Artificial Retina Market Size and Forecast – 2026 – 2033

The Global Artificial Retina Market size is estimated to be valued at USD 1.1 billion in 2026 and is expected to reach USD 2.7 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 13.4% from 2026 to 2033.

Global Artificial Retina Market Overview

Artificial retina products are implantable medical devices designed to restore partial vision in patients with retinal degenerative diseases such as retinitis pigmentosa. These systems typically include an ocular implant, external camera, image processor, and wireless transmission unit. The device converts visual information into electrical signals that stimulate remaining retinal cells or the optic nerve. Artificial retina products aim to improve light perception, object recognition, and spatial orientation. Key product characteristics include biocompatibility, signal resolution, and long-term implant stability.

Key Takeaways

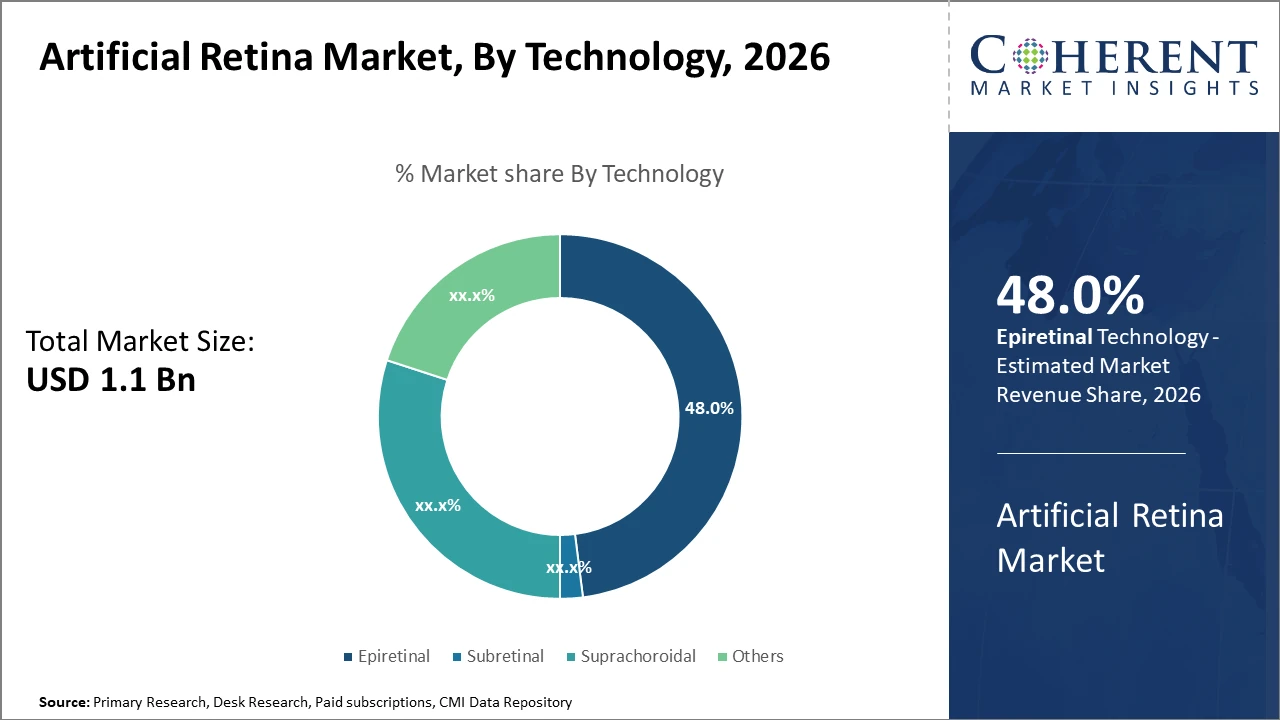

The Epiretinal technology segment dominates the market share, accounting for nearly 48%, driven by its minimally invasive implantation and proven clinical efficacy.

The Retinitis Pigmentosa application segment holds the largest market revenue due to its high disease prevalence and urgent therapeutic need.

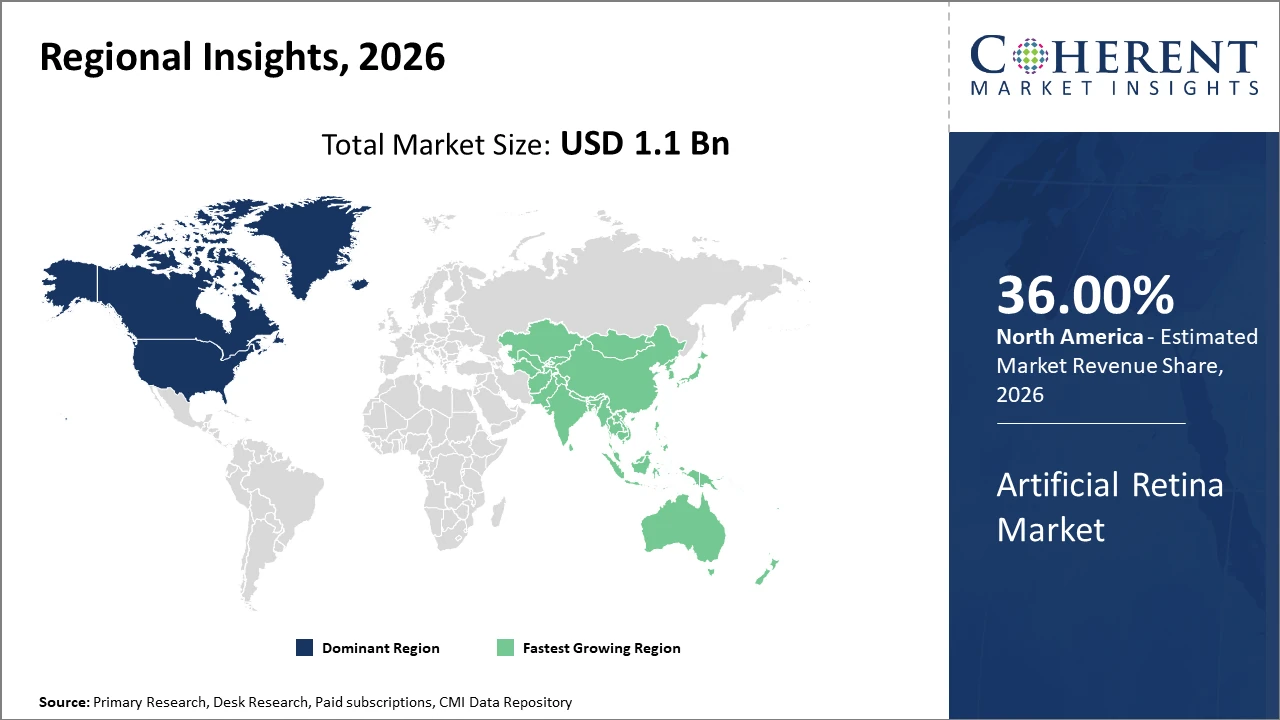

From a regional perspective, North America commands the highest market share at approximately 36%, attributable to established healthcare infrastructure and reimbursement policies supporting artificial retina adoption.

Meanwhile, the Asia Pacific is the fastest-growing region with a CAGR exceeding 15%, fueled by increased healthcare investments and rising awareness, notably in China and Japan.

Artificial Retina Market Segmentation Analysis

To learn more about this report, Download Free Sample

Artificial Retina Market Insights, By Technology

Epiretinal dominates the market share with 48%. This dominance arises from its minimally invasive surgical profile and superior clinical performance in restoring partial vision in retinal degeneration patients. The epiretinal implants offer direct stimulation of the retinal ganglion cells and have witnessed higher adoption due to favorable patient recovery metrics. Subretinal implants represent the fastest-growing subsegment, propelled by enhanced photodiode technology that mimics natural phototransduction, leading to improved visual resolution. Suprachoroidal devices offer a safer implantation route but face challenges in stimulus precision, whereas others include experimental prosthetics still in early adoption phases.

Artificial Retina Market Insights, By Application

Retinitis Pigmentosa holds the dominant market share at around 52%, reflecting its high global prevalence and the significant therapeutic need due to progressive photoreceptor loss. This application benefits from well-established clinical evidence supporting artificial retina efficacy. Age-Related Macular Degeneration is the fastest-growing application, fueled by rising incidence rates among aging populations and expanding clinical trials aiming to enhance treatment outcomes. Diabetic Retinopathy and Others represent smaller segments but gain momentum due to emerging clinical evidence of artificial retina benefits beyond traditional ophthalmic indications.

Artificial Retina Market Insights, By End-User

Hospitals command the largest market share at 43%, attributable to their superior infrastructure and capability for complex surgical implantation. Hospitals remain primary settings for both device implantation and postoperative care. Specialty Clinics are recognized as the fastest-growing subsegment, leveraging niche expertise in visual prosthetics and rehabilitation, often offering tailored patient therapies.

Artificial Retina Market Trends

The Artificial Retina Market continues to reflect significant transitions, primarily due to accelerated technological integration within medical devices.

Key trends include the fusion of optogenetics with traditional implant technologies, exemplified by the 2025 introduction of hybrid devices that improve visual function beyond electrical stimulation alone.

Additionally, the trend towards AI-enabled stimulation programming enhances patient outcomes and device adaptability.

These technological advances are complemented by a growing focus on minimally invasive surgical procedures, allowing wider adoption within less specialized healthcare settings.

Artificial Retina Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Artificial Retina Market Analysis and Trends

Regionally, North America leads in the artificial retina market share with approximately 36%, supported by advanced healthcare infrastructure and reimbursement policies that favor innovation adoption. For example, increasing Medicare coverage for retinal prosthetics in the U.S. has pushed demand upwards by 11% annually.

Asia Pacific Artificial Retina Market Analysis and Trends

Meanwhile, Asia Pacific emerges as the fastest-growing region with a CAGR of over 15%, propelled by government initiatives to combat blindness and expanding gthe astro-retinal implant manufacturing hubs in China and Japan. The region benefits from an evolving healthcare ecosystem, rising investments, and expanding patient awareness—factors that collectively boost market dynamics.

Artificial Retina Market Outlook for Key Countries

USA Artificial Retina Market Analysis and Trends

The U.S. market is characterized by leading-edge research institutions and commercialization of innovative retinal implant technologies. Companies such as Second Sight Medical Products have established a robust clinical and commercial footprint, contributing to over 40% of the North American market revenue. The U.S. benefits from supportive FDA approvals and reimbursement schemes, which facilitated a 14% market revenue rise in 2024.

Japan Artificial Retina Market Analysis and Trends

Japan’s artificial retina market has transitioned rapidly toward integration of advanced bioelectronics and wireless systems. Supported by strong government healthcare funding and a high prevalence of retinal diseases, Japan accounts for a substantial share of Asia Pacific's market revenue. Companies like Pixium Vision have collaborated with academic centers to conduct pioneering studies, resulting in a notable 17% market expansion in 2024.

Analyst Opinion

The rising demand-side indicator for artificial retina systems stems largely from an aging global population, which has driven a 12% increase in retinal degeneration cases from 2023 to 2025, primarily in developed regions. This demographic shift directly correlates with expanding market revenue opportunities, especially as healthcare infrastructure improves. For example, in 2024, healthcare providers in Japan reported a 15% surge in patient adoption of retinal prostheses.

Supply-side factors include enhanced production capacities of microelectronic components, with manufacturers expanding output by over 18% in 2024 to meet growing sector demands, thus optimizing manufacturing costs and pricing models. This shift has reduced device costs by approximately 8% over two years, facilitating wider market accessibility.

Diverse clinical applications within ophthalmology, neurology, and rehabilitative medicine create multiple verticals for artificial retina utilization. In 2025, clinical trials for combined optic nerve stimulation exhibited a 9% improvement in patient vision outcomes over standalone retinal implants, highlighting new avenues of market growth.

The influence of imports and exports—particularly in Asia-Pacific markets where China and South Korea have increased export volumes of implant components by 22% in 2024—shows robust supply-chain integration, boosting the regional market share and global competitive footprint.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 1.1 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 13.4% | 2033 Value Projection: | USD 2.7 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Nano Retina, Optobionics, Bio-Retina LLC, IMI, Retina Medical, Walk Vascular, Ocular Therapeutix, Lumus, WideTech Optics, Visus Technologies. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Artificial Retina Market Growth Factors

Several factors are decisively propelling market growth. Firstly, increasing cases of retinal diseases—approximately 15 million people globally affected by retinal degeneration in 2024 alone—are intensifying demand for artificial retina solutions. Secondly, continuous technological advancements, such as wireless power transmission and improved photodiode arrays, boost system efficiency and patient comfort. Thirdly, rising healthcare investments and reimbursement programs in North America and Europe are reducing market entry barriers. Lastly, growing collaborations between biotechnology firms and academic institutions are accelerating product innovation cycles, contributing to rapid market growth.

Artificial Retina Market Development

In 2024–2025, Second Sight Medical Products (now Cortigent) continued advancing its Orion cortical visual prosthesis, a next-generation system designed to bypass the retina and optic nerve by directly stimulating the visual cortex. This approach targets patients with profound blindness where retinal implants are ineffective. Alongside Orion, the company continued post-market support and long-term clinical insights from its earlier Argus II retinal prosthesis, reinforcing its leadership in brain–computer interface–based vision restoration.

In 2024, Pixium Vision made continued progress with its PRIMA subretinal implant system for patients with advanced dry age-related macular degeneration (AMD). The PRIMA system, which works in combination with augmented-reality glasses to stimulate surviving retinal cells, advanced through clinical trials, demonstrating functional vision improvements and highlighting the growing potential of photovoltaic subretinal technologies in restoring central vision.

Key Players

Leading Companies of the Market

Nano Retina

Optobionics

Bio-Retina LLC

IMI

Retina Medical

Walk Vascular

Lumus

WideTech Optics

Visus Technologies

Several market players have adopted collaborative innovation and strategic partnership models to secure competitive edges. For instance, Second Sight Medical Products expanded its research network in 2024, partnering with neuroprosthetics research institutions, resulting in a 14% improvement in device sensitivity. Similarly, Pixium Vision leveraged its integration with advanced microelectromechanical systems (MEMS) to reduce power consumption by 10%, aiding market penetration in energy-sensitive regions.

Artificial Retina Market Future Outlook

The future outlook for the artificial retina market is shaped by rising prevalence of retinal degenerative diseases, continued innovation in implantable medical technologies, and growing investment in neuroprosthetics. Advancements in electrode miniaturization, signal processing, and artificial intelligence are expected to significantly enhance image resolution and functional vision outcomes. The market is likely to expand beyond rare conditions into broader applications as clinical performance improves. Increasing awareness, improved surgical techniques, and more favorable reimbursement environments will support wider adoption. Emerging markets may gradually enter the landscape as device costs decline and healthcare infrastructure improves. Over the long term, artificial retina technologies are expected to evolve toward more personalized, adaptive, and minimally invasive systems, strengthening their role within advanced ophthalmic care.

Artificial Retina Market Historical Analysis

The artificial retina market has developed over a long period of scientific exploration into retinal degeneration, neural stimulation, and visual signal processing. Early market activity was heavily research-driven, with most developments confined to academic laboratories and publicly funded medical research institutions. Initial retinal prostheses were experimental, expensive, and limited in functionality, often restoring only rudimentary light perception rather than meaningful vision. Commercialization was slow due to significant technological barriers, including biocompatibility challenges, limited electrode resolution, surgical complexity, and high development costs. Regulatory approvals were difficult to obtain, requiring extensive long-term clinical evidence to demonstrate safety and durability.

Sources

Primary Research Interviews:

Ophthalmologists

Retinal surgeons

Biomedical engineers

Implant manufacturers

Databases:

NIH Vision Research

FDA Medical Devices Database

ClinicalTrials.gov

Magazines:

Ophthalmology Times

Retina Today

Medical Device Network

BioSpectrum

MedTech Insight

Journals:

Investigative Ophthalmology & Visual Scienc

Progress in Retinal and Eye Research

Translational Vision Science & Technology

Eye Journal

Nature Biomedical Engineering

Newspapers:

Reuters Health

The New York Times (Health)

Financial Times (Healthcare)

The Guardian (Science)

Bloomberg Health

Associations:

American Academy of Ophthalmology

Association for Research in Vision and Ophthalmology

International Society for Artificial Organs

Biomedical Engineering Society

Vision Research Society

Share

Share

About Author

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients