Laboratory Equipment Market Size and Forecast – 2026 – 2033

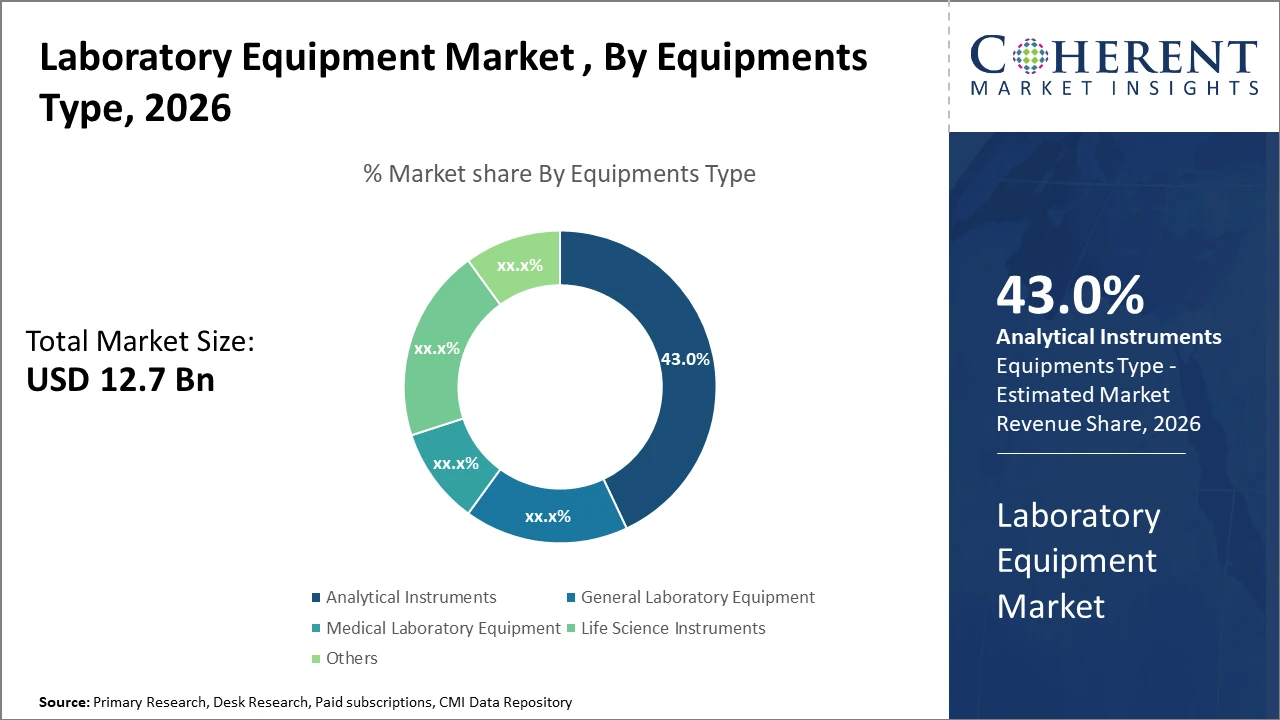

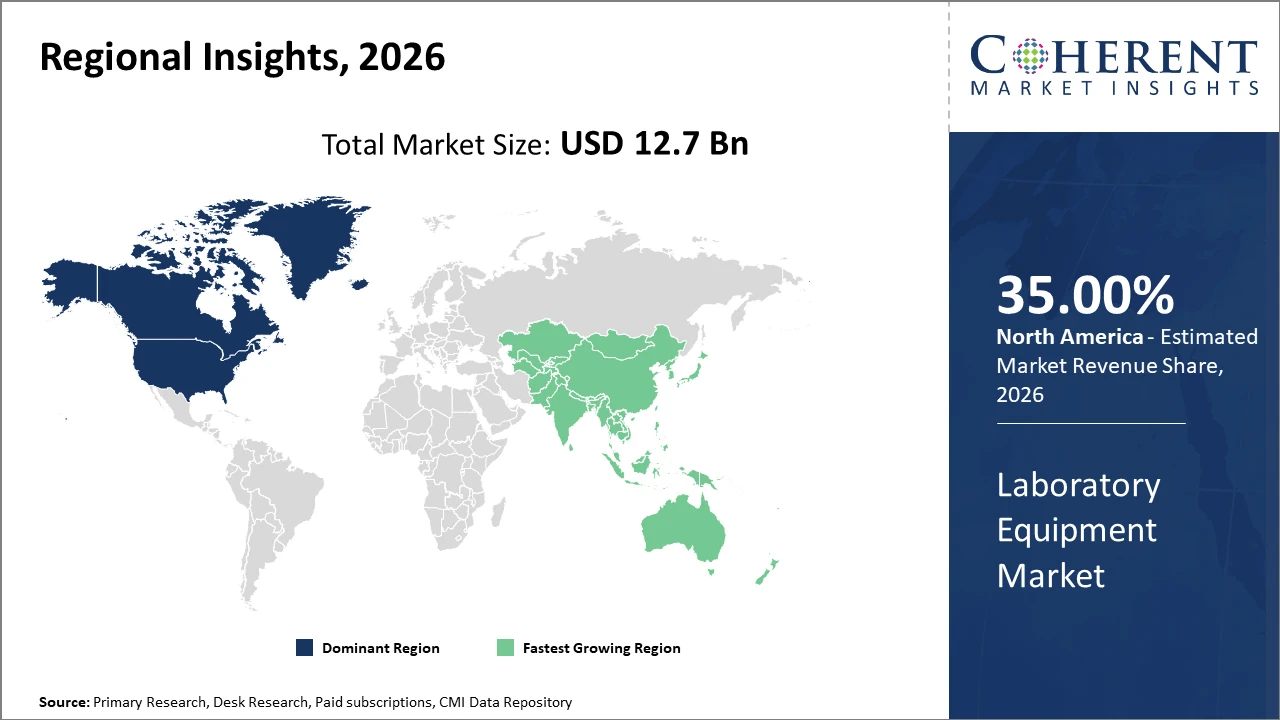

The global laboratory equipment market size is estimated to be valued at USD 12.7 billion in 2026 and is expected to reach USD 21.9 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 8.1% from 2026 to 2033.

Global Laboratory Equipment Market Overview

The global laboratory equipment market comprises instruments and devices used in research, diagnostics, quality control, and testing across healthcare, pharmaceuticals, biotechnology, and academic sectors. The market is experiencing steady growth driven by rising R&D activities, increasing healthcare demand, and technological advancements such as automation and digital laboratories. Expanding research infrastructure in emerging economies and growing adoption of advanced analytical instruments further support market growth worldwide.

Key Takeaways

Analytical instruments dominate the market with a 43% share, driven by increasing demand for high-resolution equipment in pharmaceutical research and development.

Spectrometry leads product category turnover due to its versatility, accuracy, and wide range of laboratory applications.

North America holds approximately 35% of the market share in 2026, supported by robust healthcare infrastructure and substantial R&D investments.

Asia Pacific is the fastest-growing region with a CAGR exceeding 9%, driven by rapid industrialization, government incentives, and expanding pharmaceutical manufacturing in China and India.

Europe demonstrates steady growth, supported by strict regulatory standards and well-established research institutions promoting laboratory equipment adoption.

Laboratory Equipment Market Segmentation Analysis

To learn more about this report, Download Free Sample

Laboratory Equipment Market Insights, By Equipment Type

Analytical instruments dominate the market with a 43% share, supported by sustained investments in pharmaceutical and biotechnology research that require precise, high-throughput testing, along with continuous advancements in spectrometry and chromatography technologies. Life science instruments are the fastest-growing segment, driven by rapid progress in genomics and proteomics research. General laboratory equipment, such as centrifuges and incubators, remains essential for routine operations but grows at a moderate pace. Medical laboratory equipment maintains steady demand from diagnostic laboratories and hospitals due to increasing medical testing needs, while the others segment includes niche products like microfluidics instruments with emerging growth potential.

Laboratory Equipment Market Insights, By End User

The pharmaceutical industry holds the largest share, driven by continuous drug discovery activities and strict regulatory compliance requirements that rely heavily on advanced laboratory equipment. Biotechnology is the fastest-growing segment, supported by rising investments in personalized medicine and cell and gene therapies, which increase demand for genetic and molecular analysis tools. Environmental testing is expanding due to stricter pollution control regulations that require sophisticated analytical instruments. Academic research contributes steady demand from universities and government laboratories. The food and beverage sector focuses on quality control and safety testing, gradually adopting advanced instrumentation for improved accuracy and efficiency. Other end-user industries, including cosmetics and petrochemicals, show niche growth driven mainly by regulatory compliance needs.

Laboratory Equipment Market Insights, By Product Type

Spectrometry dominates the segment due to its wide applicability across pharmaceutical quality control, environmental analysis, and research applications, offering precise compositional insights supported by ongoing technological enhancements in resolution and sensitivity. Chromatography is the fastest-growing category, driven by advances in ultra-high-performance liquid chromatography systems that enable rapid and detailed biomolecular separation critical for drug development. Microscopy continues to play a vital role in life science research, particularly for cellular and structural analysis, with fluorescence and confocal microscopy creating new growth opportunities. Electrophoresis maintains steady demand as a reliable tool in molecular biology research. The others category includes emerging analytical technologies such as microfluidics and lab-on-a-chip devices, which are expanding niche applications and demonstrating strong future growth potential.

Laboratory Equipment Market Trends

Emerging trends show a shift toward automation and smart laboratories, with interconnected equipment powered by AI providing real-time data, predictive maintenance, and reduced downtime.

Miniaturization of analytical instruments enables rapid on-site testing, benefiting sectors like personalized medicine and environmental monitoring.

Portable PCR devices experienced a 20% shipment increase in 2026, driven by growing point-of-care applications in healthcare globally.

Cloud-based data management solutions integrated into laboratory equipment are enhancing data accessibility and compliance workflows, resulting in a 13% productivity increase in pharmaceutical labs in 2025.

These trends improve workflow efficiency but also introduce market challenges that require adaptive growth strategies.

Laboratory Equipment Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Laboratory Equipment Market Analysis and Trends

In North America, the laboratory equipment market is dominant, supported by a well-established pharmaceutical industry, advanced healthcare infrastructure, and significant R&D spending, accounting for approximately 35% of the market share in 2026. Strong regulatory standards and substantial government funding further drive market growth, while companies such as Thermo Fisher and Agilent lead innovations in high-end laboratory instrumentation.

Asia Pacific Laboratory Equipment Market Analysis and Trends

Asia Pacific is the fastest-growing region in the laboratory equipment market, with a CAGR exceeding 9%, driven by rising investments in healthcare infrastructure, expanding biopharmaceutical hubs in China and India, and supportive trade policies. Growth is further fueled by local manufacturing expansions and increasing adoption of automation technologies by laboratory end users. Companies operating in the region have reported doubling their revenue between 2024 and 2026, supported by government initiatives focused on healthcare modernization.

Laboratory Equipment Market Outlook for Key Countries

USA Laboratory Equipment Market Analysis and Trends

The USA retains its market leadership in laboratory equipment, supported by life sciences R&D investments exceeding USD 50 billion in 2025, with advanced equipment underpinning biopharma innovation pipelines. Major companies such as Danaher and PerkinElmer have increased capital expenditure to develop AI-powered instruments integrated with electronic lab notebooks, raising laboratory automation adoption by 15%. The country’s strict regulatory environment ensures high standards, driving demand for precision instruments and analytical systems, solidifying its influence on the global market.

China Laboratory Equipment Market Analysis and Trends

China’s laboratory equipment market has experienced rapid growth, driven by government-led healthcare reforms and expanding pharmaceutical manufacturing, achieving a CAGR above 10% between 2024 and 2026. Domestic manufacturers, in collaboration with multinational companies, have formed joint ventures to meet rising demand, particularly for analytical instruments used in quality control and environmental monitoring. Strengthened digital infrastructure and stricter environmental regulations further boost demand. Leading companies like Mettler Toledo and Shimadzu Corporation have intensified localization strategies, resulting in substantial market expansion and higher revenue capture.

Analyst Opinion

New facilities in Asia-Pacific that began operations in 2024 increased output volumes by over 15%, helping stabilize prices despite raw material inflation in 2025. A key manufacturer reported a 12% quarter-over-quarter rise in equipment output in late 2024, reflecting intensified production and market responsiveness.

High demand for precision instruments enabled premium pricing, with high-end chromatography equipment prices rising 7.6% in 2025. Modular and customizable lab solutions saw a 9% increase in average revenue per unit due to growing preference for tailored equipment in biotechnology research.

The pharmaceutical industry’s focus on personalized medicine drove an 18% increase in imports of advanced laboratory analyzers in 2026. Environmental labs increased capital expenditure on automation products by 11% in 2025 to meet stricter pollutant monitoring regulations, broadening market demand.

Miniaturized instruments, such as portable spectrometers, grew strongly with a 22% shipment increase in 2026, supporting point-of-care diagnostics and field environmental testing. This reflects a shift toward decentralized and agile laboratory setups, contributing to overall market expansion.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: |

USD 12.7 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 8.1% | 2033 Value Projection: |

USD 21.9 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Thermo Fisher Scientific, Agilent Technologies , Perkin Elmer, Mettler Toledo, Shimadzu Corporation, Danaher Corporation, Bruker Corporation, Waters Corporation, Hitachi High Tech, Bio-Rad Laboratories | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Laboratory Equipment Market Growth Factors

The growth of the laboratory equipment market is primarily driven by increasing research and development activities across pharmaceuticals, biotechnology, and life sciences, which create strong demand for advanced and precise instruments. Technological advancements, including automation, AI integration, and smart laboratory solutions, are enhancing efficiency, accuracy, and throughput, further propelling market expansion. Additionally, rising healthcare needs, expanding diagnostic and environmental testing, and investments in emerging economies contribute to the sustained growth of the laboratory equipment market worldwide.

Laboratory Equipment Market Development

In January 2026, the Laboratory of Advanced Wireless Technologies was inaugurated at Saint Petersburg Electrotechnical University “LETI.” It is the first educational laboratory in Russia equipped with domestically developed systems for the design, deployment, and maintenance of 4G and 5G communication equipment.

In January 2026, Southern Arkansas University announced that its Department of Biology was awarded a $50,000 New Faculty Recruitment Start-up Package from the Arkansas IDeA Network of Biomedical Research Excellence (INBRE). The competitive award supports an innovative laboratory initiative proposed by Dr. Samia Amin, a newly appointed assistant professor of Public Health, to establish an undergraduate research program in public health informatics at SAU.

Key Players

Leading Companies of the Market

Thermo Fisher Scientic

Agilent Technologies

PerkinElmer

Shimadzu Corporation

Mettler Toledo

Danaher Corporation

Bruker Corporation

Waters Corporation

Hitachi High Tech

Bio-Rad Laboratories

Competitive strategies in the laboratory equipment market have focused on acquisitions, partnerships, and technological innovation. Thermo Fisher strengthened its market leadership in 2025 by acquiring specialized biotech equipment firms, expanding its product portfolio and accelerating innovation cycles. Agilent Technologies partnered with academic institutions to develop products tailored to emerging research needs, increasing adoption by over 10% in key segments during 2026. Danaher’s investment in AI-powered laboratory automation led to a 15% improvement in customer retention among pharmaceutical clients in 2025.

Laboratory Equipment Market Future Outlook

The future outlook for the laboratory equipment market remains strong, driven by continual advancements in technology, growing demand across life sciences, and expanding applications in healthcare, environmental monitoring, and industrial testing. Automation and AI integration will increasingly shape laboratory workflows, enhancing efficiency, data accuracy, and predictive capabilities. Emerging miniaturized and portable instruments will support decentralized testing in point‑of‑care and field environments. Investments in R&D, particularly in genomics, proteomics, and precision medicine, will sustain long‑term demand for advanced analytical platforms. Additionally, expanding healthcare infrastructure and rising regulatory standards in emerging economies will further broaden market opportunities. Overall, the market is expected to maintain robust growth as laboratories modernize and adopt smart, connected solutions to address complex scientific and diagnostic challenges.

Laboratory Equipment Market Historical Analysis

The laboratory equipment market has grown steadily over the past decade, driven by rising pharmaceutical and biotech R&D, healthcare demand, and technological advancements. Automation, digitalization, and miniaturization have improved lab efficiency and accuracy, while emerging economies expanded demand through increased healthcare and research investments. Strong regulatory standards and environmental monitoring requirements also supported equipment upgrades, marking a shift from basic instruments to advanced, integrated laboratory systems.

Sources

Primary Research Interviews:

Laboratory Managers

R&D Scientists

Clinical and Diagnostic Lab Technicians

Laboratory Equipment Manufacturers

Databases:

WHO Health Statistics

OECD Health Data

UN World Health Statistics

Magazines:

Lab Manager Magazine

The Scientist

Analytical Scientist

Laboratory Equipment Magazine

Laboratory News

Journals:

Journal of Laboratory Automation

Analytical Chemistry Journal

Clinical Chemistry and Laboratory Medicine

Lab on a Chip

Journal of Applied Laboratory Medicine

Newspapers:

The New York Times (Health & Science)

The Guardian (Science & Health)

Financial Times (Healthcare & Life Sciences)

The Hindu (Science & Health)

Reuters Health & Science

Associations:

World Health Organization (WHO)

American Association for Clinical Chemistry (AACC)

International Federation of Laboratory Medicine (IFLM)

Association for Laboratory Automation

Clinical and Laboratory Standards Institute (CLSI)

Share

Share

About Author

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients