Technological advancements, such as continuous flow reactors deployed in 2025, improved production efficiency by 18%, lowering costs and enhancing yield, supporting overall market expansion.

Organic Chemicals Market Development

In August 2024, Vipul Organics Limited announced the development of a refined-grade organic intermediate for manufacturing specialty chemicals used in the automobile industry. The compound was developed over more than a year by the company’s internal R&D team.

Key Players

Leading Companies of the Market

BASF SE

Dow Inc.

SABIC

Evonik Industries AG

Covestro AG

Eastman Chemical Company

LG Chem

Mitsui Chemicals

Albemarle Corporation

Key players in the Organic Chemicals market include Chemical Holdings Corporation, Clariant AG, Covestro AG, Eastman Chemical Company, LG Chem, Mitsui Chemicals, and Albemarle Corporation. BASF SE has focused on sustainable chemical production, investing $500 million in green technologies, which achieved a 12% reduction in carbon emissions by 2025. SABIC strengthened its market presence through strategic partnerships in Asia Pacific, expanding organic synthesis facilities and driving a 10% increase in market share in 2024. In 2026, Dow Inc. launched bio-based solvent product lines to meet growing end-user demand for eco-friendly ingredients, particularly in personal care and pharmaceutical applications.

Organic Chemicals Market Future Outlook

The Organic Chemicals market is poised for steady growth driven by rising demand for bio-based and sustainable chemicals, technological advancements, and expanding end-use industries. Increasing adoption of green synthesis methods, continuous flow reactors, and AI-driven process optimization will enhance production efficiency and product quality while reducing environmental impact. Growth in pharmaceuticals, automotive, electronics, and construction sectors will further fuel market expansion. Emerging markets in Asia Pacific are expected to lead in volume growth due to cost advantages and industrialization, while Europe and North America will focus on high-value specialty chemicals and sustainability initiatives, ensuring a balanced global market trajectory.

Organic Chemicals Market Historical Analysis

The Organic Chemicals market has experienced steady growth over the past decade, driven by rising industrialization, expanding pharmaceutical production, and increasing demand for specialty chemicals. Historically, aromatic compounds dominated the market due to their extensive applications in pharmaceuticals, agrochemicals, and dyes. North America and Europe led in market share, supported by advanced manufacturing infrastructure, regulatory frameworks, and early adoption of bio-based chemicals. Asia Pacific emerged as a key growth region in the 2010s, fueled by industrial expansion and cost-effective production. Technological innovations, including catalytic synthesis and process automation, gradually improved efficiency, yield, and product quality, laying the foundation for current and future market growth.

Sources

Primary Research Interviews:

Chemical Manufacturers (Bulk & Specialty Organic Chemicals)

R&D Heads / Process Chemists

Chemical Distributors & Traders

Regulatory & Compliance Experts

End-use Industry Experts (Pharma, Agrochemicals, Plastics, Textiles, Paints & Coatings)

Databases:

World Bank Chemical Industry Data

OECD Chemical Industry Statistics

UN Comtrade Database

US International Trade Commission (USITC)

Magazines:

Chemical & Engineering News (C&EN)

Chemical Week

ICIS Chemical Business

Speciality Chemicals Magazine

Green Chemistry

Journals:

Journal of Organic Chemistry

Chemical Reviews

Organic Process Research & Development

Industrial & Engineering Chemistry Research

Journal of Chemical Technology & Biotechnology

Newspapers:

The New York Times (Health)

Bloomberg (Materials & Chemicals)

Financial Times (Chemicals & Materials)

Business Standard (Chemicals & Petrochemicals)

Reuters (Chemicals & Commodities)

Associations:

International Council of Chemical Associations (ICCA)

Indian Chemical Council (ICC)

Royal Society of Chemistry (RSC)

American Chemistry Council (ACC)

Society of Chemical Industry (SCI)

Share

Share

About Author

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients