Medical Alert Systems Market Size and Forecast – 2026 – 2033

The Global Medical Alert Systems Market size is estimated to be valued at USD 4.8 billion in 2026 and is expected to reach USD 9.5 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 10.5% from 2026 to 2033.

Global Medical Alert Systems Market Overview

Medical alert systems are personal safety and monitoring devices designed to provide immediate assistance during medical emergencies. These products include wearable devices, in-home alert buttons, fall detection sensors, and GPS-enabled mobile units connected to monitoring centers. When activated, the system sends alerts to caregivers, family members, or emergency response teams. Medical alert systems are widely used by elderly individuals, patients with chronic conditions, and people living alone to ensure rapid emergency response and continuous personal safety.

Key Takeaways

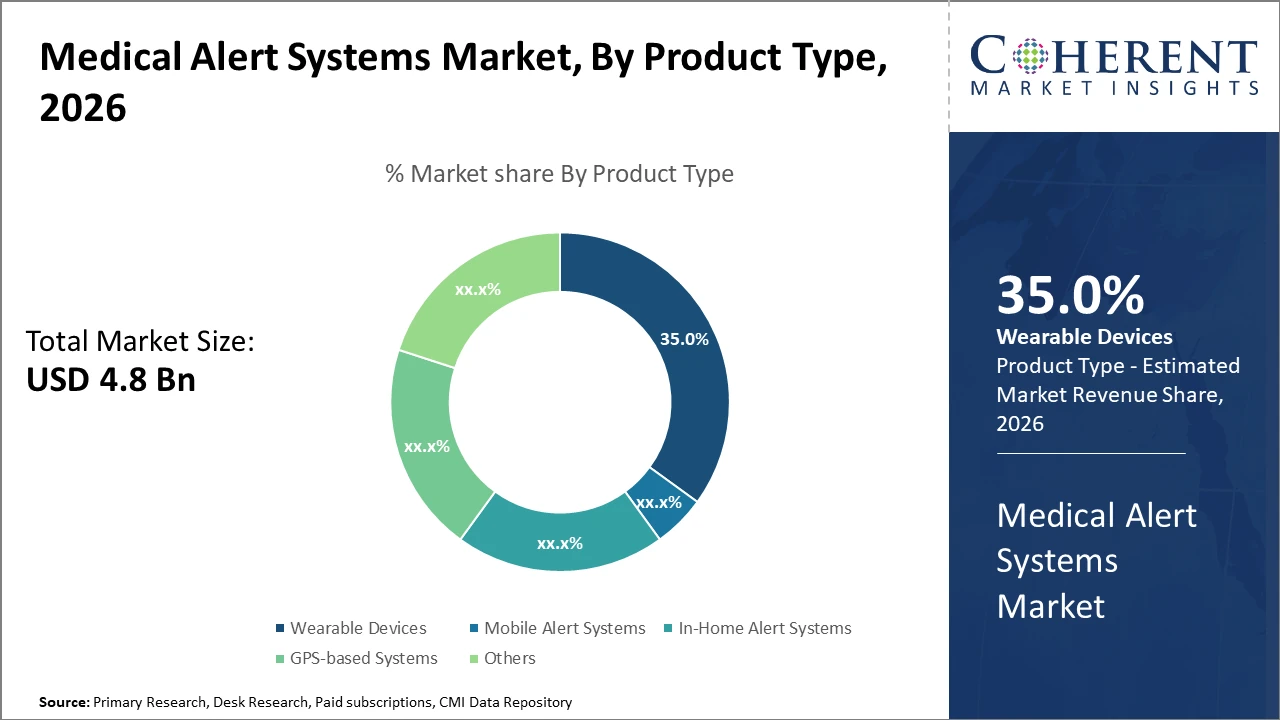

The wearable devices segment, dominating with a 35% share, remains a core driver due to its adaptability and demand in remote patient monitoring.

Cellular connectivity technology leads adoption, benefiting from widespread network coverage and reliability, crucial for emergency communications.

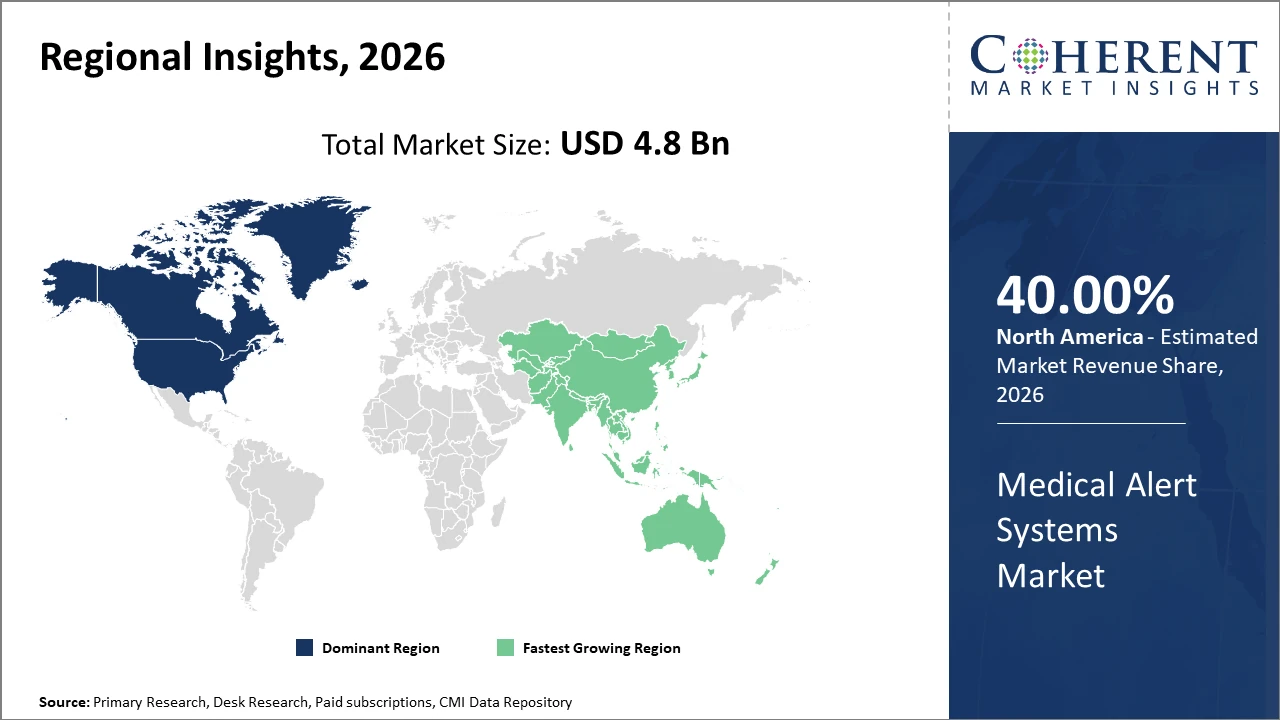

Regionally, North America commands the highest market share, driven by robust healthcare infrastructure and technological advancement.

Conversely, the Asia Pacific is the fastest-growing region, attributed to expanding healthcare access and government initiatives encouraging medical alert system adoption.

Medical Alert Systems Market Segmentation Analysis

To learn more about this report, Download Free Sample

Medical Alert Systems Market Insights, By Product Type

Wearable Devices are dominating the market share at 35%. The dominance of wearable devices is driven by their portability, continuous monitoring capabilities, and advanced integrations, which appeal particularly to mobile elderly users and chronic patients. This segment's growth is buoyed by advancements in sensor technologies and miniaturization. The fastest-growing subsegment is GPS-based systems due to the increasing demand for location tracking and enhanced user safety in outdoor environments. Mobile Alert Systems are gaining traction given their flexibility, whereas In-Home Alert Systems remain critical in institutional settings but are growing at a slower pace.

Medical Alert Systems Market Insights, By End-User

The Elderly Population segment dominates the market share. Their growing numbers and the necessity for independent living solutions support this dominance. The fastest growing subsegment is Hospitals & Healthcare Centers, driven by the integration of medical alert systems into broader patient management and telehealth programs. Chronic Patients benefit from personalized alert mechanisms, while Disabled Individuals form a steady but slower growth segment.

Medical Alert Systems Market Insights, By Technology

Cellular Connectivity holds the largest market share. Its widespread network availability and reliability support critical communication needs, underpinning its dominant position. The fastest growing technology subsegment is Wi-Fi, as more systems incorporate internet connectivity to enhance functionality and integrate with smart home devices. Landline Connectivity remains relevant in certain geographic regions but sees a decline. GPS technology supports precise location tracking and is rapidly adopted in mobile alert systems.

Medical Alert Systems Market Trends

The market is increasingly adopting AI and IoT technologies, exemplified by the 35% growth in AI-based alert device sales in 2024.

Integration with telehealth services exemplifies the seamless shift towards connected healthcare.

Notably, the rising demand for multi-functional wearable devices is shifting consumer demographics toward younger users, expanding market reach.

Medical Alert Systems Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Medical Alert Systems Market Analysis and Trends

In North America, the dominance in the market stems from its advanced healthcare infrastructure, early technology adoption, and strong private sector participation, comprising over 40% of the market share. U.S. government policies supporting telehealth reimbursement further consolidate its leadership position.

Asia Pacific Medical Alert Systems Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth, led by countries like China and India where healthcare infrastructure modernization and increasing public health awareness drive a CAGR exceeding 12%. Government initiatives aimed at elderly care and chronic disease management accelerate medical alert systems adoption.

Medical Alert Systems Market Outlook for Key Countries

USA Medical Alert Systems Market Analysis and Trends

The USA commands a pivotal role in the market, supported by widespread healthcare digitization, extensive insurance coverage, and proactive regulatory frameworks. In 2024, adoption rates increased by 18% due to favorable reimbursement policies and partnerships between alert system providers and home healthcare agencies. Companies like Philips Healthcare and ADT continue to dominate through continuous innovation and expansive distribution networks, influencing the industry's structure significantly.

China Medical Alert Systems Market Analysis and Trends

China’s Medical Alert Systems market exhibits rapid expansion attributed to a growing elderly population, urbanization, and increasing healthcare spending. In 2024, government programs promoting smart healthcare devices contributed to a 24% growth rate in medical alert system shipments. Local enterprises combining IoT with low-cost manufacturing are challenging international players, fostering competitive pricing and accelerated market penetration, especially in tier-1 and tier-2 cities.

Analyst Opinion

The rapid adoption of AI-powered fall detection algorithms significantly increases market revenue by improving response accuracy and reducing false alarms. For example, in 2024, a major telehealth provider integrated AI-based alerts, leading to a 30% reduction in delayed emergency responses across North America. Such supply-side innovation enhances user trust and broadens market share substantially.

Demand from the senior care segment continues to fuel market expansion, with about 40% of new users aged 65 and above purchasing medical alert devices in 2025. Rising import volumes of wearable alert devices by 25% year-over-year underscore the intensifying need for portable, non-invasive systems that facilitate independent living.

Micro-indicators such as increased private healthcare expenditure and insurance reimbursement policies have marginalized market restraints, accelerating growth. Notably, countries with enhanced healthcare reimbursement saw medical alert systems usage rise by over 20% in 2024 alone, reinforcing the market's positive trajectory.

The emergence of connected healthcare ecosystems is driving sector-wide business growth. Healthcare providers integrating remote patient monitoring with medical alert systems witness a 15% uptick in patient satisfaction scores, highlighting the market’s evolving dynamics and extended use cases beyond emergency response.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 4.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 10.5% | 2033 Value Projection: | USD 9.5 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Tunstall Healthcare, MobileHelp, Protect America, Mobile Assist, iHelp, VRI (Verification Response, Inc.), Samsung Electronics, Apple Inc., Garmin Ltd., Huawei Technologies | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Medical Alert Systems Market Growth Factors

The prevalence of chronic diseases among the aging population has sharply elevated the demand for reliable medical alert systems, as confirmed by a 15% rise in device enrollments among elderly users in 2025. Technological integration of GPS and cellular connectivity with medical alert devices enhances user mobility, driving growth as seen by a 22% increase in wearable medical alert system shipments globally. Increasing investments in smart home healthcare solutions further contribute to market revenue, with North America's smart home healthcare integration witnessing a CAGR of 12% in 2024. Additionally, government healthcare policies incentivizing remote patient monitoring adoption have lowered market barriers, stimulating business growth, particularly in developed economies.

Medical Alert Systems Market Development

In June 2025, SOS Technologies launched specialized emergency alert solutions for the deaf and hard-of-hearing community, incorporating ASL-based video and GIF notifications to improve accessibility and response effectiveness during critical situations.

In 2020, MobileHelp introduced the Micro, an all-in-one, compact personal emergency response device with built-in fall detection, designed to provide reliable mobile alerts while maintaining portability and ease of use.

In January 2025, Nomo Smart Care launched an AI-powered in-home monitoring platform that uses intelligent sensors instead of cameras, enabling continuous care monitoring while enhancing privacy and reducing caregiver dependency.

Key Players

Leading Companies of the Market

Tunstall Healthcare

MobileHelp

Protect America

Mobile Assist

iHelp

VRI (Verification Response, Inc.)

Samsung Electronics

Apple Inc.

Garmin Ltd.

Huawei Technologies

Several key market players implement aggressive growth strategies such as mergers and acquisitions to strengthen technological portfolios and expand market presence. For instance, Life Alert Emergency Response recently acquired a regional telehealth company to amplify device distribution, resulting in a 20% revenue increase in 2024. Meanwhile, Philips Healthcare emphasized collaborative innovation with AI startups, enhancing its market edge by launching a new line of AI-integrated alert systems that boosted product adoption across North America and Europe.

Medical Alert Systems Market Future Outlook

The future of medical alert systems will be shaped by Internet of Things (IoT) connectivity, artificial intelligence, and integration with broader smart-home ecosystems. Devices will increasingly incorporate predictive analytics and continuous monitoring of vital signs, enabling earlier detection of potential health emergencies. Wearable form factors will continue to shrink and improve comfort, while multi-sensor platforms will enhance accuracy for fall detection and health tracking. Integration with telemedicine platforms and electronic health records will create seamless care pathways. Expansion into preventative health and wellness monitoring will broaden their utility beyond emergency response, further embedding alert systems into comprehensive health management.

Medical Alert Systems Market Historical Analysis

The medical alert systems market originated as a response to the growing need for rapid emergency assistance among elderly populations and individuals with chronic conditions. Early alert systems were simple radio-based alarms that connected users to call centers. With the advent of cellular networks and wireless technologies, products evolved to include wearable pendants, GPS-enabled mobile units, and automatic fall detection sensors. Integration with monitoring centers enabled 24/7 response services, greatly enhancing personal safety. Advances in miniaturization and battery technology contributed to more comfortable, reliable devices. The proliferation of mobile health technologies further expanded capabilities, allowing real-time tracking, two-way voice communication, and integration with caregiver networks.

Sources

Primary Research Interviews:

Elder care providers

Device manufacturers

Caregivers

Emergency response coordinators

Databases:

CDC Aging Reports

WHO Elderly Care Data

Medicare Statistics

OECD Aging Data

Magazines:

Aging Today

Medical Device Network

HomeCare Magazine

HealthTech Magazine

Senior Living News

Journals:

Gerontology

Journal of Aging and Health

Telemedicine and e-Health

Journal of Medical Systems

Aging Clinical and Experimental Research

Newspapers:

The Guardian (Aging)

Reuters Healthcare

Financial Times (Health)

The New York Times (Wellness)

Bloomberg Health

Associations:

AARP,

National Council on Aging

Medical Alert Monitoring Association

American Geriatrics Society

Aging Life Care Association

Share

Share

About Author

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients