Heavy Power Surgical Tools Market Size and Forecast – 2026 – 2033

The Global Heavy Power Surgical Tools Market size is estimated to be valued at USD 3.6 billion in 2026 and is expected to reach USD 6.8 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 9.8% from 2026 to 2033.

Global Heavy Power Surgical Tools Market Overview

Heavy power surgical tools are electrically or pneumatically powered instruments used in complex surgical procedures that require high torque, cutting force, or precision. These products include surgical drills, saws, reamers, and powered handpieces commonly used in orthopedic, neurosurgical, and trauma surgeries. They are designed for durability, ergonomic handling, and compatibility with sterilization processes. Advanced models integrate speed control, vibration reduction, and modular attachments.

Key Takeaways

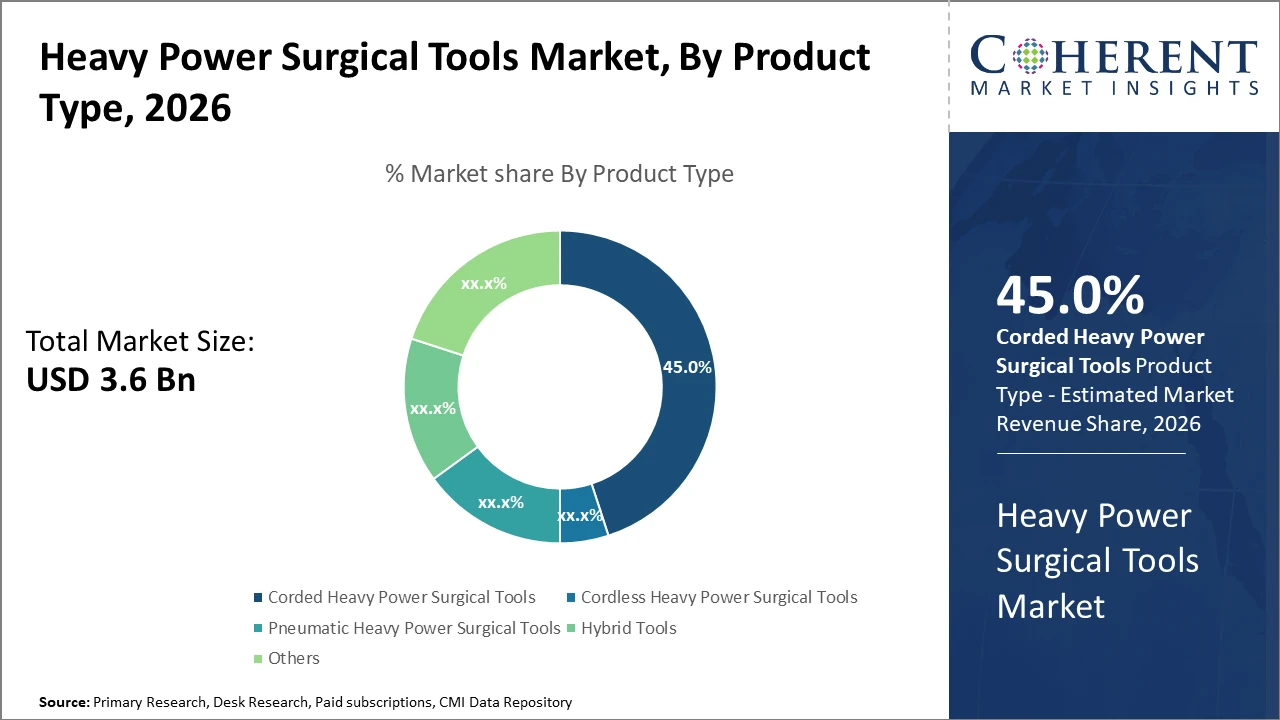

The Corded Heavy Power Surgical Tools segment retains its dominance due to its robustness and adaptability across varied surgical applications, while the Cordless Tools subsegment is the fastest growing, supported by technological advancements improving portability.

Orthopedic surgery remains the principal application segment, accounting for over 50% of the industry's revenue, driven by escalating surgical volume in developed economies.

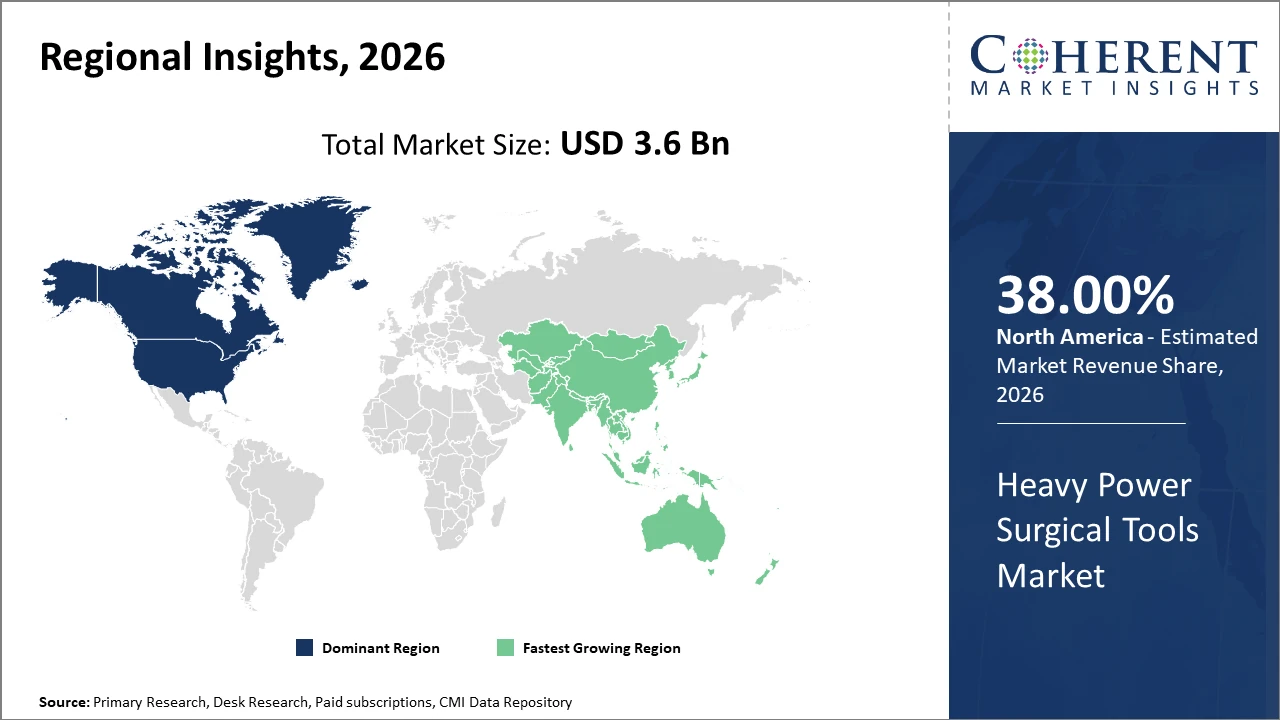

Regionally, North America holds the largest market share owing to its advanced healthcare ecosystem and investments in surgical innovations.

Meanwhile, Asia Pacific is the fastest-growing region with a CAGR surpassing 11%, fueled by expanding healthcare infrastructure and rising prevalence of musculoskeletal disorders.

Heavy Power Surgical Tools Market Segmentation Analysis

To learn more about this report, Download Free Sample

Heavy Power Surgical Tools Market Insights, By Product Type

Corded Heavy Power Surgical Tools lead due to their reliability and consistent power output, making them the preferred choice for complex procedures requiring precision and steady tool performance. Their robust design supports prolonged surgeries without downtime, which explains their dominance in hospital operating rooms globally. Meanwhile, Cordless Heavy Power Surgical Tools emerge as the fastest-growing subsegment, driven by continuous improvements in battery technology that enhance portability and user convenience. Pneumatic Heavy Power Surgical Tools, though gradually seeing reduced demand, still retain significance in institutions prioritizing lighter equipment. Hybrid Tools, with combined electric and pneumatic features, offer versatile applications, while Others include specialized or custom tools addressing niche surgical needs.

Heavy Power Surgical Tools Market Insights, By Application

Orthopedic Surgery remains the foremost application segment due to the rising aging population requiring joint replacements and trauma-related interventions. This segment’s dominance is also supported by increasing sports injuries and the incidence of bone diseases worldwide. Neurosurgery is the fastest-growing application subsegment, benefiting from technological advances enabling minimally invasive brain surgeries that rely on specialized power tools. General Surgery continues to represent a significant portion of market revenue due to its broad array of procedures requiring power instruments. Dental Surgery tools are gaining momentum, especially with advances in implantology and prosthetics, whereas Others comprise veterinary and niche surgical uses.

Heavy Power Surgical Tools Market Insights, By End-User

Hospitals command the largest share by virtue of handling the majority of complex and high-volume surgical cases requiring heavy power surgical tools. They invest substantially in upgrading surgical equipment to maintain high procedural standards. Ambulatory Surgical Centers are identified as the fastest-growing subsegment owing to the global shift towards outpatient surgeries requiring efficient and portable tools. Specialty Clinics are carving out niche spaces by focusing on targeted surgical interventions, while Others involve research institutions and teaching hospitals adopting heavy power tools for clinical trials and training.

Heavy Power Surgical Tools Market Trends

Recent market trends indicate a clear preference for cordless heavy power surgical tools, driven by enhanced battery technology and sterilization ease, exemplified by a 20% sales increase in the U.S. market during 2025.

Digital integration with surgical workflow software is also gaining traction, improving precision and procedure times in orthopedic and neurosurgeries globally.

Another notable trend is the rising demand for sustainable manufacturing processes, prompted by healthcare providers aiming to reduce carbon footprints, which influenced 2026 procurement patterns in Europe.

Heavy Power Surgical Tools Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Heavy Power Surgical Tools Market Analysis and Trends

In North America, the dominance in the Heavy Power Surgical Tools market is underpinned by a well-established healthcare infrastructure, robust R&D investments, and high public and private health expenditure. The region accounts for approximately 38% market share in 2026, supported by proactive adoption of cutting-edge surgical tools and favorable regulatory frameworks. Major U.S. and Canadian market players contribute significantly to technological innovation, influencing regional market revenue and business growth.

Asia Pacific Heavy Power Surgical Tools Market Analysis and Trends

Meanwhile, the Asia Pacific exhibits the fastest growth, with a CAGR exceeding 11%. This growth is driven by increased healthcare infrastructure development, rising incidence of orthopedic disorders, and expanding middle-class healthcare access. Government initiatives in countries like China and India, promoting domestic manufacturing and imports of advanced surgical tool,s further stimulate this expansion. The presence of several emerging heavy power surgical tools companies in Taiwan and South Korea also enhances the regional market scope.

Heavy Power Surgical Tools Market Outlook for Key Countries

USA Heavy Power Surgical Tools Market Analysis and Trends

The USA’s Heavy Power Surgical Tools market accounts for the largest share within North America due to strong hospital networks and substantial R&D investments. Hospitals across the U.S. increased capital expenditure on orthopedic tools by nearly 18% in 2025, reflecting heightened demand for next-generation surgical power tools. Companies like Medtronic and Stryker have introduced innovative cordless models tailored for complex surgeries, driving both market revenue and market growth strategies in the region. The presence of stringent regulatory standards also ensures that products maintain high quality and performance, further solidifying market confidence.

Germany Heavy Power Surgical Tools Market Analysis and Trends

Germany’s market stands as the largest in Europe, bolstered by advanced healthcare infrastructure and a high volume of orthopedic procedures. In 2026, orthopedic surgeries in Germany increased by 14%, signaling escalating demand for heavy power surgical tools. Leading European companies such as B. Braun and Aesculap have focused on precision engineering and smart tool integration to cater to Europe’s sophisticated surgical requirements. Government support for medical innovation and investments in hospital modernization enhance market revenue and supply chain resilience within the country.

Analyst Opinion

The rising adoption of battery-powered surgical tools over pneumatic models is reshaping the market landscape. In 2025, nearly 65% of new tool acquisitions in North American hospitals were battery-operated, reflecting a 20% increase over 2024, driven by their portability and ease of use. This transition is a critical supply-side indicator enhancing the industry's production capacity and pricing dynamics, allowing manufacturers to command premium pricing for advanced models.

Demand-side dynamics reveal that expanding applications across orthopedic surgeries contribute significantly to market growth. For example, data from a leading orthopedic hospital in Germany showed a 15% surge in the use of heavy power surgical tools in joint replacement surgeries between 2024 and 2026. This increasing use case diversity fuels market size expansion while also affecting imports of technologically sophisticated tools in regions like Asia Pacific.

Export volumes from top manufacturing hubs in East Asia climbed by 12% in 2025 compared to the previous year, reflecting strong global demand for high-quality surgical tools. Countries like China and Taiwan have ramped up production capacities to meet global needs, with focused investments from key market players enhancing output efficiency.

Pricing strategies have evolved amidst fluctuating raw material costs, especially for titanium and stainless grades essential in tool manufacturing. The market witnessed an average price increase of 3.5% in 2026, following a tight supply chain in late 2025 that affected production costs. These pricing trends, integral to market revenue forecasts, directly influence purchasing decisions in public and private healthcare facilities.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 3.6 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 9.8% | 2033 Value Projection: | USD 6.8 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Stryker Corporation, Zimmer Biomet, DePuy Synthes, Medtronic, Smith & Nephew, B. Braun Melsungen AG, Olympus Corporation, Conmed Corporation, Arthrex Inc. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Heavy Power Surgical Tools Market Growth Factors

The expansion of Heavy Power Surgical Tools is primarily driven by the escalating incidence of orthopedic and trauma-related surgeries, notably in aging populations with rising osteoporosis cases. Supporting this trend, WHO reports highlighted a 12% increase in orthopedic procedures globally between 2024 and 2026. Innovation in battery technology has enhanced tool performance and surgical efficiency, encouraging widespread adoption in emerging markets. Furthermore, government initiatives aimed at modernizing healthcare infrastructure, especially in Asia Pacific and North America, have significantly boosted capital expenditure, thereby stimulating demand. Lastly, the emergence of minimally invasive surgeries requiring specialized power tools propels market growth by enabling shorter operation times and better patient outcomes.

Heavy Power Surgical Tools Market Development

In January 2024, Paragon 28 launched the FJ2000 Power Console & Burr System, a specialized powered instrumentation platform designed to support minimally invasive foot and ankle surgical procedures. The system delivers precise, controlled bone resection with improved ergonomics and efficiency, enabling surgeons to perform complex corrections through smaller incisions while reducing operative time and soft tissue disruption.

In October 2023, Johnson & Johnson launched the VELYS Robotic-Assisted Solution for knee surgery in Europe, expanding access to its advanced orthopedic robotics platform outside the U.S. The system integrates real-time data, personalized surgical planning, and intraoperative guidance to enhance implant positioning accuracy and consistency in total knee arthroplasty, supporting improved clinical outcomes and workflow efficiency for orthopedic surgeons.

Key Players

Leading Companies of the Market

Stryker Corporation

Zimmer Biomet

DePuy Synthes

Medtronic

Smith & Nephew

B. Braun Melsungen AG

Olympus Corporation

Conmed Corporation

Arthrex Inc.

Several leading market players, including Stryker and Zimmer Biomet, have adopted aggressive growth strategies such as mergers and acquisitions to consolidate their market share, resulting in a 10% increase in combined revenue in 2025. Additionally, Medtronic's strategic investment in R&D for cordless surgical tool technology culminated in a 15% uplift in their Heavy Power Surgical Tools segment sales in North America during 2026.

Heavy Power Surgical Tools Market Future Outlook

The future of the heavy power surgical tools market is expected to be shaped by continued technological refinement and the increasing adoption of advanced surgical techniques. Integration with robotic-assisted surgery, navigation systems, and digital control interfaces is likely to enhance surgical precision and safety. Manufacturers are focusing on lightweight materials, modular tool designs, and improved battery-powered systems to increase flexibility in operating rooms. As surgical volumes rise due to aging populations and higher rates of musculoskeletal disorders, demand for reliable, high-performance power tools is expected to remain strong. Additionally, emerging markets are anticipated to contribute significantly to future growth as healthcare infrastructure improves.

Heavy Power Surgical Tools Market Historical Analysis

The heavy power surgical tools market has historically been driven by the growing complexity and volume of surgical procedures, particularly in orthopedics, trauma care, neurosurgery, and cardiothoracic surgery. Early surgical tools were manually operated, limiting precision, consistency, and surgeon endurance during lengthy procedures. The introduction of electric and pneumatically powered tools marked a major technological shift, enabling higher torque, improved cutting accuracy, and reduced procedure times. Over time, manufacturers focused on ergonomic design, vibration reduction, noise control, and sterilization compatibility to meet hospital standards. The expansion of orthopedic implant surgeries and trauma care worldwide significantly contributed to sustained demand for heavy power surgical tools.

Sources

Primary Research Interviews:

Orthopedic surgeons,

Neurosurgeons

surgical nurses

biomedical engineers

device manufacturers

Databases:

FDA Medical Device Database

WHO Surgical Care Data

OECD Health Statistics

GlobalData MedTech

Magazines:

Medical Device Network

Orthopedic Design & Technology

MedTech Dive

Surgical Products Magazine

Healthcare Business Today

Journals:

Journal of Orthopaedic Surgery

Journal of Neurosurgery

Medical Engineering & Physics

Clinical Orthopaedics and Related Research

BMJ Surgery

Newspapers:

Financial Times (Healthcare)

Reuters Health

The New York Times (Medical Technology)

The Guardian (Health)

Bloomberg Health

Associations:

American College of Surgeons

AdvaMed

Orthopaedic Research Society

European Society of Surgery

WHO

Share

Share

About Author

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients