Cardiac Assist Devices Market Size and Forecast – 2026 – 2033

The Global Cardiac Assist Devices Market is estimated to be valued at USD 5.20 billion in 2026 and is projected to reach USD 9.80 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.1% between 2026 and 2033.

Global Cardiac Assist Devices Market Overview

The Cardiac Assist Devices market includes a range of medical devices designed to support or replace heart function in patients with cardiac conditions. Key products include ventricular assist devices (VADs) such as left, right, and biventricular assist systems that aid blood circulation, and intra-aortic balloon pumps (IABPs) that improve myocardial perfusion. Extracorporeal membrane oxygenation (ECMO) systems provide temporary heart and lung support in critical care settings. Other devices include percutaneous cardiac support systems and implantable pumps for long-term therapy. Technological advancements, miniaturization, and enhanced biocompatibility are driving adoption, enabling improved patient outcomes and expanding use across acute, chronic, and surgical care settings.

Key Takeaways

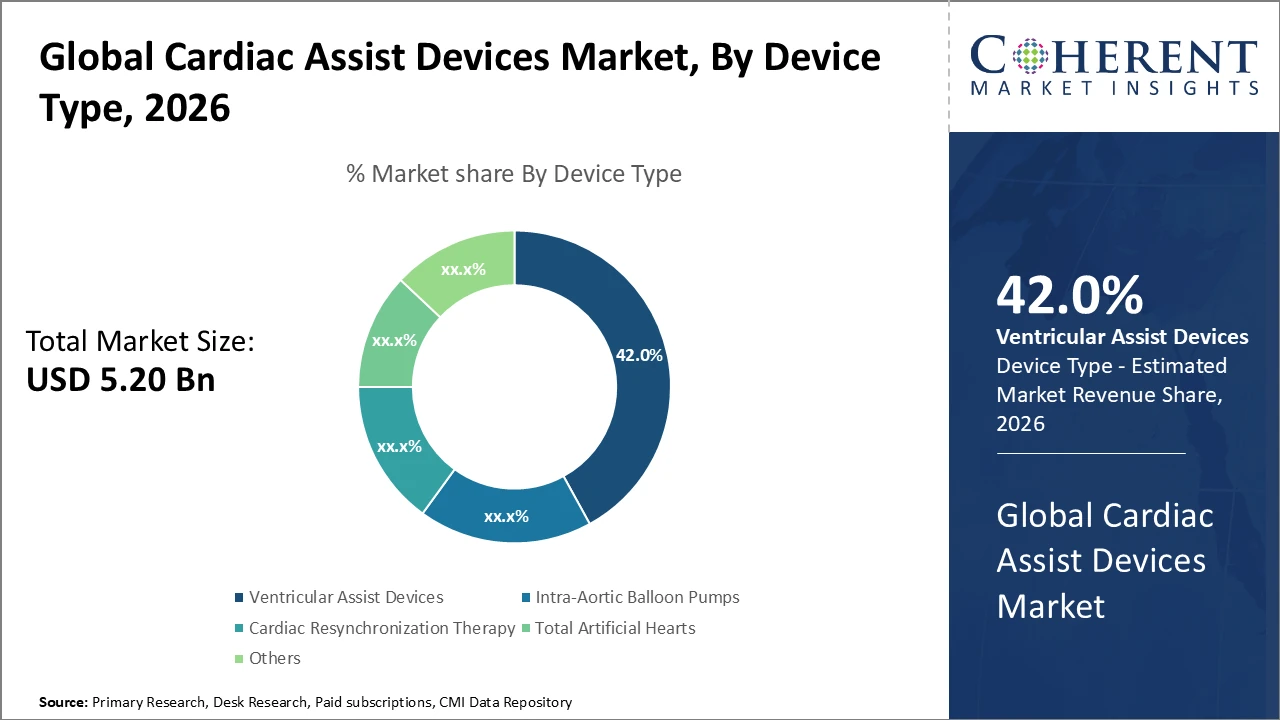

Ventricular assist devices (VADs) dominate the device type segment, accounting for 42% of market revenue in 2026, due to their clinical efficacy and wide applicability across cardiac indications.

Heart failure represents the largest indication segment, driving the highest consumption of cardiac assist devices in line with the growing patient population and treatment adoption.

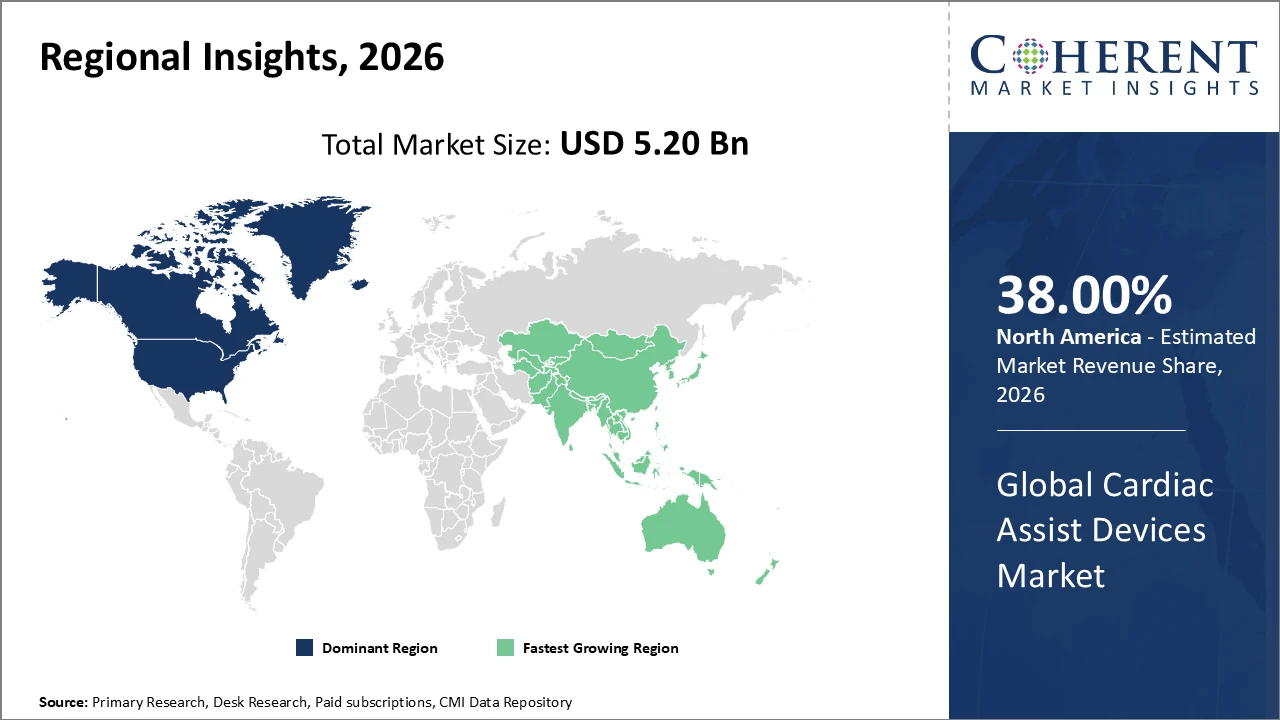

North America leads the market regionally, supported by advanced healthcare infrastructure, regulatory facilitation, and strong R&D investments.

Asia Pacific exhibits the highest CAGR, driven by expanding healthcare access, rising awareness, and government initiatives aimed at reducing cardiovascular mortality, creating significant growth opportunities.

Cardiac Assist Devices Market Segmentation Analysis

To learn more about this report, Download Free Sample

Cardiac Assist Devices Market Insights, By Device Type

Ventricular assist devices (VADs) dominate the market due to their advanced capabilities in supporting both short-term and long-term cardiac function, making them essential for severe heart failure cases. Innovations such as portable power sources and remote monitoring features further sustain demand. The fastest-growing subsegment is intra-aortic balloon pumps, driven by minimally invasive technology and cost-effective procedural integration. Cardiac resynchronization therapy devices, used for heart rhythm disorders, show steady growth supported by technological upgrades. Total artificial hearts remain niche but are gradually advancing for terminal cardiac failure, while other emerging devices continue to expand the assistive cardiology landscape.

Cardiac Assist Devices Market Insights, By Indication

Heart failure represents the largest share of the market, driven by its high incidence and chronic nature, which require consistent use of cardiac assist devices and stimulate significant R&D and market investment. Cardiogenic shock is the fastest-growing subsegment, as increasing emphasis on emergency care and critical intervention protocols boosts demand for rapid assist devices like intra-aortic balloon pumps. Myocardial infarction-related device usage remains stable, supported by advances in acute cardiac care pathways. Cardiomyopathy forms a specialized but expanding niche due to global genetic predispositions, while other indications include congenital heart disease and related cardiovascular conditions.

Cardiac Assist Devices Market Insights, By End-User

Hospitals and clinics dominate the market share, driven by their infrastructure capabilities and the need for continuous patient monitoring following device implantation. Ambulatory surgical centers are the fastest-growing segment, fueled by the increasing number of outpatient cardiac procedures and accelerated recovery protocols. Home care settings are becoming more relevant as advancements in portable cardiac assist devices enable patient independence while ensuring continuous cardiac support. Other end users include rehabilitation centers and specialty cardiac care facilities, which contribute to segment diversification and support broader adoption of assistive cardiac technologies across various care settings.

Cardiac Assist Devices Market Trends

The Cardiac Assist Devices market is shifting toward smarter and more adaptable devices, emphasizing innovation and patient-centric features.

In 2025, AI-integrated ventricular assist devices (VADs) were launched, enabling real-time monitoring and predictive analytics to improve patient management.

Device designs increasingly focus on portability and user-friendly interfaces, supporting broader adoption in home care settings.

Collaborations between device manufacturers and telemedicine platforms are expanding, accelerating market growth and integration of remote cardiac care solutions, especially after 2024.

Cardiac Assist Devices Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Cardiac Assist Devices Market Analysis and Trends

North America dominates the Cardiac Assist Devices market, supported by advanced healthcare infrastructure, early adoption of cutting-edge technologies, and favorable regulatory frameworks. In 2026, the region accounted for over 38% of the global market share. High healthcare expenditure, exceeding USD 4 trillion in 2025, enables widespread access to cardiac assist devices and supports continuous innovation. Extensive research and development efforts by leading companies, combined with strong clinical adoption of ventricular assist devices, intra-aortic balloon pumps, and cardiac resynchronization therapy devices, reinforce the region’s leadership. Robust funding, technological integration, and a focus on improving cardiac patient outcomes drive sustained market growth in North America.

Asia Pacific Cardiac Assist Devices Market Analysis and Trends

The Asia Pacific region is the fastest-growing market for Cardiac Assist Devices, with a projected CAGR of approximately 11.5% during the forecast period. Growth is driven by government healthcare reforms, increasing prevalence of cardiovascular diseases, and rising investments in healthcare infrastructure, particularly in India and China. Expanding access to advanced cardiac technologies, such as ventricular assist devices and intra-aortic balloon pumps, supports broader adoption across hospitals, clinics, and emerging homecare settings. Favorable reimbursement policies and growing awareness of cardiac health further enhance market opportunities. These factors collectively position Asia Pacific as a key growth region in the global cardiac assist devices market.

Cardiac Assist Devices Market Outlook for Key Countries

USA Cardiac Assist Devices Market Analysis and Trends

The U.S. Cardiac Assist Devices market remains a global benchmark, supported by advanced healthcare infrastructure, sophisticated clinical practices, and high patient awareness. Leading companies such as Abbott Laboratories and Medtronic drive growth through significant investments in innovation, R&D, and clinical collaborations. In 2025, the U.S. accounted for nearly 30% of global cardiac assist device shipments, highlighting its strong market presence and revenue contribution. Continuous FDA approvals for novel devices, including ventricular assist devices and intra-aortic balloon pumps, reinforce adoption and technological advancement. These factors collectively sustain the country’s leadership and position it as a key driver of global market growth.

Germany Cardiac Assist Devices Market Analysis and Trends

Germany’s Cardiac Assist Devices market is driven by advanced healthcare infrastructure, strong reimbursement frameworks, and high adoption of innovative cardiac technologies. Leading companies, including GE Healthcare and Abbott, actively contribute through R&D and localized product offerings. The country’s significant elderly population and rising cardiovascular disease prevalence fuel demand for devices like ventricular assist devices, intra-aortic balloon pumps, and cardiac resynchronization therapy systems. Technological advancements, such as portable and AI-enabled devices, support homecare and hospital-based applications. Government initiatives aimed at reducing hospital burden and improving patient outcomes further promote market growth, positioning Germany as a key leader in Europe’s cardiac assist device sector.

Analyst Opinion

Product Innovation and Capacity Expansion: Production capacity, especially for ventricular assist devices (VADs), increased by nearly 15% in 2025 to meet rising demand from heart failure patients. Stabilized pricing in 2024, driven by economies of scale, enabled wider market penetration.

Diverse Adoption Across Clinical Applications: Use of cardiac assist devices in emergency cardiogenic shock care and perioperative cardiac support expanded the demand base. In 2026, approximately 43% of device deployments were in critical care, a 7% increase from 2024, reflecting broader clinical applications.

Import-Export Dynamics: Asia Pacific emerged as a key importer, with imports rising about 20% in 2025 due to healthcare investments in countries like Japan and South Korea, improving supply chain efficiency and adoption.

Emerging Miniaturization and Portability Trends: Development of smaller, portable, and less invasive devices has increased patient compliance. Clinical trials in 2024 showed positive outcomes, with adoption rates projected to rise by 12% in 2026.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 5.20 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 9.1% | 2033 Value Projection: | USD 9.80 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Abbott Laboratories, Medtronic, Abiomed, Inc., Boston Scientific Corporation, Terumo Corporation, LivaNova PLC, Getinge AB, Zurich MedTech AG, SyntheMed, Inc., SynCardia Systems, LLC | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Cardiac Assist Devices Market Growth Factors

The growing global prevalence of cardiovascular diseases, driven by lifestyle changes and aging populations, remains the primary driver of the cardiac assist devices market. WHO data indicate a 6% increase in heart failure cases between 2024 and 2026, fueling device demand. Technological advancements, including IoT-enabled monitoring, have improved patient management and outcomes, as evidenced by 2025 clinical studies. Rising healthcare infrastructure investments, particularly in emerging regions like Asia Pacific—where India increased healthcare spending by nearly 12% in 2026—expand market reach. Additionally, growing patient awareness and physician preference for minimally invasive, durable devices drove an 18% increase in hospital procurement in North America in 2025.

Cardiac Assist Devices Market Development

In 2025, Abbott Laboratories launched an advanced ventricular assist device (VAD) featuring AI-enabled predictive analytics and remote monitoring capabilities. This innovation allowed clinicians to track patient heart function in real-time, optimize therapy adjustments, and reduce hospital readmissions. The device’s portable design and enhanced biocompatibility also supported home-based care, expanding patient access and improving quality of life for those with severe heart failure.

Key Players

Leading Companies of the Market

Abbott Laboratories

Medtronic

Abiomed, Inc.

Boston Scientific Corporation

Terumo Corporation

LivaNova PLC

Getinge AB

Zurich MedTech, Inc.

SyntheMed, Inc.

SynCardia Systems, LLC

Leading market players are pursuing aggressive growth strategies to strengthen their positions in the cardiac assist devices market. In 2025, Medtronic acquired specialized technology startups, resulting in a 10% increase in market share within cardiovascular segments. Companies like Abiomed have focused on expanding their geographic presence and securing regulatory approvals across Asia Pacific, achieving rapid revenue growth in 2026. Strategic collaborations with hospitals for clinical research, device trials, and advanced training programs have also become common, helping companies enhance product adoption, improve clinical outcomes, and reinforce their leadership in the competitive cardiac assist devices landscape.

Cardiac Assist Devices Market Future Outlook

The Cardiac Assist Devices market is poised for strong growth, driven by rising cardiovascular disease prevalence, aging populations, and increasing patient preference for minimally invasive therapies. Technological advancements, including AI-enabled monitoring, IoT integration, and portable device designs, are enhancing patient management and expanding homecare applications. Emerging markets in Asia Pacific and Latin America offer significant growth potential due to expanding healthcare infrastructure, favorable reimbursement policies, and rising awareness of cardiac health. Additionally, ongoing R&D, strategic collaborations, and regulatory approvals for innovative devices are expected to accelerate adoption. Overall, the market outlook is characterized by innovation, digital integration, and global expansion.

Cardiac Assist Devices Market Historical Analysis

The Cardiac Assist Devices market has experienced steady growth over the past decade, driven by increasing cardiovascular disease prevalence and advancements in medical technology. Ventricular assist devices (VADs) and intra-aortic balloon pumps (IABPs) have historically dominated, supported by hospital adoption and critical care applications. North America and Europe led early market development due to advanced healthcare infrastructure, strong reimbursement policies, and high clinical adoption rates. Technological improvements, such as portable designs and enhanced biocompatibility, facilitated gradual expansion into homecare settings. Rising investments in R&D, increasing patient awareness, and the shift toward minimally invasive therapies further shaped market growth, establishing a foundation for future innovation and adoption.

Sources

Primary Research Interviews:

Cardiologists and Cardiac Surgeons

Cardiac Care Nurses and Perfusionists

Biomedical Engineers and Device Specialists

Cardiac Assist Device Manufacturers and Distributors

Databases:

World Health Organization (WHO) Cardiovascular Statistics

Global Burden of Disease Database

OECD Health Data

UN Disability Reports

Magazines:

Medical Design & Outsourcing

Cardiovascular Business

Heart Rhythm News

HealthTech Magazine

Medical Device Network

Journals:

Journal of Cardiac Failure

Circulation: Heart Failure

Heart and Lung Journal

European Journal of Cardio-Thoracic Surgery

Journal of Medical Devices

Newspapers:

The New York Times (Health)

The Guardian (Health)

Financial Times (Healthcare)

The Hindu (Health)

Reuters Health

Associations:

World Health Organization (WHO)

American Heart Association (AHA)

Heart Rhythm Society (HRS)

Society of Thoracic Surgeons (STS)

European Society of Cardiology (ESC)

Share

Share

About Author

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients