Dairy Protein Market Size and Forecast – 2025 – 2032

The Global Dairy Protein Market size is estimated to be valued at USD 15.6 billion in 2025 and is expected to reach USD 24.3 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.8% from 2025 to 2032.

Global Dairy Protein Market Overview

Dairy proteins are nutrient-rich ingredients extracted from milk, primarily in the form of whey proteins, casein, and milk protein concentrates. These proteins are valued for their high amino acid content, excellent digestibility, and functional properties such as emulsification, gelation, and water-binding. They are widely used in sports nutrition, infant formulas, functional foods, bakery items, and dietary supplements. Dairy proteins also support muscle growth, weight management, and clinical nutrition applications, making them essential components in health-focused food formulations.

Key Takeaways

Whey protein dominates the protein type segment with 62% market share, supported by its multifunctionality and high nutritional value, expected to maintain leadership through 2032.

Sports nutrition is the fastest-growing application segment, accounting for 34% of market revenue, driven by increasing fitness trends globally and product innovations.

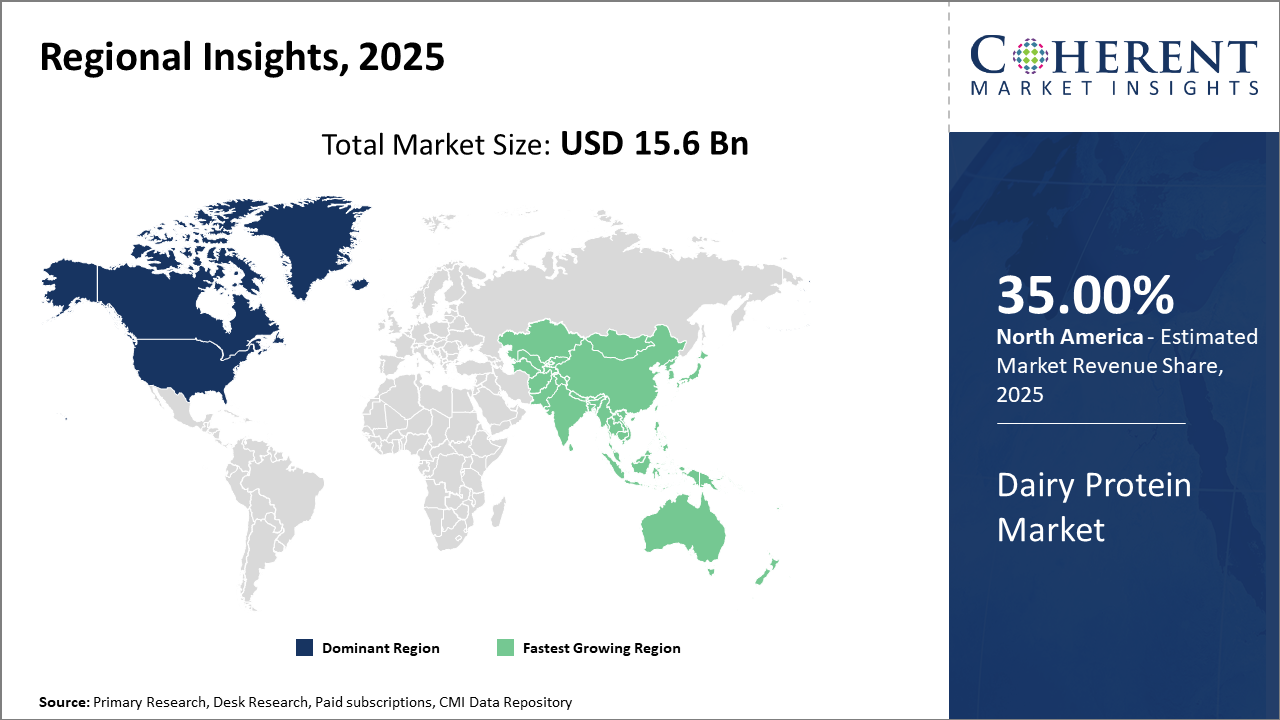

North America continues to lead in market share, backed by strong industry presence and consumer base, while Asia Pacific is the fastest-growing region due to rising urbanization and increasing disposable income.

Europe’s regulatory emphasis on fortified foods and clean-label products creates promising opportunities for market players to expand.

Dairy Protein Market Segmentation Analysis

To learn more about this report, Download Free Sample

Dairy Protein Market Insights, By Protein Type

Whey Protein dominates the market share with 62%. Whey protein’s dominance stems from its superior digestibility, versatile functionality in food formulations, and significant presence in sports nutrition products. The expanding application of whey protein in dietary supplements and infant formulas also makes it a star growth driver. Casein protein, known for its slow absorption properties and sustained amino acid release, ranks as the fastest growing subsegment, favored particularly in weight management and clinical nutrition sectors. Milk Protein Concentrate and Milk Protein Isolate serve niche purposes with protein-enrichment capabilities and enjoy stable demand.

Dairy Protein Market Insights, By Application

Sports Nutrition is dominating the market share at 34%. This leadership owes to the robust growth in fitness culture globally, propelling the demand for dairy proteins in muscle recovery and endurance enhancement products. Infant Nutrition is the fastest-growing application segment, driven by increasing birth rates coupled with enhanced awareness of dairy proteins' health benefits in baby formulas and toddler foods. The Food & Beverages segment incorporates dairy proteins as functional additives in bakery, dairy, and confectionery products, maintaining steady growth.

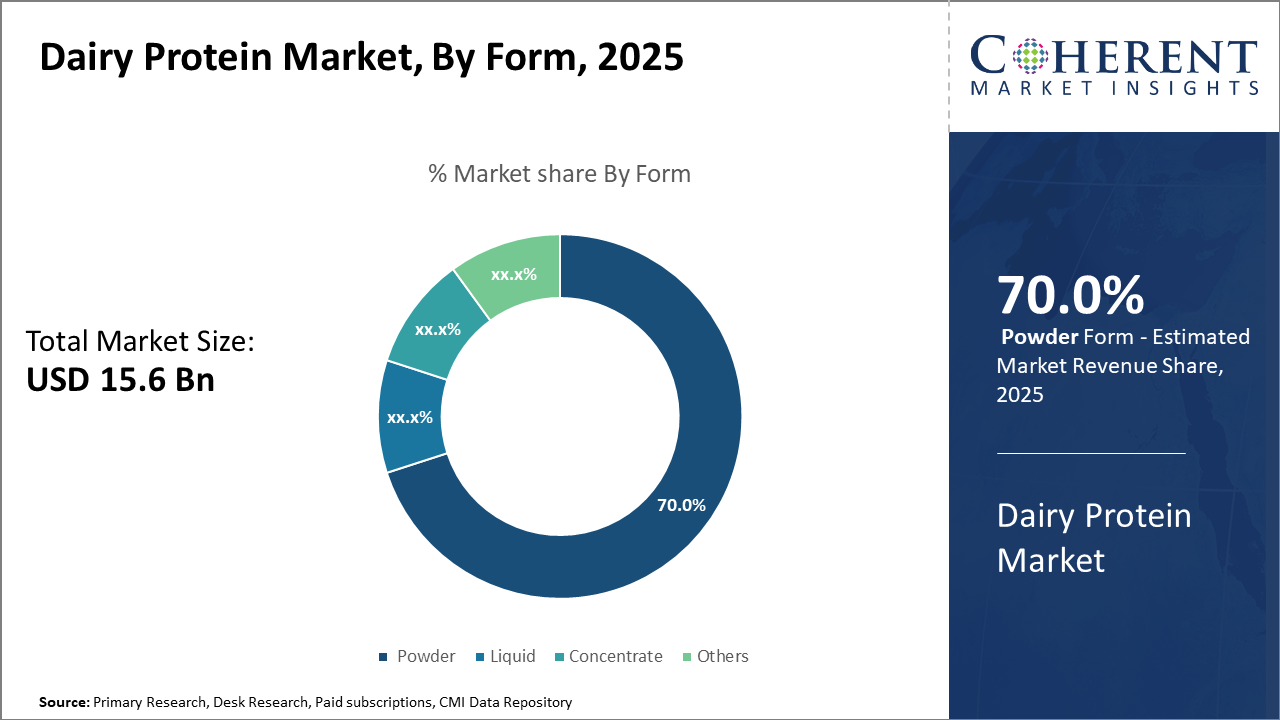

Dairy Protein Market Insights, By Form

Powder commands a dominant market share of 70%. Powders’ shelf stability, ease of transportation, and broad applicability in product formulation make it the leading form factor in dairy protein products. The Liquid subsegment is garnering growth as ready-to-drink nutritional beverages gain popularity among on-the-go consumers, establishing itself as the fastest-growing form segment. Concentrates, offering high-protein content, find specialized use in sports recovery and clinical nutrition domains.

Dairy Protein Market Trends

Recent market trends include intensified product innovation focusing on sustainability and functional enhancement.

For example, in 2025, companies launched dairy protein products incorporating probiotics, meeting consumer demand for holistic health benefits.

The rise of direct-to-consumer distribution models facilitated by e-commerce has also revolutionized accessibility, enabling personalized product offerings.

Hybrid proteins blending whey with plant derivatives surged by 11% in market revenue, indicating a clear shift towards diversified nutritional portfolios.

Dairy Protein Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Dairy Protein Market Analysis and Trends

In North America, the dominance in the Dairy Protein market is sustained by established dairy industries in the U.S. and Canada, where technological advancements and consumer preferences for high-protein functional foods drive significant market share. North America accounts for approximately 35% of the industry's size, powered by major companies like Glanbia Plc and DuPont Nutrition & Health, expanding production capacities. Government initiatives supporting nutrition and health further amplify market growth strategies in this region.

Asia Pacific Dairy Protein Market Analysis and Trends

Meanwhile, the Asia Pacific exhibits the fastest growth with a CAGR of nearly 8%, fueled by rising urban populations, increasing health awareness, and government subsidies for infant nutrition enhancement. Countries such as China and India are key contributors, witnessing vigorous demand for dairy protein-based infant formulas and sports nutrition products. The growing middle class and evolving market dynamics provide fertile ground for market expansion, bolstered by local companies partnering with multinational dairy protein producers to scale business growth.

Dairy Protein Market Outlook for Key Countries

USA Dairy Protein Market Analysis and Trends

The USA remains a pivotal market for dairy protein, driven by high consumer adoption of sports nutrition and wellness trends. Major players like Glanbia Plc and DuPont focus on innovation and sustainability, evidenced by investments in zero-waste processing plants in 2024 that reduced production costs by 7%. The country’s established supply chain ecosystem and increasing exports bolster its industry share, contributing substantially to the global Dairy Protein market size and revenue. The US market’s preference for clean-label and organic-certified protein products leads to new product launches and premium segment growth.

India Dairy Protein Market Analysis and Trends

India’s Dairy Protein market has rapidly evolved due to growing infant nutrition demand and rising disposable income, with dairy protein imports increasing by 18% in 2025. The government’s National Nutrition Mission prioritizes protein supplementation for child development, creating expansive opportunities. Leading local dairy cooperatives have partnered with global market players to improve product quality and distribution networks. This collaboration accelerates market growth through innovation in casein and whey products targeted at the health-conscious youth demographic. Furthermore, evolving regulatory frameworks aligned with international standards enhance market confidence and expand business growth prospects.

Analyst Opinion

The rising demand for whey protein as a versatile ingredient in the food and beverage industry is a primary quantitative driver expanding market size. In 2024, global whey protein production increased by 12% driven by surging utilization in sports nutrition formulations, as reported by the International Dairy Federation. Additionally, pricing trends have shown relative stability despite raw material fluctuations, supporting steady market revenue growth.

The infant nutrition segment shows increasing adoption of dairy proteins, particularly casein and whey fractions, which contributed to over 30% of the market revenue share in 2025. This segment's import volumes in developing economies grew by 15% in 2024, reflecting evolving consumer preferences toward premium infant formulas enriched with dairy protein, accelerating market dynamics.

Technological advances in protein isolation have fostered supply-side scalability, reducing production costs by 8% in 2025. This improvement facilitated higher production capacity in major dairy-producing countries such as the US and New Zealand, enhancing market share penetration.

Micro-market indicators reveal growing demand for alternative protein blends involving dairy proteins in personalized nutrition, catering to niche dietary requirements. In 2024, customized dairy-protein blends constituted nearly 10% of total market revenue, emphasizing emerging trends and market shifts towards innovation.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 15.6 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 6.8% | 2032 Value Projection: |

USD 24.3 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | FrieslandCampina, Glanbia Plc, Hilmar Cheese Company, DuPont Nutrition & Health, Kerry Group Plc, Agropur Inc., Dairy Farmers of America, Synlait Milk Limited, Saputo Inc., Westland Milk Products. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Dairy Protein Market Growth Factors

The increasing consumer inclination toward health and wellness is a fundamental growth driver, reflected in a 20% surge in sports nutrition sales involving whey proteins in 2024. Regulatory support for fortified foods in emerging economies further propels growth, with India and China introducing guidelines favouring dairy protein incorporation by 2025. Moreover, rising demand from infant nutrition due to improved awareness about whey and casein benefits fuels consistent market revenue growth. Lastly, continuous innovations in dairy protein extraction technologies enable cost-effective production, supporting business growth and market penetration.

Dairy Protein Market Development

In March 2025, Mother Dairy launched its high-protein milk variant “Promilk,” featuring 30% more protein than regular milk, marking a significant step into India’s fast-expanding functional dairy segment. The launch accelerated competitive momentum, shortly followed by Amul’s entry into the high-protein milk category, intensifying the race among India’s dairy giants to capture rising consumer demand for protein-rich, health-focused dairy beverages.

In November 2025, Akshayakalpa Organic introduced a lactose-free, high-protein organic milk, targeting consumers seeking gut-friendly, clean-label, and nutritionally enhanced dairy options. The product reinforced the company’s leadership in organic functional dairy by combining allergen-sensitive formulation with elevated protein content and fully traceable organic sourcing.

Key Players

Leading Companies of the Market

FrieslandCampina

Glanbia Plc

Hilmar Cheese Company

DuPont Nutrition & Health

Kerry Group Plc

Agropur Inc.

Dairy Farmers of America

Synlait Milk Limited

Saputo Inc.

Westland Milk Products

Notable competitive strategies include DuPont Nutrition & Health’s acquisition of precision fermentation start-ups in 2024, enhancing its portfolio of sustainable dairy proteins. Similarly, Glanbia Plc expanded capacity in the US with a new plant commissioned in 2025, contributing to a 9% increase in its market share through enhanced supply capabilities.

Dairy Protein Market Future Outlook

The future of the market is poised for continued expansion as manufacturers shift toward high-value, clean-label, and fortified nutrition solutions. Demand is expected to grow in sports nutrition, medical nutrition, elderly nutrition, and personalised wellness products. Technological advancements will improve sustainable processing, reduce environmental impacts, and enhance protein purity. Hybrid protein formulations—combining dairy and plant proteins—are expected to rise as consumers seek both performance and sustainability. Asia-Pacific will continue to outpace other regions due to urbanisation, fitness adoption, and growing infant formula consumption. Pharmaceutical and nutraceutical sectors will also increase the usage of casein and whey derivatives for therapeutic nutrition. Overall, evolving consumer health trends and innovation in protein forms (e.g., hydrolysates, bioactive peptides) will strengthen long-term market growth.

Dairy Protein Market Historical Analysis

The dairy protein market has evolved significantly over the past two decades, driven by the rapid expansion of sports nutrition and increasing consumer awareness of high-quality protein sources. Historically, the market was dominated by traditional uses such as infant formula, bakery, and dairy beverages, but the rise of fitness culture and aging populations reshaped demand — particularly for whey protein isolates and concentrates. Improvements in filtration technologies, such as microfiltration and ultrafiltration, boosted production efficiency and purity levels, enabling manufacturers to scale globally. Western markets, especially North America and Europe, led early adoption, while Asia-Pacific surged later due to growing middle-class incomes and rising interest in functional foods. Volatility in milk supply, dairy price fluctuations, and the emergence of plant proteins influenced market cycles, but dairy proteins retained strong relevance due to superior amino acid profiles and clinical validation in muscle recovery and medical nutrition.

Sources

Primary Research Interviews:

Dairy Process Engineers

Whey Fractionation Managers

Nutrition Scientists

Ingredient Application Chefs

Quality & Regulatory Leads

Databases:

FAO Dairy Statistics

USDA Dairy Reports

ICIS Food Commodity Data

Magazines:

Dairy Foods

FoodNavigator

Nutraceuticals World

International Dairy Journal (industry section)

Food Technology Magazine

Journals:

Journal of Dairy Science

International Dairy Journal

Journal of Food Science

Food Hydrocolloids

Nutrients

Newspapers:

Financial Times (Food & Agribusiness)

The Economic Times (Dairy)

The Wall Street Journal (Food)

The Guardian (Food)

Reuters Food News

Associations:

International Dairy Federation (IDF)

American Dairy Products Institute (ADPI)

Institute of Food Technologists (IFT)

International Whey Products Association

Dairy Council

Share

Share

About Author

Pankaj Poddar is a seasoned market research consultant with over 12 years of extensive experience in the fast-moving consumer goods (FMCG) and plastics material industries. He holds a Master’s degree in Business Administration with specialization in Marketing from Nirma University, one of India’s reputed institutions, which has equipped him with a solid foundation in strategic marketing and consumer behavior.

As a Senior Consultant at CMI for the past three years, he has been instrumental in harnessing his comprehensive understanding of market dynamics to provide our clients with actionable insights and strategic guidance. Throughout his career, He has developed a robust expertise in several key areas, including market estimation, competitive analysis, and the identification of emerging industry trends. His approach is grounded in a commitment to understanding client needs thoroughly and fostering collaborative relationships. His dedication to excellence and innovation solidifies his role as a trusted advisor in the ever-evolving landscape of not only FMCG but also chemicals and materials markets.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients