Milk Protein Concentrate Market Size and Forecast – 2025 – 2032

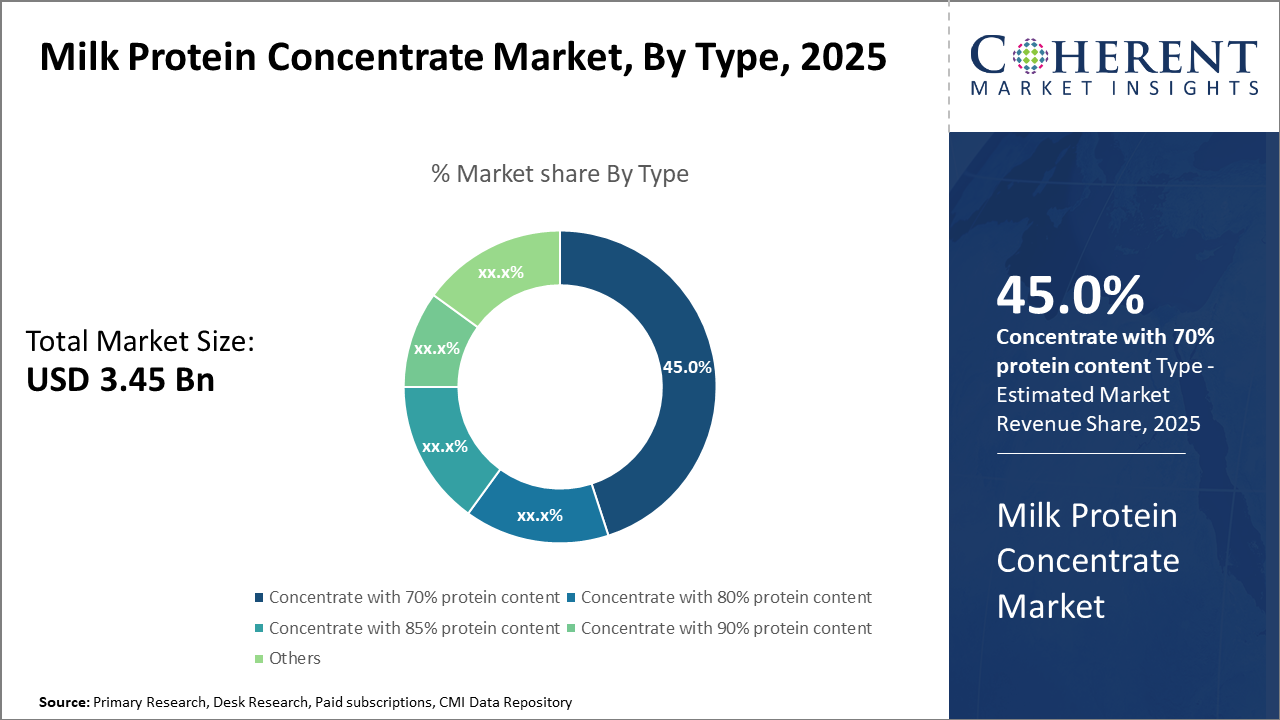

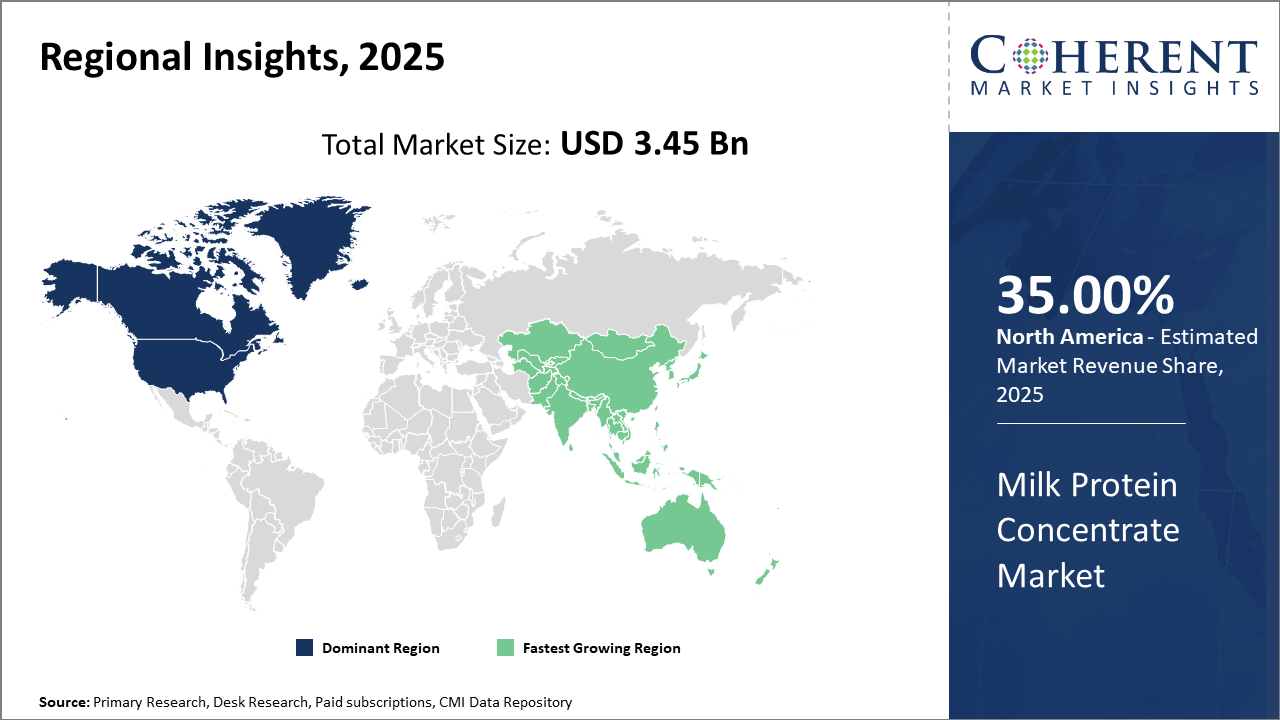

The Global Milk Protein Concentrate Market size is estimated to be valued at USD 3.45 billion in 2025 and is expected to reach USD 5.60 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.1% from 2025 to 2032.

Global Milk Protein Concentrate Market Overview

Milk protein concentrate (MPC) products are dairy-derived powders containing varying ratios of casein and whey proteins, typically produced through ultrafiltration and spray-drying processes. These ingredients are widely used in nutritional supplements, sports beverages, infant formula, and functional foods for their high protein content and excellent amino acid profile. MPCs are available in multiple protein concentrations, from 40% to over 85%, depending on application needs. Advances in membrane filtration and low-heat processing have improved solubility, flavor, and functional properties, enabling broader use in health and wellness formulations.

Key Takeaways

The concentrate with 70% protein content segment dominates the type category with 45% market share, supported by its balanced protein profile, cost efficiency, and broad usage in infant and sports nutrition formulations.

Infant formula remains the leading application segment, driven by increasing birth rates and protein fortification initiatives ensuring nutritional adequacy.

Powder form dominates the form segment, benefiting from its convenience, shelf stability, and wide incorporation across food and beverage formulations.

North America dominates the Milk Protein Concentrate market with over 35% share, underpinned by advanced dairy infrastructure, high consumer awareness, and robust export capacity led by the U.S. dairy industry.

Asia Pacific is the fastest-growing regional market, exhibiting a CAGR exceeding 9%, driven by urbanization, rising incomes, and expanding infant and sports nutrition sectors in countries like India and China.

Milk Protein Concentrate Market Segmentation Analysis

To learn more about this report, Download Free Sample

Milk Protein Concentrate Market Insights, By Type

Concentrate with 70% protein content dominates the market share, accounting for 45%, favored for its balanced protein and cost efficiency, widely accepted across infant nutrition and sports formulations. This subsegment’s versatility drives sustained demand in both developed and emerging markets. The fastest-growing subsegment is concentrate with 85% protein content, witnessing rapid adoption in premium sports nutrition products where high protein purity is critical.

Milk Protein Concentrate Market Insights, By Application

Infant formula continues to dominate the market share because of increasing birth rates and protein fortification policies, making it critical for nutritional adequacy. The fastest-growing segment is sports nutrition, fueled by rising fitness trends and the growing emphasis on maintaining muscle mass among aging populations globally. Bakery and confectionery applications are gaining traction, leveraging MPC’s protein enrichment to improve nutritional profiles. Functional foods and beverages are evolving with new product launches targeting wellness consumers. Other applications include specialized medical and pet nutrition.

Milk Protein Concentrate Market Insights, By Form

Powder form dominates market share due to its convenience in storage, transport, and versatile integration into various food and beverage products. The expanding demand in infant formula and sports nutrition primarily supports the powder segment. Liquid form is the fastest growing, particularly in functional beverages and ready-to-drink products, where ease of use and formulation stability are prioritized. The ‘others’ segment includes gel and semi-solid forms used in niche medical and functional food applications.

Milk Protein Concentrate Market Trends

Recent market trends emphasize the growing importance of sustainability and technological integration in the Milk Protein Concentrate industry.

For example, companies like Fonterra and Arla Foods have incorporated renewable energy sources in their manufacturing processes as part of environmental commitments announced in 2024.

Blockchain traceability systems are enhancing transparency, allowing end-users to verify product origin, which is becoming a standard in premium market segments.

Moreover, personalized nutrition backed by extensive clinical trials, especially in Europe and North America, is shaping product innovation, providing targeted benefits beyond basic protein supplementation.

Milk Protein Concentrate Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Milk Protein Concentrate Market Analysis and Trends

In North America, the dominance in the Milk Protein Concentrate market stems from well-established dairy infrastructure, advanced processing technologies, and high consumer awareness of protein-enriched products. The region holds over 35% of the total industry share, supported by stringent regulatory standards and strong export activities led by major U.S. dairy companies. The U.S. leads the market here with increasing investments in production capacity and innovation.

Asia Pacific Milk Protein Concentrate Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth, reflecting a CAGR exceeding 9% driven primarily by rising urban populations, increased disposable income, and expanding infant nutrition and sports nutrition sectors. Government initiatives promoting nutrition and health awareness in India and China further support this growth, alongside improvements in cold chain logistics, facilitating product distribution.

Milk Protein Concentrate Market Outlook for Key Countries

USA Milk Protein Concentrate Market Analysis and Trends

The USA’s Milk Protein Concentrate market continues to expand rapidly, propelled by investments in dairy farming and processing technology upgrades. In 2024, the U.S. increased its MPC production capacity by roughly 8%, alongside robust export growth to Europe and Asia. Market leaders such as Agropur Inc. and Hilmar Ingredients leverage advanced filtration technologies to optimize protein yields, securing substantial market revenue. Furthermore, shifting consumer preferences towards plant-based alternatives and high-protein diets have motivated product diversification and portfolio expansion in protein-rich beverages and infant nutrition categories.

India Milk Protein Concentrate Market Analysis and Trends

India’s market is experiencing exponential growth due to increasing demand in the infant formula and functional food sectors. The country’s dairy industry has benefited from government-backed programs aiming to enhance nutritional standards, raising consumer awareness of protein-enriched dairy products. Local market companies, in collaboration with international players, have launched tailored MPC formulations addressing the regional nutritional needs

Analyst Opinion

Demand-side dynamics indicate a sharp uptick in the adoption of milk protein concentrates across infant formula and sports nutrition segments. In 2024, infant formula manufacturers reported an average 12% year-on-year increase in milk protein concentrate use, driven by rising protein fortification standards. Meanwhile, sports nutrition product imports grew by 9%, aligning with growing consumer health consciousness globally.

Supply chain efficiencies, especially in North America, have enhanced production capacity, helping maintain pricing stability despite fluctuating milk prices. The U.S. dairy industry expanded MPC output by 8% in 2024, while export volumes increased by 6%, indicating robust supply-side momentum that supports market revenue growth.

The market is witnessing dynamic shifts in pricing strategies to accommodate rising raw material costs and consumer sensitivity. In 2025, key players increased MPC prices marginally by 3-5%, balancing affordability and profitability while retaining volume growth, especially in emerging markets across Asia Pacific.

Diverse use cases across food and beverage applications provide sustained demand growth. Recent data reveal a 15% CAGR in MPC application within fortified dairy beverages in Europe, and a 10% increase in bakery and confectionery industries worldwide, reinforcing the broadening scope of the market.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 3.45 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.1% | 2032 Value Projection: |

USD 5.6 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Arla Foods, Fonterra Co-operative Group, Glanbia Plc, Hilmar Ingredients, Inc., FrieslandCampina, Carbery Group, Agropur Inc., Kerry Group, Agri-Mark Inc., Meiji Holdings Co., Ltd., Mengniu Dairy Company. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Milk Protein Concentrate Market Growth Factors

The growing focus on high-protein nutritional supplements is a primary driver accelerating market expansion, with consumers increasingly seeking protein-enriched diets backed by health benefits. Additionally, technological advancements in milk processing—such as ultrafiltration and microfiltration—have significantly improved the efficiency and quality of milk protein concentrate production, enhancing market revenue. Demand from emerging economies, propelled by rising disposable incomes and urbanization, is pushing market share higher, particularly in the Asia Pacific, where protein deficiency concerns are addressed through fortified food products. Furthermore, expanding applications across infant nutrition and sports supplements continue to fuel market growth strategies, with several companies adapting product portfolios to meet specialized nutritional needs and regulatory guidelines.

Milk Protein Concentrate Market Development

In April 2023, Arla Foods Ingredients introduced its Nutrilac® ProteinBoost range, a patented microparticulated whey-protein ingredient designed for applications in high-protein sports nutrition, desserts, yogurts, and beverages. The ingredient allows manufacturers to add significant protein (e.g., up to ~15 %) without substantially increasing viscosity, thereby preserving desirable texture and mouthfeel in finished products. The launch reflects Arla’s strategic push into protein-enriched formulations and addresses the dual challenge of delivering high-quality complete proteins while maintaining product appeal.

In November 2023, Valio Ltd launched Valio Eila® MPC 65, a high-protein, lactose-free milk protein concentrate tailored for premium nutritional products such as shakes, puddings, ice creams, and beverages. The ingredient offers a protein content of around 65 g per 100 g, with residual lactose levels below 0.1 %, and is designed to provide the functional and sensory benefits of milk-derived proteins (whey + casein) without the taste/texture compromises often associated with high-protein powders. The launch aims to support food and beverage manufacturers in creating better-tasting high-protein products for active and wellness-oriented consumers.

Key Players

Leading Companies of the Market

Arla Foods

Fonterra Co-operative Group

Glanbia Plc

Hilmar Ingredients, Inc.

FrieslandCampina

Carbery Group

Agropur Inc.

Kerry Group

Agri-Mark Inc.

Meiji Holdings Co., Ltd.

Mengniu Dairy Company

Several leading companies have recently implemented strategic partnerships and capacity expansions to enhance their market footprint. For instance, Arla Foods’ joint venture in 2024 with a regional dairy cooperative boosted its production capability by 15% in North America, leading to improved supply chain resilience. Similarly, Fonterra’s investment in advanced membrane filtration technology resulted in a 20% increase in MPC yield and reduced production costs, reinforcing its competitive edge. Innovations in product formulations and sustainability initiatives by these entities continuously reshape market competition and growth strategies.

Milk Protein Concentrate Market Future Outlook

In the future, MPC products are expected to expand into personalized nutrition, infant formula innovation, and ready-to-drink health beverages. Sustainable dairy processing and membrane efficiency improvements will reduce environmental impact and production costs. Hybrid formulations combining dairy and plant proteins will cater to flexitarian consumers. Functional enhancements such as bioactive peptides and improved digestibility will be key differentiators. With consumer focus shifting toward high-quality protein and clean ingredients, MPC products will remain integral to global nutritional product innovation.

Milk Protein Concentrate Market Historical Analysis

Milk protein concentrates (MPCs) were initially developed to improve protein fortification in food processing and dairy applications. The early production methods relied on ultrafiltration of skim milk, yielding concentrates with varying protein levels. Over time, technological improvements such as microfiltration, diafiltration, and low-heat drying enhanced solubility, flavor, and functional performance. The rise of sports nutrition, clinical nutrition, and functional foods in the 2000s significantly increased demand for MPCs as a versatile protein source. Their clean label, natural origin, and balanced amino acid profile positioned them as a premium alternative to synthetic proteins.

Sources

Primary Research Interviews:

Dairy Technologists

Food Scientists

Nutrition Product Developers

Process Engineers

Databases:

FAO Dairy Data

USDA Food Composition Database

GlobalData Nutrition Ingredients Reports

Dairy Industries International Data

Magazines:

Dairy Industries International

Food Navigator

Nutritional Outlook

Food Processing

Journals:

Journal of Dairy Science

International Dairy Journal

Food Hydrocolloids

Nutrition & Metabolism

Newspapers:

The Economic Times (Agribusiness)

The Guardian (Food)

The Hindu (Nutrition)

Reuters (Agriculture)

Associations:

International Dairy Federation (IDF)

Food and Agriculture Organization (FAO)

Global Dairy Platform

American Dairy Products Institute (ADPI)

Share

Share

About Author

Kalpesh Gharte is a senior consultant with approximately 5 years of experience in the consulting industry. Kalpesh holds an MBA in Operations and Marketing Management, providing him with a strong foundation in market strategy and analysis. He has contributed to various consulting and syndicated reports, delivering valuable insights that support informed business decisions

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients