Blowing Agents Market Size and Forecast – 2026 – 2033

The Global Blowing Agents Market size is estimated to be valued at USD 3.2 billion in 2026 and is expected to reach USD 5.1 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 7.4% from 2026 to 2033.

Global Blowing Agents Market Overview

Blowing agents are materials used to create cellular structures in plastics, rubbers, and foams by generating gas during processing. The market includes physical blowing agents such as hydrocarbons, CO₂, and nitrogen, and chemical blowing agents that decompose to release gases like nitrogen or carbon dioxide. These products are widely used in polyurethane, polystyrene, polyethylene, and polypropylene foams. Key applications include building insulation, refrigeration, automotive components, packaging, and footwear. Growing demand for lightweight materials, energy-efficient insulation, and eco-friendly formulations is driving innovation toward low-global-warming-potential and non-ozone-depleting blowing agent products.

Key Takeaways

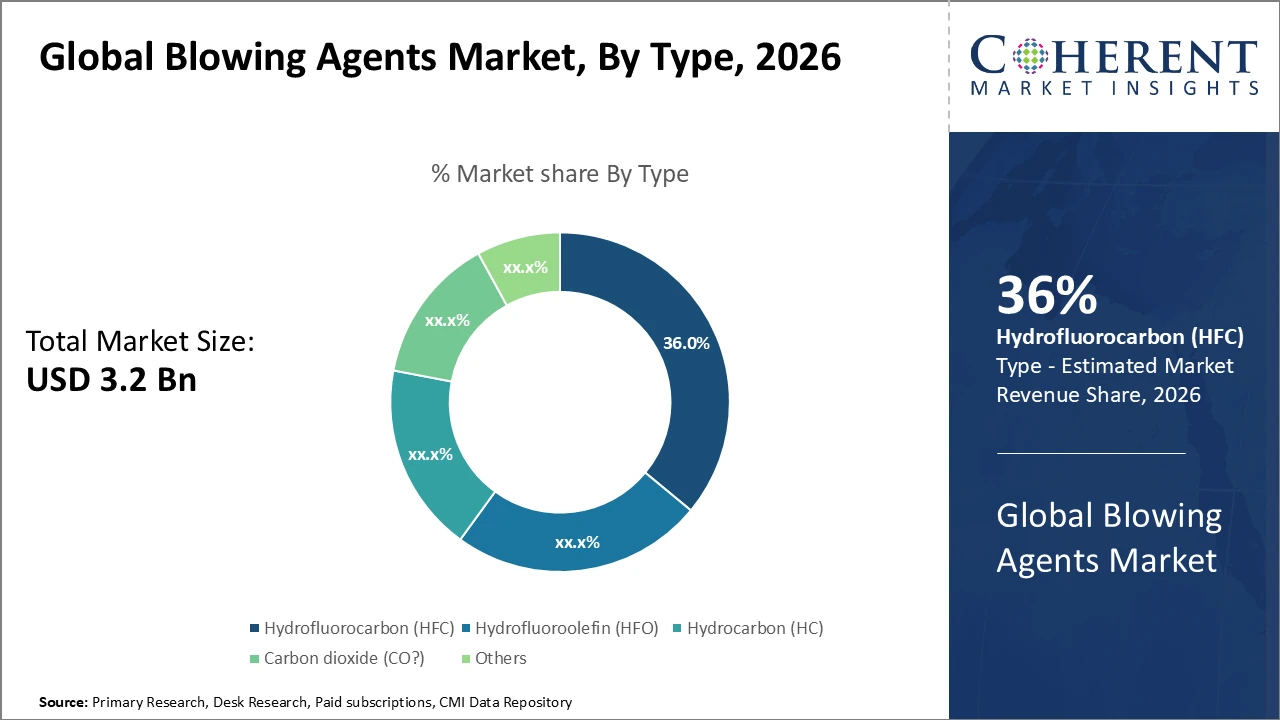

The Hydrofluorocarbon (HFC) type segment holds a dominant share of around 36%, supported by regulatory frameworks that encourage the use of transitional low-GWP blowing agents.

Polyurethane foam represents the largest application segment, driven by its widespread use in energy-efficient construction insulation and accounting for nearly 45% of market revenue in 2025.

The construction industry remains the leading end-user, benefiting from increasingly stringent energy-efficiency and building performance regulations across multiple regions.

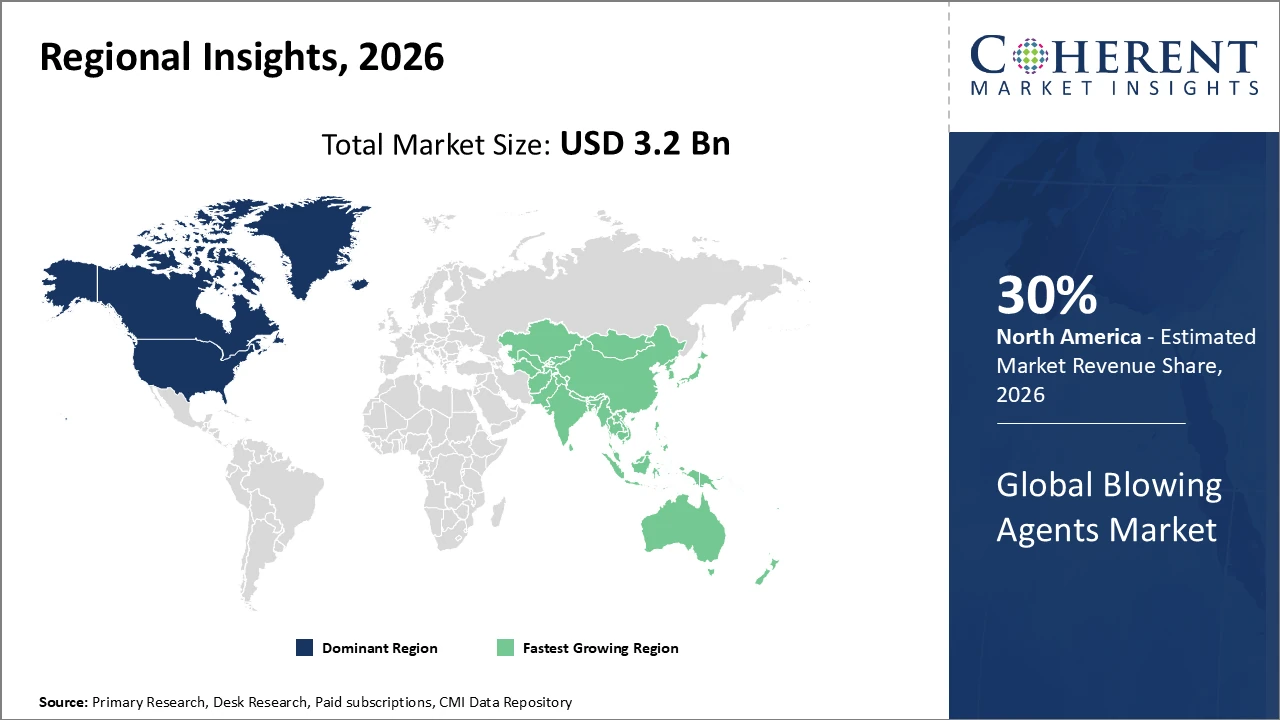

North America dominates the market with over 30% share, backed by strong R&D capabilities and regulatory policies promoting environmentally friendly blowing agents.

Asia Pacific is expected to witness the fastest growth, fueled by rapid industrialization, expanding automotive production, and rising adoption of lightweight foam materials in China and India.

Blowing Agents Market Segmentation Analysis

To learn more about this report, Download Free Sample

Blowing Agents Market Insights, By Type

Hydrofluorocarbon (HFC) leads the market with a 36% share, supported by its widespread adoption, proven performance, and balanced cost structure amid evolving environmental regulations. Hydrofluoroolefin (HFO) is the fastest-growing subsegment, driven by its ultra-low global warming potential and strong regulatory acceptance, making it a preferred replacement following post-2023 regulatory tightening in Europe and North America. Hydrocarbon (HC) blowing agents show moderate growth in applications where flammability risks are manageable. Carbon dioxide (CO₂) gains adoption due to non-flammability and environmental safety. Other niche agents remain limited but highlight future R&D opportunities.

Blowing Agents Market Insights, By Application

Polyurethane foam dominates the market, generating the largest share of revenue due to its widespread use in thermal insulation, packaging solutions, and automotive interior components. It continues to see stable demand, particularly in building and construction insulation applications. PVC foam serves specialized uses, including automotive trim, signage, and electrical insulation, where durability and rigidity are critical. The “Others” segment includes emerging foam formulations and niche applications, but it remains comparatively small relative to the leading application categories.

Blowing Agents Market Insights, By End-User

The construction sector dominates the market, driven by strict energy-efficiency regulations that mandate the use of advanced foam insulation, resulting in strong investments and a substantial market share. Automotive is the fastest-growing end-use segment, fueled by the rapid expansion of electric vehicles and rising demand for lightweight, thermally efficient materials. Packaging shows steady growth, supported by increasing use of protective and environmentally friendly foam solutions. Electronics contribute through specialized foams used for cushioning, vibration control, and insulation. The “Others” segment includes applications such as sports equipment and consumer goods. Overall, growth in construction and automotive remains central to market expansion and revenue generation.

Blowing Agents Market Trends

The blowing agents market is witnessing accelerated adoption of sustainable chemistry, largely driven by regulatory pressures such as the Kigali Amendment, which contributed to an estimated 25% increase in HFO sales between 2024 and 2026.

Integration of nano-blowing agents is emerging as a key trend, focused on enhancing insulation performance and material efficiency, with pilot-scale commercial deployments reported by select manufacturers in 2025.

Cross-industry expansion into automotive and packaging applications is creating new growth opportunities, supported by rising demand for lightweight, high-performance foam materials.

Blowing Agents Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Blowing Agents Market Analysis and Trends

North America maintains a dominant position in the blowing agents market, supported by stringent environmental regulations and substantial investments in sustainable and green technologies. The region accounts for over 30% of global market share, driven by a well-established manufacturing base and early adoption of advanced foam technologies. Regulatory frameworks promoting low–global warming potential (GWP) blowing agents have accelerated the transition toward environmentally compliant solutions, particularly in construction, refrigeration, and automotive applications. Strong research and development capabilities, coupled with government incentives and industry collaboration, further reinforce market leadership. As a result, North America continues to set benchmarks for innovation, regulatory compliance, and sustainable growth in the blowing agents’ industry.

Asia Pacific Blowing Agents Market Analysis and Trends

Asia Pacific represents the fastest-growing region in the blowing agents market, recording a CAGR exceeding 9%, driven by rapid industrialization and accelerating urbanization across emerging economies such as China and India. Strong expansion in the construction sector, supported by large-scale infrastructure development and housing projects, is significantly boosting demand for advanced insulation materials. Additionally, the growing automotive industry, including increased electric vehicle production, is fueling the adoption of lightweight and energy-efficient foam solutions. Government incentives and policy initiatives promoting energy-efficient, low-emission materials further support market growth, positioning Asia Pacific as a key driver of future industry expansion.

Blowing Agents Market Outlook for Key Countries

USA Blowing Agents Market Analysis and Trends

The U.S. blowing agents market is strongly supported by substantial investments in research and development focused on low-GWP and environmentally sustainable technologies. Major industry players such as Honeywell and Chemours dominate domestic supply chains, reinforcing technological leadership and production capacity. The market reached an estimated value of approximately USD 950 million in 2025, driven by stringent energy-efficient building codes and rising demand from electric vehicle manufacturing. Additionally, rigorous environmental regulations at both federal and state levels are accelerating the transition away from high-emission agents toward sustainable formulations. These factors collectively position the United States as a mature yet innovation-driven market with steady long-term growth prospects.

Germany Blowing Agents Market Analysis and Trends

Germany’s blowing agents market is characterized by strong regulatory support, technological innovation, and a focus on sustainability. Strict EU and national environmental regulations, including F-gas restrictions, have accelerated the adoption of low-GWP alternatives such as HFOs and CO₂-based agents. Polyurethane and polystyrene foams dominate applications in construction, refrigeration, and automotive sectors, driven by energy-efficiency and lightweight material demands. The market is further strengthened by Germany’s robust manufacturing infrastructure, advanced R&D capabilities, and presence of leading global players. Emerging trends include the integration of bio-based and nano-enhanced blowing agents to improve insulation performance and environmental compliance, reflecting a shift toward greener, high-performance solutions.

Analyst Opinion

The surge in demand for next-generation low Global Warming Potential (GWP) blowing agents is a key supply-side driver, expanding market size. In 2025, Asia Pacific increased HFO imports by 22%, reflecting a strategic shift toward sustainable chemicals in line with regulatory changes, influencing pricing as manufacturers invest in cost-competitive green solutions.

Demand-side growth in automotive lightweighting is accelerating, with blowing agents used in foam insulation for electric vehicles rising 18% year-over-year in 2024. This expansion into new end-use sectors boosts revenue and regional market penetration, particularly in North America and Europe.

Production capacity expansions in China and India in 2026 increased global export capabilities, with polymer foaming agent shipments rising 15% early in 2026. This alleviated prior supply constraints, supported competitive pricing, and positively affected market revenue and share.

Raw material availability constraints for fluorocarbon-based blowing agents in Europe during 2024 spurred innovation in hydrocarbon blends. Companies adopting hybrid formulations achieved a 12% increase in market share for advanced blowing agents balancing cost efficiency and environmental compliance.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 3.2 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 7.4% | 2033 Value Projection: | USD 5.1 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Honeywell International Inc., Arkema S.A., Linde plc, Solvay SA, BASF SE, SRF Limited, Arkema Group, Daikin Industries, Ltd., Chemours Company, Asahi Glass Co., Ltd. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Blowing Agents Market Growth Factors

Increasing regulatory mandates aimed at reducing environmental impact are significantly propelling growth in the blowing agents market. The implementation of the Kigali Amendment in 2024 accelerated the adoption of HFOs, driving market revenue growth by over 20% in regulated economies. Rising demand for energy-efficient insulation materials in building construction further expands the application scope of blowing agents, particularly polyurethane foam, which accounted for nearly 45% of market revenue in 2025. Innovations in bio-based and sustainable blowing agents, combined with advancements in production technologies, are mitigating limitations associated with conventional hydrofluorocarbon emissions. Additionally, the growing electric vehicle market is creating substantial opportunities for lightweight foams using advanced blowing agents, contributing to overall industry expansion.

Blowing Agents Market Development

In October 2025, Arkema developed and patented key technologies for the use of Forane® FBA 1233zd, a next-generation low-GWP foam blowing agent that offers superior thermal performance, reduced environmental impact compared with previous-generation blowing agents, and improved safety for polyurethane foam applications.

Key Players

Leading Companies of the Market

Honeywell International Inc.

Arkema S.A.

Linde plc

Solvay SA

BASF SE

SRF Limited

Arkema Group

Daikin Industries, Ltd.

Chemours Company

Asahi Glass Co., Ltd

Leading market players are actively pursuing expansion and collaboration strategies to strengthen their positions. In 2025, Honeywell partnered with major polyurethane foam manufacturers to enable the global rollout of low-GWP HFO blowing agents, significantly boosting business growth in North America and Asia Pacific. Similarly, Daikin’s focus on research and development produced optimized hydrocarbon blowing agents, which contributed to a 10% increase in market penetration in Europe during 2024. These strategic initiatives highlight how alliances, innovation, and regulatory alignment are driving competitive advantage and accelerating adoption of environmentally friendly blowing agent solutions across key regional markets.

Blowing Agents Market Future Outlook

The blowing agents market is poised for robust growth, driven by rising demand for sustainable, low-GWP solutions and energy-efficient materials across construction, automotive, and packaging sectors. Regulatory frameworks like the Kigali Amendment will continue to accelerate the shift toward hydrofluoroolefins, carbon dioxide, and bio-based alternatives. Innovations in nano-enhanced and hybrid blowing agents are expected to improve thermal insulation, material efficiency, and environmental compliance. Expanding electric vehicle production and lightweight foam applications will open new growth avenues, particularly in Asia Pacific and North America. Overall, the market outlook reflects strong adoption of green technologies, ongoing R&D, and diversification across end-use industries.

Blowing Agents Market Historical Analysis

The blowing agents market has experienced steady growth over the past decade, driven by increasing demand for insulation, lightweight materials, and energy-efficient solutions. Historically, hydrofluorocarbons (HFCs) dominated the market due to their effective foaming properties and cost advantages. However, growing environmental concerns and regulatory measures, such as the Montreal Protocol and F-gas regulations, gradually shifted the industry toward low-GWP alternatives like hydrofluoroolefins (HFOs), carbon dioxide, and hydrocarbons. Expansion in construction, automotive, and packaging sectors fueled market adoption, while technological advancements in foam production improved efficiency and performance. This historical trajectory laid the foundation for the current focus on sustainable and high-performance blowing agents.

Sources

Primary Research Interviews:

Chemical manufacturers and suppliers of blowing agents

Foam producers (polyurethane, polystyrene, polyolefin)

Automotive and construction material specialists

Packaging and insulation industry experts

Databases:

International Energy Agency (IEA) Reports

UN Environment Programme (UNEP) Chemicals Data

OECD Environmental Statistics

Magazines:

Chemical Week

Plastics Today

Packaging Strategies

Insulation Outlook

Journals:

Journal of Applied Polymer Science

Journal of Foam Materials

Polymer Engineering & Science

Materials Today: Proceedings

Industrial & Engineering Chemistry Research

Newspapers:

The New York Times (Business & Environment)

The Guardian (Sustainability & Industry)

Financial Times (Chemicals & Materials)

Business Standard (Manufacturing & Materials)

Reuters (Commodities & Chemicals)

Associations:

American Chemistry Council (ACC)

European Association of Chemical Distributors (FECC)

International Institute of Refrigeration (IIR)

Global Foam Alliance

Environmental Protection Agency (EPA)

Share

Share

About Author

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients