Industrial Diamond Market Size and Forecast – 2025 – 2032

The Global Industrial Diamond Market size is estimated to be valued at USD 2.1 billion in 2025 and is expected to reach USD 3.8 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.2% from 2025 to 2032.

Global Industrial Diamond Market Overview

Industrial diamonds are synthetic or natural diamonds used for cutting, grinding, drilling, and polishing in various industrial applications. Unlike gem-quality diamonds, these are valued for hardness and thermal conductivity rather than aesthetic qualities. The market includes synthetic diamonds produced through high-pressure high-temperature (HPHT) and chemical vapor deposition (CVD) methods, which now dominate global supply due to consistency and cost efficiency.

Industrial diamonds are utilized in mining tools, semiconductor manufacturing, construction equipment, and precision machining. Recent product innovations focus on nanodiamond composites, thermal management materials, and coated diamond abrasives, expanding applications in electronics, optics, and high-performance materials industries.

Key Takeaways

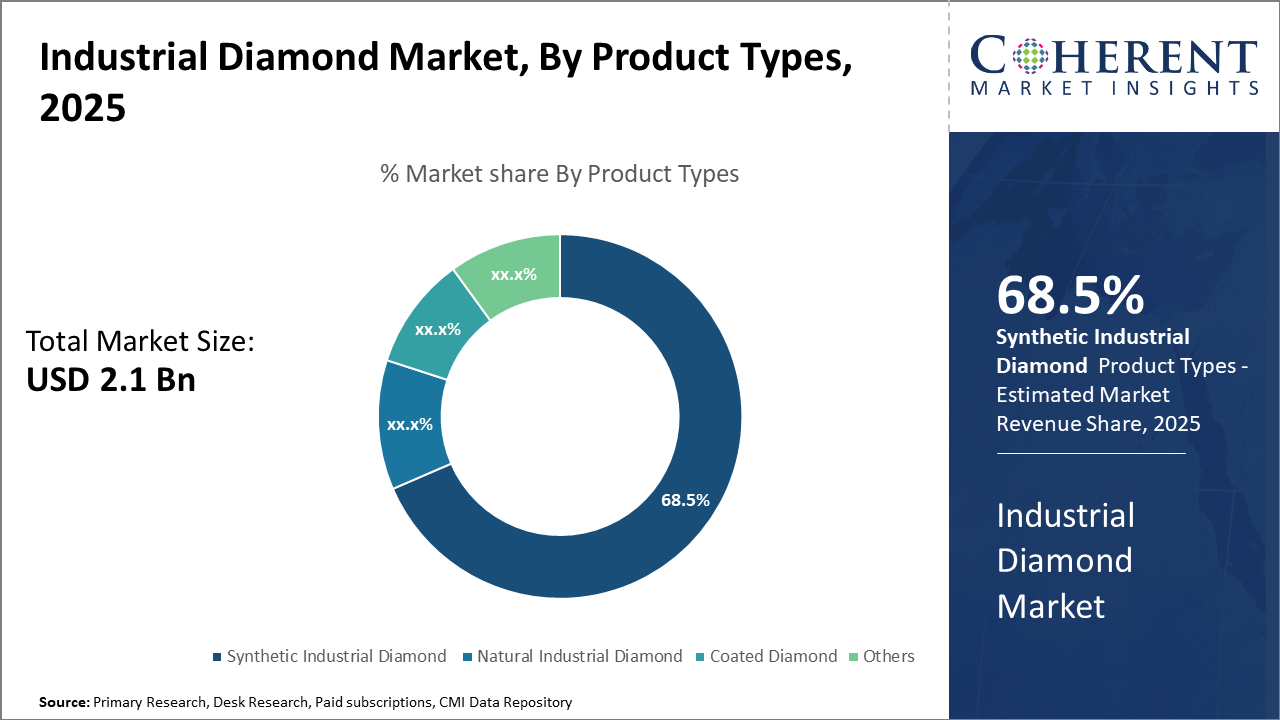

A dominating segment in the product category continues to be Synthetic Industrial Diamonds, commanding over 68.5% industry share due to advancements in cost-effective manufacturing.

Within applications, the Cutting & Grinding Tools segment leads owing to extensive use in automotive and aerospace sectors, with significant market revenue inflows reported in 2024.

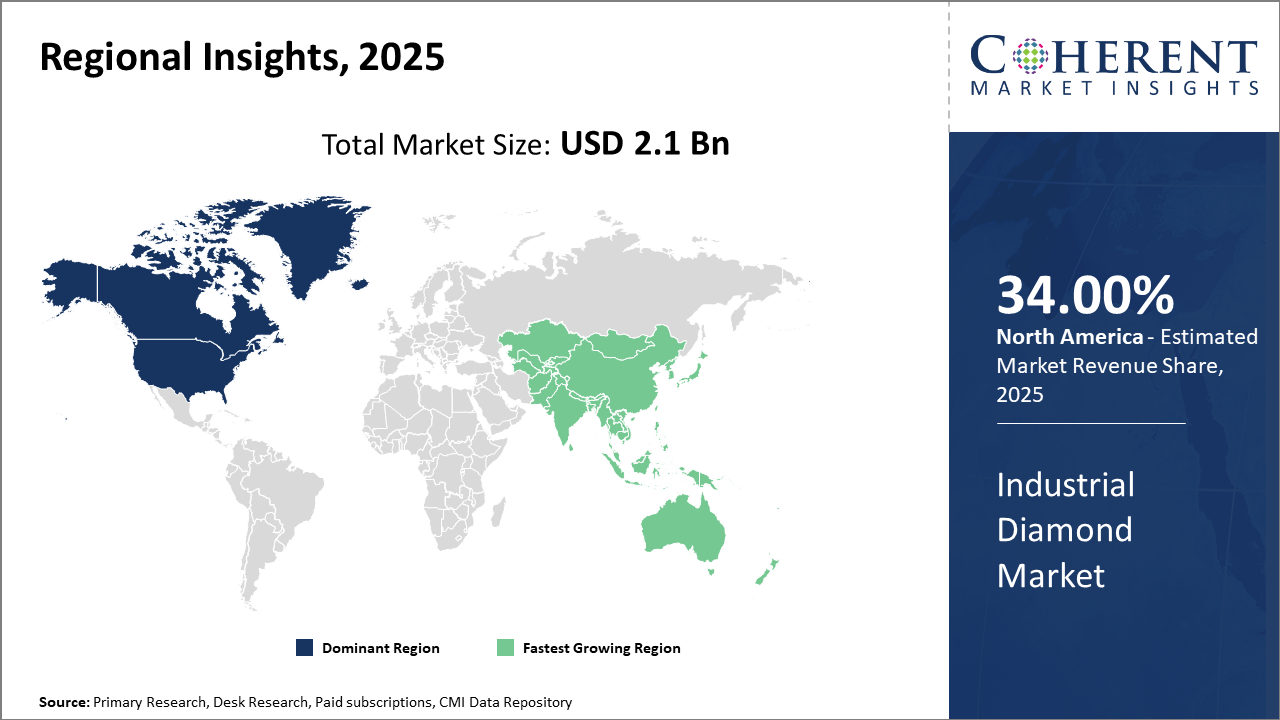

Regionally, North America holds a substantial market share attributable to advanced manufacturing hubs and high industrial automation adoption.

Meanwhile, the Asia Pacific exhibits the fastest growth due to rising electronics and renewable energy investments, accompanied by supportive government policies incentivizing technological innovation.

Industrial Diamond Market Segmentation Analysis

To learn more about this report, Download Free Sample

Industrial Diamond Market Insights, By Product Type

Synthetic Industrial Diamond is dominating the market share at 68.5% owing to their enhanced performance, cost efficiency, and scalability. These diamonds have become the preferred choice for industrial applications requiring high precision and durability, largely replacing natural diamonds in cutting and grinding tools. The fastest growing subsegment within synthetic types is Chemical Vapor Deposition (CVD) diamonds, which deliver superior purity and uniformity ideal for semiconductor and electronics applications, driving innovation and revenue growth. Natural Industrial Diamonds, while experiencing slower growth, remain critical in niche applications requiring high toughness.

Industrial Diamond Market Insights, By Application

Cutting & Grinding Tools dominate, driven by extensive usage in automotive and aerospace manufacturing, contributing significant market revenue through high consumption of industrial diamonds. Fastest growth is observed in the Drilling subsegment, particularly within oil & gas and construction industries, where diamond-based drill bits are gaining preference for enhanced durability and efficiency. Polishing applications cater mainly to the electronics and jewelry industries, with steady demand growth supported by miniaturization trends and refined surface finishing requirements.

Industrial Diamond Market Insights, By Form

Powder form leads the market due to its versatility across multiple applications, from abrasives to precision polishing, capturing substantial industry share. The fastest growing form is Monocrystalline diamonds, favored in high-end electronics manufacturing and semiconductor wafer slicing due to their exceptional structural uniformity and thermal conductivity. Segment diamonds find extensive use in cutting tools requiring precise orientation and hardness. Polycrystalline diamonds remain vital in applications demanding toughness and performance under high-stress conditions.

Industrial Diamond Market Trends

The Industrial Diamond market is notably influenced by the rapid adoption of synthetic diamond technologies that have reshaped industry cost structures and supply reliability in 2024.

With the electronics sector driving demand for superfine diamond powders, manufacturers have intensified R&D efforts to enhance product precision and performance.

The increasing environmental regulations globally have fueled a preference for synthetic diamonds over mined varieties, contributing to a more sustainable market trajectory.

Additionally, the push towards electric vehicle manufacturing and renewable energy infrastructure has created significant new use cases, accelerating industrial diamond adoption.

Industrial Diamond Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Industrial Diamond Market Analysis and Trends

In North America, dominance in the Industrial Diamond market stems from the presence of high-technology manufacturing hubs, including semiconductor fabrication and aerospace industries. North America holds approximately 34% market share driven by extensive government-funded innovation and industrial automation initiatives. Companies such as Element Six and Sumitomo Electric maintain deep-rooted operations here, capitalizing on robust industrial ecosystems and demand for high-performance cutting and grinding tools.

Asia Pacific Industrial Diamond Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth, with a CAGR exceeding 10%, fueled by rapidly expanding electronics and automotive manufacturing sectors in China, India, and South Korea. Supportive governmental policies promoting renewable energy projects and industrial digitization have bolstered this growth. The region hosts major industrial diamond manufacturing hubs, with companies like Henan Huanghe Whirlwind capturing significant market shares through cost-competitive production and export.

Industrial Diamond Market Outlook for Key Countries

USA Industrial Diamond Market Analysis and Trends

The USA’s industrial diamond landscape is characterized by advanced synthetic diamond manufacturing infrastructure, supporting high-value applications in aerospace, defense, and semiconductor industries. Manufacturing investments increased by 18% in 2024, boosting market revenue significantly. Leading market companies leverage cutting-edge R&D to maintain competitive advantages, focusing on innovation in monocrystalline diamond applications tailored for semiconductor wafer slicing and high-precision tooling, consolidating the USA’s prominent market share within North America.

China Industrial Diamond Market Analysis and Trends

China’s industrial diamond market growth is propelled by rapid expansion in electronics and automotive sectors, combined with increased export capabilities. Investments in synthetic diamond production witnessed a 22% surge in 2024, positioning China as a critical global manufacturing hub. The presence of key market players, supporting cost-effective production, and government incentives for technological upgrades have contributed to China’s emergence as a leading market revenue generator within the Asia Pacific region.

Analyst Opinion

Production Capacity Expansion: The industrial diamond market’s supply side is witnessing significant growth, with manufacturing capacities increasing by over 15% in key countries during 2024. Notably, synthetic diamond production surged globally, supported by advancements in high-pressure high-temperature (HPHT) and chemical vapor deposition (CVD) technologies, underpinning the market share growth in 2025.

Demand from High-Precision Industries: Demand-side indicators reflect accelerated imports and usage across highly precise industries such as microelectronics and medical devices. In 2024, the electronics sector alone accounted for nearly 22% of the industrial diamond consumption, representing a substantial driver of market revenue and reinforcing market forecast estimates.

Pricing Trends and Cost Efficiency: Despite raw material scarcity in natural diamonds, synthetic industrial diamonds have rendered cost advantages. In 2024, pricing for synthetic industrial diamonds decreased by approximately 5% due to technological innovations, enabling broader adoption and boosting market revenue.

Application Diversification and Market Scope: Industrial diamonds are expanding their applications beyond traditional sectors into emerging fields like semiconductor wafer processing and renewable energy equipment manufacturing. This diversification, seen prominently in Asia Pacific markets, contributes to evolving market segments and underpins dynamic industry growth strategies.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 2.1 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 8.2% | 2032 Value Projection: | USD 3.8 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Element Six, Henan Huanghe Whirlwind Co. Ltd., Sumitomo Electric Industries, IIa Technologies, De Beers Group, Industrial Diamonds Inc., Sino-Crystal Diamond, Scio Diamond Technology Corporation, Diamond Innovations, AB Diamond Technologies. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Industrial Diamond Market Growth Factors

Market growth is largely driven by increased industrial automation and demand for high-performance materials capable of withstanding extreme operating conditions. Growing applications in the automotive sector’s electric vehicle manufacturing, with over 40% year-over-year increase in abrasive tool usage, are significantly bolstering market revenue. Additionally, advancements in synthetic diamond manufacturing processes are improving product quality while reducing costs, enhancing market scope by making synthetic diamonds attractive across multiple industries. The rising investment in sustainable energy resources, particularly solar panel manufacturing, utilizes industrial diamonds for slicing silicon wafers, providing a robust growth opportunity through 2032.

Industrial Diamond Market Development

In early 2025, the Government of Japan announced that Ookuma Diamond Device Co., Ltd. would build a facility to manufacture diamond semiconductor devices in Okuma Town, Futaba District, Fukushima Prefecture. The decision builds on decade-long research initiated after the Fukushima Daiichi Nuclear Power Station accident, where these diamond-semiconductor devices are designed to operate in extremely high temperature and radiation environments for decommissioning efforts. Construction is set to begin in early 2025, with operations expected by the end of 2026.

In August 2022, Hyperion Materials & Technologies acquired Premium Diamond Solutions SA (PDS), a Switzerland-based company specializing in synthetic diamond and cubic boron nitride (cBN) superabrasive products. The acquisition strengthens Hyperion’s global footprint in hard and superhard materials and expands its portfolio and distribution capabilities across industries including aerospace, electronics, automotive, and medical.

Key Players

Leading Companies of the Market

Element Six

Henan Huanghe Whirlwind Co., Ltd.

IIa Technologies

De Beers Group

Industrial Diamonds Inc.

Sino-Crystal Diamond

Scio Diamond Technology Corporation

Diamond Innovations

AB Diamond Technologies

Competitive Strategies: Element Six has focused on capital expenditure towards expanding synthetic diamond production, increasing its industrial diamond market share by 12% in 2024. Meanwhile, Henan Huanghe Whirlwind utilized strategic partnerships within the electronics segment, enabling a 20% increase in sales volume, targeting precision cutting tools. Sumitomo Electric Industries adopted a product innovation approach, launching advanced monocrystalline industrial diamonds tailored for semiconductor applications, resulting in revenue growth of over 15% in 2024.

Industrial Diamond Market Future Outlook

The industrial diamond market is set for sustained growth, fueled by the rise of advanced manufacturing, semiconductor fabrication, and high-performance machining. Continuous improvements in CVD synthesis will unlock new uses in optics, electronics, and quantum technologies. Cost reductions in lab-grown diamond production will further expand industrial utilization. Moreover, as sustainability and supply chain transparency gain importance, synthetic diamonds will increasingly replace mined counterparts, reinforcing their position as essential materials in modern industry.

Industrial Diamond Market Evolution

The Industrial Diamond Market has evolved from natural diamond usage in abrasives to the widespread production of synthetic diamonds through HPHT and CVD technologies. The move toward synthetic alternatives allowed consistent quality, scalability, and lower production costs. Over the years, industrial diamonds have found increasing applications in cutting tools, drilling, polishing, and thermal management due to their superior hardness and conductivity. The mining, electronics, and construction industries have remained key demand drivers, supported by rapid industrialization and precision manufacturing.

Sources

Primary Research Interviews:

Mining Professionals

Material Scientists

Cutting Tool Manufacturers

Industrial Procurement Heads

Databases:

World Mining Data

Magazines:

Mining Technology

Industrial Minerals

Metal Bulletin

Cutting Tool Engineering

Journals:

Diamond and Related Materials

Journal of Superhard Materials

Materials Science Forum

Wear Journal

Associations:

International Diamond Council (IDC)

World Diamond Council (WDC)

Industrial Diamond Association

International Council on Mining and Metals (ICMM)

Share

Share

About Author

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients