Global Green And Bio Polyols Market Overview

Polyol is a type of alcohol which contains multiple hydroxyl groups. Green polyols are derived from polyurethanes and polyethylene terepthalate. Bio polyols or Natural oil polyols (NOPs) are derived from oils such as canola oil, castor oil, coconut oil, corn oil, rapeseed oil, palm oil, and soya bean oil. Increasing cost of petrochemical feedstock, public desire, and regulatory pressure for environment friendly products, which reduce the carbon footprint are the major growth drivers of green and bio polyols market.

The demand for green and bio polyols is majorly due to its requirement in several industries such as packaging, construction, automotive, furniture, and bedding. Green and bio polyols are mainly utilized for the synthesis of polyurethane, which is further used for making coatings and foam. Furniture and construction industry is expected to increase the growth of green and bio polyols.

Green and Bio Polyols Market Size and Forecast – 2025 – 2032

The Green and Bio Polyols Market size is estimated to be valued at USD 2.3 billion in 2025 and is expected to reach USD 5.8 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 13.8% from 2025 to 2032.

Key Takeaways

The flexible polyurethane foam segment holds dominant market share, driven by robust demand in automotive and furniture sectors, representing nearly 42% of market revenue.

Meanwhile, castor oil-based polyols remain the preferred sub segment in type classification, accounting for 38% of industry share predominantly due to their favorable chemical properties and sustainability credentials.

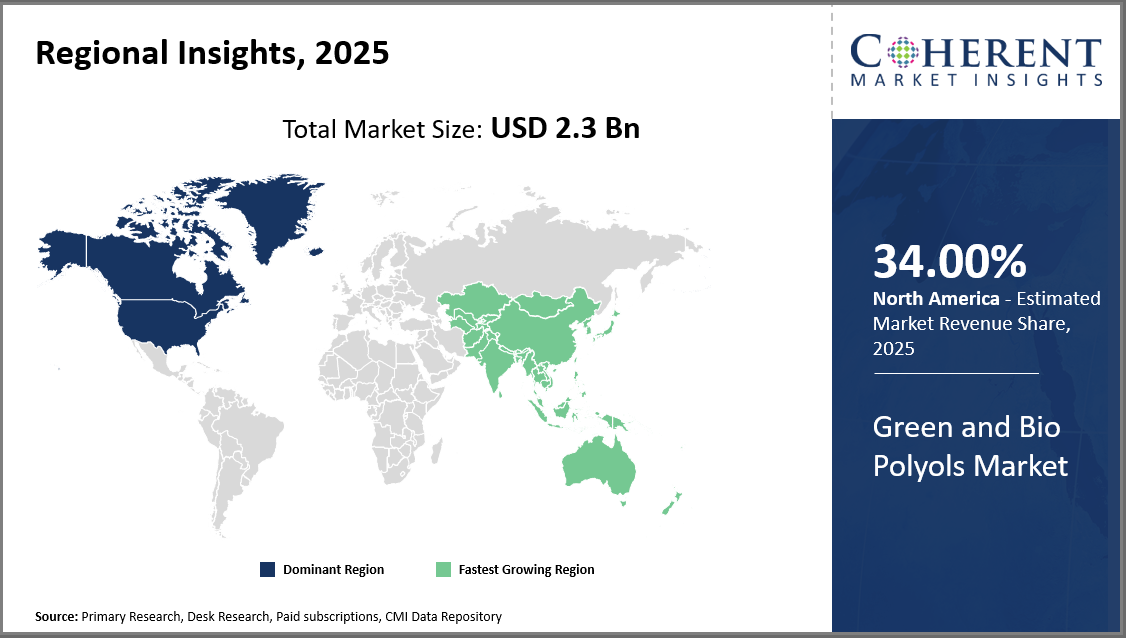

North America commands a significant industry share of 34%, supported by stringent environmental regulations and a robust automotive sector.

The Asia Pacific is the fastest-growing region with a CAGR exceeding 15%, fueled by increasing construction activities and government incentives promoting biopolymers in China and India.

Europe also exhibits strong growth potential with rising investments in bio-based chemical manufacturing infrastructure and favorable trade policies.

Green and Bio Polyols Market – Segmentation Analysis

To learn more about this report, Download Free Sample

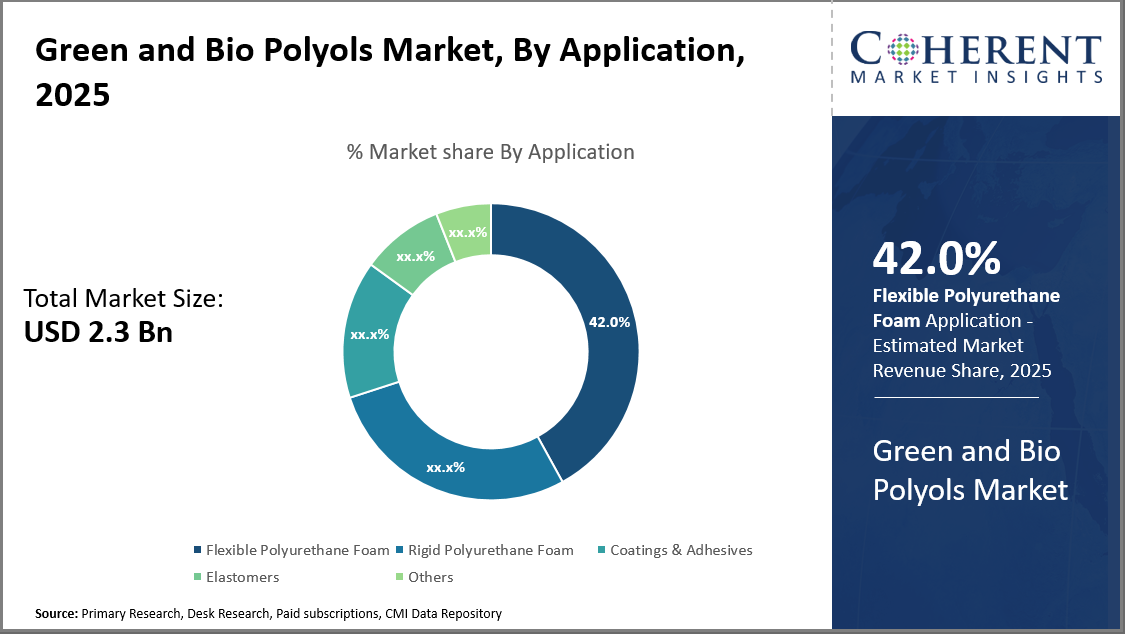

Analysis of the Green and Bio Polyols Market, By Application

According to application, the market is divided into Coatings & Adhesives, Flexible Polyurethane Foam, Rigid Polyurethane Foam, Elastomers, and Others. At 42.0%, Flexible Polyurethane Foam holds the largest market share. Its widespread use in the bedding, furniture, and automobile industries which value durability and lightweight cushioning in addition to eco-friendly profiles is what has led to its domination.

Analysis of the Green and Bio Polyols Market, By Type

The Green and Bio Polyols market is segmented into Castor Oil-Based Polyols, Soybean Oil-Based Polyols, Palm Oil-Based Polyols, and Others, among which Castor Oil-Based Polyols dominate target market due to their superior hydroxyl functionality and consistent renewable sourcing, making them highly suitable for flexible foam and coating applications.

Analysis of the Green and Bio Polyols Market, By End-Use Industry

The end-use segments include Automotive, Construction, Furniture, Footwear, Packaging, and Others, with Automotive leading due to stringent emission norms and vehicle light weighting efforts that raised bio-polyol demand capturing a significant market share.

Green and Bio Polyols Market Insights, By Geography

To learn more about this report, Download Free Sample

Green and Bio Polyols Market Analysis and Trends in North America

Strong environmental regulations, the high demand for sustainable materials in the automobile industry, and advanced manufacturing infrastructure are the main factors driving North America's market dominance in green and biopolyols. Supported by strong industry partnerships encouraging the adoption of bio-based polymers and regulatory frameworks like the U.S. EPA's push for sustainable chemicals, where the region has around 34% of the overall market share. This region is home to important activities for well-known businesses like Covestro AG and Huntsman Corporation, which support technical innovation and demand creation.

Analysis and Trends of the Asia Pacific Green and Bio Polyols Market

As a result of rising building activity, rapid urbanization, and government incentives supporting the production of green chemicals, particularly in China and India, the Asia Pacific region is growing at the highest rate, with a compound annual growth rate (CAGR) of over 15%. Local businesses are making significant investments in the manufacturing of bio-based polyol in order to satisfy both domestic and international demand. Market dynamics in this region are further accelerated by initiatives promoting circular economy principles in nations such as South Korea and Japan.

Green and Bio Polyols Market Outlook for Key Countries

United States Green and Bio Polyols Market Analysis and Trends

Government policies supporting sustainable materials and top polyurethane producers incorporating bio-based polyols into their product ranges are driving the US market. Adoption of vehicle insulation foams increased by more than 20% in 2024 as a result of OEM pledges to become carbon neutral. In order to develop next-generation bio-polyols, major industry participants are establishing partnerships and growing their manufacturing facilities. Favorable trade policies and the availability of a large supply of agricultural feedstocks assist this expansion by allowing for competitive pricing that raises the nation's market revenue and industry share. Furthermore, utilization in construction applications has increased due to the rise in green building certifications like LEED.

Green and Bio Polyols Trends and Market Analysis in Germany

Germany continues to lead Europe in the Green and Bio Polyols industry thanks to its strong R&D focus and integration of cutting-edge catalytic technology. Manufacturers are forced to transition to bio-based polyols due to the nation's strict environmental rules, especially in the appliance and automotive industries. Feed Acid is among the innovative products further supporting Germany’s dynamic approach, strengthening its industrial and sustainability leadership.

Increases in German production capacity in 2024 improved supply stability by 18%, which aided in the expansion of exports to European markets. Leading businesses like BASF SE and Evonik Industries AG use alliances and strategic investments to anchor local market dynamics. Germany is able to maintain its leading market share in Europe because to industrial regulations that support the circular economy and the use of renewable carbon.

Analyst Opinion

Pricing Dynamics and Supply Constraints: The supply of feedstock, which is mostly derived from agricultural byproducts, fluctuates, which affects the price power of green and bio polyols. A spike in vegetable oil prices in 2024 raised the cost of raw materials by almost 8%, which had an effect on downstream pricing tactics. By 2026, though, feedstock diversification breakthroughs like the introduction of lignin-based polyols should stabilize supply and lower volatility.

Demand Diversification across End-Use Industries: In addition to their insulating and lightweighting properties, bio-based polyols are becoming more and more popular in the building and automotive industries. The market for green polyols increased by 22% in 2025 as a result of automotive insulating foams, indicating rising consumer and governmental push for low-emission automobiles. Additionally, the growing use of bio-polymers in flexible foams has encouraged application diversity and increased import quantities in Asia Pacific by 15% annually.

Import-Export Dynamics and Regional Trade Flows: Export orders from North American and European regions to developing countries rose by 18% in 2024, indicating a strong cross-border trade focus on sustainable raw materials. Price arbitrage between regions, driven by tariff relaxations in Southeast Asia, has incentivized producers to optimize logistics and volume exports, boosting market share consolidation among key players.

Production Capacity Expansion and Technological Upgrades: The ongoing capacity expansion in bio polyols production facilities, especially in China and Germany, has enhanced the overall market supply by 20% since 2023. New-generation catalytic processes yielding higher hydroxyl values with lower energy consumption are also improving product quality and cost efficiency, supporting a more competitive market landscape into 2025 and beyond.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 2.3 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 13.8% | 2032 Value Projection: | USD 5.8 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Covestro AG, BASF SE, Dow Inc., Huntsman Corporation, Evonik Industries AG, Stepan Company, Vencorex, Oleon, Emery Oleochemicals, Perstorp Holding AB | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Growth factors

The market expansion for green and biopolyols is supported by a number of important growth drivers. Makers of polyurethane have been encouraged to transition to bio-based polyols by favorable environmental rules in North America and Europe that require reductions in lifecycle greenhouse gas emissions. The use of bio-based rigid foam in insulation applications increased by 30% in 2024 due to consumer demand for environmentally friendly building materials.

Producers are now able to overcome prior pricing constraints in the market owing to improvements in enzymatic catalytic procedures, which have made the manufacturing of bio-polyol more affordable and scalable. Apart from this, the bio-based polyols' compatibility with current polyurethane manufacturing lines makes industry adoption simple and supports expansion in the furniture and automotive industries, where sustainability and lightweighting are top priorities.

Green and Bio Polyols Market Development

Market Trends

The market trend is increasingly pivoting towards the integration of lignin-derived polyols, anticipated to capture a larger share due to its abundant availability and superior thermal properties.

In 2025, a 25% surge in R&D investments toward lignin polyols reflects the growing interest from producers aiming to diversify feedstock beyond traditional vegetable oils.

Additionally, digitalization in supply chain management is improving feedstock traceability and sustainability verification, which large OEMs emphasize to comply with circular economy mandates.

The bio-circular polyols segment's rapid adoption in flexible foam applications for automotive seat cushioning is another notable market shift.

Key Players

Covestro AG

BASF SE

Dow Inc.

Huntsman Corporation

Evonik Industries AG

Stepan Company

Vencorex

Emery Oleochemicals

Perstorp Holding AB

Strategic capacity ramp-ups and collaborations to create polyols produced from castor oil and lignin are examples of competitive tactics used by industry participants. For example, in 2024, Covestro and Oleon formed a joint venture that allowed Oleon to scale the purchase of renewable feedstock, which reduced production costs by 12% and increased market penetration in Europe and Asia.

Future Market Prospects for Green and Bio Polyols

The market for green and biopolyols is expected to increase significantly in the future as a result of global environmental initiatives and a trend toward renewable materials in several industries. As consumer awareness, government incentives, and regulatory laws fuel demand for eco-friendly substitutes for petroleum-based polyols, further impetus is anticipated. This market will gain from widespread use in industries including construction, automotive, furniture, packaging, and bedding, where producers are favoring bio-based materials more and more in an effort to lower carbon emissions and advance circular economy principles.

The adaptability and competitiveness of green and bio polyols are expected to be strengthened by sustained investments in R&D as well as improvements in product performance and production technology. To support sustainability goals and meet changing market demands, industry participants are concentrating on growing applications, developing new ways to get raw materials, and stepping up partnerships. All things considered, the market is expected to continue on its strong trajectory as long as industries emphasize environmentally friendly solutions for the future.

Historical Analysis

For instance, in October 2018, Covestro launched thermoplastic polyurethanes (TPU) containing polyether carbonate polyols based on CO2 technology. This new product lowered carbon footprint more than conventional ones, and helped close the carbon cycle. This new product helped Covestro to expand its product portfolio in the global market.

In March 2016, Mitsui Chemicals & SKC Polyurethanes’ (MCNS) formed a new joint venture for manufacturing bio-polyol and a joint venture called Vithal Castor Polyols (VCP), in India. VCP manufactured bio polyols castor oil with an annual capacity of 8,000 tonnes.

For instance, in August 2015, BASF SE launched a new bio-based Polyol for Volatile Organic Compound (VOC) free* 2K Polyurethane applications. The product was sold under the name Sovermol. This new product helped BASF SE to expand its product portfolio in the global market.

For instance, in May 2017, Cargill Inc. acquired Arkansas (U.S.) based BioBased Technologies. BioBased Technologies manufactured soybean-based polyols to create more sustainable products for their consumers. This acquisition strengthened its portfolio into applications beyond the foam market, such as elastomers, sealants, coatings, binders and adhesives.

Sources

Primary Research interviews:

Manufacturers of polyols (bio-based & green)

Raw material suppliers (natural oils, CO???-based feedstocks, biomass processors)

Polyurethane producers (foams, coatings, adhesives)

Databases:

ScienceDirect

SpringerLink

Wiley Online Library

Magazines:

Urethanes Technology International

Chemical Weekly

ICIS Chemical Business

Journals:

Industrial Crops and Products

Polymer Degradation and Stability

Green Chemistry

Newspapers:

The Hindu Business Line

Financial Times

The Wall Street Journal

Associations:

American Chemistry Council (ACC)

Polyurethane Manufacturers Association (PMA)

Center for the Polyurethanes Industry (CPI)

Share

Share

About Author

Kalpesh Gharte is a senior consultant with approximately 5 years of experience in the consulting industry. Kalpesh holds an MBA in Operations and Marketing Management, providing him with a strong foundation in market strategy and analysis. He has contributed to various consulting and syndicated reports, delivering valuable insights that support informed business decisions

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients