Erythropoietin Drugs Market Size and Forecast – 2026 – 2033

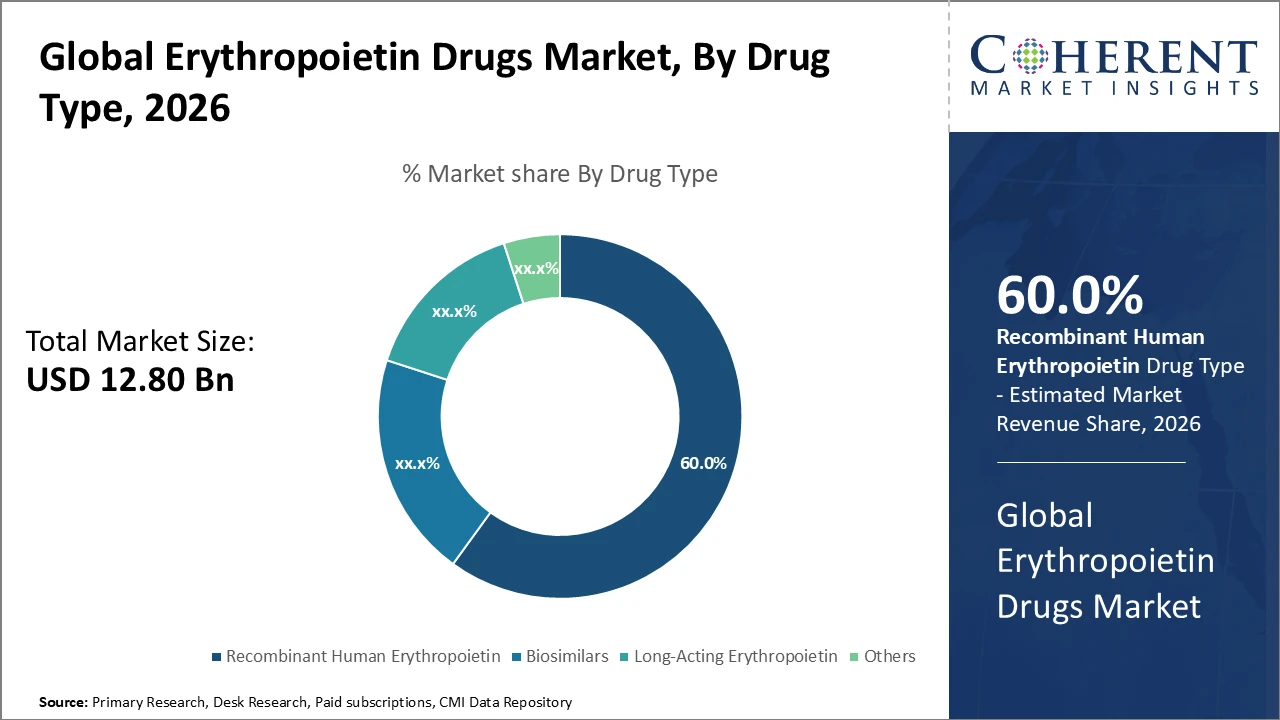

The Global Erythropoietin Drugs Market size is estimated to be valued at USD 12.8 billion in 2026 and is expected to reach USD 22.4 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 8.5% from 2026 to 2033.

Global Erythropoietin Drugs Market Overview

The Erythropoietin (EPO) drugs market primarily comprises recombinant human erythropoietin (rHuEPO) and its biosimilars, designed to stimulate red blood cell production. Key products include epoetin alfa, epoetin beta, darbepoetin alfa, and methoxy polyethylene glycol-epoetin beta, targeting anemia associated with chronic kidney disease, chemotherapy, and certain surgeries. The market is witnessing a shift toward long-acting formulations and biosimilars due to cost-effectiveness and improved patient compliance. Innovative delivery methods, such as subcutaneous injections and prefilled pens, enhance convenience and adherence. The pipeline also focuses on next-generation EPO analogs with better safety profiles and reduced dosing frequency.

Key Takeaways

The rHuEPO drug type segment holds over 60% market share, reflecting its entrenched usage and ongoing demand in anemia treatments related to chronic kidney disease.

The chemotherapy-induced anemia application segment is the fastest growing due to increased cancer incidence rates and enhanced regulatory approvals for erythropoietin use in oncology protocols.

North America dominates the erythropoietin drugs market with around 38% market share, supported by advanced healthcare infrastructure and favorable reimbursement frameworks.

Asia Pacific is the fastest-growing regional market, with a CAGR of 11%, driven by expanding healthcare access, increasing prevalence of anemia-related disorders, and development of biosimilar manufacturing hubs in China and India.

Erythropoietin Drugs Market Segmentation Analysis

To learn more about this report, Download Free Sample

Erythropoietin Drugs Market Insights, By Drug Type

Recombinant Human Erythropoietin dominates the market share with 60%, serving as the backbone of current anemia therapies due to its established efficacy and regulatory approval across major markets. Biosimilars are the fastest-growing segment, driven by rising cost pressures and regulatory support, which enables broader access in emerging economies. Long-acting erythropoietins are gaining traction as patients prefer reduced dosing frequency, improving compliance and quality of life. The ‘Others’ segment includes various novel formulations but currently maintains a smaller market presence.

Erythropoietin Drugs Market Insights, By Application

Anemia due to chronic kidney disease dominates erythropoietin drug consumption, driven by the condition's global prevalence and well-established clinical treatment guidelines. Chemotherapy-induced anemia is the fastest-growing application segment, as rising cancer incidences are prompting expanded therapeutic protocols that incorporate erythropoietin drugs. Anemia related to HIV/AIDS and other conditions represents niche but steady demand segments, often concentrated in regions with higher infectious disease burdens.

Erythropoietin Drugs Market Insights, By End-User

Hospitals are the dominant end user, accounting for the majority of market share due to the controlled environments required for administration and monitoring of erythropoietin therapies. Specialty clinics are the fastest-growing subsegment, as targeted anemia treatments for oncology and nephrology patients increasingly shift to specialized care settings. Home care has experienced moderate growth, driven by user-friendly delivery devices that enable patient self-administration. Ambulatory care centers represent a smaller yet expanding segment, focusing on outpatient services.

Erythropoietin Drugs Market Trends

The erythropoietin drugs market is rapidly evolving with a strong shift toward biosimilar adoption, driven by global healthcare cost containment policies.

In 2026, biosimilars accounted for nearly 35% of the global market share, with accelerated uptake in Europe and Asia Pacific.

Advances in drug delivery systems, including auto-injectors and personalized dosing regimens, have improved patient adherence and reduced hospital visits, aligning with digital healthcare trends.

Emerging economies are increasingly contributing to market growth by expanding healthcare infrastructure and establishing biosimilar manufacturing hubs, driving faster revenue growth compared to traditional markets.

Erythropoietin Drugs Market Insights, By Geography

North America Erythropoietin Drugs Market Analysis and Trends

The erythropoietin drugs market is rapidly evolving, with a strong shift toward biosimilar adoption driven by global healthcare cost containment policies. In 2026, biosimilars accounted for nearly 35% of the global market, with Europe and Asia Pacific leading in uptake. Advances in drug delivery systems, including auto-injectors and personalized dosing regimens, have enhanced patient adherence and reduced hospital visits, supporting digital healthcare trends. Emerging economies are contributing significantly to market growth by expanding healthcare infrastructure and establishing biosimilar manufacturing hubs. These dynamics are collectively accelerating revenue growth and reshaping the competitive landscape of the erythropoietin drugs market.

Asia Pacific Erythropoietin Drugs Market Analysis and Trends

The Asia Pacific region is the fastest-growing market for erythropoietin drugs, with an 11% CAGR, driven by improving healthcare access and supportive government initiatives targeting anemia. The rise of biosimilar manufacturers, including companies like Celltrion and Cipla, is accelerating adoption and expanding treatment availability. Large patient populations and increasing awareness about erythropoiesis-stimulating agents further boost demand. Additionally, enhanced regulatory support and investments in healthcare infrastructure are facilitating broader distribution and accessibility. These factors collectively position Asia Pacific as a key growth driver in the global erythropoietin drugs market, outpacing traditional markets in both revenue and adoption rates.

Erythropoietin Drugs Market Outlook for Key Countries

USA Erythropoietin Drugs Market Analysis and Trends

The U.S. leads the global erythropoietin drugs market in revenue, driven by the high prevalence of anemia among chronic kidney disease and oncology patients. Well-established reimbursement frameworks support widespread adoption, with usage rates increasing by approximately 6.5% in 2025. Major industry players, including Amgen, have introduced biosimilar versions, capturing significant market share and promoting cost-effective treatment options. Additionally, ongoing clinical trials of long-acting erythropoietins are expected to further enhance treatment adoption and patient compliance. Strong healthcare infrastructure, regulatory support, and innovation in drug formulations continue to solidify the U.S. as a dominant and influential market globally.

Germany Erythropoietin Drugs Market Analysis and Trends

Germany’s erythropoietin drugs market is characterized by steady growth, driven by a high prevalence of anemia linked to chronic kidney disease and oncology treatments. The country benefits from well-established healthcare infrastructure, strong reimbursement systems, and supportive regulatory frameworks, facilitating widespread adoption of both originator and biosimilar erythropoietins. Biosimilars are gaining traction due to cost-effectiveness, while long-acting formulations are increasingly preferred for improved patient compliance. Key players, including Amgen and Sandoz, actively compete, investing in clinical trials and innovative delivery systems. Growing awareness of anemia management and government initiatives promoting efficient healthcare delivery further support market expansion in Germany.

Analyst Opinion

Rising prevalence of chronic kidney disease (CKD) and cancer-related anemia has increased demand for erythropoietin drugs. In 2025, the global CKD patient population requiring erythropoiesis-stimulating agents (ESAs) grew by 7.6%, boosting market revenues. The shift toward outpatient dialysis centers has further driven ESA consumption by improving patient access.

Leading pharmaceutical manufacturers have expanded production facilities and adopted biosimilar technology to optimize costs. In 2024, a key company increased erythropoietin biosimilar production capacity by 30%, reducing prices by 15% and enhancing market competitiveness.

Erythropoietin drugs are increasingly used beyond kidney-related anemia, including myelodysplastic syndromes and HIV-related anemia. By 2026, treatment protocols for cancer-induced anemia using erythropoietin drugs rose by 9%, contributing to market growth and revenue diversification.

Streamlined biosimilar approvals in the European Union and Asia Pacific in 2024 accelerated market penetration. By late 2025, biosimilar erythropoietins represented around 35% of market share, supporting competitive pricing and wider patient access, positively influencing market growth.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 12.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 8.5% | 2033 Value Projection: | USD 22.4 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Amgen Inc., Johnson & Johnson, Biogen Idec Inc., Pfizer Inc., Sandoz, Lupin Limited, Mylan N.V., Zydus Cadila, Cipla Limited, Teva Pharmaceuticals Industries Ltd. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Erythropoietin Drugs Market Growth Factors

The surge in anemia associated with chronic diseases is the primary driver of the erythropoietin drugs market, with CKD and chemotherapy patients fueling demand, particularly in developed nations, which accounted for approximately 45% of global market revenue in 2025. Advances in biopharmaceutical technology, including biosimilars and long-acting erythropoietins, have enhanced patient compliance and reduced treatment costs, expanding usage in middle-income countries. Government initiatives promoting anemia awareness and reimbursement policies in the U.S. and Europe have created a favorable market environment. Expanding healthcare infrastructure in Asia Pacific and Latin America is opening untapped markets, driving annual revenue growth of around 10%.

Erythropoietin Drugs Market Development

In 2025, Amgen expanded its erythropoietin biosimilar portfolio in Europe by launching a next-generation long-acting formulation designed for chronic kidney disease patients. The launch aimed to improve patient adherence through reduced dosing frequency and enhanced delivery systems, while also offering a more cost-effective alternative to originator products. This development strengthened Amgen’s position in the European market and accelerated biosimilar adoption across key healthcare centers.

Key Players

Leading Companies of the Market

Amgen Inc.

Johnson & Johnson

Biogen Idec Inc.

Pfizer Inc.

Sandoz

Lupin Limited

Mylan N.V.

Zydus Cadila

Cipla Limited

Teva Pharmaceuticals Industries Ltd.

Several market-leading companies have strategically invested in biosimilar development to strengthen their competitive positioning. In 2025, Amgen introduced a cost-effective erythropoietin biosimilar, boosting its market share in the U.S. by 12% and enhancing access for chronic kidney disease and oncology patients. Meanwhile, Pfizer’s acquisition of local manufacturers in emerging markets expanded its contract manufacturing capacities, improving supply chain efficiency and enabling deeper market penetration. This strategy contributed to a 22% revenue increase in the Asia Pacific region in 2024, highlighting the impact of strategic investments and localized production on global erythropoietin drug growth.

Erythropoietin Drugs Market Future Outlook

The future of the erythropoietin drugs market is poised for strong growth, driven by rising anemia prevalence from chronic kidney disease, cancer, and other chronic conditions. Expansion of biosimilars and long-acting formulations will enhance affordability, patient adherence, and treatment accessibility, particularly in emerging markets. Technological innovations in drug delivery, such as auto-injectors and personalized dosing, alongside digital healthcare integration, will further support market expansion. Regulatory support and government initiatives promoting anemia management are expected to sustain adoption. Overall, increasing healthcare infrastructure, awareness, and cost-effective therapies will position the global erythropoietin drugs market for steady revenue growth over the coming decade.

Erythropoietin Drugs Market Historical Analysis

The erythropoietin drugs market has experienced steady growth over the past decade, driven primarily by rising cases of anemia related to chronic kidney disease and chemotherapy. Initially dominated by originator products like epoetin alfa and darbepoetin alfa, the market witnessed gradual entry of biosimilars, improving affordability and expanding patient access. Technological advancements, including long-acting formulations and improved delivery systems, enhanced patient compliance and treatment outcomes. North America and Europe historically led in revenue due to advanced healthcare infrastructure and strong reimbursement frameworks, while emerging economies began contributing to growth in the late 2010s, setting the stage for broader global adoption.

Sources

Primary Research Interviews:

Hematologists

Oncologists

Pharmacists

Nephrologists

Databases:

WHO Global Health Observatory

IQVIA Drug and Biologic Database

IMS Health Data

OECD Health Statistics

UN Disability Reports

Magazines:

Pharmaceutical Executive

BioPharma Dive

Generics Bulletin

European Pharmaceutical Review

Journals:

Blood

Journal of Clinical Oncology

Clinical Therapeutics

Therapeutic Advances in Hematology

Newspapers:

The New York Times (Health)

The Guardian (Health)

Financial Times (Healthcare)

The Hindu (Health)

Reuters Health

Associations:

World Health Organization (WHO)

International Society on Thrombosis and Haemostasis (ISTH)

European Medicines Agency (EMA)

Biotechnology Innovation Organization (BIO)

Share

Share

About Author

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients