Global Medical Imaging Devices Market Size and Forecast – 2026 – 2033

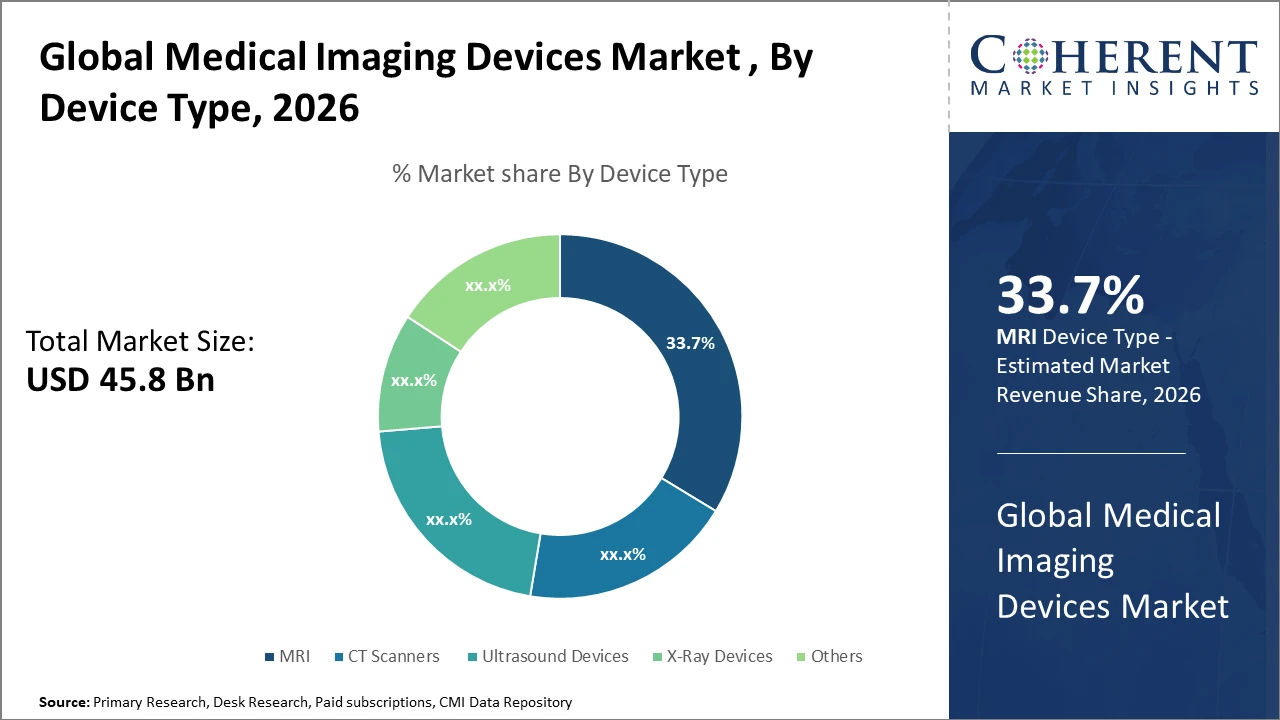

The Global Medical Imaging Devices Market is estimated to be valued at USD 45.8 billion in 2026 and is expected to reach USD 74.3 billion by 2033, growing at a compound annual growth rate (CAGR) of 7.4% from 2026 to 2033.

Global Global Medical Imaging Devices Market Competitive Overview

The global medical imaging devices market plays a vital role in modern healthcare by enabling accurate diagnosis, disease monitoring, and treatment planning. It includes technologies such as X-ray, ultrasound, MRI, CT, and nuclear imaging systems used across multiple clinical applications. Market growth is driven by the rising prevalence of chronic diseases, an aging population, increasing demand for early diagnosis, and continuous technological advancements such as AI-enabled imaging and portable devices. Expanding healthcare infrastructure and growing adoption in emerging economies further support sustained market expansion worldwide.

Key Takeaways

The Magnetic Resonance Imaging segment dominates the market with a 33.7% share, supported by continuous technological advancements and wide-ranging clinical applications.

Hospitals remain the leading end users due to significant investments in healthcare infrastructure and equipment upgrades.

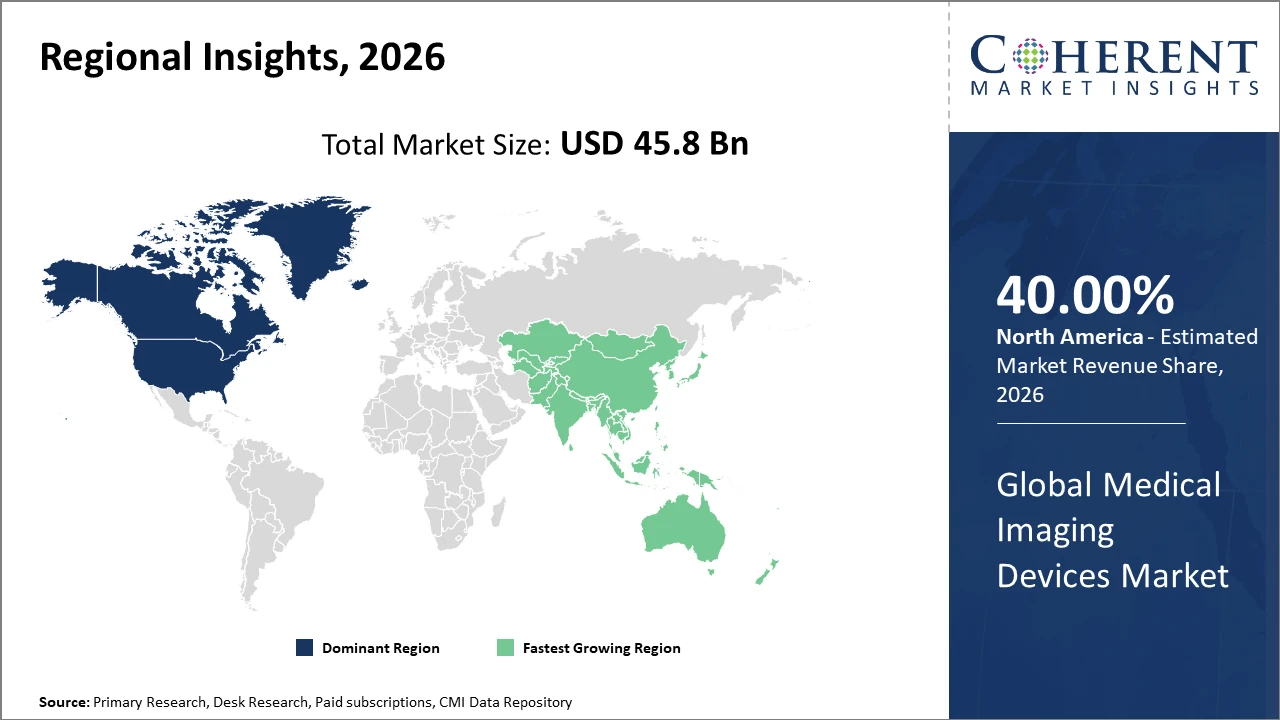

North America holds the largest market share, supported by a mature healthcare system, favorable reimbursement policies, and the presence of major industry players.

Asia Pacific is the fastest growing regional market, fueled by rising healthcare spending, expanding hospital networks, and rapid adoption of advanced imaging technologies in China and India.

Europe continues to experience steady growth, driven by advanced medical infrastructure and strong focus on innovation.

Global Medical Imaging Devices Market Segmentation Analysis

To learn more about this report, Download Free Sample

Global Medical Imaging Devices Market Insights, By Device Type

Among these, Magnetic Resonance Imaging (MRI) dominates the market with a 33.7% share, driven by continuous advancements in high-field and ultra-high-field MRI systems that enhance soft-tissue contrast and diagnostic accuracy, particularly in neurology and oncology. Computed Tomography (CT) scanners represent the fastest growing subsegment, supported by innovations in low-dose radiation technologies and faster scan times, which are especially valuable in emergency and trauma diagnostics. Ultrasound devices are steadily gaining adoption due to their portability, cost-effectiveness, and non-invasive nature, particularly in outpatient settings. X-ray systems remain essential for routine imaging, while other modalities, including mammography and fluoroscopy, address specialized diagnostic requirements.

Global Medical Imaging Devices Market Insights, By Application

Oncology accounts for the largest market share, driven by the rising incidence of cancer and the growing need for advanced imaging solutions to enable accurate tumor detection, characterization, and treatment planning. The oncology segment increasingly benefits from hybrid imaging technologies such as PET/CT and MRI/PET, which deliver combined metabolic and anatomical insights. Cardiology represents the fastest growing application subsegment, supported by increasing cardiovascular disease burden and technological advances in cardiac MRI and CT angiography that improve vascular visualization. Neurology and orthopedics continue to experience steady growth due to higher diagnostic and procedural volumes for neurodegenerative and musculoskeletal conditions. Other applications include gastrointestinal and respiratory imaging.

Global Medical Imaging Devices Market Insights, By End-User

Hospitals continue to dominate the medical imaging devices market due to their extensive infrastructure and broad range of multi-specialty services that support comprehensive diagnostic imaging needs. Diagnostic centers represent the fastest growing end-user subsegment, driven by their cost-effectiveness, patient convenience, and ability to attract high outpatient volumes, encouraging rapid adoption of portable and digital imaging technologies. Ambulatory surgical centers show moderate growth, supported by increasing minimally invasive procedures that require intraoperative imaging support. The others category includes research institutes and academic centers that invest in advanced imaging modalities to support clinical research, trials, and technological innovation.

Global Medical Imaging Devices Market Trends

Integration of AI-driven image analysis is streamlining diagnostic workflows and reducing human error across imaging modalities.

In 2026, AI-assisted diagnostics in oncology imaging improved early tumor detection rates by approximately 15% in pilot hospitals across Europe.

Hybrid imaging systems combining PET and CT are transforming cancer staging and treatment monitoring by delivering both metabolic and anatomical insights.

Adoption of PET/CT systems in the Asia Pacific region surged by around 20% in 2025, reflecting strong regional demand for advanced oncology diagnostics.

A growing shift toward outpatient imaging centers, driven by cost efficiency and patient convenience, is reshaping utilization patterns and market demand.

These trends highlight the ongoing evolution of imaging technologies aligned with modern healthcare delivery models.

Global Medical Imaging Devices Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Global Medical Imaging Devices Market Analysis and Trends

In North America, leadership in the medical imaging devices market is supported by well-established healthcare infrastructure, strong regulatory systems, and high per capita healthcare spending. The United States accounts the prominent share, driven by rapid adoption of AI-enabled imaging technologies and extensive hospital networks equipped with advanced devices. Favorable reimbursement structures and substantial investments in research and development further strengthen market growth. Major industry players such as Philips and GE Healthcare play a pivotal role through continuous innovation, strategic collaborations, and new product launches that shape regional market dynamics.

Asia Pacific Global Medical Imaging Devices Market Analysis and Trends

Asia Pacific represents the fastest growing region in the medical imaging devices market, recording a CAGR exceeding 9%, driven by rapid expansion of healthcare infrastructure, supportive government initiatives, and the rising burden of chronic diseases. Countries such as China and India play a crucial role, with China’s government healthcare spending increasing by nearly 13% annually through 2026. Accelerated urbanization and improved access to advanced medical technologies are further boosting market penetration. Regional manufacturers such as Mindray Medical International and Samsung Medison are strengthening growth by offering cost-effective, locally adapted solutions and expanding their distribution networks across emerging markets.

Global Medical Imaging Devices Market Outlook for Key Countries

USA Global Medical Imaging Devices Market Analysis and Trends

The USA continues to lead the medical imaging devices market, supported by advanced healthcare infrastructure and favorable reimbursement policies. In 2025, AI-enabled imaging devices accounted for over 25% of total MRI and CT shipments, improving diagnostic accuracy and operational efficiency. Major players like GE Healthcare and Siemens Healthineers expanded their portfolios to meet diverse clinical needs, reinforcing their market dominance. Additionally, government investment in digital health initiatives increased by 14% in 2025, promoting the adoption of next-generation imaging technologies across hospitals and diagnostic centers nationwide.

India Global Medical Imaging Devices Market Analysis and Trends

India’s medical imaging devices market is growing rapidly, driven by rising public and private investments in healthcare infrastructure and a large population affected by chronic diseases such as cardiovascular conditions and cancer. In 2026, demand for ultrasound and portable imaging systems increased by 20%, particularly in tier-2 and tier-3 cities. Local manufacturers like Mindray Medical, along with collaborations with international companies, have accelerated technology adoption. Regulatory relaxations and the expansion of telemedicine are further supporting the use of advanced imaging devices in rural areas, highlighting significant market potential.

Analyst Opinion

The demand for portable and point-of-care imaging devices is rising, driven by the growth of outpatient care and home healthcare services. In 2024, portable ultrasound shipments increased by 18% YoY, highlighting the need for bedside diagnostics in emergency units and rural healthcare facilities, supporting market revenue growth and focus on smaller form-factor imaging equipment.

Advanced imaging modalities, including 3D and 4D technologies, are expanding market share by enabling detailed anatomical visualization. MRI systems with 3T strength saw a 12% increase in installations across tier-1 U.S. hospitals in 2025, particularly in neurology and oncology, boosting innovation-driven market strategies.

Regulatory approvals and reimbursement policies significantly influence market dynamics. Enhanced reimbursement for digital imaging in North America and Europe increased utilization rates by over 15% from 2024 to 2026, encouraging investments and shaping competitive landscapes.

Supply-side challenges, such as semiconductor shortages in early 2024, affected manufacturing and pricing. Recovery by Q3 2025 improved supply chain efficiency, allowing production to scale by 9% and stabilize prices, highlighting the balance between demand and supply in recent years.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 45.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 7.4% | 2033 Value Projection: | USD 74.3 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: |

|

||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Global Medical Imaging Devices Market Growth Factors

Key growth drivers for the medical imaging devices market include the rising prevalence of chronic diseases, which increases demand for accurate diagnostic imaging and advanced devices. Global investments in healthcare infrastructure, especially in emerging economies, are supporting hospital modernization and wider adoption of cutting-edge imaging technologies. The integration of AI and machine learning into imaging systems enhances diagnostic accuracy and patient throughput, further encouraging adoption. Additionally, regulatory support in developed markets, through improved reimbursement schemes and faster device approvals, drives business growth. For example, North America saw a 12% increase in government funding for digital health technologies in 2025, positively impacting the sector.

Global Medical Imaging Devices Market Development

In January 2026, iSono Health announced the commercial launch of its wearable breast ultrasound system designed for women’s health applications.

In September 2025, Tata Elxsi announced the inauguration of the Bayer Development Centre in Radiology at its Pune, India facility, established to co-develop advanced radiology devices and technologies with Bayer to support early, accurate diagnosis and treatment of critical illnesses worldwide.

Key Players

Leading Companies of the Market

GE Healthcare

Siemens Healthineers

Philips Healthcare

Canon Medical Systems

Fujifilm Holdings Corporation

Hitachi Medical Corporation

Samsung Medison

Carestream Health

Shimadzu Corporation

Esaote SpA

Several leading companies are prioritizing product innovation and strategic collaborations to strengthen their market presence. For instance, Siemens Healthineers launched an AI-powered MRI suite in 2025, improving imaging precision and workflow efficiency, which increased its installed base by 14% in the U.S. Similarly, GE Healthcare expanded its direct-to-consumer imaging platform in the Asia Pacific region, gaining a 10% increase in market share through partnerships with local health networks. Such initiatives have intensified competition, enhanced company positioning, and broadened product portfolios across the medical imaging devices market.

Global Medical Imaging Devices Market Future Outlook

This market is expected to grow steadily, driven by the demand for early disease detection, precision diagnostics, and cost-effective care. Future trends include wider adoption of AI and deep learning for improved image analysis, hybrid and advanced modalities like 3D/4D and molecular imaging, and expansion across oncology, cardiology, and neurology applications. Emerging markets, especially in Asia Pacific, will see rapid growth due to healthcare investments and outpatient imaging adoption, while developed regions focus on next-generation technologies and digital healthcare integration.

Global Medical Imaging Devices Market Historical Analysis

This market has experienced significant expansion over the past decade, driven by rising prevalence of chronic diseases, aging populations, and growing investments in healthcare infrastructure worldwide. Traditional modalities such as X‑ray and ultrasound maintained large installed bases due to broad clinical use and lower costs, while advanced technologies like MRI and CT saw accelerated adoption as hospitals and diagnostic centers upgraded capabilities. Technological innovations—including digital imaging, PACS integration, and early AI‑assisted features—improved diagnostic accuracy and workflow efficiency. Developed regions like North America and Europe led early growth due to strong healthcare systems and reimbursement support, while emerging markets in Asia Pacific gradually gained momentum through enhanced access and rising healthcare expenditure. Overall, historical trends reflect steady market evolution toward more sophisticated, efficient, and accessible imaging solutions.

Sources

Primary Research Interviews:

Industry experts such as imaging device engineers and product managers

Hospital radiology department heads and clinicians

Diagnostic center directors and radiographers

Imaging equipment distributors and service personnel

Databases:

World Health Organization (WHO) medical device data and device atlas (for imaging equipment)

OECD Health Data including imaging equipment statistics

World Bank health and medical technology indicators

National Bureau of Statistics / government health statistics

Magazines:

Imaging Technology News covering trends and technology in imaging devices

HealthTech Magazine

Medical Design & Outsourcing

Diagnostic Imaging

Medical Device Network

Journals:

Journal of Medical Imaging (SPIE)

IEEE Transactions on Medical Imaging

Medical Image Analysis

Other radiology and imaging research publications

Newspapers:

Reuters Health reporting on device approvals and industry deals

The New York Times (Health)

Financial Times (Healthcare)

The Guardian (Health)

Associations:

World Health Organization (WHO)

International Society of Radiology

Radiological Society of North America (RSNA)

Medical Imaging & Technology Alliance (MITA)

European Society of Radiology

Share

Share

About Author

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients