Cellulose Acetate Fibers Market Size and Forecast – 2025 – 2032

The Global Cellulose Acetate Fibers Market size is estimated to be valued at USD 2.8 billion in 2025 and is expected to reach USD 4.5 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.1% from 2025 to 2032.

Global Cellulose Acetate Fibers Market Overview

Cellulose Acetate Fibers are semi-synthetic fibers derived from purified cellulose, typically sourced from wood pulp, and chemically modified with acetic anhydride. They provide a soft, silky hand feel, excellent drape, and high breathability, making them ideal for apparel, linings, home textiles, cigarette filter tow, and specialty industrial applications. Their resistance to shrinkage, good dyeability, and ability to mimic natural silk have contributed to their long-standing popularity in the textile sector. Cellulose acetate fibers are also used in nonwovens, medical materials, and photographic films due to their stability, biodegradability, and consistent performance across processing environments.

Key Takeaways

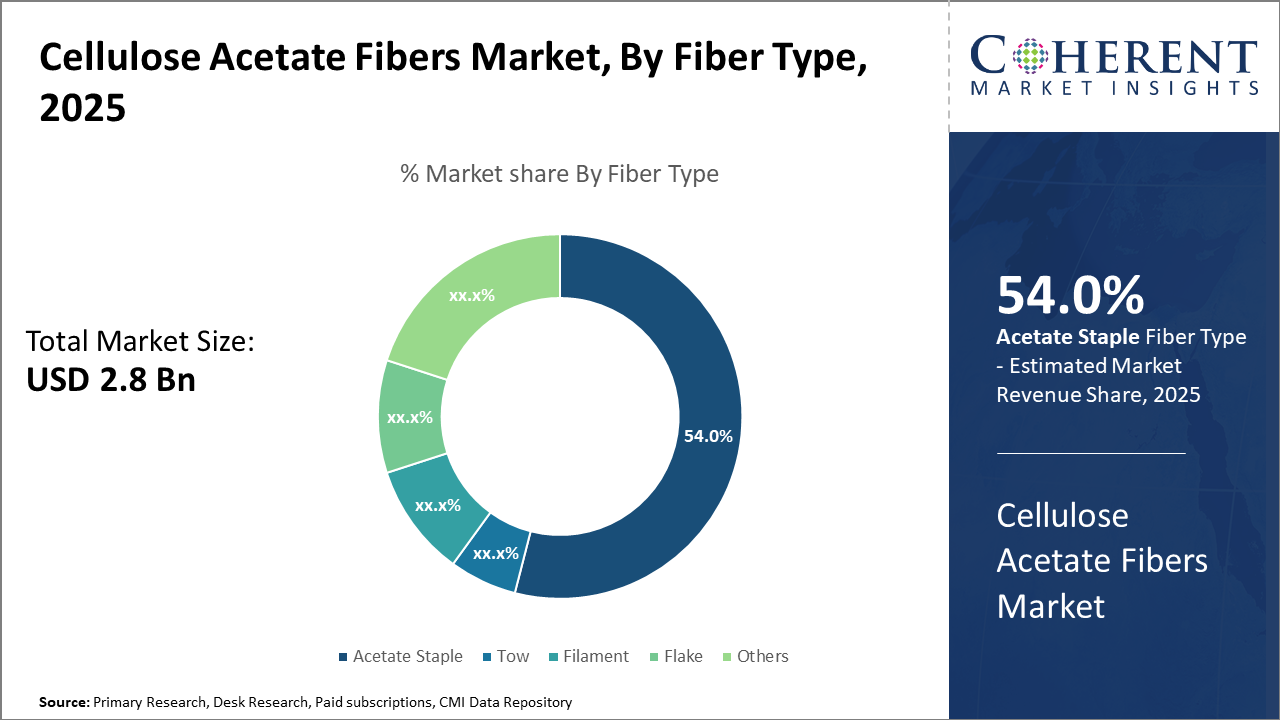

In the Fiber Type segment, acetate staple dominates with a 54% market share, driven by widespread adoption in textile manufacturing, while tow and filament remain vital for technical applications.

Cigarette filters hold a commanding 62% share within the application segment, underscoring strong reliance on cellulose acetate fibers in tobacco product formulation.

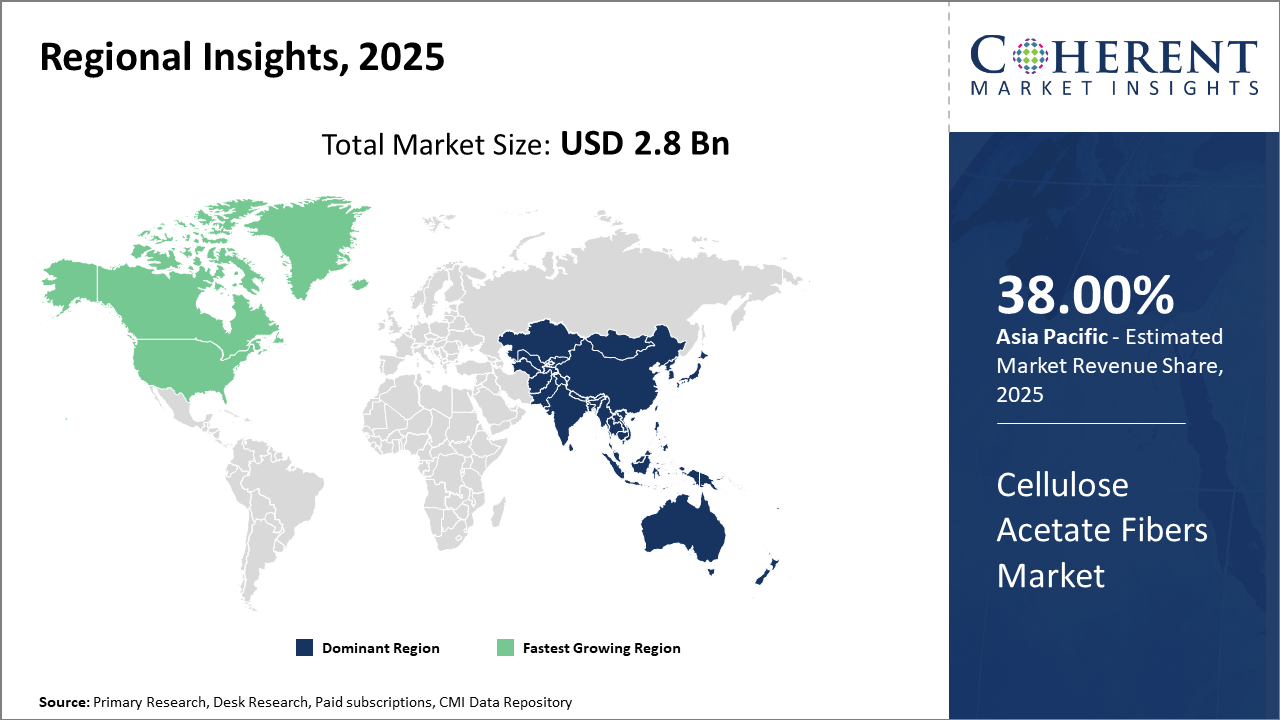

Asia Pacific leads as the dominant region, accounting for over 38% industry share, propelled by strong manufacturing bases in China and India with scalable production infrastructure.

North America is prominent for innovation-driven market strategies, while the Middle East & Africa, despite smaller market revenue contributions, exhibit steady growth driven by emerging industrial demand.

Cellulose Acetate Fibers Market Segmentation Analysis

To learn more about this report, Download Free Sample

Cellulose Acetate Fibers Market Insights, By Fiber Type

Acetate Staple dominates due to its versatility in textile manufacturing and ease of blending with other fibers, driving substantial uptake in eco-friendly apparel collections. The segment benefits from strong demand across Asia Pacific and Europe, where sustainable textile initiatives are a priority. The tow segment, while smaller, is currently the fastest-growing subsegment, propelled by increased use in technical textiles and filtration media that require enhanced fiber alignment and strength. Filament and Flake segments serve niche markets such as specialized packaging and biochemical applications, offering steady but moderate industry expansion.

Cellulose Acetate Fibers Market Insights, By Application

Cigarette Filters sustain dominance, accounting for the majority of the cellulose acetate fibers market revenue due to their specialized fiber properties and established industry integration. Despite challenges in tobacco consumption trends, emerging markets keep demand buoyant. Meanwhile, Packaging applications are the fastest-growing segment, driven by increased demand for biodegradable food packaging materials, aligning with global regulatory shifts. Other Filters segment growth is supported by industrial needs for eco-friendly filtration products, especially in automotive and HVAC industries, adopting cellulose acetate blends.

Cellulose Acetate Fibers Market Insights, By End-User Industry

Textiles and Apparel dominate by volume, anchored by rising sustainable fashion trends and consumer preference shifts. The Automotive sector is the fastest-growing end user, fueled by stringent emission regulations demanding cellulose acetate-based filter media and composite materials with lighter weight and biodegradability. Industrial applications grow steadily, encompassing air and liquid filtration systems leveraging cellulose acetate fibers for environmental compliance. Consumer Goods cover non-textile applications such as packaging films and non-woven fabrics, supporting niche expansions.

Cellulose Acetate Fibers Market Trends

The Cellulose Acetate Fibers industry is rapidly advancing towards closed-loop production systems, aiming to reduce waste generation substantially.

For example, key manufacturers in Europe have integrated chemical recycling technologies by 2025, reducing fiber waste by 20%.

Additionally, the integration of bio-based cellulose acetate fibers in high-end fashion brands has reshaped consumer market dynamics, with 2024 data showing apparel collections with up to 30% sustainable fiber content gaining a 15% sales premium.

Apart from this, regulatory pressures on cigarette filter biodegradability have spurred R&D investments, leading to novel filter prototypes that degrade 40% faster in landfill conditions, anticipated to redefine market growth trajectories.

Cellulose Acetate Fibers Market Insights, By Geography

To learn more about this report, Download Free Sample

Asia Pacific Cellulose Acetate Fibers Market Analysis and Trends

In the Asia Pacific, the dominance in the Cellulose Acetate Fibers market is underpinned by extensive manufacturing capabilities and government incentives promoting bio-based materials. China and India, in particular, contribute heavily with large-scale production units and rising domestic consumption. The region accounts for over 38% of the industry share, driven by expanding textile and cigarette manufacturing sectors alongside rising export volumes.

Asia Pacific Cellulose Acetate Fibers Market Analysis and Trends

Meanwhile, North America exhibits the fastest growth with a CAGR exceeding 8%, supported by technological innovation hubs, strict environmental regulations favoring biodegradable fibers, and growing industrial filtration applications. Regulatory frameworks in the U.S. incentivize sustainable materials, bolstered by leading companies investing substantially in capacity expansions.

Cellulose Acetate Fibers Market Outlook for Key Countries

USA Cellulose Acetate Fibers Market Analysis and Trends

The USA's Cellulose Acetate Fibers market benefits from innovative fiber technologies and integration in high-performance textiles and filtration. Leading manufacturers such as Eastman Chemical have expanded production capacity by 20% since 2024, catering to increased demand from automotive and industrial filtration sectors. The market's revenue is buoyed by stringent emissions regulations stimulating demand for cellulose acetate-based filter media and rising interest from sustainable apparel manufacturers.

China Cellulose Acetate Fibers Market Analysis and Trends

China's market is driven by a robust manufacturing ecosystem and government backing for sustainable fiber production. Major market players have scaled up acetate staple fiber production significantly during 2024-2025, combining favorable policies that incentivize renewable resource utilization. In addition, the expanding cigarette manufacturing industry, especially in China, accounts for a major proportion of the cellulose acetate fibers market share regionally, while export-oriented textile manufacturers leverage this growth to solidify international trade positions.

Analyst Opinion

The surge in demand from sustainable textile manufacturing has been a primary driver. Data from 2024 indicates a 12% rise in cellulose acetate fiber consumption by eco-conscious apparel brands, revealing a significant shift towards biodegradable materials that complement circular economy initiatives.

Production capacity expansion in the Asia Pacific reached over 15,000 tons in 2024 alone, fostering competitive pricing that stimulated import volumes across Europe and North America by 9% and 7% respectively. This reflects a stable supply-side growth underpinning market revenue increases.

Filter application utilization contributed to an augmented market share as stringent air quality regulations galvanized the automotive and HVAC industries. Notably, filter media incorporating cellulose acetate fibers achieved a 14% penetration in new vehicle production lines in 2025, a rise supported by environmental agencies’ emission standards.

Pricing trends observed a moderate increase of approximately 3.5% YoY in 2024 due to feedstock variability, but remained competitive relative to synthetic alternatives, thus maintaining demand-side growth momentum in emerging economies that collectively witnessed a 10% market revenue jump.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 2.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.1% | 2032 Value Projection: |

USD 4.5 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Aksa Akrilik Kimya Sanayii A.S., Kolon Industries Inc., Kuraray Co., Ltd., Rhodia Solvay Group, Hengli Group, Nitto Boseki Co., Ltd., Zhejiang Fulida New Material Co., Ltd., Shandong Gobang New Materials Co., Ltd., Jilin Chemical Fiber Group Co., Ltd., Toray Advanced Materials Korea Inc. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Cellulose Acetate Fibers Market Growth Factors

The escalating demand for sustainable and biodegradable fibers has become a foremost growth driver, catalyzed by mounting regulatory pressure against synthetic fibers and plastic waste. This has propelled cellulose acetate fibers to the forefront between 2024 and 2025, particularly in Europe and North America, where market revenue linked to eco-textiles surged by 18% in 2024 alone. The cigarette filter market continues as a dominant application, driven by increasing tobacco consumption in developing countries and stricter product quality requirements in developed regions. Cigarette filters made from cellulose acetate fibers accounted for nearly 62% market share, supporting industry trends upwards in production and consumption. Technological advancements facilitating improved fiber functionalization and blending have unlocked new applications in industrial filtration and packaging, leading to diversified market growth.

Cellulose Acetate Fibers Market Development

In 2023, Eastman Chemical Company launched Naia™ Renew, a sustainable filament yarn made with significant recycled content to support eco-conscious apparel brands. The product is engineered to reduce environmental impact through advanced molecular recycling, offering a lower-carbon, traceable alternative for fashion manufacturers seeking high-performance yet sustainable textiles.

In 2020, Celanese Corporation introduced BlueRidge Cellulosic Pellets, a bio-based and fully compostable material designed to align with circular-economy principles. The pellets deliver strong processing performance for consumer goods, packaging, and textile applications while helping manufacturers transition away from traditional petrochemical-based plastics.

Key Players

Leading Companies of the Market

Aksa Akrilik Kimya Sanayii A.S.

Kolon Industries Inc.

Kuraray Co., Ltd.

Rhodia Solvay Group

Hengli Group

Nitto Boseki Co., Ltd.

Zhejiang Fulida New Material Co., Ltd.

Shandong Gobang New Materials Co., Ltd.

Jilin Chemical Fiber Group Co., Ltd.

Toray Advanced Materials Korea Inc.

Competitive strategies among these players focus on capacity expansions and strategic acquisitions. For instance, Eastman Chemical’s 2024 expansion in the North American acetate staple fiber plant resulted in a 20% increase in market share locally. Similarly, Daicel Corporation’s partnership with major textile manufacturers in Asia in 2025 enhanced supply chain integration, supporting a revenue growth of 15% in the region.

Cellulose Acetate Fibers Market Future Outlook

Future demand for cellulose acetate fibers is expected to be influenced by rising interest in biodegradable, bio-based materials as industries move away from fully synthetic fibers. The apparel industry is increasingly adopting these fibers for premium and eco-conscious products. Cigarette filter demand may gradually decline in mature markets, but will remain stable in developing economies. Innovation in acetate-based performance fibers, sustainable dyeing technologies, and new industrial applications such as filtration and specialty textiles will expand long-term opportunities. As environmental regulations strengthen globally, cellulose acetate fibers are well-positioned to benefit from their renewable sourcing and lower ecological footprint.

Cellulose Acetate Fibers Market Historical Analysis

The Cellulose Acetate Fibers market historically developed through its early use in textiles, cigarette filters, and industrial applications. Derived from purified cellulose, the fibers gained popularity for their breathability, color retention, and soft feel, making them suitable for apparel and home furnishings. The cigarette industry became a major consumer, using cellulose acetate tow for filter production—a demand that shaped global production capacity. Advancements in fiber spinning technologies and chemical modification improved fiber quality, dyeability, and biodegradability. Growth in sustainable materials and semi-synthetic fiber adoption also supported long-term market stability.

Sources

Primary Research Interviews:

Fiber Technologists

Textile Manufacturers

Filter Production Managers

Databases:

TextileWorld Data

GlobalData Fibers

UN Comtrade Fiber Trade Statistics

Magazines:

Textile World

Fibre2Fashion Magazine

Nonwovens Industry

Journals:

Textile Research Journal

Journal of Polymer Science

Cellulose Journal

Materials Today

Newspapers:

Business Standard (Textiles)

Financial Times (Manufacturing)

The Hindu Business Line (Industry)

Associations:

ITMF

American Chemical Society (ACS)

CEFIC

Textile Association of India

Share

Share

About Author

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients