Electronic Aspirin Market Size and Forecast – 2026 – 2033

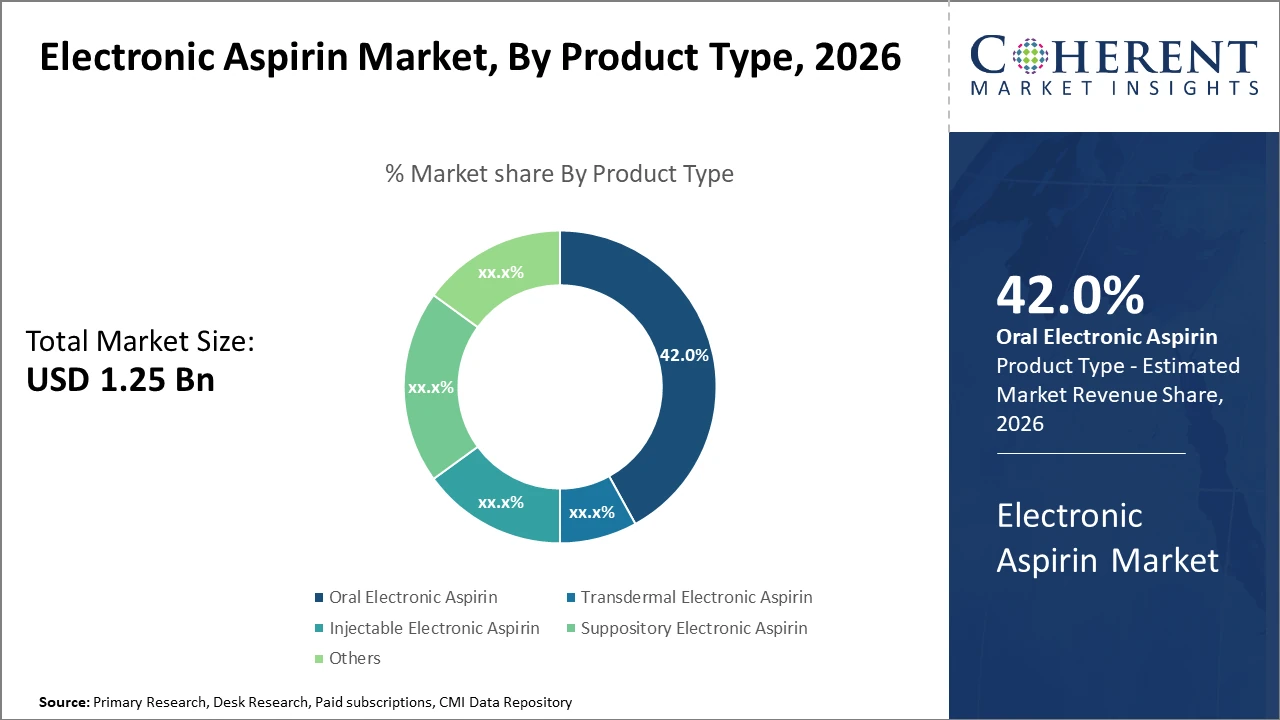

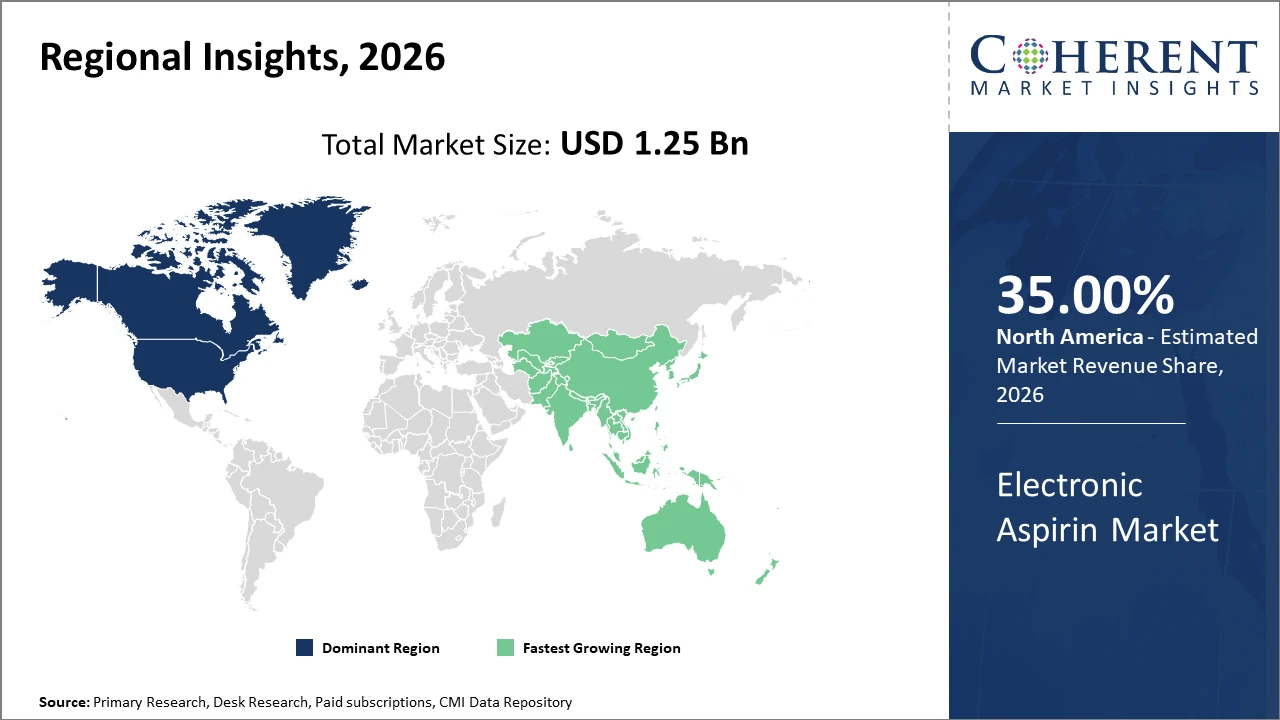

The Global Electronic Aspirin Market size is estimated to be valued at USD 1.25 billion in 2026 and is expected to reach USD 2.85 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 12.8% from 2026 to 2033.

Global Electronic Aspirin Market Overview

Electronic aspirin products are neuromodulation devices designed to relieve pain by stimulating specific nerve pathways rather than using chemical drugs. These devices deliver targeted electrical pulses to interrupt pain signals at their source. Electronic aspirin products are used for conditions such as migraine, cluster headaches, and chronic pain disorders. They are often wearable or handheld and designed for patient-controlled use. Key characteristics include non-invasiveness, precision targeting, and drug-free pain management.

Key Takeaways

Oral electronic aspirin dominates the product segment with a 42% market share, benefiting from ease of administration and patient familiarity.

Transdermal electronic aspirin presents the fastest-growing opportunity due to its non-invasive nature and better compliance.

Cardiovascular disease prevention remains the largest application segment, capitalizing on increasing incidence rates and preventive healthcare emphasis.

Pain management is emerging rapidly, as indicated by increasing prescriptions in post-operative care units globally.

North America leads the regional market, commanding over 35% industry share, driven by robust healthcare infrastructure and active research investments.

Asia Pacific is the fastest-growing region, projected to register a CAGR exceeding 14%, fueled by an expanding geriatric population and improved healthcare access in countries like China and India.

Electronic Aspirin Market Segmentation Analysis

To learn more about this report, Download Free Sample

Electronic Aspirin Market Insights, By Product Type

Oral Electronic Aspirin dominates the market share. Oral formulations are preferred for their familiarity, easier regulatory acceptance, and established efficacy profile, making them the frontline product in both cardiovascular prevention and pain management. The fastest-growing subsegment is Transdermal Electronic Aspirin due to its non-invasive delivery that enhances patient compliance and reduces gastrointestinal side effects, appealing particularly to elderly and comorbid patients. Injectable Electronic Aspirin, while smaller in volume, is critical in acute care settings requiring a rapid onset. Suppository Electronic Aspirin offers an alternative drug administration in patients unable to take oral medication.

Electronic Aspirin Market Insights, By Application

Cardiovascular Disease Prevention maintains the largest market share given aspirin’s historic role in preventing thrombosis and ensuing heart attacks. Recent studies from 2024 reinforce electronic aspirin’s improved safety profile in this domain, driving adoption. Pain Management is the fastest-growing application, propelled by expanded use in chronic conditions and post-surgical care, supported by patient preference for technology-enabled, precise dosing. Anti-inflammatory Therapy remains steady, with electronic aspirin offering better localized control. Stroke Prevention is emerging due to increasing stroke prevalence and rising awareness of aspirin’s prophylactic benefits.

Electronic Aspirin Market Insights, By End-User

Hospitals dominate market share, leveraging their established clinical protocols and access to diverse patient populations, especially in cardiology and neurology departments. Home Healthcare is the fastest-growing end-user segment, enabled by rising digital health trends and patient empowerment through remote monitoring technologies that electronic aspirin devices facilitate. Clinics offer focused outpatient care but represent a smaller share compared to hospitals. Pharmaceutical Companies are involved primarily in formulation development and partnering with healthcare providers to drive awareness and distribution, playing a critical role in market ecosystem expansion.

Electronic Aspirin Market Trends

The market trends are increasingly shaped by digital healthcare integration and patient-centric therapeutic models.

The shift toward IoT-enabled dosing devices ensures precise drug delivery and real-time patient monitoring.

For example, products launched in 2024 incorporate Bluetooth connectivity, improving adherence rates by over 20%.

Another notable trend is the adoption of sustainable manufacturing practices, motivated by regulatory pressures in North America and Europe to reduce e-waste from electronic medical devices.

Moreover, combination therapy platforms utilizing electronic aspirin alongside other cardiovascular drugs are emerging, enabling multi-pronged treatment approaches, as indicated by ongoing trials.

Electronic Aspirin Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Electronic Aspirin Market Analysis and Trends

In North America, the dominance in the Electronic Aspirin market is propelled by advanced healthcare infrastructure, extensive R&D activity, and strong regulatory frameworks facilitating faster product approvals. The U.S. holds the largest share due to widespread clinical adoption and substantial investment by leading companies like Pfizer and Johnson & Johnson, who pioneered IoT-based aspirin delivery in clinical settings. Moreover, supportive health policies targeting cardiovascular disease prevention fuel consistent market revenue growth.

Asia Pacific Electronic Aspirin Market Analysis and Trends

Meanwhile, the Asia Pacific region exhibits the fastest growth driven by demographic factors such as an expanding elderly population and increasing healthcare accessibility, particularly in China and India. Market growth here is amplified by government initiatives focused on digital health transformation and rising awareness around cardiovascular diseases. Local companies like Lupin Limited and Sun Pharmaceutical are increasingly investing in electronic aspirin innovations to capture regional demand, benefiting from rising disposable incomes and expanding distribution channels.

Electronic Aspirin Market Outlook for Key Countries

USA Electronic Aspirin Market Analysis and Trends

The USA’s market leads due to expansive healthcare expenditure exceeding USD 4 trillion annually and high adoption rates of electronic healthcare devices. Major players such as Bayer AG and Medtronic have launched advanced electronic aspirin formulations integrated into hospital systems, boosting patient management protocols. The FDA's streamlined approval process in 2024 expedited market entries, facilitating rapid product launches and a surge in prescriptions. Telehealth integration further augmented usage amid chronic disease management scenarios, making the U.S. a pivotal market for electronic aspirin growth.

India Electronic Aspirin Market Analysis and Trends

India’s market is growing rapidly due to increased cardiovascular disease prevalence and expanding healthcare infrastructure. Government programs aimed at chronic disease mitigation have increased demand, supported by investments in digital health startups developing innovative electronic aspirin patches and oral devices. Companies like Sun Pharmaceutical Industries and Cipla are capitalizing on competitive pricing and local manufacturing to increase market penetration. The rise of home healthcare and mobile health management solutions since 2023 also underscore India as a critical growth hub within Asia Pacific.

Analyst Opinion

Precision Dosage Control Remains a Crucial Market Driver: The advent of electronic aspirin allows precise control over dosing, significantly reducing risks associated with traditional aspirin therapy. For instance, clinical trials in 2024 documented a 15% decrease in adverse gastric events among patients switching to electronic aspirin. This supply-side metric underscores the rising preference for electronically enhanced formulations among healthcare providers.

Expanding Application Across Cardiovascular and Pain Management Sectors: Demand-side analysis indicates increasing usage of electronic aspirin not only in cardiovascular prophylaxis but also in chronic pain management sectors, such as arthritis and post-operative care. Sales data from 2025 reveal a 20% rise in prescriptions in multi-specialty hospitals integrating electronic aspirin into standard protocols.

Cost-Effectiveness Driving Import Competitiveness: The electronic aspirin market’s import volumes surged by 11% in 2024, driven by pricing strategies optimizing production cost without compromising efficacy. This quantitative factor suggests a healthy trade dynamic where emerging market players leverage cost advantages to increase market penetration.

Micro-Market Indicators Reflecting Personalized Medicine Trend: Nano-scale electronic aspirin formulations targeting patient-specific needs are gaining traction, evidenced by a 2024 pilot study showing a 25% improvement in therapeutic outcomes. These micro-indicators align with broader market shifts toward personalized healthcare solutions integrating IoT and AI-enabled dosage systems.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 1.25 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 12.8% | 2033 Value Projection: | USD 2.85 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Boehringer Ingelheim GmbH, Hikma Pharmaceuticals PLC, Lupin Limited, Alkem Laboratories Limited, Sun Pharmaceutical Industries Ltd., Cipla Limited, Aurobindo Pharma Limited, Medtronic Plc, Abbott Laboratories, Boston Scientific Corporation. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Electronic Aspirin Market Growth Factors

The rising incidence of cardiovascular diseases globally continues to be the primary catalyst behind the market growth, with organizations like the American Heart Association estimating a 8% year-over-year increase in related prescriptions in 2024. Secondly, advancements in wearable and IoT-enabled drug delivery tech have made electronic aspirin more accessible and user-friendly, enhancing market adoption. Thirdly, the aging global population is fueling demand; in 2025, the population aged 60 and above is projected to hit 1 billion, significantly boosting chronic disease management needs. Finally, favorable regulatory policies easing approval processes for digitally enhanced pharmaceuticals have accelerated market revenue streams, particularly in North America and Europe.

Electronic Aspirin Market Development

In 2025, Aspirin AI was launched as an AI-powered virtual pharmacist application designed to support safe and informed medication use. The app provides guidance on dosage, drug interactions, and adherence, positioning itself as a digital health tool for medication management rather than a pain-treatment device, and reflecting the growing role of AI in consumer healthcare decision support.

In August 2025, Bayer launched Aspirina in the U.S. market, expanding its well-established aspirin portfolio. The launch focused on reinforcing Bayer’s leadership in over-the-counter cardiovascular and pain-relief therapies, leveraging strong brand recognition while addressing continued consumer demand for trusted aspirin-based products.

Key Players

Leading Companies of the Market

Boehringer Ingelheim GmbH

Hikma Pharmaceuticals PLC

Lupin Limited

Alkem Laboratories Limited

Sun Pharmaceutical Industries Ltd.

Cipla Limited

Aurobindo Pharma Limited

Medtronic Plc

Abbott Laboratories

Boston Scientific Corporation

Several leading companies have increasingly invested in integrating electronic delivery mechanisms with conventional aspirin to expand their product portfolios. For example, Bayer AG's partnership with a medical device firm in 2024 resulted in an electronic aspirin patch that saw a 30% market share increase within six months of commercial launch. Pfizer’s 2025 strategy, focused on enhancing IoT-connected aspirin therapies, has positioned it favorably within hospital systems prioritizing digital healthcare solutions.

Electronic Aspirin Market Future Outlook

The future outlook for the electronic aspirin market is supported by increasing demand for drug-free, non-invasive pain therapies. Growing concerns over medication side effects, dependency, and long-term drug use are expected to drive adoption. Technological advances will enable expanded indications beyond migraines, including chronic pain and neurological disorders. Integration with mobile applications and wearable health technologies will enhance personalization and patient engagement. Over the long term, electronic aspirin devices are expected to become a mainstream component of holistic pain management strategies.

Electronic Aspirin Market Historical Analysis

The electronic aspirin market developed from research into non-drug pain management and neuromodulation technologies aimed at treating headaches and migraine disorders. Early devices were primarily used in clinical settings and targeted specific nerve pathways to interrupt pain signals. Initial market growth was slow due to limited awareness, high device costs, and skepticism regarding efficacy compared to pharmaceutical options. Over time, improvements in device design, portability, and ease of use enabled broader consumer adoption. Regulatory approvals and clinical studies demonstrating reduced reliance on medications helped establish legitimacy. The market gradually transitioned from a niche therapeutic segment to a recognized alternative within pain management ecosystems.

Sources

Primary Research Interviews:

Neurologists

Pain specialists

Digital therapeutics developers

Device engineers

Databases:

NIH Pain Research Data

FDA Neuromodulation Devices

ClinicalTrials.gov

MedTech Europe

Magazines:

Neurology Today

Digital Health Today

MedTech Insight

Pain Management Today

Medical Device Network

Journals:

Cephalalgia

Journal of Headache and Pain

Neuromodulation

The Lancet Neurology

Newspapers:

Reuters Healthcare

The Guardian (Health)

Financial Times (Life Sciences)

The New York Times (Science)

Bloomberg Health

Associations:

American Headache Society

International Neuromodulation Society

American Academy of Neurology

Digital Therapeutics Alliance

International Association for the Study of Pain

Share

Share

About Author

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients