Furniture Foam Market Size and Forecast – 2025 – 2032

The Global Furniture Foam Market size is estimated to be valued at USD 8.4 billion in 2025 and is expected to reach USD 13.9 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% from 2025 to 2032.

Global Furniture Foam Market Overview

Furniture foam includes a range of materials such as polyurethane foam, memory foam, latex foam, and hybrid foam blends used in sofas, mattresses, recliners, office chairs, and cushions. These foams offer varying densities, firmness levels, and resilience characteristics, enabling manufacturers to design products that balance comfort, support, and longevity. Innovations such as gel-infused foams, high-resilience (HR) foams, and plant-based alternatives are increasingly integrated to enhance performance and sustainability. Additionally, regulatory emphasis on low VOC emissions and flame retardancy is shaping the design of modern furniture foams, prompting producers to invest in cleaner chemicals and recyclable formulations.

Key Takeaways

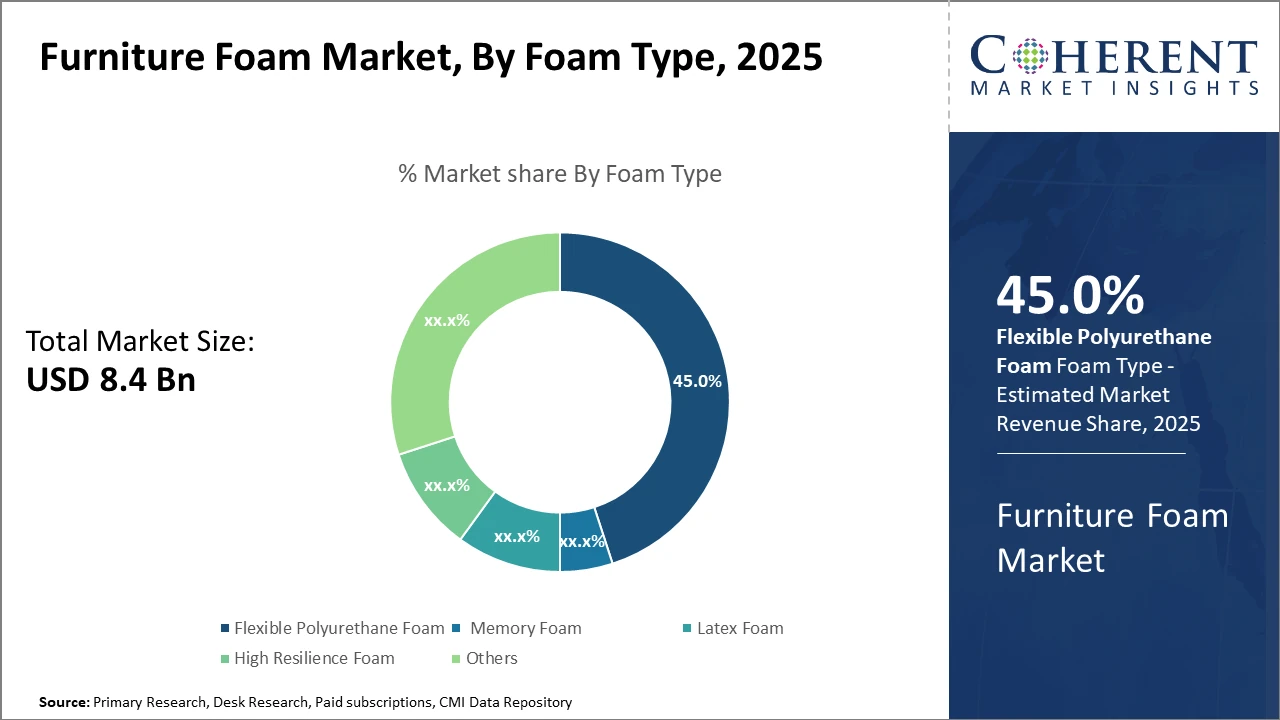

Flexible Polyurethane Foam dominates the foam type segment with a market share of 45%, driven by widespread application in residential and commercial furniture due to its versatility and cost-effectiveness.

Among applications, residential upholstery holds the largest market revenue share, propelled by housing sector growth in the Asia Pacific and North America. Automotive seating is the fastest-growing application, supported by innovations in seating comfort and lightweight materials.

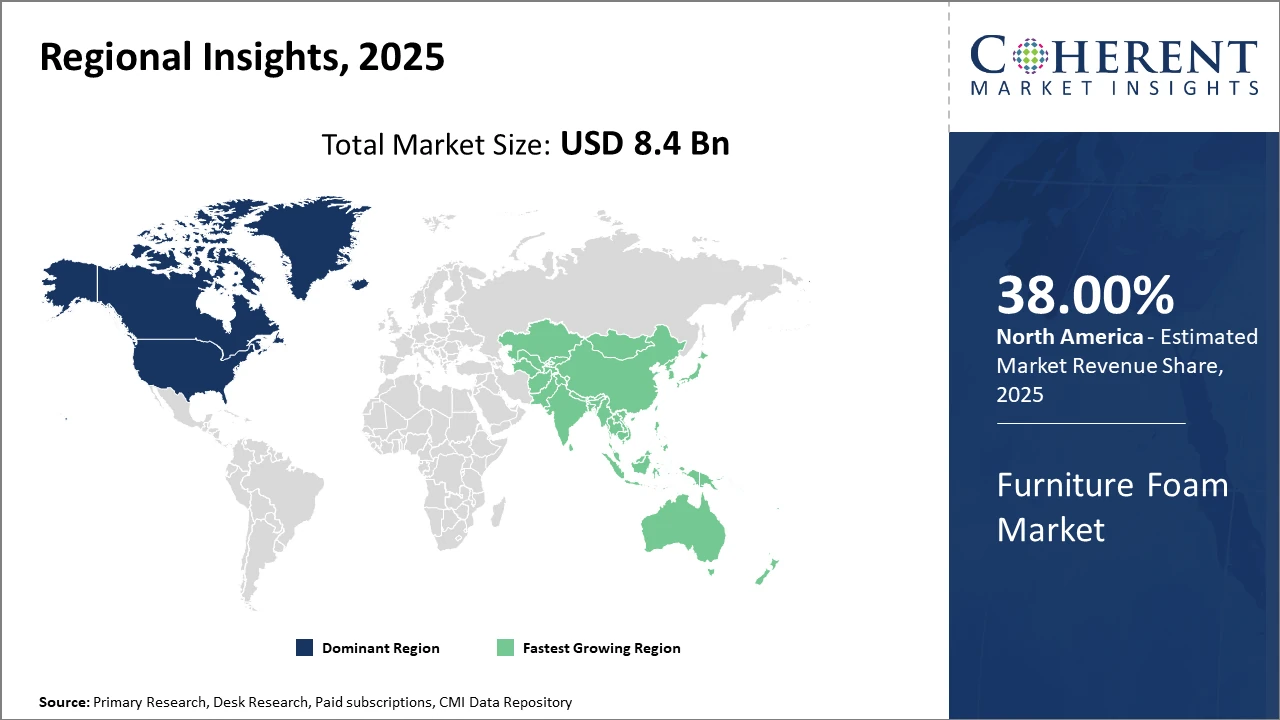

Regionally, North America maintains dominance in market share at 38% due to the presence of established furniture manufacturing hubs and stringent quality standards. Asia Pacific exhibits the fastest CAGR, fueled by expanding automotive and hospitality industries and favorable government infrastructure initiatives.

Furniture Foam Market Segmentation Analysis

To learn more about this report, Download Free Sample

Furniture Foam Market Insights, By Foam Type

Flexible Polyurethane Foam dominates the market share at 45%. This dominance stems from its extensive versatility, cost efficiency, and applicability across multiple furniture and automotive seating applications. Its adaptability in providing consistent support and cushioning remains unmatched, sustaining steady demand. Memory Foam showcases the fastest growth as users increasingly seek advanced comfort and pressure relief features, especially in premium mattresses and automotive seat cushions. Latex Foam is favored for its natural origin and resilience, but maintains a niche market.

Furniture Foam Market Insights, By Application

Residential Upholstery commands the largest market share, driven by sustained growth in housing and renovation projects globally. The consumer preference for comfortable yet durable foam in sofas, recliners, and lounge chairs further anchors this dominance. Automotive Seating is the fastest-growing application segment, driven by demand for lightweight and ergonomic seat cushioning in electric and hybrid vehicles. Advanced foams improving thermal regulation and reducing vehicle weight are pivotal in this sector's growth. Commercial Seating, comprising offices and hospitality furniture, benefits from the trend toward ergonomic and multifunctional office solutions, albeit at a moderate growth pace. Bedding applications sustain steady demand through innovations in memory foam mattresses.

Furniture Foam Market Insights, By Density Grade

High-density foam dominates this segment due to its superior durability, comfort, and insulation properties, especially required in automotive seating and premium furniture. Its high load-bearing capacity ensures a longer lifespan and enhanced user experience, supporting its preference in high-end applications. The fastest growth is seen in Medium Density foam, balancing cost and performance for mainstream furniture and commercial seating. Low-density foam plays a substantial role in cost-effective applications like budget mattresses and basic upholstery. Manufacturers focus significantly on optimizing density grades to tailor product performance for evolving customer demands and application-specific needs.

Furniture Foam Market Trends

Recent furniture foam market trends highlight the prioritization of sustainability, evidenced by the increased introduction of bio-based and recyclable foam materials.

For example, companies invested over USD 200 million in green foam technologies in 2024.

Another key trend is the technological innovation in foam design, such as the adoption of 3D printing techniques to create tailored foam components, reducing waste by up to 15%.

Additionally, antimicrobial foams gained traction amid heightened hygiene concerns across healthcare and hospitality sectors globally.

Furniture Foam Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Furniture Foam Market Analysis and Trends

In North America, the dominance in the Furniture Foam market is supported by a well-established furniture manufacturing ecosystem, stringent quality and safety regulations, and significant demand in both residential and automotive sectors. The U.S. leads this dominance, with major players like Carpenter Company and FXI Holdings contributing substantially towards market share, backed by continuous investments in advanced manufacturing and sustainability programs. Government incentives promoting green building practices further stimulate demand for eco-friendly foam products in this region.

Asia Pacific Furniture Foam Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth, registering a CAGR exceeding 9% due to rapid urbanization, infrastructure expansion, and rising automotive production in China, India, and Southeast Asia. The region benefits from increasing disposable incomes and a growing middle class, driving business growth for foam manufacturers. Leading market companies have ramped up capacity and localized production facilities in countries such as China, supported by favorable trade policies and growing export opportunities.

Furniture Foam Market Outlook for Key Countries

USA Furniture Foam Market Analysis and Trends

The USA’s market is characterized by high demand from residential remodeling and commercial furniture sectors, coupled with rising investments in smart and ergonomic furniture technologies. Major industry players headquartered in the USA have leveraged AI and IoT to enhance foam product customization and lifecycle monitoring, improving customer retention. Additionally, regulatory frameworks emphasizing emission controls have accelerated the adoption of sustainable foam products, aligning market growth with environmental objectives.

China Furniture Foam Market Analysis and Trends

China’s market for furniture foam is expanding rapidly, driven by aggressive urban housing projects and robust automotive manufacturing growth. Local manufacturers have increased output by over 12% in 2024, propelled by government incentives supporting eco-friendly manufacturing. The presence of large-scale furniture production clusters in regions like Guangdong has enabled scalability and export-oriented growth strategies. Noteworthy is the collaboration between Chinese foam producers and international design firms, creating innovative foam products for both domestic and global customers.

Analyst Opinion

Increasing Demand from Residential Upholstery: The surge in new housing developments and refurbishment projects worldwide is boosting the demand for flexible polyurethane foam used in sofas, mattresses, and chairs. Notably, in 2024, residential furniture output in countries like China and the USA increased by 4.5% and 3.7% respectively, directly elevating furniture foam consumption.

Price Volatility in Raw Materials Impacting Market Revenue: Fluctuating petrochemical prices, particularly isocyanates and polyols essential for foam production, have affected production costs. In Q1 2025, global isocyanate prices rose by approximately 9%, pressuring manufacturers to optimize costs through supply chain efficiencies and alternative sourcing.

Shift Toward High-Density and Specialty Foams: Emerging applications in ergonomic office furniture and performance automotive seating are driving the uptake of high-density foam variants, which accounted for nearly 38% of market volume in 2024, reflecting an increase of 6% year-over-year.

Growth in Asia Pacific Due to Expanding Automotive and Hospitality Sectors: The Asia Pacific region showed a 10% increase in furniture foam demand in 2024, with India and Southeast Asian countries leading growth. This stems from rapid automotive production and burgeoning hospitality infrastructure investments.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 8.4 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.2% | 2032 Value Projection: | USD 13.9 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Greymarurethane, IKEA Industry AB, Tafisa Canada Ltd., Eurofoam Group, LG Chem Ltd., Intertek Group Plc, Dynamic Foam, Inc., FoamPartner Group, Riviana Foods, Inc., Sealed Air Corporation. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Furniture Foam Market Growth Factors

The rise in urbanization and growing middle-class population in the Asia Pacific has catalyzed housing developments requiring functional and comfortable furniture, driving foam market growth. Moreover, the expanding automotive seating segment, especially in electric and hybrid vehicles, demands advanced foam solutions to enhance passenger comfort and reduce vehicle weight. The increasing emphasis on sustainability, with manufacturers introducing bio-based and recyclable foam varieties, is opening new avenues for growth despite regulatory challenges. Finally, the growth of e-commerce has contributed to higher furniture replacement rates, thus augmenting market revenue through increased demand for foam in shipping-protected furniture.

Furniture Foam Market Development

In 2025, BASF introduced new generations of eco-friendly polyurethane (PU) foams for the furniture industry, incorporating bio-based and biomass balance raw materials to reduce reliance on fossil resources.

In 2023, Covestro launched new low-VOC flexible polyurethane foams for the furniture sector, addressing increasing demand for healthier indoor air quality and reduced emissions in residential and commercial interiors. Alongside product innovation, Covestro collaborated on initiatives to advance polyurethane foam mattress recycling technologies, reinforcing its long-term commitment to circular economy principles and sustainable materials management.

Key Players

Leading Companies of the Market

Greymarurethane

IKEA Industry AB

Tafisa Canada Ltd.

Eurofoam Group

LG Chem Ltd.

Intertek Group Plc

Dynamic Foam, Inc.

FoamPartner Group

Riviana Foods, Inc.

Sealed Air Corporation

The market companies are increasingly focusing on strategic collaborations, capacity expansion, and sustainable product innovations. For instance, a leading foam manufacturer recently invested USD 150 million in a new plant dedicated to soy-based bio-foam production, resulting in a 15% reduction in carbon emissions and scaling supply for North American furniture manufacturers. Another key player implemented AI-driven process optimization in their European operations, which improved manufacturing efficiency by 12% while reducing waste.

Furniture Foam Market Future Outlook

The market will increasingly transition toward sustainable and bio-based foam alternatives as governments and consumers push for lower environmental impact. Innovations in plant-based polyols, recyclable foams, and carbon-neutral production processes are expected to gain market share. Demand for premium comfort solutions will rise as urbanization, remote work culture, and premium home furnishing trends continue to strengthen. Smart foams with temperature regulation, gel infusion, and pressure-mapping compatibility will proliferate in high-end seating and bedding. Additionally, automation in foam cutting, molding, and shaping processes will improve manufacturing efficiency, while e-commerce-driven furniture sales will raise demand for lightweight, durable foam packaging and cushioning.

Furniture Foam Market Historical Analysis

The furniture foam market has historically been shaped by the rising demand for residential furniture, mattresses, and seating solutions. Polyurethane foam emerged as the dominant material due to its versatility, cost-efficiency, and ability to be molded into various densities and comfort grades. Over time, innovations such as memory foam, latex alternatives, and high-resilience foam expanded the market’s performance range. Consumer preferences for ergonomic and premium comfort products—especially in North America and Europe—accelerated the adoption of advanced foam technologies. Environmental regulations concerning VOC emissions and flammability sparked the development of cleaner chemical formulations and enhanced safety standards. Global furniture manufacturing, particularly in China, India, and Southeast Asia, also played a critical role in scaling foam production and reducing costs.

Sources

Primary Research Interviews:

Furniture Manufacturers

Foam Technologists

Upholstery Designers

Mattress Engineers

Material Procurement Heads

Databases:

IBISWorld Foam Manufacturing Reports

Euromonitor Home Furnishings

UN Comtrade Polyurethane Data

World Bank Industrial Data

Magazines:

Furniture Today

PU Magazine

Upholstery Journal

Foam Industry News

Home Furnishings Business

Journals:

Journal of Polymer Science

Materials Today

Journal of Applied Polymer Science,

Furniture Design Journal

Industrial Materials Journal

Newspapers:

Financial Express (Manufacturing)

Bloomberg Markets

The New York Times (Home)

Financial Times (Industry)

Reuters Manufacturing News

Associations:

Polyurethane Manufacturers Association

American Home Furnishings Alliance

International Sleep Products Association

Foam Expo Association

Furniture Society

Share

Share

About Author

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients