Cat Wet Food Market Size and Forecast – 2025 – 2032

The Global Cat Wet Food Market size is estimated to be valued at USD 6.8 billion in 2025 and is expected to reach USD 10.9 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.8% from 2025 to 2032.

Global Cat Wet Food Market Overview

Cat wet food products are moisture-rich, nutritionally balanced meals designed to provide hydration, protein, and essential nutrients for feline health. They are available in various textures such as pâté, chunks in gravy, and minced forms to appeal to different cat preferences. These formulations often include high-quality animal proteins, taurine, vitamins, and minerals to support digestion, coat health, and immunity. Many products are grain-free and fortified with omega fatty acids for optimal wellness. Innovations in packaging—like easy-open cans and single-serve pouches—enhance freshness and convenience for pet owners.

Key Takeaways

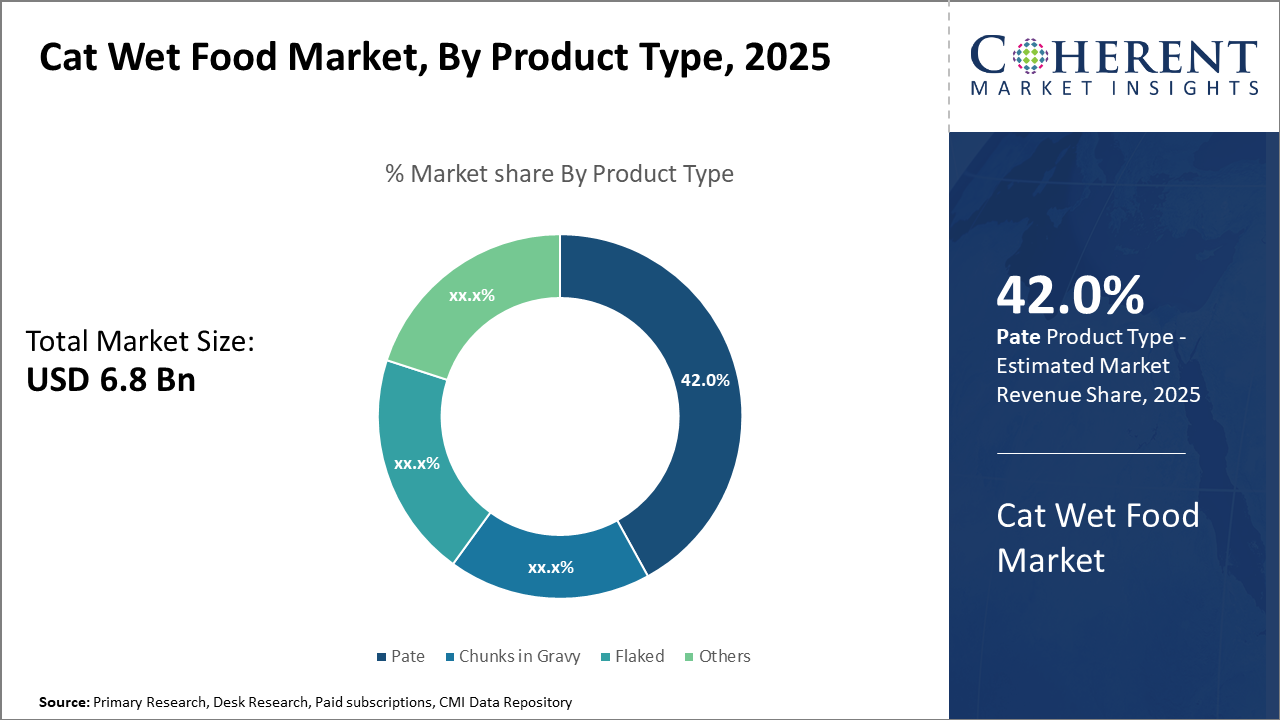

The Pâté product type dominates the cat wet food market segment, accounting for 42%, supported by ease of consumption and palatability enhancements.

Online Retail is the fastest-growing distribution channel, driven by convenience and expanded consumer reach, with growth exceeding 15% in 2025.

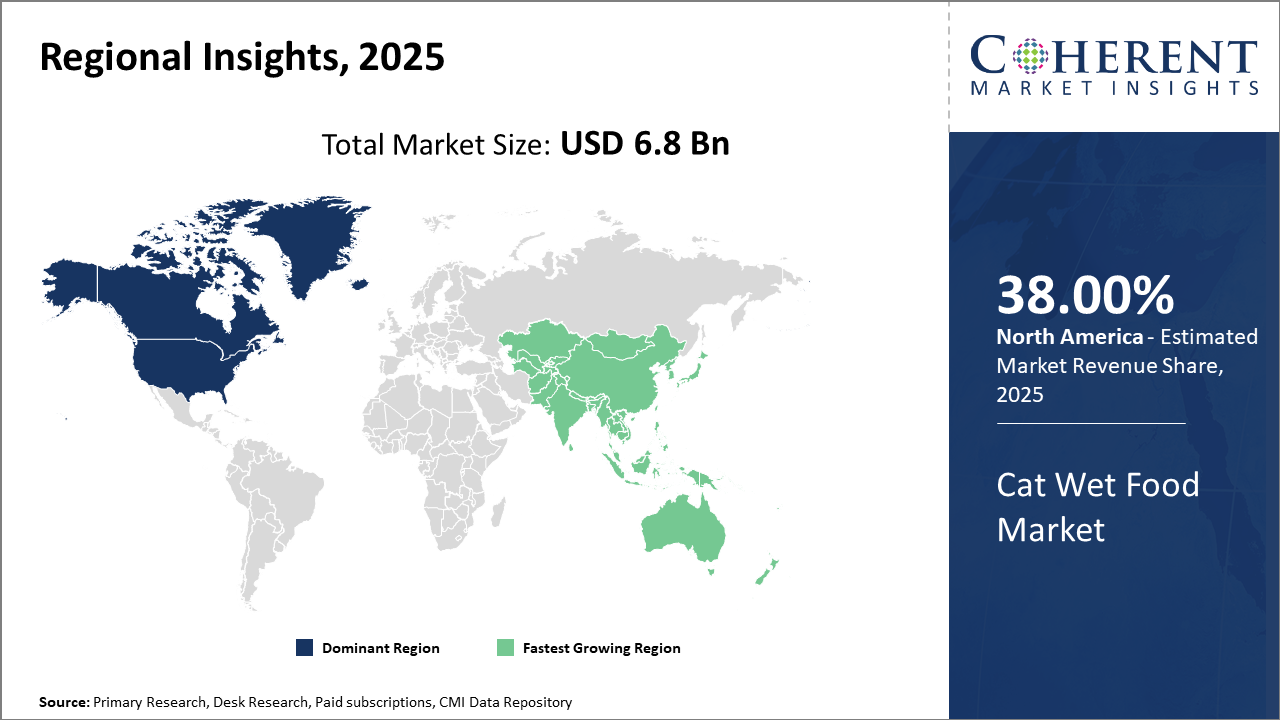

In terms of geography, North America leads the market share due to high pet ownership and premiumization trends, contributing over 38% to global market revenue.

Asia Pacific shows the fastest growth rate, fueled by rising urbanization and disposable incomes, with an estimated CAGR of 9.4% from 2025-2032.

Cat Wet Food Market Segmentation Analysis

To learn more about this report, Download Free Sample

Cat Wet Food Market Insights, By Product Type

Pâté dominates the market share with 42%, due to its smooth texture, which is preferred by a wide variety of cats, making it a staple in feeding routines. This subsegment also benefits from innovations such as enhancing nutritional profiles without compromising palatability. The fastest-growing subsegment is Chunks in Gravy, notable for combining texture variety with moisture content, which appeals to cats desiring a more natural eating experience.

Cat Wet Food Market Insights, By Packaging

In packaging, cans are gaining the largest industry share at 52%, primarily due to their convenience, longer shelf life, and cost-effectiveness for manufacturers and consumers. The robust materials used in cans preserve product freshness and enable easier storage, which are crucial factors for pet owners. The fastest-growing packaging format is Pouch packaging, driven by consumer demand for portability and resealability, which supports freshness after opening. Trays serve a niche market focusing on single-serving sizes with premium aesthetics, appealing to convenience-seeking buyers.

Cat Wet Food Market Insights, By Distribution Channel

Online Retail emerges as the leading channel due to the ease of access, subscription offerings, and personalized buying experiences that resonate with millennial and Gen Z pet owners. Online Retail’s agility in launching new products and promotional campaigns positions it as a key growth driver, supporting increased market revenue and share. Veterinary Clinics serve a specialized niche focusing on prescription and health-specific cat wet foods, ensuring targeted nutritional benefits.

Cat Wet Food Market Trends

Current market trends indicate a decisive move toward sustainable packaging and ingredient transparency, aligned with consumer demand for clean-label products.

The adoption of novel protein sources, including insect-based and plant-based ingredients, is gaining momentum, supported by manufacturer investments in R&D and shifting consumer preferences toward sustainability.

Subscription-based DTC models are disrupting traditional retail by providing personalized cat wet food solutions accompanied by convenience, which is evidenced by a 25% growth in online sales channels in 2025.

These trends are substantiated by increased launch activity of environmentally friendly products, which made up 30% of market introductions that year.

Cat Wet Food Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Cat Wet Food Market Analysis and Trends

North America remains dominant in the Cat Wet Food market because of its mature pet care ecosystem, extensive premium product penetration, and strong regulatory frameworks that ensure product quality. The region commands approximately 38% market share globally. Established market companies like Nestlé and Mars have reinforced their positions through product innovation and strategic partnerships, driving consistent revenue growth. Government initiatives that support pet health awareness and an expanding network of online retailers further fuel this dominance.

Asia Pacific Cat Wet Food Market Analysis and Trends

Asia Pacific exhibits the fastest growth with a CAGR approaching 9.4%, propelled by rapid urbanization, rising disposable incomes, and increased pet adoption trends, especially in countries like China and India. The expanding middle-class population shows preferences for premium and functional wet cat foods, supported by the growth of e-commerce platforms. Market leaders in the region focus on localizing products to fit regional tastes and dietary preferences, contributing to sustained business growth.

Cat Wet Food Market Outlook for Key Countries

USA Cat Wet Food Market Analysis and Trends

The USA represents the largest individual national market within North America, contributing approximately 30% of global cat wet food revenue. High pet ownership rates and a trend toward pet humanization have propelled demand for specialized wet food variants emphasizing health benefits such as urinary tract support and weight management. Key players like Mars, Inc. and Hill’s Pet Nutrition invest heavily in functional product lines and digital marketing to capitalize on evolving consumer preferences.

China Cat Wet Food Market Analysis and Trends

China’s cat wet food market is rapidly maturing due to fast-growing urban pet populations and increasing disposable income. Market dynamics are shaped by rising demand for premium and organic wet foods, as well as an accelerating e-commerce footprint. Brands have localized formulations to cater to regional feline dietary habits, contributing to a staggering double-digit sales growth observed throughout 2024 and into 2025. Imports have surged by over 15% due to heightened consumer inclination toward international brands, with companies focusing on building brand trust using digital platforms and influencer marketing.

Analyst Opinion

Supply-side dynamics remain pivotal, with manufacturers increasing production capacities to meet surging demand. For instance, in 2024, leading production hubs in North America expanded manufacturing lines by 15%, enabling faster product turnover and reinforcing supply chain robustness across regions.

Pricing strategies are increasingly competitive due to growing market penetration by premium brands; data from late 2024 indicates a 10% average price reduction for mid-tier cat wet food to attract a broader consumer base, thereby driving revenue growth and increasing market share.

Demand-side indicators reveal expanding use cases emphasizing health-specific variants such as grain-free and high-protein formulations, which accounted for over 35% of new product launches in 2025. These variants address feline dietary sensitivities and preferences, reinforcing steady market growth.

Imports are witnessing a steady rise, as noted in 2024 import data showing a 12% increase in imported cat wet food products in Europe, demonstrating enhanced consumer preference for international quality brands and diversified ingredient profiles.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: | USD 6.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.8% | 2032 Value Projection: | USD 10.9 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Nestlé S.A., Mars, Incorporated, Hill’s Pet Nutrition, Royal Canin (subsidiary of Mars), Colgate-Palmolive Company, Spectrum Brands (United Pet Group), Blue Buffalo Co., Ltd., The J.M. Smucker Company, WellPet LLC, Big Heart Pet Brands, Diamond Pet Foods, Tuffy's Pet Food, Nutro Products, Spectrum Brands Holdings, Nature’s Variety. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Cat Wet Food Market Growth Factors

The rising trend of pet humanization continues to act as the most significant driver, influencing consumers to invest in premium quality and nutritionally enriched cat wet foods. Statistically, premium segment products contributed to approximately 48% of the total market revenue in 2024. Expansion of e-commerce platforms has further accelerated market growth, with online retail channels exhibiting a CAGR above 15% since 2023. Increasing awareness about pet health and wellness fosters demand for specialized wet food targeting weight management, digestion, and allergies; in 2025, functional wet food variants grew 18% faster than mainstream formulations. Urbanization and dual-income households facilitate higher consumer spending on premium pet food, especially in the Asia Pacific, reflecting market revenue surges in emerging economies.

Cat Wet Food Market Development

In January 2025, Allana Consumer Products Ltd., part of the diversified Allana Group, entered the premium pet nutrition segment with the launch of “Purrfeto”, a high-quality cat food line designed for both kittens and adult cats. The product is manufactured at Allana’s state-of-the-art automated facility in Zaheerabad, Hyderabad, which is equipped with advanced extrusion and packaging technologies ensuring nutrient retention and consistent quality.

In March 2025, Avanti Pet Care, a subsidiary of Avanti Feeds Ltd., unveiled “Avant Furst”, a new premium pet food brand developed in collaboration with Thailand’s Bluefalo Group, a well-known name in Asian pet nutrition manufacturing. The partnership combines Avanti’s regional distribution strength and raw material expertise with Bluefalo’s technological know-how in formulating protein-rich, functional pet foods tailored to tropical climates.

Key Players

Leading Companies of the Market

Nestlé S.A.

Mars, Incorporated

Hill’s Pet Nutrition

Royal Canin (subsidiary of Mars)

Colgate-Palmolive Company

Spectrum Brands (United Pet Group)

Blue Buffalo Co., Ltd.

The J.M. Smucker Company

WellPet LLC

Big Heart Pet Brands

Tuffy's Pet Food

Nutro Products

Spectrum Brands Holdings

Nature’s Variety

Several leading companies deploy advanced R&D to diversify portfolios towards natural, organic, and functional wet food products, responding directly to shifting consumer preferences. For example, Mars Incorporated's 2024 launch of plant-based wet food lines resulted in a 20% sales uplift across North America. Similarly, Nestlé's adoption of sustainable packaging reduced costs by 8%, enhancing market competitiveness in Europe.

Cat Wet Food Market Future Outlook

The future of the cat wet food market will be defined by premiumization, functional innovation, and personalized nutrition. As consumers continue to treat pets as family members, demand for clean-label, grain-free, and high-protein products will grow rapidly. Companies are expected to invest in sustainable packaging, recyclable cans, and alternative proteins such as insects and plant-based meats to meet environmental and ethical expectations. Digital retail expansion and subscription-based models will enhance accessibility and customer retention, while collaborations with veterinarians and nutritionists will strengthen brand credibility. The market will increasingly leverage data analytics and AI-driven recommendations to personalize feeding plans and enhance consumer engagement globally.

Cat Wet Food Market Evolution

The cat wet food market has evolved from a niche luxury segment to a mainstream component of the global pet food industry. Initially, wet cat food was primarily sold as canned meat-based formulations targeting urban pet owners in developed regions. However, over time, rising pet humanization, improved distribution channels, and growing awareness of feline dietary needs transformed the category. Brands began diversifying flavors, textures, and packaging to meet consumer expectations for variety, quality, and convenience. The emergence of premium and super-premium product lines, featuring high meat content and functional ingredients for specific health benefits, helped the segment expand across both traditional retail and e-commerce channels. In recent years, sustainability, traceability, and ethically sourced ingredients have gained importance, shaping new standards for formulation and marketing.

Sources

Primary Research interviews:

Pet Nutritionists

Veterinarians

Pet Food Manufacturers

Retail Category Managers

Databases:

Euromonitor Pet Care Reports

FAO Animal Feed Statistics

Magazines:

Pet Food Processing

Global Pets

Pet Product News

Modern Cat

Journals:

Journal of Animal Physiology and Animal Nutrition

Animal Feed Science and Technology

Journal of Feline Medicine and Surgery

Veterinary Sciences

Newspapers:

The Guardian (Lifestyle)

The Economic Times (FMCG)

The New York Times (Pets)

The Times of India (Consumer Goods)

Associations:

Pet Food Institute

World Pet Association

European Pet Food Industry Federation (FEDIAF)

American Feed Industry Association

Share

Share

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients