High Performance Plastics Market Size and Forecast – 2026 – 2033

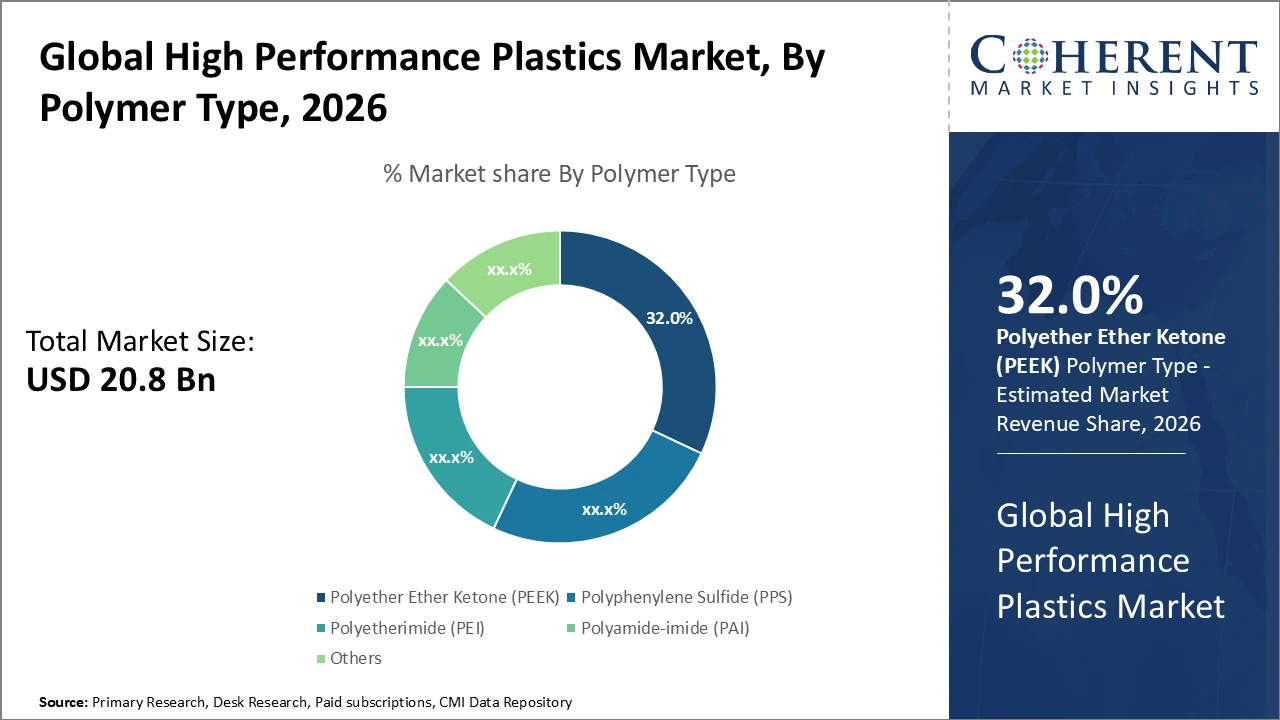

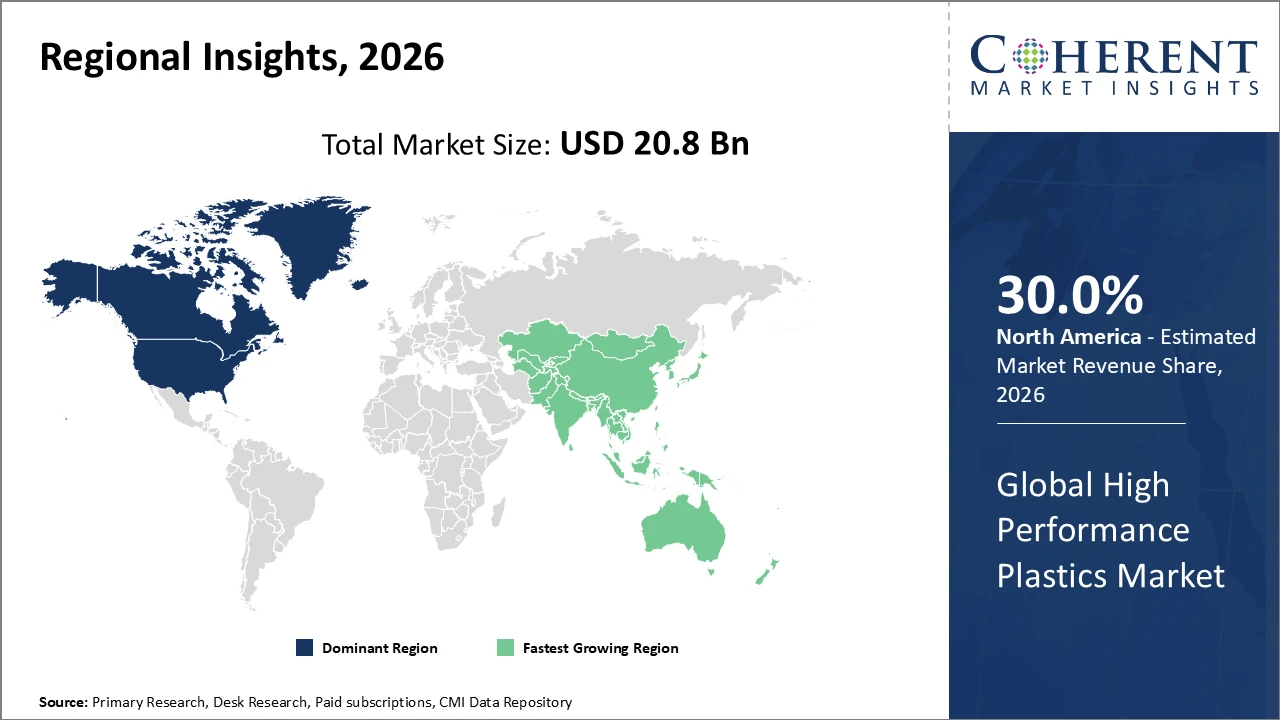

The Global High Performance Plastics Market size is estimated to be valued at USD 20.8 billion in 2026 and is expected to reach USD 38.5 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 8.6% from 2026 to 2033.

Global High Performance Plastics Market Overview

The High Performance Plastics (HPP) market encompasses advanced polymer materials known for exceptional mechanical, thermal, and chemical properties. Key product categories include polyether ether ketone (PEEK), polyphenylene sulfide (PPS), polyetherimide (PEI), and polyamide-imide (PAI), widely used in industries requiring durability and high performance under extreme conditions. These plastics offer superior heat resistance, dimensional stability, and chemical inertness, making them ideal for automotive, aerospace, electronics, and medical applications. Additionally, specialty grades tailored for electrical insulation, lightweight components, and structural applications drive demand. Continuous innovation in polymer formulations further expands HPP applications, supporting industry growth and technological advancements.

Key Takeaways

Polyether Ether Ketone (PEEK) dominates the polymer type segment with 32% market share, driven by its unmatched thermal stability and mechanical strength, making it ideal for aerospace and automotive applications.

Automotive and transportation remains the largest application segment, propelled by stringent emission regulation reforms globally. Healthcare and medical devices represent the fastest-growing application, fueled by innovations in biocompatible materials.

North America leads in market revenue owing to a mature aerospace industry and advanced healthcare infrastructure, holding over 30% industry share. Asia Pacific is the fastest-growing region, with a CAGR surpassing 9%, driven by rapid industrialization and increased adoption in electronics manufacturing.

High Performance Plastics Market Segmentation Analysis

To learn more about this report, Download Free Sample

High Performance Plastics Market Insights, By Polymer Type

Polyether Ether Ketone (PEEK) leads the market with a 32% share, valued for its exceptional thermal, mechanical, and chemical resistance, making it essential in aerospace and automotive applications requiring durable, lightweight materials. Its ability to withstand extreme temperatures makes it ideal for engine components, electrical insulation, and structural parts. Polyphenylene Sulfide (PPS) is the fastest-growing subsegment, driven by chemical resistance and cost efficiency, increasingly used in electronics and industrial machinery. Polyetherimide (PEI) provides high strength and dimensional stability for medical devices and electrical components, while Polyamide-imide (PAI) addresses niche applications requiring superior wear resistance. Other polymers serve specialized roles.

High Performance Plastics Disability Devices Market Insights, By Application

Automotive and transportation dominates the market, driven by electrification trends where high-performance plastics replace metals to reduce vehicle weight and meet stringent emission norms. Healthcare and medical devices represent the fastest-growing subsegment, expanding rapidly due to biocompatible polymers essential for implantables and sterilizable products, supported by advances in polymer chemistry. Electrical and electronics benefit from 5G deployment and miniaturization, steadily increasing their market contribution. Aerospace applications require polymers that withstand thermal cycling and harsh environments, while industrial machinery demands materials with chemical resistance and mechanical durability. Other applications include consumer goods and defense sectors.

High Performance Plastics Market Insights, By Form

Granules dominate the market due to their versatility in downstream processing and compatibility with injection molding and extrusion, enabling large-scale production. Pellets are essential for precision molding and compounding, ensuring consistent material properties. Films and sheets cater to niche but expanding markets, particularly in electronics and barrier applications, and are the fastest-growing segment driven by demand for flexible electronics and protective solutions. Molded components represent value-added finished products customized for specific industries. Other forms include powders used in additive manufacturing and specialty applications. Each form serves distinct needs, collectively supporting diverse industrial requirements.

High Performance Plastics Market Trends

The high-performance plastics market is shifting toward sustainable polymers and bio-based alternatives, offering comparable performance while addressing environmental concerns.

In 2026, bio-based Polyamide variants gained traction due to lower carbon footprints in production.

Additive manufacturing is reshaping fabrication, enabling rapid prototyping and customization, which proved critical during 2024–2025 supply constraints.

Industry 4.0 integration allows real-time monitoring and optimization of polymer processing, enhancing yield and quality while reducing waste.

These trends indicate a move toward more agile, eco-conscious, and technologically advanced manufacturing within the high-performance plastics sector.

High Performance Plastics Market Insights, By Geography

To learn more about this report, Download Free Sample

North America High Performance Plastics Market Analysis and Trends

In North America, the High Performance Plastics market is dominated by a mature aerospace and automotive industry, supported by well-established supply chains and stringent regulatory standards that ensure high-quality materials. The region holds over 30% of the global market share, with the United States driving much of the demand through its extensive aerospace manufacturing ecosystem. High-performance polymers are essential in applications requiring reliability, durability, and thermal and chemical resistance. Strong industrial infrastructure, coupled with advanced research and development capabilities, further reinforces North America’s leadership, making it a critical hub for innovation and high-value applications in the global high-performance plastics market.

Asia Pacific High Performance Plastics Market Analysis and Trends

The Asia Pacific region is witnessing the fastest growth in the High-Performance Plastics market, with a CAGR exceeding 9%, driven by rapid industrialization, expanding electronics manufacturing, and government initiatives supporting polymer research and innovation. Key countries such as China and India lead this expansion, with local companies investing heavily to increase production capacity and meet rising domestic and international demand. Growth is further supported by infrastructure development, rising automotive production, and the adoption of advanced manufacturing technologies. The region’s dynamic industrial ecosystem and favorable policies make it a critical driver of global high performance plastics market growth.

High Performance Plastics Market Outlook for Key Countries

USA High Performance Plastics Market Analysis and Trends

The USA leads the High Performance Plastics market due to advanced aerospace, automotive, and healthcare sectors requiring precise material performance. In 2025, several aerospace manufacturers increased polymer substitution by 15%, reducing component weight without compromising structural integrity. Major companies like DuPont and Solvay maintain strong research and manufacturing bases, driving innovation and supply reliability. Government policies targeting emissions reduction further boost automotive applications, with PEEK and PPS composites widely adopted. The country’s well-developed infrastructure, skilled workforce, and robust industrial ecosystem reinforce its position as a key contributor to both market revenue and technological advancement in high performance plastics.

Germany High Performance Plastics Market Analysis and Trends

Germany’s High Performance Plastics market is bolstered by a strong automotive sector, especially in luxury and electric vehicles, along with a thriving industrial machinery industry. Leading companies have heavily invested in high thermal resistance polymers for electric vehicle components, driving a 13% rise in polymer demand in 2026. The country’s adoption of Industry 4.0 enhances polymer processing efficiency, supporting lean manufacturing practices. A regional focus on quality and sustainability further promotes the use of bio-based and recyclable polymers. These factors position Germany as a key hub for high-reliability, high-performance plastics in Europe, fostering innovation and industrial growth.

Analyst Opinion

High performance plastics are increasingly replacing metals in automotive and aerospace sectors, driven by global efforts to reduce vehicle weight for better fuel efficiency and emissions control. In 2025, automotive OEMs increased high performance plastics use in structural components by over 12% compared to 2023, reflecting a strategic shift toward polymer-based lightweighting solutions.

Production facilities for PEEK and PPS are expanding, with Asia-Pacific capacity growing 15% in 2024. This expansion aims to stabilize pricing and address past feedstock fluctuations caused by geopolitical tensions in 2023.

Healthcare use for implantable and sterilizable components grew 18% in 2026, driven by biocompatible polymer innovations. Electrical and electronics demand surged with 5G rollout, increasing imports of specialty polymers for miniaturized components.

New processing methods, including additive manufacturing, reduced production costs by up to 10% in 2024 for select applications, enabling cost-competitive entry into smaller volume, high-margin segments and supporting overall market revenue growth.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 20.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 8.6% | 2033 Value Projection: | USD 38.5 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Solvay, Evonik Industries, SABIC, Celanese Corporation, Victrex plc, DuPont, 3M, Arkema, Toray Industries, BASF SE | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

High Performance Plastics Market Growth Factors

Increasing environmental regulations worldwide are driving demand for lightweight materials in the automotive and aerospace sectors, accelerating the adoption of high performance plastics. Compliance with Euro 7 emission standards, for instance, led to a 14% growth in polymer composites applications in automotive manufacturing in 2026. Rapid urbanization in emerging Asia Pacific markets has boosted industrial machinery demand, where these plastics provide enhanced durability and operational efficiency. The electronics segment is benefiting from growing demand for miniaturized, efficient components, with 5G deployment projected to increase demand for high-performance polymer substrates by 19% through 2025. Technological advancements in polymer synthesis and processing further improve material properties and reduce costs, making applications more economically viable across industries.

High Performance Plastics Market Development

In October 2025, Mitsui Chemicals, Inc. and Polyplastics Co., Ltd., a wholly owned subsidiary of Daicel Corporation, announced that they had entered into an agreement covering the marketing of engineering plastics products. The agreement pertains to the ARLEN® and AURUM® brands, which are developed and manufactured by Mitsui Chemicals.

Key Players

Leading Companies of the Market

Solvay

Evonik Industries

SABIC

Victrex plc

DuPont

3M

Arkema

Toray Industries

BASF SE

Several leading companies have adopted aggressive growth strategies, including capacity expansion and strategic partnerships. In 2025, Victrex plc expanded its PEEK production line, resulting in a 20% increase in supply capacity and strengthening its position in aerospace applications. Meanwhile, SABIC entered into a joint venture in 2024 with regional manufacturers in Asia Pacific, enabling broader market penetration through localized production and distribution networks. These strategies have enhanced market shares by aligning supply chain efficiencies with growing demand and supporting the increasing adoption of high performance plastics across key industries.

High Performance Plastics Market Future Outlook

The High Performance Plastics market is poised for robust growth driven by rising demand from automotive, aerospace, healthcare, and electronics sectors. Increasing emphasis on lightweighting, emissions reduction, and energy efficiency will continue to fuel polymer substitution for metals. Innovations in bio-based and recyclable polymers, along with advancements in additive manufacturing and Industry 4.0-enabled production, are expected to enhance material performance and cost efficiency. Emerging markets in Asia Pacific will remain key growth drivers due to rapid industrialization and infrastructure expansion. Overall, the market outlook points toward sustainable, technologically advanced, and diversified applications, supporting long-term revenue growth and industry innovation.

High Performance Plastics Market Historical Analysis

Historically, the High Performance Plastics market has experienced steady growth driven by demand from aerospace, automotive, and electronics industries. From 2015 to 2025, increasing emphasis on lightweighting, thermal and chemical resistance, and durability fueled adoption of polymers such as PEEK, PPS, and PEI. Technological advancements in polymer synthesis and processing enabled broader industrial applications, while capacity expansions by major players stabilized supply amid fluctuating raw material prices. The rise of biocompatible polymers in healthcare and miniaturized components in electronics further diversified end-use segments. Overall, the period reflects a shift toward high-performance, specialized plastics replacing traditional materials across industries.

Sources

Primary Research Interviews:

Material Scientists and Polymer Engineers

R&D Heads of Automotive, Aerospace, and Electronics Companies

Production Managers in High Performance Plastics Manufacturing

Supply Chain and Procurement Professionals

Databases:

PlasticsEurope Market Data

ICIS Chemical Prices & Reports

Magazines:

Plastics Today

Plastic News

Material Today

Composites World

Industrial Heating & Processing

Journals:

Journal of Applied Polymer Science

Polymer Engineering & Science

Journal of Materials Science

Macromolecular Materials and Engineering

Advanced Materials

Newspapers:

The Financial Times (Industrials & Materials)

The Wall Street Journal (Manufacturing & Materials)

Chemical & Engineering News

The Economic Times (Industry & Chemicals)

Reuters Business (Plastics & Polymers)

Associations:

Plastics Industry Association (PLASTICS)

European Plastics Converters (EuPC)

Society of Plastics Engineers (SPE)

American Chemistry Council (ACC) – Plastics Division

International Association of Plastics Distribution (IAPD)

Share

Share

About Author

Pankaj Poddar is a seasoned market research consultant with over 12 years of extensive experience in the fast-moving consumer goods (FMCG) and plastics material industries. He holds a Master’s degree in Business Administration with specialization in Marketing from Nirma University, one of India’s reputed institutions, which has equipped him with a solid foundation in strategic marketing and consumer behavior.

As a Senior Consultant at CMI for the past three years, he has been instrumental in harnessing his comprehensive understanding of market dynamics to provide our clients with actionable insights and strategic guidance. Throughout his career, He has developed a robust expertise in several key areas, including market estimation, competitive analysis, and the identification of emerging industry trends. His approach is grounded in a commitment to understanding client needs thoroughly and fostering collaborative relationships. His dedication to excellence and innovation solidifies his role as a trusted advisor in the ever-evolving landscape of not only FMCG but also chemicals and materials markets.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients