Drug Discovery Informatics Market Size and Forecast – 2026 – 2033

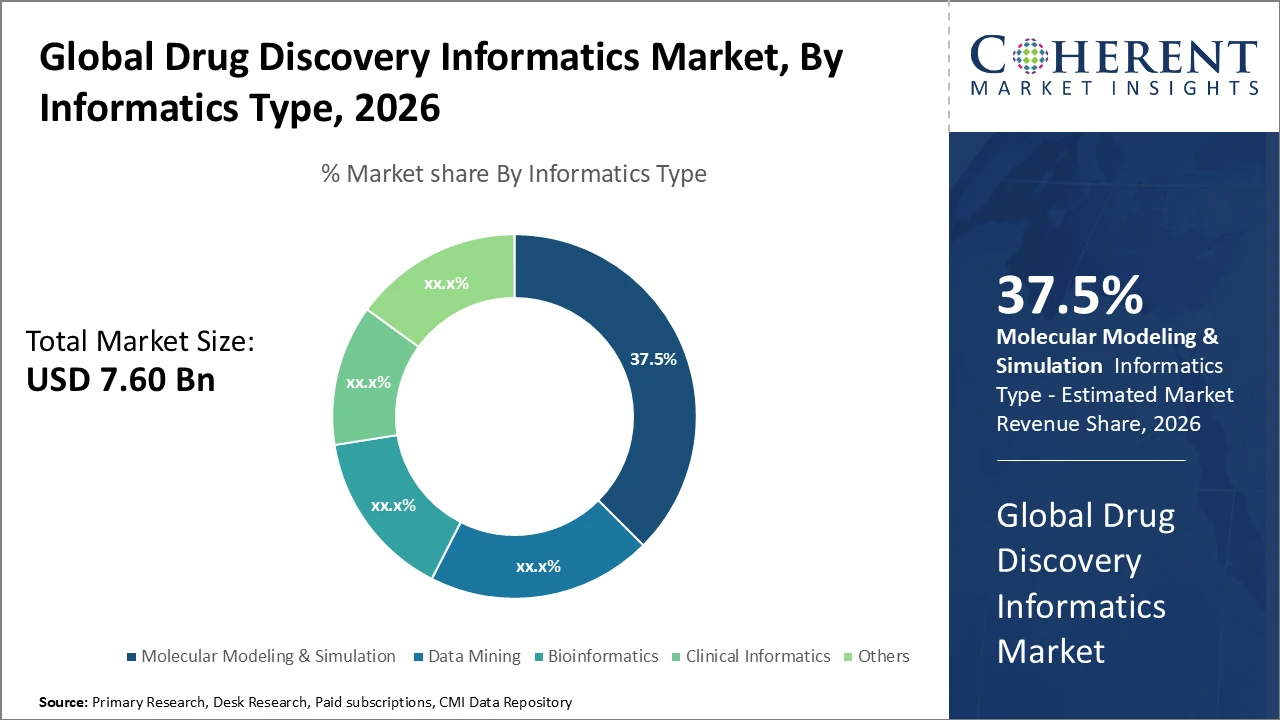

The Global Drug Discovery Informatics Market size is estimated to be valued at USD 7.60 billion in 2026 and is expected to reach USD 15.90 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 11.2% from 2026 to 2033.

Global Drug Discovery Informatics Market Overview

The Drug Discovery Informatics market comprises software and platform solutions designed to streamline and accelerate the drug development process. Key products include bioinformatics tools, cheminformatics platforms, molecular modeling software, and laboratory information management systems (LIMS) that enable data integration, analysis, and visualization. Artificial intelligence (AI) and machine learning-enabled platforms are increasingly used for predictive modeling, target identification, and virtual screening. Additionally, workflow management and collaboration tools facilitate seamless communication across research teams. These products are widely adopted by pharmaceutical and biotechnology companies, contract research organizations (CROs), and academic institutions, enhancing efficiency, reducing development timelines, and supporting data-driven decision-making in drug discovery.

Key Takeaways

The Molecular Modeling & Simulation segment dominates the market in terms of industry share, driven by rising demand for in silico screening in targeted drug design.

The Target Identification subsegment under Applications is the fastest-growing, fueled by increased use in oncology pipelines and the focus on precision medicine breakthroughs.

Pharmaceutical companies lead as end users, generating significant revenue due to high R&D spending and ongoing digital transformation initiatives.

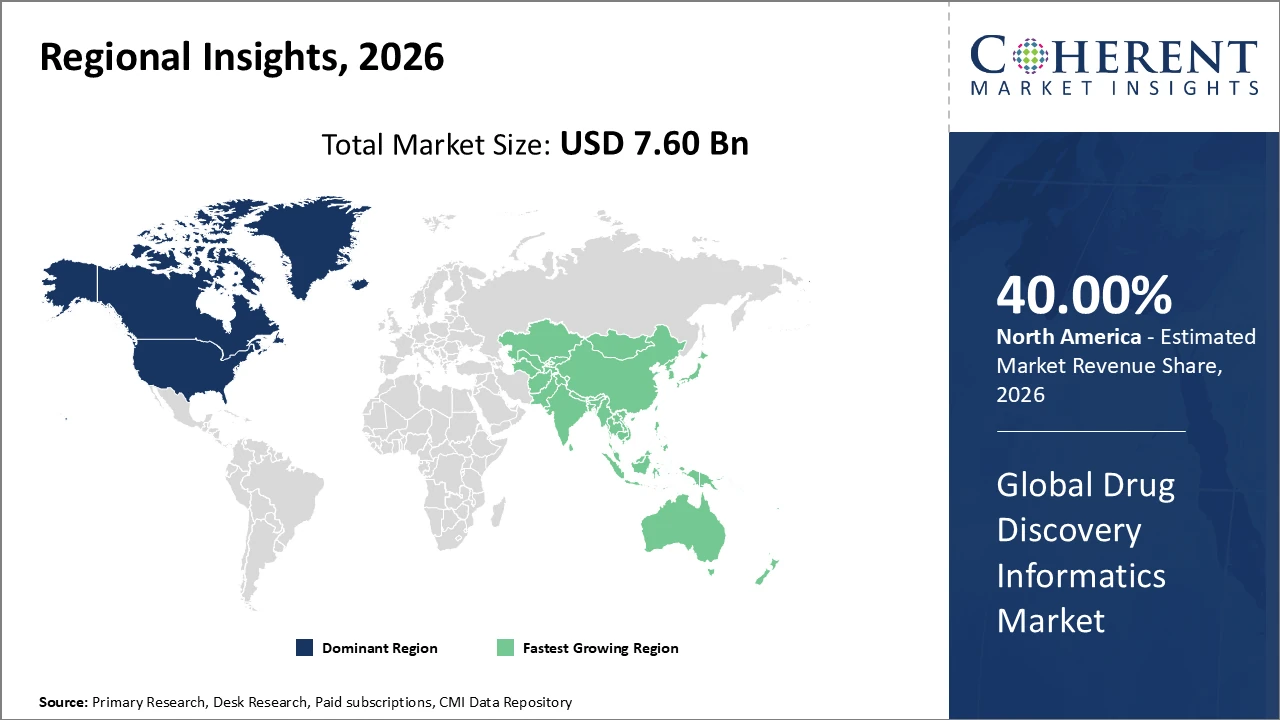

North America holds the largest regional market share, exceeding 40%, supported by a strong biotech presence, government grants for drug discovery innovation, and advanced cloud infrastructure.

Asia Pacific is the fastest-growing region, with a CAGR above 13%, driven by pharma R&D outsourcing, expanding biotech startups, and regulatory reforms promoting adoption of drug discovery informatics.

Drug Discovery Informatics Market Segmentation Analysis

To learn more about this report, Download Free Sample

Drug Discovery Informatics Market Insights, By Informatics Type

Molecular Modeling & Simulation dominates the market share, driven by its essential role in accelerating drug design and reducing experimental costs through in silico predictions of molecular interactions. The integration of AI with molecular modeling workflows is the fastest-growing driver, enhancing predictive accuracy and efficiency, with adoption among pharmaceutical companies rising by 20% in 2025. Data Mining enables large-scale analysis of biomedical data, supporting novel target discovery, while Bioinformatics aids in interpreting complex genomic information for precision medicine. Clinical Informatics manages clinical trial data and patient stratification, gaining importance with regulatory requirements for real-world evidence. Other subsegments serve niche research applications.

Drug Discovery Informatics Market Insights, By Application

Target Identification leads the market share, driven by its critical role in early-stage drug discovery, particularly with the expansion of oncology and neurodegenerative disease pipelines using informatics tools for biomarker discovery. The fastest-growing segment, Lead Optimization, is propelled by AI-based simulation enhancements that streamline candidate selection and improve efficacy and toxicity predictions. ADMET Predictions support early assessment of drug safety profiles, helping reduce late-stage development failures. Clinical Trial Data Management enhances compliance and operational efficiency through integrated informatics platforms, increasingly vital for complex trial designs. Other subsegments cover niche applications, including pharmacogenomics and biomarker validation.

Drug Discovery Informatics Market Insights, By End-User

Pharmaceutical companies dominate the market share, driven by substantial R&D budgets and the adoption of integrated informatics platforms to accelerate drug development cycles. Biotechnology firms are the fastest-growing end-user segment, supported by increasing investments in biologics and precision therapies, and their reliance on advanced informatics tools to manage complex biological data. Academic research institutes primarily contribute to foundational research and early-stage informatics innovation, while contract research organizations (CROs) leverage these technologies to deliver specialized drug discovery services to clients. The Others category includes governmental and non-profit research organizations using informatics solutions for public health initiatives and rare disease research.

Drug Discovery Informatics Market Trends

AI-enabled platforms are increasingly adopted, improving molecular dynamics simulations, with a 28% rise in 2025.

Cloud-based informatics solutions are expanding, reducing costs and supporting real-time collaborative data analysis.

North America and Europe lead in cloud adoption due to advanced infrastructure and strong biotech presence.

Blockchain technology is being piloted to secure clinical trial data and protect intellectual property.

Early 2025 initiatives by select North American firms highlight growing investment in secure and efficient informatics workflows.

Drug Discovery Informatics Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Drug Discovery Informatics Market Analysis and Trends

North America dominates the Drug Discovery Informatics market due to the strong presence of leading biopharmaceutical and pharmaceutical companies, substantial research funding, and advanced cloud computing infrastructure that enables efficient data management and collaborative research. The United States alone contributes over 35% of global market revenue, driven by high R&D investments from both industry players and government-backed initiatives promoting digital innovation in drug discovery. Robust adoption of AI, molecular modeling, and bioinformatics tools further strengthens the region’s position. Supportive regulatory frameworks, skilled talent, and early technology adoption collectively reinforce North America’s leadership in the global drug discovery informatics market.

Asia Pacific Drug Discovery Informatics Market Analysis and Trends

Asia Pacific is the fastest-growing region in the Drug Discovery Informatics market, with a CAGR exceeding 13%. This growth is driven by increasing outsourcing of R&D by Western pharmaceutical companies and the expansion of biotech hubs in countries such as China and India. Proactive regulatory reforms in the region are also encouraging the adoption of digital solutions and informatics platforms. Market players like Certara and Biovia are actively expanding their presence through local partnerships, further accelerating market penetration and supporting sustained growth across the Asia Pacific drug discovery informatics sector.

Drug Discovery Informatics Market Outlook for Key Countries

USA Drug Discovery Informatics Market Analysis and Trends

The USA dominates the Drug Discovery Informatics market due to its strong pharmaceutical R&D ecosystem, emphasizing AI integration and cloud-powered informatics solutions. In 2025, several companies collaborated with leading technology firms, such as a major U.S. pharmaceutical company integrating a cloud-based simulation platform, which reduced drug candidate screening timelines by 30%. High R&D investment, supportive government initiatives, and a culture of innovation further strengthen the market position. Advanced infrastructure, skilled talent, and early adoption of emerging technologies ensure the U.S. remains a pivotal contributor to global drug discovery informatics trends, driving both revenue growth and industry leadership.

Germany Drug Discovery Informatics Market Analysis and Trends

Germany holds a strong position in the European Drug Discovery Informatics market, driven by its advanced pharmaceutical and biotechnology sectors and high R&D investment from companies such as Bayer, Boehringer Ingelheim, and Merck. The adoption of AI, machine learning, and cloud-based platforms is enhancing molecular modeling, target identification, and collaborative research. Supportive regulatory frameworks encourage digital innovation, while growth in oncology and rare disease research fuels demand for advanced informatics tools. Local partnerships with global vendors accelerate technology adoption. Integration of bioinformatics, clinical informatics, and real-world evidence supports precision medicine initiatives, with government grants and funding fostering startup innovation in the sector.

Analyst Opinion

Enhanced computational power and AI algorithms are driving demand-side growth, enabling faster target identification and compound screening, with AI-enabled platform investment growing over 25% in 2025.

Supply-side trends show increased deployment of cloud-based infrastructure, with quarterly shipments of cloud informatics solutions rising approximately 30% in 2026, supporting scalable data management.

Sector-specific applications in oncology and neurodegenerative disease research are expanding, with oncology-focused informatics platforms accounting for over 35% of market share in 2026, driven by precision medicine initiatives.

Pricing dynamics have stabilized due to competition in software licensing and bundled service models.

Subscription-based models grew by 40% in 2025, improving accessibility for small and mid-sized biotech firms.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 7.60 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 11.2% | 2033 Value Projection: | USD 15.90 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Schrondinger, Certara, OpenEye Scientific, BIOVIA, Cresset, Biovia, Chemical Computing Group, Genedata AG, Cyclica Inc., Insilico Medicine | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Drug Discovery Informatics Market Growth Factors

The Drug Discovery Informatics market is driven by the integration of AI and machine learning technologies, which reduce time and costs in drug R&D cycles. Adoption of cloud computing has increased computational throughput by 35% in 2025, enabling efficient handling of large pharmaceutical datasets. Rising investments in personalized medicine and genomics informatics have fueled demand, with targeted therapies representing nearly 40% of new drug pipelines in 2026. Collaborations between biopharmaceutical companies and technology firms enhance data sharing, promoting innovation in predictive modeling and simulation. Supportive regulatory frameworks encouraging data standardization and interoperability further bolster market growth by improving cross-platform data usability.

Drug Discovery Informatics Market Development

In 2025, BioAro launched its PanOmiQ Research platform, an AI-driven drug discovery and multi-omics solution that integrates deep drug discovery capabilities with multilingual clinical reporting, representing a significant step toward unified “omics-to-therapeutics” informatics ecosystems. This platform streamlines complex data analysis and accelerates insights across drug research workflows, addressing the growing demand for comprehensive computational solutions.

In 2025, Revvity Inc. introduced its Signals One software platform, designed to unify and simplify data management across the entire drug discovery lifecycle. The platform enhances collaboration, supports real-time data integration, and helps drug developers manage increasingly complex research workflows efficiently, reflecting broader trends toward integrated, cloud-enabled informatics solutions.

Key Players

Leading Companies of the Market

Schrondinger

Certara

OpenEye Scientific

BIOVIA

Cresset

Biovia

Chemical Computing Group

Genedata AG

Cyclica Inc.

Insilico Medicine

Competitive strategies in the Drug Discovery Informatics market frequently focus on strategic partnerships and technology integration to enhance capabilities and market reach. In 2025, a leading company partnered with a major cloud service provider, improving its platform efficiency by 20% and enabling faster molecular docking simulations. Such collaborations allow companies to leverage advanced computational resources, streamline data processing, and accelerate drug discovery timelines. These approaches not only strengthen competitive positioning but also foster innovation, improve workflow efficiency, and enhance value propositions for pharmaceutical and biotechnology clients.

Drug Discovery Informatics Market Future Outlook

The Drug Discovery Informatics market is poised for strong growth, driven by increasing adoption of AI, machine learning, and cloud-based platforms that accelerate drug development and reduce R&D costs. Expansion of personalized medicine, genomics, and targeted therapies will further fuel demand for advanced informatics solutions. Emerging markets in Asia Pacific are expected to witness rapid growth due to rising pharma R&D outsourcing and supportive regulatory reforms. Integration of predictive modeling, bioinformatics, and clinical data management will enhance efficiency and decision-making. Ongoing collaborations between biopharma and tech firms, coupled with standardized data frameworks, will continue to shape innovation and market expansion globally.

Drug Discovery Informatics Market Historical Analysis

The Drug Discovery Informatics market has experienced steady growth over the past decade, driven by increasing complexity in drug development and the need for efficient data management. Early adoption focused on bioinformatics and molecular modeling tools, enabling researchers to analyze genomic data and predict molecular interactions. Over time, cloud computing and AI integration transformed workflows, improving computational efficiency and accelerating target identification and lead optimization. North America historically dominated due to strong pharmaceutical R&D, while Europe followed closely with high adoption in oncology and rare disease research. Growing collaborations, regulatory support, and the emergence of biotech startups have collectively shaped the market’s evolution.

Sources

Primary Research Interviews:

Pharmaceutical R&D Heads

Biotech Scientists

Bioinformatics Specialists

Contract Research Organization (CRO) Executives

Databases:

World Health Organization (WHO) – Global Health Observatory Data

OECD Health Data – Pharmaceutical R&D Statistics

Global Burden of Disease (GBD) Study

PubChem and ChEMBL Databases

Magazines:

Medical Design & Outsourcing

Drug Discovery & Development Magazine

Bio-IT World

HealthTech Magazine

Medical Device Network

Journals:

Journal of Chemical Information and Modeling

Bioinformatics

Nature Biotechnology

Molecular Informatics

Drug Discovery Today

Newspapers:

The New York Times (Health)

The Guardian (Health)

Financial Times (Healthcare)

The Hindu (Health)

Reuters Health

Associations:

American Chemical Society (ACS)

Drug Information Association (DIA)

European Federation for Pharmaceutical Sciences (EUFEPS)

International Society for Computational Biology (ISCB)

Biotechnology Innovation Organization (BIO)

Share

Share

About Author

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients