Inorganic Chemicals Market Size and Forecast – 2026 – 2033

The Global Inorganic Chemicals Market size is estimated to be valued at USD 210 billion in 2026 and is expected to reach USD 325 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 6.3% from 2026 to 2033.

Global Inorganic Chemicals Market Overview

The inorganic chemicals market encompasses a wide range of products including acids, alkalis, salts, oxides, and metal-based compounds used across industries such as agriculture, pharmaceuticals, water treatment, construction, and electronics. Key products include sulfuric acid, hydrochloric acid, sodium hydroxide, ammonium salts, and titanium dioxide, valued for their versatility and industrial significance. Specialty inorganic chemicals, such as catalysts, pigments, and battery-grade compounds, are increasingly adopted in high-tech applications. Products are available in liquid, powder, and granular forms to meet diverse processing requirements. Market growth is driven by industrialization, rising demand for chemical intermediates, and applications in sustainable and energy-efficient technologies globally.

Key Takeaways

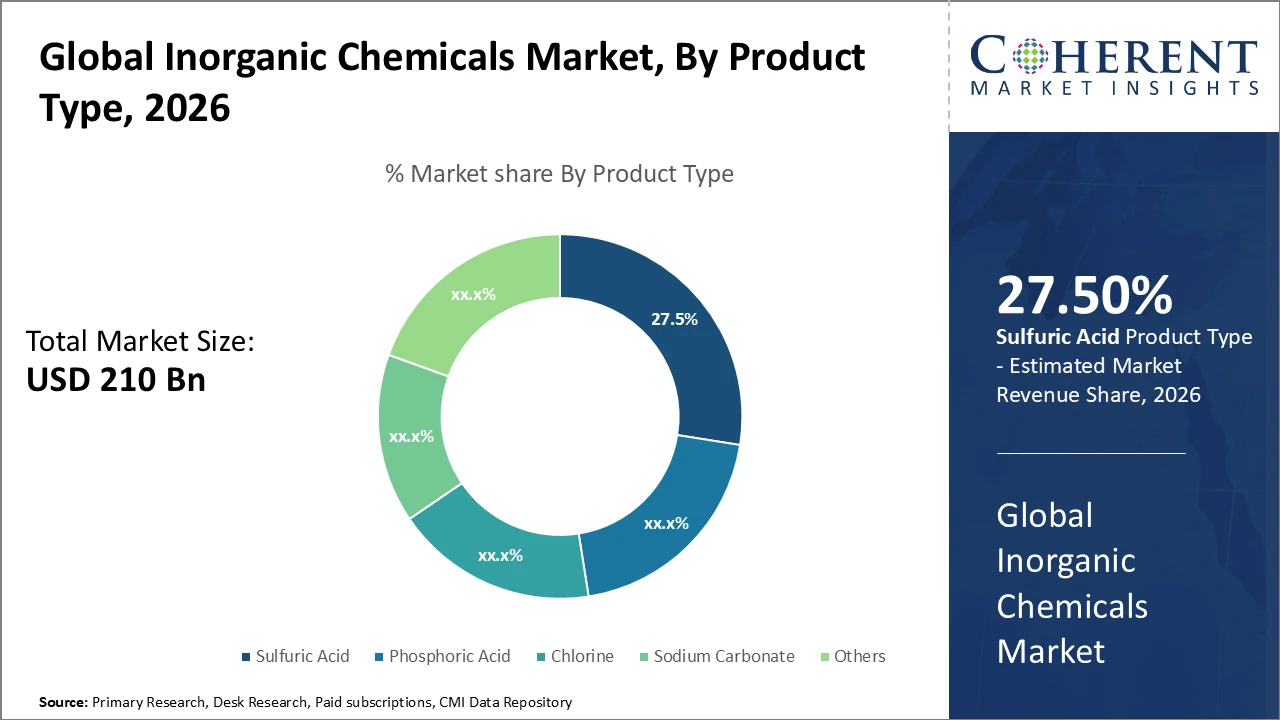

Sulfuric acid holds the dominant position by product type with a 27.5% market share, driven by extensive use in fertilizers and industrial processing, while phosphoric acid is the fastest-growing subsegment due to increasing demand in food additives and pharmaceuticals.

In terms of applications, agriculture remains the largest segment, supported by global food security initiatives and rising fertilizer usage, whereas the electronics segment exhibits the fastest growth, propelled by expansion in the semiconductor industry.

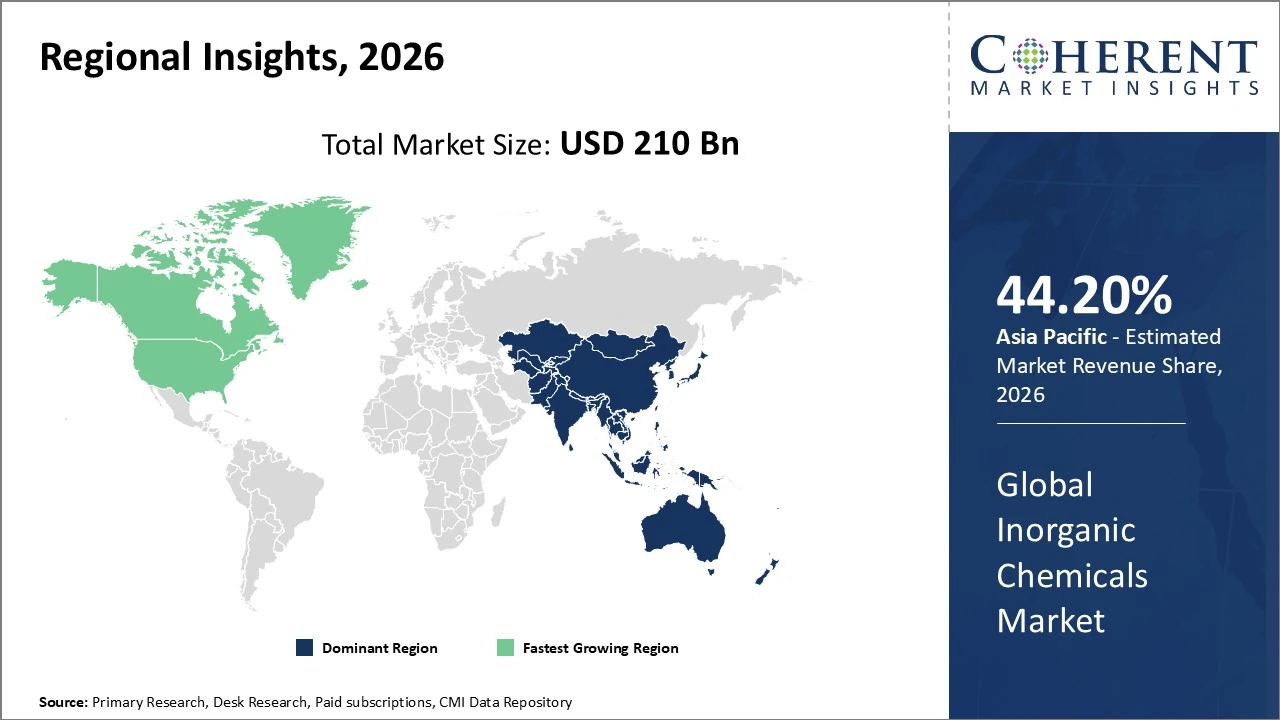

Asia Pacific holds the largest regional market share due to strong industrialization in China and India and government incentives for chemical manufacturing, while North America is the fastest-growing region with a CAGR of 7.1%, driven by innovations in sustainable chemical production and stringent environmental regulations.

Inorganic Chemicals Market Segmentation Analysis

To learn more about this report, Download Free Sample

Inorganic Chemicals Market Insights, By Product Type

Sulfuric acid dominates the market share, driven by its wide-ranging applications in fertilizer production, chemical synthesis, and petroleum refining, accounting for over 27.5% of industry volume. Phosphoric acid is the fastest-growing subsegment, fueled by increasing use in food-grade additives and pharmaceutical manufacturing. Chlorine continues to be important for disinfection and plastics production, though its growth is moderate due to environmental regulations. Sodium carbonate maintains steady demand in glass manufacturing and detergent production, while the ‘Others’ category includes niche inorganic chemicals that hold a consistent but smaller presence within the overall market segment.

Inorganic Chemicals Market Insights, By Application

Agriculture remains the largest market segment, supported by rising global fertilizer consumption driven by food security priorities and government subsidy programs. The water treatment segment is experiencing steady growth, addressing municipal and industrial wastewater management needs. The electronics subsegment shows the fastest growth, fueled by the expanding semiconductor and display manufacturing industries that require ultra-pure inorganic chemicals. Pharmaceuticals contribute consistently, emphasizing bio-compatible inorganic compounds for drug formulation.

Inorganic Chemicals Market Insights, By Form

Liquid form chemicals dominate the market due to their versatility across industrial and agricultural applications and ease of integration into production processes. The gas form subsegment, especially chlorine and ammonia, is experiencing rapid growth driven by increasing demand in chemical synthesis and water treatment that require gaseous reactants. Solid forms remain steadily relevant for compounds like sodium carbonate and phosphates, valued for convenient transportation and handling in industrial settings. The ‘Others’ category includes powdered and slurry forms, catering to specialized formulations and niche applications, supporting specific requirements across various sectors within the inorganic chemicals market.

Inorganic Chemicals Market Trends

Market trends show increasing adoption of environmentally sustainable inorganic chemicals, driven by global emphasis on green manufacturing practices.

Government policies in North America and Europe provide incentives for eco-friendly production methods, encouraging industry-wide sustainability initiatives.

In 2025, European Union regulations accelerated the phase-out of high-emission production techniques, promoting innovation in performance chemicals.

These regulatory measures have strengthened competitiveness among market players, pushing the development of safer and more efficient inorganic chemical solutions.

Rapid growth in Asia Pacific’s electronics and agriculture sectors is further boosting demand, contributing to overall market volume expansion.

Inorganic Chemicals Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Inorganic Chemicals Market Analysis and Trends

North America demonstrates the fastest growth in the inorganic chemicals market, with a CAGR of 7.1%, driven by advanced technological adoption and innovation. The region benefits from stringent environmental regulations that encourage cleaner, safer, and more efficient chemical manufacturing processes, prompting companies to invest in sustainable production techniques. Strong research and development initiatives further support the creation of high-performance and eco-friendly inorganic chemicals for diverse applications across agriculture, water treatment, electronics, and pharmaceuticals. Combined with robust industrial infrastructure and growing demand for high-purity chemicals, these factors are contributing to an expanding market forecast and steady business growth throughout North America.

Asia Pacific Inorganic Chemicals Market Analysis and Trends

In Asia Pacific, the inorganic chemicals market is dominated by industrial growth in major manufacturing hubs, particularly China and India, which together account for over 40% of the global market share. Rapid urbanization, infrastructure investments, and government subsidy programs have supported large-scale chemical production and modernization of facilities. Additionally, favorable international trade agreements have boosted exports, enabling regional manufacturers to reach global markets efficiently. Strong demand from agriculture, and water treatment sectors further fuels production. This combination of supportive policies, industrial expansion, and rising domestic and international demand has established a robust and rapidly growing inorganic chemicals market ecosystem in the Asia Pacific region.

Inorganic Chemicals Market Outlook for Key Countries

USA Inorganic Chemicals Market Analysis and Trends

The USA’s inorganic chemicals market is a key driver of North America’s 7.1% CAGR, underpinned by diverse applications in agriculture, pharmaceuticals, water treatment, and electronics. Leading companies, including FMC Corporation and The Chemours Company, have focused on extensive R&D and sustainable process innovations, enhancing efficiency, product performance, and market share. Regulatory support promoting green chemistry, environmental compliance, and digitalization of manufacturing processes has further strengthened the country’s competitive position. Coupled with robust industrial infrastructure and growing demand for high-purity inorganic chemicals, these factors contribute to increased market revenue, expanded industry size, and the USA’s strategic leadership within the North American inorganic chemicals sector.

Germany Inorganic Chemicals Market Analysis and Trends

Germany’s inorganic chemicals market is characterized by advanced industrial infrastructure, stringent environmental regulations, and a strong focus on innovation and sustainability. The country maintains a significant presence in specialty and performance chemicals, including catalysts, pigments, and high-purity compounds for pharmaceuticals, automotive, and electronics applications. Regulatory frameworks emphasizing eco-friendly production and reduced emissions have accelerated the adoption of green manufacturing practices. Investments in research and development drive formulation improvements, energy-efficient processes, and high-value product development. Germany’s well-established chemical industry, combined with export-oriented strategies and growing demand for sustainable solutions, positions it as a leading market influencer in Europe and the global inorganic chemicals sector.

Analyst Opinion

Production capacity enhancements have been crucial in meeting rising global demand for inorganic chemicals. In 2025, major manufacturing hubs in Asia increased output by approximately 12%, driven by investments in automation technologies and energy-efficient plants, boosting supply and intensifying competition among market players.

Pricing dynamics show relative stability, with moderate fluctuations tied to raw material availability. In 2024, prices for key products like sulfuric acid and caustic soda rose by 4-5% due to supply chain challenges and higher energy costs, impacting market revenue projections and growth strategies.

Demand-side indicators reveal diversification across end-use industries, particularly electronics and water treatment. Semiconductor manufacturing applications grew over 15% in 2026, highlighting emerging opportunities and shifting growth trajectories.

Import-export volumes emphasize international trade’s influence on market dynamics. Imports of inorganic chemicals into Europe increased by 9% in 2025, mainly from Asia Pacific suppliers, shaping regional competition and strategic planning for industry players.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 210 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 6.3% | 2033 Value Projection: | USD 325 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | BASF SE, The Chemours Company, Akzo Nobel N.V., FMC Corporation, Ecolab Inc., Solvay SA, Aditya Birla Chemicals, OCI Chemical Corporation, Mosaic Company, Hebei Jinxi Energy Chemical Co. Ltd. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Inorganic Chemicals Market Growth Factors

Industrial transformation in developing countries has been a key driver of inorganic chemicals market growth, with infrastructure expansion increasing demand for base chemicals, resulting in a 10% rise from the construction sector in 2026. Regulatory frameworks promoting cleaner production have encouraged companies to innovate greener alternatives that comply with environmental standards, widening market scope. The growth of electronic device manufacturing in Asia Pacific, supported by favorable trade policies, drove demand for high-purity inorganic chemicals by over 12% in 2025. Additionally, global water treatment initiatives aligned with sustainability goals contributed to a 9% annual increase in related chemical consumption between 2024 and 2026, further accelerating market expansion.

Inorganic Chemicals Market Development

In 2025, BASF announced plans to expand its production capacity for semiconductor‑grade sulfuric acid at its Ludwigshafen site in Germany, aiming to meet the growing demand for ultra‑pure chemicals in advanced semiconductor manufacturing and strengthen its position in the high‑tech chemicals value chain. This development reflects broader industry efforts to support rapid growth in electronics and chip fabrication demand with high‑purity inorganic materials.

Also in 2025, Honeywell International Inc. completed the acquisition of a specialty inorganic chemicals manufacturer, enhancing its portfolio of high‑purity inorganic materials for electronics and pharmaceutical applications. This move is expected to bolster the company’s market presence and drive innovation in high‑performance inorganic chemicals, positioning it for growth in key end‑use industries.

Key Players

Leading Companies of the Market

BASF SE

The Chemours Company

Akzo Nobel N.V.

FMC Corporation

Ecolab Inc.

Solvay SA

Aditya Birla Chemicals

OCI Chemical Corporation

Mosaic Company

Hebei Jinxi Energy Chemical Co. Ltd.

Competitive strategies in the inorganic chemicals market focus on capacity expansions, strategic partnerships, and process technology innovations. In 2025, BASF SE partnered with a leading technology provider, achieving a 7% improvement in production efficiency, which boosted market revenue and strengthened its industry share. Similarly, The Chemours Company emphasized sustainability-driven growth by launching eco-friendly product lines, securing new contracts in water treatment sectors across North America. These approaches reflect a broader industry trend where companies leverage operational efficiency, strategic collaborations, and environmentally responsible solutions to enhance competitiveness, expand market presence, and meet evolving regulatory and consumer demands.

Inorganic Chemicals Market Future Outlook

The inorganic chemicals market is expected to continue strong growth, driven by rising demand across agriculture, water treatment, electronics, and pharmaceuticals. Consumer and regulatory focus on sustainability will accelerate the adoption of eco-friendly, energy-efficient, and high-purity inorganic chemicals. Advances in process technologies, digitalization, and automation will enhance production efficiency, reduce costs, and improve product quality. Asia Pacific is projected to remain the largest market, while North America will experience rapid growth due to innovation and stringent environmental regulations. Overall, expanding industrialization, infrastructure development, and global sustainability initiatives will create new opportunities, shaping a competitive and dynamic inorganic chemicals market in the coming years.

Inorganic Chemicals Market Historical Analysis

The inorganic chemicals market has historically shown steady growth, driven by industrialization, urbanization, and rising demand across agriculture, water treatment, electronics, and pharmaceuticals. Early market expansion was dominated by basic chemicals such as sulfuric acid, hydrochloric acid, and sodium carbonate due to their widespread industrial applications. Over time, regulatory pressures and environmental concerns prompted shifts toward greener production processes and higher-purity chemicals. Europe and North America historically led the market in production and innovation, while Asia Pacific emerged as a major manufacturing hub in the 2000s, driven by rapid industrialization in China and India. Technological advancements and diversified applications have continually shaped market evolution.

Sources

Primary Research Interviews:

Chemical Manufacturing Executives

Process Engineers and R&D Scientists

Industrial Chemists

Inorganic Chemical Suppliers and Distributors

Databases:

International Energy Agency (IEA) Chemical Statistics

OECD Chemical and Industrial Data

UN Industrial Development Organization (UNIDO) Reports

Magazines:

Chemical Week

Chemistry World

ICIS Chemical Business

Global Chemical Industry

Journals:

Journal of Industrial & Engineering Chemistry

Journal of Inorganic Chemistry

Chemical Engineering Journal

Powder Technology

Materials Chemistry and Physics

Newspapers:

The New York Times (Business & Industry)

The Guardian (Environment & Industry)

Financial Times (Chemical Sector)

The Hindu (Business & Industry)

Reuters (Chemicals & Industrial News)

Associations:

American Chemical Society (ACS)

International Council of Chemical Associations (ICCA)

European Chemical Industry Council (CEFIC)

Society of Chemical Industry (SCI)

Chemical Manufacturers Association (CMA)

Share

Share

About Author

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients