Hdac Inhibitors Market Size and Forecast – 2025 – 2032

The Global Hdac Inhibitors Market size is estimated to be valued at USD 2.8 billion in 2025 and is expected to reach USD 5.6 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.7% from 2025 to 2032.

Global Hdac Inhibitors Market Overview

HDAC inhibitors are pharmaceutical compounds that regulate gene expression by blocking histone deacetylases, enzymes involved in chromatin remodeling. These products are primarily developed as anticancer therapeutics, targeting blood cancers like lymphomas and multiple myeloma, as well as solid tumors. Next-generation HDAC inhibitors are also being formulated for neurological disorders, rare genetic diseases, and combination therapies. They are available in oral tablets, capsules, and injectable formulations, often designed for selective inhibition of specific HDAC isoforms to reduce toxicity.

Key Takeaways

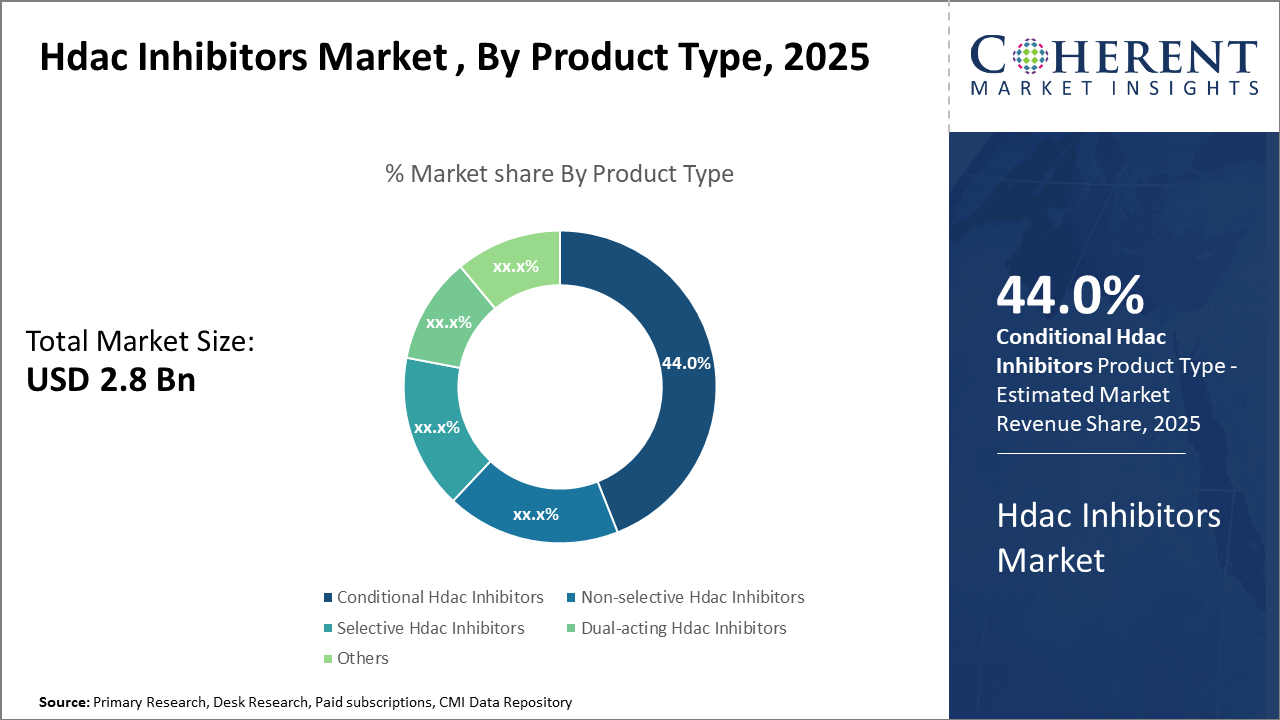

The Conditional Hdac Inhibitors segment commands a dominant industry share of 44%, leveraging its broad efficacy across oncological indications.

Oncology applications remain the most lucrative segment, driven by rising cancer incidence and expanded clinical approval of HDAC inhibitors.

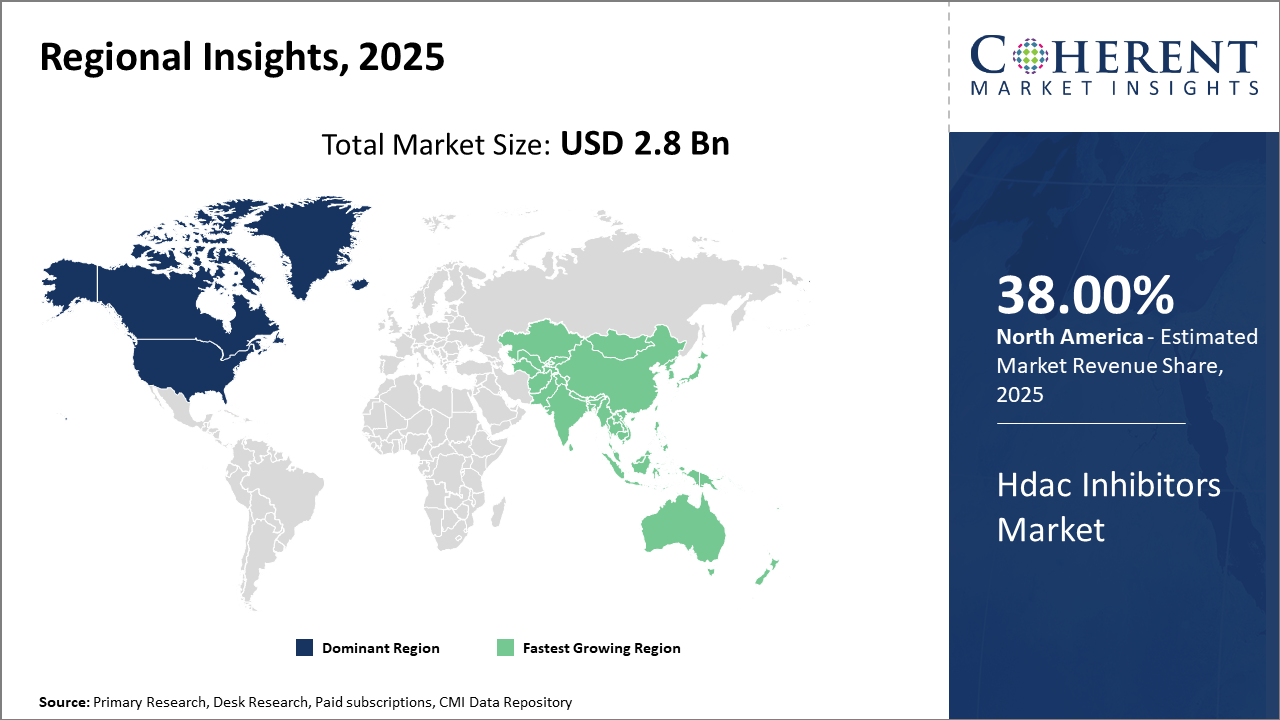

North America leads the market in terms of market revenue, underpinned by strong pharmaceutical infrastructure and progressive regulatory frameworks.

Asia Pacific emerges as the fastest-growing region, particularly driven by expanding healthcare infrastructure in China and India, with an estimated CAGR surpassing 12% from 2025 onward.

Hdac Inhibitors Market Segmentation Analysis

To learn more about this report, Download Free Sample

Hdac Inhibitors Market Insights, By Product Type

In terms of product type, the Conditional Hdac Inhibitors dominate the market share with 44%, primarily due to their broad-spectrum efficacy in cancer applications and favorable safety profile compared to non-selective counterparts. This segment benefits from strong pipeline developments and several blockbuster drugs driving market revenue and business growth. The fastest-growing subsegment is Selective Hdac Inhibitors, gaining traction due to a rising shift toward isoform-specific targeting, which minimizes adverse reactions and improves patient adherence.

Hdac Inhibitors Market Insights, By Application

Oncology holds the dominant position in market share, driven by extensive clinical adoption of Hdac inhibitors in treating hematologic and solid tumors. The focus on hematologic cancers such as multiple myeloma and lymphomas fuels consistent growth, supported by several FDA approvals and positive clinical outcomes, enhancing market revenue streams. Neurological Disorders represent the fastest-growing subsegment, propelled by recent breakthroughs in treating Alzheimer’s disease and psychiatric illnesses using Hdac inhibitors, with ongoing phase II and III trials indicating significant therapeutic potential.

Hdac Inhibitors Market Insights, By End-User

Hospitals & Clinics dominate market share, attributed to direct patient treatment demand and adoption of Hdac inhibitor therapies in mainstream oncology and neurology departments. The large patient base and established healthcare delivery systems in developed regions underpin this dominance. Research Laboratories are the fastest-growing subsegment, fueled by intensified R&D activities exploring novel Hdac inhibitor compounds and combination therapies, supported by increasing funding and academic collaborations.

Hdac Inhibitors Market Trends

Market trends in Hdac inhibitors focus largely on targeted drug innovation and expanding therapeutic applications.

The increasing integration of Hdac inhibitors with immunotherapy regimens has proven influential, with patient response rates improving dramatically, as seen in recent lymphoma clinical trials.

Drug delivery enhancements, including nanotechnology-based vectors, are optimizing drug efficacy and reducing systemic toxicity, reflecting a major paradigm shift in treatment approaches.

Advances in genomic research are also facilitating precise patient stratification, which directly affects market segmentation and clinical success rates.

Hdac Inhibitors Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Hdac Inhibitors Market Analysis and Trends

In North America, dominance in the Hdac Inhibitors market is attributed to robust healthcare infrastructure, higher R&D expenditure, and proactive regulatory frameworks that streamline drug approvals. The region accounts for approximately 38% market share, with the U.S. spearheading innovation through leading pharmaceutical companies and clinical trial activities. FDA approvals have accelerated new product launch timelines, enhancing business growth and industry revenue significantly.

Asia Pacific Hdac Inhibitors Market Analysis and Trends

The Asia Pacific exhibits the fastest growth, fueled by expanding healthcare access, increasing government support for biotech development, and rising prevalence of target diseases. A CAGR of over 12% is anticipated due to growing demand in China and India. Significant investment from multinational companies establishing regional hubs further propels growth, complementing increasing clinical trial activities and patient populations.

Hdac Inhibitors Market Outlook for Key Countries

USA Hdac Inhibitors Market Analysis and Trends

The USA market is the largest contributor to market revenue, supported by strategic partnerships and comprehensive clinical research advancing Hdac inhibitor portfolios. Companies such as Novartis and Bristol-Myers Squibb have introduced innovative therapies and combination regimens that have gained rapid adoption from oncologists. The presence of advanced healthcare infrastructure, coupled with high healthcare expenditure also fosters the adoption of specialized therapies. Regulatory approvals have expedited market access, and increasing patient awareness drives business growth, particularly in hematologic malignancies and neurological disorder segments.

China Hdac Inhibitors Market Analysis and Trends

China’s market is rapidly expanding due to the government's focus on biotech innovation and drug accessibility reforms. The country benefits from significant R&D investment and the establishment of pharmaceutical manufacturing facilities by leading market players, enhancing supply chain efficiency. Increasing cancer and neurodegenerative disorder incidence rates have led to growing demand for Hdac inhibitors. Moreover, China’s evolving regulatory environment facilitates quicker approvals, further boosting market revenue and industry trends. Local collaborations with global firms continue to advance innovation and market presence.

Analyst Opinion

Capitalizing on expanding oncology applications is a driving force for Hdac inhibitors. Cancer treatments using Hdac inhibitors such as vorinostat and panobinostat reported a combined market revenue growth of over 14% in 2024 alone, underscoring increasing clinical adoption. For instance, the U.S. FDA approval of new Hdac inhibitor formulations in late 2023 boosted treatment accessibility, contributing significantly to market share expansion.

Emerging indications in neurodegenerative and mental disorders are reshaping demand dynamics. The uptake of Hdac inhibitors targeting Alzheimer’s disease and depression demonstrated promising clinical trial results in 2024, adding diversity to market revenue streams. A phase III study showcased a 20% improvement in cognitive function, underlining the therapeutic potential and driving market growth strategies.

Pricing pressures amid increasing competition in generic Hdac inhibitor formulations have led to refined market growth strategies, focusing on value-based pricing and patient access programs. In China and South Korea, government-led price regulation reforms implemented in early 2025 have caused slight shifts in market share distribution, prompting companies to enhance cost-efficiency and patient outreach.

Supply chain optimization through regional manufacturing hubs in North America and Europe has strengthened industry share by reducing lead times and cost overheads. Notably, localized API (Active Pharmaceutical Ingredient) production in the U.S. increased by 18% in 2024, enhancing supply-side resilience and supporting sustained growth in global market revenue.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 2.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 10.7% | 2032 Value Projection: | USD 5.6 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Novartis AG, Bristol-Myers Squibb, Roche Holding AG, Pfizer Inc., Merck & Co., Inc., AbbVie Inc., Takeda Pharmaceutical Company Limited, Sanofi S.A., Janssen Pharmaceuticals, Epizyme, Inc., Celleron Therapeutics, Spectrum Pharmaceuticals. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Hdac Inhibitors Market Growth Factors

The Hdac Inhibitors Market growth is being propelled by several key factors: increasing global prevalence of cancers, notably hematologic malignancies and solid tumors, is generating robust demand; for example, in 2024, new cancer incidences rose by 3.8% globally, directly influencing Hdac inhibitor prescriptions. Advances in personalized medicine and molecular diagnostics enable tailored HDAC inhibitor therapies, contributing to better clinical outcomes and growing user acceptance. Regulatory approvals of HDAC inhibitors for expanding indications such as multiple myeloma and T-cell lymphoma have broadened the therapeutic scope, as witnessed by over five FDA approvals between 2023 and 2025. Furthermore, surging R&D investments from pharmaceutical companies, averaging a 15% annual increase since 2023, have accelerated the pipeline of innovative HDAC inhibitors, amplifying market revenue prospects.

Hdac Inhibitors Market Development

In March 2024, the U.S. Food and Drug Administration (FDA) approved Duvyzat (givinostat), an oral histone deacetylase (HDAC) inhibitor, for the treatment of Duchenne Muscular Dystrophy (DMD) in patients aged 6 years and older. This approval marked the first HDAC inhibitor authorized for a neuromuscular disorder, broadening the scope of HDAC inhibitors beyond oncology.

In January 2025, the European Commission granted marketing authorization for Duvyzat (givinostat) for the treatment of Duchenne Muscular Dystrophy across the European Union. This milestone expanded the availability of givinostat to patients in Europe, positioning it as a key therapy in the rare disease space.

Key Players

Leading companies include:

Bristol-Myers Squibb

Roche Holding AG

Pfizer Inc.

Merck & Co., Inc.

AbbVie Inc.

Takeda Pharmaceutical Company Limited

Sanofi S.A.

Janssen Pharmaceuticals

Epizyme, Inc.

Celleron Therapeutics

Spectrum Pharmaceuticals

Competitive strategies across these market players revolve around innovation-led product development and strategic partnerships. For instance, Novartis’s recent collaboration with a biotech firm in 2024 to co-develop next-generation selective HDAC inhibitors has expanded its oncology portfolio, yielding a 12% revenue uplift. Similarly, Bristol-Myers Squibb’s focus on market penetration through enhanced patient access programs in emerging markets has notably increased its market share in the Asia Pacific.

Hdac Inhibitors Market Future Outlook

In the coming years, HDAC inhibitors are likely to evolve in several directions. First, we will see more isoform-selective or tissue-selective agents (minimizing side effects by targeting specific HDAC classes). Second, greater integration with combination regimens (e.g., with immune checkpoint inhibitors, targeted therapies, or gene therapies) is expected, particularly in oncology. Third, the neurology / CNS space may see breakthroughs if compounds achieve sufficient brain penetration and safety margins, possibly enabling treatment for neurodegenerative or neuroinflammatory diseases. Finally, precision medicine approaches (biomarker-driven patient selection) may drive improved response rates and reposition HDAC inhibitors more successfully.

Hdac Inhibitors Market Historical Analysis

HDAC (histone deacetylase) inhibitors emerged originally in oncology, targeting epigenetic regulation in cancers such as T-cell lymphomas, multiple myeloma, and solid tumors. Over the past decade, they expanded into other therapeutic areas, including neurology (e.g., Huntington’s disease, Alzheimer’s) and rare genetic disorders (e.g., muscular dystrophies). Early molecules had limitations (off-target toxicity, limited specificity, poor brain penetration), which spurred the development of next-generation, isoform-selective inhibitors, brain-penetrant compounds, and combination strategies (pairing HDAC inhibitors with immunotherapy or targeted agents). Clinical successes have been modest and incremental, with careful balancing of efficacy and safety being key.

Sources

Primary Research interviews:

Endocrinologists

Oncology Researchers

Pharmaceutical R&D Specialists

Clinical Trial Investigators

Databases:

NCBI

PubMed

ClinicalTrials.gov

WHO Database

Magazines:

Nature Reviews Drug Discovery

Pharmaceutical Executive

BioCentury

PharmaVoice

Journals:

Journal of Clinical Oncology

Epigenetics

Molecular Cancer Therapeutics

Cancer Research

Newspapers:

The New York Times

The Guardian

Economic Times

The Washington Post

Associations:

International Society for Epigenetics

ESMO

European Society for Medical Oncology

Share

Share

About Author

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients