Biomaterial Coating Market Size and Forecast – 2026 – 2033

The Global Biomaterial Coating Market size is estimated to be valued at USD 4.3 billion in 2026 and is expected to reach USD 7.8 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 8.5% from 2026 to 2033.

Global Biomaterial Coating Market Overview

Biomaterial coating market products include surface coatings designed to enhance the performance, biocompatibility, and durability of medical and industrial materials. These coatings are widely used on medical implants, surgical instruments, cardiovascular devices, orthopedic implants, and dental products to improve corrosion resistance, wear resistance, and biological interaction. Common biomaterial coatings include hydroxyapatite, antimicrobial coatings, polymer-based coatings, and ceramic coatings. They help promote tissue integration, reduce infection risks, and extend product lifespan. Beyond healthcare, biomaterial coatings are also applied in food packaging and industrial equipment where biocompatibility and surface protection are essential.

Key Takeaways

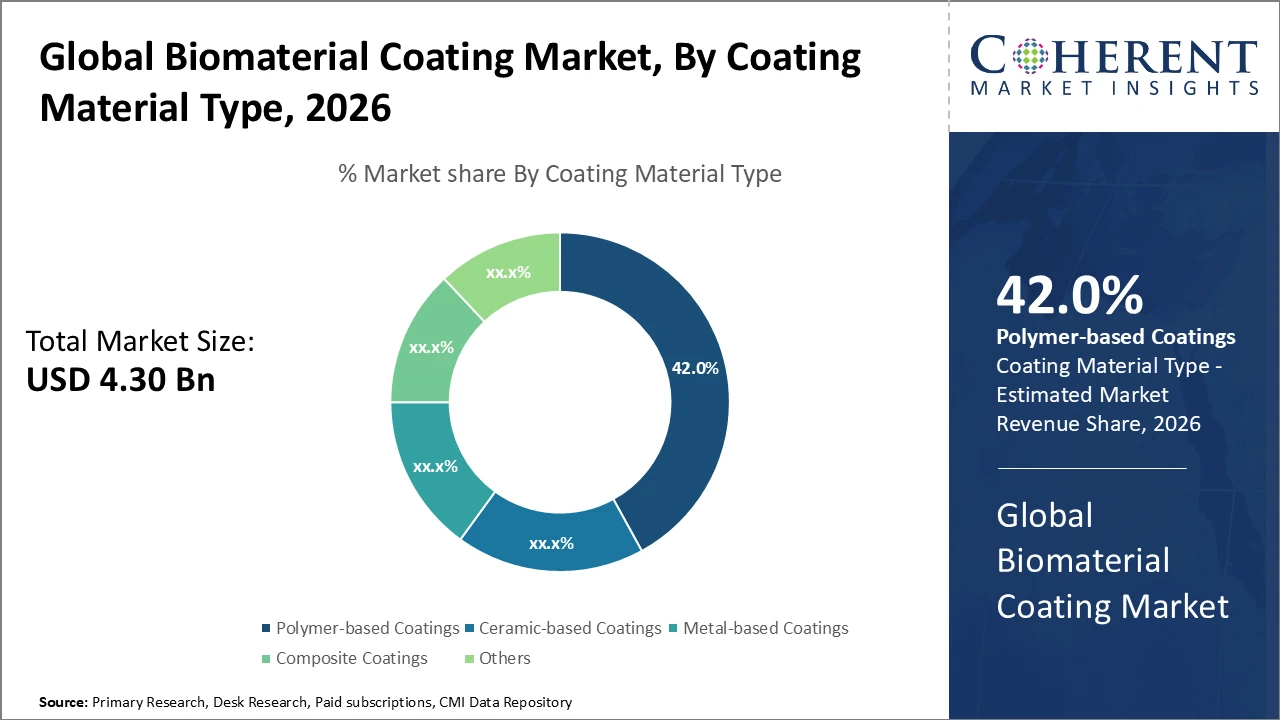

The polymer-based coating segment dominates due to its versatility and cost-effectiveness, accounting for 42% of the market share, while ceramic coatings are rapidly growing because of their superior biocompatibility.

From an application perspective, orthopedic implants generate the highest revenue, driven by the rising number of joint replacement surgeries worldwide.

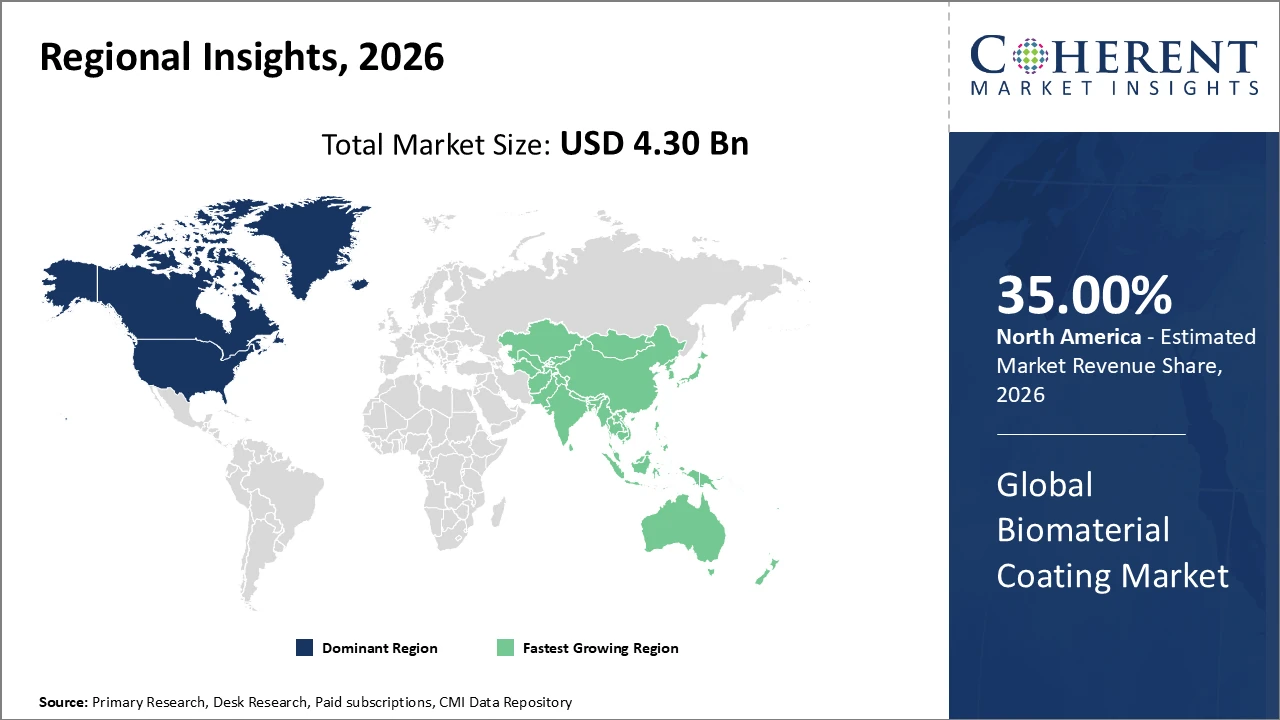

North America leads the biomaterial coating market with a 35% share, supported by high healthcare spending and strong innovation ecosystems.

Asia Pacific is the fastest-growing region, registering an 11.2% CAGR, fueled by expanding healthcare infrastructure and favorable government policies encouraging advanced biomaterial adoption.

Biomaterial Coating Market Segmentation Analysis

To learn more about this report, Download Free Sample

Biomaterial Coating Market Insights, By Coating Material Type

Polymer-based coatings dominate the market with a 42% share, driven by their adaptability, cost-effectiveness, and proven performance across a wide range of implant applications. These coatings provide excellent corrosion resistance and enhanced biocompatibility, making them a preferred choice for cardiovascular and orthopedic devices. Ceramic-based coatings are the fastest-growing segment, supported by advancements in plasma spraying technologies and valued for their superior hardness and biocompatibility. They are widely used in dental and joint implants to improve wear and fatigue resistance. Metal-based coatings, such as titanium and stainless steel, offer strong mechanical support but remain niche due to higher costs. Composite coatings combine polymers and ceramics to enable multifunctional performance, while the “Others” segment includes experimental biomaterials with limited commercialization but strong future potential.

Biomaterial Coating Market Insights, By Application

Orthopedic implants dominate the market share, driven by the high volume of joint replacement procedures and trauma devices that require durable coatings to enhance osseointegration and reduce infection risks. Cardiovascular devices follow, supported by the rising prevalence of cardiovascular diseases and the need for coatings that improve blood compatibility and prevent thrombosis. Dental implants represent a significant and steadily growing application, utilizing ceramic and polymer-based coatings to extend implant longevity and reduce peri-implantitis. Tissue engineering applications are emerging rapidly, benefiting from bioactive and scaffold-based coatings used in regenerative therapies. Drug delivery systems remain a niche but growing segment, enabled by advances in controlled-release technologies. The “Others” category includes wound care products and biosensors, contributing modestly with strong future growth potential.

Biomaterial Coating Market Insights, By Technique

Plasma spraying dominates the market share, primarily due to its ability to deposit thick, wear-resistant coatings, particularly ceramic-based coatings used in orthopedic and dental implants. Its growing dominance is supported by improvements in process control, which increased coating uniformity by approximately 12% in 2025. Dip coating is the fastest-growing technique, driven by its cost efficiency and suitability for polymer-based coatings, especially in drug delivery systems and tissue engineering scaffolds. Chemical vapor deposition enables the formation of thin, dense films and is increasingly adopted for cardiovascular stents as a next-generation coating technology. Sol-gel coating offers flexibility in producing bioactive coatings but faces limitations from slower production rates. Electrochemical deposition is mainly used for metallic coatings, providing strong adhesion and effective surface modification. The “Others” segment includes emerging hybrid coating technologies under development with strong future potential.

Biomaterial Coating Market Trends

The market is witnessing a rise in personalized and patient-specific biomaterial coatings enabled by AI-driven process controls, improving implant success rates; customized orthopedic coatings introduced in 2026 reduced implant rejection by 18%.

Growing antimicrobial resistance is accelerating the adoption of silver- and copper-based antimicrobial coatings, with clinical data from 2025 indicating a 30% reduction in infection rates for treated implants.

Sustainability and biocompatibility concerns are driving increased use of biodegradable polymer coatings, particularly across European and Asia Pacific markets, reflecting a stronger focus on environmental responsibility and patient safety.

Biomaterial Coating Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Biomaterial Coating Market Analysis and Trends

In North America, dominance in the biomaterial coating market is driven by substantial investment in advanced healthcare infrastructure, widespread adoption of innovative medical devices, and supportive regulatory frameworks that enable faster commercialization. Favorable FDA approval pathways encourage the introduction of new and improved coating technologies, strengthening market growth. The United States accounts for the largest regional share, supported by the presence of major industry players actively developing advanced biomaterial coatings for orthopedic, cardiovascular, and dental applications. Additionally, a strong network of research institutions, coupled with sustained government funding and private investments, enhances innovation, accelerates product development, and reinforces the region’s highly competitive market ecosystem.

Asia Pacific Biomaterial Coating Market Analysis and Trends

Asia Pacific represents the fastest-growing region in the biomaterial coating market, registering a CAGR of 11.2%, driven by rapidly expanding healthcare infrastructure, rising prevalence of chronic diseases, and supportive government initiatives promoting medical device manufacturing and innovation. Accelerated urbanization in major economies such as China and India has increased demand for advanced medical treatments, including coated implants and devices. Additionally, the availability of cost-effective manufacturing capabilities and skilled labor attracts global market players to establish production and R&D facilities in the region. These factors collectively strengthen regional market expansion and significantly boost overall market revenue growth.

Biomaterial Coating Market Outlook for Key Countries

USA Biomaterial Coating Market Analysis and Trends

The United States remains a pivotal market for biomaterial coatings, supported by its advanced healthcare infrastructure and a large patient population undergoing orthopedic and cardiovascular procedures. Leading companies such as BioSurface Engineering Corp. and SynCoat Technologies have accelerated innovation through clinical collaborations and advanced coating solutions, achieving an 18% reduction in post-surgical infection rates in 2025. Strong government emphasis on precision medicine, combined with high R&D spending, continues to strengthen innovation pipelines. These factors position the U.S. as a central hub for technological advancement, market leadership, and sustained business growth in the global biomaterial coating industry.

Germany Biomaterial Coating Market Analysis and Trends

Germany’s biomaterial coating market is strengthened by robust regulatory frameworks and active collaborations between research institutes and medical device manufacturers such as CeramicTech Innovations. The country has experienced significant adoption of dental implant coatings in clinical practice, accounting for roughly 15% of Europe’s market share. Ongoing investments in nanostructured coatings, combined with a growing aging population in need of advanced implantable devices, further drive demand. These factors make Germany a key contributor to the European biomaterial coating market, supporting regional revenue growth and shaping strategic initiatives for innovation and market expansion across Europe.

Analyst Opinion

Demand-side indicators show that the rising volume of orthopedic and cardiovascular implantable devices, driven by aging populations and chronic disease prevalence, is a key revenue driver. In 2025, over 30 million joint replacement procedures were performed globally, boosting demand for high-performance biomaterial coatings that enhance implant longevity and reduce infection risks.

On the supply side, advances in coating technologies such as plasma spraying, dip coating, and chemical vapor deposition have expanded production capacity and improved quality. In 2024, leading manufacturing hubs in Asia, particularly China and Japan, recorded a 15% year-over-year increase in coating throughput, lowering costs and fueling market growth.

Micro-indicators highlight increasing research grants and innovation investment in multifunctional coatings that integrate antimicrobial and drug-eluting properties. Interest from the biopharmaceutical sector in controlled drug delivery via biomaterial coatings rose by 22% in 2026, broadening market applications.

Nano-scale surface modification techniques are emerging as critical factors shaping competitive dynamics. In 2026, over 40% of newly launched coatings incorporated nanostructured layers to optimize cell adhesion and reduce biofilm formation, directly enhancing the market share of advanced specialized coatings.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 4.3 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 8.5% | 2033 Value Projection: | USD 7.8 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | SynCoat Technologies, BioSurface Engineering Corp., NanoCoat Ltd., MedCoat Solutions, Advanced Biomaterials Inc., Ceramic Tech Innovations, PolyMed Coatings, Surface Dynamics, BioLayer Systems, CoatX Biotech | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Biomaterial Coating Market Growth Factors

The biomaterial coating market is strongly driven by the growing geriatric population, which fuels demand for orthopedic implants that accounted for nearly 38% of market revenue in 2026. The global rise in cardiovascular diseases, with over 523 million cases reported in 2025, has increased the need for cardiovascular implants requiring specialized coatings to ensure biocompatibility and reduce thrombosis risks. Technological advancements in coating methods, including plasma spraying and nanotechnology, enhance implant performance and are increasingly applied in tissue engineering scaffolds. Additionally, stringent regulatory frameworks promoting safety and efficacy encourage innovation, supporting market expansion into emerging regions, particularly Asia Pacific.

Biomaterial Coating Market Development

In April 2022, Biocoat, Inc., a manufacturer of hydrophilic biomaterial coatings, announced its expansion into the design, development, and supply of hydrophilic dip-coating equipment. The new equipment line, called EMERSE, provides medical device companies with in-house dip-coating systems to support device coating and production.

Key Players

Leading Companies of the Market

SynCoat Technologies

BioSurface Engineering Corp.

NanoCoat Ltd.

MedCoat Solutions

Advanced Biomaterials Inc.

CeramicTech Innovations

PolyMed Coatings

Surface Dynamics

BioLayer Systems

CoatX Biotech

Several leading market players are pursuing aggressive R&D initiatives and strategic partnerships to broaden their product portfolios and expand geographically. For instance, BioSurface Engineering Corp.’s collaboration with major U.S. orthopedic device manufacturers resulted in a 12% revenue increase in 2025 through the launch of innovative antimicrobial coatings. Similarly, PolyMed Coatings invested USD 50 million in 2026 to expand production capacity in the Asia-Pacific region, enabling the company to capture growing demand in emerging markets and strengthen its regional presence. These strategies reflect a focused approach to innovation and market penetration in the global biomaterial coating industry.

Biomaterial Coating Market Future Outlook

The biomaterial coating market is poised for robust growth driven by rising demand for orthopedic, cardiovascular, and dental implants, particularly among aging populations. Advances in coating technologies, including nanostructured layers, plasma spraying, and multifunctional antimicrobial and drug-eluting coatings, will enhance implant performance and broaden applications in tissue engineering and drug delivery. Emerging markets in Asia Pacific are expected to contribute significantly due to expanding healthcare infrastructure and favorable government policies. Sustainability trends promoting biodegradable and environmentally friendly coatings will shape product development. Strong R&D focus, strategic collaborations, and regulatory support will continue to drive innovation, market expansion, and competitive dynamics globally.

Biomaterial Coating Market Historical Analysis

The biomaterial coating market has experienced steady growth over the past decade, driven by rising demand for medical implants and advancements in coating technologies. Between 2016 and 2025, increasing orthopedic and cardiovascular procedures, coupled with growing awareness of implant longevity and infection prevention, fueled market expansion. Polymer-based coatings dominated early adoption due to cost-effectiveness and versatility, while ceramic and metal coatings gained traction for their superior biocompatibility and mechanical properties. Technological innovations such as plasma spraying, dip coating, and nanostructured surfaces improved coating performance and reliability. Early investments in R&D and collaborations among medical device manufacturers laid the foundation for the market’s sustained growth trajectory.

Sources

Primary Research Interviews:

Medical Device Manufacturers

Biomaterials Scientists and Engineers

Orthopedic, Cardiovascular, and Dental Surgeons

R&D Heads of Coating Technology Firms

Databases:

World Health Organization (WHO) Medical Device Data

OECD Health Statistics

Global Market Research Databases (e.g., Statista, MarketsandMarkets)

UN Health and Technology Reports

Magazines:

Medical Design & Outsourcing

Biomaterials & Tissue Engineering Today

Orthopedic Design & Technology

HealthTech Magazine

Medical Device Network

Journals:

Journal of Biomedical Materials Research

Acta Biomaterialia

Journal of Orthopaedic Research

Biomaterials Science

Newspapers:

The New York Times (Health)

The Guardian (Health)

Financial Times (Healthcare)

The Hindu (Health)

Reuters Health

Associations:

International Union of Biomaterials Science and Engineering (IUSBSE)

Society for Biomaterials (SFB)

European Society for Biomaterials (ESB)

International Organization for Standardization (ISO – Medical Devices & Biomaterials)

Share

Share

About Author

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients