Light Sensors Market Size and Forecast – 2025 – 2032

The Global Light Sensors Market size is estimated to be valued at USD 3.2 billion in 2025 and is expected to reach USD 7.1 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 12.1% from 2025 to 2032, reflecting robust market dynamics and expanding industry share influenced by escalating market revenue and evolving market trends.

Global Light Sensors Market Overview

Light sensors, also known as photodetectors, are semiconductor devices that detect and measure light intensity, wavelength, or color. Key product types include photodiodes, phototransistors, ambient light sensors, and proximity sensors. They are integral components in smartphones, automotive lighting systems, smart home devices, and industrial automation.

Modern light sensors incorporate digital output interfaces, low-power operation, and on-chip signal processing for enhanced precision. In automotive and IoT applications, adaptive light sensors enable automatic brightness adjustment, headlamp control, and energy optimization. The development of miniaturized sensors and integration with AI-driven systems is expanding their use in wearable electronics and environmental monitoring.

Key Takeaways

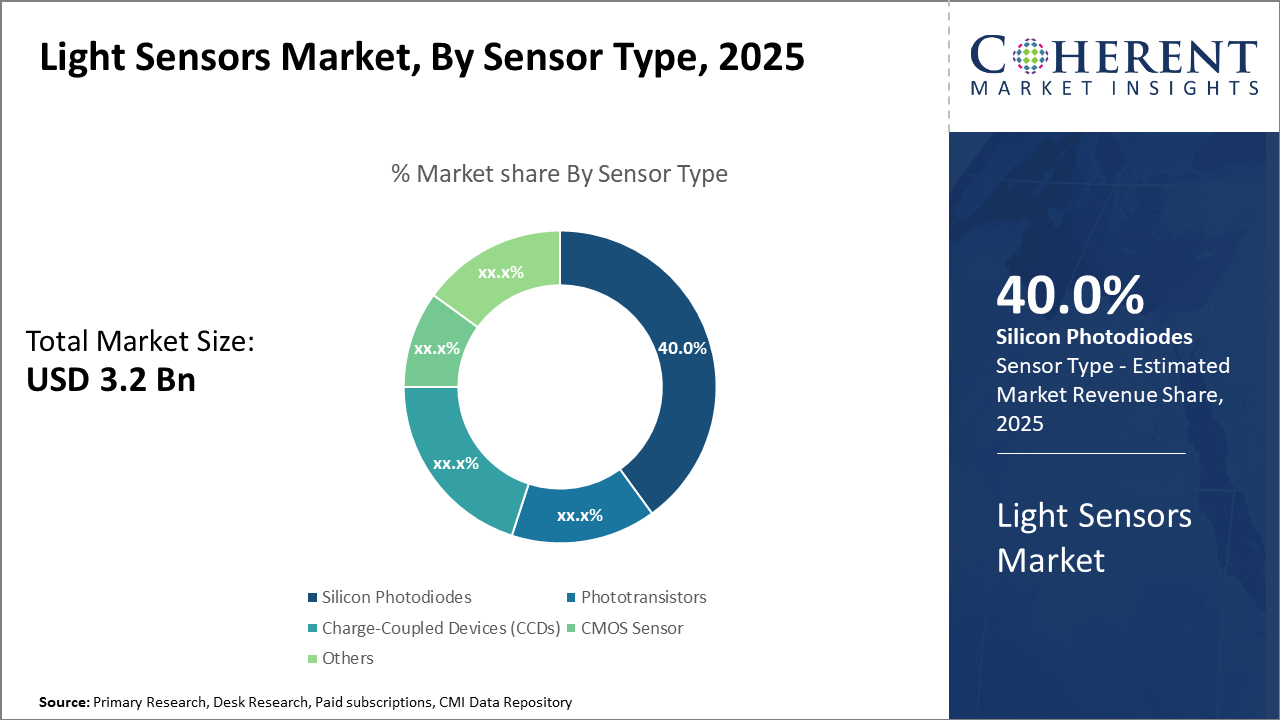

The Silicon Photodiodes segment dominates global light sensors market share, owning 40% of sensor type revenue due to cost-effectiveness and broad application scope.

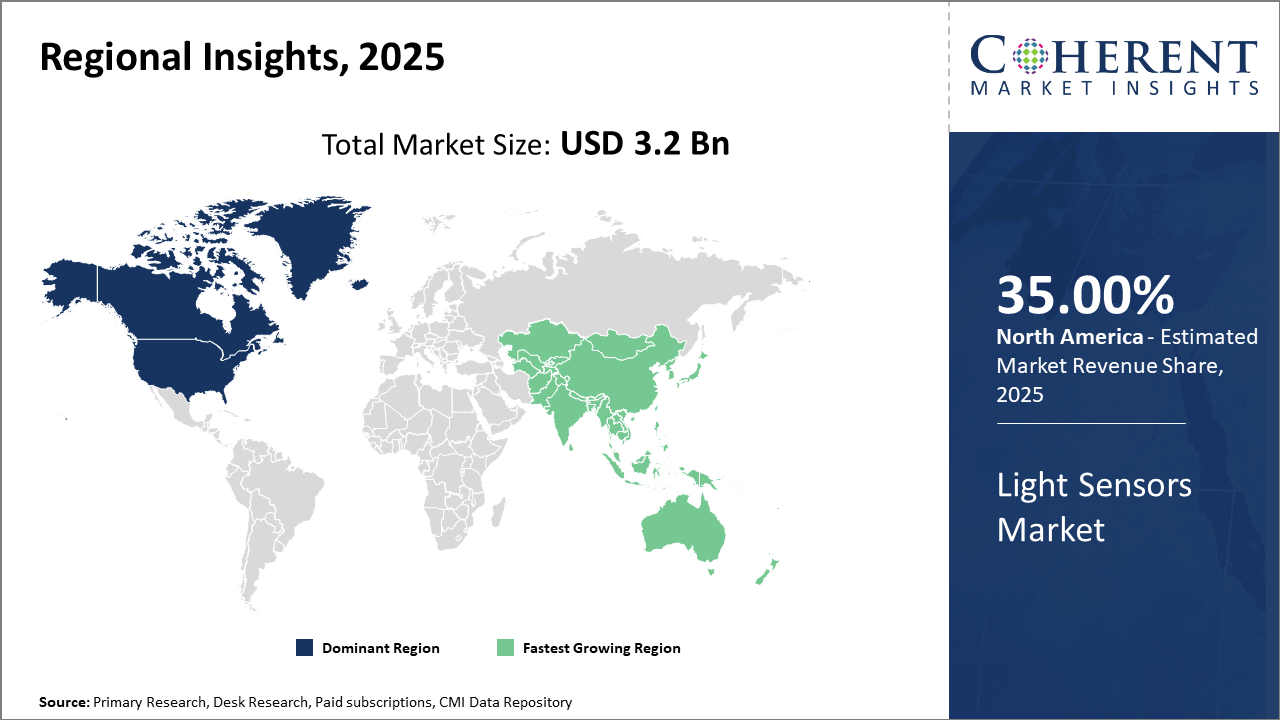

North America holds the largest market share with approximately 35%, propelled by strong automotive infrastructure and innovative sensor ecosystems.

Asia Pacific is the fastest-growing regional market with a CAGR exceeding 14%, bolstered by rapid industrialization, government incentives, and expanding electronics manufacturing hubs.

Light Sensors Market Segmentation Analysis

To learn more about this report, Download Free Sample

Light Sensors Market Insights, By Sensor Type

Silicon Photodiodes, accounting for 40% market share, are preferred for their high sensitivity, low cost, and versatile application spectrum. This dominance is further supported by their extensive usage in consumer electronics and automotive lighting systems. The fastest-growing subsegment is CMOS Sensors, experiencing burgeoning adoption due to their integration capabilities with imaging and miniaturized form factors, extensively used in optical communication devices.

Light Sensors Market Insights, By Application

The automotive sector leads with over 28% revenue contribution, propelled by the integration of ADAS, occupant detection, and adaptive lighting systems that demand sophisticated light sensing technology. The fastest-growing segment is Healthcare, where non-invasive patient monitoring systems and wearable health trackers increasingly employ light sensors to measure vital parameters with high precision. Consumer Electronics exhibit steady demand across smartphones and IoT devices, while Industrial Automation benefits from light sensors in safety and process optimization.

Light Sensors Market Insights, By Technology

MEMS-based technology dominates the market owing to its miniaturization, low power consumption, and integration versatility, positioning it as the preferred choice in automotive and consumer electronics markets. The fastest-growing technology subsegment is Optical Fiber sensors, boosted by increased demand in industrial automation and smart infrastructure for precise and remote sensing capabilities. Infrared sensors sustain steady growth driven by proximity sensing and environmental applications. Ultrasonic sensors, while relevant in niche applications such as level detection in industrial tanks, hold a smaller market share.

Light Sensors Market Trends

Market trend analysis reveals that AI-enabled light sensors are redefining industry benchmarks across the automotive and consumer electronics sectors.

For example, sensor fusion systems integrating ambient light detection with AI algorithms reduce false positive detections by up to 25%, as reported in 2024 deployments in North American vehicle models.

Another pivotal trend is the adoption of eco-conscious sensor designs, supported by European Union regulations targeting carbon footprint reduction, driving development in energy-harvesting sensor technologies.

Light Sensors Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Light Sensors Market Analysis and Trends

In North America, the dominance in the Light Sensors market is attributed to the strong presence of automotive and aerospace industries and a cutting-edge ecosystem that favors research and innovation. Approximately 35% of the global market share is concentrated here, propelled by widespread adoption of ADAS and smart device integration initiatives. The U.S. government’s stringent safety policies and investments in IoT infrastructure further bolster industry growth.

Asia Pacific Light Sensors Market Analysis and Trends

Meanwhile, the Asia Pacific exhibits the fastest growth, with a CAGR exceeding 14%, supported by expanding manufacturing bases in China, South Korea, and Taiwan, and government incentives for smart city projects and electronics innovation. The rapid industrialization, combined with a growing consumer electronics market, fuels this accelerated expansion.

Light Sensors Market Outlook for Key Countries

USA Light Sensors Market Analysis and Trends

The USA’s Light Sensors market benefits from its robust automotive manufacturing sector, spearheading ADAS integration with leading companies such as STMicroelectronics and Texas Instruments, contributing significantly. In 2024, automotive light sensor deployments in the U.S. surpassed USD 750 million in market revenue, reflecting escalating safety compliance. Additionally, burgeoning smart wearable technology addresses healthcare and lifestyle applications, further amplifying business growth fueled by supportive regulatory frameworks.

India Light Sensors Market Analysis and Trends

China’s light sensors market is propelled by its massive consumer electronics ecosystem and government-backed smart city initiatives. Leading domestic companies alongside major multinational manufacturers are amplifying production capacities, driving the market’s swift expansion. In 2025, China accounted for over 25% of the Asia Pacific’s light sensor market revenue, with a focus on MEMS sensor development fostering industry growth in sectors ranging from industrial automation to automotive safety.

Analyst Opinion

Technological innovation in photodiodes and phototransistors is catalyzing market growth. In 2024, silicon photodiodes accounted for a dominant 40% share of sensor type revenue due to their efficiency and cost-effectiveness. Recent advancements are enabling detection accuracy improvements surpassing 95% in ambient light adaptation applications.

Demand-side indicators exhibit a surge in light sensor applications within automotive safety systems, including adaptive headlights and occupant detection. In 2025 alone, the automotive sector contributed over 28% to the market share, driven by enhanced regulatory requirements in the U.S. and Europe aimed at reducing road accidents through sensor integration.

The production capacity of MEMS-based light sensors has increased by 22% year-over-year in 2024, reflecting an uptick in exports from manufacturing hubs in Asia. This scaling facilitates reduced unit costs and supports market expansion into price-sensitive end-use segments such as consumer electronics.

Nano-optomechanical materials integrated with light sensors have promoted ultra-compact sensor designs; these are projected to capture a growing share in wearable devices, registering a 15% increase in applications in the healthcare sector in 2025, improving patient monitoring precision.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 3.2 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 12.1% | 2032 Value Projection: | USD 7.1 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Sony Corporation, Panasonic Corporation, Broadcom Inc., Texas Instruments, Vishay Intertechnology, Everlight Electronics, Toshiba Corporation, Infineon Technologies, Cree, Inc., Rohm Semiconductor, Analog Devices. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Light Sensors Market Growth Factors

Growth in the Light Sensors Market is fundamentally driven by rising adoption in the automotive industry for advanced driver-assistance systems (ADAS), which require precise and reliable light sensing for safety-critical functions. Regulatory mandates and safety standards have led to increased light sensor integration, accounting for over 28% of market revenue in 2025. The burgeoning smart wearable devices segment demands ultra-compact and energy-efficient sensors, resulting in a surge in investments towards MEMS-based sensor research and development. Rapid urbanization and the expanding smart city initiatives globally have escalated the deployment of light sensors in street lighting and environmental monitoring systems, adding further impetus. Moreover, industry trends toward miniaturization and AI-enabled sensor fusion are driving growth by enhancing sensor versatility and application scope across industrial automation.

Light Sensors Market Development

In May 2023, DANLERS, CALUMINO, and INGY jointly introduced the CAL-CEFL12V smart lighting-control sensor, a next-generation device that leverages thermal sensing, embedded AI, and computer-vision algorithms to perform real-time, privacy-preserving people-counting within intelligent lighting systems. The ceiling flush-mount unit uses CALUMINO’s proprietary low-resolution thermal sensor with on-edge AI, enabling detection of human presence, count, location, and even hot-object count and thermal mapping within a ~70 m² detection zone. The device includes a light sensor and wired DALI control lines, integrates with INGY’s wireless mesh network for smart-building workflows, and is sized like a standard PIR sensor—making it ideal for retrofit and new lighting installations.

In August 2023, ams OSRAM introduced an advanced ambient-light sensor for smartphones, engineered to provide more accurate light detection across complex lighting environments—thereby enabling optimal display brightness, improved battery efficiency, and enhanced user experience. The sensor blends miniaturized photodiode and algorithmic innovations to sense ambient light levels, color temperature, and spectral characteristics—critical for mobile devices, wearables, and smart displays. While the specific product model is not named in the available release, the announcement highlights ams OSRAM’s leadership in optical-sensor technology tailored to the consumer-electronics market.

Key Players

Leading Companies of the Market

Sony Corporation

Panasonic Corporation

Broadcom Inc.

Texas Instruments

Vishay Intertechnology

Everlight Electronics

Toshiba Corporation

Infineon Technologies

Cree, Inc.

Rohm Semiconductor

Analog Devices

Leading companies are increasingly adopting collaboration and strategic acquisitions to expand product portfolios and enhance technological capabilities. For example, STMicroelectronics’ acquisition of a niche optical sensor startup in 2024 facilitated a 10% boost in its sensor technology efficiency, strengthening its competitive positioning in automotive and consumer electronics domains. Additionally, Sony Corporation’s strategic partnership with a healthcare tech firm yielded advancements in wearable sensor applications, increasing its market share in medical-grade light sensor devices.

Light Sensors Market Future Outlook

The light sensors market is expected to evolve toward intelligent sensing and multifunctional integration. AI-enabled light sensors will support adaptive illumination, environmental analytics, and autonomous driving systems. Miniaturized, low-power sensors will enhance wearable and portable electronics, while spectral sensors will find growing use in agriculture and environmental monitoring. The shift toward smart cities and connected lighting infrastructure will further drive innovation in sensor sensitivity, accuracy, and data processing capabilities.

Light Sensors Market Historical Analysis

The light sensors market has grown in tandem with advancements in consumer electronics and automotive lighting systems. Initially used in cameras and mobile phones for brightness adjustment, light sensors expanded into industrial automation, smart homes, and IoT devices post-2015. The integration of photodiodes and ambient light sensors into compact chips reduced costs and improved efficiency, leading to mass adoption across consumer electronics and energy-efficient lighting.

Sources

Primary Research Interviews:

Optical Engineers

Semiconductor Scientists

Electronics Designers

IoT Developers

Databases:

Statista Semiconductor Data

GlobalData Sensors Market Reports

IEEE Photonics Data

SEMI Industry Statistics

Magazines:

Photonics Spectra

Electronics Weekly

EE Times

Sensors Online

Journals:

IEEE Photonics Journal

Sensors and Actuators

Journal of Lightwave Technology

Optics Express

Newspapers:

The Wall Street Journal (Tech)

The Hindu (Electronics)

The Guardian (Science)

Nikkei Asia (Semiconductors)

Associations:

IEEE Photonics Society

SEMI

International Electrotechnical Commission (IEC)

Share

Share

About Author

As an accomplished Senior Consultant with 7+ years of experience, Pooja Tayade has a proven track record in devising and implementing data and strategy consulting across various industries. She specializes in market research, competitive analysis, primary insights, and market estimation. She excels in strategic advisory, delivering data-driven insights to help clients navigate market complexities, optimize entry strategies, and achieve sustainable growth.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients