Computerized Physician Order Entry Systems Market Size and Forecast – 2026 – 2033

The Global Computerized Physician Order Entry Systems Market size is estimated to be valued at USD 6.3 billion in 2026 and is expected to reach USD 12.8 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 10.5% from 2026 to 2033.

Global Computerized Physician Order Entry Systems Market Overview

Computerized physician order entry (CPOE) systems are healthcare IT products that allow clinicians to electronically enter medical orders for medications, tests, and treatments. These systems replace handwritten or verbal orders and integrate with electronic health records. CPOE products help reduce medication errors, improve workflow efficiency, and enhance patient safety. Features include clinical decision support, alerts, and standardized order sets. Reliability, interoperability, and ease of use are core product characteristics.

Key Takeaways

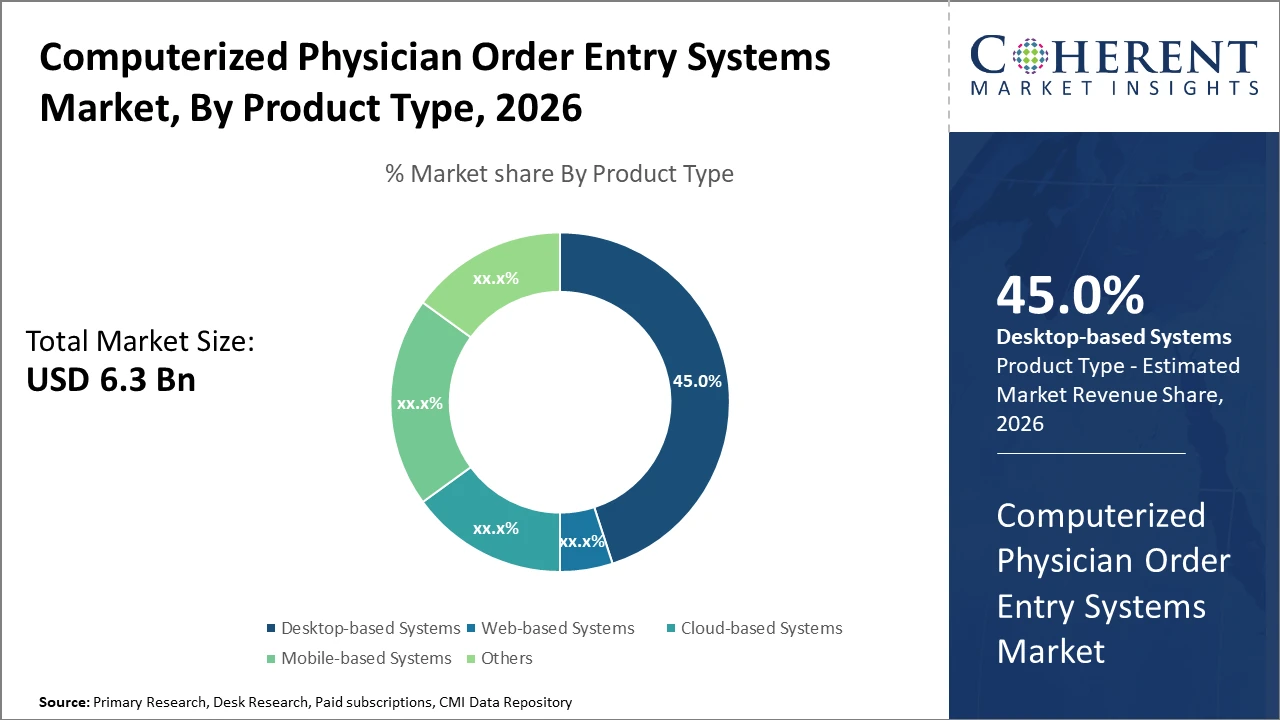

Desktop-based Systems dominate the product type segment, holding a significant market share of 45% due to their widespread adoption in hospital environments, while cloud-based systems exhibit rapid growth fueled by the need for scalable, cost-effective solutions.

The hospital's end-user segment maintains the largest industry share, primarily driven by regulatory mandates and the high criticality of medication accuracy in inpatient care settings.

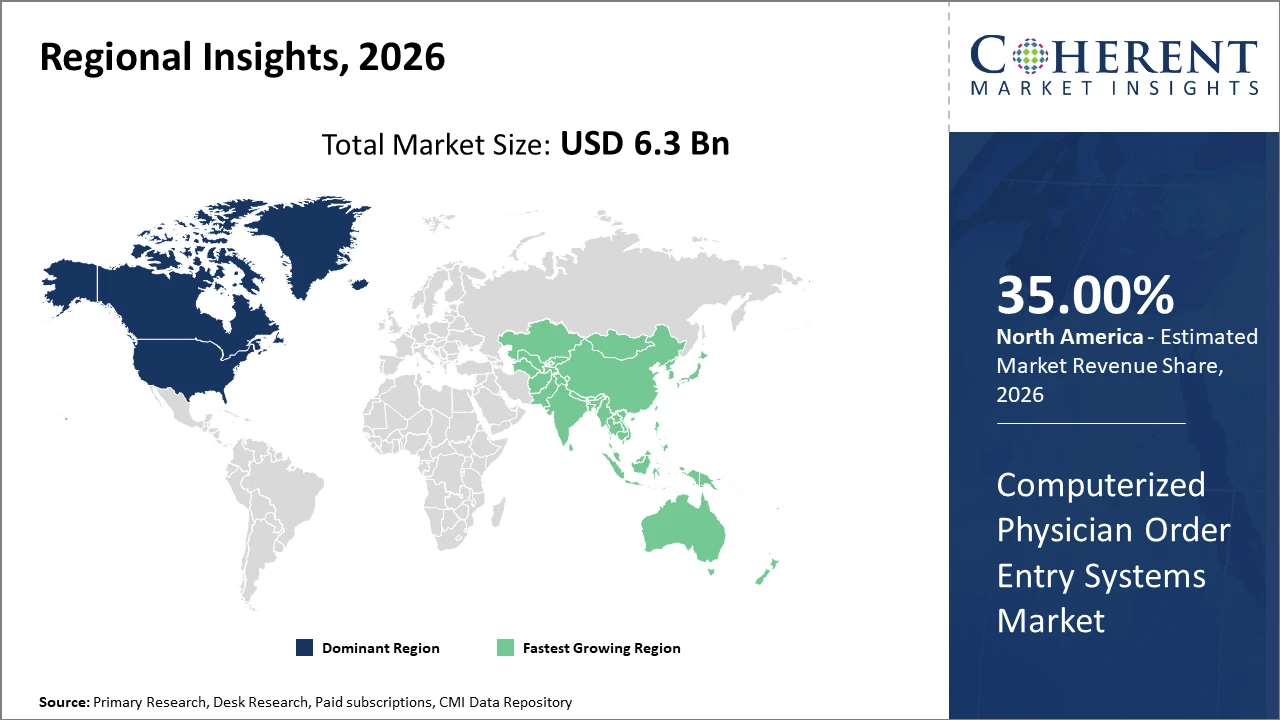

North America leads the market share by 35% owing to advanced healthcare infrastructure, stringent regulatory frameworks, and high government expenditure on healthcare IT adoption.

Asia Pacific is the fastest-growing region, attributed to increasing digitization efforts, expanding healthcare coverage, and favorable policies promoting health IT investments.

Computerized Physician Order Entry Systems Market Segmentation Analysis

To learn more about this report, Download Free Sample

Computerized Physician Order Entry Systems Market Insights, By Product Type

Desktop-based Systems dominate the market share with 45%, owing to their longstanding integration in hospital IT infrastructure and the reliability they provide in critical clinical environments. Their stability and customization capabilities remain valuable despite rapid advancements in alternative platforms. Cloud-based Systems are the fastest-growing segment, driven by increased adoption in outpatient clinics and smaller hospitals seeking scalability and reduced upfront costs. Web-based Systems provide flexible accessibility across facilities, facilitating real-time data access, whereas Mobile-based Systems enhance point-of-care convenience, particularly in ambulatory and specialty clinics.

Computerized Physician Order Entry Systems Market Insights, By Component

Software is the dominating segment due to its core role in enabling order entry, clinical decision support, and system integration. Continuous software innovation, including AI integration and interoperability standards, fuels demand. Services encompass implementation, training, and support, a fast-growing subsegment as healthcare providers seek turnkey solutions and regulatory compliance assistance. Hardware includes terminals, barcode scanners, and servers, essential but are experiencing a slower growth rate due to virtualization trends.

Computerized Physician Order Entry Systems Market Insights, By End-User

Hospitals dominate the market share, attributed to their extensive medication management needs, regulatory scrutiny, and larger budgets supporting comprehensive CPOE deployment. Ambulatory Care Centers constitute the fastest-growing end-user segment as outpatient services expand globally, necessitating digital tools to streamline processing and reduce errors. Specialty Clinics, including oncology and cardiology centers, integrate focused CPOE functionalities tailored to specific clinical workflows, albeit with limited market share compared to hospitals and ambulatory centers.

Computerized Physician Order Entry Systems Market Trends

The Computerized Physician Order Entry Systems market shows a clear trend toward increased efficiency and safety through technology integration.

The incorporation of AI-driven clinical decision support is reshaping care delivery by reducing errors and facilitating personalized medicine.

A notable example is the adoption of natural language processing modules in U.S. hospitals during 2024, which improved order accuracy by 18%.

Additionally, cloud computing adoption accelerated by 35% in Asia Pacific, enabling smaller healthcare facilities to access robust CPOE functionalities without heavy capital expenditure.

Cybersecurity enhancements remain a pivotal market tendency due to escalating cyber threats targeting healthcare data, with blockchain adoption pilots underway in European nations.

Computerized Physician Order Entry Systems Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Computerized Physician Order Entry Systems Market Analysis and Trends

In North America, the dominance in the Computerized Physician Order Entry Systems market is underpinned by strong healthcare IT infrastructure, regulatory mandates such as the HITECH Act, and substantial government funding. The U.S., in particular, accounts the prominent market share globally, supported by leading healthcare providers and technology innovators such as Epic Systems and Cerner. These companies’ ongoing investments in R&D and cloud-based solutions contribute significantly to maintaining North America’s leading market position.

Asia Pacific Computerized Physician Order Entry Systems Market Analysis and Trends

Meanwhile, the Asia Pacific exhibits the fastest growth with a CAGR exceeding 14%, propelled by rising healthcare digitization, expanding healthcare coverage, and increasing health IT investments in China and India. Government initiatives like India’s National Digital Health Mission have accelerated CPOE adoption rates in the region, enabling cloud and mobile-based implementations that address the needs of varied healthcare settings

Computerized Physician Order Entry Systems Market Outlook for Key Countries

USA Computerized Physician Order Entry Systems Market Analysis and Trends

The USA remains the largest and most mature market globally, driven by federal regulations and reimbursement policies that incentivize health IT adoption. Leading companies such as Epic Systems and Cerner dominate the landscape, continually enhancing their offerings to include AI-powered functionalities and interoperability features. In 2024, the U.S. recorded a 60% year-on-year growth in cloud-based CPOE deployments, reflecting a shift toward scalable infrastructures. The country’s considerable hospital network and focus on patient safety continue to underpin stable market revenue and shape competitive dynamics.

India Computerized Physician Order Entry Systems Market Analysis and Trends

India’s market is ascending rapidly with increasing government initiatives to digitize healthcare and improve clinical workflows. Major domestic and international players are capitalizing on cloud solutions to penetrate the tier 2 and 3 cities’ healthcare segments. The adoption of CPOE systems in private and government hospitals grew by over 30% in 2024, driven by public health programs and digital health frameworks aimed at improving medication safety and operational efficiency across diverse healthcare settings.

Analyst Opinion

The increasing deployment of integrated CPOE systems within large hospital networks is a significant demand-side indicator contributing to market expansion. For instance, by 2024, over 60% of tertiary healthcare centers in the U.S. reported full integration of CPOE with electronic health records, correlating with a measurable 25% reduction in prescription errors, highlighting the system’s efficacy and driving further adoption.

Supply-side dynamics reflect an upsurge in software-as-a-service (SaaS) models providing scalable, cost-effective options for smaller healthcare facilities. Recent data from 2025 indicate a 35% rise in cloud-based CPOE implementations in outpatient clinics, enhancing market reach and contributing to an overall 18% increase in market revenue attributed to subscription-based models.

Market analysis reveals regulatory pressure, such as the U.S. Centers for Medicare & Medicaid Services (CMS) mandates tied to meaningful use of health IT, as a potent market growth stimulator. Compliance-driven investments increased by 22% in North America alone in 2024, reinforcing the significance of policy frameworks as catalysts for business growth in the Computerized Physician Order Entry Systems market.

Micro-indicators signal rising adoption of artificial intelligence-enabled decision support to reduce clinician workload and improve diagnostic accuracy within CPOE platforms. A recent pilot study in Japan’s leading hospitals demonstrated a 15% uptick in clinician adherence to treatment protocols when using AI-augmented CPOE, suggesting transformative potential and influencing future market dynamics.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 6.3 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 10.5% | 2033 Value Projection: | USD 12.8 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Allscripts Healthcare Solutions, Inc., MEDITECH, eClinicalWorks, NextGen Healthcare, GE Healthcare, McKesson Corporation, Siemens Healthineers, Philips Healthcare, Athenahealth, Inc., Greenway Health. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Computerized Physician Order Entry Systems Market Growth Factors

The shift towards reducing medication errors through automated order entry has driven healthcare providers to invest extensively in CPOE systems; studies have documented a 30% decline in adverse drug events post-implementation among large hospitals in 2024. Government Healthcare IT Incentives: Various countries have introduced reimbursement incentives encouraging CPOE adoption. For example, the U.S. government’s extended Meaningful Use program, active through 2025, accelerated the deployment in ambulatory care settings by nearly 28%.

Increasing Healthcare Digitization in Emerging Economies: Asia Pacific markets, notably India and China, show rapid integration of CPOE systems supported by government initiatives aimed at digital healthcare transformation, leading to a 35% CAGR in regional market revenue over recent years.Growing Demand for Integrated Health Systems: The trend toward interoperable healthcare platforms combining CPOE with clinical decision support and EHRs facilitates streamlined workflows, evidenced by over 40% of hospitals in Europe adopting integrated solutions in 2025.

Computerized Physician Order Entry Systems Market Development

In 2024, Epic Systems launched an integrated ERP suite that unifies supply chain and financial management with Computerized Physician Order Entry (CPOE) workflows. The platform was designed to create a single, end-to-end operational and clinical environment, improving visibility, cost control, and coordination across hospital systems.

In 2025, InterSystems released IntelliCare, an AI-enabled electronic health record (EHR) platform featuring automated clinical note generation and predictive analytics. The solution aims to reduce clinician documentation burden while enhancing decision support and care quality through real-time insights.

In 2022, Allscripts launched the Expanse CPOE solution as part of its cloud-native Expanse EHR portfolio. The system was engineered to improve patient safety and clinical efficiency by streamlining medication ordering, clinical decision support, and provider workflows.

Key Players

Leading Companies of the Market

Allscripts Healthcare Solutions, Inc.

MEDITECH

eClinicalWorks

NextGen Healthcare

GE Healthcare

McKesson Corporation

Siemens Healthineers

Philips Healthcare

Athenahealth, Inc.

Greenway Health

Several leading companies have displayed aggressive market growth strategies such as strategic partnerships and acquisitions. For example, in 2024, Cerner expanded its AI-powered CPOE capabilities by acquiring a healthcare AI startup, resulting in a 12% growth in its market revenue. Epic Systems strengthened its market presence by launching tailored modular offerings for small and medium hospitals, increasing adoption in emerging regions by 18%. These strategies underline the focus on innovation and regional expansion among top market players.

Computerized Physician Order Entry Systems Market Future Outlook

The future of the CPOE systems market is expected to be shaped by advances in artificial intelligence, interoperability standards, and value-based healthcare models. Next-generation systems will focus on predictive analytics, personalized clinical decision support, and seamless integration across care settings. Expansion into outpatient clinics, ambulatory centers, and telehealth environments will broaden market reach. As healthcare systems emphasize efficiency, safety, and cost control, CPOE platforms will evolve from transactional tools into intelligent clinical workflow engines. Emerging markets are expected to contribute significantly as healthcare IT infrastructure investments increase globally.

Computerized Physician Order Entry Systems Market Historical Analysis

The CPOE systems market originated as part of broader healthcare digitization initiatives aimed at improving patient safety and reducing medication errors. Early implementations were often met with resistance from clinicians due to poor user interfaces, workflow disruptions, and limited interoperability with other hospital systems. Initial adoption was largely confined to large hospitals in developed markets, driven by government incentives, patient safety campaigns, and regulatory mandates. Over time, system functionality expanded beyond medication orders to include laboratory tests, imaging requests, and clinical decision support. Integration with electronic health records transformed CPOE systems into core components of hospital information systems. Continuous improvements in usability, clinical relevance, and error prevention capabilities gradually increased physician acceptance and institutional adoption.

Sources

Primary Research Interviews:

Hospital CIOs

Physicians

Pharmacists

Health IT vendors

Databases:

CMS Health IT Data

HIMSS Analytics

OECD Health Statistics

AHRQ Data

Magazines:

Healthcare IT News

Modern Healthcare

HealthTech Magazine

Becker’s Health IT

Medical Economics

Journals:

Journal of the American Medical Informatics Association

BMJ Health & Care Informatics

Journal of Patient Safety

International Journal of Medical Informatics

Applied Clinical Informatics

Newspapers:

The New York Times (Health)

Reuters Health

Financial Times (Healthcare)

The Guardian (Health)

Bloomberg Health

Associations:

HIMSS

American Medical Informatics Association

Healthcare Information and Management Systems Society

National Patient Safety Foundation

American Hospital Association

Share

Share

About Author

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients