Laundry Care Products Market Size and Forecast – 2025 – 2032

The Global Laundry Care Products Market size is estimated to be valued at USD 42.7 billion in 2025 and is expected to reach USD 62.3 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.6% from 2025 to 2032.

Global Laundry Care Products Market Overview

Laundry care products include detergents, fabric softeners, stain removers, and conditioners formulated to clean, protect, and refresh fabrics. Available in liquid, powder, pod, and bar forms, these products combine surfactants, enzymes, and fragrance agents to deliver superior cleaning performance. Manufacturers are focusing on eco-friendly, biodegradable, and concentrated formulations that cater to sustainability-conscious consumers. The market serves both household and commercial laundry applications across diverse global regions.

Key Takeaways

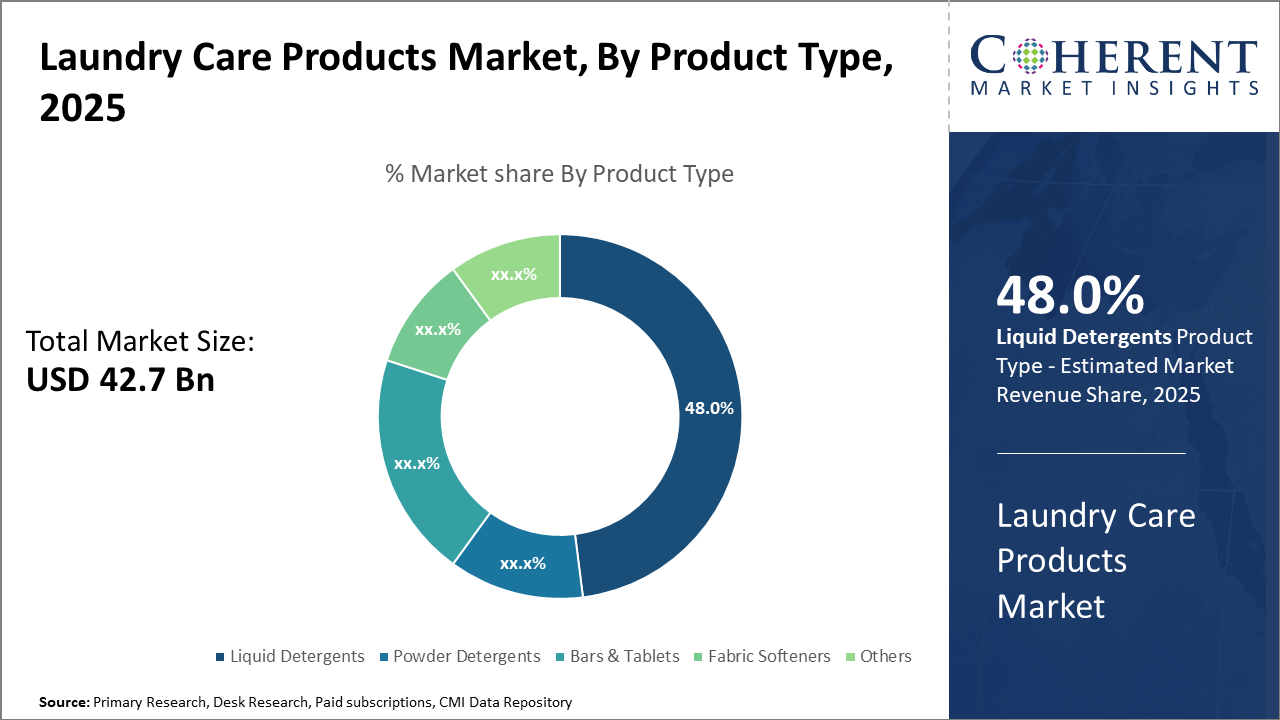

The Liquid Detergents segment dominates the Laundry Care Products market, driven by enhanced stain removal technology and consumer convenience, accounting for 48% of the overall industry share.

Within distribution channels, supermarkets and hypermarkets maintain leadership due to extensive reach and promotional capabilities, comprising 45% of the market revenue share.

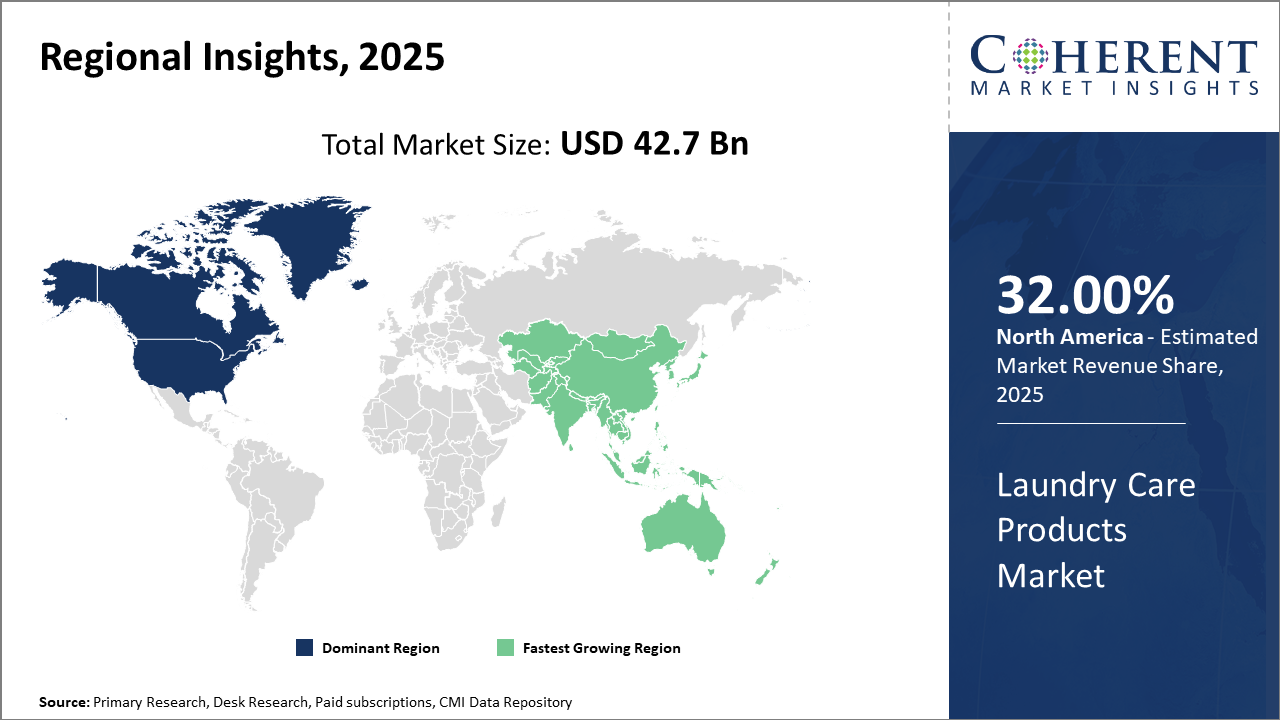

Regionally, North America leads the market in size with a strong industry presence and robust regulatory frameworks supporting premium product adoption.

Asia Pacific, with its urbanizing population and rising disposable incomes, is the fastest-growing region, registering a CAGR exceeding 7% driven by expanding e-commerce and local manufacturing initiatives.

Laundry Care Products Market Segmentation Analysis

To learn more about this report, Download Free Sample

Laundry Care Products Market Insights, By Product Type

Liquid Detergents dominate the market share with 48%, owing to their ease of use, superior dissolvability, and enhanced stain removal technology. Liquid detergents also benefit from consumer preferences shifting toward concentrated formulas that reduce environmental impact. Powder Detergents remain a significant segment favored in price-sensitive markets due to cost-effectiveness and long shelf life.

Laundry Care Products Market Insights, By Application

Household Laundry accounts for the dominant market share at 68%, driven by increasing hygiene awareness, urbanization, and expanding middle-class households globally. This segment is propelled by product innovations catering to diverse fabric types, water hardness levels, and consumer preferences for fragrance and skin sensitivity. Commercial Laundry holds a steady presence, primarily supported by the hospitality and healthcare industries demanding bulk, effective solutions.

Laundry Care Products Market Insights, By Distribution Channel

Supermarkets/Hypermarkets dominate with 45% market share, as these formats offer extensive product variety and promotional campaigns that attract brand visibility. Online Retailers are the fastest-growing channel due to changing consumer shopping patterns; online sales grew by over 14% in 2025, driven by quick delivery, subscription models, and access to premium and eco-conscious products.

Laundry Care Products Market Trends

The Laundry Care Products market is heavily driven by sustainability as a core market trend. For example, the rise of biodegradable powders and refillable liquid detergents in 2024 illustrates a decisive shift in consumer expectations supported by stricter environmental regulations worldwide.

Another significant trend involves the integration of advanced enzymes and multifunctional capabilities in products, boosting product efficacy and consumer interest, as demonstrated by the 20% sales increase in enzyme-based products in North America in 2025.

Furthermore, the surge in online sales of laundry care products, contributing up to 14% of total revenue globally in 2025, marks a digital transformation influencing industry dynamics and customer purchase habits.

Laundry Care Products Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Laundry Care Products Market Analysis and Trends

In North America, the dominance in the Laundry Care Products market stems from a mature and innovation-driven industry ecosystem, supported by stringent environmental standards and high consumer spending capability. The market share here stands at approximately 32% as of 2025. Key players actively engage in sustainable product development and premiumization strategies, maintaining leadership through product diversification and strong retail networks.

Asia Pacific Laundry Care Products Market Analysis and Trends

The Asia Pacific experiences the fastest growth with a CAGR exceeding 7% owing to expanding urban households, rising disposable incomes, and increasing access to e-commerce. Government initiatives promoting local manufacturing and environmental safety further bolster growth, alongside rising consumer adoption of liquid and concentrated detergents.

Laundry Care Products Market Outlook for Key Countries

USA Laundry Care Products Market Analysis and Trends

The USA leads the Laundry Care Products market in North America through strong demand for eco-friendly detergents and technological advancement. Premium liquid detergents and biodegradable products accounted for more than 40% of market revenue in 2025, driven by consumer trends valuing sustainability and fabric care. Key market players continually invest in R&D to launch innovative variants, contributing to the market's steady revenue growth despite raw material cost fluctuations.

India Laundry Care Products Market Analysis and Trends

India's market is rapidly expanding due to rising middle-class income, urban population growth, and increasing penetration of both premium and mid-tier products. The strong growth of e-commerce platforms has accelerated access to a broad product portfolio. Local manufacturers leveraging cost-efficient production and distribution hold a competitive edge, while multinational companies focus on premium product launches and sustainability initiatives, driving a diverse market landscape.

Analyst Opinion

One notable insight is the significant uplift in market revenue linked to concentrated detergent formulas driven by sustainability trends. Concentrated detergents, accounting for approximately 37% of the total laundry care market share in 2024, reduce packaging waste and transportation costs. Brands incorporating these formulations reported a 12% increase in sales in North America during 2024, signaling strong consumer preference for eco-conscious alternatives.

Pricing strategies remain a pivotal market driver, especially in emerging economies. For instance, in India and Brazil, mid-tier laundry care products with competitive pricing captured over 45% of market revenue in 2025, reflecting affordability's critical role amid growing disposable incomes. Meanwhile, premium segments in developed regions like Europe expanded by nearly 8% CAGR from 2023 to 2025, fueled by innovation and brand loyalty.

Market dynamics reveal an increasing penetration of liquid laundry detergents, which held a 48% market share in 2024 globally. This segment's growth correlates with enhanced detergent formulations offering better stain removal and fabric care, exemplified by a 10% sales surge in the Asia Pacific region in 2025, driven by rising urban households adopting liquid over powder detergents.

The sector's exports have intensified, notably from China and Germany, accounting together for 30% of global laundry care product exports in 2024. This supply-side strength supports price stability even amid volatile raw material costs and is expected to underpin market growth momentum through 2032.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 42.7 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 5.6% | 2032 Value Projection: | USD 62.3 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Procter & Gamble, Henkel AG & Co. KGaA, Unilever, Church & Dwight Co., Colgate-Palmolive, Kao Corporation, Reckitt Benckiser Group PLC, Lion Corporation, SC Johnson & Son, Inc., The Clorox Company, Whirlpool Corporation, and LG Household & Health Care. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Laundry Care Products Market Growth Factors

Increasing environmental regulations are compelling manufacturers to innovate eco-friendly formulations, boosting market growth. In 2024, biodegradable detergent sales grew by over 15% worldwide, reflecting regulatory compliance as a growth impetus. Rising consumer inclination towards premium and multifunctional laundry care products, such as stain removers with fabric protection, significantly enhanced product demand, with premium segment revenue growing 7% year-on-year in 2025. Additionally, technological advancements in enzyme-based detergents have improved efficacy and reduced water usage, supporting sustainability objectives and capturing a higher industry share. Expansion of modern retail channels, including e-commerce, contributed to expanded market access, contributing to a 14% rise in online laundry care product sales globally in 2025.

Laundry Care Products Market Development

In February 2025, Unilever launched Wonder Wash, its first liquid laundry detergent formulated to work in ultra-short cycles — as little as 15 minutes. This was done to meet rising consumer demand for speed and convenience in laundry.

In September 2025, Kao (Japan) and CP Group (Thailand) introduced a new detergent brand “extra” across Thailand through channels including Makro, Lotus’s, and 7-Eleven. The product is positioned for eco-conscious consumers and intends to merge performance with affordability.

Key Players

Leading companies in the market:

Procter & Gamble

Henkel AG & Co. KGaA

Unilever

Church & Dwight Co.

Colgate-Palmolive

Reckitt Benckiser Group PLC

Lion Corporation

SC Johnson & Son, Inc.

The Clorox Company

Whirlpool Corporation

LG Household & Health Care

Market players are emphasizing digital transformation and sustainability. For example, Procter & Gamble launched a refillable detergent packaging initiative in 2024 that reduced plastic use by 25%, gaining notable consumer traction in Europe. Meanwhile, Henkel's strategic acquisition of local eco-friendly brands in the Asia Pacific expanded its regional market share by approximately 6% within one year. Unilever’s pricing strategies in emerging markets enhanced penetration by 10%, focusing on affordability combined with active social media marketing campaigns.

Laundry Care Products Market Future Outlook

In the future, the laundry care market is expected to expand further as sustainability, premiumization, and smart appliance integration become major trends. Manufacturers will continue to invest in concentrated, low-water, and allergen-free formulations that meet consumer preferences for performance and safety. E-commerce and digital retail platforms will strengthen distribution networks, especially in emerging economies. Additionally, collaborations between detergent brands and washing machine manufacturers are expected to foster the development of compatible, energy-efficient cleaning systems tailored for the modern consumer.

Laundry Care Products Market Historical Analysis

The laundry care products market has undergone continuous evolution driven by changing consumer lifestyles, hygiene awareness, and product innovation. Traditionally dominated by powdered detergents, the market witnessed a shift toward liquid and pod formats offering greater convenience and cleaning efficiency. Manufacturers introduced enzyme-based formulations and fabric conditioners to cater to diverse fabric types and washing methods. Over the past decade, growing environmental concerns have led to a surge in demand for biodegradable and eco-friendly laundry solutions, pushing companies toward sustainable raw materials and recyclable packaging.

Sources

Primary Research interviews:

FMCG Product Managers

Detergent Manufacturers

Chemical Formulation Experts

Retail Distribution Heads

Databases:

Euromonitor International

Others

Magazines:

Household & Personal Care Today

Clean India Journal

Chemical Weekly

Global Cosmetic Industry Magazine

Journals:

Journal of Surfactants and Detergents

International Journal of Consumer Studies

Journal of Cleaner Production

Journal of Chemical Technology & Biotechnology

Newspapers:

The Times of India (Lifestyle)

The Economic Times (FMCG)

The Guardian (Sustainability)

Business Standard (Consumer Goods)

Associations:

American Cleaning Institute (ACI)

International Association for Soaps

Detergents and Maintenance Products (A.I.S.E.)

The Soap and Detergent Association

Household & Commercial Products Association (HCPA)

Share

Share

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients