Blood Screening Market Size and Forecast – 2025 – 2032

The Global Blood Screening Market size is estimated to be valued at USD 4.8 billion in 2025 and is expected to reach USD 8.1 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% from 2025 to 2032.

Global Blood Screening Market Overview

Blood screening products encompass a wide range of diagnostic assays, reagents, and analyzers designed to detect infectious agents, antibodies, and biomarkers in blood samples. These systems are vital for ensuring transfusion safety and for early disease detection in clinical settings. Modern screening platforms utilize technologies such as enzyme-linked immunosorbent assay (ELISA), nucleic acid amplification tests (NAT), and chemiluminescent immunoassays to identify pathogens including HIV, hepatitis B and C, and syphilis.

Automated analyzers integrate robotics and digital imaging for high-throughput testing with enhanced precision. Product innovations emphasize multiplex assay capabilities, point-of-care screening, and AI-based data interpretation, enabling faster turnaround and reducing manual intervention. The ongoing shift toward fully automated, integrated systems supports scalability for both large blood banks and smaller diagnostic centers.

Key Takeaways

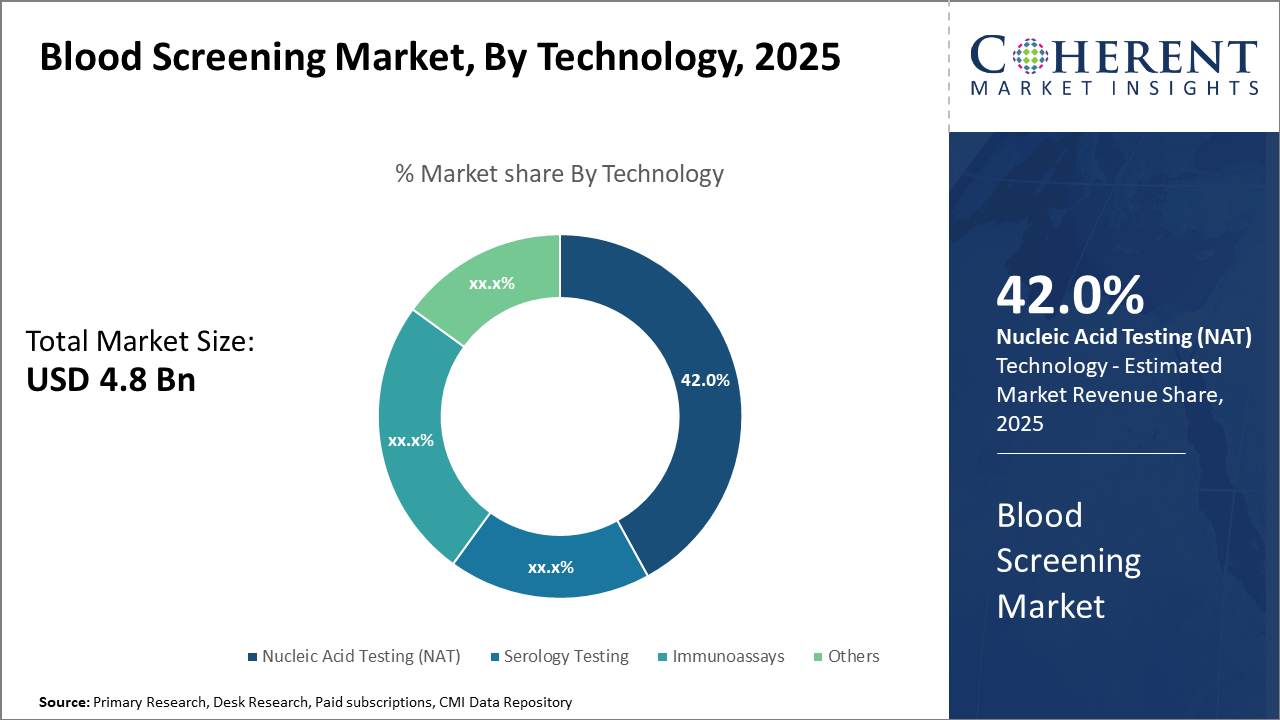

The Nucleic Acid Testing technology segment remains the major revenue driver with a 42% market share, indicating strong preference due to its high sensitivity.

Reagents and kits dominate the product segment, capturing over half of the market revenue, reflecting ongoing demand for consumables in blood screening workflows.

Blood donor screening maintains its leadership among application segments, supported by regulatory mandates for mandatory screening across most countries.

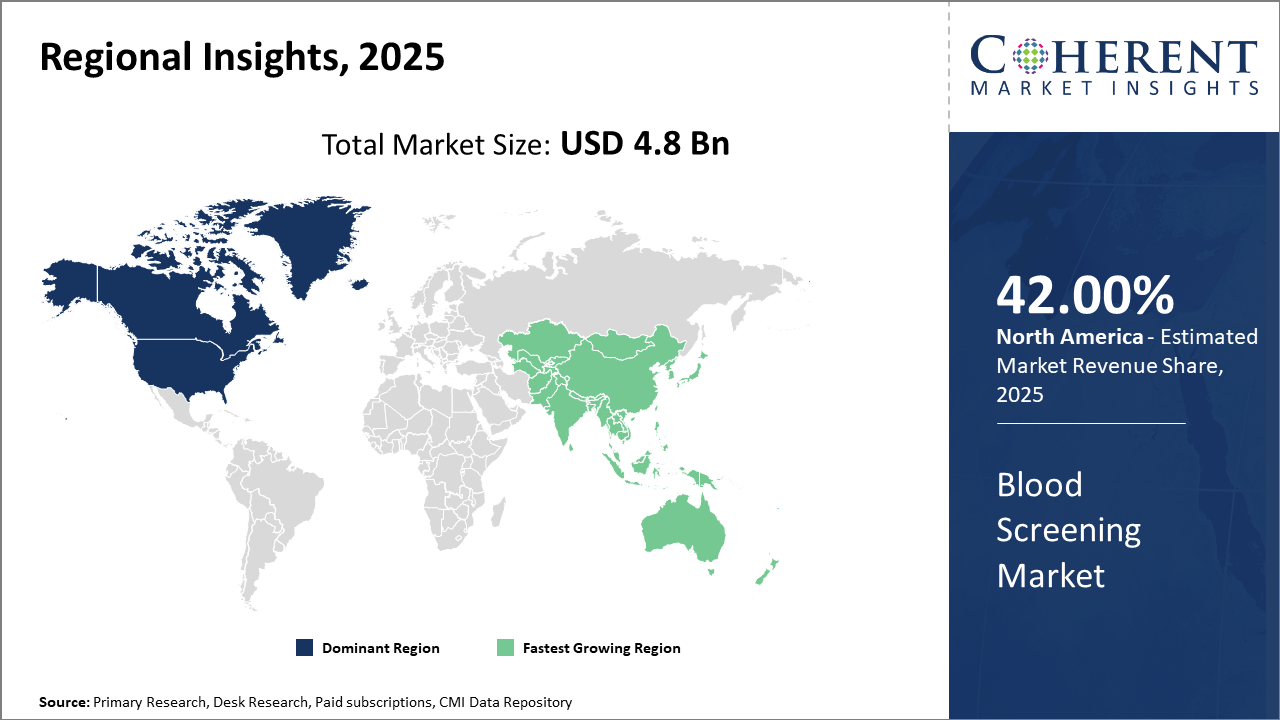

Regionally, North America continues to hold the largest market share at 42%, benefiting from robust healthcare infrastructure and regulatory compliance.

Asia Pacific is the fastest-growing market, registering an impressive CAGR fueled by rising healthcare investments and increasing blood donation awareness programs, especially in China and India.

Europe holds a steady share with significant innovation contributions from key companies headquartered in Germany and Switzerland.

Blood Screening Market Segmentation Analysis

To learn more about this report, Download Free Sample

Blood Screening Market Insights, By Technology

Nucleic Acid Testing dominates the market share with 42%. NAT remains the backbone owing to its superior sensitivity and specificity in detecting viral genomes rapidly, enabling early infection detection—a critical factor driving clinical adoption globally. It remains the technology of choice for high-throughput blood centers due to its automation compatibility and lower false-negative rates. Serology testing closely follows, offering cost-effective screening primarily for antibody detection but with limitations in early-stage infection detection. Immunoassays have witnessed steady growth, especially with developments in multiplex immunoassays providing multiple pathogen screening in a single test.

Blood Screening Market Insights, By Product

Reagents and Kits are leading at a 55% market share. This dominance reflects the consumable nature of screening tests and repeat usage cycles, which drive recurring revenue streams. Enhancements in reagent formulations have improved assay accuracy and shelf life, further strengthening this segment. Instruments follow, comprising automated analyzers and NAT platforms that provide throughput enhancements and reduce testing errors. Software and services are playing increasing roles with the advent of integrated laboratory information management systems (LIMS), enabling real-time data analytics and operational optimization in blood screening workflows.

Blood Screening Market Insights, By Application

Blood Donor Screening holds the largest share, as regulatory policies universally mandate stringent donor testing to prevent disease transmission. The rising incidence of transfusion-transmissible infections necessitates comprehensive screening protocols, securing this segment’s position. Organ Transplant Screening, while smaller, is the fastest growing, driven by increased organ transplant surgeries and the need for precise infectious disease detection in donors and recipients. Prenatal Blood Screening is gaining importance with expanded genetic and infectious disease panels helping reduce perinatal complications.

Blood Screening Market Trends

The blood screening market is increasingly shaped by advancements in molecular diagnostics, particularly Nucleic Acid Testing, which substantially improves detection reliability for transfusion-transmissible infections.

For example, multiplex NAT platforms introduced in 2024 reduced testing times by up to 30%, enabling faster donor screening.

Additionally, the introduction of AI-enhanced screening tools in hospitals across Europe and North America is speeding up diagnosis and reducing human error.

Another noted trend is the growing emphasis on decentralized testing; portable devices are now enabling initial blood screening in regions with limited laboratory infrastructure, dramatically shifting market dynamics in emerging economies.

Blood Screening Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Blood Screening Market Analysis and Trends

In North America, the blood screening market commands a dominant share owing to well-established healthcare infrastructure and stringent regulatory requirements enforced by the FDA and CDC. The U.S. healthcare ecosystem, with major blood service providers like the American Red Cross and leading companies such as Abbott Laboratories, significantly contributes to high market revenue. Robust reimbursement policies and continuous innovation have fostered high adoption of advanced blood screening technologies.

Asia Pacific Blood Screening Market Analysis and Trends

Meanwhile, the Asia Pacific exhibits the fastest growth at a CAGR exceeding 9%, propelled by government initiatives in India and China to enhance blood safety and expand infrastructure. Growth is supported by increasing healthcare expenditure, rising awareness about bloodborne diseases, and rising adoption of technologically advanced screening methods. The presence of emerging local manufacturers and expansion plans by multinational companies solidifies the regional market growth trajectory.

Blood Screening Market Outlook for Key Countries

USA Blood Screening Market Analysis and Trends

The USA remains a leading country driving the blood screening market, owing to a large base of voluntary blood donors and stringent regulatory frameworks. Investments in research and development, along with government backing for blood safety programs, have encouraged the adoption of cutting-edge NAT and immunoassay platforms. Players like Siemens Healthineers and Roche have significantly penetrated U.S. blood banking institutions, increasing the market share and revenue. Additionally, policy shifts mandating nucleic acid testing for all donated blood have elevated blood screening volumes and led to enhanced market growth.

India Blood Screening Market Analysis and Trends

India represents a sizable growth opportunity attributed to increasing healthcare infrastructure and rising awareness campaigns promoting voluntary donations. Government programs such as the National Blood Policy have significantly improved blood safety protocols. The market landscape features increasing imports of advanced screening reagents and instruments, while domestic companies are also innovating to reduce costs. Major multinational companies have entered partnership agreements with local blood banks to customize offerings suitable for the Indian market’s unique requirements, accelerating market penetration.

Analyst Opinion

Production Capacity and Technological Adoption: Recent data indicate that increasing blood collection volumes have demanded significant scalability in production capacity. In 2024, global blood service centers reported a 6% rise in donations, directly fueling the expansion of blood screening capabilities. Moreover, the adoption of next-generation sequencing (NGS) techniques has enhanced pathogen detection sensitivity, a key driver elevating market share for molecular diagnostic subsegments.

Pricing Structures and Reimbursement Trends: The pricing dynamics show an upward shift with advanced blood screening assays now commanding premium costs due to improved clinical efficacy. For instance, pricing for multiplex NAT (Nucleic Acid Testing) platforms increased by approximately 8% in 2025, underpinned by better lab throughput. Additionally, wider insurance reimbursement policies across North America and Europe have positively impacted demand-side growth.

Market Penetration in Emerging Economies: Import data from 2024 highlights sharp increases in diagnostic equipment meant for blood screening in Asia Pacific, driven predominantly by India and China. This regional uptake, accounting for over 15% annual growth in these markets, underscores the expanding use cases from blood banks to large hospitals and diagnostic laboratories.

Diversification of Use Cases Across End-User Segments: Blood screening now extends beyond transfusion services into organ transplantation and prenatal diagnostics. Reports from major healthcare centers in the U.S. confirm a 12% year-on-year rise in blood screening assays used for pre-surgical disease screening, revealing deeper integration within hospital protocols.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 4.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.2% | 2032 Value Projection: |

USD 8.1 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Abbott Laboratories, Bio-Rad Laboratories, Inc., Grifols, S.A., F. Hoffmann-La Roche Ltd., Siemens Healthineers, Terumo Corporation, Becton Dickinson and Company, Ortho Clinical Diagnostics, Hologic, Inc., Luminex Corporation, DiaSorin S.p.A. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Blood Screening Market Growth Factors

The increasing demand for safe blood transfusions remains the foremost driver, with the WHO reporting a 7% annual increase in blood donations worldwide, necessitating more rigorous screening protocols. The rising prevalence of transfusion-transmissible infections (TTIs) such as HIV, HBV, and HCV is also propelling market growth, especially in regions with stringent regulatory frameworks. Technological advancements, notably in NAT and immunoassay platforms, are enabling faster, more accurate screening processes, attracting hospitals toward automation of blood screening workflows. Moreover, increasing healthcare expenditure in emerging economies, backed by supportive government initiatives to bolster blood safety programs, has opened new avenues for market expansion, as seen in the Asia Pacific’s growing market share.

Blood Screening Market Development

In June 2025, Amazon Diagnostics launched an at-home lab testing service in India, initially available across six major cities. The service offers doorstep sample collection, digital test reports, and seamless integration with Amazon’s online healthcare ecosystem, providing users with convenient, affordable, and reliable diagnostic access. This launch marks Amazon’s continued expansion into India’s digital health and diagnostics sector, enhancing patient accessibility and preventive healthcare adoption.

In May 2025, Niloufer Hospital introduced a non-invasive, AI-based blood test tool that utilizes smartphone cameras and contact-based sensors to perform contactless health assessments. The innovation enables real-time detection of key blood parameters without the need for needle-based sampling, improving patient comfort, infection control, and diagnostic efficiency.

Key Players

Leading Companies of the Market

Abbott Laboratories

Bio-Rad Laboratories, Inc.

Grifols, S.A.

F. Hoffmann-La Roche Ltd.

Siemens Healthineers

Terumo Corporation

Becton Dickinson and Company

Ortho Clinical Diagnostics

Hologic, Inc.

Luminex Corporation

DiaSorin S.p.A.

Several leading companies have adopted strategic collaborations and product innovation to sustain and expand their market presence. For example, Siemens Healthineers’ recent strategic partnership with major U.S. blood banks resulted in a 15% increase in market penetration of their multiplex NAT platforms within 12 months of launch. Similarly, Grifols leveraged acquisitions to strengthen its reagent portfolios in Europe, leading to a 10% surge in regional revenue in 2024. Abbott Laboratories focused on enhancing point-of-care blood screening instruments, expanding its footprint in emerging markets through targeted growth strategies.

Blood Screening Market Future Outlook

Future expansion in the blood screening market will be driven by automation, digital integration, and multi-pathogen detection capabilities. Innovations in molecular diagnostics and point-of-care platforms are expected to make blood testing faster and more accessible. The growing prevalence of infectious diseases, along with heightened emphasis on transfusion safety in emerging economies, will sustain strong demand. The next decade will see significant uptake of AI-assisted analysis, automated workflow systems, and fully integrated analyzers that enhance operational efficiency. Moreover, rising investments in blood donation infrastructure and public health initiatives will strengthen screening coverage worldwide. North America and Asia-Pacific will remain key growth regions due to robust healthcare spending and evolving diagnostic technologies.

Blood Screening Market Historical Analysis

The blood screening market has developed as a critical component of transfusion medicine and infectious disease control. Historically, screening practices began in the mid-20th century with basic serological tests for hepatitis and syphilis, later expanding to cover HIV, hepatitis B, and hepatitis C. Technological progress in the 1990s introduced enzyme-linked immunosorbent assays (ELISA) and nucleic acid amplification tests (NAT), dramatically improving detection sensitivity and reducing transfusion-transmitted infections. The market’s evolution was heavily influenced by global health initiatives and mandatory screening regulations, particularly in developed regions. Increased public awareness, government funding, and the establishment of national blood safety programs further strengthened market growth.

Sources

Primary Research Interviews:

Hematologists

Laboratory Directors

Clinical Pathologists

Blood Bank Managers

Databases:

WHO Global Health Observatory

CDC Blood Safety Reports

ClinicalTrials.gov

National Blood Authority Data

Magazines:

Diagnostics World

Medical Laboratory Observer

BioTechniques,

MedTech Insight

Journals:

Journal of Clinical Microbiology

Transfusion Medicine

Clinical Chemistry

Blood Journal

Newspapers:

The Hindu (Health)

The Washington Post (Science)

The Guardian (Health)

The Wall Street Journal (Medical)

Associations:

American Association of Blood Banks (AABB)

World Health Organization (WHO)

International Society of Blood Transfusion (ISBT)

Share

Share

About Author

Nikhilesh Ravindra Patel is a Senior Consultant with over 8 years of consulting experience. He excels in market estimations, market insights, and identifying trends and opportunities. His deep understanding of the market dynamics and ability to pinpoint growth areas make him an invaluable asset in guiding clients toward informed business decisions. He plays a instrumental role in providing market intelligence, business intelligence, and competitive intelligence services through the reports.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients