Operating Room Integration Market Size and Forecast – 2025 – 2032

The Global Operating Room Integration Market size is estimated to be valued at USD 2.7 billion in 2025 and is expected to reach USD 5.1 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.6% from 2025 to 2032.

Global Operating Room Integration Market Overview

Operating Room (OR) Integration refers to the seamless connection and coordination of medical devices, imaging systems, and software within a surgical environment to improve efficiency, safety, and workflow. By centralizing control and providing real-time access to patient data, OR integration enables surgical teams to make informed decisions quickly, reduce manual interventions, and minimize the risk of errors. Advanced OR integration systems often incorporate video management, anaesthesia monitoring, surgical navigation, and robotic assistance, ensuring that all devices communicate effectively within a single platform.

The adoption of OR integration enhances surgical outcomes by streamlining procedures and reducing operation times. Hospitals benefit from improved resource utilization, lower costs, and optimized staff productivity. With increasing demand for minimally invasive surgeries and complex procedures, integrated operating rooms are becoming critical in modern healthcare facilities. Technological advancements, including IoT-enabled devices and AI-driven analytics, further drive the adoption of OR integration, supporting precision medicine and improved patient care.

Key Takeaways

In the Integration segment, Video Integration dominates with high-definition, multimodal visualization. Device Integration grows fastest due to connected surgical tools. Data Integration consolidates patient data, Security ensures protection, others cover environmental and power management.

In the End-User segment, Hospitals dominate with high surgical volumes, complex procedures, and large budgets enabling comprehensive integration. ASCs grow fastest due to outpatient surgeries and compact, portable solutions. Diagnostic Centers use basic imaging and data-sharing systems.

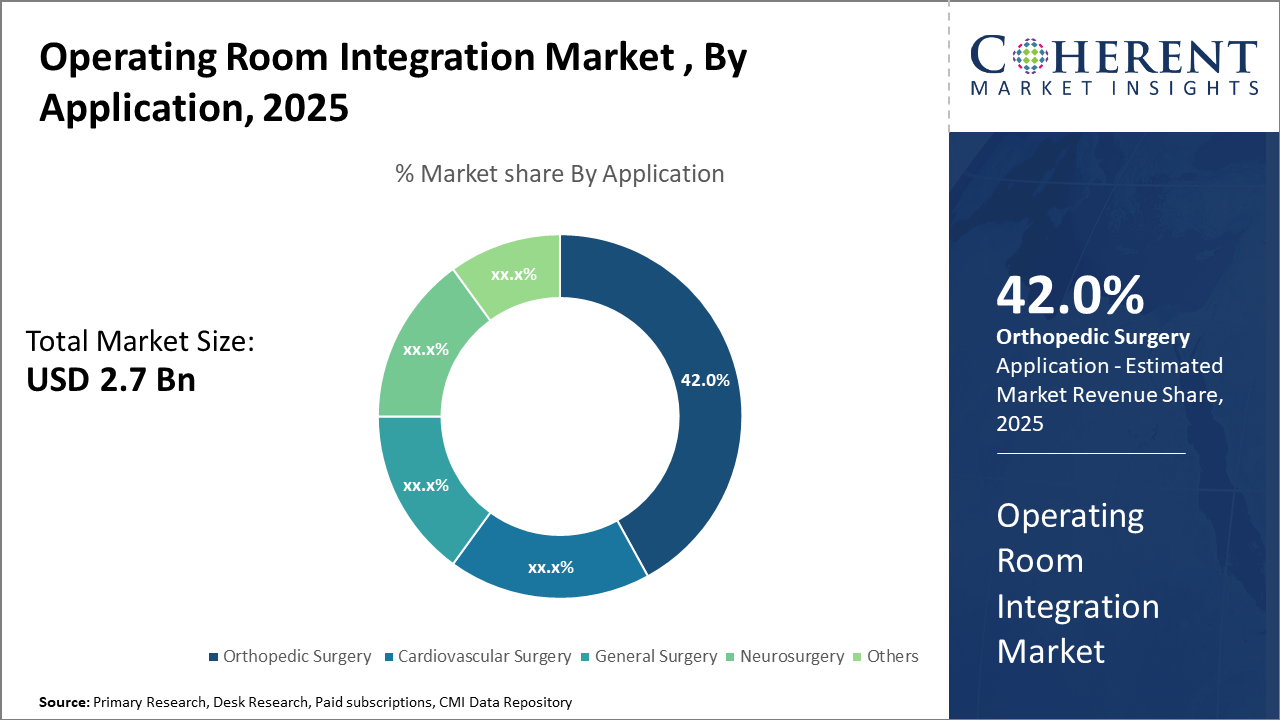

In the Application segment, Orthopedic Surgery dominates due to joint replacements and minimally invasive procedures needing synchronized imaging. General Surgery grows fastest, Cardiovascular Surgery advances with robotics, and Neurosurgery and Others use precise, specialized integration solutions.

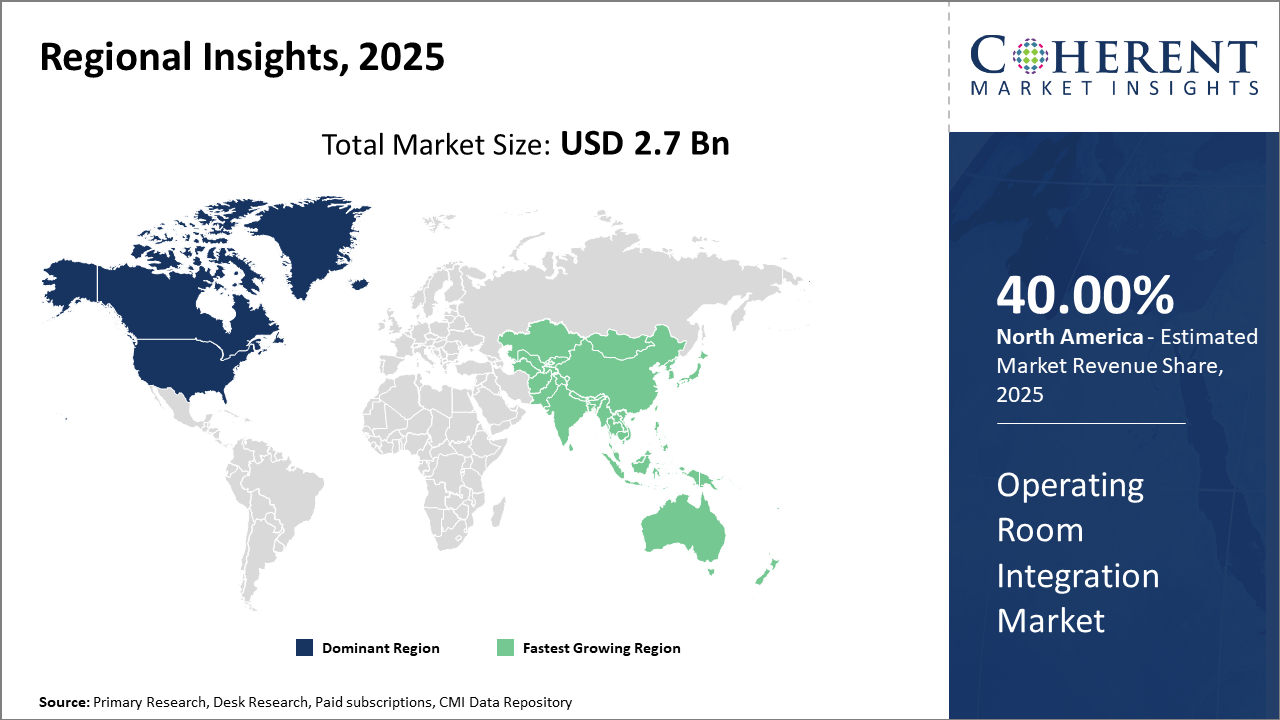

The Operating Room Integration market is led by North America, driven by advanced IT infrastructure and early technology adoption, while Asia Pacific shows fastest growth with rising healthcare investments. Key countries like the USA and Germany drive adoption through AI, robotic platforms, and hospital modernization initiatives.

Operating Room Integration Market Segmentation Analysis

To learn more about this report, Download Free Sample

Operating Room Integration Market Insights, By Application

In terms of application, Orthopedic Surgery dominates the market due to the high prevalence of joint replacements and minimally invasive procedures that rely on synchronized imaging and navigation systems. General Surgery is the fastest-growing segment, driven by diverse procedures needing flexible OR integration. Cardiovascular Surgery grows steadily with robotic-assisted technologies, while Neurosurgery and Others adopt specialized, precise integration solutions.

Operating Room Integration Market Insights, By Integration Type

In terms of integration type, Video Integration dominates the market due to its role in providing high-definition, multimodal surgical visualization, aided by ultra-HD and 3D systems. Device Integration is the fastest-growing segment, driven by connected surgical tools requiring centralized control. Data Integration consolidates real-time patient data, while Security and Control Integration protect systems, with others covering environmental and power management solutions.

Operating Room Integration Market Insights, By End-User

In terms of end-user, Hospitals dominate the market due to high surgical volumes, complex procedures, and larger budgets supporting comprehensive integration systems for workflow optimization and patient safety. Ambulatory Surgical Centers (ASCs) are the fastest-growing segment, driven by the rise of outpatient surgeries and compact, portable integration solutions, while Diagnostic Centers and Others adopt basic imaging and data-sharing systems.

Operating Room Integration Market Trends

The Operating Room Integration market is undergoing digital transformation, driven by AI and IoT-enabled devices, which enable real-time surgical data integration and advanced analytics for improved decision-making.

5G technology adoption is a key trend, supporting remote surgery capabilities and ensuring continuity of surgical services, highlighted during the COVID-19 pandemic aftermath in 2023–2024.

Modular and scalable OR integration platforms are increasingly preferred, allowing healthcare institutions to customize solutions according to specific surgical specialties, improving workflow efficiency and patient outcomes.

These advancements enhance cost efficiency and functional adaptability, enabling hospitals and surgical centers to optimize resource utilization while integrating multiple devices, imaging systems, and data streams into a unified, streamlined operating room environment.

Operating Room Integration Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Operating Room Integration Market Analysis and Trends

In North America, the Operating Room Integration market is dominated by advanced healthcare IT infrastructure, strict patient safety regulations, and strong R&D activities. The U.S. holds over 40% of the regional market, driven by high hospital IT spending and early technology adoption. Companies like Siemens Healthiness and Stryker leverage this mature ecosystem to launch AI-integrated and robotic-assisted OR platforms, supported by extensive healthcare networks and favourable reimbursement policies.

Asia Pacific Operating Room Integration Market Analysis and Trends

The Asia Pacific Operating Room Integration market is the fastest-growing, with a CAGR above 11% from 2025 to 2032, driven by rising healthcare infrastructure investments in China and India, increasing surgical volumes, and government-led hospital modernization initiatives. Growth is fuelled by demand in tier-2 and tier-3 cities and expanding private healthcare. Companies like Philips Healthcare and GE Healthcare are expanding through regional collaborations and customized solutions.

Operating Room Integration Market Outlook for Key Countries

USA Operating Room Integration Market Analysis and Trends

The USA’s operating room integration market is pivotal, representing a major share of North America’s revenue. Hospitals and advanced surgical centers are upgrading to integrated OR systems to enhance safety and efficiency. Cleveland Clinic’s 2024 project showed a 20% improvement in workflow efficiency. AI-driven video and device integration platforms tailored for U.S. clinical needs, along with supportive government programs for healthcare IT and patient safety, drive strong market growth.

Germany Operating Room Integration Market Analysis and Trends

Germany’s operating room integration market is among Europe’s most advanced, driven by medical device innovation, strict health regulations, and smart hospital initiatives. Integrated OR system installations rose 16% in 2024, supported by partnerships between key companies and hospitals to meet hygiene and data security standards. Strong public funding and investments in healthcare digitization further boost growth, establishing Germany as a central and strategic market within the European OR integration landscape.

Analyst Opinion

Increasing Adoption of IoT-enabled Surgical Devices: The proliferation of IoT-enabled devices in operating rooms is a significant supply-side indicator driving market revenue. In 2024, hospitals equipped with IoT-integrated ORs increased by 28% compared to 2023, enabling enhanced device interoperability and improved surgical outcomes. This transition is expected to accelerate through 2025 as operating room integration solutions expand their compatibility across various medical instruments.

Surge in Demand for Real-Time Data Visualization: Demand-side dynamics reveal that medical professionals require real-time visualization capabilities for complex surgeries to reduce errors. For instance, a leading North American hospital reported a 15% reduction in procedural time in 2024 after implementing advanced OR integration video management systems, highlighting the direct impact on clinical efficiency.

Expanding Use Cases Across Multiple Specialties: The micro-indicator of diverse end-use applications is pivotal in market growth. Orthopedics and cardiovascular surgeries accounted for over 40% of market usage in 2024, driven by the need for synchronized imaging and data management during intricate procedures. This diversification underpins steady market expansion.

Growing Investment in Smart Hospital Infrastructure: Nano-level indicators such as increased capital expenditure on smart hospital infrastructure bolster market share growth. The Asia Pacific region experienced a 22% rise in healthcare IT investments in 2024, particularly in countries like India and China, fuelling demand for integrated OR solutions tailored to emerging markets.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 2.7 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.6% | 2032 Value Projection: | USD 5.1 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Stryker Corporation, Siemens Healthineers, Philips Healthcare, Medtronic plc, Drägerwerk AG & Co. KGaA, Karl Storz SE & Co. KG, GE Healthcare, Olympus Corporation, Smith & Nephew plc, Zimmer Biomet Holdings Inc., Fujifilm Holdings Corporation, Intel Corporation, Cisco Systems, Inc., Barco NV, Carestream Health Inc., Agfa-Gevaert Group, Getinge AB, Boston Scientific | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Operating Room Integration Market Growth Factors

The Operating Room Integration market is being driven by the rising shift toward minimally invasive surgeries, which require precise synchronization of data across multiple devices. Hospitals increasingly adopt sophisticated OR integration systems to enhance surgical accuracy, improve workflow efficiency, and reduce the risk of human error. Government funding for smart healthcare infrastructure, particularly in North America and Asia Pacific, has further accelerated system upgrades, with several large hospitals implementing advanced integration platforms in 2024.

Growing awareness of patient safety and operational efficiency is motivating hospital management to invest in technologies that optimize surgical outcomes. Additionally, the expansion of healthcare facilities in emerging markets, supported by public-private partnerships, is boosting demand, contributing to increased market revenue and fostering global business growth across regions.

Operating Room Integration Market Development

In December 2024, KARL STORZ introduced Pathway.AI, an innovative solution built on the Artisight Smart Hospital Platform. Using advanced sensors and machine-learning technology, Pathway.AI tracks and streamlines OR workflows in real time, helping clinicians spend less time on administrative tasks and more on patient care.

Key Players

Leading Companies of the Market

Stryker Corporation

Siemens Healthineers

Philips Healthcare

Medtronic plc

Drägerwerk AG & Co. KGaA

Karl Storz SE & Co. KG

GE Healthcare

Olympus Corporation

Smith & Nephew plc

Zimmer Biomet Holdings, Inc.

Fujifilm Holdings Corporation

Intel Corporation

Cisco Systems, Inc.

Barco NV

Carestream Health, Inc.

Agfa-Gevaert Group

Getinge AB

Boston Scientific Corporation

Competitive strategies include Stryker’s expansion of its OR integration platform via strategic acquisitions, enhancing device compatibility and increasing market penetration in emerging markets. Siemens Healthineers invested heavily in AI-powered control integration modules, which enhanced surgical workflow automation and resulted in a 20% increase in hospital adoption rates in Europe in 2024.

Operating Room Integration Market Future Outlook

The Operating Room Integration market is expected to grow significantly, driven by advancements in AI, IoT, and robotic-assisted surgical technologies. Increasing adoption of minimally invasive procedures and rising demand for real-time data integration will continue to propel market expansion. Hospitals and surgical centers are focusing on digital transformation and smart OR initiatives to improve patient safety, workflow efficiency, and surgical precision. Emerging markets, supported by government investments and public-private partnerships, will present new growth opportunities. Modular, scalable, and customizable OR integration platforms are likely to gain traction, enabling healthcare providers to optimize resources and meet evolving clinical needs globally.

Operating Room Integration Market Historical Analysis

The Operating Room Integration market has witnessed steady growth over the past decade, driven by the increasing adoption of digital healthcare solutions and advanced surgical technologies. Early developments focused on video and device integration to enhance visualization and instrument control during complex procedures. Hospitals in North America and Europe led initial adoption due to higher healthcare IT investments and stringent patient safety regulations. Over time, integration expanded to include data management, security, and control systems, improving workflow efficiency and reducing surgical errors. Rising awareness of patient safety, coupled with advancements in minimally invasive and robotic-assisted surgeries, has consistently supported market expansion globally.

Sources

Primary Research Interviews:

Hospital IT Directors

Surgical Department Heads

Biomedical Engineers

Health Information Management (HIM) Specialists

Clinical Technology Managers

Databases:

ClinicalTrials.gov

PubMed / MEDLINE

Global Health Data Exchange (GHDx)

World Health Organization (WHO) Global Health Observatory

Magazines & Industry Publications:

Healthcare IT News

Health Data Management

Modern Healthcare

Journals:

Journal of Medical Systems

International Journal of Medical Informatics

Journal of Surgical Research

Journal of the American Medical Informatics Association (JAMIA)

Associations & Organizations:

American Hospital Association (AHA)

Association for the Advancement of Medical Instrumentation (AAMI)

Society of American Gastrointestinal and Endoscopic Surgeons (SAGES)

European Association of Hospital Managers (EAHM)

Share

Share

About Author

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients