Laparotomy Sponge Market Size and Forecast – 2025 – 2032

The Global Laparotomy Sponge Market size is estimated to be valued at USD 1.35 billion in 2025 and is expected to reach USD 2.05 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.1% from 2025 to 2032

Global Laparotomy Sponge Market Overview

Laparotomy sponges are sterile surgical products used to absorb fluids, protect tissue, and maintain a clear operative field during abdominal procedures. Available in various sizes, thicknesses, and materials, these sponges are designed for high absorbency, minimal lint, and radiopacity to ensure detection if inadvertently retained. Modern sponges often feature antimicrobial coatings or advanced weaving techniques to enhance safety and reduce postoperative complications.

Key Takeaways

The cotton laparotomy sponge segment continues to dominate with 62% industry share, benefiting from its cost-efficiency and widespread acceptance in hospitals worldwide.

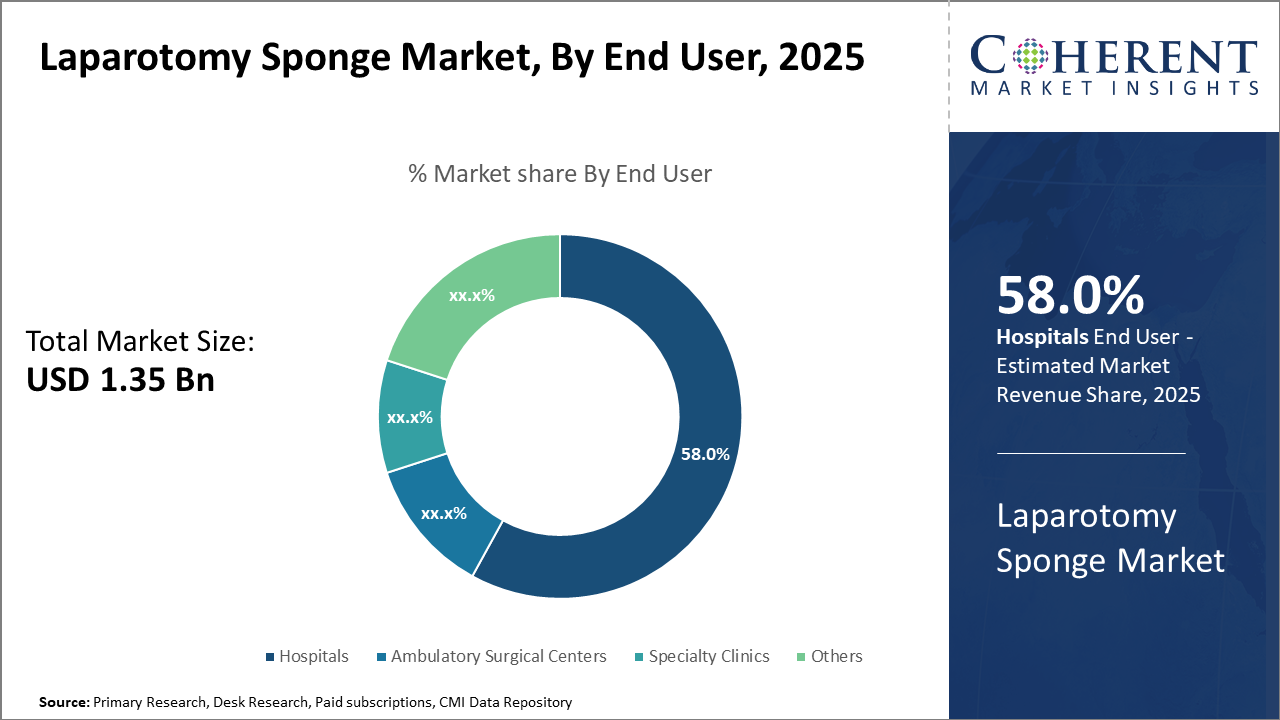

Hospitals, accounting for 58% of end-user consumption, remain the primary drivers of the Laparotomy Sponge market size, fueled by high surgical volumes and stringent safety mandates.

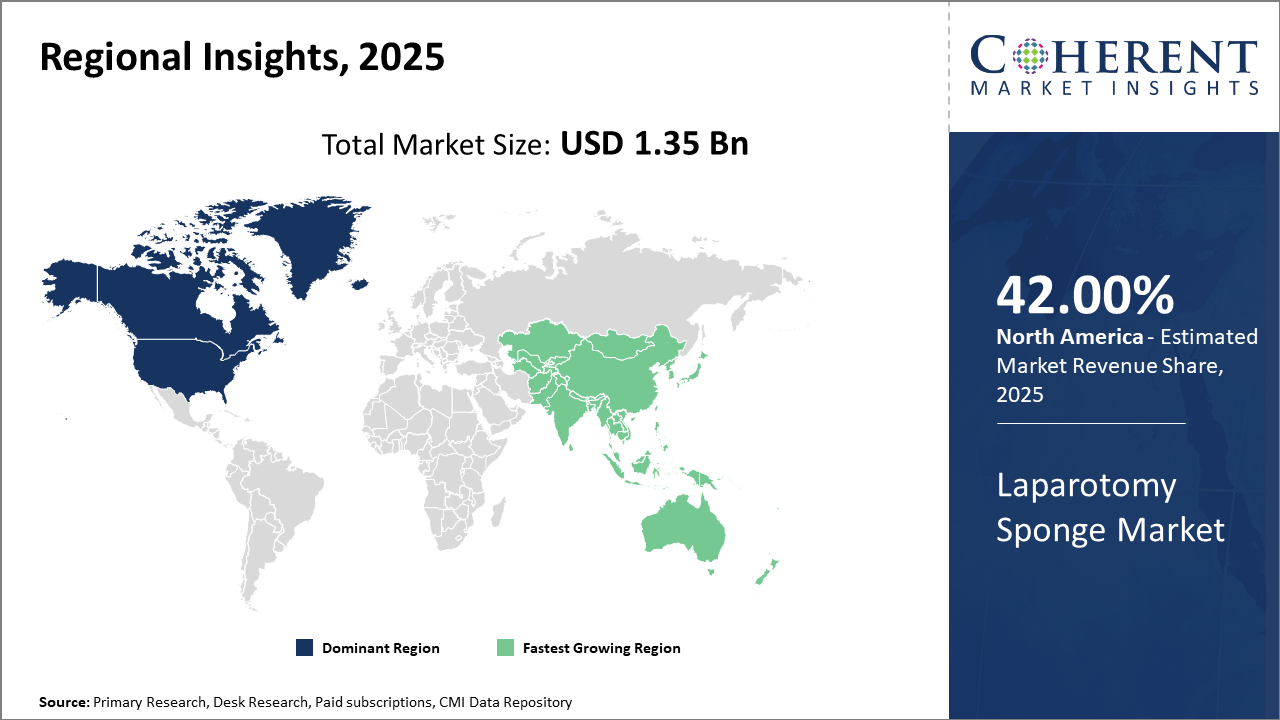

Regionally, North America holds the largest market share due to high healthcare spending and widespread adoption of advanced surgical products, while Asia Pacific exhibits the fastest growth driven by expanding healthcare infrastructure and increasing surgical procedure rates.

Laparotomy Sponge Market Segmentation Analysis

To learn more about this report, Download Free Sample

Laparotomy Sponge Market Insights, By End User

Hospitals lead with 58% market share as the primary healthcare providers handling the largest volumes of complex surgical procedures requiring stringent sponge management protocols. The hospital segment’s growth is fueled by continuous investments in surgical safety technologies and nationwide healthcare reforms promoting patient care quality. Ambulatory Surgical Centers represent the fastest growing segment, driven by increasing preference for outpatient surgeries where minimally invasive techniques reduce patient stay and resource utilization.

Laparotomy Sponge Market Insights, By Product Type

Cotton Laparotomy Sponges dominate the market share with 62%. This dominance is attributable to their cost-effectiveness, biocompatibility, and established presence in hospital surgical suites worldwide. Cotton sponges continue to benefit from broad acceptance and ease of manufacture, catering well to routine abdominal surgeries. Radiopaque sponges are the fastest-growing subsegment due to their enhanced visibility under X-ray, which addresses critical surgical safety concerns by significantly reducing retained sponge incidences. Synthetic Fiber Sponges offer durability and reduced linting suitable for lengthy procedures, whereas Ultrasonic Detectable Sponges provide cutting-edge detection capabilities, supporting high-risk and complex surgeries.

Laparotomy Sponge Market Insights, By Application

General Surgery dominates due to the high-frequency nature of such interventions, encompassing a wide range of procedures requiring laparotomy sponges to prevent retained foreign objects, holding the largest share. Trauma Surgery is the fastest growing application area, reflecting increased emergency surgeries resulting from accidents and conflict zones, which drive demand for reliable detection and safety-enhanced sponge products. Gynecological Surgery also consumes significant volumes due to routine and specialty procedures involving abdominal access. Oncology Surgery, while a smaller segment, shows consistent growth propelled by increasing cancer incidence rates worldwide.

Laparotomy Sponge Market Trends

The Laparotomy Sponge market is witnessing a pivotal trend towards digital integration with technologies like RFID, enhancing surgical safety protocols globally.

This technological adoption has been particularly strong in North America, where hospitals invested roughly USD 120 million in RFID-equipped sponges alone in 2024.

Moreover, sustainable product development with biodegradable sponges is becoming a critical focus, reflecting shifting regulatory and environmental attitudes, especially in Europe.

Emerging markets are experiencing an increasing shift from generic to specialized products, driven by growing awareness and healthcare spending.

Laparotomy Sponge Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Laparotomy Sponge Market Analysis and Trends

North America commands the largest Laparotomy Sponge market share at 42% due to sophisticated healthcare infrastructure and stringent surgical safety regulations mandating advanced products. The U.S. accounts for over 70% of this region’s revenue, bolstered by high surgical volumes and early adoption of RFID- and barcode-based detection systems. Increased government funding for hospital modernization and patient safety enhances business growth opportunities.

Asia Pacific Laparotomy Sponge Market Analysis and Trends

Asia Pacific exhibits the fastest CAGR, estimated at around 7.5%, facilitated by expanding healthcare infrastructure, rising surgical procedures, and growing awareness about hospital-acquired complications. Countries like China and India drive growth, with manufacturers establishing regional production hubs to meet local demand cost-effectively. Favorable government initiatives aimed at healthcare accessibility and quality improvement are also contributing factors.

Laparotomy Sponge Market Outlook for Key Countries

USA Laparotomy Sponge Market Analysis and Trends

The U.S. market is a significant contributor due to the high number of surgical procedures performed annually, estimated at over 14 million laparotomies in 2024 alone. Market players such as Medline Industries and Johnson & Johnson dominate by supplying RFID-enabled and radiopaque sponges to large hospital networks. Strict regulatory frameworks by the FDA around retained surgical items enforce widespread adoption of advanced laparotomy sponges, fuelling market revenue. Moreover, federal funding to improve surgical safety protocols enhances business growth strategies for market companies in this region.

India Laparotomy Sponge Market Analysis and Trends

India's market has shown accelerated expansion due to increased healthcare expenditure and rising access to advanced medical facilities in urban and semi-urban areas. With a large patient pool and growing surgical interventions in both private and government hospitals, demand for laparotomy sponges is steadily rising. Local manufacturers have increased production capacity, leveraging cost efficiencies to compete with imports. The government’s focus on improving surgical care standards via new policy frameworks further stimulates market dynamics, attracting global players to form partnerships and joint ventures.

Analyst Opinion

Enhanced Demand Driven by Surgical Volume Expansion: The steady increase in the number of abdominal surgeries, especially in oncology and trauma care, strongly influences the market size. For example, over 24 million laparotomies were reported globally in 2024, driving a proportional increase in laparotomy sponge consumption. Institutional adoption of new safety guidelines requiring multiple counts of surgical sponges has also contributed to higher demand.

Cost Optimization and Pricing Dynamics: The market revenue has been shaped by competitive pricing strategies and bulk procurement by hospital groups. Pricing analysis from 2025 shows a moderate upwards adjustment by manufacturers due to rising raw material costs, particularly cotton and synthetic fibers, impacting inventory turnover rates positively. This dynamic underlines the importance of efficient supply chains in maintaining market growth.

Technological Integration Supporting Market Growth: Introduction of sponges embedded with radio-frequency identification (RFID) and barcode technologies has driven market expansion by enhancing traceability and reducing surgical errors. In 2024, installations of RFID-enabled laparotomy sponges rose by 28% in hospitals across North America and Europe, substantiating increasing investments in surgical safety technologies.

Regional Import-Export Trends Impacting Market Distribution: Export demand from Asia Pacific increased by 15% in 2024 due to growing manufacturing hubs, enabling competitive pricing advantages. Conversely, North America remains a key importer with steady demand growth, supported by infrastructural advancements and rising surgical interventions. These factors combined contribute to expanding market share in respective regions.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 1.35 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 6.1% | 2032 Value Projection: | USD 2.05 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Johnson & Johnson, Cardinal Health, Medline Industries, 3M Company, B. Braun Melsungen AG, Halyard Health, Paul Hartmann AG, Teleflex Incorporated, Aspen Surgical Products, Terumo Corporation, Nissha Medical Technologies, Becton Dickinson and Company. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Laparotomy Sponge Market Growth Factors

The rising incidence of abdominal surgical procedures globally directly propels market growth. According to recent hospital data, a 7% year-over-year increase in laparotomies has been recorded in key markets. Secondly, the enforcement of stringent regulatory requirements concerning retained surgical item prevention compels healthcare providers to invest in advanced laparotomy sponges with embedded detection features. Thirdly, technological advancements such as radiopaque and RFID-tagged sponges enhance procedural safety and efficiency, gaining traction across developed healthcare setups. Finally, the expansion of healthcare infrastructure and rising healthcare expenditure in developing nations such as India and Brazil further fuel market revenue, offering vast untapped growth potential.

Laparotomy Sponge Market Development

In November 2024, Stryker Corporation launched the SurgiCount+ Safety-Sponge System, a next-generation surgical sponge management platform designed to enhance accuracy and safety in operating rooms. The system integrates unique-coded sponge tagging with digital scanning technology, allowing real-time counting, tracking, and reconciliation of surgical sponges during procedures. By seamlessly connecting with electronic medical record (EMR) systems, SurgiCount+ enables automatic data capture, improving compliance with surgical safety protocols and reducing the risk of retained surgical items (RSIs)—a critical concern in operative care.

In March 2025, researchers at the Indian Institute of Technology (IIT) Kanpur developed a groundbreaking seagrass-based hemostatic sponge, combining biodegradable seagrass fibers with cellulose composites to create a rapid-action, eco-friendly wound management material. The innovative sponge is designed to halt bleeding within one minute, offering a cost-effective and sustainable alternative to synthetic hemostatic materials commonly used in emergency and trauma care.

Key Players

Leading companies of the market include:

Johnson & Johnson

Medline Industries

3M Company

B. Braun Melsungen AG

Halyard Health

Paul Hartmann AG

Teleflex Incorporated

Aspen Surgical Products

Terumo Corporation

Nissha Medical Technologies

Becton Dickinson and Company

Several top market players have adopted product innovation and strategic acquisitions to consolidate market presence. For instance, Medline Industries’ acquisition of Aspen Surgical in 2024 led to a 12% increase in hospital contract wins, while Mölnlycke focused on developing cost-effective RFID-enabled sponges, reinforcing its competitive edge in European markets. Johnson & Johnson’s expansion into emerging markets through localized manufacturing has driven volume sales substantially, particularly in the Asia Pacific.

Laparotomy Sponge Market Future Outlook

The market is expected to grow with the development of sponges offering higher absorbency, antimicrobial properties, and advanced materials that reduce postoperative infection risks. Increasing surgical volumes, expansion of hospital infrastructure, and rising awareness of patient safety protocols will drive demand. Integration with digital surgical tracking systems, standardized hospital procedures, and minimally invasive surgery adaptations will enhance market potential. Emerging regions are likely to experience significant adoption as healthcare access and surgical capabilities improve.

Laparotomy Sponge Market Historical Analysis

Laparotomy sponges have long been essential tools in surgical procedures, particularly for abdominal operations. Initially, sponges were simple cotton-based products with basic absorbency, used primarily to control fluids during surgery. Over time, innovations in absorbent materials, radiopaque markers, and antimicrobial coatings improved safety, visibility, and infection control. The market evolved alongside surgical practices, with increasing adoption in hospitals, ambulatory centers, and specialized surgical units. Clinical protocols and regulatory standards emphasized the importance of sponge counts, traceability, and patient safety, further shaping product development.

Sources

Primary Research interviews:

General Surgeons

Operating Room Nurses

Surgical Technologists

Hospital Procurement Officers

Product Design Engineers

Databases:

FDA MAUDE Database

PubMed

Magazines:

Surgical Products Magazine

Medical Device Network

OR Today

MedTech Dive

Journals:

AORN Journal

Journal of Surgical Research

Surgical Innovation

International Journal of Surgery

Newspapers:

The Washington Post (Health)

The Guardian (Science)

The New York Times (Health)

The Economic Times (Healthcare)

Associations:

Association of Perioperative Registered Nurses (AORN)

American College of Surgeons (ACS

World Health Organization (WHO)

U.S. FDA

Share

Share

About Author

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients