Gastroscopy Devices Market Size and Forecast – 2026 – 2033

The Global Gastroscopy Devices Market size is estimated to be valued at USD 3.2 billion in 2026 and is expected to reach USD 5.1 billion by 2033, exhibiting a compound annual growth rate of 7.1% during the forecast period from 2026 to 2033.

Global Gastroscopy Devices Market Overview

The gastroscopy devices market comprises a range of products used for the diagnosis and treatment of upper gastrointestinal disorders. Key products include flexible and rigid gastroscopes, video gastroscopes, capsule endoscopy systems, and disposable gastroscopes. These devices are supported by accessories such as light sources, video processors, monitors, biopsy forceps, and cleaning and sterilization equipment. Technological advancements have led to high-definition imaging, narrow-band imaging, and improved maneuverability, enhancing diagnostic accuracy and patient safety. Growing demand for minimally invasive procedures and rising gastrointestinal disease prevalence continue to drive product innovation and adoption worldwide.

Key Takeaways

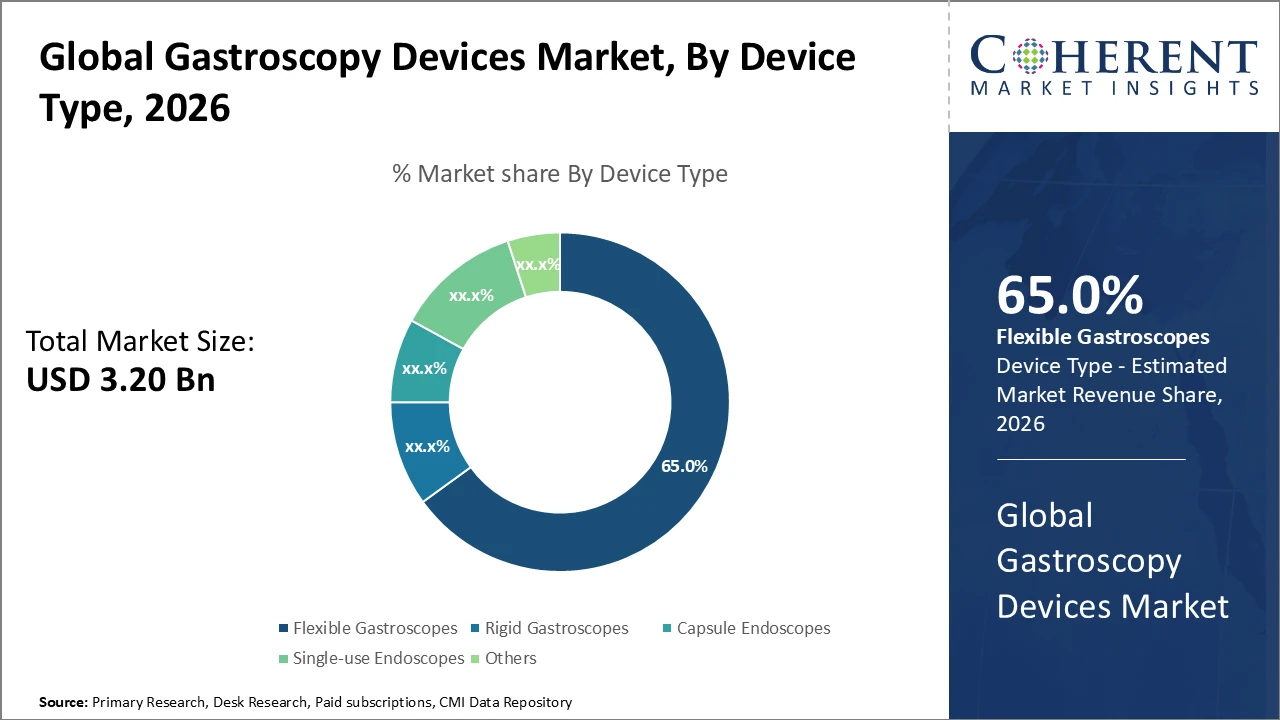

Flexible gastroscopes account for the highest industry share due to their versatility and widespread clinical acceptance, while single-use gastroscopes are the fastest-growing subsegment driven by infection control advantages.

Diagnostic procedures generate the largest market revenue, whereas therapeutic gastroscopy is rapidly gaining momentum supported by innovations in interventional endoscopy.

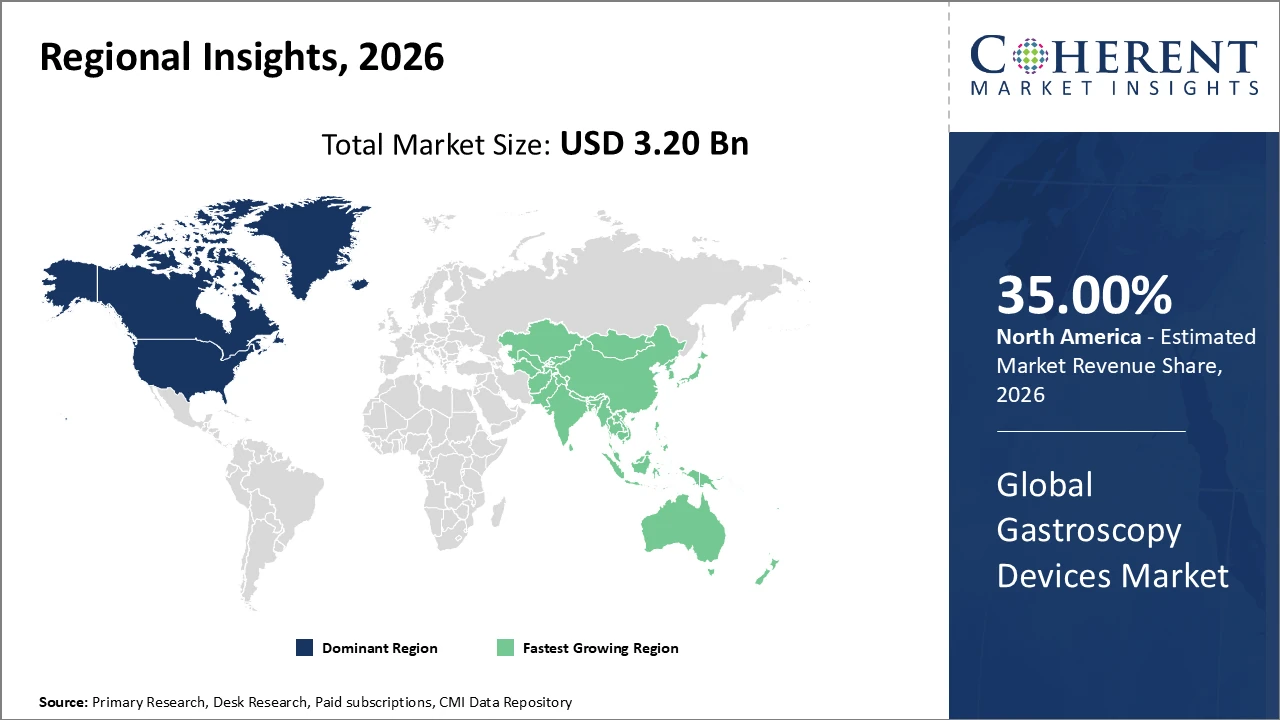

North America holds over 35% of the market share, supported by advanced healthcare infrastructure and established reimbursement frameworks.

Asia Pacific represents the fastest-growing region, driven by increasing government initiatives to improve healthcare access and the expansion of gastroenterology centers across China and India.

Gastroscopy Devices Market Segmentation Analysis

To learn more about this report, Download Free Sample

Gastroscopy Devices Market Insights, By Device Type

Flexible gastroscopes dominate the market, accounting for approximately 65% of the overall device share, and remain the gold standard due to their superior maneuverability and broad diagnostic versatility. Their widespread clinical adoption is reinforced by continuous technological advancements such as high-definition imaging and AI-assisted diagnostics. Single-use gastroscopes represent the fastest-growing segment, driven by strong infection prevention benefits and operational efficiencies, particularly in regions with stringent hygiene regulations.

Rigid gastroscopes hold a smaller share but continue to be used in specific high-precision surgical applications. Capsule endoscopes occupy a niche for non-invasive visualization, though their adoption is limited by high costs and narrow clinical indications. Specialized scopes for pediatric or bariatric use form a minor portion of the market.

Gastroscopy Devices Market Insights, By Application

Diagnostic applications account for the largest share of the market, driven by the rising prevalence of gastrointestinal disorders and the growing need for accurate early detection. This segment enables clinicians to identify conditions such as ulcers, tumors, and inflammation and benefits significantly from advances in imaging technologies and AI integration. Therapeutic applications represent the fastest-growing segment, supported by the expansion of interventional endoscopy procedures including polypectomy and hemostasis, which enhance patient outcomes and reduce the need for surgical interventions.

Screening gastroscopy generates steady revenue, particularly in high-risk populations for gastric cancer, supported by organized national screening programs in several Asian countries. Research applications encompass experimental and clinical studies, while other uses such as veterinary and educational applications account for a smaller share of the market.

Gastroscopy Devices Market Insights, By End-User

Hospitals dominate the market share due to their comprehensive procedural capabilities and high patient throughput, accounting for the majority of gastroscopy device revenue as they manage both complex diagnostic and therapeutic procedures. Ambulatory surgical centers are the fastest-growing end-user segment, driven by the increasing shift toward outpatient minimally invasive procedures that lower costs and shorten hospital stays. Clinics maintain a stable market share, primarily performing routine diagnostic gastroscopy. Research institutes represent a smaller volume segment but play a vital role in driving innovation through clinical trials and technology validation. Other end users, including veterinary and specialized clinics, constitute a small yet emerging share, reflecting the diversification of healthcare delivery models and evolving demand patterns.

Gastroscopy Devices Market Trends

Accelerating adoption of AI-powered gastroscopy devices is enhancing lesion detection accuracy and reducing diagnostic errors, with clinical pilot programs reporting approximately 25% improvement in outcomes in 2025.

Growing demand for single-use gastroscopes is evident in regions emphasizing strict infection control, where adoption rates increased by nearly 30% between 2024 and 2026.

The emergence of tele-endoscopy services is expanding access to gastroscopy in remote and underserved areas, particularly across Asia Pacific, supporting improved healthcare delivery in developing markets.

Gastroscopy Devices Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Gastroscopy Devices Market Analysis and Trends

North America dominates the gastroscopy devices market, supported by a well-established healthcare infrastructure, favorable reimbursement policies, and high procedural volumes. The region accounts for over 35% of the global market share, with the United States leading due to the widespread adoption of advanced endoscopic technologies across hospitals and outpatient facilities. The strong presence of major industry players, such as Olympus Corporation, further reinforces regional leadership, as these companies continue to invest in innovation, including AI-enabled gastroscopy platforms, to enhance diagnostic accuracy and maintain competitive advantage.

Asia Pacific Gastroscopy Devices Market Analysis and Trends

Asia Pacific represents the fastest-growing region in the gastroscopy devices market, with a CAGR exceeding 9% from 2026 to 2033. Growth is driven by government-led initiatives to modernize healthcare infrastructure in countries such as China and India, along with increasing awareness of early gastrointestinal disease diagnosis. In addition, both regional manufacturers and global players are actively investing in capacity expansion and strategic collaborations, which is accelerating market revenue growth and enhancing device penetration across the region.

Gastroscopy Devices Market Outlook for Key Countries

USA Gastroscopy Devices Market Analysis and Trends

The U.S. gastroscopy devices market is a key driver of global growth, supported by advanced endoscopy infrastructure and high patient volumes. In 2025, over 7 million procedures were performed, reflecting a steady 6.5% annual growth. Leading companies are investing in AI-powered systems and single-use gastroscopes, improving diagnostic accuracy and addressing infection control challenges associated with reusable devices. These technological advancements enhance procedural efficiency, reduce complications, and streamline clinical workflows. Combined with strong reimbursement frameworks and widespread adoption across hospitals and outpatient centers, these trends are fueling sustained market expansion and reinforcing the U.S. as a major hub for gastroscopy device innovation.

Germany Gastroscopy Devices Market Analysis and Trends

The Germany gastroscopy devices market is growing steadily, driven by a strong healthcare system, high patient awareness, and widespread adoption of advanced endoscopic technologies. Hospitals dominate device usage due to their capacity for complex diagnostic and therapeutic procedures, while outpatient clinics and ambulatory centers are gradually increasing their share. Rising prevalence of gastrointestinal disorders, coupled with government initiatives promoting early diagnosis, fuels demand for diagnostic and therapeutic gastroscopy. Technological innovations, including AI-assisted imaging, high-definition scopes, and single-use devices, are enhancing procedural accuracy and safety. Strategic investments by leading market players and growing focus on minimally invasive procedures support continued market expansion in Germany.

Analyst Opinion

Global diagnostic gastroscopy procedures are rising, driving market growth. In 2025, over 7 million procedures were performed in the U.S., a 6.5% increase from the previous year, fueled by improved screening protocols and expanding endoscopy infrastructure in emerging economies.

Technologies like narrow-band imaging (NBI) and confocal laser endomicroscopy are boosting demand. In 2024, hospitals using these devices reported 12% higher diagnostic accuracy for early gastric cancer detection, supporting their growing market share.

Manufacturers increased production and exports from hubs like Japan and South Korea by 8% in 2025. Competitive pricing models have improved accessibility in developing regions, supporting growth.

Gastroscopy devices are increasingly used beyond gastroenterology, including bariatric and oncology applications. By 2026, utilization in multi-disciplinary clinical settings grew 15%, expanding the total addressable market.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 3.20 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 7.1% | 2033 Value Projection: | USD 5.10 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Olympus Corporation, Pentax Medical, Medtronic plc, Hoya Corporation, Cook Medical, AmbU A/S, Micro-Tech Endoscopy, Boston Scientific Corporation, Richard Wolf GmbH, Steris Plc | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Gastroscopy Devices Market Growth Factors

Several factors are driving the growth of the gastroscopy devices market. The rising incidence of gastrointestinal diseases, including gastroesophageal reflux disease (GERD) and gastric cancer, is increasing demand for diagnostic gastroscopy, with gastric cancer alone accounting for over 1 million new cases globally in 2025. Advancements in endoscopic technology, such as AI integration and 4K visualization, are improving diagnostic accuracy and procedural efficiency, prompting healthcare providers to upgrade devices. Increasing healthcare expenditure in emerging markets like India and Brazil is enhancing access, with India reporting a 14% rise in gastroscopy-related revenue in 2026. Greater awareness of early diagnosis and minimally invasive procedures is further expanding market opportunities worldwide.

Gastroscopy Devices Market Development

In 2025, Olympus Corporation launched its next-generation AI-powered gastroscopy system, integrating real-time lesion detection and high-definition 4K imaging. This development enhanced diagnostic accuracy for early gastric cancer and other gastrointestinal disorders, reducing procedural errors and improving workflow efficiency in hospitals and outpatient centers. The introduction of this advanced platform strengthened Olympus’s market position and set a benchmark for AI integration in endoscopic devices.

Key Players

Leading Companies of the Market

Olympus Corporation

Pentax Medical

Boston Scientific Corporation

Medtronic plc

Hoya Corporation

Cook Medical

Ambu A/S

Micro-Tech Endoscopy

Richard Wolf GmbH

Steris Plc

Several leading companies have pursued targeted growth strategies to strengthen their market positions. FUJIFILM Holdings Corporation expanded its presence in the Asia-Pacific region through strategic partnerships with regional hospital chains, resulting in over a 20% increase in device adoption in 2024. Boston Scientific Corporation invested in single-use gastroscope technology, addressing infection control concerns and tapping into new market segments, which contributed to a 10% growth in its annual market revenue and reinforced its competitive foothold in the gastroscopy devices sector.

Gastroscopy Devices Market Future Outlook

The gastroscopy devices market is poised for strong growth over the coming years, driven by rising prevalence of gastrointestinal disorders, increasing demand for early diagnosis, and advancements in endoscopic technologies. AI integration, high-definition imaging, and single-use devices are expected to enhance diagnostic accuracy, procedural efficiency, and infection control, further boosting adoption across hospitals and outpatient centers. Emerging markets, particularly in Asia Pacific, will witness rapid expansion due to improving healthcare infrastructure, government initiatives, and growing patient awareness. Additionally, the rise of tele-endoscopy and minimally invasive procedures will expand access to care, supporting sustained market growth and innovation globally.

Gastroscopy Devices Market Historical Analysis

The gastroscopy devices market has experienced steady growth over the past decade, driven by increasing gastrointestinal disease prevalence and rising demand for minimally invasive diagnostic and therapeutic procedures. Technological advancements, including high-definition imaging, video gastroscopes, and early iterations of AI-assisted systems, improved procedural accuracy and clinician confidence. Hospitals and specialized clinics remained the primary end users, while single-use devices began gaining traction in response to infection control concerns. North America and Europe dominated the market historically due to advanced healthcare infrastructure and reimbursement frameworks, while Asia Pacific showed gradual growth, laying the foundation for rapid adoption in subsequent years as healthcare access expanded.

Sources

Primary Research Interviews:

Gastroenterologists

Endoscopy Nurses and Technicians

Hospital Procurement Managers

Gastroscopy Device Manufacturers

Databases:

World Health Organization (WHO) Global Health Observatory

OECD Health Statistics

Centers for Disease Control and Prevention (CDC) GI Disease Data

Magazines:

Medical Design & Outsourcing

Endoscopy Today

Gastrointestinal Endoscopy News

HealthTech Magazine

MedTech Outlook

Journals:

Gastrointestinal Endoscopy Journal

Endoscopy Journal

Digestive Endoscopy

Surgical Endoscopy

Newspapers:

The New York Times (Health)

The Guardian (Health)

Financial Times (Healthcare)

The Hindu (Health)

Reuters Health

Associations:

American Society for Gastrointestinal Endoscopy (ASGE)

European Society of Gastrointestinal Endoscopy (ESGE)

World Endoscopy Organization (WEO)

National Institute for Health and Care Excellence (NICE)

International Federation for Endoscopic Surgery

Share

Share

About Author

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients